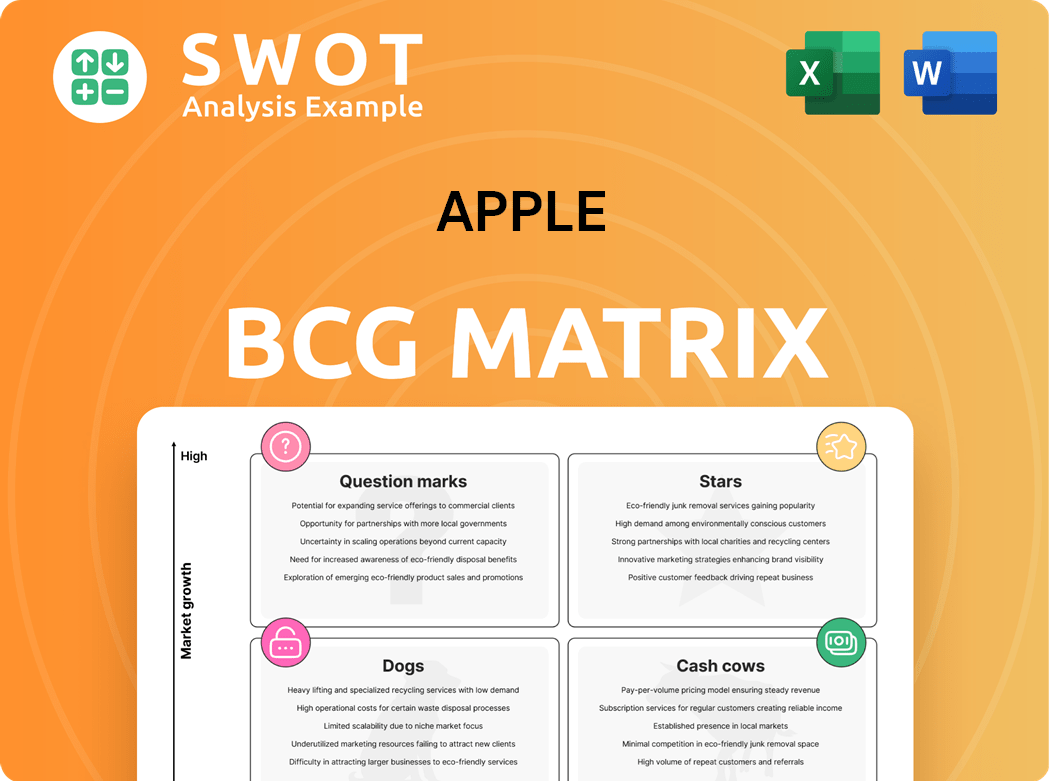

Apple Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apple Bundle

What is included in the product

Tailored analysis for Apple's product portfolio across the BCG Matrix.

One-page overview placing each business unit in a quadrant.

Full Transparency, Always

Apple BCG Matrix

The BCG Matrix you're previewing is the complete document you'll receive after purchase. This fully-featured analysis tool is ready for immediate use, with no extra steps required post-download.

BCG Matrix Template

Apple's BCG Matrix paints a picture of its product portfolio. See how iPhones dominate as Stars. Understand how iPads fit as Cash Cows. Learn about product potential, like the Question Marks. This sneak peek only scratches the surface. Get the full BCG Matrix for deep analysis, strategic recommendations, and impactful business decisions.

Stars

The iPhone, Apple's star, leads the premium smartphone market with substantial market share. Apple's innovation, marketing, and customer loyalty fuel high demand. In 2024, the iPhone generated $200.5 billion in revenue, a key financial driver. Its dominance ensures consistent growth and strong profitability for Apple.

Apple's Services, a star in its BCG matrix, is a major growth driver. In 2023, this segment, including the App Store and Apple Music, generated $85.2B in revenue. This represented a 24.7% year-over-year increase. Apple Music has 93M subscribers, and Apple TV+ has 47M, highlighting its strong market position.

Apple's Wearables, including Apple Watch and AirPods, are Stars due to their market dominance. Apple Watch leads the smartwatch market, and AirPods dominate wireless earbuds. Sales are strong, with Apple Watch projected to sell over 55 million units in 2025. AirPods sales are expected to hit 120 million units in 2025, reflecting their continued success.

AI and Machine Learning

Apple's AI and machine learning initiatives are key. They're fueling growth in new and existing products. In 2024, Apple's R&D hit $30 billion, with AI a major focus. The generative AI market could reach $126.5 billion by 2025.

- R&D Budget: $30 billion in 2024.

- Focus: AI integration in Siri and iPhone.

- Generative AI Market: $126.5 billion by 2025.

Expansion in Emerging Markets

Apple's expansion in emerging markets is a key strategy for growth. Strong growth is seen in India and Southeast Asia, fueled by channel expansion and branding. iPhone user growth is projected to rise in these regions by 2025. Apple is strategically shifting its supply chain, including increased manufacturing in India to lower dependence on China and tariff risks.

- Apple's revenue in India grew by over 40% in 2023.

- iPhone sales in Southeast Asia increased by 15% in Q4 2023.

- Apple plans to increase manufacturing capacity in India by 30% by the end of 2024.

- The number of iPhone users in India is expected to reach 100 million by 2025.

Apple's Stars—iPhone, Services, and Wearables—are crucial for revenue. The iPhone's 2024 revenue was $200.5 billion. Services hit $85.2B in 2023, up 24.7% YoY. Wearables, like Apple Watch and AirPods, show strong market dominance.

| Product | 2024 Revenue (Est.) | Key Market Position |

|---|---|---|

| iPhone | $200.5B | Premium Smartphone Leader |

| Services (2023) | $85.2B | Strong YoY Growth (24.7%) |

| Wearables | Projected Strong Sales | Dominant in Smartwatches & Earbuds |

Cash Cows

The Mac line is a cash cow for Apple, consistently generating revenue. Mac sales increased by 15% year-over-year. These computers require less investment compared to other lines, producing excess cash flow. Apple leverages this to fund other ventures. This strategy allows Apple to reinvest profits effectively.

The iPad is a Cash Cow for Apple, consistently delivering substantial revenue. Despite market maturity, the iPad maintains a loyal customer base, ensuring steady sales. Apple strategically launches new iPad models to maximize sales. In 2024, iPad sales contributed significantly to Apple's overall revenue, helping Apple to diversify their product portfolio.

The App Store is a key cash cow for Apple, driving substantial revenue. In 2024, developer payouts exceeded $100 billion. It is the second-largest division, accounting for 24% of Apple's revenue in 2024. Growth is projected for 2025.

iCloud

iCloud, Apple's cloud storage service, is a prime example of a cash cow within the Apple ecosystem. As of 2024, iCloud boasts over 32 million subscribers, demonstrating a significant market share. This service generates consistent revenue in a market that, while not rapidly expanding, offers stability. iCloud's profitability allows Apple to invest in other areas.

- High market share in a mature market.

- Generates consistent revenue.

- Supports other Apple products.

- Contributes to overall financial stability.

Apple Pay

Apple Pay is a cash cow for Apple, with adoption rates soaring. In developed markets, 75% of iPhone users regularly use it. This service generates revenue through transaction fees, a steady income stream. Apple continuously invests in R&D to improve it.

- 75% of iPhone users in developed markets use Apple Pay.

- Apple Pay generates revenue via transaction fees.

- Apple continues to invest in R&D for Apple Pay.

Cash Cows represent Apple's strengths in mature markets, generating reliable revenue. The Mac line saw a 15% year-over-year sales increase, indicating strong performance. Apple Pay adoption is also high, with 75% of iPhone users in developed markets utilizing it.

| Product | Market | Revenue Stream |

|---|---|---|

| Mac | Mature | Hardware Sales |

| iPad | Mature | Hardware Sales |

| App Store | Mature | Commissions, In-App Purchases |

| iCloud | Growing | Subscription Fees |

| Apple Pay | Mature | Transaction Fees |

Dogs

Apple TV hardware is considered a "Dog" in the Apple BCG Matrix. In 2023, Apple TV device sales were about 4.1 million units. This represents less than 2% of the streaming device market. Its market share and revenue are limited, with minimal strategic importance for Apple.

Older iPhones, like models predating the iPhone 13, fit into the "Dogs" quadrant as their market share shrinks and growth stagnates. These devices contribute little to Apple's overall revenue, with sales figures significantly lower compared to newer models. For example, older iPhones account for less than 5% of total iPhone sales in 2024. They have diminished strategic value, and Apple focuses on newer releases. Therefore, these older models should be phased out.

Apple Arcade is a gaming subscription with low market share and growth. Its performance has been underwhelming, with limited user adoption. In 2024, Apple's focus shifted to more profitable services. Analysts suggest considering divestiture due to its underperformance.

HomePod

HomePod, a "Dog" in Apple's BCG matrix, struggles against giants like Amazon and Google. Despite positive reviews, its market share remains small, indicating limited growth potential. Turnaround strategies often prove costly and ineffective for such products. HomePod's strategic importance is minimal within Apple's broader portfolio.

- Market share under 10% as of late 2024.

- High competition from Amazon and Google.

- Minimal strategic investment in recent years.

- Sales figures indicate slow growth.

Apple TV+

Apple TV+ is a "Dog" in Apple's BCG matrix. Despite a rising subscriber count, its market share lags behind competitors. Turnaround strategies are often costly and ineffective in this situation. Apple TV+ generated $2.8 billion in revenue in 2024, but faces intense competition.

- Low market share compared to rivals like Netflix.

- Turnaround strategies are expensive and may not yield returns.

- Minimal strategic importance within Apple's portfolio.

- 2024 revenue of $2.8 billion.

Several Apple products fall into the "Dog" category, facing low market share and growth challenges. Apple TV hardware and Apple TV+ struggle against established competitors. Older iPhones and Apple Arcade contribute minimally to overall revenue and strategy.

| Product | Market Share (late 2024) | Revenue (2024) |

|---|---|---|

| Apple TV | <2% Streaming Market | N/A |

| Older iPhones | <5% of iPhone Sales | Limited |

| Apple Arcade | Low, limited user adoption | N/A |

| HomePod | Small | N/A |

| Apple TV+ | Lower than Netflix | $2.8B |

Question Marks

The Apple Vision Pro, a February 2024 debut, is in the "Question Mark" quadrant of the BCG Matrix. It targets the nascent mixed reality market, with high growth potential. Priced at $3,499, the Vision Pro currently has a low market share. The mixed reality market is projected to reach $42.5 billion by 2027.

AI-driven Siri features, especially those in development or delayed, are question marks in Apple's BCG Matrix. Delays in rolling out AI-enhanced Siri may impact iPhone sales. Apple's marketing strategy focuses on driving adoption of these AI products. In 2024, Apple invested heavily in AI, with $20 billion allocated to R&D.

If Apple were to develop an electric vehicle, it would be a question mark in its BCG matrix. The EV market shows strong growth, with global sales expected to reach $823.75 billion by 2030. Apple would be a new entrant, needing to quickly gain market share. Without rapid growth, the product risks becoming a dog.

Health Tech Initiatives (beyond Apple Watch)

Apple's health tech ventures, like advanced blood glucose monitoring and expanded ECG features, fit the question mark category. These initiatives aim at high-growth markets but currently have low market share. For example, the global health tech market was valued at $284.8 billion in 2023. Apple's strategy involves aggressive marketing to boost adoption and gain market share.

- Market size: The global health tech market was valued at $284.8 billion in 2023.

- Apple's Health Revenue: Apple's health-related revenue is not explicitly broken down, but is part of its "Wearables, Home, and Accessories" segment.

- Growth Potential: The health tech market is projected to reach $660 billion by 2028.

- Competitive Landscape: Apple competes with companies like Google (Fitbit) and Samsung in the wearable health tech space.

New Product Categories

Any new product categories that Apple enters, such as home automation or augmented reality beyond the Vision Pro, would initially be question marks. These products are in growing markets but have low market share. The best way to handle Question marks is to either invest heavily in them to gain market share or to sell them. Apple's investment in the AR/VR space, for example, is a high-risk, high-reward strategy. In 2024, the AR/VR market is projected to reach $50 billion, but Apple's market share is still developing.

- Question marks are in growing markets but have low market share.

- Apple's AR/VR investment is a high-risk, high-reward strategy.

- The AR/VR market is projected to reach $50 billion in 2024.

- The best way to handle Question marks is to either invest heavily in them to gain market share or to sell them.

Question marks in Apple's BCG Matrix include new products with high growth potential but low market share. These ventures, like the Vision Pro and health tech initiatives, require significant investment. Apple must decide whether to aggressively invest or divest from these projects. AR/VR market is expected to reach $50B in 2024.

| Category | Description | Examples |

|---|---|---|

| Market Characteristics | High growth potential, low market share. | New technologies, emerging markets. |

| Strategic Decisions | Invest heavily to gain share, or divest. | R&D spending, strategic partnerships. |

| Risk Level | High-risk, high-reward investments. | AR/VR, health tech, EV projects. |

BCG Matrix Data Sources

The Apple BCG Matrix is crafted from financial statements, industry analysis, and market research to pinpoint strategic opportunities.