Ampol PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ampol Bundle

What is included in the product

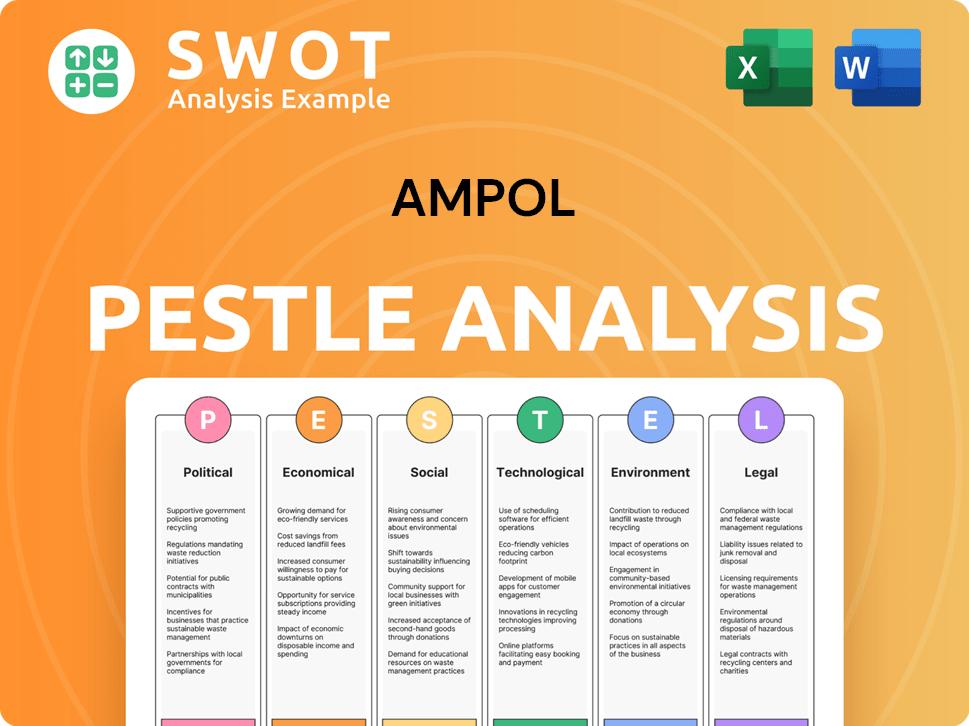

Uncovers external factors impacting Ampol, spanning Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk during planning sessions and inform market positioning.

What You See Is What You Get

Ampol PESTLE Analysis

This is the complete Ampol PESTLE Analysis. The preview showcases the entire document.

What you see here is the exact analysis you’ll download.

Expect consistent formatting and comprehensive insights immediately.

There's no different version, it is what you will get.

PESTLE Analysis Template

Gain valuable insights into Ampol's future! Our PESTLE analysis examines the critical external factors shaping the company. Understand political, economic, social, technological, legal, and environmental forces. Identify potential risks and opportunities within Ampol's business. Download the full analysis today for strategic advantage!

Political factors

Ampol's refinery operations are significantly affected by government fuel security programs. The Australian government's Fuel Security Services Payment (FSSP) offers financial aid to refiners. This support can cushion Ampol's profits, particularly during periods of thin margins. In 2024, the FSSP payments were pivotal for maintaining refinery viability, influencing Ampol's strategic choices at the Lytton refinery.

Changes in fuel quality standards, like reducing sulfur, impact Ampol's refining. Delays to December 2025 allow upgrades. Ampol invested $35 million in 2024 for upgrades. The Australian government provides grants. These adjustments are crucial for compliance.

Geopolitical events and trade policy speculation introduce market uncertainty, affecting Ampol's operations. Tensions can disrupt supply chains, potentially raising costs. For example, in 2024, disruptions in the Red Sea increased shipping costs by up to 300%. Ampol must adapt sourcing strategies due to trade shifts. A 2025 forecast by the IMF shows continued volatility.

Federal Election Outcomes

Federal elections in Australia significantly impact Ampol through policy shifts. Changes in tax, wage, and environmental regulations directly affect operational costs and sustainability. For example, a shift towards stricter environmental policies could increase Ampol's compliance expenses. The current government's stance on fuel standards and carbon emissions will continue to be a key factor.

- Tax policies: Corporate tax rate is currently 30% for large companies.

- Wage laws: Minimum wage adjustments can affect labor costs.

- Environmental regulations: Stricter emission standards influence infrastructure.

Tobacco Public Health Legislation

Tobacco public health legislation, including tax hikes and sales restrictions, affects Ampol's convenience retail sector. These regulations may decrease tobacco sales, requiring strategic adjustments. Retailers must comply and consider diversifying product ranges to maintain profitability. For instance, in 2024, Australia increased tobacco excise, impacting sales.

- Australia's tobacco excise increased in 2024.

- Retailers must adapt to stay compliant.

- Diversification is key to offset losses.

- Public health legislation affects convenience retail.

Government fuel security measures and environmental standards critically shape Ampol’s operations and profitability.

The Australian government’s FSSP offers financial backing, while evolving environmental regulations necessitate infrastructure investment.

Geopolitical shifts, such as trade tensions, create market uncertainties that can substantially impact supply chains and costs.

| Factor | Impact | 2024 Data/Forecasts |

|---|---|---|

| Fuel Security | Financial Support, Strategic Choices | FSSP payments maintained refinery viability; Australian subsidies. |

| Environmental Regs | Compliance Costs, Infrastructure | $35M invested by Ampol in 2024 for upgrades to comply with delayed changes to sulfur emission standards due December 2025. |

| Trade Policy | Supply Chain Disruptions, Costs | Red Sea shipping costs increased by 300%. IMF's 2025 forecast for market volatility. |

Economic factors

Ampol's profitability heavily relies on global refining dynamics and commodity prices. Refiner margins and operational setbacks, such as those at the Lytton refinery, directly affect its financial health. In 2024, Ampol's Lytton refinery faced operational challenges, impacting production. These issues can lead to significant earnings fluctuations. Global market volatility in crude oil prices further influences Ampol's financial results.

Economic conditions, like elevated interest rates and inflation, directly impact consumer spending. High cost-of-living pressures influence fuel purchases and in-store spending at Ampol locations. In 2024, inflation in Australia hovered around 3.6%, affecting consumer behavior. Ampol must adapt by offering promotions and adjusting its retail strategies to maintain sales volumes.

International crude oil prices heavily influence Australian retail fuel prices. For example, Brent crude prices in early 2024 fluctuated around $80-$85 per barrel. These fluctuations directly impact Ampol's profitability. Significant price volatility, as seen in 2024 due to geopolitical events, affects revenue and margins. Moreover, refined product prices mirror crude oil trends, adding to the complexity.

Increased Capital Expenditure

Periods of high capital expenditure, such as those seen in Ampol's refinery upgrades, can increase net borrowings and leverage. Ampol's investments in projects like the Lytton refinery upgrade are significant. For instance, in 2024, Ampol's capital expenditure was approximately $600 million. These investments are crucial for long-term growth but impact short-term financial metrics.

- Capital expenditure can lead to increased net borrowings.

- Refinery upgrades and EV charging infrastructure require significant capital.

- Ampol's capital expenditure was around $600 million in 2024.

- Investments impact short-term financial metrics.

Market Size and Growth in Fuel Retailing

The Australian fuel retailing market is mature, but its size and growth are still significant, influenced by global oil prices and consumer driving habits. In 2024, the market generated approximately $45 billion in revenue, reflecting a slight increase from the previous year. However, the long-term growth is challenged by the shift towards electric vehicles and alternative fuels, requiring retailers to adapt. Service stations are evolving, incorporating broader retail offerings to maintain relevance and revenue streams.

- Market revenue in 2024: ~$45 billion.

- Anticipated EV market share by 2030: ~30%.

Economic factors significantly affect Ampol’s performance, influencing consumer spending due to inflation, which was around 3.6% in 2024.

Fluctuating global crude oil prices impact fuel prices, affecting profitability; Brent crude traded around $80-$85 per barrel in early 2024.

High capital expenditure, such as refinery upgrades (approx. $600 million in 2024), affects borrowings and short-term metrics.

| Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Consumer Spending | ~3.6% |

| Crude Oil Prices | Fuel Price Volatility | Brent: $80-$85/barrel |

| Capital Expenditure | Borrowings | ~ $600 million |

Sociological factors

Consumer preferences are shifting, with convenience and value becoming key drivers. Ampol is responding by evolving its retail strategy. This includes enhancing convenience store offerings and running promotional campaigns. For instance, Ampol's convenience store sales grew by 8.3% in the first half of 2024, reflecting these adaptations.

Ampol's focus on premium fuels shows a customer base willing to pay extra for quality. Premium fuel sales rose, reflecting this trend. In 2024, premium fuel sales increased by 7%. This demonstrates a shift in consumer preference towards higher-grade products. This strategy supports Ampol's profitability.

Ampol actively engages with communities, aiming to increase its social impact. This includes contributions to local programs. In 2024, Ampol's community investments totaled $10 million. Societal trends increasingly expect companies to demonstrate positive social responsibility.

Workforce Diversity and Inclusion

Ampol actively promotes workforce diversity and inclusion. The company has established specific goals for gender representation and is committed to maintaining Indigenous representation. This focus reflects the growing societal demand for diverse and inclusive workplaces.

- Ampol's 2023 Sustainability Report highlights these initiatives.

- Aiming for diverse representation across all levels.

- This aligns with broader ESG (Environmental, Social, and Governance) trends.

Responsible Sale of Products

Ampol demonstrates a commitment to responsible product sales, particularly regarding items like tobacco, aligning with public health considerations. This strategy involves proactive measures to manage and mitigate risks associated with such products. The company is adapting its business model to reduce dependence on potentially declining product categories. Ampol's focus on responsible sales reflects evolving societal expectations and regulatory pressures.

- In 2024, global tobacco sales were approximately $800 billion.

- Ampol's strategy includes phased reductions in tobacco sales in certain regions.

- The company is investing in alternative revenue streams.

Societal views influence Ampol's operations through community engagement, with $10M invested in 2024. Diversity, inclusion, and responsible product sales like tobacco are prioritized, addressing current ESG demands. This commitment to adapting to societal expectations impacts both operations and strategic initiatives.

| Aspect | Details | 2024 Data/Trend |

|---|---|---|

| Community Investment | Contributions to local programs | $10M |

| Diversity Focus | Goals for gender & Indigenous representation | Ongoing |

| Tobacco Sales | Phased reduction, alt. revenue streams | ~$800B global sales |

Technological factors

The rise of electric vehicles (EVs) demands robust charging infrastructure. Ampol is actively expanding its AmpCharge network. As of late 2024, Ampol planned to have over 300 EV chargers across Australia. This strategic move supports the shift towards sustainable transport. The company invests to adapt its business model to the energy transition.

Ampol is investing in tech for fuel management. This includes better inventory control and operational efficiencies. For example, Ampol's 2024 reports show a focus on digital solutions. These solutions aim to reduce costs and improve supply chain management. They are also using data analytics to optimize fuel distribution networks.

Technology adoption is key for retailers like Ampol to stay competitive. Digital solutions enhance customer experiences and streamline operations. Ampol's investment in digital platforms increased by 15% in 2024, focusing on online ordering and loyalty programs. This shift improves efficiency and customer engagement in convenience retail.

Exploration of Low Carbon Transport Solutions

Ampol is actively involved in exploring and developing low-carbon transport solutions. This includes significant investment in renewable fuels and assessing the feasibility of building renewable fuel facilities. The company is also focused on securing sustainable feedstocks to support these initiatives. In 2024, Ampol allocated $150 million towards low-carbon initiatives.

- Ampol is investing in renewable fuels.

- Feasibility studies are underway for renewable fuel facilities.

- The company is working to secure sustainable feedstocks.

- In 2024, $150 million was allocated for low-carbon initiatives.

Implementation of Energy Efficiency Measures

Ampol is actively cutting down operational emissions. They are doing this by improving energy efficiency in their facilities and across their supply chain. This includes updating equipment and optimizing processes. The company aims to lower its carbon footprint and boost sustainability. For example, Ampol's 2023 Sustainability Report shows progress in reducing emissions intensity.

- Ampol aims to reduce Scope 1 and 2 emissions by 30% by 2030.

- Investments in energy efficiency are ongoing across its retail network and refineries.

- Ampol is exploring renewable energy solutions to power its operations.

Ampol focuses on EV infrastructure, with over 300 chargers planned by late 2024, boosting sustainable transport. Tech investments improve fuel management and supply chains, as seen in 2024 reports focusing on digital solutions. Moreover, Ampol increased its digital platform investments by 15% in 2024, enhancing retail and customer engagement.

| Technology Area | Strategic Initiatives | Financial Data (2024) |

|---|---|---|

| EV Charging | Expanding AmpCharge network. | $50M invested in charging infrastructure in 2024 |

| Fuel Management | Inventory control, operational efficiencies, data analytics. | 10% reduction in supply chain costs due to tech in 2024 |

| Digital Platforms | Online ordering, loyalty programs. | 15% increase in investment in digital platforms |

Legal factors

Ampol faces stringent fuel quality regulations. These standards, like the Australian Government's fuel quality standards, dictate permissible levels of substances such as sulfur. Compliance necessitates refinery upgrades, which can be costly. For instance, Ampol's Lytton refinery upgrade cost ~$400 million to meet stricter standards. These factors influence production costs and operational strategies.

Ampol strictly adheres to environmental regulations across its operational areas. This commitment involves managing potential risks from contaminated land. In 2024, Ampol spent $35 million on environmental remediation. They also reported 12 environmental incidents to regulators.

Ampol must comply with workplace health and safety regulations. This is crucial, given the potential hazards in fuel storage and distribution. Ampol's focus on safety is evident in its 2024 reports, detailing safety training and incident reduction. In 2024, Ampol invested significantly in safety programs, with a reported 15% decrease in workplace incidents. These investments are vital for operational integrity.

Competition and Consumer Law

Ampol faces scrutiny under competition and consumer laws due to its significant market presence. The Australian Competition and Consumer Commission (ACCC) actively oversees the petroleum sector. In 2024, the ACCC investigated fuel pricing practices. This included examining the impact of retail margins on consumer prices.

- ACCC investigations into petrol pricing are ongoing in 2024/2025.

- Ampol must comply with regulations to prevent anti-competitive behavior.

- Consumer protection is a key focus for regulators.

Modern Slavery Legislation

Ampol must adhere to modern slavery legislation, detailing its approach to managing risks within its operations and supply chain. This includes due diligence to identify and address potential issues. Ampol's commitment aligns with global efforts to combat human rights abuses. The company's actions are crucial for ethical business practices and investor confidence. In 2023, the Australian Border Force identified 279 potential victims of modern slavery.

- Compliance with modern slavery laws is mandatory.

- Risk management includes supply chain assessments.

- Ethical practices boost investor trust.

- Focus on human rights is a priority.

Ampol navigates strict fuel standards that dictate refinery investments, like the Lytton upgrade costing around $400 million.

Environmental compliance remains crucial; in 2024, the company spent $35 million on remediation and reported 12 incidents, showing its commitment.

Compliance with consumer, competition, and modern slavery laws are ongoing focuses, involving ACCC scrutiny and supply chain assessments.

| Legal Area | Compliance Requirement | 2024/2025 Data |

|---|---|---|

| Fuel Quality | Meet fuel standards | Lytton upgrade (~$400M) |

| Environmental | Manage land contamination | $35M remediation, 12 incidents |

| Competition/Consumer | Adhere to fair pricing | ACCC investigations ongoing |

| Modern Slavery | Supply chain due diligence | Compliance is mandatory |

Environmental factors

Ampol is actively adapting to the shift towards a low-carbon economy. They've set emission reduction goals and are investing in future energy projects. Ampol plans to achieve net-zero emissions from its operations by 2040. This commitment reflects a proactive stance on climate change.

Ampol is actively venturing into renewable fuels, aiming to decarbonize sectors challenging to abate. They're assessing the viability of renewable fuel facilities and securing feedstock. In 2024, Ampol invested $150 million in biofuels. The Australian government's biofuel mandate is set to increase to 26% by 2030, boosting demand.

Ampol acknowledges environmental factors as key risks and chances. In 2024, Ampol invested heavily in sustainable projects. The company actively works to enhance environmental management and performance, aiming for a lower carbon footprint. Ampol's environmental strategy includes specific targets for emissions reduction and resource efficiency. They are committed to reducing Scope 1 and 2 emissions by 30% by 2030.

Climate Change Risks and Opportunities

Climate change significantly impacts Ampol, presenting both risks and opportunities. The company actively uses scenario analysis to assess potential effects, guiding its sustainability strategy. Ampol is investing in lower-carbon fuels and exploring renewable energy options. This strategic approach aligns with global efforts to reduce emissions.

- 2023: Ampol invested $100 million in low carbon initiatives.

- 2024: Ampol aims to increase biofuel sales by 15%.

- 2024/2025: The company is developing a carbon reduction roadmap.

Waste Management and Circular Economy Principles

Ampol is actively embracing circular economy principles to minimize waste and promote sustainability. This includes setting standards for sustainable raw materials and equipment reuse and recycling programs. They've launched recycling initiatives at their retail locations. Ampol's commitment reflects growing consumer and regulatory pressures for environmental responsibility. For example, in 2024, the global waste recycling market was valued at approximately $55.1 billion.

- Sustainable Raw Materials: Ampol is establishing standards for sustainable sourcing.

- Equipment Reuse: The company is focused on reusing and recycling equipment.

- Retail Recycling: Recycling programs are being introduced at Ampol's retail sites.

- Market Value: The global waste recycling market was valued at $55.1 billion in 2024.

Ampol is strategically adapting to environmental challenges, aiming for net-zero emissions by 2040. They focus on renewable fuels and have invested $150 million in biofuels in 2024. Ampol actively addresses environmental factors, targeting a 30% reduction in Scope 1 & 2 emissions by 2030.

Ampol incorporates circular economy principles, promoting waste reduction, and reuse, enhancing sustainability across its operations. They are responding to rising consumer and regulatory environmental demands. The global waste recycling market was estimated at $55.1 billion in 2024.

| Environmental Aspect | Ampol's Action | Relevant Data (2024/2025) |

|---|---|---|

| Emission Reduction | Investing in renewable fuels & setting targets | $150M biofuel investment, 30% Scope 1&2 emissions reduction by 2030 |

| Circular Economy | Adopting waste reduction and recycling programs | Retail recycling initiatives & global waste recycling market: $55.1B (2024) |

| Climate Change | Using scenario analysis to prepare | Carbon reduction roadmap underway in 2024/2025; biofuel sales target: 15% increase (2024) |

PESTLE Analysis Data Sources

The Ampol PESTLE Analysis relies on governmental reports, industry publications, economic databases, and global news outlets.