Allegiant Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allegiant Bundle

What is included in the product

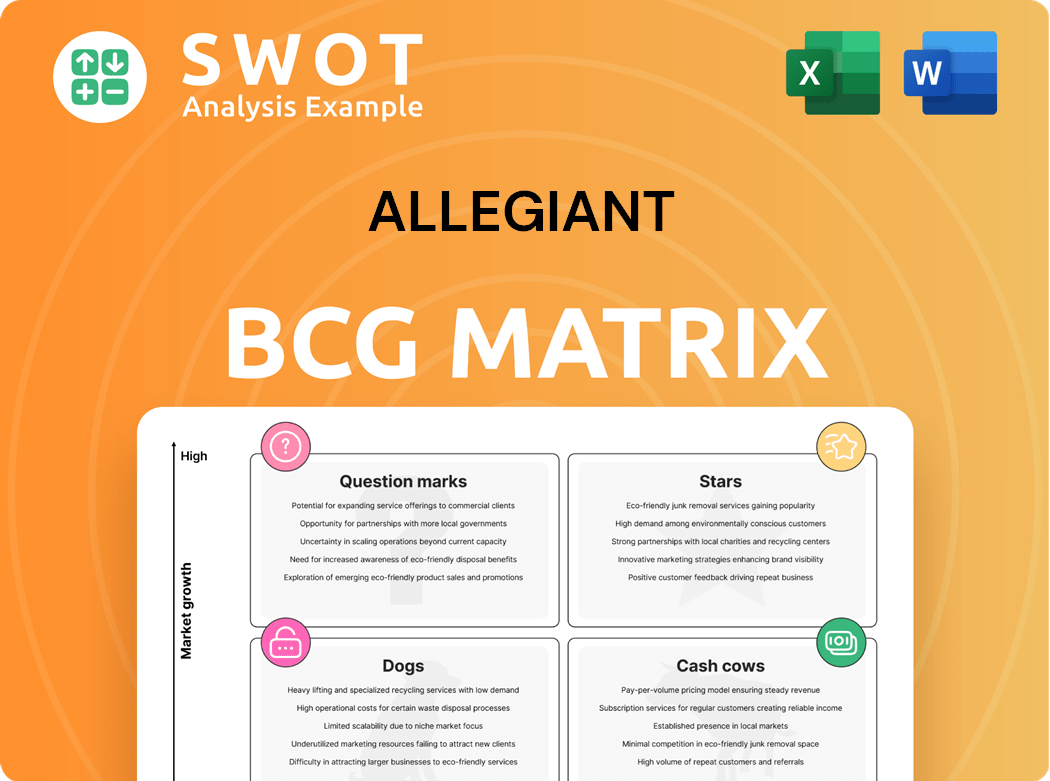

Strategic Allegiant's product portfolio analysis using the BCG Matrix.

Customizable matrix with business unit data for rapid market analysis and strategic decision-making.

Preview = Final Product

Allegiant BCG Matrix

The BCG Matrix preview is the same document you'll get when you buy. No hidden extras or changes—it's a complete, polished report ready for strategic decision-making. Instantly downloadable, this analysis-ready file is formatted professionally for direct application.

BCG Matrix Template

Allegiant's BCG Matrix unveils its product portfolio's strategic positions. See which offerings are stars, cash cows, question marks, or dogs. This snapshot offers a glimpse into their market dynamics and resource allocation strategies. Understand growth potential versus cash generation for each segment. The full BCG Matrix dives deeper, offering strategic recommendations and actionable insights for informed decisions.

Stars

Allegiant's new Boeing 737 MAX aircraft are a 'Star' for growth. These planes boost fuel efficiency and earnings compared to older A320s. In 2024, Allegiant operated 127 aircraft; 9 MAX deliveries are planned for 2025. This will lead to a 17% capacity increase, as projected.

Allegiant's expansion of Allegiant Extra is boosting ancillary revenue. 56 aircraft currently offer this premium seating, showing positive returns. This move caters to travelers wanting flexibility. In 2024, Allegiant reported a 16.8% increase in total revenue per passenger compared to the same period last year.

Allegiant excels at generating ancillary revenue. In Q4 2024, they hit a record of over $78 per passenger. This includes baggage fees and hotel bookings. This shows their skill in making money from various services. Their success boosts overall profitability.

Strategic Route Expansion

Allegiant's "Stars" in the BCG Matrix shines brightly with its strategic route expansion. In 2025, the airline plans to add 44 new nonstop routes and three new city destinations. This expansion is fueled by solid leisure demand and a focus on ultra-low-cost fares. The new routes will boost its network, reaching 51 cities nationwide.

- 2024 Revenue: Allegiant reported $2.75 billion in total operating revenue.

- Q1 2024: Allegiant's total operating revenue was $706.6 million.

- Route Expansion: The airline plans to expand to 51 cities.

- Demand: Driven by strong leisure demand in the US.

Strong Leisure Demand

Allegiant Air thrives on leisure travel, linking smaller cities to vacation spots. This strategy lets them profit during peak leisure times. The company's growth hinges on the sustained demand for leisure travel. Allegiant's expansion plans are fueled by confidence in this demand.

- Allegiant reported a Q3 2024 revenue of $699.5 million.

- Q3 2024 passenger revenue increased 4.5% year-over-year.

- Allegiant's load factor for Q3 2024 was 86.5%.

Allegiant's "Stars" include route expansions and ancillary revenue growth. Their Boeing 737 MAX fleet enhances earnings and efficiency. In 2024, total operating revenue reached $2.75 billion.

| Metric | 2024 Data | Details |

|---|---|---|

| Total Operating Revenue | $2.75 Billion | Reflects overall financial performance. |

| Q1 2024 Revenue | $706.6 Million | Illustrates revenue trends at the start of the year. |

| New Routes Planned (2025) | 44 | Shows aggressive expansion plans. |

Cash Cows

Allegiant's ultra-low-cost model remains a cash cow. The airline's core business generates strong cash flow. Offering fares below the average domestic roundtrip cost attracts budget travelers. This model connects underserved cities to vacation spots. In 2024, Allegiant's revenue reached $2.8 billion.

Allegiant's point-to-point network skips traditional hubs, boosting efficiency. This method cuts layovers, improving resource use. Allegiant connects smaller cities to vacation spots. In 2024, Allegiant's load factor was around 85%. This unique strategy targets a specific market segment.

Allegiant's strong brand recognition, built since 1999, is synonymous with affordable travel. The airline's established presence in the ultra-low-cost carrier market gives it a competitive edge. In 2024, Allegiant reported a revenue of $2.8 billion, demonstrating its ability to generate substantial cash flow. This brand recognition is a key factor in customer attraction and retention.

Vacation Packages

Allegiant's vacation packages are a cash cow, generating consistent revenue through ancillary services. These include baggage fees, seat selection, and hotel bookings. Allegiant earns commissions from hotel rooms, car rentals, and attractions on its website. They sell package vacations under the Allegiant Vacations brand.

- In 2023, Allegiant reported significant revenue from ancillary sources, highlighting the importance of these services.

- Allegiant Vacations contributed substantially to the company's overall revenue.

- Commissions from partnerships boosted the financial performance of Allegiant.

Customer Loyalty Program

Allegiant's Customer Loyalty Program, a cash cow in its BCG Matrix, thrives. By the end of 2024, they had 18 million active Allways Rewards members. The Allways Visa card has performed strongly. The program is projected to bring in over $140 million from the bank in 2024, with further growth anticipated in 2025.

- 18 million active Allways Rewards members by the end of 2024.

- The Allways Visa card continues to perform strongly.

- The program is expected to generate over $140 million in 2024.

- Continued growth is expected in 2025.

Allegiant's cash cows consistently generate strong revenue. These include core air travel, vacation packages, and loyalty programs. Ancillary services and the Allways Visa card boost profits.

| Cash Cow | Revenue Source | 2024 Performance |

|---|---|---|

| Air Travel | Fares, Baggage | $2.8B Revenue |

| Vacation Packages | Hotels, Cars | Significant Revenue |

| Loyalty Program | Allways Visa | $140M+ from bank |

Dogs

Allegiant's Sunseeker Resort venture has struggled, contributing to losses in 2024. The company's diversification into hotels has proved challenging. Allegiant is now exploring options like investors or a sale. This strategic shift reflects a reevaluation of its hospitality investment. In Q1 2024, Allegiant reported a net loss of $83.9 million.

Allegiant's older Airbus A320s, with an average age of 15 years, are less fuel-efficient. These planes have higher maintenance costs. In 2024, Allegiant plans to accelerate the transition, replacing older aircraft with Boeing 737 MAX. This strategy helps reduce operational expenses.

Allegiant's "Dogs" are routes with low demand, impacting revenue. In 2024, some routes underperformed, necessitating reevaluation. Allegiant, with a smaller network than rivals, must optimize these flights. Data from 2024 showed specific routes faced load factor challenges. The airline may cut them.

High Debt Levels

Allegiant faces challenges due to high debt levels, classifying it as a "Dog" in the BCG matrix. Its debt-to-equity ratio of 1.75 indicates a substantial debt burden. This impacts its ability to invest and respond to market changes. The company's financial health is rated as WEAK.

- Debt-to-Equity Ratio: 1.75

- Financial Health Score: WEAK

- Limited Investment Flexibility

- Vulnerable to Market Changes

High reliance on ancillary revenue

Allegiant's "Dogs" status in the BCG matrix highlights its vulnerability due to its reliance on ancillary revenue. This revenue stream, which includes fees for baggage, seat selection, and other services, is susceptible to fluctuations. Allegiant's profitability is directly tied to customers' willingness to pay extra for these add-ons. In 2024, ancillary revenue accounted for a significant portion of Allegiant's total revenue.

- Ancillary revenue is crucial for Allegiant's financial health.

- Changes in customer behavior can significantly impact this revenue.

- The airline collects $110 from passengers at the end of their trip.

- CEO Maurice Gallagher said if he tried to charge the passengers $110 up front, they wouldn't pay it.

Allegiant's "Dogs" struggle with low demand and high debt. The airline's financial health, rated WEAK in 2024, highlights vulnerabilities. Ancillary revenue, crucial for profitability, faces customer behavior shifts.

| Metric | Value (2024) | Impact |

|---|---|---|

| Debt-to-Equity Ratio | 1.75 | High debt burden, limited investment |

| Ancillary Revenue | Significant Portion of Total Revenue | Vulnerable to customer behavior. |

| Financial Health Score | WEAK | Weakens ability to respond to market changes. |

Question Marks

Allegiant's domestic focus might shift with international expansion, a "question mark" in the BCG matrix. Entering new markets demands substantial investment, potentially increasing risks. Spirit Airlines is eyeing more low-cost international flights. In 2024, Allegiant's revenue was around $2.8 billion, and international routes could diversify this.

Allegiant could broaden its appeal by introducing premium services, such as upgraded seating or complimentary meals. This strategy aligns with the trend of budget airlines incorporating premium options. In 2024, the global premium economy market was valued at $15.7 billion, indicating growth potential. Allegiant's shift towards a mixed service model could tap into this market.

Allegiant could forge alliances to boost its services. Consider partnerships like code-sharing or joint marketing. Strategic alliances are crucial in dynamic markets. Low-cost carriers now represent 31% of global capacity. This offers more travel options.

New Technologies

Allegiant could boost efficiency and customer satisfaction by investing in new technologies, such as AI and advanced data analytics. The airline industry is significantly investing in technology. Recent data shows £8.58 billion in airport IT investments and £27.40 billion in airline technology spending. This strategic move could lead to new revenue sources and competitive advantages.

- Enhance Customer Experience

- Improve Operational Efficiency

- Generate New Revenue Streams

- Competitive Advantage

Untapped Markets

Allegiant's strategy focuses on untapped markets, offering direct flights to vacation spots. For example, Gulf Shores, Alabama, initiated six routes, demonstrating its investment in smaller markets. This approach connects leisure travelers to destinations like the Gulf Coast. Allegiant's model emphasizes underserved areas with growth potential, a key element in their strategy. This focus allows them to capture a specific customer base and reduce competition.

- Gulf Shores, Alabama, as a prime example of the strategy.

- Focus on direct flights to popular vacation spots.

- Investment in smaller markets with significant potential.

- Targeting underserved areas to reduce competition.

Allegiant faces "question marks" regarding international expansion and premium services in the BCG matrix. These moves require investments, increasing risks and uncertainty. Data from 2024 shows revenue around $2.8 billion, with potential from international routes.

| Category | 2024 Data | Implication |

|---|---|---|

| Revenue | ~$2.8 billion | Diversification needed |

| Premium Market | $15.7 billion (global) | Opportunity for premium services |

| Low-Cost Carrier Share | 31% (global capacity) | Alliance potential |

BCG Matrix Data Sources

Allegiant's BCG Matrix uses airline financials, route performance data, and market analysis reports for robust strategic assessments.