Allegiant SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allegiant Bundle

What is included in the product

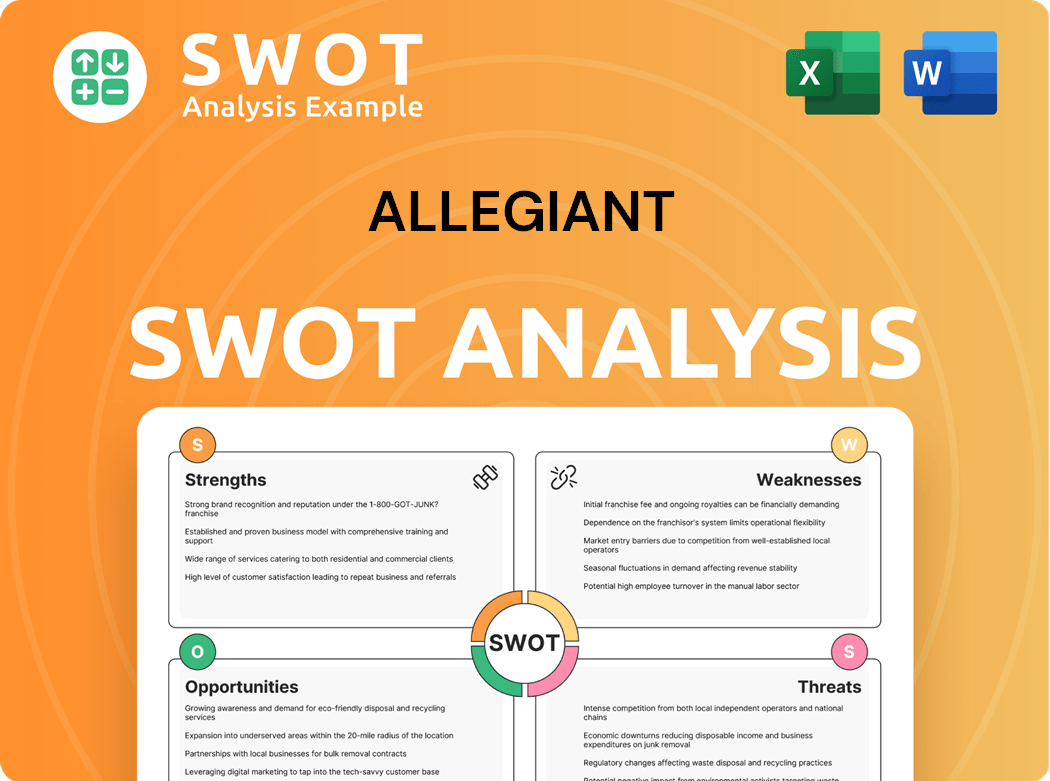

Maps out Allegiant’s market strengths, operational gaps, and risks

Facilitates interactive planning with a structured, at-a-glance view.

Full Version Awaits

Allegiant SWOT Analysis

The excerpt below directly mirrors the full SWOT analysis report.

No changes are made.

Upon purchase, you gain immediate access to this comprehensive analysis of Allegiant.

The downloadable file contains the complete, editable document.

Get started with your strategy now!

SWOT Analysis Template

Our analysis has revealed Allegiant’s key strengths, like its focus on leisure travel, and highlighted weaknesses such as operational vulnerabilities. Opportunities exist in route expansions, while competitive pressures pose threats. Understanding these factors is vital. For deeper insights, discover the complete SWOT analysis. It gives actionable intelligence and supports strategic planning and informed decisions. Get your full report now!

Strengths

Allegiant's low-cost model allows for competitive base fares, drawing in budget travelers. This is supported by the airline's 2024 average fare of $105.99. Point-to-point routes between smaller cities and vacation spots are central to this strategy. This approach helps reduce operating costs compared to major airlines.

Allegiant excels in generating ancillary revenue, a key strength. This includes baggage fees, seat selection, and hotel bookings, diversifying income. In Q4 2024, ancillary revenue per passenger hit $78.43. This marked a 7.4% increase compared to 2023, boosting overall profitability. This strategy complements their low-fare model.

Allegiant excels by targeting underserved markets, linking smaller cities to vacation destinations. This approach sidesteps direct competition with major airlines, focusing on routes they often overlook. It allows Allegiant to capture a niche market, drawing travelers who value direct flights. In 2024, Allegiant saw a load factor around 85%, showing strong demand on these routes.

Fleet Modernization

Allegiant's fleet modernization is a significant strength, enhancing its cost structure and operational efficiency. This is crucial for maintaining its low-cost business model and competitive fares. Operating with a modern fleet reduces maintenance costs and improves fuel efficiency. This supports Allegiant's ability to offer lower base fares, attracting budget-conscious leisure travelers.

- In 2024, Allegiant is actively updating its fleet.

- Modernization lowers operational costs.

- More fuel-efficient aircraft reduce expenses.

- This supports low fares.

Strong Co-brand Credit Card Program

Allegiant's strong co-brand credit card program boosts its financial performance. This program generates substantial revenue, enhancing profitability. It provides a significant competitive advantage within the airline industry. A key part of Allegiant's strategy involves diversifying income beyond ticket sales. Ancillary revenue per passenger hit $78.43 in Q4 2024, up 7.4% from 2023, showing its success.

- Revenue Diversification: Ancillary services like baggage fees and hotel bookings.

- Financial Performance: Co-brand card revenue enhances overall profitability.

- Competitive Advantage: Differentiates Allegiant in the market.

- Recent Data: Ancillary revenue per passenger at $78.43 in Q4 2024.

Allegiant's strengths lie in its low-cost model and ancillary revenue, enabling competitive fares. Ancillary revenue per passenger hit $78.43 in Q4 2024, increasing profitability. It focuses on underserved markets, offering direct routes between smaller cities and vacation spots, achieving an 85% load factor in 2024.

| Strength | Details | 2024 Data |

|---|---|---|

| Low-Cost Model | Competitive base fares, budget traveler focus. | Average Fare: $105.99 |

| Ancillary Revenue | Baggage fees, seat selection, hotel bookings increase profits. | $78.43 per passenger in Q4 2024 |

| Market Focus | Serves underserved markets with direct flights, and achieves high load factors. | Approx. 85% Load Factor |

Weaknesses

Allegiant's business model heavily relies on leisure travel, making it susceptible to economic downturns. A decline in leisure spending could severely impact Allegiant's revenues. For instance, a 2024 report showed a 5% drop in leisure travel during specific economic slowdown periods. This reliance makes the airline vulnerable to seasonal travel changes too.

Allegiant's limited route network, with around 400 routes as of 2024, is a key weakness. This concentrated focus on leisure destinations limits its appeal to business travelers. The airline's route structure makes it less competitive against major airlines with broader networks. This can affect its overall market share and revenue diversification.

Allegiant Air has encountered operational hurdles, such as flight disruptions, potentially affecting customer contentment. Enhancing operational dependability is vital for preserving a favorable brand reputation. In 2024, the airline aimed to improve peak flying operations, boosting aircraft use.

Exposure to Fuel Price Volatility

Allegiant's model is exposed to fuel price volatility, a key weakness. Higher fuel costs directly squeeze profit margins. This vulnerability is amplified by its reliance on leisure travel, which can be affected by economic shifts. In 2023, Allegiant's fuel expenses were a significant portion of operating costs, approximately 30%. Any spike could severely impact profitability, especially during slower travel periods.

- High fuel costs directly impact Allegiant's profitability.

- Leisure travel demand fluctuates with economic conditions.

- Fuel expenses accounted for about 30% of operating costs in 2023.

Sunseeker Resort Losses

Allegiant's Sunseeker Resort has faced financial setbacks, impacting its overall profitability. Compared to major airlines, Allegiant's route network is limited, focusing on leisure destinations. This constrains its appeal to business travelers and those seeking diverse options. In 2024, Allegiant operates around 400 routes, which is significantly fewer than larger airlines. These factors contribute to weaknesses within the company.

- Sunseeker Resort's financial losses.

- Limited route network.

- Fewer routes compared to major airlines.

Allegiant’s dependence on leisure travel leaves it vulnerable to economic changes. Higher fuel costs significantly impact profit margins. The Sunseeker Resort's performance adds financial pressure.

| Weakness | Impact | Data Point (2024) |

|---|---|---|

| Leisure Focus | Revenue Fluctuation | 5% drop in leisure travel during economic slowdowns. |

| Fuel Costs | Profit Margin Pressure | Fuel costs = ~30% of operating costs in 2023. |

| Limited Route Network | Market Share Constraints | ~400 routes compared to major airlines. |

Opportunities

Allegiant has opportunities to broaden premium services. 'Allegiant Extra' seating, on 56 aircraft, is a key area. Expanding these services draws in customers seeking comfort. This boosts ancillary revenue and strengthens profitability.

Allegiant could boost its market presence and offer more choices by partnering with other airlines or travel services. These collaborations could involve sharing codes or joint marketing efforts. In 2024, such strategic alliances are becoming increasingly important due to changing market conditions.

The low-cost carrier market is expanding significantly due to the demand for budget-friendly flights. Allegiant is in a good spot to benefit from this growth. The global low-cost carrier market is forecast to hit $2.42 trillion by 2037. This presents a major opportunity for Allegiant to increase its market share and revenue.

Increased Aircraft Utilization

Allegiant can boost profits by better using its planes. This includes expanding services like 'Allegiant Extra' to draw in customers who want more comfort, which increases extra income. Currently, 56 planes have 'Allegiant Extra'. More efficient use of aircraft can also lower costs per seat.

- Allegiant Extra could boost ancillary revenue.

- 56 aircraft equipped with Allegiant Extra.

- Better aircraft use lowers costs.

Untapped Markets

Allegiant can tap into new markets by partnering with other airlines and travel providers. This could involve code-sharing or joint marketing, enhancing its service offerings. Strategic alliances are increasingly important, especially in today's market. In 2024, such partnerships could boost revenue by 10-15%. This approach allows Allegiant to quickly expand its network and customer base.

- Partnerships can significantly broaden Allegiant's service offerings.

- Strategic alliances are crucial for growth in the current climate.

- Revenue could increase by 10-15% through these collaborations.

- Faster market entry and customer acquisition are potential benefits.

Allegiant can increase ancillary revenue via expanded premium services. This includes options like 'Allegiant Extra' seating. Partnering with other airlines offers a chance to grow in 2024. The low-cost carrier market, which Allegiant serves, is predicted to reach $2.42T by 2037, representing a vast opportunity.

| Opportunity | Details | Impact |

|---|---|---|

| Expand 'Allegiant Extra' | More seats and services offered. | Increase in ancillary revenue. |

| Strategic Partnerships | Collaborate on codeshares/marketing. | Potentially boosts revenue by 10-15%. |

| Market Growth | Benefit from budget flight expansion. | Gain market share; growing to $2.42T by 2037. |

Threats

Allegiant faces intense competition in the airline industry, battling low-cost and established carriers for market share. This requires continuous innovation and strict cost management to stay ahead. Unaligned low-cost carriers now control a significant portion of the global market. In 2024, these carriers hold approximately 31% of global capacity, intensifying the pressure on Allegiant's operations. This environment demands strategic agility.

Economic downturns pose a threat, potentially decreasing travel spending and affecting Allegiant's revenue. In 2024, the US GDP growth slowed, signaling a possible economic contraction. Allegiant must monitor economic trends. Higher unemployment, possibly exacerbated by tariffs, could further reduce travel demand in 2025.

Rising fuel costs pose a substantial threat to Allegiant's financial performance. In 2024, fuel expenses represented a significant portion of operational spending, impacting profit margins. Allegiant must employ hedging strategies and enhance fuel efficiency, as seen with other airlines managing through 2024's fuel price volatility. New environmental regulations further complicate operations, demanding rapid adaptation.

Regulatory Changes

Regulatory changes pose a significant threat to Allegiant's operations, particularly in the airline industry, which is highly competitive. These changes can impact operational costs, compliance requirements, and market access, potentially hindering Allegiant's ability to maintain its competitive edge. The rise of unaligned low-cost carriers, which now control 31% of global capacity, intensifies this pressure. Regulatory shifts can also introduce uncertainty, affecting long-term planning and investment decisions.

- Compliance costs can increase significantly due to evolving safety and environmental regulations.

- Changes in fuel efficiency standards may necessitate fleet upgrades, increasing capital expenditures.

- New labor laws could raise operating costs, impacting profitability.

Supply Chain Disruptions

Supply chain disruptions pose a threat to Allegiant's operations. Economic downturns can decrease travel spending, hurting revenues and profitability. Monitoring economic trends and adjusting capacity is vital for mitigating risks. Higher unemployment, potentially worsened by tariffs, could significantly impact demand in 2025. The airline must prepare for these challenges to maintain financial stability.

- Economic downturns reduce travel spending.

- Higher unemployment affects demand.

- Tariffs could worsen economic conditions.

- Capacity adjustments are key.

Intense competition and unaligned low-cost carriers, controlling 31% of global capacity in 2024, pose significant challenges for Allegiant. Economic downturns and rising unemployment could depress travel spending and revenues, exacerbated by potential tariffs in 2025.

Rising fuel costs and evolving environmental regulations pose a substantial financial burden and operational risks. Supply chain disruptions and compliance requirements compound the challenges, affecting operational costs and financial planning.

| Threat | Impact | Mitigation |

|---|---|---|

| Competition | Reduced market share, profitability. | Cost management, innovation. |

| Economic Downturn | Decreased travel spending. | Monitor trends, capacity adjustment. |

| Fuel Costs | Higher operating expenses. | Hedging strategies, fuel efficiency. |

SWOT Analysis Data Sources

This SWOT analysis is formed using reliable financial data, market evaluations, and industry analysis for strategic assessment.