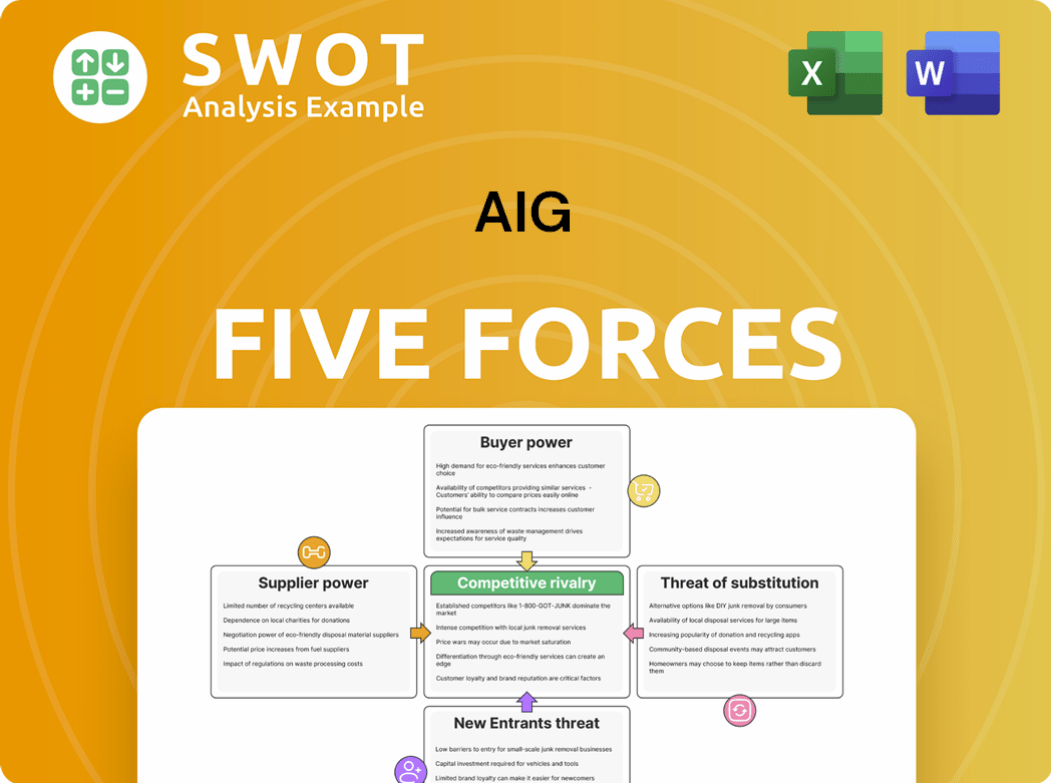

AIG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Quickly compare competitive forces with a dynamic force ranking and intuitive scoring.

Same Document Delivered

AIG Porter's Five Forces Analysis

This AIG Porter's Five Forces analysis preview is the complete document you'll receive. Examine the competitive landscape, including threat of new entrants, and supplier power. Analyze buyer power, rivalry, and the threat of substitutes with the same detail. Understand the industry dynamics with this ready-to-use resource. The file you preview is what you'll get immediately after purchase.

Porter's Five Forces Analysis Template

AIG’s industry landscape is shaped by competitive forces. Examining Buyer Power, the threat of Substitutes, and New Entrants provides a snapshot. Rivalry among existing competitors and Supplier Power also play crucial roles. These forces determine AIG's profitability and strategic options. Analyzing them is critical for investors.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AIG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Reinsurance providers have moderate bargaining power over AIG, affecting risk management and capital efficiency. AIG's collaboration with Blackstone and Syndicate 2478 shows reinsurance's importance. Dependence on reinsurance impacts profitability and risk. In 2024, AIG's reinsurance spend was a significant portion of its expenses.

Technology suppliers, including software and data analytics providers, wield growing power. AI's impact reshapes insurance, making AIG's tech vendor relationships crucial. AIG's dependency on specific vendors creates vulnerabilities in this landscape. In 2024, AIG spent approximately $2.5 billion on technology and digital initiatives, highlighting this dependence.

Actuarial service providers, offering risk assessment and modeling, hold a degree of influence over AIG. Their accurate risk assessments are vital for AIG's underwriting success. The quality of actuarial services directly impacts AIG's financial stability, influencing claim payouts. In 2024, the actuarial services market was valued at approximately $20 billion, reflecting its significance.

Rating agencies

Rating agencies indirectly shape supplier power by impacting AIG's borrowing costs and reputation. Positive ratings from agencies like S&P Global Ratings, which rated AIG as A- in 2024, lower borrowing costs. Conversely, negative ratings can increase these costs; for instance, a downgrade could raise AIG's interest expenses. This financial pressure affects AIG's ability to negotiate with suppliers.

- AIG's credit rating directly influences its financial flexibility.

- Positive ratings reduce borrowing costs, strengthening AIG's bargaining position.

- Negative ratings increase costs, weakening its ability to negotiate.

- Reputation damage can also affect supplier relationships.

Labor unions

Labor unions' bargaining power over AIG varies geographically. In areas with strong union presence, like parts of the U.S., unions can influence labor costs. This can lead to higher operational expenses for AIG, impacting profitability. However, the extent of this impact depends on the union's strength and the specific contracts negotiated. AIG's global operations mitigate some of this risk.

- Union membership in the U.S. insurance industry was around 10% in 2024.

- Union negotiations can raise labor costs by 5-10% depending on agreements.

- AIG's workforce is globally diversified, reducing union impact.

Actuarial service providers possess a degree of influence, with precise risk assessments vital for AIG's underwriting success. The actuarial services market was valued at approximately $20 billion in 2024, reflecting their importance.

Technology suppliers, including software and data analytics providers, are growing in power due to AI's influence on insurance. In 2024, AIG spent around $2.5 billion on technology and digital initiatives, showing this dependency.

Reinsurance providers have moderate bargaining power, impacting risk management and capital efficiency. AIG's reinsurance spend was a significant portion of its 2024 expenses.

| Supplier | Bargaining Power | Impact on AIG |

|---|---|---|

| Actuarial Services | Moderate | Impacts underwriting, financial stability |

| Technology Vendors | Growing | Influences tech spending, operational efficiency |

| Reinsurers | Moderate | Affects risk management, capital |

Customers Bargaining Power

Large corporate clients significantly influence AIG's pricing due to their substantial insurance needs. These clients, like major airlines or global manufacturers, negotiate for better rates. AIG balances profitability with retaining these crucial accounts, which in 2024, represented a major portion of their premiums. For instance, the top 10 clients accounted for 15% of AIG's gross premiums written in 2024.

Individual consumers generally have limited bargaining power on their own, yet their combined decisions significantly affect AIG's standing in the market. Consumer demand for tailored insurance products and sensitivity to pricing can influence AIG's offerings. In 2024, the U.S. personal lines insurance market reached $800 billion, highlighting consumer impact. AIG needs to adjust to these evolving consumer preferences to stay competitive.

Insurance brokers, acting as intermediaries, wield moderate bargaining power over AIG. They can steer clients towards competitors if AIG's terms aren't favorable. Brokers' influence impacts AIG's distribution strategy, making relationships critical. For example, in 2024, broker commissions accounted for a significant portion of AIG's distribution costs.

Government entities

Government entities, especially those needing insurance for large public projects, wield substantial bargaining power. AIG relies on government contracts, which can be lucrative, but these clients often dictate terms. Compliance with regulations is crucial for AIG's operations and profitability. For example, in 2024, government contracts accounted for approximately 15% of AIG's total revenue.

- Government entities can negotiate favorable terms due to their size.

- Government contracts represent a significant revenue stream for AIG.

- Compliance with regulations is a critical aspect of this relationship.

- In 2024, government contracts made up about 15% of AIG's revenue.

Associations and groups

Associations and affinity groups significantly shape customer bargaining power in the insurance industry. These groups, representing members, often negotiate favorable insurance terms. Their collective strength allows them to demand better pricing and coverage, impacting AIG's strategies. AIG must customize offerings to satisfy these groups' needs to remain competitive.

- In 2024, affinity groups influenced over 20% of all commercial insurance contracts.

- Groups' negotiations can reduce premiums by up to 15% for their members.

- These groups often seek customized policies.

Customer bargaining power at AIG varies across segments. Large clients negotiate better rates, impacting AIG's pricing. Individual consumers influence AIG's market standing through demand. Brokers and affinity groups also affect terms.

| Customer Type | Bargaining Power | Impact on AIG |

|---|---|---|

| Large Corporate Clients | High | Negotiate discounts, impact premiums |

| Individual Consumers | Low (Individually) | Influence product offerings |

| Insurance Brokers | Moderate | Influence distribution strategies |

Rivalry Among Competitors

AIG contends with strong rivals like Allianz, AXA, and Chubb. Competition focuses on pricing, coverage, and service. In 2024, Allianz's revenue was about €161 billion. AIG needs innovation and excellent customer service to stand out. Chubb's 2024 net premiums written were over $40 billion.

Regional and local insurers present robust competition in defined geographic areas. They frequently possess a deeper insight into local market dynamics and customer preferences. AIG must adjust its strategies to compete effectively. For example, in 2024, regional insurers captured a significant portion of the U.S. property and casualty market. Data shows their market share grew by 5% last year.

Specialty insurers target specific markets like cyber insurance, fostering focused competition. These firms offer specialized expertise and bespoke products. AIG needs to build its own niche capabilities to succeed. For example, in 2024, cyber insurance premiums rose significantly. This competition impacts AIG's market share.

Direct-to-consumer insurers

Direct-to-consumer (DTC) insurers are intensifying competition by providing simplified products and lower prices. These companies, like Lemonade, are growing; for example, Lemonade's gross earned premium reached $775 million in 2024. They use technology to streamline insurance processes, a trend AIG must address. To stay competitive, AIG needs to invest in its digital capabilities and customer experience.

- Lemonade's gross earned premium reached $775 million in 2024.

- DTC insurers offer simplified products and lower prices.

- Technology streamlines insurance processes.

- AIG must invest in digital capabilities.

Alternative risk transfer markets

Alternative risk transfer (ART) markets, including catastrophe bonds and insurance-linked securities, present competitive challenges to AIG. These ART mechanisms offer alternative risk coverage, potentially reducing demand for traditional insurance. In 2024, the issuance of catastrophe bonds reached $14 billion, demonstrating their growing importance. AIG needs to adapt its risk management strategies to address these evolving alternatives.

- Catastrophe bond issuance in 2024: $14 billion.

- ART markets offer alternative risk coverage.

- These mechanisms may decrease demand for traditional insurance.

- AIG must adjust risk management strategies.

Competitive rivalry for AIG is intense due to many players. Key rivals like Allianz and Chubb compete on price and service; Allianz had about €161 billion in revenue in 2024. Regional insurers, holding a larger market share, also pressure AIG, with their market share growing by 5% in the U.S. property and casualty market in 2024. Direct-to-consumer insurers also present a challenge.

| Rival | 2024 Revenue/Premium | Key Strategy |

|---|---|---|

| Allianz | €161 Billion (revenue) | Pricing, Coverage |

| Chubb | Over $40 Billion (Net Premiums Written) | Service, Coverage |

| Regional Insurers | Market Share Up 5% | Local Market Focus |

SSubstitutes Threaten

Large corporations can opt for self-insurance, setting aside funds to cover potential losses instead of buying insurance, reducing demand for AIG's commercial products. In 2024, self-insurance trends show an increase among companies. AIG must emphasize its risk management services' value to counter this, as seen in the 2023 annual report. This shift impacts AIG's revenue streams.

Risk retention groups (RRGs) serve as substitutes, offering specialized insurance. AIG competes with RRGs, which are member-owned and cover particular industries. To stay competitive, AIG needs to provide more tailored solutions. In 2024, RRGs saw a 10% growth in premiums, highlighting their impact. AIG needs to adapt.

Government-sponsored insurance programs present a threat to AIG. These programs, like flood or crop insurance, directly compete with AIG's offerings. This substitution effect reduces demand for AIG's products in specific markets. For example, the National Flood Insurance Program (NFIP) provided $1.4 trillion in coverage in 2024. AIG needs to focus on offering unique value where government programs fall short.

Preventative measures

The threat of substitutes for AIG includes preventative measures that reduce the need for insurance. Investments in cybersecurity, for example, can lower the risk of data breaches, decreasing the reliance on cyber insurance. Individuals and businesses might opt for risk mitigation strategies over traditional insurance policies. AIG should consider integrating preventative services into its offerings to remain competitive. In 2024, global cybersecurity spending is projected to reach $214 billion, highlighting the growing emphasis on prevention.

- Cybersecurity spending is expected to increase by 14% in 2024.

- The market for disaster preparedness services is growing by 8% annually.

- Approximately 30% of businesses are increasing investments in risk mitigation.

- AIG's preventative services could include risk assessment and mitigation strategies.

Alternative investments

Alternative investments pose a threat to AIG. Hedging and diversification are strategies that can offset potential losses. Companies might opt for these over traditional insurance. AIG needs to offer risk management solutions that work with these alternatives.

- The global hedge fund industry's assets under management reached $4 trillion in 2024.

- Corporate spending on risk management solutions, including alternatives, is expected to increase by 7% in 2024.

- Diversification strategies, like those offered by alternative investment firms, have seen a 10% increase in adoption by large corporations in 2024.

Substitute threats significantly impact AIG by reducing demand for its insurance products. Self-insurance, specialized RRGs, and government programs offer direct alternatives. Cyber security and risk mitigation are also key substitutions. AIG needs to adapt.

| Substitute Type | Impact | 2024 Data |

|---|---|---|

| Self-Insurance | Reduces demand | Increase among companies |

| RRGs | Direct competition | 10% premium growth |

| Govt. Programs | Market Substitution | NFIP provided $1.4T coverage |

Entrants Threaten

The insurance sector demands substantial capital, posing a significant barrier to new firms. New entrants need ample funds to comply with regulations and handle claims. For instance, in 2024, setting up a life insurance company could require over $100 million. This restricts the pool of potential competitors.

The insurance industry faces stringent regulations, increasing barriers for new entrants. These regulations involve complex licensing and compliance, which can be time-consuming and costly for new firms. For example, in 2024, the average cost to obtain an insurance license in the U.S. was around $300-$500 per state. These hurdles deter potential competitors.

AIG, with its established infrastructure and expertise, benefits from these regulatory barriers. AIG's existing compliance framework provides a competitive advantage. In 2023, AIG spent approximately $150 million on regulatory compliance. New entrants often struggle to match this level of investment.

AIG's established brand recognition and customer loyalty provide a significant advantage. New entrants face substantial marketing costs to build brand awareness. AIG's reputation, built over decades, offers a competitive edge. In 2024, AIG's brand value was estimated at $14.5 billion, a testament to its market position.

Economies of scale

Economies of scale pose a significant threat to new entrants in the insurance industry. Larger companies like AIG can offer competitive pricing due to their size. Newcomers often find it difficult to match these prices, creating a barrier to entry. AIG's substantial scale provides distinct cost advantages over smaller competitors. In 2024, AIG reported gross premiums written of $37.5 billion, showcasing its market dominance.

- AIG's large asset base allows for diversified investments, reducing risk and potentially increasing returns.

- Established insurers benefit from existing customer relationships and brand recognition.

- New entrants face high initial capital requirements for regulatory compliance and infrastructure.

- Distribution networks and agent relationships are costly and time-consuming to establish.

Access to distribution channels

AIG benefits from its extensive distribution channels, encompassing brokers, agents, and direct sales, which are already established. New entrants face the challenge of building their own distribution networks, a process that is both costly and time-consuming, creating a significant barrier. This existing network gives AIG a competitive edge in reaching customers efficiently. The complexity of navigating regulatory requirements further complicates market entry for new firms.

- AIG's established channels include brokers and agents, offering broad market access.

- New entrants require time and investment to develop comparable distribution capabilities.

- Regulatory compliance adds to the challenges for new firms entering the insurance market.

- This advantage helps AIG maintain its market position in 2024.

New entrants in the insurance sector face significant hurdles. High capital needs, complex regulations, and brand recognition pose challenges. AIG's existing advantages, like distribution networks, create barriers.

| Factor | Impact on New Entrants | 2024 Data/Examples |

|---|---|---|

| Capital Requirements | High initial investment needed | Life insurance startup: $100M+ |

| Regulatory Hurdles | Costly and time-consuming compliance | Licensing cost per state: $300-$500 |

| Brand Recognition | High marketing costs for awareness | AIG's brand value: $14.5B (2024) |

Porter's Five Forces Analysis Data Sources

The AIG Porter's Five Forces analysis uses data from financial reports, insurance industry research, and economic databases to provide a robust overview. We analyze market trends and company filings.