Argan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argan Bundle

What is included in the product

Identifies strategic actions for each business unit across all BCG Matrix quadrants.

Clean, distraction-free view optimized for C-level presentation of your company's portfolio.

Preview = Final Product

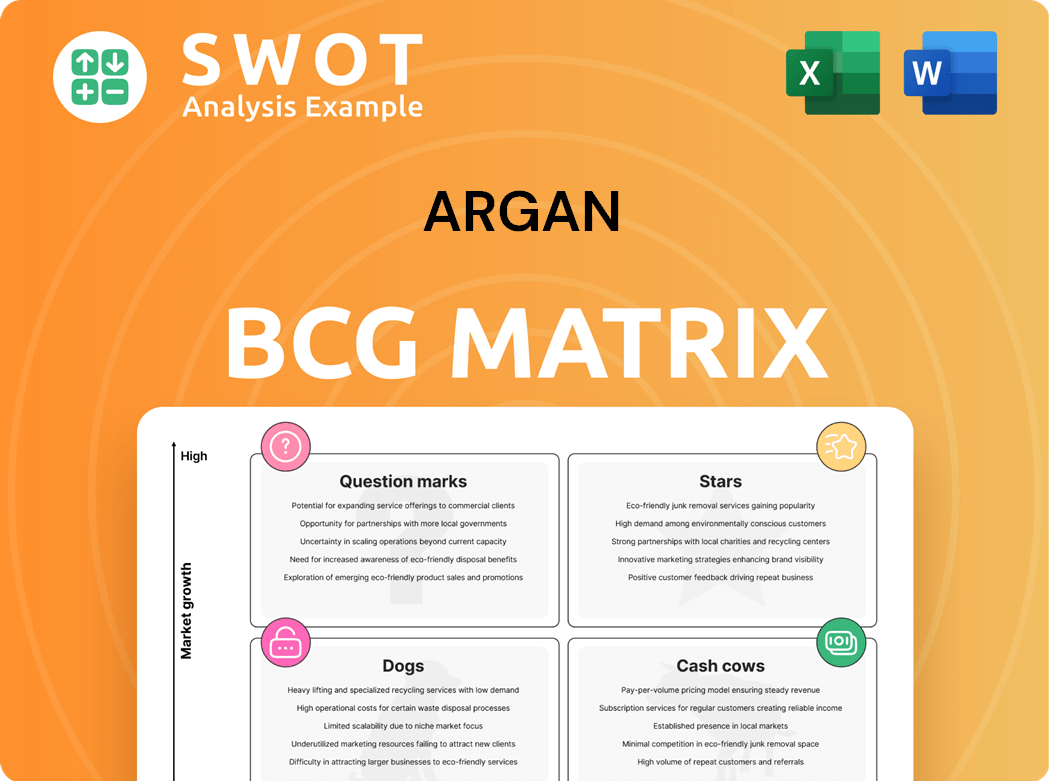

Argan BCG Matrix

The Argan BCG Matrix preview displays the identical document you'll receive upon purchase. This comprehensive report provides a clear, strategic framework, immediately ready for your business analysis and decision-making.

BCG Matrix Template

See how Argan products fit into the BCG Matrix! We've placed key offerings in Stars, Cash Cows, Dogs, & Question Marks. This reveals their market share & growth potential. Understand Argan's strategic positioning with our expert analysis. Learn where to invest for maximum ROI.

The complete BCG Matrix report offers data-rich insights, revealing detailed quadrant placements. Get strategic recommendations and a roadmap for smart investment and product decisions.

Stars

Argan's power industry services, especially in natural gas and renewables, shine as a "Star" in its BCG Matrix. In 2024, this segment boasted a significant backlog and revenue growth. Its strategic focus on reliable energy and grid upgrades fuels its leading market share. Continued investment is vital, with potential to become a cash cow as the market matures.

The Roberts Company, Argan's industrial construction services, shines as a "Star." Strong performance is fueled by industrial activity and infrastructure growth, especially in the Southeast. In 2024, the segment's revenue rose, reflecting robust demand. Strategic investments can boost this star's dominance.

Argan excels in EPC contracts for power projects. Securing deals like the 1.2 GW plant in Texas boosts revenue. In 2024, such projects drove substantial growth. Maintaining this focus is crucial for continued success.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships can be stars for Argan. While cautious, well-chosen moves can boost market reach and enhance capabilities. These initiatives should align with the company's long-term strategy for sustained growth. Careful evaluation is key to success.

- In 2024, Argan's revenue was $643.9 million.

- Strategic partnerships could expand this figure.

- Acquisitions must align with long-term goals.

- Focus on sectors offering high growth potential.

Financial Prudence and Strong Balance Sheet

Argan's robust financial health truly shines. Their solid balance sheet, loaded with cash and free of debt, sets them apart. This financial prudence allows them to invest wisely and reward shareholders generously. Argan's financial strategy is a key strength in its overall success.

- Cash and Equivalents: ~$300 million (2024).

- Debt: Zero.

- Dividend Increases: Consistent, year-over-year.

- Share Repurchases: Ongoing, enhancing shareholder value.

Argan's "Stars" like power industry services and Roberts Company showed robust growth in 2024. EPC contracts and strategic moves boost revenue, as seen with the 1.2 GW plant. Financial strength supports these ventures.

| Key Metric | Value | Notes |

|---|---|---|

| 2024 Revenue | $643.9M | Overall company performance |

| Cash & Equivalents | ~$300M | Bolsters investment and stability |

| Debt | Zero | Financial health and flexibility |

Cash Cows

Argan's maintenance services, especially for natural gas plants, are a cash cow. They boast a high market share and steady revenue. These services need little investment, ensuring reliable cash flow. In 2024, Argan's services in this sector generated approximately $400 million. Focusing on efficiency boosts profits.

Argan's commissioning services, crucial for new power plant startups, are a cash cow due to their consistent revenue and limited growth. These services guarantee operational reliability and efficiency. Argan's strong reputation supports this cash flow, as seen in 2024's steady revenue from these services. In Q3 2024, commissioning contributed significantly to Argan's stable financials.

Argan's technical consulting services, including power plant expertise, are cash cows. These services offer consistent revenue streams with limited growth potential. Leveraging their industry knowledge and client relationships is key. In 2024, Argan reported approximately $200 million in revenue from technical services, showcasing their stability.

Industrial Fabrication Services (The Roberts Company)

The Roberts Company's industrial fabrication services are cash cows due to their stable revenue streams, despite serving mature industries. These services, including on-site turnaround support, offer consistent income with limited growth. Focusing on efficiency and expanding services within current client relationships is key. For example, in 2024, this segment generated $150 million in revenue.

- Stable revenue streams from mature industries.

- Consistent income from services like on-site support.

- Focus on efficiency and client relationship expansion.

- 2024 revenue of $150 million.

Legacy Telecommunications Infrastructure Services

Argan's legacy telecommunications infrastructure services, like trenchless boring, remain cash cows. These services provide consistent revenue from established clients. Optimization and high-margin projects are key to maximizing this segment's cash generation. In 2024, this segment contributed significantly to Argan's overall revenue.

- Steady revenue streams from existing contracts.

- Focus on profitable, high-margin projects.

- Operational efficiency improvements to boost profits.

- Continued demand from established infrastructure.

Cash Cows in Argan’s portfolio feature high market share and consistent revenue with low investment needs. They include maintenance, commissioning, and technical services, generating substantial cash. The Roberts Company's fabrication services and telecom infrastructure services also fit this category. Focusing on operational efficiency and leveraging existing client relationships boosts profitability.

| Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Maintenance Services | Services for natural gas plants | $400M |

| Commissioning Services | Power plant startup services | Significant contribution to financials |

| Technical Consulting | Power plant expertise | $200M |

| Roberts Co. Fabrication | Industrial fabrication | $150M |

| Telecom Infrastructure | Trenchless boring, etc. | Significant contribution |

Dogs

Projects in areas with dwindling natural gas infrastructure, like those affected by renewable energy growth, could be dogs. Profitability might suffer, and growth could stall for these projects. For example, natural gas consumption in the U.S. power sector is projected to decline by 2% in 2024. Divesting or repurposing these assets could be vital in such scenarios.

Fixed-price contracts facing substantial cost overruns often turn into dogs for companies. These contracts, due to issues like unforeseen events or poor management, can severely impact profitability. In 2024, construction projects frequently saw overruns; for instance, a study showed average cost escalations of 15%. Stronger risk management and project oversight are vital to prevent these situations.

Dogs, within the BCG matrix, are services with low margins and limited differentiation. These services often face profitability challenges. For instance, in 2024, many retail services saw margins compressed due to intense competition. Strategic restructuring or divestiture might be considered.

Investments in outdated technologies

Outdated technology investments can turn into dogs, becoming uncompetitive. These assets often need costly upgrades or replacements. For example, in 2024, companies spent an average of $1.2 million to upgrade outdated machinery. Phasing out these technologies and investing in newer alternatives boosts competitiveness.

- Outdated tech becomes a liability.

- Upgrades and replacements are expensive.

- Newer tech enhances competitiveness.

- Companies spent millions upgrading in 2024.

Projects facing regulatory hurdles or environmental opposition

Projects encountering regulatory or environmental issues often suffer delays, cost overruns, and reduced profitability. These obstacles can severely impact project completion, limiting growth prospects. For instance, in 2024, renewable energy projects faced significant delays due to permitting issues, with some experiencing up to a 20% increase in initial costs. Thoroughly evaluating regulatory and environmental factors is crucial to mitigate these risks.

- Regulatory delays can lead to a 10-20% cost increase.

- Environmental opposition can halt projects.

- Projects may not meet projected profitability targets.

- Careful assessment is vital for risk management.

Dogs represent underperforming business units with low market share in slow-growing markets. These ventures typically generate low profits or losses. In 2024, many such projects saw declining revenues and profitability. Strategic options involve divesting or restructuring these segments.

| Characteristic | Impact | Example (2024 Data) |

|---|---|---|

| Low Market Share | Reduced Revenue | Retail service margins compressed due to competition |

| Slow-Growth Market | Limited Growth | Natural gas consumption in the U.S. power sector declined by 2% |

| Low Profitability | Financial Strain | Construction project overruns averaged 15% |

Question Marks

Argan's foray into new renewable energy, like battery storage, is a question mark. These areas boast high growth potential but are risky. They demand substantial investment and face market uncertainties. For instance, the global battery storage market is projected to reach $15.1 billion by 2024. Careful market research, strong partnerships, and risk management are key.

Argan's move into emerging markets, where energy needs are rising yet infrastructure is lacking, fits the "Question Mark" category. These areas promise high growth, but come with risks like political instability and regulatory issues. For instance, in 2024, renewable energy investments in developing nations increased by 20%. Success hinges on careful research, local tie-ups, and solid risk management.

SMC Infrastructure Solutions' push into high-growth telecom areas puts it squarely in "question mark" territory within Argan's BCG matrix. The potential is huge, fueled by the need for infrastructure upgrades. However, the telecom market is competitive. Success hinges on strategic investments and smart marketing to gain ground. Consider that in 2024, global telecom spending neared $2 trillion.

Development of new service offerings

Developing new service offerings, like energy consulting, positions Argan as a question mark in the BCG matrix. These services target growing markets, but demand heavy investment with uncertain returns. Success hinges on proving market demand and managing risk effectively. Argan's stock price, as of late 2024, has shown volatility, reflecting these uncertainties.

- Market demand validation is key for success.

- Significant investment with uncertain returns.

- Risk management is crucial.

- Argan's stock price reflects market uncertainties.

Investment in innovative project management technologies

Investing in innovative project management technologies, such as AI-powered scheduling or predictive analytics, fits the "question mark" quadrant of the BCG matrix. These technologies promise to boost project efficiency and cut costs, but their value isn't yet proven. Piloting these technologies on specific projects and closely tracking their impact is crucial for assessing their worth and potential ROI. For example, in 2024, the project management software market is valued at over $6 billion, with AI integration growing rapidly.

- Potential for high growth, but uncertain returns.

- Requires careful evaluation and pilot programs.

- Impact should be measured to determine value.

- Market size is significant, with AI integration.

Question Marks in Argan's portfolio represent high-growth potential but uncertain returns.

These ventures require significant investment and face market risks, such as in the telecom sector, where 2024 spending neared $2 trillion.

Success depends on validating market demand, managing risks, and piloting new technologies.

| Investment Area | Growth Potential | Risks |

|---|---|---|

| Renewable Energy | High | Market Uncertainty, $15.1B market by 2024 |

| Emerging Markets | High | Political Instability, Regulatory Issues |

| Telecom | High | Competition, High Investment |

BCG Matrix Data Sources

The Argan BCG Matrix leverages financial statements, market research, and competitor analyses to position strategic business units.