Accenture Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Export-ready design for quick drag-and-drop into PowerPoint, saving time and effort.

Delivered as Shown

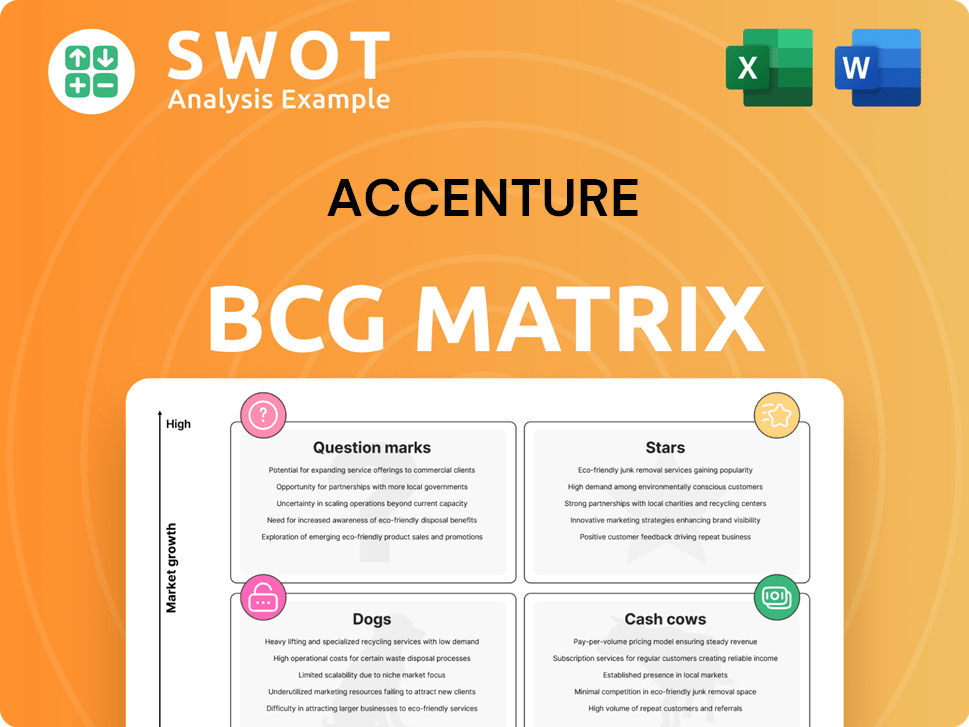

Accenture BCG Matrix

The preview showcases the complete Accenture BCG Matrix you'll receive. This isn't a demo; it's the fully functional report, ready for immediate integration into your strategic planning.

BCG Matrix Template

Explore a snapshot of this company's product portfolio through the BCG Matrix lens. Identify Stars, Cash Cows, Question Marks, and Dogs in its landscape. This analysis provides key insights into strategic product management. Understand where to focus resources for optimal growth and profitability. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Accenture shines in digital transformation, aiding businesses in navigating the digital realm. It's a leader, boosting growth significantly. In 2024, digital services fueled substantial revenue, solidifying its market position. Digital transformation's importance ensures Accenture's star status.

Accenture shines as a Star in the BCG Matrix, fueled by Generative AI solutions. They've built a strong foothold via partnerships and impressive bookings. Accenture is heavily investing in AI, with $4 billion allocated for AI in fiscal year 2024. This commitment is already paying off, driving substantial growth, with AI bookings reaching $450 million in Q1 2024 alone, showing their leadership in the market.

Accenture is a leader in cloud services, guiding organizations through cloud enablement and digital core transformations. The cloud computing market is expanding rapidly, with projections estimating it will reach $1.6 trillion by 2024. Accenture's comprehensive cloud services, from strategy to management, position it well in this growth area. In 2023, Accenture's cloud revenue reached $34 billion.

Cybersecurity Services

Accenture's cybersecurity services are a "Star" in its BCG Matrix, reflecting high growth and market share. The escalating need for robust cybersecurity solutions drives strong demand for Accenture's offerings. The company strategically invests in cybersecurity, aiming to fortify its position in this expanding market. Accenture's comprehensive security solutions establish it as a leader in safeguarding organizations against cyber threats.

- Cybersecurity spending is projected to reach $270 billion in 2024.

- Accenture's security revenue grew by 18% in fiscal year 2023.

- Accenture has made over 20 acquisitions in the cybersecurity space since 2020.

- Accenture employs over 20,000 cybersecurity professionals worldwide.

Managed Services

Accenture's managed services are a star in its BCG matrix, showing strong growth. In 2024, new bookings for managed services outpaced traditional consulting. Accenture helps clients with application modernization, cloud, and cybersecurity. This segment's demand makes it a key performer.

- Managed services growth drives Accenture's success.

- Cloud and cybersecurity are high-demand areas.

- New bookings are a key performance indicator.

- Accenture's services are in high demand.

Accenture's "Stars" are high-growth, high-share businesses. They are fueled by digital, AI, cloud, cybersecurity, and managed services. These areas drive substantial revenue growth and market leadership. Accenture's investments and strategic moves cement its "Star" status.

| Service | 2023 Revenue (USD) | Key Drivers |

|---|---|---|

| Cloud | $34B | Cloud adoption, digital core transformations |

| Cybersecurity | Significant Growth | Rising cyber threats, security spending projected to $270B in 2024 |

| AI | $450M bookings (Q1 2024) | GenAI solutions, $4B AI investment |

Cash Cows

Accenture, a cash cow, excels in traditional consulting. It's a top global management consulting firm. In 2024, Accenture's revenue reached $64.1 billion. This success stems from strong client ties and expertise. They leverage deep industry knowledge for sustained revenue.

Operations consulting is a cash cow for Accenture, fueled by the demand for efficiency. Accenture offers advisory and implementation services for various functions. Streamlining processes and supply chains bolsters its market standing. In 2024, operational consulting accounted for a large portion of Accenture's revenue. This includes a strong revenue growth in the past year.

Accenture's tech consulting is a cash cow, offering steady revenue through tech integration and digital transformation. Accenture's focus on building technology competencies and enhancing delivery capabilities strengthens its position. In 2024, Accenture's revenue was over $64 billion. Comprehensive solutions ensure continued relevance.

Business Process Outsourcing (BPO)

Accenture's Business Process Outsourcing (BPO) arm is a cash cow due to its consistent revenue generation. They use global capabilities and industry knowledge for cost-effective client solutions. This established presence in the market helps Accenture streamline processes and boost efficiency for its clients.

- Accenture's revenue from outsourcing in 2024 reached $32.1 billion.

- The BPO market is projected to grow, with an estimated value of $398 billion by the end of 2024.

- Accenture's operating margin for BPO services in 2024 was around 15%.

- Accenture has over 732,000 employees worldwide, supporting its BPO operations.

Legacy IT Services

Accenture's legacy IT services, a cash cow in its BCG matrix, continue to generate substantial revenue. These services, including IT infrastructure and maintenance, are crucial for many businesses. Despite slower growth, they provide a reliable income stream. Accenture's expertise ensures steady financial returns from these established services. In 2024, this segment accounted for a significant portion of Accenture's overall revenue.

- Legacy IT services provide a stable revenue base for Accenture.

- These services include IT infrastructure and maintenance.

- Accenture's expertise ensures financial returns.

- The segment contributed significantly to overall revenue in 2024.

Accenture's cash cows consistently generate strong revenue and profits, indicating a mature and stable market presence. Operations consulting, a key area, saw significant revenue, reflecting its crucial role in efficiency improvements. Tech consulting and Business Process Outsourcing (BPO) also contribute substantially, securing steady financial returns.

| Area | 2024 Revenue (approx.) | Key Characteristics |

|---|---|---|

| Operations Consulting | Major Share | Efficiency, process improvement. |

| Tech Consulting | Over $64B total | Tech integration and digital transformation. |

| BPO | $32.1B | Cost-effective solutions, global capabilities. |

Dogs

Accenture faces slower client spending, particularly on smaller, short-term consulting contracts, as of 2024. These projects offer lower returns compared to larger engagements. For instance, in Q1 2024, Accenture's revenue grew by only 1%, indicating this trend. Securing more impactful projects is crucial for growth.

Accenture's EMEA consulting revenue faced headwinds in 2024. This decline, impacting overall growth, signals a "Dog" quadrant status. EMEA's unique market challenges require tailored strategies. Accenture needs to understand and adapt services to boost performance.

Accenture's acquisition strategy, though asset-light, faces risks, especially with AI's volatility. Misaligned acquisitions, failing to deliver synergies, become "dogs." For instance, in 2024, Accenture's acquisition spending was substantial, with some deals possibly underperforming. Careful evaluation is crucial to avoid value destruction; the firm needs to ensure acquisitions boost long-term growth and profitability.

Services with Limited Digital Integration

Accenture's services with limited digital integration could see slower growth due to changing client demands. Clients are increasingly looking for digitally-driven solutions, potentially impacting services lagging in this area. To stay competitive, Accenture must prioritize digital transformation across all offerings. In 2024, digital transformation spending reached $2.3 trillion globally, highlighting the urgency.

- Slow Growth: Services lacking digital integration might experience slower growth.

- Reduced Demand: Clients are increasingly seeking digitally-driven solutions.

- Digital Transformation: Accenture needs to prioritize digital transformation.

- Global Spending: Digital transformation spending hit $2.3 trillion in 2024.

Traditional Marketing Tech Services

Accenture's traditional marketing tech services face challenges due to specialized competitors. These services may need strategic adjustments to stay relevant and profitable. Accenture should differentiate with AI and data-driven insights. In 2024, the marketing tech market was estimated at $190 billion, and Accenture's share is about 4%. Revitalization is key.

- Market share challenged by specialized competitors.

- Revitalization or partnerships needed for profitability.

- Differentiation through AI and data insights is crucial.

- 2024 market estimated at $190 billion.

Accenture's "Dogs" include slower-growing services and underperforming acquisitions, as of 2024. These face challenges like decreased client spending and the need for digital upgrades. Marketing tech services also struggle amidst strong competition, and digital transformation is crucial.

| Category | Challenge | 2024 Data |

|---|---|---|

| Slow Growth | Limited digital integration | Digital transformation spending hit $2.3T |

| Reduced Demand | Client demand for digital solutions | Marketing tech market $190B |

| Underperforming Acquisitions | Misaligned acquisitions | Accenture's acquisition spending substantial |

Question Marks

Accenture's Industry X, focusing on digitalizing engineering and manufacturing, represents a high-growth area needing investment. They help clients reinvent offerings, yet market uptake varies. In 2024, the digital manufacturing market was valued at $476.9 billion. Accenture should invest to meet the rising demand for digital solutions.

Accenture's metaverse consulting is a question mark in the BCG Matrix, reflecting its newness and uncertain demand. The metaverse market was valued at $47.69 billion in 2023, but growth is still speculative. Accenture's ROI is unclear as adoption evolves. They must watch trends closely. Accenture's revenue grew to $64.1 billion in fiscal year 2023.

Accenture's quantum computing ventures are classified as Question Marks within its BCG Matrix. The market is in its early stages, offering significant growth potential. Accenture's commitment to R&D is crucial. The quantum computing market is projected to reach $2.5 billion by 2024.

Blockchain Technology Applications

Accenture's blockchain ventures are positioned in the Question Mark quadrant. While blockchain could revolutionize sectors, its uptake is slow. Accenture must convert its blockchain skills into real-world solutions, delivering value to its clients. Focusing on industry-specific blockchain applications is vital for driving adoption in the market.

- Accenture invested $1 billion in Web3, including blockchain, in 2022.

- Only 10% of enterprises have adopted blockchain solutions in 2024.

- The global blockchain market is projected to reach $94 billion by 2024.

- Accenture's revenue in 2023 was $64.1 billion.

Smart Cities Consulting

Accenture's increasing focus on smart cities consulting highlights a growing market with substantial potential. This market is projected to reach billions in revenue by 2024. However, the complexity of smart city projects necessitates collaboration. Accenture should prioritize partnerships and scalable solutions to succeed.

- Market size for smart city solutions is projected to reach $615.3 billion by 2024.

- Accenture has been actively involved in various smart city projects globally.

- Successful projects require integration of technology and stakeholder management.

- Developing scalable solutions is crucial for long-term success in this market.

Accenture's ventures in new markets like quantum computing, blockchain, and metaverse are "Question Marks". These areas show high growth potential but uncertain market adoption. Investments require careful monitoring of ROI and market trends.

| Venture | Market Value (2024) | Accenture Focus |

|---|---|---|

| Metaverse | $53.69B (projected) | Consulting, Adoption |

| Blockchain | $94B (projected) | Industry solutions |

| Quantum Computing | $2.5B (projected) | R&D, Innovation |

BCG Matrix Data Sources

The Accenture BCG Matrix uses market reports, financial statements, industry research, and expert analysis to create strategic positioning.