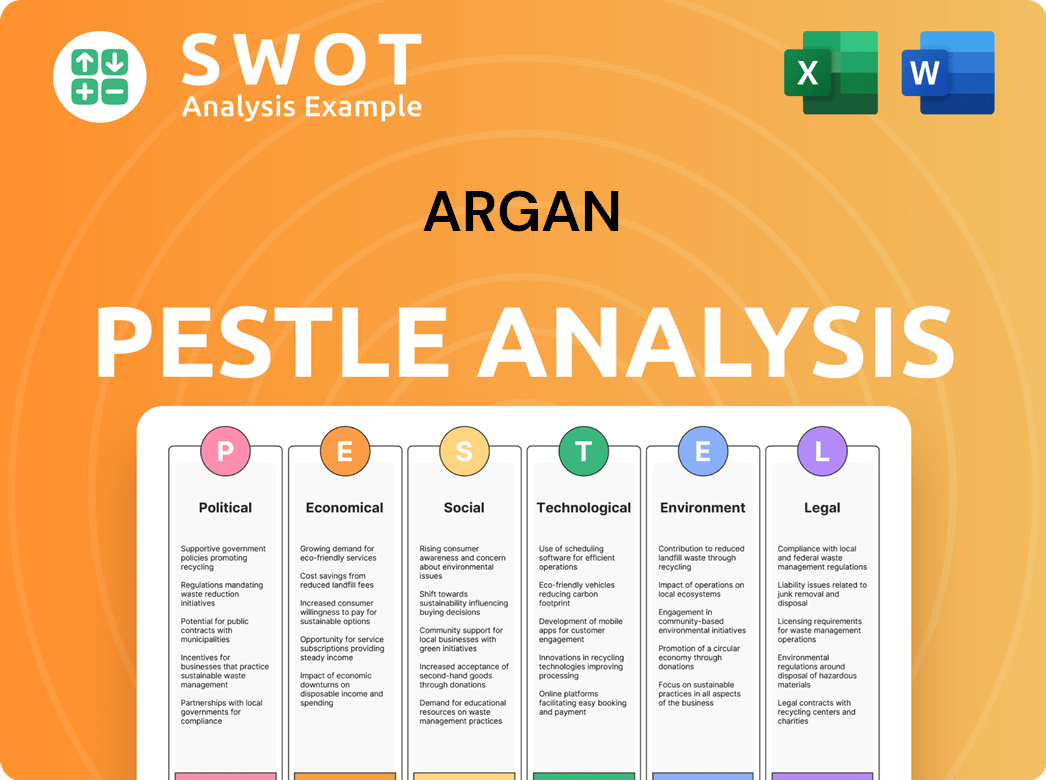

Argan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Argan Bundle

What is included in the product

A comprehensive look at Argan via six external macro factors: Political, Economic, Social, Technological, Environmental, and Legal.

Allows easy identification of specific external challenges. Quick reference point during brainstorming.

Preview the Actual Deliverable

Argan PESTLE Analysis

This is the Argan PESTLE Analysis document preview. The layout, content, and structure visible here are exactly what you’ll download immediately after buying.

PESTLE Analysis Template

Explore Argan's landscape with our PESTLE Analysis. Uncover political and economic factors shaping its trajectory. Social and technological shifts also impact this company. Identify environmental concerns and legal hurdles it faces. Understand global forces. Access deeper insights and strategize smartly with the full report!

Political factors

Government infrastructure spending significantly impacts Argan. The Infrastructure Investment and Jobs Act (IIJA) is a key driver. It allocates substantial funds for projects. Billions are slated for distribution in 2024-2026. This boosts demand for Argan's services.

Government policies significantly shape the energy sector. The Inflation Reduction Act (IRA) offers incentives boosting renewable energy projects. Bipartisan support exists, yet potential policy shifts could alter renewable deployment. Argan's dual expertise positions it well. However, the political landscape remains critical. In 2024, renewable energy capacity additions are expected to reach 30 GW in the U.S.

The EPA's emission regulations, finalized in 2024, are pivotal for power plants. These rules, targeting coal and new natural gas plants, may necessitate carbon capture tech. The regulations face legal battles and potential shifts under new leadership, creating uncertainty. Companies in environmental control and alternative energy could find opportunities. The U.S. power sector emitted 1.06 billion metric tons of CO2 in 2023.

Telecommunications policy and investment

Government policies significantly affect Argan's telecommunications infrastructure services. The US has seen growth in telecoms infrastructure, yet further expansion needs government backing. Broadband access expansion and spectrum allocation are key. Argan's services are directly tied to these policy decisions and investment levels.

- The US government allocated $42.5 billion through the Broadband Equity, Access, and Deployment (BEAD) program to expand broadband access.

- In 2024, the FCC continued to auction off spectrum, with the latest auctions raising billions for infrastructure development.

- Private investment in telecom infrastructure reached $90 billion in 2023, and is projected to increase in 2024/2025.

International trade policies

International trade policies, including tariffs, significantly impact construction costs. Tariffs on imports can raise expenses for materials and equipment. For example, tariffs on coal exports have been observed. Changes in trade policies can impact project feasibility, affecting Argan's project pipelines and costs in power and industrial sectors.

- Tariffs on steel imports can increase construction costs by up to 10%.

- The US-China trade war impacted infrastructure project costs by an average of 5%.

- Recent data indicates a 7% rise in material costs due to new trade regulations.

- Global construction output is projected to grow by 3.6% in 2024, influenced by trade policies.

Political factors highly influence Argan's business. Infrastructure spending, particularly via the IIJA, is a primary driver, boosting demand.

Energy sector policies, like the IRA, impact renewables, but shifts in government can alter project viability. Regulations, such as EPA's emission rules, create opportunities but also introduce uncertainty, especially for carbon capture technologies.

Trade policies, tariffs included, change construction costs for materials and equipment. Broadband expansion and telecom spectrum allocation also impact Argan.

| Political Aspect | Impact on Argan | Data/Facts |

|---|---|---|

| Infrastructure Spending | Increased demand | IIJA: Billions allocated 2024-2026 |

| Energy Policies | Opportunity/Uncertainty | 2024 renewable capacity additions: 30 GW |

| Trade Policies | Cost & Project Risks | Tariffs on steel: up to 10% increase |

Economic factors

Overall economic growth and investment are vital for Argan. High interest rates and inflation have presented challenges. However, the construction industry remains strong, with increasing employment. Anticipated interest rate decreases could significantly boost construction demand. This would indirectly benefit Argan's service offerings. For example, in early 2024, construction spending rose, indicating resilience despite economic pressures.

Argan benefits from a significant increase in electricity demand. Electrification, AI-driven data centers, and manufacturing growth are key drivers. This surge requires more power infrastructure, aligning with Argan's expertise. U.S. electricity demand is projected to grow, offering a strong economic advantage. The U.S. Energy Information Administration forecasts continued growth.

Continued investment in renewables like solar and wind, plus natural gas-fired plants, shapes Argan's project pipeline. Early 2024 data shows Argan's backlog significantly supports the low-carbon economy. This indicates a strong focus on renewable projects, alongside contracts in natural gas. The investment balance between these influences Argan's project choices. As of Q1 2024, renewables made up 60% of new energy investments.

Construction costs and labor market

Rising construction costs and skilled labor shortages present economic headwinds for Argan. These challenges could lead to project delays and higher operational costs. The construction sector faces a tight labor market, even with employment growth, necessitating workforce management strategies. Data from 2024 indicates construction costs increased by about 5%, impacting project budgets.

- Construction costs increased by 5% in 2024.

- Labor shortages persist in engineering and construction.

- Project delays are a potential risk.

- Workforce management strategies are crucial.

Wholesale power prices

Wholesale power prices are critical for the profitability of power generation projects. Rising natural gas costs are projected to push wholesale power prices up in certain areas during 2025. For instance, in the U.S., natural gas spot prices are estimated to average around $3.00 per million British thermal units (MMBtu) in 2024, potentially increasing to $3.50/MMBtu in 2025, affecting power prices. These price shifts directly impact investment decisions in power plants and the demand for Argan's services.

- Natural gas prices are crucial for power generation costs.

- Increased fuel costs can lead to higher wholesale power prices.

- These changes affect investment in power plants.

- Argan's market is sensitive to these price fluctuations.

Economic growth affects Argan through construction demand, currently boosted by resilient construction sectors. Electricity demand is on the rise, supported by renewables and infrastructure, driven by growth. Rising costs, labor shortages, and volatile wholesale power prices pose challenges.

| Economic Factor | Impact on Argan | 2024/2025 Data Points |

|---|---|---|

| Construction Spending | Affects Service Demand | Increased in early 2024, 5% cost rise, projects may be delayed. |

| Electricity Demand | Creates Project Opportunities | Growth in the US. Renewables form 60% of new energy investment (Q1 2024). |

| Wholesale Power Prices | Impacts Power Projects | Natural gas $3.00/MMBtu in 2024, to $3.50/MMBtu in 2025 (est). |

Sociological factors

Public perception significantly shapes energy project outcomes. Renewable projects often face community opposition, potentially delaying timelines. Argan, indirectly affected by social acceptance, must consider these factors. A 2024 study shows that 70% support solar, but wind faces more local resistance. This social license is crucial for project success.

The construction and engineering sectors heavily rely on skilled labor. In 2024, these sectors faced over 400,000 job openings, signaling talent shortages. High labor costs and project delays can result from workforce gaps. Argan must secure and manage a qualified workforce to succeed in these conditions.

Argan's community engagement focuses on building positive local relationships, crucial for project success. Social responsibility enhances Argan's reputation, supporting smooth operations. They emphasize community engagement in investor communications. This approach aligns with growing investor and public expectations for ethical business practices. In 2024, companies with strong CSR saw up to a 10% brand value increase.

Impact of infrastructure development on communities

Infrastructure development significantly impacts communities, with projects like power plants and telecom networks creating both opportunities and challenges. These projects can boost local economies through job creation, offering improved services and connectivity. However, they may also introduce environmental concerns or disrupt existing social structures, requiring careful management. Argan, as a player in these projects, is indirectly involved in these multifaceted community impacts.

- In 2024, infrastructure spending in the U.S. reached $3.4 trillion.

- Telecommunications sector growth is projected at 3.5% annually through 2025.

- Environmental impact assessments are now standard for large projects.

Changing energy consumption behaviors

Societal shifts are reshaping energy use. Electric vehicles and heat pumps boost electricity demand. This impacts the energy infrastructure needs. Argan's power generation services market is thus affected.

- EV sales rose, e.g., 1.2 million in Q1 2024 in the US.

- Heat pump installations are increasing, with 20% growth in 2023.

- Electricity demand is projected to increase by 10% by 2025.

Social acceptance influences energy projects; Argan must address community views, as support for renewables varies. Skilled labor availability impacts costs; in 2024, there were labor shortages. Strong community relations boost Argan's reputation; they focus on this in their investor communication.

| Factor | Impact on Argan | Data |

|---|---|---|

| Public Opinion | Project Delays/Support | 70% solar support, varied wind resistance (2024 study) |

| Labor Market | Cost, Project Time | 400K+ job openings in construction in 2024 |

| Community Engagement | Brand Value, Operations | CSR can boost brand value by up to 10% (2024) |

Technological factors

Argan benefits from advancements in power tech. Efficiency gains in natural gas turbines and solar tech are crucial. The global solar PV market is projected to reach $336.6B by 2030. Argan's expertise in these areas boosts its market position.

The rise of advanced energy storage, like battery energy storage systems (BESS), is vital for integrating renewable energy into the grid. Argan's work in projects involving battery storage highlights the technology's growing importance. The energy storage market's expansion creates direct opportunities for Argan. The global BESS market is projected to reach $23.6 billion by 2025.

The evolution of telecommunications infrastructure technology significantly impacts Argan. Advancements like 5G and AI drive infrastructure expansion needs. Argan's services, including project management, construction, and maintenance, are directly linked to these developments. 5G adoption is projected to reach 5.8 billion connections globally by 2029, creating considerable demand for infrastructure upgrades.

Integration of AI in power electronics and operations

The integration of AI in power electronics and operations is rapidly advancing, potentially enhancing efficiency and predictive maintenance. Argan's projects may incorporate these technologies, requiring the workforce to adapt to new tools. The global AI in power electronics market is projected to reach $2.8 billion by 2025, growing at a CAGR of 20% from 2020. This growth reflects the increasing adoption of AI.

- Market Growth: The AI in power electronics market is expected to reach $2.8 billion by 2025.

- Technological Adoption: Power electronics is increasingly integrating AI.

- Workforce Impact: Argan's staff must adapt to new tools and techniques.

Innovation in construction technologies

Technological advancements in construction, like Building Information Modeling (BIM) and drone-based site monitoring, significantly affect Argan. These innovations can boost efficiency and safety, reducing project timelines and costs. For instance, BIM adoption can cut project expenses by up to 10%, as reported in 2024 studies. Argan's ability to integrate these technologies is crucial for maintaining a competitive edge.

- BIM can decrease project costs by up to 10%.

- Drone use in construction is projected to grow by 15% annually through 2025.

- Project management software adoption has increased by 20% in the last two years.

Argan's growth hinges on power tech, including gas turbines and solar. AI in power electronics is a key market. BIM and drones boost efficiency in construction.

| Technology Area | Market Size/Growth | Impact on Argan |

|---|---|---|

| AI in Power Electronics | $2.8B by 2025; 20% CAGR | Workforce adaptation and enhanced services. |

| Construction Tech (BIM/Drones) | BIM cuts costs up to 10%; Drone use +15%/yr | Efficiency gains, faster project times. |

| Energy Storage (BESS) | $23.6B by 2025 | Growth opportunities in renewable integration. |

Legal factors

Argan faces environmental regulations, impacting project costs and timelines. Compliance includes air and water standards and permitting. EPA changes can create challenges. In 2024, stricter rules increased compliance expenses. Argan's projects must meet these legal demands.

Worker safety regulations, primarily enforced by OSHA, are paramount for Argan, given its construction and engineering focus. A robust safety record is crucial, as emphasized in its annual reports. Compliance is legally required, directly influencing operational practices. In 2024, OSHA fines for safety violations could significantly impact Argan's profitability and reputation. Consider that OSHA penalties can reach thousands of dollars per violation.

Argan's EPC projects heavily rely on contract law. These contracts outline project scope, timelines, and payment terms. Understanding legal frameworks for dispute resolution is key. In 2024, contract disputes in construction averaged $3.5 million. Liability terms significantly impact project risk.

Land use and zoning laws

Land use and zoning laws are critical legal factors for Argan. These regulations affect the location and construction of power plants and infrastructure. Compliance is essential for project viability. For instance, in 2024, delays due to zoning issues added 10-15% to project timelines.

Navigating these legal hurdles is fundamental for strategic planning. Argan must ensure all projects adhere to local, state, and federal guidelines. Non-compliance can lead to significant financial penalties and project cancellations.

- Zoning laws can restrict project locations.

- Compliance costs are a significant factor.

- Permitting processes can cause delays.

Telecommunications licensing and regulations

Argan's telecommunications infrastructure services are governed by licensing, network access, and service provision regulations. These legal structures shape the telecommunications industry, impacting the services Argan offers. Compliance with these regulations is essential for Argan's operations and market access. Regulatory changes can influence Argan's business strategies and investment decisions.

- In 2024, the global telecom market was valued at approximately $1.7 trillion.

- Licensing fees and compliance costs represent a significant operational expense for telecom companies.

- Network access regulations can impact Argan's ability to deploy and operate infrastructure.

Legal factors significantly shape Argan's operations, affecting project feasibility and profitability. Strict environmental rules and worker safety standards are paramount. In 2024, compliance costs rose, impacting financials.

Contract law governs EPC projects. Land use and zoning laws further dictate project locations. Telecoms face licensing and network access regulations. Compliance is key.

Adherence to legal guidelines is crucial, preventing penalties. Regulatory changes can substantially influence strategic decisions. Failure to comply can lead to project failure.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Environmental | Compliance Costs, Delays | EPA fines up 15% |

| Worker Safety | OSHA Penalties | Avg. fine $7,000/violation |

| Contract Law | Project Risks | Avg. dispute $3.5M |

Environmental factors

Climate change and extreme weather events are becoming more frequent. The construction industry is already seeing delays and damage due to these events. The push for renewable energy, a key climate change solution, is boosting demand for Argan's services. In 2024, the U.S. saw over $100 billion in damages from extreme weather.

Resource availability is crucial, especially water for operations, and the push for sustainable sourcing is growing. Projects must reduce their environmental impact. The global water crisis affects various sectors. The construction industry aims to minimize its carbon footprint, with green building practices becoming more common. In 2024, sustainable practices gained prominence.

Construction activities significantly affect ecosystems, causing habitat loss and soil erosion. Argan needs to address these issues to adhere to environmental rules. In 2024, environmental fines for non-compliance in construction averaged $50,000 per violation. Effective mitigation strategies are essential.

Waste management and pollution control

Waste management and pollution control are critical for construction and power projects. Regulations dictate how waste is disposed of and emissions are handled. Argan's operations must comply with environmental standards. For instance, in 2024, the global waste management market was valued at $2.1 trillion. Power plants face strict emission limits to reduce air pollution.

- Compliance with environmental regulations is crucial to avoid penalties.

- Investment in sustainable practices can enhance Argan's reputation.

- Proper waste disposal and emission control reduce environmental impact.

- Adherence to standards ensures long-term operational sustainability.

Transition to a low-carbon economy

The shift to a low-carbon economy is a key environmental driver, significantly influencing energy markets. This transition encourages investment in renewables and cleaner technologies, presenting opportunities for companies like Argan. Argan's backlog highlights a strategic focus on low-carbon projects. The global renewable energy market is projected to reach $1.977.7 billion by 2030.

- Global renewable energy market is expected to grow to $1.977.7 billion by 2030.

- Argan's projects align with the increasing demand for sustainable energy solutions.

- Government policies and incentives further support the low-carbon transition.

Environmental factors heavily influence Argan's operations. Climate change, resource availability, and waste management are critical aspects of sustainable construction. The renewable energy market is projected to reach nearly $2 trillion by 2030, driving the demand for sustainable projects. Non-compliance in the construction industry can result in average fines of $50,000 per violation.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| Climate Change | Increased extreme weather; delays/damage | U.S. weather damages exceeded $100B |

| Resource Availability | Water scarcity; need for sustainable sourcing | Sustainable practices gaining prominence |

| Ecosystem Impact | Habitat loss; soil erosion | Fines averaged $50k/violation |

| Waste Management | Regulations and emissions compliance | Waste mkt $2.1T globally (2024) |

| Low-Carbon Economy | Growth of renewable energy projects | Renewables mkt $1,977.7B by 2030 |

PESTLE Analysis Data Sources

The Argan PESTLE Analysis relies on verified economic reports, environmental assessments, and governmental resources. Industry-specific publications and market data also contribute.