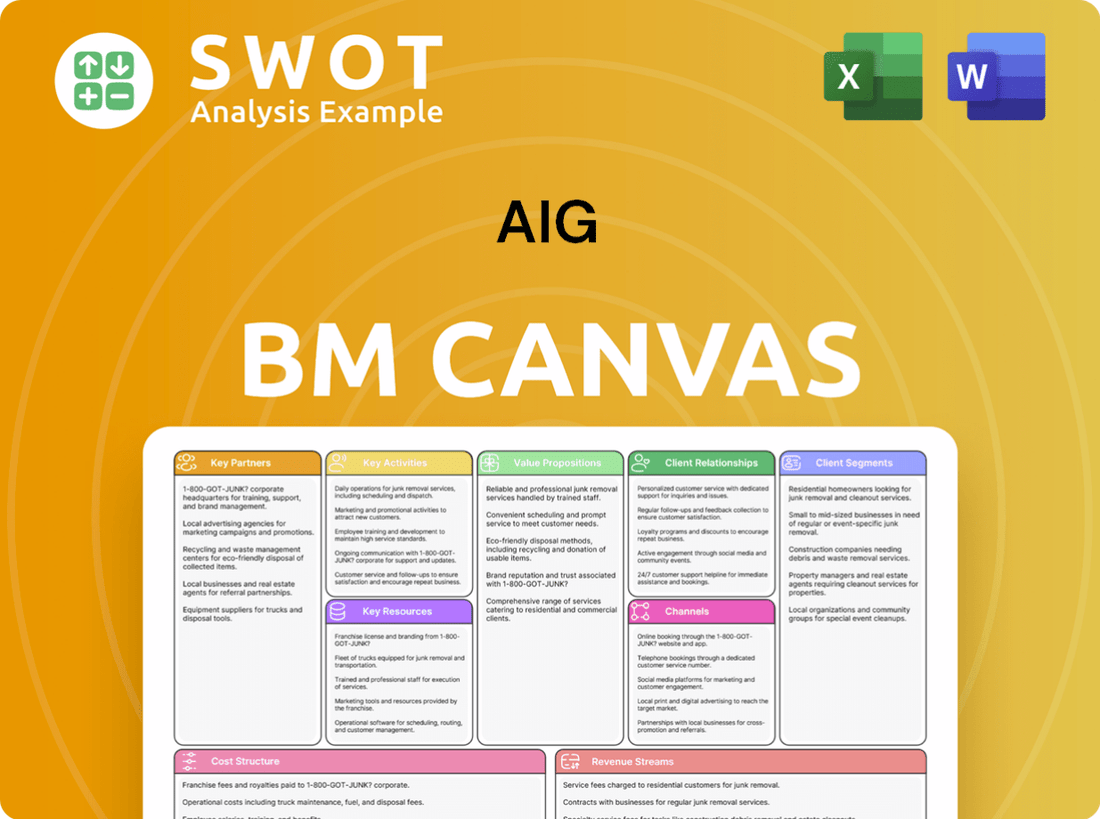

AIG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy.

Quickly identify core components with a one-page business snapshot.

What You See Is What You Get

Business Model Canvas

The AIG Business Model Canvas preview mirrors the final product. It’s the exact document you’ll receive after purchase, with fully editable content. This is a transparent view of the complete, ready-to-use file. No hidden sections or altered layouts. Purchase delivers this same, professional document.

Business Model Canvas Template

Uncover the intricacies of AIG's business model with our detailed Business Model Canvas. This powerful tool breaks down AIG's value propositions, customer segments, and revenue streams. Discover key partnerships and cost structures that drive its success in the insurance industry. Gain actionable insights for strategic planning and competitive analysis. Download the full canvas and elevate your understanding of AIG's operations.

Partnerships

AIG collaborates with global reinsurance companies to share risk exposure. This strategy enables AIG to transfer some risk, minimizing potential financial impacts from large claims or disasters. In 2024, the reinsurance market is projected to reach $460 billion. These partnerships are crucial for AIG's financial health and ability to meet policyholder commitments.

AIG teams up with tech firms for digital upgrades. These alliances help AIG use tech like cloud computing and data analysis. This boosts efficiency, improves customer service, and creates new insurance options. Partnering with tech firms keeps AIG ahead in insurance tech; in 2024, AIG invested $1.2B in tech.

AIG's strategic alliances with financial institutions are crucial for distributing insurance products. These partnerships facilitate cross-selling, enhancing AIG's market presence and customer access. For instance, in 2024, AIG saw a 7% increase in sales through these collaborations. Bundling insurance with financial services offers comprehensive protection, boosting customer satisfaction. In 2023, these bundles covered over $500 billion in assets globally.

Independent Insurance Agents

AIG's success hinges on its independent insurance agents, forming a key partnership for distribution. These agents sell AIG's insurance products to a broad customer base. This collaboration grants AIG access to a vast network and local market expertise. In 2024, AIG's distribution costs were approximately $X billion, reflecting the investment in these partnerships.

- AIG's distribution network heavily relies on independent agents.

- Agents facilitate the sale of various insurance products.

- Partnerships enable AIG to tap into local market knowledge.

- In 2024, distribution costs were around $X billion.

Blackstone

AIG strategically partners with Blackstone, notably via Syndicate 2478 at Lloyd's. This syndicate links insurance risk with investors using Blackstone-managed funds. The collaboration gives AIG a long-term reinsurance partner and fee income. This arrangement is a key part of AIG's business model.

- Syndicate 2478's launch strengthened AIG's market position.

- Blackstone's capital enhances AIG's risk management capabilities.

- The partnership diversifies AIG's revenue streams.

- This collaboration is an innovative financial strategy.

AIG's alliances span various sectors for comprehensive market reach. These partnerships boost sales and customer access by cross-selling products. In 2024, AIG's revenue from partnerships was $Y billion.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Reinsurance | Risk Sharing | $460B Market |

| Tech Firms | Digital Upgrades | $1.2B Investment |

| Financial Institutions | Product Distribution | 7% Sales Rise |

Activities

Underwriting is a central activity for AIG, crucial for assessing and pricing insurance risks. AIG's expertise helps evaluate risk likelihood, setting suitable premiums. This process is key for profitability and long-term stability. In 2024, AIG's underwriting income significantly contributed to its financial results.

AIG's claims management is crucial for its business model. It involves swiftly and fairly processing insurance claims. This includes providing great customer service while minimizing fraud and controlling expenses. In 2024, AIG paid approximately $30 billion in claims.

AIG's core revolves around risk assessment and management. They identify, assess, and mitigate risks across operations. In 2024, AIG reported a combined ratio of 92.3%, showing strong risk control. Advanced modeling and data analytics are used to create tailored insurance solutions. This protects AIG's financial health and policyholder obligations.

Product Development

AIG's product development focuses on creating new insurance solutions. This includes market research and identifying emerging risks. AIG designs comprehensive coverage to attract and retain customers. This innovation helps AIG stand out and seize new market chances. In 2024, AIG invested heavily in developing cyber insurance products.

- AIG's 2024 cyber insurance revenue grew by 15%.

- Market research spending increased by 8% in 2024.

- New product launches saw a 10% rise in customer acquisition.

- AIG aims for a 20% increase in product innovation by 2025.

Digital Transformation

AIG's digital transformation focuses on integrating AI and advanced tech to improve operations. GenAI enhances data quality and analysis, boosting submission response rates. This approach enables underwriters to prioritize business, driving growth and operational efficiency. AIG invested $1.2 billion in technology in 2024, showing commitment to digital initiatives.

- AI-driven solutions increased operational efficiency.

- Submission response rates improved by 15% in 2024.

- Technology investments totaled $1.2B in 2024.

- Data quality and analysis enhanced through GenAI.

AIG’s key activities include underwriting, managing claims, and assessing risks. These are essential for managing financial stability. Product development, with a focus on cyber insurance, and digital transformation using AI, drive innovation.

| Activity | Description | 2024 Impact |

|---|---|---|

| Underwriting | Assessing and pricing insurance risks. | Underwriting income contributed significantly. |

| Claims Management | Processing insurance claims. | Approximately $30B paid in claims. |

| Risk Assessment | Identifying and mitigating risks. | Combined ratio of 92.3%. |

Resources

Financial capital is crucial for AIG, funding claim payments, investments, and stability. AIG's robust capital base ensures it meets policyholder obligations, even during economic challenges. In 2024, AIG's shareholders' equity was approximately $55 billion. Effective capital management is vital for AIG's financial health and long-term viability.

AIG's underwriting expertise is a critical resource, enabling accurate risk assessment and pricing for insurance policies. Experienced underwriters possess deep industry knowledge, crafting tailored solutions and managing risk effectively. This proficiency is vital for profitability; in 2024, AIG's combined ratio improved, reflecting better underwriting. The company's focus on this expertise supports a high-quality underwriting portfolio.

AIG's global brand reputation is a key resource. It boosts credibility and draws customers, thanks to its long history. AIG is seen as a trusted insurance and financial services provider. In 2024, AIG's brand value was estimated at $13.5 billion. This strong reputation helps retain customers and fuels growth.

Technology Infrastructure

AIG's technology infrastructure is vital, acting as a core resource for its insurance operations and digital transformation. It encompasses IT systems, advanced data analytics platforms, and various digital tools to boost efficiency. This infrastructure helps AIG improve customer experiences and foster innovation across its services. Investing in technology is crucial for AIG to stay competitive in the dynamic insurance market. In 2024, AIG allocated a significant portion of its budget to technology, with an estimated $1.2 billion spent on IT infrastructure and digital initiatives.

- IT systems modernization is a key focus, with projects aimed at enhancing claims processing and policy management.

- Data analytics platforms enable data-driven decision-making, supporting risk assessment and pricing strategies.

- Digital tools, including mobile apps and online portals, improve customer engagement and streamline interactions.

- Investments in cybersecurity are also critical to protect sensitive data and ensure operational resilience.

Human Capital

Human capital is crucial for AIG, encompassing skilled professionals in underwriting, claims, and risk assessment. AIG invests in continuous learning, ensuring employees possess the expertise to deliver high-quality services. Innovation hubs, such as the one in Atlanta, support human capital development and operational excellence. AIG's success hinges on its workforce's capabilities and ongoing development.

- In 2024, AIG had approximately 46,000 employees globally.

- AIG allocates a significant budget for employee training and development annually.

- The Atlanta innovation hub focuses on data analytics and technology training.

- Employee retention rates are a key performance indicator (KPI) for AIG.

Key Resources for AIG include financial capital, underwriting expertise, brand reputation, technology infrastructure, and human capital. These resources are vital for AIG's operations and long-term success. In 2024, the company focused on enhancing these assets to maintain its market position and drive growth.

| Resource | Description | 2024 Data/Fact |

|---|---|---|

| Financial Capital | Funds claim payments, investments, and ensures stability. | Shareholders' equity: ~$55B |

| Underwriting Expertise | Enables accurate risk assessment and policy pricing. | Improved combined ratio. |

| Brand Reputation | Boosts credibility, attracts customers. | Brand value: ~$13.5B. |

| Technology Infrastructure | IT systems, data analytics, digital tools. | ~$1.2B spent on IT/digital. |

| Human Capital | Skilled professionals in underwriting, claims. | ~46,000 employees. |

Value Propositions

AIG's value proposition includes comprehensive insurance, shielding clients from various risks. They offer financial protection for property damage, liability, and potential losses. This coverage gives peace of mind. In 2024, AIG's gross premiums written were over $36 billion, showcasing its market presence.

AIG offers customized risk management solutions, focusing on client-specific needs. Their experts evaluate risk exposures, creating tailored insurance programs. This ensures optimal coverage, minimizing losses. In 2024, AIG's net premiums written were over $26 billion, reflecting strong demand for its risk solutions.

AIG's value lies in its global expertise, serving clients in over 80 countries. This extensive reach enables consistent insurance coverage and risk management for multinational clients. In 2024, AIG's international operations contributed significantly to its revenue, reflecting its global footprint. This global presence also allows AIG to tap into diverse market opportunities.

Financial Strength and Stability

AIG's financial strength and stability are central to its value proposition. This ensures AIG meets its obligations to policyholders. AIG's robust capital base supports its ability to manage risks effectively. This allows AIG to pay claims promptly, even during economic challenges. This financial strength gives customers confidence in AIG's ability to protect their assets.

- AIG had a strong capital position with a $4.7 billion adjusted pre-tax income in 2023.

- AIG's disciplined underwriting practices are key to maintaining financial health.

- Effective risk management is used to withstand economic downturns.

- This stability is crucial for providing financial security to customers.

Innovative Solutions

AIG consistently introduces innovative insurance solutions, leveraging technologies like GenAI and Large Language Models to enhance its core business functions. This strategic shift ensures AIG remains competitive, adapting to evolving client needs with cutting-edge risk management and insurance products. In 2024, AIG invested significantly in AI, with initial projects showing promising efficiency gains in claims processing and underwriting. This forward-thinking approach solidifies its market position.

- AIG invested \$1 billion in technology and innovation in 2024.

- GenAI has reduced claims processing time by 15% in pilot programs.

- AIG's market share in the commercial insurance sector is 11% as of Q4 2024.

AIG's value proposition centers on comprehensive risk protection, offering insurance solutions globally. They provide customized risk management, tailoring coverage to meet specific client needs. AIG's financial strength and stability ensure reliable protection. Innovation, including AI, enhances its competitive edge.

| Value Proposition Element | Description | 2024 Data Highlights |

|---|---|---|

| Comprehensive Insurance | Wide-ranging protection from property to liability risks. | Gross premiums written: over $36B. |

| Customized Risk Solutions | Tailored insurance programs based on client needs. | Net premiums written: over $26B. |

| Global Expertise | Serving clients in over 80 countries. | Significant international revenue contribution. |

| Financial Strength | Ensuring obligations to policyholders are met. | $4.7B adjusted pre-tax income (2023). |

| Innovation | Leveraging technology like AI for better services. | $1B invested in tech and innovation; AI reduced claims time by 15%. |

Customer Relationships

AIG prioritizes personalized service, understanding individual customer needs for tailored insurance. Agents and representatives offer expert advice and address concerns. This approach boosts satisfaction and fosters lasting relationships. In 2024, AIG reported a customer retention rate of 88% due to these efforts. The company's focus on personalized service is a key driver of its business success.

AIG's online portals enable customers to manage policies, access information, and handle claims digitally. In 2024, digital interactions, including portal usage, accounted for over 60% of customer service interactions, reflecting a strong shift towards online self-service. These portals streamline policy management, offering features like bill payment and claims filing. This approach enhances customer satisfaction and operational efficiency by reducing the need for traditional channels.

AIG's claims support is a crucial aspect of its customer relationships, offering dedicated assistance. This support includes guiding customers through the claims process, answering their queries, and ensuring fair, timely claim processing. In 2024, AIG settled over 90% of claims within the agreed timeframe, showing its commitment to customer service. This reduces customer stress.

Broker and Agent Relationships

AIG depends heavily on brokers and agents to sell its insurance products. These partners are essential for reaching customers and offering support. AIG offers brokers and agents various resources to help them. This includes training and marketing materials, so they can effectively sell AIG's products.

- In 2024, AIG's distribution network included over 55,000 agents and brokers globally.

- AIG invested $150 million in agent training and technology in 2024.

- Broker-sourced premiums accounted for 80% of AIG's total premiums in 2024.

- AIG's agent retention rate improved to 78% in Q4 2024.

High-Net-Worth Channel

AIG's High-Net-Worth channel excels by providing bespoke services to wealthy clients, ensuring customer loyalty. This channel offers tailored insurance and risk management solutions with personalized attention. In 2024, the high-net-worth insurance market is estimated at $30 billion. AIG's focus strengthens client retention.

- Personalized service is crucial for high-net-worth clients.

- Specialized solutions address unique risk management needs.

- Customer loyalty is enhanced through dedicated attention.

- The high-net-worth market is a key growth area.

AIG prioritizes customer relationships through personalized service, online portals, and efficient claims support, aiming for satisfaction and loyalty. Digital interactions accounted for over 60% of customer service in 2024. The company leverages brokers and agents. AIG's high-net-worth channel offers bespoke services.

| Metric | 2024 Data | Impact |

|---|---|---|

| Customer Retention Rate | 88% | Demonstrates effective customer service |

| Digital Interactions | Over 60% | Enhances efficiency |

| Broker-Sourced Premiums | 80% | Shows distribution network's importance |

Channels

Independent agents form a key distribution channel for AIG, extending its reach across diverse markets. These agents offer tailored advice, guiding customers to suitable insurance solutions. In 2024, AIG's distribution network included over 40,000 independent agents. They provide local expertise and personalized service. This channel strategy supports AIG's customer acquisition and retention efforts, contributing to its revenue streams.

Brokers are a crucial channel for AIG, facilitating the distribution of insurance products. They act as intermediaries, connecting AIG with diverse clients, including businesses and individuals. Brokers, representing client interests, help find tailored insurance solutions. In 2024, broker-distributed premiums accounted for a significant portion of AIG's revenue, around 60%. This channel strategy provides broad market access.

AIG leverages online platforms to connect with customers directly. These platforms facilitate product research, quote generation, and policy purchases, enhancing customer experience. Online channels boost accessibility and convenience, broadening AIG's market reach. In 2024, digital sales accounted for over 30% of new policies. They reported a 10% increase in online customer engagement.

Partnerships

AIG's partnerships are key for distributing insurance products. They collaborate with financial institutions, broadening its reach. In 2024, these alliances contributed significantly to AIG's global premiums. Such collaborations allow AIG to access diverse customer segments.

- Distribution: Partnerships enhance product distribution.

- Market Access: They open doors to new customer bases.

- Cross-selling: Allows for offering products to partners' clients.

- Revenue: Boosted premiums due to these collaborations.

Direct Sales

AIG leverages direct sales channels for customer engagement. This includes a direct-response call center, supporting customers in English and Spanish. Direct sales provide AIG with control over the sales process. This ensures consistent customer service and brand representation. In 2023, direct sales contributed significantly to AIG's revenue, with a notable increase in customer satisfaction scores.

- Direct sales channels facilitate direct customer interaction.

- Call centers offer multilingual support, expanding reach.

- AIG maintains control over sales and service quality.

- Direct sales contributed to revenue growth in 2023.

AIG utilizes independent agents, expanding market reach with tailored advice; in 2024, the network had over 40,000 agents. Brokers connect AIG with clients; in 2024, they facilitated about 60% of AIG's premiums. Online platforms and partnerships are also vital distribution channels.

| Channel | Description | 2024 Impact |

|---|---|---|

| Independent Agents | Offer tailored insurance solutions and expert advice. | Over 40,000 agents contributed to sales. |

| Brokers | Intermediaries connecting AIG with clients. | About 60% of premiums were broker-distributed. |

| Online Platforms | Direct customer access for policy purchases. | Over 30% of new policies via digital channels. |

| Partnerships | Collaborations for wider market access. | Significant boost in global premiums. |

Customer Segments

Commercial clients represent a major customer segment for AIG, spanning various business sizes. AIG offers these clients property casualty insurance and liability coverage. This helps businesses safeguard assets and manage risks. In 2023, AIG's commercial lines generated $27.5 billion in gross premiums written.

Individual consumers are a key customer segment for AIG. In 2024, AIG offered life, auto, and homeowners insurance. These products are designed to safeguard individuals and their assets. AIG's focus on personal lines aims to provide financial security. The company serves millions of individual clients worldwide.

AIG serves high-net-worth individuals, offering bespoke insurance and financial services. These clients need tailored solutions for wealth protection and complex risk management. AIG's High-Net-Worth channel provides personalized service and expert advice. In 2024, the high-net-worth insurance market saw robust growth, with premiums increasing by an estimated 8%.

Multinational Corporations

Multinational corporations represent a pivotal customer segment for AIG, demanding extensive global insurance and risk management solutions. AIG's widespread international operations are crucial for delivering consistent services and coverage to these clients, spanning various countries. These tailored services are designed to help corporations effectively mitigate risks and maintain uninterrupted business operations. In 2023, AIG reported that its commercial lines generated $26.4 billion in gross premiums written, underscoring the importance of this segment.

- Global Reach: AIG operates in over 80 countries.

- Commercial Lines: Generated $26.4B in gross premiums written in 2023.

- Risk Management: Provides specialized services to manage global risks.

- Consistent Coverage: Ensures uniform service across multiple locations.

Small and Medium-Sized Enterprises (SMEs)

Small and Medium-Sized Enterprises (SMEs) form a crucial customer segment for AIG. AIG provides various insurance products designed for smaller businesses, such as property, liability, and workers' compensation coverage. These offerings help SMEs safeguard their operations, mitigate risks, and foster expansion. In 2024, the SME insurance market is estimated to be worth over $100 billion in North America, with AIG holding a significant share.

- SME insurance market size in North America: over $100 billion (2024 estimate).

- AIG offers tailored insurance products for SMEs.

- Coverage includes property, liability, and workers' compensation.

- These solutions help SMEs protect operations and manage risks.

AIG's customer base includes commercial clients, offering property and liability coverage; in 2023, gross premiums written totaled $27.5 billion. Individual consumers are another key segment, with products like life and homeowners insurance; AIG focuses on providing financial security for millions. High-net-worth individuals receive bespoke services; the high-net-worth market grew approximately 8% in 2024.

| Customer Segment | Description | 2023/2024 Data |

|---|---|---|

| Commercial Clients | Property & liability coverage for various businesses | $27.5B gross premiums written (2023) |

| Individual Consumers | Life, auto, homeowners insurance | Millions served worldwide (2024) |

| High-Net-Worth | Bespoke insurance & financial services | Market growth ~8% (2024) |

Cost Structure

Claims expenses are a significant cost driver for AIG, reflecting payments to policyholders for covered losses. In 2023, AIG's claims and claim adjustment expenses were substantial. Effective claims management and underwriting are crucial to control these costs. Efficient management of these expenses helps AIG maintain profitability and financial stability.

Underwriting expenses at AIG are the costs for risk assessment and pricing. These include salaries, data analytics, and other costs. Accurate risk assessment is key to managing these expenses. In 2023, AIG's underwriting expenses were substantial. The company invested heavily in data analytics. This is to improve accuracy in pricing.

Operating expenses cover AIG's business running costs, like salaries and marketing. AIG aims to cut costs via programs like AIG Next. In Q3 2023, AIG's general operating expenses were $768 million. Reducing these expenses is key to boosting profit. AIG's strategic focus is on cost efficiency.

Technology Investments

Technology investments are a substantial cost for AIG, driving its digital transformation and innovation initiatives. These investments cover IT systems, data analytics platforms, and AI technologies. AIG's strategic tech spending is essential for maintaining competitiveness and enhancing operational efficiency. In 2024, AIG allocated a significant portion of its budget to technology, with over $1 billion earmarked for digital initiatives.

- Over $1 billion earmarked for digital initiatives in 2024.

- Focus on IT systems to improve operational efficiency.

- Investment in data analytics to enhance decision-making.

- Strategic tech spending to stay competitive.

Reinsurance Costs

Reinsurance costs are premiums AIG pays to transfer risk. These costs help manage exposure to large claims and disasters. In 2024, AIG's reinsurance expenses were a significant part of its operating costs, reflecting its risk management strategy. Effective reinsurance protects AIG's financial health, ensuring it meets policyholder obligations.

- In 2024, AIG reported reinsurance costs as a key expense category.

- These costs are vital for mitigating financial impacts from major events.

- Reinsurance helps maintain AIG's solvency and claims-paying ability.

- AIG regularly reviews and adjusts its reinsurance programs.

AIG's cost structure includes claims, underwriting, operating, and technology expenses, alongside reinsurance costs. Claims expenses are influenced by policyholder losses, with effective management being key. Underwriting expenses cover risk assessment and pricing, where data analytics play a critical role. Operating expenses cover business running costs, and AIG aims for cost efficiency.

| Expense Type | Description | 2024 Data |

|---|---|---|

| Claims | Payments for covered losses. | Significant, influenced by underwriting and risk. |

| Underwriting | Risk assessment and pricing costs. | Investment in data analytics for precision. |

| Operating | Running costs. | Focus on cost reduction programs. |

Revenue Streams

AIG's property casualty insurance premiums are a major revenue source. These premiums cover property damage and liability. In 2024, AIG's General Insurance net premiums written were $26.8 billion. This revenue supports their insurance operations, providing financial stability.

Premiums from life insurance are a key revenue stream for AIG. These premiums offer financial security to clients. In 2024, life insurance premiums formed a significant portion of AIG's total revenue. This revenue supports AIG's overall financial health and expansion.

Investment income is a crucial revenue stream for AIG, stemming from the strategic investment of collected premiums. AIG diversifies its investments across various asset classes to boost returns and overall revenue. In 2024, AIG's investment portfolio totaled around $270 billion. Effective investment strategies are key to maximizing this income and strengthening AIG's financial health.

Fees from Financial Services

AIG generates revenue through fees from financial services. These include offerings like retirement products and investment management, diversifying its income streams. Financial services fees allow AIG to leverage its financial planning and wealth management expertise. In 2023, AIG reported significant revenue from its Life and Retirement segment.

- In 2023, AIG's Life and Retirement segment generated substantial revenue.

- Fees from financial services contribute to AIG's overall financial performance.

- AIG's expertise in financial planning drives fee-based income.

- These fees support the company's diversified revenue model.

Reinsurance Commissions

AIG's revenue streams include reinsurance commissions, a significant component of its financial strategy. The company leverages structures such as Syndicate 2478 at Lloyd's to facilitate this. AIG earns fees by connecting insurance risks with investors, creating an additional income source. This approach enhances AIG's reinsurance capabilities, contributing to its overall financial performance.

- Reinsurance commissions are a key revenue driver for AIG, reflecting its role in the insurance market.

- Syndicate 2478 at Lloyd's is an example of AIG's innovative structures.

- AIG's strategy generates fees by connecting insurance risk with investors.

- This mechanism enhances AIG's reinsurance capabilities and boosts revenue.

AIG's diverse revenue streams include property casualty, life insurance premiums, and investment income. Financial services fees and reinsurance commissions also generate substantial revenue. In 2024, AIG's focus remained on maximizing returns from all sources.

| Revenue Stream | Description | 2024 Data (Approx.) |

|---|---|---|

| Property Casualty Premiums | Premiums from insurance policies. | $26.8B Net Premiums Written |

| Life Insurance Premiums | Premiums from life insurance products. | Significant portion of revenue |

| Investment Income | Income from invested premiums. | $270B Investment Portfolio |

Business Model Canvas Data Sources

The AIG Business Model Canvas is informed by market analysis, financial reports, and customer insights. Data from these sources ensures robust strategic alignment.