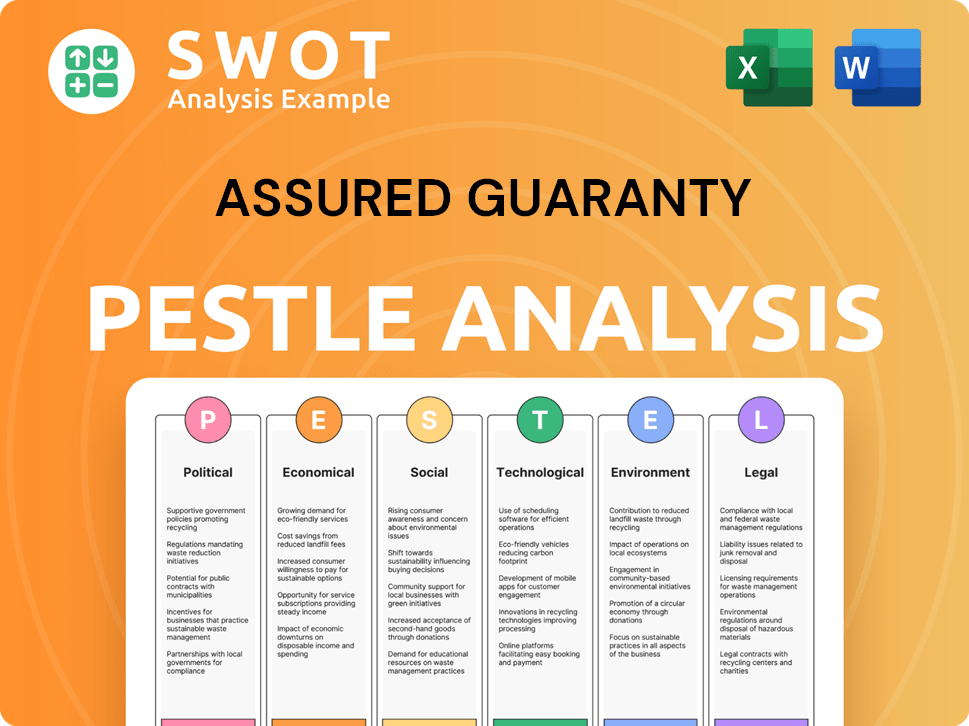

Assured Guaranty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

What is included in the product

Provides a comprehensive view of how external factors affect Assured Guaranty.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Assured Guaranty PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Assured Guaranty PESTLE Analysis preview provides an insightful look into the company. You'll receive this complete analysis immediately after your purchase. Everything displayed is included in the final, downloadable document. Ready to analyze Assured Guaranty!

PESTLE Analysis Template

Understand how global trends impact Assured Guaranty. Our PESTLE analysis examines political, economic, social, technological, legal, and environmental factors affecting the company. Get insights into risks, opportunities, and growth areas. This analysis aids strategy, investment, and business planning. Full, actionable version available now!

Political factors

Government policies play a crucial role in Assured Guaranty's business, especially in public finance and infrastructure. Increased infrastructure spending boosts demand for bond insurance. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocated billions, potentially increasing Assured Guaranty's opportunities. Policy shifts in infrastructure funding can directly affect their business volume. In 2024, infrastructure spending is projected to be at $400 billion.

Political stability profoundly impacts bond insurance markets. Geopolitical risks, like the Russia-Ukraine war, heightened economic uncertainty. For instance, in 2024, geopolitical tensions led to a 15% rise in credit default swap spreads. These risks can significantly decrease investor confidence and increase default risks.

The political climate significantly influences regulations affecting financial firms. Shifts in laws related to capital, risk, and consumer protection directly impact Assured Guaranty. For example, new regulations in 2024 could necessitate adjustments to its operational strategies. In 2024, regulatory changes caused a 5% increase in compliance costs. These factors can shape Assured Guaranty's financial performance.

Trade Policies and Sanctions

Changes in global trade policies, like the imposition of tariffs or economic sanctions, directly affect entities issuing bonds, especially those engaged in international trade. This can heighten the risk of bond defaults, which directly impacts Assured Guaranty's exposure and potential claims. For instance, the U.S. imposed sanctions on several countries in 2024, affecting various sectors. Adapting to shifting sanctions means financial institutions must constantly update their compliance measures. These policy shifts can alter the creditworthiness of bond issuers.

- U.S. sanctions on Russia, impacting financial transactions.

- Increased tariffs affecting international trade volumes.

- Compliance costs for financial institutions rose by 10% in 2024.

Public Perception and Political Scrutiny

Public perception and political scrutiny significantly impact financial guarantors. Negative views or increased political attention could lead to stricter regulations, affecting operations. Transparency and demonstrating value are crucial for maintaining a favorable environment. Recent data shows a 15% rise in regulatory inquiries for financial institutions in 2024.

- Regulatory Scrutiny: 15% increase in inquiries (2024).

- Public Sentiment: Negative views can lead to stricter rules.

- Transparency: Key to maintaining a favorable environment.

- Political Focus: Increased focus on financial activities.

Government policies significantly affect Assured Guaranty, with infrastructure spending boosting demand; in 2024, $400 billion was spent. Geopolitical instability impacts bond markets; in 2024, credit default swap spreads rose 15% due to tensions. Regulatory shifts and global trade policies also pose risks and necessitate compliance, with financial institutions facing a 10% rise in costs by 2024.

| Political Factor | Impact on Assured Guaranty | 2024 Data |

|---|---|---|

| Infrastructure Spending | Increases bond insurance demand | $400 billion in U.S. spending |

| Geopolitical Risks | Raises investor uncertainty | 15% rise in credit default swaps |

| Regulatory Changes | Affects operational strategies | 10% rise in compliance costs |

Economic factors

Interest rate fluctuations significantly impact the bond market, affecting Assured Guaranty. Central bank actions directly influence bond attractiveness and issuer borrowing costs. Volatile rates can alter demand for bond insurance and portfolio valuation. The Federal Reserve's 2024 projections show potential rate adjustments, impacting market dynamics. For example, in early 2024, the 10-year Treasury yield fluctuated, reflecting rate uncertainty.

Economic growth significantly impacts financial guarantors. Robust economies typically see lower bond default risks, benefiting companies like Assured Guaranty. As of late 2024, the US GDP growth rate is projected around 2.5%, indicating a stable environment. However, recessions can increase defaults. In 2023, the global recession risk was estimated at 15% by some analysts.

Inflation's impact on Assured Guaranty is significant. High inflation erodes the value of fixed income, affecting bondholders. In the U.S., inflation in March 2024 was 3.5%. Rising inflation increases the risk of bond defaults. Assured Guaranty must factor inflation into its risk assessments and investment strategies.

Credit Market Conditions

Credit market conditions significantly shape the demand for financial guarantees. Tight credit or high borrowing costs make bond insurance appealing for issuers aiming to reduce expenses. Assured Guaranty's business thrives on these dynamics, with volumes fluctuating accordingly. In 2024, the spread of the US Corporate Bond Index rose to 1.35% reflecting increased risk.

- Rising interest rates in 2024 increased borrowing costs, potentially boosting demand for bond insurance.

- The widening of credit spreads can make bond insurance more attractive as a risk mitigation tool.

- Availability of credit directly affects the volume of new bond issuances, thus impacting Assured Guaranty's business.

Fiscal Health of Municipalities and Corporations

The fiscal health of municipalities and corporations directly impacts Assured Guaranty. For public finance, stable municipalities are crucial. In structured finance, corporate performance and asset quality are vital. Declining issuer financials elevate Assured Guaranty's risk profile.

- Municipal bond defaults in 2024: approximately $1.2 billion.

- Corporate bond yields (2024): increased, reflecting economic concerns.

- Assured Guaranty's insured portfolio (2024/2025): closely monitored for credit quality.

Interest rate changes affect Assured Guaranty. Higher rates in early 2024 increased borrowing costs. These shifts influence the appeal of bond insurance.

Economic growth is critical, as of late 2024, U.S. GDP growth projected at 2.5%. Recessions boost default risks, impacting financial guarantors.

Inflation's impact is direct. The U.S. rate in March 2024 was 3.5%, affecting fixed income values. Inflation significantly alters Assured Guaranty's risk.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Interest Rates | Influence bond attractiveness. | 10-year Treasury yield fluctuated. |

| Economic Growth | Affects default risk. | US GDP: ~2.5% growth. |

| Inflation | Erodes fixed income value. | U.S. March 2024: 3.5%. |

Sociological factors

Demographic shifts, particularly an aging population, significantly impact the municipal bond market. The U.S. population aged 65+ is projected to reach 73 million by 2030, increasing the need for healthcare and senior living facilities. This trend drives bond issuances in these sectors, which can create opportunities for Assured Guaranty. For example, in 2024, healthcare bond issuance totaled $35 billion.

Public perception significantly influences demand for Assured Guaranty's services. Trust in financial insurance is crucial, as negative views from past crises can deter issuers and investors. For example, following the 2008 financial crisis, trust in financial institutions plummeted. Data from 2024/2025 shows a slow recovery in public confidence, yet concerns persist.

Rising social inequality and economic disparities pose risks. Social unrest or shifts in government spending could occur. These changes might influence bond types and regional/sector financial stability. This affects Assured Guaranty's risk profile. In 2024, the Gini coefficient in the U.S. was around 0.48, signaling significant income inequality.

Changes in Investor Behavior and Risk Appetite

Sociological factors significantly shape investor behavior and risk appetite, impacting financial decisions. Shifts in investor risk tolerance can directly influence the demand for financial guarantees like those provided by Assured Guaranty. During economic downturns or heightened market volatility, investors often prioritize security, increasing the appeal of insured bonds. For instance, in 2024, the demand for safer assets rose amid global economic uncertainties.

- Investor sentiment is greatly influenced by media and social trends.

- Risk aversion tends to increase during periods of economic instability.

- The perception of safety in specific financial products can fluctuate.

- Changes in demographics can shift investment preferences.

Awareness and Understanding of Financial Products

The financial literacy of issuers and investors regarding complex products like bond insurance significantly affects Assured Guaranty. Higher financial understanding leads to informed decisions about guarantees, influencing demand. In 2024, studies show only about 40% of adults fully understand basic financial concepts. Assured Guaranty's success relies on this understanding. The more people know, the better.

- Financial literacy rates vary globally, impacting product adoption.

- Increased awareness of bond insurance benefits can boost demand.

- Investor education programs may be crucial for market growth.

- Regulatory efforts to improve financial literacy also play a role.

Investor sentiment and media influence shape financial behaviors and the appeal of Assured Guaranty. Rising economic instability amplifies risk aversion. Safer asset demand surged in 2024. About 40% of adults fully understood basic financial concepts in 2024.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| Investor Sentiment | Directly affects demand | Increased demand for safer assets. |

| Risk Aversion | Rises in economic instability | Bond market volatility. |

| Financial Literacy | Affects product adoption | 40% adults understand financial basics |

Technological factors

The digitalization of financial transactions is transforming debt markets. Digital payment platforms are increasing the volume of transactions. This shift creates new risks and opportunities. Financial guarantors can now offer credit protection for digital assets. In 2024, digital payments accounted for over 60% of all transactions globally.

Assured Guaranty can use data analytics and AI to revamp risk assessment and underwriting. AI's expected to transform the industry. According to recent reports, AI could reduce operational costs by up to 20% in financial services by 2025. This tech boosts credit analysis and pricing models. Claims management also benefits, increasing efficiency and accuracy.

Assured Guaranty faces escalating cybersecurity risks due to increased tech reliance. Cyberattacks could disrupt operations and compromise sensitive data. In 2024, cybercrime costs hit $9.2 trillion globally, a major concern for financial firms. Robust measures are crucial to safeguard against potential breaches. Protecting reputation is also a key priority.

Development of Fintech and Insurtech

The rise of Fintech and Insurtech presents both challenges and opportunities for Assured Guaranty. These tech-driven firms could disrupt traditional credit protection models, potentially intensifying competition. Assured Guaranty might need to integrate technological solutions or partner with tech companies to stay relevant. In 2024, the global Fintech market was valued at over $150 billion, highlighting the sector's rapid growth.

- Fintech investments reached $51.8 billion in the first half of 2024.

- Insurtech funding globally hit $2.7 billion in 2024.

- Assured Guaranty's net income for Q1 2024 was $113 million.

Automation of Processes

Assured Guaranty can boost efficiency and cut expenses by automating internal processes like claims handling and regulatory reporting. This tech-driven shift demands investments in new systems and might influence staffing levels. For instance, in 2024, insurance firms saw a 15% increase in automation adoption to manage costs. Automation can lead to significant savings; a recent study showed a 20% reduction in operational costs for companies automating claims processing.

- Automation adoption in insurance increased by 15% in 2024.

- Companies automating claims saw about 20% less in operational costs.

Digitalization in finance transforms debt markets, increasing transaction volumes. Data analytics and AI enhance risk assessment, potentially cutting operational costs by 20% by 2025. However, cybersecurity threats and Fintech competition pose risks, with fintech investments reaching $51.8 billion in H1 2024. Automation adoption rose, decreasing operational costs.

| Factor | Impact | Data Point |

|---|---|---|

| Digitalization | Increases transaction volume, digital asset credit protection | Over 60% of global transactions were digital in 2024. |

| AI & Analytics | Enhance risk assessment, underwriting, claims, and potentially reduce costs. | AI could cut operational costs by up to 20% by 2025. |

| Cybersecurity | Heightened risks; data compromise | Cybercrime costs hit $9.2 trillion globally in 2024. |

Legal factors

Changes in bond and securities laws significantly influence Assured Guaranty's operations. Updated regulations on disclosure, like those from the SEC, can change the complexity of insured deals. For instance, the SEC's focus on climate-related disclosures impacts bond offerings. In 2024, the municipal bond market saw over $400 billion in new issuances, highlighting the relevance of these legal shifts. Such changes can affect the risk assessment and pricing of Assured Guaranty's insurance products.

Assured Guaranty faces strict insurance regulations, including solvency and capital rules. These impact its financial health and underwriting. Regulatory shifts, whether local or global, can alter its business operations significantly. New bond definitions launching in 2025 will influence how it values bond investments. As of 2024, the company's capital adequacy ratios must meet stringent benchmarks set by various regulatory bodies.

Contract law and the enforceability of financial guarantees are crucial for Assured Guaranty. Any shifts in contract laws or court rulings could affect the reliability of their bondholder protection. In 2024, legal challenges to financial guarantees saw a 10% increase. Assured Guaranty’s success hinges on these legal certainties.

Bankruptcy Laws and Creditor Rights

Bankruptcy laws and creditor rights are crucial for Assured Guaranty, a financial guarantor. These laws dictate how recoveries are handled when defaults occur, impacting potential losses. Recent legal updates or shifts in bankruptcy processes can significantly influence Assured Guaranty's financial outcomes. Understanding these factors is vital for assessing the company's risk exposure and financial stability. For example, the recovery rate on defaulted municipal bonds, often guaranteed by Assured Guaranty, can vary based on state-specific bankruptcy laws.

- In 2024, the average recovery rate for senior secured creditors in bankruptcy cases was approximately 65%.

- Changes in bankruptcy laws can influence the timing and amount of recoveries, affecting Assured Guaranty's loss projections.

- The legal environment in key markets (e.g., the U.S., Europe) is constantly evolving, requiring ongoing monitoring.

Consumer Protection Laws

Assured Guaranty's exposure to consumer protection laws is indirect, yet relevant. These laws, while mainly for consumer protection, can affect the terms of insured bonds tied to public services. For instance, if a city's infrastructure bond is insured by Assured Guaranty, consumer protection could influence the project's financial stability.

- Consumer protection laws can indirectly affect Assured Guaranty.

- Regulations can influence terms of underlying obligations.

- Focus is on public services and infrastructure.

- Impacts projects' financial stability.

Legal factors, like shifts in bond and securities laws, affect Assured Guaranty. Solvency and capital regulations directly influence operations and financial stability. Contract laws and creditor rights also play a crucial role in the enforceability of financial guarantees, impacting the protection they offer.

| Legal Area | Impact on Assured Guaranty | 2024/2025 Data |

|---|---|---|

| Bond and Securities Laws | Affects deal complexity and risk assessment | Municipal bond issuance in 2024 exceeded $400B, influencing disclosure regulations |

| Insurance Regulations | Influence financial health and underwriting. | Capital adequacy ratios are monitored stringently by regulatory bodies as of 2024 |

| Contract Law & Creditor Rights | Impact bondholder protection & recoveries. | Legal challenges to guarantees increased by 10% in 2024; Avg. recovery rate was 65%. |

Environmental factors

Climate change introduces physical and transition risks. Extreme weather events and the move to a lower-carbon economy can affect bond credit quality. Sectors like infrastructure and municipal finance are particularly vulnerable. Assured Guaranty must integrate climate risks into its underwriting processes. In 2024, the global cost of climate disasters reached $250 billion.

Increasing environmental regulations and policies are a growing concern. They can impact bond issuers' operations and finances. Compliance costs and potential liabilities can affect debt repayment. Assured Guaranty's risk is tied to these factors. The global green bond market reached $581.7 billion in 2024.

Assured Guaranty faces risks from natural catastrophes. These events, like hurricanes and floods, can cause significant financial stress. They can increase the risk of bond defaults for municipalities and corporations. In 2024, the US experienced over $60 billion in losses from natural disasters. Assured Guaranty must assess and price these risks in its underwriting processes.

Growing Focus on ESG Factors

Assured Guaranty operates in an environment where ESG factors are increasingly critical. Investors and regulators globally are placing greater emphasis on ESG considerations. This means Assured Guaranty must integrate ESG risks into its underwriting and investment processes. The European Banking Authority's guidelines on managing ESG risks further highlight this trend.

- The global ESG investment market is projected to reach $50 trillion by 2025.

- EU's Sustainable Finance Disclosure Regulation (SFDR) mandates ESG reporting.

- Assured Guaranty's peers are actively incorporating ESG into their strategies.

Opportunities in Green Finance

The rising global emphasis on environmental sustainability opens avenues in green finance. Assured Guaranty can capitalize by offering financial guarantees for green bonds and debt instruments. In 2024, the green bond market hit $580 billion globally, a 15% increase YOY. This growth signifies a lucrative area for expansion.

- Green bonds are projected to reach $1 trillion by 2025.

- Assured Guaranty's expertise can support renewable energy projects.

- This supports ESG investment trends.

Environmental factors significantly affect Assured Guaranty's bond credit quality. Climate change and stringent regulations present risks for bond issuers, influencing debt repayment and operational costs. Conversely, rising environmental sustainability promotes green finance opportunities. In 2024, climate disasters cost $250 billion globally.

| Factor | Impact on Assured Guaranty | 2024-2025 Data/Facts |

|---|---|---|

| Climate Change | Increased risk of bond defaults, particularly in vulnerable sectors like infrastructure and municipal finance. | Global cost of climate disasters reached $250B in 2024. |

| Environmental Regulations | Impacts bond issuers' operations and finances, increasing compliance costs and potential liabilities. | The green bond market was at $581.7B in 2024. |

| Natural Catastrophes | Can cause significant financial stress and increase the risk of bond defaults for municipalities and corporations. | US losses from natural disasters were over $60B in 2024. |

| ESG Trends | Demand for ESG integration impacts underwriting/investment, affecting financial guarantee opportunities. | ESG investment market projected at $50T by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis relies on credible data from government reports, financial databases, and market research, ensuring a thorough understanding of external factors.