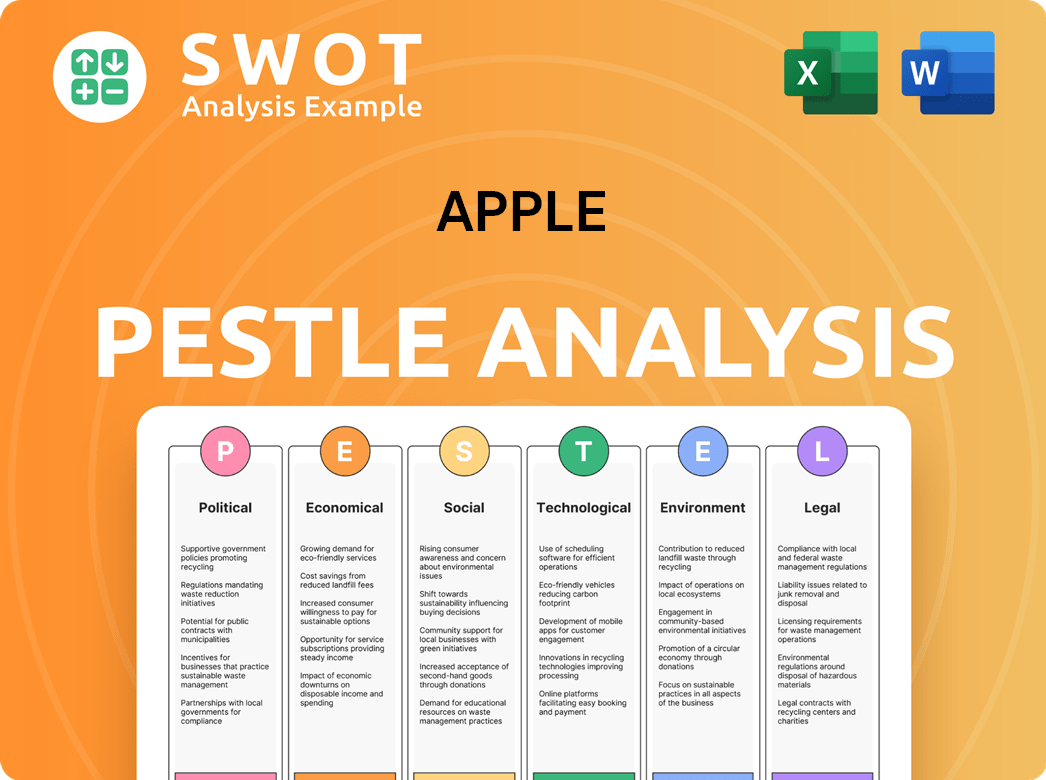

Apple PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apple Bundle

What is included in the product

Explores Apple's external influences across Political, Economic, Social, Tech, Environmental, and Legal areas.

Supports dynamic impact analyses, quickly surfacing the core competitive risks and opportunities for strategic forecasting.

Full Version Awaits

Apple PESTLE Analysis

This Apple PESTLE analysis preview displays the actual document. Its content and organization are exactly what you'll receive. Purchase now to instantly download and utilize this analysis. It’s completely ready for your review and strategic use.

PESTLE Analysis Template

Navigate the complex landscape surrounding Apple with our detailed PESTLE analysis. Uncover the external factors impacting their strategy, from technological advancements to global regulations. Understand political influences and economic trends reshaping their market position. This analysis offers actionable insights perfect for strategic planning, investments, and market research. Download the complete PESTLE analysis now to make informed decisions!

Political factors

Changes in international trade policies, tariffs, and import/export regulations significantly impact Apple's global operations. The US-China trade tensions, for example, increase manufacturing costs. Apple's reliance on Chinese manufacturing makes it vulnerable. In 2024, Apple faced tariffs affecting product pricing, impacting its bottom line. Political unrest and import restrictions pose risks.

Apple's global operations face political risks. Instability in key markets can disrupt supply chains and sales. China's importance poses risks, given its political climate. In 2024, geopolitical tensions impacted tech trade. Apple's revenue in Greater China was $20.8 billion in Q1 2024, a decrease from Q1 2023.

Governments globally enforce regulations impacting Apple, focusing on data privacy, consumer protection, and intellectual property. Compliance is vital, with changes affecting operations and reputation. Recent data shows a 15% increase in data privacy-related lawsuits against tech companies in 2024. As Apple integrates AI, expect increased scrutiny regarding data ethics and privacy. For example, the EU's AI Act, effective in 2025, will significantly influence Apple's AI practices.

Government Support for Technology

Government backing for technology is crucial for Apple's success. Incentives like R&D tax credits and grants can significantly cut operational costs. For instance, in 2024, the U.S. government allocated over $10 billion for AI research, potentially benefiting Apple. Supportive policies create favorable conditions for Apple's expansion and innovation. This includes streamlined regulations and infrastructure investments.

- R&D tax credits can reduce Apple's expenses, boosting profitability.

- Grants can directly fund Apple's research projects.

- Favorable regulations make market entry easier.

- Infrastructure investments improve operational efficiency.

Geopolitical Tensions and Supply Chain Diversification

Escalating geopolitical tensions, especially between the US and China, significantly influence Apple's supply chain strategy. The company actively diversifies its manufacturing locations to reduce dependency on China. Apple aims for a more resilient supply chain by expanding production in India and Vietnam. This diversification is crucial due to potential tariffs and political instability.

- Apple's investment in India has increased significantly, with production in India reaching an estimated $14 billion in fiscal year 2024.

- Vietnam's role is also growing, with Apple increasing its manufacturing presence there to diversify its production base.

- A recent report suggests that Apple plans to shift 20% of its production to India by 2025.

Political factors significantly affect Apple through trade policies and global instability. US-China tensions influence manufacturing and tariffs, increasing costs and impacting Apple's bottom line, such as a revenue decrease in Greater China in Q1 2024. Regulations globally, including those on data privacy, also require Apple to adapt its operations and practices to align with various new legal frameworks.

| Political Factor | Impact on Apple | 2024 Data/Example |

|---|---|---|

| Trade Policies | Affects manufacturing costs, pricing. | Tariffs > price increases; decreased revenue. |

| Geopolitical Risks | Supply chain disruptions; sales risks. | China's revenue: $20.8B in Q1 2024. |

| Regulations | Compliance; operational adjustments. | EU AI Act influencing AI practices by 2025. |

Economic factors

Global economic conditions significantly impact Apple. Fluctuations in growth rates, recessions, or booms directly affect consumer spending on Apple products. Economic downturns can reduce demand for premium goods, while growth boosts purchasing power. Apple's sales and profitability are sensitive to these economic trends. For example, the IMF projects global growth at 3.2% in 2024 and 2025.

Apple's global operations expose it to exchange rate volatility. Currency fluctuations affect the profitability of sales. For example, in Q1 2024, a strong dollar impacted international revenue. Hedging strategies are crucial for mitigating these risks. The company's financial reports detail these impacts.

Rising inflation rates pose a challenge for Apple. Increased costs for labor and raw materials, impacting profit margins. Consumer purchasing power may decrease, potentially reducing demand. In 2024, the U.S. inflation rate was around 3.1%, impacting Apple's operational strategies.

Increased Competition

The technology market, especially the smartphone sector, is incredibly competitive. Apple competes with global tech giants, affecting market share and pricing. This is especially true in price-sensitive markets and emerging economies. For instance, in Q4 2023, Apple's global smartphone market share was around 22%, facing challenges from Samsung and others. This competition could impact Apple's profitability.

- Apple's market share in Q4 2023 was approximately 22%.

- Intense competition impacts pricing and market share.

- Price-sensitive markets are key battlegrounds.

Consumer Purchasing Power and Income Levels

Consumer purchasing power and income levels significantly influence demand for Apple products globally. Rising incomes, particularly in emerging markets, expand Apple's potential customer base. Demographic shifts and income distribution are crucial for market targeting. For example, in 2024, India's smartphone market saw a 17% increase, indicating rising purchasing power.

- India's smartphone market grew by 17% in 2024.

- Apple's revenue in China decreased by 13% in Q1 2024.

- Global inflation rates impact consumer spending.

Global economic growth influences Apple’s sales; IMF projects 3.2% for 2024 & 2025. Exchange rate volatility affects profits, especially in Q1 2024. Inflation impacts costs and consumer spending; the 2024 U.S. rate was ~3.1%.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Economic Growth | Affects consumer spending | IMF: 3.2% global growth projected. |

| Exchange Rates | Impacts revenue profitability | Strong USD affected Q1 2024 revenue. |

| Inflation | Raises costs & reduces spending | U.S. ~3.1% in 2024. |

Sociological factors

Consumer preferences and lifestyle changes significantly shape demand for Apple. Mobile access and digital dependence are rising. Health and wellness trends also influence product features. For example, in 2024, wearable tech sales grew by 10%, indicating consumer interest in health-focused devices. Apple must adapt to these shifts.

Apple's market is significantly shaped by demographic shifts. The rising global median age and varying income levels across regions influence product demand. Urbanization, particularly in emerging markets, impacts Apple's reach. For example, consumer spending in Africa grew by 3.9% in 2024, offering Apple a chance to expand, despite challenges like brand awareness.

Growing consumer awareness of ethical issues and social responsibility significantly impacts Apple. Concerns about labor practices and environmental sustainability influence brand image and customer loyalty. Apple's commitment to ethical practices is crucial. In 2024, Apple spent over $2 billion on environmental initiatives. This includes renewable energy and carbon reduction programs.

Social Media Influence

Social media platforms like TikTok and Instagram heavily shape consumer choices, affecting Apple's product sales through reviews and trends. Positive social media mentions correlate with increased sales, while negative reviews can lead to a decline. Apple's social media strategy is key to managing its brand image and engaging with consumers. Successful campaigns can boost product visibility and drive revenue. In 2024, Apple spent approximately $2.5 billion on advertising, including social media.

- 2024 Apple's advertising spending was about $2.5 billion.

- Social media impacts product popularity and sales significantly.

- Brand image management is crucial in the digital age.

- Viral trends can quickly boost or hurt sales.

Cultural Values and Trends

Cultural values and trends greatly impact tech adoption. Apple must adapt its products and marketing to fit regional nuances. Its design is now a cultural icon. In 2024, Apple's brand value hit $355.1 billion. This reflects its strong cultural resonance.

- Brand value of $355.1 billion in 2024.

- Global market share in smartphones.

- Cultural impact of design.

Consumer preferences are influenced by lifestyle changes and digital trends; wearable tech grew 10% in 2024. Demographic shifts, including urbanization and varying incomes, shape Apple's market reach. Consumer ethics influence brand image; Apple spent over $2 billion on environment in 2024. Social media plays a huge role in product sales. Brand value reached $355.1 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Consumer Trends | Wearable Tech Sales Growth | 10% |

| Social Media | Advertising Spend | $2.5 billion |

| Brand Value | Total Value | $355.1 billion |

Technological factors

Apple faces rapid tech advancements, crucial for staying competitive. AI, chip tech, and device capabilities are key. In Q1 2024, Apple invested $6.3 billion in R&D. Innovation is vital; it drives product updates like the M3 chip, enhancing performance and user experience. Staying ahead ensures market relevance.

Emerging technologies like AR/VR and health tech offer Apple opportunities and risks. Apple must integrate these to stay ahead. Apple's Vision Pro showcases its emerging tech focus. The global AR/VR market is projected to reach $78.3 billion in 2024. Competitors are also using these technologies.

Cybersecurity threats are a major concern due to Apple's heavy reliance on digital systems. Apple must invest in security to protect user data and infrastructure. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion. A strong security reputation is key for consumer trust.

Growing Demand for Cloud Computing

The escalating need for cloud computing offers Apple avenues to bolster its iCloud and related service revenues. This rise in cloud usage, driven by digital system dependence, creates significant growth potential. Apple's strategic investments in cloud infrastructure are crucial. In 2024, the global cloud computing market was valued at $670 billion, projected to reach $1.6 trillion by 2030.

- Cloud computing market valued at $670 billion in 2024.

- Projected to reach $1.6 trillion by 2030.

Increasing Technological Integration

The increasing technological integration across all facets of life provides Apple with significant growth opportunities. This trend fuels demand for interconnected solutions, enhancing the value of Apple's ecosystem. The global smart home market, a key area for Apple, is projected to reach $185.8 billion in 2024, reflecting this integration. Seamless user experiences across devices are crucial.

- Growth of IoT devices, expected to reach 29.4 billion globally by 2025, benefits Apple.

- Apple's focus on AI and machine learning further strengthens its competitive edge.

Technological factors greatly impact Apple. Key areas include AI, chip tech, and cloud services, which drive innovation. Apple’s R&D spending in Q1 2024 was $6.3 billion. Growth in AR/VR and IoT markets creates opportunities.

| Factor | Impact | Data |

|---|---|---|

| R&D Investment | Drives product innovation | $6.3B in Q1 2024 |

| Cloud Computing Market | Supports services growth | $670B (2024), $1.6T (2030) |

| IoT Devices | Boosts ecosystem value | 29.4B by 2025 |

Legal factors

Apple frequently deals with antitrust issues globally, reflecting its significant market power. Regulatory bodies worldwide, including the European Commission and the U.S. Department of Justice, are actively investigating Apple's business practices. These investigations can lead to considerable fines and potentially reshape Apple's market strategies. In 2024, Apple faced a $1.8 billion fine from the EU for antitrust violations in the music streaming market.

Operating globally, Apple must adhere to data privacy regulations like GDPR and CCPA. These rules dictate how personal data is handled. Apple's user privacy focus and compliance are key for trust and avoiding fines. In 2024, GDPR fines hit €1.2 billion. New regulations constantly emerge.

Apple heavily relies on robust intellectual property laws to safeguard its designs, software, and brand. In 2024, Apple spent over $29 billion on research and development, reflecting its commitment to innovation and the need to protect its new creations. Any shifts in these laws, or how they're enforced, can directly impact Apple's market position and potentially lead to legal battles over infringement. For example, Apple's ongoing legal battles over patent infringements highlight the continuous effort required to protect its intellectual property.

Consumer Protection Laws

Apple faces stringent consumer protection laws globally. These laws dictate product safety, warranty terms, and advertising accuracy. Non-compliance can lead to hefty fines and reputational damage, as seen in past settlements. For instance, in 2024, Apple faced scrutiny in Europe regarding battery health and repair policies.

- Product recalls cost Apple millions annually.

- Warranty claims and disputes are ongoing.

- Advertising standards compliance is constantly monitored.

Government Demands for Data Access

Apple faces legal hurdles regarding government data access requests. These demands, for law enforcement or national security, create legal and ethical dilemmas. Apple balances user privacy with legal obligations, a complex tightrope. Recent UK cases highlight this tension, showing the ongoing struggle.

- In 2024, data requests globally increased by 10% for tech companies.

- The UK's Investigatory Powers Act allows broad data access.

- Apple's transparency reports detail compliance with these requests.

Apple navigates complex antitrust issues globally, facing regulatory scrutiny and substantial fines, like the $1.8B EU penalty in 2024. Data privacy regulations, such as GDPR and CCPA, are crucial; GDPR fines totaled €1.2B in 2024, impacting its operations. Intellectual property protection, with R&D spending exceeding $29B in 2024, and consumer protection laws remain key legal considerations.

| Legal Factor | Impact on Apple | 2024 Data |

|---|---|---|

| Antitrust | Fines, market strategy changes | EU fine: $1.8B |

| Data Privacy | Compliance costs, user trust | GDPR fines: €1.2B |

| Intellectual Property | Patent battles, R&D focus | R&D spending: $29B+ |

Environmental factors

Climate change and sustainability are increasingly important. Apple faces pressure to cut its environmental impact. This involves reducing emissions and using renewable energy. Apple aims for carbon neutrality, with investments in eco-friendly practices. In 2024, Apple reported a 47% reduction in its carbon footprint since 2020.

Resource scarcity is a major environmental factor for Apple. The company is pressured to responsibly source materials. For example, in 2024, Apple used 25% recycled materials. This reduces reliance on depleting resources and supply chain issues.

Waste disposal, especially e-waste, presents a major environmental hurdle for Apple. The company faces pressure to improve recycling programs and design more easily disassembled products. In 2024, Apple recycled over 150,000 metric tons of electronic waste globally. Reducing waste from manufacturing and packaging is also key; Apple aims for carbon neutrality across its value chain by 2030.

Environmental Regulations and Compliance

Apple faces environmental regulations across its global operations, impacting manufacturing, product design, and waste management. Compliance is crucial to avoid penalties and maintain a positive brand image. Stringent environmental legislation is a growing concern. Apple's commitment to sustainability is reflected in its environmental reports, with a focus on reducing its carbon footprint. In 2024, Apple reported a 50% reduction in carbon emissions compared to 2015 levels.

- Compliance Costs: Estimated at $100M annually for regulatory adherence.

- Renewable Energy: Apple aims to use 100% renewable energy across its operations by 2030.

- Waste Reduction: Target to reduce e-waste by 75% by 2025.

Clean Energy and Water Management

Apple's commitment to clean energy and water management is vital for its environmental strategy. The company invests in renewable electricity for its operations and encourages suppliers to do the same, aiming for a fully carbon-neutral supply chain. Water conservation measures are implemented in manufacturing, reflecting a broader sustainability focus. In 2024, Apple's operational emissions were reduced by 54% since 2015.

- Apple aims to use 100% renewable energy for its global operations and supply chain.

- In 2023, Apple's absolute carbon emissions decreased by 18% compared to 2022.

- Apple has invested in water conservation projects, like those in China, to reduce water usage.

- Apple's Supplier Clean Energy Program includes over 200 suppliers.

Environmental factors significantly influence Apple's operations. Sustainability drives key initiatives, like its push for renewable energy. Resource scarcity and waste management further shape its eco-strategy.

| Factor | Impact | Data |

|---|---|---|

| Carbon Footprint | Emissions Reduction | 47% reduction (2020-2024) |

| Recycled Materials | Resource Efficiency | 25% recycled materials used (2024) |

| E-waste Recycling | Waste Reduction | 150,000+ metric tons recycled (2024) |

PESTLE Analysis Data Sources

Our Apple PESTLE relies on IMF data, market reports, tech forecasts, & legal frameworks. It uses verified global & regional information, ensuring insightful analysis.