Accenture PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

What is included in the product

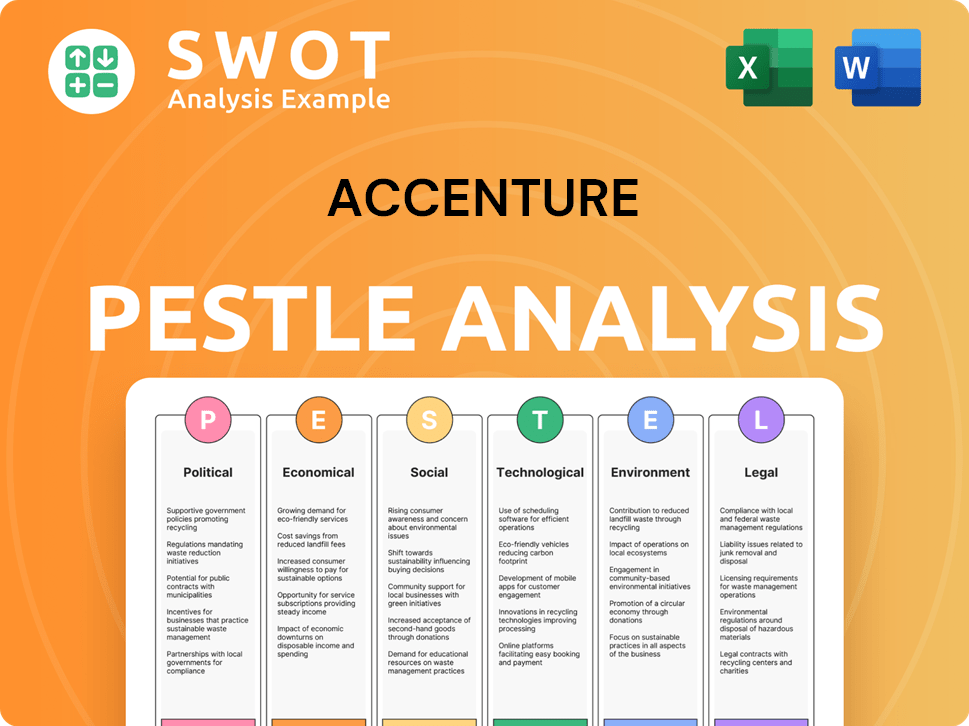

The PESTLE analysis examines Accenture's environment via six key factors, revealing external impacts.

Provides a concise version perfect for quick alignment among teams and departments.

Full Version Awaits

Accenture PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured.

This detailed Accenture PESTLE analysis, presented in the preview, will be yours to download instantly.

The same structured content you see now, with comprehensive insights, will be delivered.

No hidden surprises or variations—the finished report is available after purchase.

Begin your strategic planning using this ready-to-use, expertly crafted analysis.

PESTLE Analysis Template

Assess Accenture's market position with our expertly crafted PESTLE analysis. We explore political, economic, social, technological, legal, and environmental factors. Understand risks & opportunities impacting their strategy and performance. Enhance your own decision-making with key insights, now! Download the full report for comprehensive analysis.

Political factors

Accenture faces risks from global political instability due to its wide-ranging operations. Political conflicts and trade barriers can disrupt projects and resource flows. For instance, the Russia-Ukraine war affected project timelines and client engagements. Accenture's Q1 2024 revenue was $16.22 billion.

Accenture adapts to government policies, focusing on digital transformation. They align services with initiatives, aiding modernization efforts. For example, in 2024, Accenture secured over $2 billion in U.S. federal contracts for IT modernization. Cybersecurity contracts with public sectors are also part of their business.

Accenture faces intricate global regulatory landscapes, especially regarding data privacy like GDPR and CCPA. Compliance necessitates substantial financial investments. The company's legal and compliance expenses totaled $617 million in fiscal year 2024. These costs are projected to increase as regulations evolve, impacting operational strategies. Effective navigation is crucial for maintaining market access and client trust, particularly in regions with stringent data protection laws.

Trade Policies and Tariffs

Changes in trade policies and tariffs can significantly influence Accenture's global operations and consulting projects. For example, trade tensions between the U.S. and China, which saw tariffs on over $550 billion of goods in 2024, directly affect supply chain consulting work. These shifts can lead to project delays or alterations as clients adapt to new trade regulations. Accenture must stay agile, adjusting strategies to mitigate risks and capitalize on opportunities arising from these global trade dynamics.

- 2024 saw over $550B in goods affected by US-China tariffs.

- Trade policy changes can cause project delays.

Political Risk Management

Accenture actively manages political risks, vital for its global operations. They use localized service models to navigate international political complexities. Dedicated compliance and legal teams ensure adherence to regulations and mitigate risks. For example, in 2024, Accenture's government-related contracts totaled approximately $20 billion.

- Localized service models adapt to regional political landscapes.

- Specialized teams provide compliance and legal guidance.

- Political risk assessments are regularly updated.

- Continuous monitoring of geopolitical developments.

Accenture is impacted by political instability due to its global presence and international conflicts, affecting project timelines and resource flows, for example, the Russia-Ukraine war caused disruption.

The company closely aligns with changing government policies, especially in digital transformation, and secures IT modernization contracts, with over $2 billion in U.S. federal contracts in 2024.

They carefully navigate trade policies like U.S.-China tariffs that affected $550B in goods in 2024, adjusting strategies to mitigate risks and grasp global trade changes to remain agile in operations.

| Aspect | Impact | Examples/Data |

|---|---|---|

| Geopolitical Risks | Project Disruptions, Resource Issues | Russia-Ukraine conflict influenced projects. |

| Government Policies | Alignment and Contracts | $2B+ in U.S. federal contracts for 2024. |

| Trade Policies | Supply Chain & Project Adjustments | $550B of goods affected by U.S.-China tariffs in 2024. |

Economic factors

Global economic uncertainty significantly affects Accenture. The professional services sector faces a downturn, influencing client spending. Accenture responded by delaying promotions and salary increases in specific regions. For example, in Q1 2024, Accenture reported a 3% decline in consulting revenue. This reflects broader economic challenges.

Accenture's financial results are subject to currency fluctuations, impacting reported revenue across various global markets. The company actively employs hedging strategies to reduce the effects of these currency risks. For the fiscal year 2024, Accenture reported revenues of $64.1 billion. Currency can significantly affect these figures.

Accenture navigates diverse economic climates regionally. Emerging markets may see slower growth or currency declines. In developed markets, recession risks pose challenges. For instance, in 2024, the Eurozone's GDP grew just 0.5%. Accenture adjusts strategies to fit these varied economic realities.

Impact on Client Spending

Economic factors significantly shape client spending on consulting and technology services. Economic downturns often curtail demand for firms like Accenture. For instance, in Q1 2024, Accenture's revenue grew 1.4% in U.S. dollars, a decrease from previous periods. This trend highlights the sensitivity of consulting revenue to economic cycles.

- Accenture's Q1 2024 revenue growth was 1.4%.

- Economic uncertainty can delay or reduce project spending.

- Clients may prioritize cost-cutting over new initiatives.

- Consulting services are often discretionary expenses.

Pricing Strategies

Accenture's pricing strategies are closely tied to economic health. During economic expansions, the company may adopt premium pricing, capitalizing on increased client budgets. Conversely, in economic downturns, competitive pricing becomes crucial to retain clients and secure new projects. For instance, in 2024, Accenture's consulting revenue grew, reflecting pricing strategies that adapted to varying economic landscapes.

- Pricing adjustments are influenced by inflation rates and currency fluctuations, impacting costs and revenue.

- Economic uncertainty can lead to more cautious client spending, affecting project scopes and pricing models.

- Accenture's pricing models include fixed-fee, time-and-materials, and value-based pricing, each suited to different economic scenarios.

- Accenture's ability to adapt its pricing models to economic conditions is key to maintaining profitability and market share.

Economic factors greatly affect Accenture's business performance and strategies.

Uncertainty leads to delayed project spending and cost-cutting. The firm must adapt its pricing.

Accenture’s Q1 2024 revenue growth was 1.4%, showing market sensitivity. Economic adjustments remain crucial.

| Factor | Impact | Example |

|---|---|---|

| GDP Growth | Client Spending | Eurozone GDP: 0.5% (2024) |

| Currency Fluctuation | Reported Revenue | Hedging Strategies |

| Pricing Strategy | Profitability | Adapting to Economic Shifts |

Sociological factors

Accenture is adapting to changing workforce expectations, especially from millennials and Gen Z. They're responding to demands for hybrid work, investing in tech for better collaboration. In 2024, 72% of employees globally prefer hybrid models. Accenture's investments in AI-driven collaboration tools reflect this shift. These tools are expected to boost productivity by 15% by 2025.

Accenture actively promotes diversity and inclusion within its workforce. For instance, as of 2023, women represented 47% of the global workforce. Accenture aims to achieve a gender-balanced workforce by 2025. The company invests in programs that encourage racial and ethnic diversity, reflecting a commitment to a more inclusive environment.

Accenture's Life Trends report indicates increasing skepticism towards online content. Generative AI amplifies scams, impacting customer trust. In 2024, 60% of consumers expressed concerns about online authenticity. This necessitates brands building trust. Financial data indicates a 15% rise in digital fraud in 2024.

Work-Life Balance and Employee Well-being

Sociological factors significantly impact Accenture. Employees now highly value work-life balance, demanding flexibility and well-being support. This shift affects employee expectations and how Accenture must adapt to retain talent. The Great Resignation highlighted these trends, with many seeking better conditions. Accenture's ability to meet these needs is crucial for its success.

- In 2024, 60% of employees globally cited work-life balance as a top priority.

- Companies offering flexible work saw a 20% increase in employee retention.

- Accenture reported a 15% rise in employee satisfaction after implementing well-being programs.

Social Rewilding

Social rewilding reflects a societal shift toward authentic experiences and nature. People increasingly balance technology with real-life interactions, seeking sensory-rich experiences. This trend impacts consumer behavior and business models. For example, the global wellness market reached $7 trillion in 2024, showing this shift's economic impact.

- Demand for eco-tourism and outdoor activities is rising.

- Businesses are adapting with nature-focused products and services.

- There is a growing focus on mental well-being and mindfulness.

Sociological changes significantly influence Accenture. Employees increasingly value work-life balance, driving a need for flexibility. Digital trust is crucial; concerns about online authenticity are growing. In 2024, hybrid models grew by 72%.

| Sociological Factor | Impact on Accenture | Data (2024-2025) |

|---|---|---|

| Work-Life Balance | Requires flexibility & well-being support | 60% cite balance as a priority in 2024. |

| Digital Trust | Impacts online engagement; Generative AI | 15% rise in digital fraud (2024) |

| Hybrid work demand | Adapting collaboration | 72% prefer hybrid globally |

Technological factors

Generative AI is revolutionizing tech. Accenture views it as a major disruptor, boosting productivity. In 2024, the global AI market reached $200 billion, and is projected to hit $1.8 trillion by 2030. However, responsible use and job impacts remain key concerns.

The digital transformation market is booming. It's fueled by companies needing to adapt to shifting consumer habits and boost efficiency. Worldwide spending on digital transformation is expected to reach $3.9 trillion in 2024. This growth indicates a strong demand for technologies that enhance business operations.

Accenture benefits from the growing cloud computing market. The global cloud computing market is projected to reach $1.6 trillion by 2025. This surge boosts demand for Accenture's cloud services. They can leverage this trend to provide cloud migration and management. In 2024, Accenture's cloud revenue grew significantly, reflecting this opportunity.

Cybersecurity Landscape

The cybersecurity landscape is rapidly changing, requiring stringent adherence to information protection standards. This creates opportunities for Accenture's security services. The global cybersecurity market is projected to reach $345.7 billion by 2025. Accenture's acquisitions in cybersecurity, like Symantec's Cyber Security Services, boost its capabilities. This expansion helps Accenture meet the increasing demand for robust security solutions.

- Cybersecurity market expected to reach $345.7B by 2025.

- Accenture's cybersecurity acquisitions strengthen its position.

Automation and AI Deployment

Accenture's consulting services are directly impacted by automation and AI. The firm helps clients integrate these technologies to boost efficiency. In 2024, the AI market is projected to reach $200 billion. Accenture's revenue in 2024 was around $64 billion. This growth shows the importance of AI and automation.

- AI market value: $200B (2024)

- Accenture revenue: ~$64B (2024)

- Automation adoption is rising across industries.

- Accenture offers services in AI and automation.

Technological advancements significantly impact Accenture's strategy. The growth in AI, digital transformation, cloud computing, and cybersecurity drives the company's services. Accenture's growth benefits from market trends, including a projected $1.6 trillion cloud computing market by 2025.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Generative AI | Productivity and Efficiency Gains | AI market: $200B (2024), $1.8T (2030 projected) |

| Digital Transformation | Business Adaptation & Efficiency | Worldwide spending: $3.9T (2024) |

| Cloud Computing | Service Demand Surge | Market: $1.6T (by 2025 projected) |

| Cybersecurity | Need for Robust Security | Market: $345.7B (by 2025 projected) |

Legal factors

Accenture faces stringent international data protection regulations like GDPR, CCPA, and LGPD. Compliance necessitates substantial investment in data security measures. In 2024, global data privacy spending reached an estimated $125 billion, reflecting the scale of compliance efforts. Penalties for non-compliance can be severe, potentially impacting Accenture's financials.

Accenture faces intellectual property hurdles, requiring significant legal spending. These expenditures cover patent protection, trademark registration, and copyright management across various global markets. In fiscal year 2024, Accenture's legal and compliance costs were substantial, reflecting the complexities of safeguarding its innovations. The company invested approximately $300 million in legal services and IP protection. These measures are vital to maintain its competitive edge.

Accenture must comply with cybersecurity and information protection standards, a legal mandate. This includes costs for certifications and legal audits. Data breaches can lead to hefty fines; for example, in 2024, the average cost of a data breach was $4.45 million globally. Accenture invests heavily in these areas.

Employment Laws and Labor Regulations

Accenture faces the challenge of adhering to a wide array of employment laws and labor regulations globally. These include rules on hiring, wages, working hours, and employee benefits. Non-compliance can lead to significant fines, legal battles, and reputational damage. Accenture's HR departments must stay updated with these ever-changing regulations. In 2024, the average cost of employment litigation for large companies like Accenture was approximately $4.8 million.

- Compliance with labor laws is crucial for avoiding penalties and legal issues.

- Accenture must adapt to different regulations in each country.

- Staying current with employment law changes is a continuous process.

- Non-compliance can impact Accenture's financial and brand image.

Tax Regulations

Accenture faces constant shifts in global tax policies, influencing its financial performance. Changes in corporate tax laws, like those from the OECD's BEPS project, necessitate strategic adjustments. The company must comply with diverse regulations across numerous countries to avoid penalties. In fiscal year 2023, Accenture's effective tax rate was about 22.6%, reflecting its tax management strategies.

- OECD's BEPS project aims to curb tax avoidance strategies.

- Accenture's tax rate fluctuates due to global operations and tax planning.

- Compliance with tax laws is critical to maintaining financial health.

Accenture navigates complex data privacy regulations, with global spending on compliance hitting $125B in 2024. Legal expenses, including IP protection and cybersecurity, are critical to maintain its competitive edge and protect from cyber breaches, with an average cost of $4.45M in 2024. The company is committed to complying with labor laws, incurring litigation costs around $4.8M, as well as adapting to constantly changing global tax policies.

| Legal Area | Regulatory Issue | Financial Impact (2024) |

|---|---|---|

| Data Privacy | GDPR, CCPA, LGPD | $125B (Global Compliance Spending) |

| Intellectual Property | Patents, Trademarks, Copyright | ~$300M (Legal & IP Protection Costs) |

| Cybersecurity | Data Breach Compliance | $4.45M (Average Data Breach Cost) |

| Employment | Labor Law Compliance | $4.8M (Average Litigation Cost) |

| Taxation | BEPS project | 22.6% (Effective Tax Rate in 2023) |

Environmental factors

Accenture is deeply committed to net-zero emissions. They aim to slash operational greenhouse gas emissions. The company actively invests in carbon removal solutions. Accenture's efforts align with global sustainability goals.

Accenture champions environmental sustainability in digital transformations. They provide solutions like cloud-based sustainability tracking. AI-driven energy efficiency is a key focus. In 2024, the green technology and sustainability market reached $366.8 billion, reflecting growing demand for these services. Accenture's approach helps clients reduce their carbon footprint.

Accenture focuses on responsible waste management, aiming for zero waste through reuse and recycling. In 2024, Accenture recycled 75% of its operational waste globally. The company's 2025 target includes a further reduction in waste sent to landfills. This aligns with growing environmental regulations and stakeholder expectations.

Renewable Electricity Usage

Accenture demonstrates a strong commitment to environmental sustainability, notably by achieving 100% renewable electricity usage across its facilities. This commitment is a key aspect of their environmental strategy, reflecting broader industry trends towards decarbonization. Data from 2024 indicates that many major corporations are increasing their renewable energy investments. Accenture's initiative aligns with global goals to reduce carbon emissions.

- 100% renewable electricity usage in Accenture facilities.

- Emphasis on environmental sustainability in corporate strategy.

- Alignment with global decarbonization efforts.

Supplier Engagement on Environmental Targets

Accenture actively engages its key suppliers to promote the disclosure of environmental targets and emission reduction efforts. This initiative is part of Accenture's broader sustainability strategy, aiming to reduce its supply chain's environmental footprint. By collaborating with suppliers, Accenture seeks to drive collective action toward a lower-carbon future. In 2024, Accenture reported that over 70% of its key suppliers have set science-based targets.

- Over 70% of key suppliers set science-based targets (2024).

- Focus on Scope 3 emissions reduction.

- Collaboration to improve supply chain sustainability.

- Encouraging transparency and reporting.

Accenture prioritizes net-zero emissions, investing in carbon removal, and targets reduced operational greenhouse gases. They emphasize digital transformations with cloud-based sustainability tools. Responsible waste management aims for zero waste.

| Key Environmental Initiatives | Accenture's Actions | Relevant Data (2024-2025) |

|---|---|---|

| Renewable Energy | 100% renewable electricity usage | Renewable energy investments increased across industries. |

| Waste Management | Focus on reuse & recycling. | 75% of operational waste recycled in 2024, with plans for further reductions. |

| Supply Chain Sustainability | Engage suppliers; emissions reduction | Over 70% of key suppliers set science-based targets (2024). |

PESTLE Analysis Data Sources

Our analysis utilizes data from IMF, World Bank, Statista, and government resources to build a comprehensive PESTLE framework. This ensures reliability and relevance.