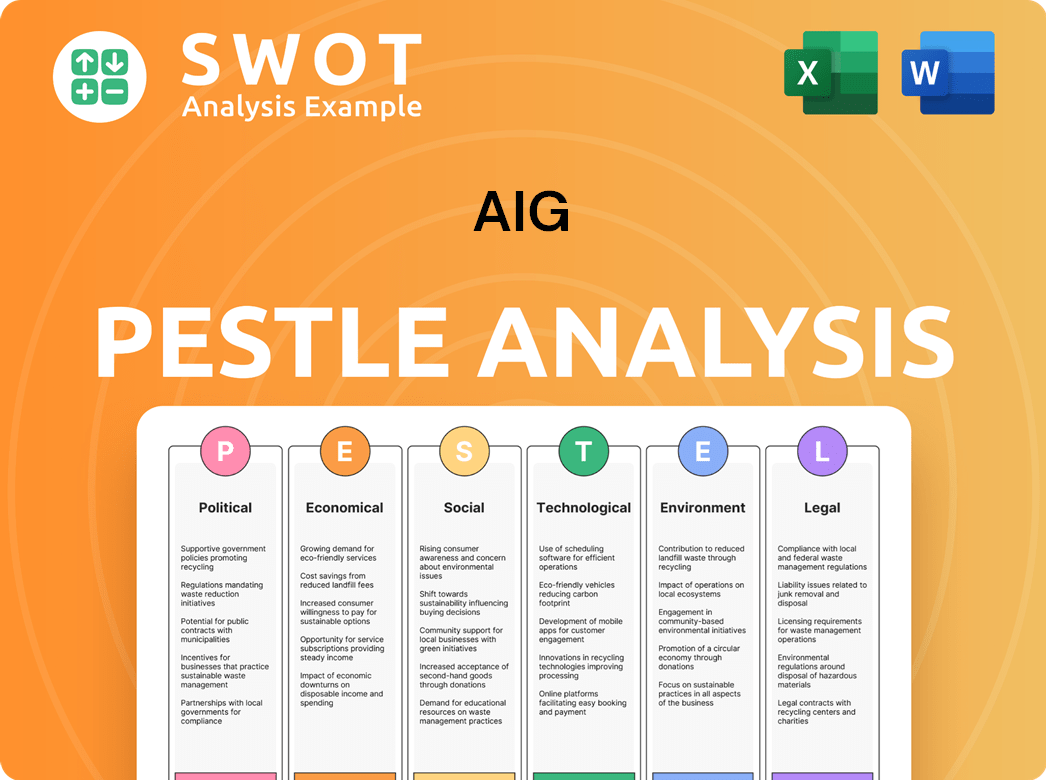

AIG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIG Bundle

What is included in the product

Examines AIG's environment, covering Political, Economic, Social, Technological, Environmental, and Legal factors. Provides insightful evaluation backed by data and current trends.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

AIG PESTLE Analysis

Preview the comprehensive AIG PESTLE analysis now. It thoroughly examines political, economic, social, technological, legal, and environmental factors affecting AIG. This detailed document is ready for your use after purchase.

PESTLE Analysis Template

Explore the external forces impacting AIG with our focused PESTLE analysis. Uncover key trends across political, economic, social, technological, legal, and environmental factors. This report offers crucial insights for understanding AIG's strategic landscape and challenges. Improve your market strategy using expert intelligence and informed decisions. Get the complete analysis instantly and gain a competitive edge.

Political factors

Ongoing conflicts and geopolitical tensions, especially in regions like the Middle East and Ukraine, heighten political risks for global businesses. These events increase market volatility and can cause operational disruptions. For instance, in 2024, the Russia-Ukraine war continues to impact global markets. Election year in many countries introduces uncertainty and potential policy shifts.

Governments globally are intensifying scrutiny of the insurance sector, focusing on systemic risks and financial stability. Regulatory bodies, like the IAIS, are working to harmonize and strengthen insurance regulations worldwide. AIG actively engages with government officials on critical issues. For example, AIG's 2024 financial reports show they are adapting to evolving regulatory landscapes.

Global trade tensions and protectionist measures pose risks to AIG. For instance, in 2024, the US-China trade dispute continues to impact international business. These shifts alter risk profiles, requiring coverage reassessment. AIG must adapt to changing trade dynamics, which influence their international operations. The World Bank reports a slowdown in global trade growth for 2024-2025, intensifying these concerns.

Political Risk Insurance Demand

Increased political violence and instability globally are pushing businesses with international operations to seek more political risk insurance. AIG is a prominent player in this market, providing coverage against various risks. In 2024, the political risk insurance market saw substantial growth, with premiums reaching an estimated $2.5 billion. AIG's market share in this sector is around 15-20%.

- Expropriation coverage

- Political violence protection

- Currency inconvertibility insurance

- AIG's market share

Policy Changes and Political Polarization

Political polarization and populist movements introduce uncertainty, influencing governance and policy shifts that affect market stability. These changes can impact economic conditions and trade barriers; consider the potential for nationalization. For instance, in 2024, political instability in several regions increased investment risk. AIG must navigate these risks.

- Increased volatility in emerging markets due to political shifts.

- Potential for higher trade barriers impacting international insurance operations.

- Greater scrutiny of multinational corporations by populist governments.

Political factors significantly impact AIG, with ongoing conflicts and geopolitical tensions, especially in regions like the Middle East and Ukraine, causing operational disruptions and market volatility. Governments globally are intensifying scrutiny of the insurance sector and are actively engaging with government officials on critical issues; in 2024, the political risk insurance market saw substantial growth.

Trade tensions, political violence, and populism pose risks, affecting AIG's operations and coverage needs, demanding adaptive strategies, AIG is a prominent player, offering coverage against various risks such as expropriation, political violence, and currency inconvertibility, securing about 15-20% market share, providing critical insurance.

| Factor | Impact on AIG | 2024-2025 Data |

|---|---|---|

| Geopolitical Risks | Market Volatility, Operational Disruptions | Russia-Ukraine War, US-China Trade Disputes continue |

| Regulatory Scrutiny | Increased Compliance Costs | IAIS regulations; 2024 Financial reports showed adaptations. |

| Political Instability | Increased Demand for Insurance | $2.5B Political Risk Insurance market (2024); AIG 15-20% market share. |

Economic factors

Global economic growth remains steady, though inflation remains a concern. The U.S. inflation rate in March 2024 was 3.5%, impacting consumer spending. High inflation can reduce disposable income. Persistently high interest rates, like the current Federal Reserve rates, can increase borrowing costs.

Interest rate volatility is a significant concern for AIG. Fluctuating rates affect investment returns and solvency. Life insurers struggle, and low rates can hinder profitability. The Federal Reserve maintained rates in early 2024, impacting AIG's investment strategy. As of Q1 2024, yields on 10-year US Treasury notes remained around 4%, influencing AIG's financial planning.

Insurers like AIG heavily invest in financial markets; market volatility directly affects investment returns. For instance, in Q4 2023, AIG's net investment income rose to $3.5 billion. Investment performance is a key risk factor, particularly for life insurers. AIG's shift towards alternative investments raises supervisory concerns about valuation and liquidity. In 2024, alternative investments make up a growing part of the investment portfolio.

Underwriting and Claims Costs

The non-life insurance sector, including AIG, faced increased claims severity due to inflation and supply chain issues, though these pressures are easing. AIG actively manages liquidity risk through asset-liability management and stress testing. Higher investment yields are anticipated to help offset some of the financial impacts. For 2024, analysts forecast a combined ratio improvement for AIG.

- Claims severity driven by inflation and supply chain shortages.

- Proactive asset-liability management and stress testing.

- Higher investment yields expected to provide relief.

- Combined ratio improvement expected for AIG in 2024.

Demand for Insurance Products

Economic factors significantly shape the demand for insurance products. Financial pressures can affect consumer choices, yet the need for essential insurance remains. The life insurance market is poised for continued growth. Non-life insurance is expected to see moderate expansion. In 2024, the global insurance market was valued at $6.7 trillion, with projected growth.

- Life insurance market projected to grow steadily.

- Non-life insurance expected to see moderate growth.

- Global insurance market valued at $6.7 trillion in 2024.

- Economic conditions directly impact insurance demand.

Economic factors such as inflation and interest rates directly affect AIG’s financial performance. The U.S. inflation rate was 3.5% in March 2024, impacting consumer spending. Fluctuating interest rates and market volatility remain key concerns for the company's investment returns.

| Metric | Value | Period |

|---|---|---|

| U.S. Inflation Rate | 3.5% | March 2024 |

| 10-year US Treasury Yields | ~4% | Q1 2024 |

| Global Insurance Market Size | $6.7 Trillion | 2024 |

Sociological factors

The aging global population, with those over 65 projected to reach 16% by 2050, concentrates wealth, influencing insurance demand. Shifting social norms, including declining marriage rates (5.1 per 1,000 in the US in 2022), challenge traditional models. Dual-income households and evolving living arrangements create opportunities for innovative, flexible insurance products. This requires AIG to adapt its offerings to meet diverse needs.

Customer expectations are evolving, pushing for tailored insurance solutions. Demand is rising for on-demand and micro-insurance, plus AI-driven personalized policies, emphasizing flexibility and accessibility. Omnichannel experiences are becoming standard. A 2024 report shows a 15% increase in demand for flexible insurance options. In 2025, expect further shifts as tech integration enhances user experience.

Societal tensions, amplified by polarization and economic inequality, are on the rise. The widening retirement savings gap, with nearly half of U.S. households nearing retirement having inadequate savings, exacerbates these issues. Globally, civil unrest is increasing, fueled by inflation and wealth disparities, potentially impacting insurance operations. AIG, like other insurers, faces heightened scrutiny to provide financial security.

Awareness of Risk and Need for Protection

Societal shifts underscore the importance of insurance. Cybercrime, climate change, and economic instability drive demand for financial protection. Insurers must offer accessible, affordable products to close protection gaps. For instance, the global cyber insurance market is projected to reach $20 billion by 2025.

- Cybercrime losses are expected to reach $10.5 trillion annually by 2025.

- Climate-related disasters caused $280 billion in damages in 2023.

- The global insurance protection gap exceeds $1.2 trillion.

Talent and Workforce Challenges

The insurance sector, including AIG, grapples with talent acquisition and retention, especially attracting younger professionals familiar with advanced tech. Demand is growing for experts in data analytics, digital marketing, and cybersecurity within the industry. Equipping employees with modern tools is vital for retaining talent, which is a key focus area. A recent report indicates that 60% of insurance firms are investing in digital transformation to attract and retain talent.

- Data analytics skills are needed in the insurance sector due to the increasing use of AI and machine learning.

- Digital marketing is important for reaching customers and promoting insurance products.

- Cybersecurity is critical to protect customer data and prevent fraud in the industry.

Societal factors are crucial for AIG's strategy.

Aging populations and declining marriage rates impact insurance needs, demanding tailored products. Polarization and economic inequality increase societal tensions.

This drives the demand for financial security. The global insurance protection gap exceeds $1.2 trillion.

| Factor | Impact | Data |

|---|---|---|

| Aging population | Increased demand for retirement & health insurance | Over 65s will reach 16% globally by 2050. |

| Social Norms | Need for flexible insurance options | U.S. marriage rate in 2022: 5.1 per 1,000. |

| Economic Inequality | Higher scrutiny on financial security | Cybercrime losses are projected to hit $10.5 trillion in 2025. |

Technological factors

Digital transformation is reshaping the insurance landscape, with insurtechs driving innovation. Digital platforms enhance customer interactions and streamline processes. AIG utilizes AI to boost decision-making and automate workflows. Globally, the insurtech market is projected to reach $1.5 trillion by 2030, reflecting rapid growth.

Artificial intelligence (AI) and machine learning (ML) are revolutionizing insurance. AIG uses AI to speed up services, cut errors, and automate. By 2024, AI-driven fraud detection saved insurers billions. AIG's early adoption of generative AI aims to scale across its business.

Expanding data volumes are opening new possibilities in risk assessment, pricing, and partnerships. Big data analytics provides insurers with insights into customer behavior and risks, allowing for tailored recommendations. Data-driven risk assessment models are growing in importance, particularly for addressing climate-related challenges. In 2024, the global big data analytics market in insurance was valued at $4.8 billion.

Internet of Things (IoT)

The Internet of Things (IoT) significantly impacts AIG. IoT devices enable real-time data collection for precise risk assessments, fostering customized products and premiums. This technology extends beyond standard insurance, monitoring air quality and detecting wildfires, enhancing risk management. The global IoT market is projected to reach $1.1 trillion by 2026, offering AIG substantial opportunities.

- IoT adoption in insurance is growing rapidly.

- AIG is exploring IoT applications.

- Data security is a key concern.

- The market is expanding.

Cybersecurity Threats

Cybersecurity threats are a significant concern for AIG and the insurance industry. They demand strong security and processes to protect against potential threats and customer data. The increasing potential for loss from cyber events is boosting demand for cyber insurance. In 2024, the global cyber insurance market was valued at approximately $20 billion.

- Cyberattacks are increasing in frequency and sophistication.

- AIG must invest in advanced cybersecurity measures.

- Cyber insurance premiums are expected to rise.

Technological advancements, like AI, are central to AIG's digital strategy, boosting efficiency. IoT applications offer enhanced risk assessment and tailored products. Cybersecurity threats require robust protection, given the rising cyber insurance demand, valued at $20B in 2024.

| Technology | Impact on AIG | Market Data (2024) |

|---|---|---|

| AI/ML | Speeds up processes, reduces errors. | AI-driven fraud detection saved insurers billions. |

| IoT | Real-time data, customized premiums. | Global IoT market valued at $850B. |

| Cybersecurity | Protects against threats, data security. | Cyber insurance market was valued at $20 billion. |

Legal factors

Insurance regulation is complex globally, with increased scrutiny and efforts to harmonize rules. The IAIS sets standards for effective sector supervision. AIG actively engages with regulators on key issues. In 2024, global insurance premiums reached $6.7 trillion, reflecting the industry's vastness and regulatory impact. AIG must comply with these regulations.

AIG, previously a systemically important financial institution (SIFI), faced heightened regulatory scrutiny. Although AIG is no longer designated as a SIFI, the focus on systemic risk remains. In 2024, regulators continue to monitor insurers' risk profiles. This includes stress tests and capital adequacy assessments. The goal is to prevent financial instability, ensuring the insurance sector's resilience.

AIG must adhere to complex compliance standards globally. Insurers are under pressure to meet new reporting demands. RegTech solutions are critical for automated compliance, especially as regulatory changes occur. In 2024, AIG invested $150 million in RegTech to improve regulatory reporting and compliance.

Data Privacy and Algorithmic Bias

Technological advancements, especially in AI, bring forth new legal and regulatory hurdles concerning data privacy and algorithmic bias for AIG. Insurers must proactively manage these challenges, establishing robust governance to guarantee ethical AI use and regulatory compliance. For instance, the EU's GDPR has led to a 20% increase in data protection spending among financial institutions since 2018. AIG must adapt.

- Data breaches in the insurance sector have increased by 15% in the last year.

- Algorithmic bias lawsuits have risen by 25% in 2024.

- GDPR fines for data breaches can reach up to 4% of global annual turnover.

Emerging Risks and Legal Interpretations

AIG faces legal hurdles from evolving risks like climate change and cyber threats, which challenge existing policy interpretations and could set new legal precedents. Litigation risks on specific policies are also a concern. For example, in 2024, climate-related litigation saw a surge, with over 2,000 cases globally. Insurers like AIG must adapt to these legal shifts to manage financial and reputational risks. Legal costs for insurance companies have also been increasing, with some firms reporting double-digit growth in litigation expenses.

- Climate change litigation cases have increased by over 20% in the last year.

- Cybersecurity breaches led to $6 billion in insurance payouts in 2024.

- Legal and regulatory changes can influence insurance premiums.

- Litigation expenses for insurers can rise up to 15%.

Legal and regulatory demands for AIG are rapidly evolving, influencing how it operates. Data privacy and algorithmic bias are becoming major compliance challenges. Litigation linked to climate change and cyber threats is on the rise.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Data breaches | Increased compliance costs | Data breaches in sector +15% |

| Algorithmic bias | Higher litigation risks | Bias lawsuits rose +25% |

| Climate litigation | Financial and reputational risk | Climate cases +20% increase |

Environmental factors

Climate change intensifies natural disasters, hitting insurers hard. The industry faces rising claims, squeezing profits and capital. For instance, in 2024, insured losses from natural catastrophes reached $118 billion globally. Insurers manage physical risks in underwriting and investments.

The shift to a low-carbon economy is impacting insurers. AIG faces transition risks due to investments in sectors affected by climate policies. Insurers must evaluate their exposure. For instance, renewable energy investments surged, with over $300 billion invested in 2024.

ESG factors significantly influence the insurance sector, emphasizing sustainability and eco-friendly products. AIG actively pursues net-zero emissions across its business segments. In 2024, ESG-linked investments in the insurance sector reached $3.5 trillion. AIG's sustainability initiatives align with this trend, aiming for long-term environmental and financial benefits. Regulatory pressures are also driving ESG integration.

Nature-Related Risks

The insurance sector, including AIG, is broadening its view of environmental risks beyond climate change. It now encompasses nature-related risks tied to the depletion of natural resources and the move toward a 'nature-positive' approach. These ecological shifts pose financial risks for underwriting and investment activities. A 2024 report estimated that nature-related risks could cost the global economy $2.7 trillion annually by 2030.

- Destruction of natural capital leads to financial risks.

- 'Nature-positive' strategies are becoming increasingly important.

- Insurers face underwriting and investment challenges.

- Global economic losses due to nature-related risks are projected.

Environmental Liability and Emerging Contaminants

Environmental liability insurance covers pollution and contamination risks, a critical aspect for AIG. The market faces challenges from emerging contaminants, especially PFAS. These "forever chemicals" lead to heightened underwriting and potential substantial liabilities. The EPA has proposed regulations for PFAS, which could increase costs for businesses.

- The global environmental liability insurance market was valued at USD 13.5 billion in 2023.

- PFAS-related claims could cost insurers billions, with estimates varying widely.

- Underwriting standards are tightening, with premiums potentially increasing due to these risks.

Environmental factors pose substantial risks to AIG's operations. Climate change and natural disasters continue to impact insurance payouts. The shift to a low-carbon economy and ESG trends shape the future of the insurance industry. The 2024 global insured losses from natural catastrophes reached $118 billion.

| Environmental Aspect | Impact | 2024 Data/Examples |

|---|---|---|

| Climate Change | Increased claims from disasters | Insured losses: $118B |

| Transition Risks | Exposure to climate policies | Renewable energy investments: $300B+ |

| ESG Factors | Sustainability pressures | ESG-linked investments: $3.5T |

PESTLE Analysis Data Sources

The AIG PESTLE Analysis utilizes diverse data from financial reports, legal databases, and government sources to create a robust overview. These inputs cover economics, technology, and legislation relevant to AIG.