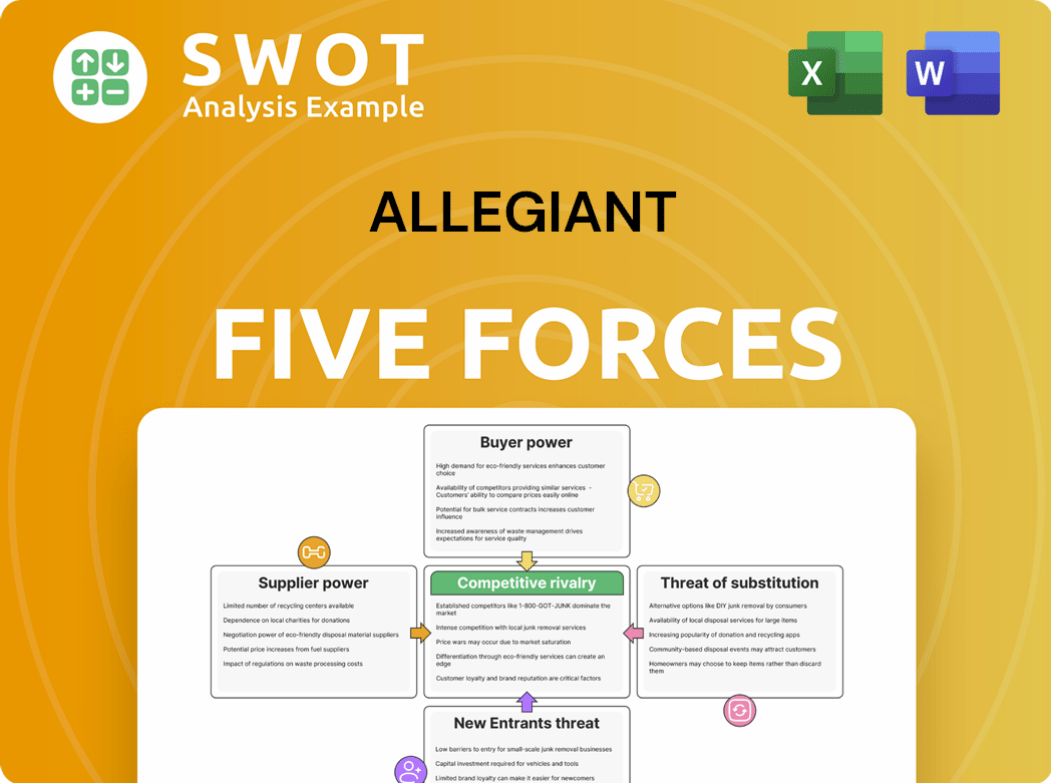

Allegiant Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allegiant Bundle

What is included in the product

Tailored exclusively for Allegiant, analyzing its position within its competitive landscape.

Swap in your own data and notes to reflect current business conditions.

Same Document Delivered

Allegiant Porter's Five Forces Analysis

This is the comprehensive Allegiant Porter's Five Forces analysis. You are viewing the exact document you will receive instantly upon purchase. It offers a detailed examination of industry rivalry, supplier power, and buyer power. The analysis also thoroughly covers the threat of new entrants and the threat of substitutes. You'll get immediate access to this ready-to-use file.

Porter's Five Forces Analysis Template

Allegiant faces moderate rivalry, with established airlines and ULCCs competing for leisure travelers. Buyer power is significant, given price sensitivity and alternatives. Supplier power is limited, with readily available aircraft and fuel. The threat of new entrants is moderate due to high capital costs. Substitute products, like road trips, pose a threat.

Ready to move beyond the basics? Get a full strategic breakdown of Allegiant’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Allegiant Air faces a strong bargaining power from suppliers due to the aircraft manufacturing duopoly of Boeing and Airbus. These two companies dominate the market. In 2024, Boeing's revenues were approximately $77.8 billion. Any production issues or delays at Boeing or Airbus directly impact Allegiant's fleet growth and operational efficiency. This dependency gives these suppliers significant pricing leverage. Allegiant must navigate this dynamic to maintain profitability and growth.

Airlines face fuel price volatility, and suppliers hold significant bargaining power. Allegiant relies on fuel, making it vulnerable to price swings. In 2024, jet fuel prices impacted airline profits. To mitigate this, Allegiant uses hedging and efficiency measures. Poor fuel cost management hurts profitability.

Unionized labor significantly impacts Allegiant. Unions for pilots, flight attendants, and mechanics influence wages and work rules. For example, in 2024, pilot unions negotiated substantial pay increases. Strikes or disputes can disrupt flights; in 2023, several airlines faced labor-related flight cancellations. Stable labor relations are vital for Allegiant's operational success.

Airport infrastructure

Airports, acting as infrastructure suppliers, hold considerable bargaining power due to limited capacity and essential services. This impacts Allegiant's operational costs and expansion plans. The availability of gates and slots directly influences flight schedules and network growth. Strategic alliances are crucial for mitigating these supplier-related risks. For example, in 2024, airport fees accounted for a significant portion of airline operating expenses.

- Limited Gate Availability: Airports often have constrained capacity.

- Infrastructure Constraints: Airports face limitations.

- Fees Impact: Airport fees affect operational costs.

- Strategic Partnerships: Alliances can mitigate risks.

Maintenance and repair services

Allegiant Air's reliance on specialized maintenance and repair services significantly impacts its operations. A limited number of certified suppliers for aircraft engines and components wield considerable bargaining power. These suppliers can influence costs and service terms, affecting Allegiant's profitability. Allegiant must negotiate effectively to secure reliable, cost-effective maintenance, crucial for minimizing downtime and ensuring airworthiness.

- In 2024, the global aircraft maintenance market was valued at approximately $90 billion.

- The top three MRO (Maintenance, Repair, and Overhaul) providers control a significant portion of the market.

- Allegiant's maintenance costs represent a substantial percentage of its operational expenses.

- Effective supplier management is critical for Allegiant's cost control strategy.

Allegiant faces supplier power from aircraft manufacturers, like Boeing, with $77.8B revenue in 2024. Fuel price volatility and labor unions also increase costs, impacting profits. Airports and maintenance providers further exert influence over operational costs and schedules.

| Supplier | Impact | Data (2024) |

|---|---|---|

| Boeing/Airbus | Aircraft Costs/Availability | Boeing revenue: $77.8B |

| Fuel Suppliers | Fuel Costs | Jet fuel price volatility |

| Labor Unions | Labor Costs/Disruptions | Pilot pay increases |

| Airports | Fees/Capacity | Airport fees = significant % of expenses |

| MRO Providers | Maintenance Costs | Global MRO market: $90B |

Customers Bargaining Power

Allegiant's customer base, primarily leisure travelers, shows strong price sensitivity. These customers readily choose cheaper alternatives, impacting Allegiant's pricing strategy. For instance, in 2024, Allegiant's average fare was around $100, highlighting its low-cost focus. This forces the airline to maintain competitive pricing to retain customers, facing the risk of losing them to rivals like Spirit or Frontier if prices increase.

Allegiant's business model is heavily reliant on ancillary revenues. In 2024, these fees accounted for a significant portion of their total revenue. Customers can push back against these fees. For example, in Q3 2024, ancillary revenue per passenger was $55.66. Balancing these fees with customer satisfaction is vital for Allegiant.

Leisure travelers can explore numerous vacation spots, intensifying customer bargaining power. Allegiant faces competition from various destinations. In 2024, the leisure travel sector saw a 10% shift in preferred destinations. Allegiant must adapt its offerings to retain customers.

Transparency of pricing

Customers have increased bargaining power due to pricing transparency. Online travel agencies and metasearch engines allow for easy fare comparisons, intensifying price competition. Allegiant must offer competitive pricing and value to attract customers in this market. Building brand loyalty is crucial.

- Allegiant's average fare in 2024 was around $100, reflecting price sensitivity.

- Online travel agencies (OTAs) control a significant portion of airline bookings, about 60% in 2024.

- Loyalty programs can increase customer retention by up to 20% in the airline industry.

- Metasearch engine usage grew by 15% in 2024, enhancing price comparison capabilities.

Service expectations

Allegiant's customers, despite seeking low fares, still expect acceptable service. Negative reviews can rapidly harm Allegiant's brand, especially online. Balancing cost-cutting with customer satisfaction is crucial for long-term success. Consider that in 2024, customer complaints in the airline industry rose by 15%.

- Allegiant needs to monitor and manage customer feedback.

- Reputation management is vital for retaining customer loyalty.

- Service failures can lead to a loss of revenue.

- Customer expectations continue to evolve.

Allegiant faces significant customer bargaining power due to leisure travelers' price sensitivity, affecting its pricing strategies. The airline's low-cost focus, with an average fare of $100 in 2024, is key. Competitive pricing and ancillary revenue balance are crucial for profitability and customer retention.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Avg. Fare: $100 |

| Ancillary Revenue | Important | $55.66/passenger (Q3) |

| Market Competition | Intense | OTA bookings ~60% |

Rivalry Among Competitors

The airline industry is fiercely competitive, with numerous airlines competing for passengers. Price wars frequently occur, particularly on high-traffic routes, squeezing Allegiant's profit margins. In 2024, average domestic airfare fluctuated, reflecting this price sensitivity. Maintaining a significant cost advantage is essential for Allegiant to remain competitive. Allegiant's operational efficiency is critical.

Allegiant faces intense competition from low-cost carriers like Spirit and Frontier. These rivals utilize comparable business models and pursue similar budget-conscious travelers. In 2024, Spirit's revenue per available seat mile (RASM) was around 9.6 cents, indicating pricing pressure. Differentiation through route choices and service is critical.

Major airlines, including American, Delta, and United, actively compete for leisure travelers, especially to popular vacation spots. These established airlines boast broad networks and strong brand recognition, creating a competitive environment for Allegiant. For instance, American Airlines reported a revenue of $52.8 billion in 2023. Focusing on underserved routes allows Allegiant to mitigate direct competition with these larger carriers.

Route overlap

Route overlap is a key factor in Allegiant's competitive landscape. The intensity of competition on a route hinges on the number of airlines and flight frequency. High overlap can trigger price wars, squeezing profits. Allegiant strategically chooses routes to limit direct competition. In 2024, Allegiant's focus on underserved markets helped mitigate some route overlap challenges.

- Allegiant's strategy prioritizes routes with less competition.

- High route overlap increases the risk of price wars.

- Frequency of flights also influences route competitiveness.

- Careful route management is essential for profitability.

Consolidation trends

The airline industry's consolidation, with mergers like Alaska Air and Virgin America, has created larger, more formidable rivals. This concentration intensifies competition, posing challenges for smaller airlines such as Allegiant. These larger entities often have greater resources, impacting pricing and market share. Adapting to these shifts is crucial for survival and growth.

- In 2024, the top four U.S. airlines controlled over 80% of the market share.

- Consolidation has led to increased route network efficiencies for major airlines.

- Smaller airlines face pressure to offer competitive fares.

- Allegiant's focus on leisure travel and secondary airports is a key differentiator.

Competitive rivalry in the airline industry is high, with intense price competition, especially on popular routes. Allegiant faces rivals like Spirit and Frontier, all vying for budget travelers; in 2024, these carriers kept the pricing under pressure. Major airlines such as American, Delta, and United also compete, requiring Allegiant to strategically choose routes to avoid direct competition. The industry's consolidation further intensifies competition.

| Factor | Impact on Allegiant | 2024 Data/Insight |

|---|---|---|

| Price Wars | Erodes profitability | Average domestic airfare fluctuated |

| Low-Cost Carriers | Direct competition | Spirit's RASM: ~9.6 cents |

| Major Airlines | Network advantage | American Airlines' revenue: $52.8B (2023) |

SSubstitutes Threaten

For shorter trips, driving is a direct substitute, especially for families. In 2024, AAA estimated the average cost of driving a sedan was around $0.68 per mile. High fuel costs can make flying cheaper, but road trips offer flexibility. Allegiant must price fares competitively, considering driving costs.

Train travel presents a substitute threat, especially in areas with efficient rail systems. High-speed rail offers a competitive travel option, potentially impacting Allegiant's market share. For example, in 2024, Amtrak saw ridership increases on several routes. Allegiant must monitor rail developments to assess potential impacts on its routes and pricing strategies. The growth of rail networks could influence passenger choices.

Bus travel poses a threat to Allegiant, especially for price-sensitive customers. Buses offer lower fares, attracting travelers on a budget. Allegiant faces direct competition from bus services on certain routes. In 2024, bus travel continues to be a cost-effective choice, with Greyhound reporting millions of passengers annually.

Video conferencing

Video conferencing poses a significant threat to Allegiant, especially for business travelers. It serves as a direct substitute for in-person meetings, cutting down on the necessity for flights. The increasing reliability and ease of use of platforms like Zoom and Microsoft Teams further enhance this threat. Allegiant must analyze how the growing preference for virtual meetings affects demand for its services. Consider that in 2024, remote work increased by 15% in the US.

- Reduced Travel: Video conferencing decreases the need for business trips.

- Technological Advancements: Improved video quality and user experience make virtual meetings more appealing.

- Demand Impact: Allegiant must monitor the shift from in-person to virtual meetings.

- Cost Savings: Companies can save on travel expenses by using video conferencing.

Virtual tourism

Virtual tourism poses a growing threat to Allegiant's business model. Advancements in VR and AR could enable immersive travel experiences from home, diminishing the need for physical travel. Although still developing, virtual tourism's potential impact warrants close monitoring by Allegiant to understand future market shifts. The VR market is projected to reach $86.29 billion by 2028.

- VR/AR adoption is increasing, with 171 million VR users globally in 2024.

- The virtual tourism market was valued at $1.4 billion in 2023.

- Companies like Meta are investing heavily in VR/AR development.

- Allegiant needs to assess potential revenue impacts from virtual tourism.

Substitute threats, such as driving, trains, and buses, impact Allegiant's market. Video conferencing and virtual tourism also pose challenges by offering alternatives to physical travel. These substitutes affect demand and require Allegiant to adapt pricing and strategies.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Driving | Direct, especially for short trips. | Average cost: $0.68/mile (AAA) |

| Train | Competition on routes with efficient rail. | Amtrak saw ridership increase. |

| Bus | Price-sensitive travelers. | Greyhound reported millions of passengers. |

Entrants Threaten

Starting an airline demands substantial capital for planes, facilities, and meeting regulations. These large upfront costs limit new competitors. Allegiant Air, for example, needed billions to build its fleet. This protects Allegiant from easy entry.

The airline industry faces significant regulatory hurdles, including stringent safety and security standards. New entrants must obtain numerous certifications, which can be a lengthy and expensive process. These regulations act as a barrier, increasing the time and cost for new airlines to start operating. Allegiant Air, having already navigated these complexities, holds a competitive advantage. In 2024, compliance costs for airlines averaged $10 million annually.

Established airlines benefit from existing customer loyalty, posing a challenge for new entrants. Building brand recognition and trust is time-consuming and expensive. Allegiant has cultivated a robust brand presence, particularly among leisure travelers. In 2024, customer loyalty programs significantly influenced airline choices. This gives established airlines an edge against new competitors.

Economies of scale

Established airlines like United and Delta have significant economies of scale. They can negotiate lower fuel prices and maintenance costs. New airlines find it tough to match these advantages, impacting profitability. Allegiant Air, however, has leveraged its unique business model to achieve some economies of scale, focusing on specific routes and aircraft types. This helps them to manage costs effectively.

- Fuel costs represent a large portion of operating expenses, and established airlines can negotiate better rates.

- Maintenance costs are lower with standardized fleets, a benefit enjoyed by established players.

- Marketing and advertising expenses are spread over a larger customer base, giving established airlines an edge.

- Allegiant's focus on point-to-point routes and specific aircraft types allows for some cost efficiencies.

Limited airport access

New airlines face a significant hurdle due to limited airport access. Many airports have restricted gate availability and slot restrictions, which hampers new entrants' ability to operate in key markets. This constraint limits their capacity to compete effectively. Allegiant, however, benefits from established relationships with airports, providing a strategic advantage.

- Airport infrastructure, including gates and slots, is a finite resource.

- New airlines struggle to secure these resources, restricting market entry.

- Allegiant's existing airport partnerships provide a competitive edge.

- This advantage helps Allegiant maintain its market position.

Threat of new entrants is moderate for Allegiant. High capital costs and strict regulations create barriers. Customer loyalty and airport access also provide protection. However, new low-cost models could pose a threat.

| Factor | Impact on Allegiant | Data (2024) |

|---|---|---|

| Capital Requirements | High barrier to entry | Average fleet cost: $60M per plane |

| Regulations | Significant compliance costs | FAA certification: 1-2 years, average cost $5M+ |

| Customer Loyalty | Established brand advantage | Loyalty programs influence 60% of bookings |

| Airport Access | Existing partnerships are key | Gate restrictions at major airports |

Porter's Five Forces Analysis Data Sources

Our analysis utilizes financial reports, industry analysis, and market data, complemented by news articles and company statements, for comprehensive force evaluation.