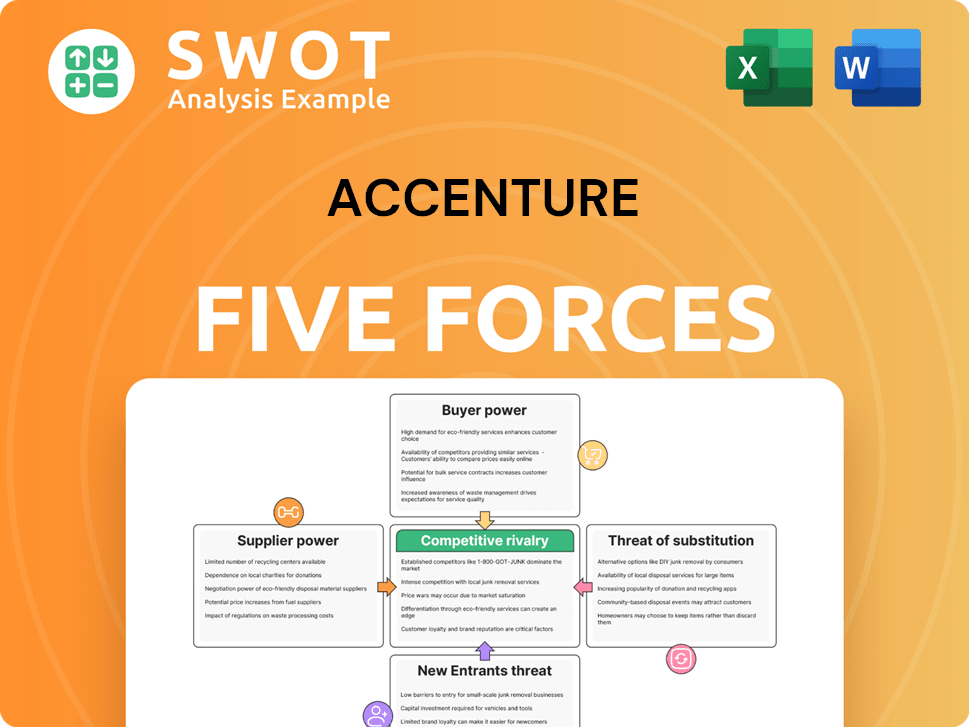

Accenture Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accenture Bundle

What is included in the product

Analyzes Accenture's competitive landscape, evaluating its position within its market.

Customize pressure levels based on new data or evolving market trends.

What You See Is What You Get

Accenture Porter's Five Forces Analysis

This is the complete Accenture Porter's Five Forces analysis. The preview you are viewing showcases the identical document you will receive immediately upon purchase, ensuring full transparency.

Porter's Five Forces Analysis Template

Accenture's industry is shaped by powerful forces. Supplier power impacts cost structures and innovation. Buyer power influences pricing and service demands. The threat of new entrants is moderate, given the high barriers. Substitute threats, like in-house consulting, are always present. Competitive rivalry among major players is intense.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Accenture’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Accenture faces supplier power due to limited specialized talent in tech and consulting. This is intensified by the concentration of major global firms. Accenture invested $1.2B in training in 2023. The high demand for expertise keeps supplier power significant.

Accenture's reliance on skilled professionals, especially in cloud computing and AI, significantly impacts its supplier power. These experts, crucial for services, hold considerable leverage due to high demand. Accenture's talent strategy focuses on these specialized areas; in 2024, cloud computing experts comprised around 35% of their workforce. This dependency can inflate labor costs, strengthening the bargaining power of these essential suppliers.

Accenture's investment in training significantly influences supplier bargaining power. The company invests heavily to reduce reliance on external talent. In 2023, Accenture spent $1.2 billion on training, representing 4.7% of revenue. Employees received an average of 58 training hours per year.

Strategic partnerships

Accenture strategically partners with educational institutions, like the 127 global universities and technology training centers, to bolster its talent pipeline. These alliances help shape curricula to align with Accenture's evolving needs, reducing reliance on external suppliers. The firm's commitment to these relationships is evident through its partnerships, including 42 in North America and 38 in Europe, mitigating the bargaining power of talent suppliers. This approach ensures a steady stream of skilled professionals.

- Accenture's global partnerships include 127 universities and training centers.

- 42 partnerships are in North America, and 38 are in Europe.

- These alliances help control the supply of skilled labor.

- Curriculum development is influenced to meet company needs.

Proprietary tools and methodologies

Accenture's suppliers, especially those in technology, wield considerable power due to their unique tools and methodologies, which enhance service offerings. These proprietary elements create differentiation, boosting supplier bargaining power. Companies like ServiceNow, with its proprietary platform, have proven this, generating over $7.2 billion in revenue in 2023. The ability to integrate these specialized services is also a key factor.

- Accenture's tech suppliers leverage unique tools.

- Proprietary tools boost supplier power.

- ServiceNow's 2023 revenue: over $7.2B.

- Integration of services is critical.

Accenture faces supplier power from specialized tech talent and unique service providers. The company invests heavily in training, spending $1.2B in 2023 to reduce dependence. Strategic partnerships with universities and tech firms help control the supply of skilled labor and new technologies.

| Aspect | Details | Impact on Supplier Power |

|---|---|---|

| Talent Acquisition | Cloud, AI experts | High |

| Training Investment (2023) | $1.2B, 4.7% of revenue | Moderate |

| Key Suppliers | ServiceNow, proprietary tools | High |

Customers Bargaining Power

Clients are pushing for cost efficiency, boosting their bargaining power for consulting services. They want high ROI, focusing on value-driven projects to maximize returns. IT spending hit $4.6 trillion in 2023, with value being key. This pressures Accenture to offer cost-effective solutions.

Customers' access to information significantly boosts their bargaining power. Market transparency enables easy comparison of service providers and offerings, increasing buyer leverage. This allows for negotiation of better terms and pricing. For example, in 2024, online price comparison tools saw a 20% increase in usage, empowering customers. This shift enables informed choices, strengthening their position.

The consulting industry is fiercely competitive, boosting customer bargaining power. Buyers have many choices, enabling favorable term negotiations. Accenture competes with Deloitte and IBM. This competition gives clients leverage. For example, in 2024, the professional services market was valued at over $1.5 trillion worldwide.

Performance-based pricing

Clients' bargaining power rises with performance-based pricing. Accenture faces increased risk as clients demand outcome-driven contracts. In fiscal year 2023, 94% of Accenture's contracts used these mechanisms. This shift empowers clients to seek better results and value from services.

- Performance-based pricing increases client control.

- Accenture bears more risk under these contracts.

- Clients demand better outcomes and value.

- Accountability becomes a key factor.

Internal capabilities growth

The bargaining power of customers is increasing as more companies build internal capabilities, impacting firms like Accenture. A significant shift shows organizations leaning towards in-house solutions for project management and IT. Recent data indicates that 70% of organizations prioritize developing internal expertise, reducing dependence on external consultants. This trend is fueled by the $2.5 trillion spent globally on IT services by enterprises annually, driving them to seek cost-effective and tailored solutions.

- Companies are investing in internal capabilities to reduce reliance on external consultants.

- 70% of organizations prefer developing in-house project management and IT solutions.

- Enterprises globally spend $2.5 trillion annually on IT services.

Customer bargaining power grows due to cost focus and information access. Market competition intensifies buyer leverage, impacting negotiation. Performance-based pricing and in-house capabilities further shift the balance.

| Aspect | Impact | Data |

|---|---|---|

| Cost Efficiency | Clients demand ROI, value | IT spend $4.6T (2023) |

| Information | Price comparison boosts power | 20% rise online tool use (2024) |

| Competition | Many choices increase leverage | $1.5T professional services market (2024) |

Rivalry Among Competitors

Accenture faces fierce competition in the consulting market. Many global and regional firms compete for market share, which increases pressure on pricing and innovation. Competitors like Deloitte, Capgemini, and TCS offer similar services. In 2024, Accenture's revenue was over $64 billion, but competition impacts profit margins.

Accenture's extensive global presence, spanning over 120 countries, places it in direct competition with a diverse array of firms. This wide geographic footprint, though a strength, means Accenture faces unique rivals in each market. Maintaining consistent service quality and brand integrity across such a broad scope presents a significant challenge. In 2024, Accenture's global revenue was approximately $64.1 billion, highlighting the scale of its operations and the competitive landscape it navigates.

Accenture's extensive service portfolio puts it in competition with specialized firms. Its broad scope requires constant innovation and adaptation to maintain its market position. Accenture's offerings span strategy, consulting, digital, technology, and operations. In 2024, Accenture's revenue was over $64 billion, reflecting its diverse service lines.

Strategic technology partnerships

Accenture's strategic technology partnerships are a double-edged sword. While collaborations with cloud and tech providers boost capabilities, they also introduce dependencies and potential conflicts. Accenture must carefully manage these relationships to stay competitive, navigating the complexities of its partner ecosystem. This strategic balancing act is crucial for maintaining its market position.

- Accenture's revenue in 2024 was approximately $64.1 billion.

- Accenture has strategic alliances with companies like Microsoft, AWS, and Salesforce.

- These partnerships contribute to Accenture's service offerings but also create dependencies.

- Competition arises from firms within the same technology partner ecosystems.

R&D investment

Accenture's R&D investment is a cornerstone of its competitive strategy, essential for staying ahead in a dynamic market. The need to continually innovate requires substantial resources and a proactive stance toward new technologies. This constant push for innovation is a key factor in the competitive landscape. Accenture's R&D spending was $1.2 billion in 2023, which was 1.9% of its revenue.

- R&D Intensity: Accenture's R&D spending as a percentage of revenue.

- Innovation Focus: Areas of R&D investment (e.g., AI, cloud, security).

- Competitive Advantage: How R&D translates into new services or solutions.

- Future Outlook: Planned R&D investments and their strategic goals.

Accenture competes fiercely with global consulting firms. The market is highly competitive, impacting pricing and innovation. In 2024, revenue was around $64.1B, facing rivals like Deloitte and Capgemini.

Accenture's global presence increases competition from diverse firms. Its wide footprint requires constant effort to ensure quality. Revenue reached $64.1 billion in 2024, highlighting the challenges.

Accenture's broad service portfolio puts it against specialized firms. Constant innovation is crucial to maintain its market position. Diverse services contributed to over $64 billion in revenue in 2024.

| Key Metric | Value | Year |

|---|---|---|

| 2024 Revenue | $64.1B | 2024 |

| R&D Spending | $1.2B | 2023 |

| R&D as % of Revenue | 1.9% | 2023 |

SSubstitutes Threaten

The rise of in-house solutions presents a growing threat to Accenture. Companies are increasingly opting to build their own project management and IT solutions. A recent study found that 70% of businesses now favor developing internal capabilities. This shift reduces reliance on external consulting services. This trend could impact Accenture's revenue streams.

Digital platforms and automation pose a threat to Accenture. Automated solutions perform tasks formerly handled by consultants. The digital transformation consulting market was $662.11 billion in 2023. This shift could reduce demand for Accenture's traditional services. Automated consulting is growing rapidly.

Freelance consultants and independent contractors pose a threat to Accenture. They offer specialized expertise and are often a more cost-effective option, especially for smaller projects. In 2024, the freelance market's growth was notable, with a 15% increase in demand for independent consultants. This is attractive for clients. Accenture's revenues in 2024 were impacted by this shift, with a 3% decrease in some project areas.

Software solutions

Software solutions pose a threat to Accenture by offering alternatives to consulting services. These solutions automate tasks, potentially reducing the need for Accenture's customized engagements. The adoption of software is rising, with the global software market projected to reach $722.6 billion in 2024. This shift can impact Accenture's revenue streams.

- The global software market is expected to reach $722.6 billion in 2024.

- Automated solutions are becoming more common in addressing business needs.

- This trend can reduce the demand for traditional consulting services.

DIY approaches

The threat of substitutes in Accenture's market includes clients choosing "do-it-yourself" (DIY) methods, especially for smaller projects. This shift involves clients using their own internal resources and online tools to solve problems, potentially reducing the need for Accenture's consulting services. DIY options are becoming more viable as online resources and internal expertise grow, impacting demand for external consultants. For example, in 2024, a study showed a 15% increase in companies using in-house teams for digital transformation projects instead of outsourcing.

- Increased use of in-house teams for project management.

- Growing availability of free or low-cost online project management tools.

- Rise in client expertise in specific consulting areas.

- Focus on cost-saving measures by clients.

The threat of substitutes challenges Accenture through diverse avenues. In-house solutions, digital platforms, freelance consultants, and software solutions are alternatives that can meet client needs. The global software market is expected to reach $722.6 billion in 2024, increasing the options available to clients.

| Substitute | Impact on Accenture | Data |

|---|---|---|

| In-house solutions | Reduced reliance on external consultants | 70% of businesses favor internal capabilities in 2024. |

| Digital platforms | Automation of tasks | Digital transformation consulting market was $662.11B in 2023. |

| Freelance consultants | Cost-effective alternatives | 15% increase in demand for independent consultants in 2024. |

| Software solutions | Automated task management | Global software market projected to $722.6B in 2024. |

Entrants Threaten

High capital requirements pose a significant threat to new entrants in the consulting industry. Building infrastructure and hiring experienced consultants necessitates substantial financial investment. Accenture's R&D spending in 2024 was around $1 billion, highlighting the need for substantial financial resources. This includes technology, training, and marketing investments.

Accenture's established position grants it significant economies of scale, lowering per-unit costs. This advantage makes it tough for new competitors to match prices. Accenture's 2024 revenue was approximately $64.1 billion, reflecting its extensive operational scale. New entrants struggle to compete with this cost efficiency.

Accenture's strong brand recognition and reputation are a significant barrier to new entrants. A well-established brand fosters trust and attracts clients, making it difficult for newcomers to compete. Accenture's brand value hit USD 40.5 billion in 2024, showcasing its powerful market presence. This solid brand recognition gives Accenture a substantial advantage.

Industry expertise

Accenture's extensive industry expertise acts as a significant barrier to new entrants. Its deep-rooted client relationships and sector-specific knowledge are tough to replicate. Tailored solutions across diverse sectors give Accenture a competitive edge. This complex knowledge base is hard for newcomers to quickly match. Accenture's revenue in 2024 was approximately $64.1 billion.

- Accenture's global presence strengthens its industry expertise.

- Established client trust and relationships are difficult for new firms to gain.

- Tailored solutions enhance client retention and market share.

- New entrants face challenges replicating Accenture's rapid adaptation.

Technology and innovation

The consulting industry, including Accenture, thrives on continuous technological innovation. New entrants face a significant barrier due to the ongoing need for substantial investments in technology and the associated costs. Maintaining a competitive edge requires considerable resources and specialized expertise to stay ahead of advancements. Accenture's dedication to research and development is a key factor in preserving its market position.

- Accenture's R&D spending in 2023 was approximately $3.4 billion, underscoring its commitment to innovation.

- The consulting market is highly competitive, with firms constantly investing in new technologies to attract and retain clients.

- New entrants often struggle to match the scale of investment in technology that established firms like Accenture can make.

- Technological expertise includes data analytics, AI, cloud computing, and cybersecurity, all requiring specialized skills and resources.

New consulting firms face high capital demands, needing funds for infrastructure and expert hires. Accenture’s brand and scale create a significant barrier; its 2024 revenue was about $64.1B. Continuous tech investment also challenges new entries.

| Barrier | Impact | Data (2024) |

|---|---|---|

| Capital Needs | High | R&D: ~$1B |

| Economies of Scale | Significant | Revenue: ~$64.1B |

| Brand Recognition | Strong | Brand Value: $40.5B |

Porter's Five Forces Analysis Data Sources

Our analysis uses market reports, financial statements, and industry surveys for competitive force evaluations. These sources inform assessments of suppliers, buyers, and industry rivals.