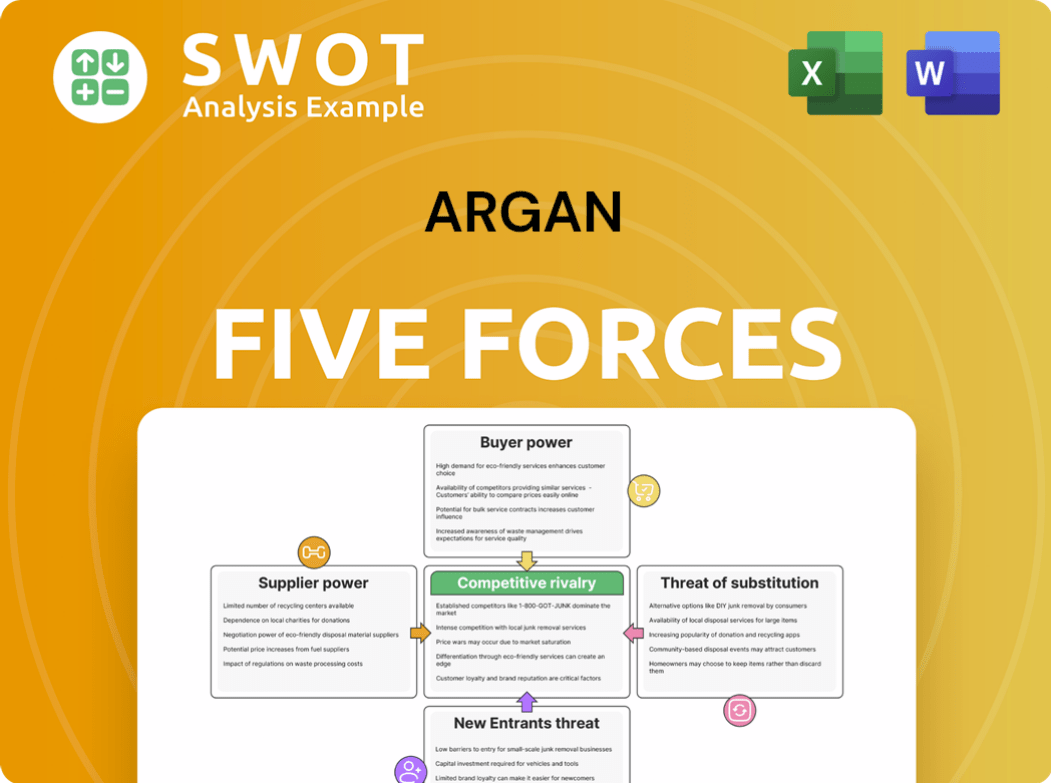

Argan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argan Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Quickly visualize the competitive landscape with a dynamic spider chart.

Preview the Actual Deliverable

Argan Porter's Five Forces Analysis

This preview details the Argan Porter's Five Forces Analysis. The analysis covers all aspects of the company and its environment. It dissects each force impacting the industry. After purchase, you'll receive this exact comprehensive analysis. The document is ready for immediate use.

Porter's Five Forces Analysis Template

Argan's industry dynamics are shaped by a complex interplay of forces. Buyer power, a key factor, is driven by project concentration. Competitive rivalry is fierce, reflecting the nature of the industry. The threat of new entrants is moderate, given industry barriers. Substitute products pose a limited challenge, but supplier power is significant. These elements influence Argan's market position.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Argan.

Suppliers Bargaining Power

Argan Inc. depends on specific suppliers for engineering, procurement, and construction. If there are few specialized suppliers, they gain bargaining power. This can increase Argan's project costs. In 2024, the construction industry faced rising material costs, impacting project profitability. For instance, steel prices increased by 15% in Q3 2024.

Supplier concentration significantly affects Argan Porter's pricing. If few suppliers dominate crucial inputs, they can set prices. This impacts Argan's costs and profitability. For example, the top three global oilseed crushers control over 50% of the market. Monitoring supplier market share is key.

If Argan Inc. faces low switching costs, its suppliers' power decreases. This means Argan can readily change suppliers without major expenses. In 2024, average switching costs across industries varied, yet Argan benefits from this flexibility. It supports Argan in securing better prices and terms during negotiations, enhancing its competitive edge.

Supplier's ability to vertically integrate

Suppliers' ability to integrate forward, like offering EPC services directly, boosts their bargaining power over Argan Inc. This poses a significant threat that demands ongoing evaluation. Argan Inc. must develop strategies to lessen this risk, such as forming strategic alliances or diversifying its supplier base. For instance, in 2024, the construction industry saw a 5% increase in supplier consolidation, increasing the importance of this factor.

- Forward integration by suppliers can lead to higher costs for Argan Inc.

- Strategic partnerships can help mitigate supplier power.

- Diversifying the supplier base reduces dependence.

- Continuous monitoring of supplier activities is essential.

Impact of raw material price volatility

Raw material price volatility significantly influences supplier costs, potentially affecting Argan Inc.'s profitability. Suppliers, especially those providing steel and concrete, may transfer increased costs to Argan. External factors, like inflation and supply chain disruptions, can intensify these price fluctuations. To mitigate risks, hedging strategies and long-term contracts become crucial.

- In 2024, steel prices fluctuated by up to 15% due to geopolitical events.

- Concrete costs rose by approximately 8% in Q2 2024, impacting construction projects.

- Argan Inc. could experience a 5-10% reduction in project margins because of these fluctuations.

- Long-term contracts can stabilize costs, but require careful negotiation.

Supplier bargaining power impacts Argan Inc.'s costs, especially in a concentrated market. High supplier concentration, like the top three oilseed crushers controlling over 50% of the market, increases their power. Forward integration by suppliers and raw material price volatility, with steel prices fluctuating up to 15% in 2024, amplify risks.

| Factor | Impact on Argan Inc. | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher Costs | Top 3 crushers >50% market share |

| Forward Integration | Increased Costs | Construction supplier consolidation +5% |

| Raw Material Volatility | Reduced Margins | Steel price fluctuation up to 15% |

Customers Bargaining Power

Argan Inc.'s large project sizes often empower customers in negotiations. These substantial projects translate to significant financial commitments, bolstering customer bargaining power. For instance, a 2024 study showed that large infrastructure projects saw customer-driven price adjustments of up to 15%. Understanding project-specific dynamics is critical for Argan to manage this.

If Argan Inc. relies on a few major customers, especially in sectors like energy, these clients gain considerable bargaining power. This concentration makes Argan vulnerable to their demands. For instance, in 2024, if 70% of Argan's revenue comes from just three clients, its profitability is at risk. Broadening the customer base mitigates this risk, as seen in companies with over 500 clients, reducing dependency and enhancing financial stability.

Argan's customers experience high switching costs, primarily due to the intricate and extended nature of Engineering, Procurement, and Construction (EPC) projects. This complexity makes it difficult for clients to readily switch to rival firms mid-project. For example, in 2024, the average EPC project duration was 2-3 years. Argan should leverage this customer "stickiness" by delivering outstanding service, ensuring projects are completed efficiently and effectively.

Availability of in-house capabilities

Some Argan Inc. customers possess in-house engineering or construction teams, decreasing their need for Argan's services. It's vital to evaluate clients' internal capacities to understand their self-sufficiency levels. This insight enables Argan to customize its offerings, ensuring they complement client resources effectively. The availability of these internal capabilities impacts Argan's negotiating position. For example, in 2024, Argan's backlog was approximately $1.3 billion, indicating its ability to secure contracts despite client capabilities.

- Client self-sufficiency influences Argan's contract terms.

- Internal capabilities assessment is crucial for service tailoring.

- Argan's backlog reflects its market position.

- In-house teams can reduce reliance on external contractors.

Customer's access to information

Customers today have unprecedented access to information, which significantly boosts their bargaining power. They can easily compare prices and assess the value of services. This increased transparency forces companies like Argan Inc. to be upfront with their pricing and project costs to remain competitive. For example, in 2024, the average consumer utilized at least three different sources to research a product before making a purchase, according to a study by the Pew Research Center.

- Price comparison websites allow consumers to easily compare costs.

- Online reviews and ratings provide valuable insights into service quality.

- Social media platforms amplify customer feedback and influence purchasing decisions.

- Transparency in pricing and project costs is key.

Argan's customer bargaining power varies with project size, as shown by 15% price adjustments on large infrastructure projects in 2024. High client concentration, such as 70% revenue from three clients in 2024, elevates customer influence. Customers' access to data via online sources, used by 3 sources on average in 2024, also strengthens their negotiating stance.

| Factor | Impact | 2024 Data |

|---|---|---|

| Project Size | Higher Power | 15% price adjustments |

| Client Concentration | Increased Influence | 70% revenue from 3 clients |

| Information Access | Enhanced Bargaining | 3 research sources |

Rivalry Among Competitors

The EPC market is fiercely competitive, hosting numerous firms. This competition squeezes pricing and profitability. Argan Inc. needs strong differentiation to succeed. In 2024, the EPC market saw significant project bidding wars, impacting margins. Companies are focusing on specialized services.

Price-based competition is a key factor in the industry, potentially squeezing profit margins. To combat this, Argan Inc. should emphasize value-added services beyond just pricing. This includes showcasing superior project management skills. In 2024, companies focusing on these areas have seen better profitability.

The Engineering, Procurement, and Construction (EPC) market's fragmented nature, featuring numerous small to medium-sized firms alongside larger entities, intensifies competition. In 2024, the market saw over 2,000 EPC firms globally, heightening rivalry. Argan must capitalize on its scale and specialized knowledge to gain an edge in this competitive environment. For example, in 2024, the top 10 EPC firms controlled roughly 30% of the market share.

Geographic competition varies

Competition in Argan's markets varies significantly across different geographic regions. Some areas might be highly saturated, while others present fewer competitors and more opportunities. A deep understanding of regional market dynamics is crucial for Argan to succeed. By analyzing these differences, Argan can strategically target regions with more favorable competitive landscapes.

- Market saturation can vary dramatically.

- Regional analysis is key for strategic decisions.

- Targeting less competitive areas can boost growth.

- Competitive intensity differs significantly by location.

Differentiation through specialization

Argan Porter can reduce competitive rivalry through differentiation via specialization. Focusing on specific project types, like renewable energy, allows Argan to build unique expertise. This specialization helps shield the company from direct competition. Argan Inc. should consistently cultivate its niche expertise. In 2024, the renewable energy sector saw significant growth, with investments reaching $366 billion globally.

- Focus on niche markets to reduce competition.

- Build expertise in specific project types, such as renewable energy.

- In 2024, the renewable energy sector grew significantly.

- Investments in renewable energy reached $366 billion worldwide.

Intense competition in the EPC market squeezes profits. Argan Inc. needs differentiation to thrive, focusing on specialized services and value-added skills. Market fragmentation and regional variations further impact rivalry. Analyzing these dynamics is essential for strategic decisions.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Structure | Fragmented with many firms | Over 2,000 EPC firms globally |

| Competitive Pressure | Price-based competition is common | Bidding wars impacted margins |

| Differentiation | Focus on specialized services | Renewable energy sector reached $366B in investments worldwide |

SSubstitutes Threaten

The emergence of solar and wind power presents a significant, long-term threat to Argan Inc.'s traditional power generation projects. To mitigate this, Argan needs to proactively adapt to the changing energy landscape. Investing in renewable energy engineering, procurement, and construction (EPC) capabilities is a crucial step. In 2024, the global renewable energy market is projected to reach $881.1 billion, highlighting the urgency of this transition.

The growing emphasis on energy efficiency presents a threat to Argan Inc. as it diminishes the need for new power generation projects. This shift impacts the demand for Argan's services, potentially lowering revenue. For instance, in 2024, investments in energy efficiency increased by 15% globally. Argan should consider entering the energy efficiency sector to offset these risks and capitalize on new opportunities.

Distributed generation systems, like on-site solar, pose a threat to traditional centralized power plants. This shift alters project scales and types, potentially impacting Argan Inc.'s business model. The increasing adoption of distributed generation, with the global market valued at $195.6 billion in 2023, necessitates strategic adaptation.

Argan Inc. should consider offering distributed generation solutions to remain competitive. The distributed generation market is projected to reach $325.8 billion by 2030. This proactive approach can mitigate the risk of substitution.

Modular construction techniques

Modular construction presents a significant threat as a substitute for Argan's traditional engineering, procurement, and construction (EPC) methods. This approach, which involves prefabricating building components off-site, can offer faster project timelines and potentially lower costs. The substitution threat necessitates careful monitoring by Argan to assess the competitive landscape. Argan should actively evaluate incorporating modular construction into its project strategies to remain competitive.

- Modular construction market is projected to reach $157 billion by 2030.

- Modular construction can reduce project timelines by up to 50%.

- Cost savings from modular construction can range from 5% to 20%.

- Argan's revenue in 2023 was $583 million.

Technological advancements

Technological advancements pose a threat to Argan's services. Innovations like AI-driven project management could streamline operations and cut costs. Argan must adopt new tech to avoid becoming obsolete. Investment in these areas is essential for maintaining competitiveness, with the construction tech market projected to reach $19.8 billion by 2028.

- AI's impact: AI is expected to significantly reduce project completion times.

- Market growth: The construction technology market is growing rapidly.

- Cost reduction: New technologies can lower operational expenses.

- Competitive edge: Innovation helps maintain a strong market position.

The threat of substitutes for Argan Inc. arises from shifts in technology, construction methods, and energy sources. Renewable energy and energy efficiency efforts challenge traditional projects. Modular construction offers faster, potentially cheaper alternatives, as the modular construction market is projected to reach $157 billion by 2030.

| Substitute | Impact on Argan | 2024 Data |

|---|---|---|

| Renewable Energy | Reduces demand for fossil fuel projects | Global renewable energy market: $881.1 billion |

| Energy Efficiency | Decreases the need for new power projects | Investments in energy efficiency: up 15% globally |

| Modular Construction | Offers faster project timelines, lower costs | Projected market: $157 billion by 2030 |

Entrants Threaten

The EPC industry demands substantial upfront capital, acting as a significant hurdle for new companies. This high capital intensity shields established firms from new competitors. Argan Inc., as a seasoned player, profits from this barrier. In 2024, the average project cost in the EPC sector was around $50 million, showcasing the financial commitment needed.

EPC projects require specialized engineering and project management, which is a significant barrier. New entrants find it challenging to quickly gain this expertise. Argan's extensive experience gives it a strong competitive edge. In 2024, the market for EPC services was valued at approximately $400 billion, highlighting the scale of projects demanding this specialized knowledge.

Strong relationships with clients and suppliers are vital in the EPC industry, creating barriers for new entrants. Establishing and nurturing these connections is essential for success. Argan Inc. benefits from its existing, robust network. For instance, in 2024, Argan secured several key contracts, leveraging its established partnerships, contributing to a revenue of $850 million.

Regulatory hurdles

Regulatory hurdles significantly impact new entrants in power generation and telecommunications. These industries face stringent oversight, creating barriers. Argan Inc.'s established expertise in regulatory compliance is a key advantage. The cost of navigating these complexities can be substantial. New entrants must meet specific standards to compete effectively.

- Compliance costs can be high, potentially millions of dollars for a new power plant.

- Regulatory delays can significantly postpone project completion, impacting ROI.

- Existing firms, like Argan, benefit from their established regulatory relationships.

- Failure to comply can result in hefty fines and operational shutdowns.

Economies of scale

Economies of scale pose a significant barrier to entry in the Engineering, Procurement, and Construction (EPC) industry. Larger firms like Argan Inc. benefit from lower costs due to their scale, making it difficult for new entrants to compete on price. This scale advantage allows established companies to bid more competitively on projects. Argan Inc. should leverage its existing scale by pursuing larger projects to maintain its competitive edge.

- Argan Inc. operates within the EPC industry.

- Economies of scale give established firms a cost advantage.

- New entrants struggle to match the cost efficiency of larger companies.

- Argan Inc. should focus on larger projects to maintain its scale advantage.

The threat of new entrants in the EPC industry is moderate due to high barriers. These include substantial capital needs, specialized expertise, and established industry relationships. Regulatory hurdles and economies of scale further limit new competitors. For example, in 2024, new entrants faced average compliance costs of millions.

| Barrier | Impact on New Entrants | 2024 Data |

|---|---|---|

| Capital Requirements | High upfront investment needed | Avg. project cost: $50M |

| Expertise | Challenges in acquiring specialized skills | Market value of EPC services: $400B |

| Relationships | Difficulty building client and supplier networks | Argan's revenue in 2024: $850M |

Porter's Five Forces Analysis Data Sources

The analysis uses financial statements, industry reports, market research, and economic databases for a comprehensive competitive assessment.