Assured Guaranty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

What is included in the product

Strategic analysis of Assured Guaranty using BCG Matrix, detailing unit performance and strategic recommendations.

Export-ready design for quick drag-and-drop into PowerPoint, saving valuable time when presenting.

Preview = Final Product

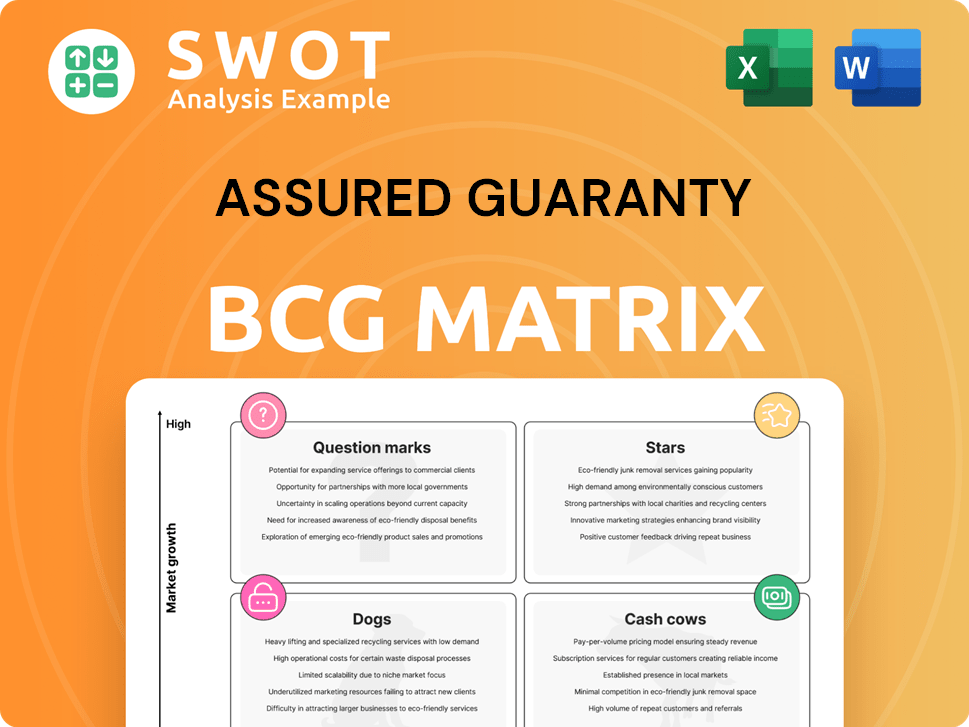

Assured Guaranty BCG Matrix

The BCG Matrix you see here is identical to the one you'll receive after purchase. This fully formatted, analysis-ready report is designed for seamless integration into your strategic planning and decision-making processes. Upon purchase, you'll gain immediate access to the complete, customizable document. No hidden changes, just the complete matrix.

BCG Matrix Template

Discover Assured Guaranty's product portfolio through the lens of the BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. This analysis helps clarify market positioning and resource allocation. Gain a snapshot of growth potential and investment needs for each product. The matrix informs strategic decisions regarding product development and portfolio management. Purchase the full BCG Matrix for a complete breakdown and strategic insights.

Stars

Assured Guaranty is a "Star" in its BCG Matrix, dominating the U.S. public finance market. They held a 61% market share in the U.S. primary municipal market by Q4 2024, a testament to their leadership. This market dominance allows them to shape deals. Their penetration of all municipal issuance reached 6.1% in Q4 2024.

Assured Guaranty is broadening its international infrastructure footprint, with projects in the UK and Australia. They guaranteed a £140 million debt service reserve for Associated British Ports. This expansion across different regions and assets is key. In 2024, infrastructure spending is projected to increase.

The merger of Assured Guaranty Municipal Corp. into Assured Guaranty Inc. forms a larger capital pool. This consolidation boosts operational efficiency. The combined entity gains a more diversified portfolio and greater claims-paying resources. In 2024, Assured Guaranty reported a net income of $647 million.

Robust Capital Management

Assured Guaranty's "Stars" status in the BCG Matrix highlights its robust capital management. In 2024, they achieved record highs in shareholders' equity per share, adjusted operating shareholders' equity per share, and adjusted book value per share. This strong financial standing is further bolstered by their active share repurchase program. Their strategic capital allocation supports growth and boosts investor returns.

- 2024 Share Repurchases: $502 million.

- Key Metric: Record year-end highs in key financial metrics.

- Capital Management: Supports growth and investor returns.

Expanding Asset Management Segment

Assured Guaranty's expansion into asset management, notably through Sound Point Capital Management, LP, diversifies its revenue streams. This strategic move complements their core insurance business, offering a stable source of income. By investing in alternatives, they aim to boost profitability and lessen dependence on financial guaranty premiums. In 2024, the asset management segment is expected to contribute significantly to overall earnings.

- Sound Point Capital Management, LP is a key contributor to Assured Guaranty's asset management revenue.

- Diversification into alternative investments reduces reliance on insurance premiums.

- This segment enhances overall profitability for Assured Guaranty.

Assured Guaranty, a "Star," leads in the U.S. municipal market with a 61% share as of Q4 2024. Their expansion into infrastructure, like the £140 million guarantee for Associated British Ports, is strategic. The 2024 net income was $647 million.

| Key Metric | Value | Year |

|---|---|---|

| Share Repurchases | $502 million | 2024 |

| Net Income | $647 million | 2024 |

| Market Share (U.S. Muni) | 61% | Q4 2024 |

Cash Cows

Assured Guaranty's U.S. public finance guarantees are a cash cow. They guarantee municipal bonds. In 2024, they had $350 billion in par insured. This segment provides steady premium income. It benefits from a mature market.

Assured Guaranty's infrastructure finance guarantees provide stable cash flow. They support projects in the U.S. and globally, ensuring predictable income. These projects, like the $1.4 billion John Hancock Center refinancing, rely on long-term contracts. This focus on essential infrastructure taps into consistent market demand. In 2024, the infrastructure sector saw continued growth.

Structured finance guarantees, especially in real estate and subscription finance, generate consistent revenue. Assured Guaranty's guarantees protect bondholders, securing principal and interest payments. In 2024, the structured finance market saw over $200 billion in new issuances. Diversification within structured finance aids in risk management and supports profitability.

Reinsurance Business

Assured Guaranty's reinsurance business, particularly specialty lines akin to structured finance, is a reliable cash generator. These contracts provide a diversified income stream, aiding in overall risk management. Their underwriting and risk management expertise boosts profitability within this segment. In 2024, Assured Guaranty's reinsurance segment saw strong premium growth.

- Stable cash flow from reinsurance operations.

- Diversified income from various reinsurance contracts.

- Expertise in underwriting and risk management.

- Strong premium growth in 2024.

Sound Point Capital Management

Assured Guaranty's ownership in Sound Point Capital Management, LP, is a reliable source of income. Sound Point earns management fees and performance-based income from its asset management. This diversification strengthens Assured Guaranty's financial position. In 2024, Sound Point managed approximately $32 billion in assets.

- Ownership in Sound Point provides consistent earnings.

- Asset management activities generate fees.

- Diversification boosts financial stability.

- Sound Point managed ~$32B in assets in 2024.

Assured Guaranty's cash cows—U.S. public finance, infrastructure finance, and structured finance—deliver steady revenue.

These segments, like reinsurance and Sound Point Capital, generate reliable cash flows.

In 2024, insured par for U.S. public finance was $350B, showcasing their financial stability.

| Cash Cow Segment | Key Feature | 2024 Performance |

|---|---|---|

| U.S. Public Finance | Municipal Bond Guarantees | $350B Insured Par |

| Infrastructure Finance | Project Guarantees | Stable Cash Flow |

| Structured Finance | Real Estate/Subscription | $200B+ New Issuances |

Dogs

Assured Guaranty's legacy exposures, stemming from the 2008 financial crisis, pose a risk. These older assets, requiring active management, could weigh on earnings. In 2023, they managed $8.7 billion in insured par outstanding from the financial crisis. Strategic resolution is vital to limit impact.

The healthcare sector faces headwinds from COVID-19 and inflation, potentially increasing claims. This could pressure healthcare-related guarantees, impacting financial performance. In 2024, healthcare spending is projected to reach $4.8 trillion. Proactive risk management and selective underwriting are vital. The medical loss ratio (MLR) for some insurers is up to 85%.

Net economic loss in Q4 2024 was influenced by UK regulated utility exposures, with a 3% impact. Regulatory shifts and economic conditions pose continued risks. Careful oversight and strategic responses are crucial to address potential losses. For example, in 2024, the sector faced a 10% increase in operational costs.

Run-off portfolios

Run-off portfolios, acquired from other insurers, present limited growth prospects. These portfolios need meticulous management to boost value while reducing losses. Assured Guaranty's strategic focus is critical for optimal capital use. In 2024, Assured Guaranty saw a decrease in its run-off portfolio, which shows active management.

- Limited Growth: Run-off portfolios offer restricted expansion opportunities.

- Careful Management: Essential for maximizing value and reducing losses.

- Strategic Decisions: Crucial for effective capital allocation.

- Focus: Assured Guaranty actively manages its run-off portfolios.

Low-growth markets

Operating in low-growth markets restricts substantial revenue gains. Efficiency and cost management are crucial for maintaining profitability in such environments. Finding and exploiting niche opportunities is vital for generating returns. For instance, the US dog food market, a mature market, saw a 3.7% growth in 2023.

- Market growth is limited.

- Focus on cost control.

- Niche opportunities are key.

- 2023 US dog food market growth: 3.7%.

Dogs, as a mature segment, exhibit steady but limited growth, much like other low-growth markets. Focusing on efficiency and niche opportunities becomes essential to boost returns within these confined boundaries. In 2023, the global dog food market saw a 3.7% increase, indicating a stable sector. Strategic cost management helps maintain profitability, despite slow market expansion.

| Aspect | Details | 2023 Data |

|---|---|---|

| Market Growth | Steady but limited. | 3.7% (Dog Food) |

| Strategy | Cost control and niche focus. | N/A |

| Implication | Profitability depends on efficiency. | N/A |

Question Marks

Expansion into Asia offers Assured Guaranty new growth avenues. The financial guaranty sector in Asia, particularly in countries like China and India, is experiencing growth. Assured Guaranty's 2024 financial reports highlighted strategic partnerships for market entry. Understanding local regulations and economic dynamics is crucial for navigating uncertainties.

Incrementally expanding financial guaranty products to new asset classes carries increased risks. These ventures necessitate rigorous due diligence and strong risk management. A measured approach is crucial to validate potential and mitigate losses. For example, in 2024, the expansion into renewable energy projects showed varying success, with some ventures facing challenges.

Alternative investments, while potentially offering diversification and higher returns, introduce complexity and risk. Careful selection and ongoing monitoring are crucial for success. A disciplined investment approach and robust risk oversight are essential. In 2024, alternative assets saw varied performance, with some strategies outperforming traditional markets, yet overall, they remain a niche, representing about 15% of institutional portfolios.

Digital infrastructure

Guarantees linked to digital infrastructure, a question mark in Assured Guaranty's BCG matrix, offer growth potential but also carry risks. These projects, such as data centers and fiber optic networks, need thorough tech and market evaluations. Recent data shows that the global data center market was valued at $200 billion in 2023 and is projected to reach $500 billion by 2030. Strategic moves here could pay off.

- Market growth: Data center market expected to hit $500B by 2030.

- Technological assessment: Key for project viability.

- Market demand: Crucial for investment returns.

- Strategic investment: Could lead to significant gains.

Sustainability-linked bonds

Providing guarantees for sustainability-linked bonds (SLBs) represents a growing market with opportunities. However, the performance of SLBs is dependent on achieving specific sustainability targets, which introduces potential risks. Effective management of these risks requires robust monitoring and evaluation of the set targets. The SLB market has seen significant growth, with issuance reaching $284 billion in 2023.

- Market Growth: SLB issuance reached $284 billion in 2023.

- Risk Factor: Performance tied to sustainability targets.

- Mitigation: Requires robust monitoring and evaluation.

The digital infrastructure guarantees represent a question mark in Assured Guaranty's portfolio.

These guarantees, involving data centers and fiber optic networks, require thorough assessments.

Strategic investment could yield high returns within the rapidly expanding digital infrastructure market. The global data center market was at $200B in 2023.

| Aspect | Consideration | Data |

|---|---|---|

| Market Size | Data Centers | $200B (2023), $500B (projected 2030) |

| Risk | Technological assessment | Key for project viability |

| Opportunity | Strategic investment | Potential significant gains |

BCG Matrix Data Sources

Assured Guaranty's BCG Matrix uses financial statements, market analysis, and industry insights to determine positions and provide value.