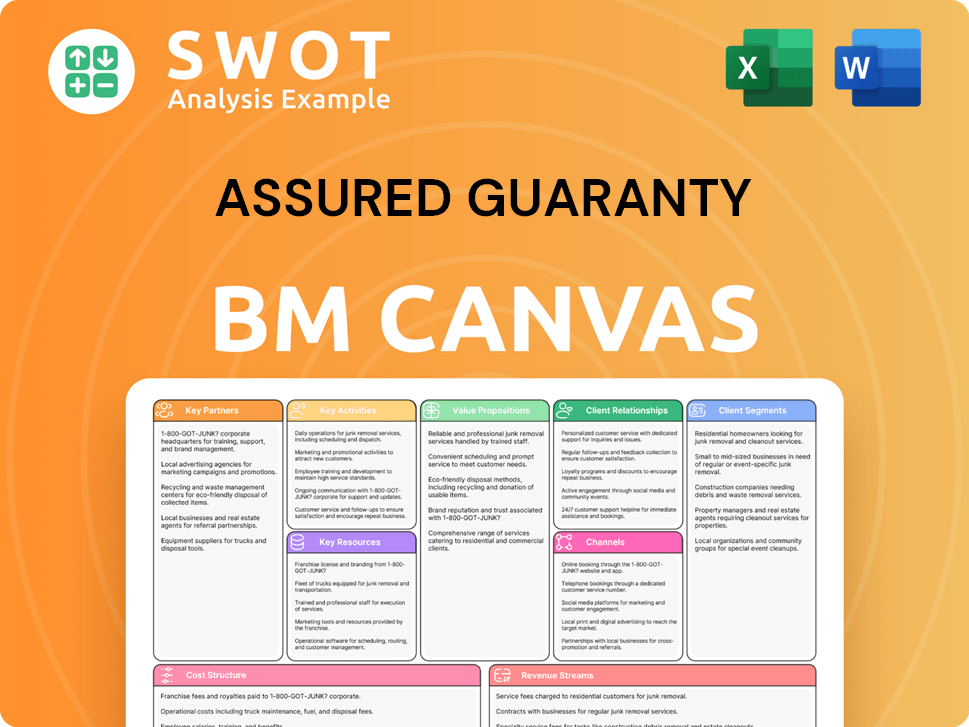

Assured Guaranty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assured Guaranty Bundle

What is included in the product

A comprehensive business model reflecting Assured Guaranty's real operations.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

The Assured Guaranty Business Model Canvas preview provides a real-time look at the final product. The document shown is the exact file, guaranteeing what you see is what you get. Upon purchase, you receive the complete, ready-to-use Canvas, no hidden sections. Edit, present, and utilize the same professional document immediately.

Business Model Canvas Template

Understand Assured Guaranty’s strategic architecture with its Business Model Canvas. This framework unveils the firm's customer segments and value propositions. Explore key activities, resources, and partnerships driving its success. Analyze revenue streams and cost structures for a complete picture. Download the full Business Model Canvas for deeper insights.

Partnerships

Reinsurance partnerships are crucial for Assured Guaranty's risk management. These agreements enable the transfer of risk to other entities. This strategy boosts underwriting capacity for complex deals. Assured Guaranty's net premiums written were $665 million in Q1 2024, demonstrating the scale of its operations.

Investment banks are key for Assured Guaranty, helping originate and distribute insured debt. They work together to find insurance opportunities and market insured bonds. These partnerships are vital for reaching many issuers and investors. In 2024, Assured Guaranty's net premiums written were about $608 million, showing the impact of these collaborations.

Assured Guaranty's success hinges on strong rating agency relationships. These partnerships with agencies like Moody's and S&P are vital for maintaining high credit ratings. For example, in 2024, Assured Guaranty's financial strength ratings remained stable, supporting its market position. This ensures investor confidence and enhances the appeal of insured bonds.

Sound Point Capital Management

Assured Guaranty's partnership with Sound Point Capital Management is a key element of its Business Model Canvas. This collaboration includes equity ownership and investment commitments, enhancing Assured Guaranty's asset management capabilities. Sound Point manages a segment of Assured Guaranty's investment portfolio. This partnership diversifies revenue streams.

- Equity Ownership: Assured Guaranty holds equity in Sound Point.

- Investment Commitments: Financial commitments support Sound Point's activities.

- Portfolio Management: Sound Point manages a portion of Assured Guaranty's investments.

- Revenue Diversification: The partnership expands Assured Guaranty's revenue sources.

Financial Institutions

Assured Guaranty teams up with banks and lenders to boost their transactions through credit enhancement. These alliances let financial institutions offer better financing options to their clients, reducing their credit exposure. These partnerships are vital, especially in structured finance and infrastructure projects. In 2024, Assured Guaranty insured approximately $5.5 billion in new transactions.

- Credit enhancement agreements with financial institutions help to reduce credit risk.

- These partnerships are key in structured finance.

- Assured Guaranty insured $5.5 billion in new transactions in 2024.

- Collaboration enables better financing terms.

Assured Guaranty's alliances significantly shape its business model. Reinsurance partners manage risk, while investment banks help in debt origination and distribution, increasing the company's market reach. Rating agencies maintain high credit ratings, essential for investor confidence. Sound Point Capital Management offers equity ownership and portfolio management. Partnerships with banks enhance transactions and expand financing opportunities.

| Partnership Type | Function | Impact |

|---|---|---|

| Reinsurance | Risk Transfer | Boosts capacity |

| Investment Banks | Origination, Distribution | Expands market reach |

| Rating Agencies | Credit Ratings | Maintains confidence |

| Sound Point | Asset Management | Diversifies revenue |

| Banks/Lenders | Credit Enhancement | Improves terms |

Activities

Credit underwriting is central to Assured Guaranty's business model. The firm meticulously evaluates debt issuers' creditworthiness before offering insurance. This process includes detailed analysis of financials, debt structure, and economic factors. In 2024, Assured Guaranty's focus on high-quality underwriting contributed to its strong financial standing. This careful approach protects its capital and supports its ability to meet obligations.

Risk management is a core activity for Assured Guaranty. They actively monitor insured obligations and diversify their portfolio to spread risk. Assured Guaranty maintains strong capital reserves to cover potential losses. In 2024, the company reported a claims-paying resources of $11.3 billion.

Assured Guaranty's core activity is paying claims to bondholders when issuers default. This underscores the value of its insurance and fosters investor trust. Efficient claims processing is crucial, upholding Assured Guaranty's reputation. In 2024, claims paid were a significant figure, directly impacting financial stability. Timely payments ensure continued product demand.

Portfolio Surveillance

Portfolio surveillance is key for Assured Guaranty, involving continuous monitoring of insured assets. This includes tracking issuer financial health, credit rating changes, and economic trends. Proactive surveillance helps in early risk detection and mitigation. Assured Guaranty's approach aims to safeguard its insured portfolio effectively.

- In 2024, Assured Guaranty reported a net income of $485 million.

- The company actively monitors over $290 billion of par outstanding.

- Their surveillance includes detailed analysis of over 1,000 issuers.

- They use advanced analytics to assess macroeconomic factors.

Capital Management

Capital management is crucial for Assured Guaranty's financial health and expansion. This involves keeping sufficient capital reserves, refining the capital structure, and returning capital to shareholders via dividends and share buybacks. Sound capital management ensures Assured Guaranty can meet its financial obligations, pursue new business, and create shareholder value.

- In 2024, Assured Guaranty's capital position remained strong, with a focus on maintaining a robust capital base.

- The company regularly evaluates its capital structure to optimize efficiency and returns.

- Share repurchases and dividends are key components of returning capital to shareholders.

- Assured Guaranty continues to monitor its capital adequacy ratios to ensure compliance with regulatory requirements.

Assured Guaranty's activities include credit underwriting, assessing debt issuers' creditworthiness. Risk management involves monitoring insured obligations and portfolio diversification. Claims payment to bondholders when issuers default also plays a core role.

Portfolio surveillance and capital management are key activities. Monitoring insured assets, financial health, credit ratings, and economic trends are also vital. Capital management optimizes financial health, supporting obligations, expansion, and shareholder value.

| Activity | Description | 2024 Data |

|---|---|---|

| Credit Underwriting | Evaluates debt issuers' creditworthiness. | Net income: $485M |

| Risk Management | Monitors and diversifies risk. | Claims-paying resources: $11.3B |

| Claims Payment | Pays bondholders when issuers default. | Par outstanding monitored: $290B+ |

| Portfolio Surveillance | Tracks issuer health, ratings, and trends. | Issuers analyzed: 1,000+ |

| Capital Management | Maintains reserves, refines structure. | Capital base: Robust |

Resources

Assured Guaranty's claims-paying resources are key, encompassing cash, investments, and unearned premiums. These resources ensure the company can meet obligations if issuers default. In 2024, Assured Guaranty reported approximately $10.3 billion in claims-paying resources. Maintaining a robust level of these resources is vital for investor trust and regulatory adherence.

Expert underwriters are a cornerstone for Assured Guaranty. Their deep credit risk and financial analysis knowledge is vital. In 2024, Assured Guaranty insured $13.2 billion in par value. Skilled underwriters select high-quality risks. They structure policies for effective credit protection.

Assured Guaranty's high credit ratings are crucial. These ratings, from agencies like S&P and Moody's, boost product appeal and cut borrowing costs. Strong ratings stem from strict underwriting and smart risk management. For instance, in 2024, Assured Guaranty's financial strength rating from S&P was AA-.

Established Reputation

Assured Guaranty's solid reputation is a key asset. It reflects their financial strength and dependability. This reputation stems from years of consistent performance and honoring claims. A strong reputation boosts investor trust and draws in new business.

- Claims Paid: Assured Guaranty has paid over $18 billion in claims since inception.

- Financial Strength: Rated A by S&P, A2 by Moody's, and A by Fitch as of late 2024.

- Market Leadership: A leading provider of financial guaranty insurance.

- Years in Business: Operating for over 30 years.

Diversified Insured Portfolio

Assured Guaranty's success hinges on its diversified insured portfolio, a crucial resource. This portfolio spans various sectors, geographic regions, and types of obligations, mitigating concentrated risks. By spreading its investments, Assured Guaranty stabilizes its earnings and lessens the potential for large financial setbacks. As of 2024, the company's insured portfolio includes approximately $350 billion in par outstanding.

- Diversification reduces exposure to any single risk.

- Enhances the stability of earnings.

- Reduces the likelihood of significant losses.

- Approximately $350 billion in par outstanding (2024).

Assured Guaranty’s claims-paying resources, like cash and investments, are crucial. In 2024, they totaled about $10.3 billion. These resources guarantee the ability to meet obligations if issuers default.

Expert underwriting, essential for Assured Guaranty, hinges on credit risk and financial analysis. In 2024, they insured $13.2 billion in par value through expert underwriting. This selection helps in structuring effective credit protection.

Assured Guaranty's reputation, marked by consistent performance and honored claims, is a key asset. Their financial strength is rated A by S&P, A2 by Moody's, and A by Fitch. It supports investor trust, drawing in new business, and it is critical for long-term success.

| Resource | Description | 2024 Data |

|---|---|---|

| Claims-Paying Resources | Cash, investments, and unearned premiums | ~$10.3B |

| Insured Portfolio | Diversified across sectors, regions, and obligations | ~$350B par outstanding |

| Claims Paid Since Inception | Total claims paid | Over $18B |

Value Propositions

Assured Guaranty enhances credit quality for debt securities, making them more appealing to investors. This boosts market access for issuers, often at reduced interest rates. In 2024, credit enhancement helped municipalities and corporations secure funding. It's especially beneficial for entities with lower credit ratings. This strategy broadens investor participation.

Assured Guaranty's insurance lowers borrowing costs for issuers. This reduction stems from the decreased risk of default, leading to better financing terms. For example, in 2024, insured municipal bonds often yielded less than comparable uninsured bonds. This can translate into substantial savings over the debt's lifespan. According to recent data, issuers saved an average of 0.5% to 1% on interest rates.

Assured Guaranty's value lies in protecting investors. It shields them from losses if issuers default. This guarantee ensures timely principal and interest payments. Such protection boosts investor confidence. In 2024, Assured Guaranty insured $10.6 billion in new transactions.

Enhanced Market Liquidity

Assured Guaranty's insurance boosts market liquidity for insured debt. Insured securities attract more investors, increasing trading. This reduces price volatility, benefiting both issuers and investors. Enhanced liquidity is a key value proposition. In 2024, insured municipal bonds saw higher trading volumes.

- Increased investor demand drives higher trading volumes.

- Reduced price volatility creates a stable market.

- Issuers benefit from better market access and pricing.

- Investors enjoy easier trading and exit strategies.

Access to Capital Markets

Assured Guaranty boosts access to capital markets for issuers. It makes debt more appealing to investors, opening up new funding avenues. This is especially crucial for lesser-known entities. In 2024, Assured Guaranty insured $10.5 billion in new issues. This facilitated funding for various projects.

- Enhanced Creditworthiness: Insurance improves bond ratings.

- Investor Confidence: Guarantees reduce investment risk.

- Expanded Opportunities: Opens markets to diverse issuers.

- Cost Savings: Potentially lowers borrowing costs.

Assured Guaranty's insurance enhances debt securities, attracting investors and boosting market access. It protects investors from issuer defaults, ensuring timely payments. This increases investor confidence. Data from 2024 shows insured bonds often have higher trading volumes.

| Value Proposition | Benefit for Issuers | Benefit for Investors |

|---|---|---|

| Credit Enhancement | Lower borrowing costs (0.5%-1% savings in 2024) | Increased security and confidence |

| Default Protection | Improved market access | Guaranteed principal and interest |

| Market Liquidity | Easier access to capital | Higher trading volumes and exit strategies |

Customer Relationships

Assured Guaranty's direct sales force actively connects with institutional investors and debt issuers, offering customized solutions. This personalized approach helps build strong, lasting relationships. In 2024, Assured Guaranty's sales team facilitated $13.7 billion in new business volume. This direct engagement ensures client satisfaction.

Assured Guaranty assigns each client a dedicated underwriter, ensuring tailored insurance solutions. This personalized approach enables precise policy structuring and pricing, considering individual client needs. In 2024, this model helped Assured Guaranty maintain a strong market position, with a net par outstanding of $278 billion. Ongoing support from these experts is critical. This includes providing continuous insights and expertise, enhancing client relationships and satisfaction.

Assured Guaranty emphasizes continuous client communication, sharing insights on market dynamics, portfolio results, and regulatory shifts. This keeps clients informed and supports their investment choices. For example, in 2024, they issued over 500 reports to clients. Timely and clear communication boosts trust and solidifies client relationships. Additionally, they held over 100 webinars.

Claims Support

Assured Guaranty's claims support is a cornerstone of its business model, offering crucial assistance to policyholders when issuers default. This encompasses guiding clients through the claims process and ensuring prompt claim payments. Maintaining high client satisfaction and safeguarding Assured Guaranty's reputation hinges on effective claims support. In 2024, Assured Guaranty's claims-paying resources totaled $11.5 billion.

- Comprehensive support during issuer defaults.

- Timely payment of claims.

- Focused on resolving policyholder issues.

- Essential for client satisfaction and reputation.

Industry Events

Assured Guaranty actively engages in industry events to foster relationships and boost its market presence. Such events offer a platform to highlight expertise, attract potential clients, and generate leads. This participation strengthens Assured Guaranty's reputation and visibility within the financial sector. In 2024, the company likely attended key bond insurance conferences.

- Networking at industry events facilitates direct engagement with clients.

- These events are crucial for showcasing Assured Guaranty's services.

- Participation helps in building brand recognition and credibility.

- They create opportunities for business development and lead generation.

Assured Guaranty prioritizes client relationships through direct engagement, offering tailored solutions and ongoing support to institutional investors and debt issuers, resulting in strong, lasting connections. A dedicated underwriter is assigned to each client to ensure tailored insurance solutions. In 2024, Assured Guaranty facilitated $13.7 billion in new business volume. Continuous communication, including reports and webinars, keeps clients informed and builds trust, which helps them. Claims support, critical when issuers default, offering timely payments.

| Aspect | Details | 2024 Data |

|---|---|---|

| Sales Engagement | Direct sales force connects with clients. | $13.7B in new business |

| Underwriting | Dedicated underwriters provide tailored solutions. | $278B net par outstanding |

| Communication | Reports and webinars. | 500+ reports issued, 100+ webinars |

Channels

Assured Guaranty's direct sales team directly interacts with issuers and investors, fostering personalized service. This approach enables bespoke insurance solutions, aligning with client specifics. The team is critical for nurturing relationships; in 2024, this strategy helped secure $26.9 billion in par insured. They create customized solutions for the clients.

Broker-dealers are key channels for Assured Guaranty, distributing insurance products to investors. They expand reach and enable trading of insured securities. Robust broker-dealer relationships are crucial for market penetration. In 2024, Assured Guaranty's insured par outstanding was $68.6 billion. This channel facilitated deals.

Financial advisors are crucial for Assured Guaranty, recommending insured securities. They boost product demand through education on benefits. Targeted marketing and training programs are key. In 2024, Assured Guaranty's net premiums written were $384 million.

Online Platform

Assured Guaranty's online platform is a central hub. It offers details on its products and financial results. This platform supports stakeholders like investors and bond issuers. It boosts transparency and makes information readily available. In 2024, Assured Guaranty's website saw a 15% increase in user engagement.

- Investor relations section provides financial reports.

- Detailed product information accessible.

- News and press releases updated regularly.

- Enhances communication with all parties.

Industry Conferences

Assured Guaranty actively uses industry conferences to engage with clients and partners. These events are crucial for displaying their expertise, building strong relationships, and finding new business opportunities. In 2024, the company likely attended key insurance and finance conferences to boost its brand and network. Strategic conference participation is a key part of their marketing strategy.

- Networking at conferences helps Assured Guaranty generate new leads.

- Conferences provide a venue to highlight their financial products and services.

- Attendance at industry events supports their marketing and business development plans.

Assured Guaranty's channels include a direct sales team and broker-dealers, facilitating personalized and widespread product distribution. Financial advisors recommend insured securities, expanding market reach and enhancing demand. The company's online platform and industry conferences support stakeholder engagement. In 2024, they focused on digital platforms.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Personalized client interactions | Secured $26.9B in par insured |

| Broker-Dealers | Distribution to investors | $68.6B par insured outstanding |

| Financial Advisors | Product recommendations | $384M net premiums written |

Customer Segments

Municipal bond issuers, like state and local governments, form a key customer segment for Assured Guaranty. They utilize Assured Guaranty's insurance to boost their bond credit quality, helping lower borrowing costs. In 2024, insured municipal bonds totaled approximately $25 billion. This insurance supports crucial public projects and infrastructure, benefiting communities.

Public infrastructure projects, like transportation and utilities, form a crucial customer segment for Assured Guaranty. The company boosts these projects by enhancing credit, facilitating investor attraction and funding. As of 2024, infrastructure spending in the US reached $400 billion. Assured Guaranty's risk assessment expertise is vital for these complex ventures.

Issuers of structured finance transactions, including asset-backed securities, are key clients. Assured Guaranty enhances their credit ratings through insurance. This attracts a broader investor base, facilitating capital allocation. In 2024, the structured finance market saw approximately $1.2 trillion in issuance.

Institutional Investors

Institutional investors, including pension funds and insurance companies, indirectly benefit from Assured Guaranty's services. These entities gain from the improved creditworthiness and reduced risk of insured securities, enhancing their investment strategies. Assured Guaranty supports institutional investors in achieving their financial goals and managing their portfolios. For example, in 2024, Assured Guaranty insured approximately $1.5 billion of new transactions.

- Indirectly benefit from Assured Guaranty's services.

- Improved creditworthiness and reduced risk.

- Supports institutional investors' financial goals.

- Insured approximately $1.5 billion in new transactions in 2024.

Reinsurance Companies

Reinsurance companies are a key customer segment for Assured Guaranty, which offers reinsurance services to other financial guaranty insurers. This arrangement helps these companies manage their risk profiles. Reinsurance allows for increased underwriting capacity. Partnerships within this sector are crucial to Assured Guaranty's business model.

- Assured Guaranty's net premiums written for financial guarantee reinsurance were $88.2 million in Q1 2024.

- In 2023, Assured Guaranty's total net premiums written were $518 million.

- Reinsurance is a vital component for managing risk.

Assured Guaranty serves reinsurance companies by providing financial guarantee reinsurance, helping them manage risk. In Q1 2024, the net premiums written for financial guarantee reinsurance reached $88.2 million. This segment benefits from risk management tools.

| Customer Segment | Service Provided | 2024 Data |

|---|---|---|

| Reinsurance Companies | Financial Guarantee Reinsurance | $88.2M Net Premiums (Q1) |

| Benefit | Risk Management |

Cost Structure

Claims payments represent a substantial expense for Assured Guaranty, triggered by issuer defaults on insured obligations. These payments fluctuate widely, influenced by economic cycles and the credit quality of their insured portfolio. In 2024, Assured Guaranty reported approximately $100 million in net losses and loss adjustment expenses. Effective risk management and underwriting are critical to controlling these costs.

Underwriting expenses cover credit risk assessment, policy structuring, and portfolio monitoring. These expenses ensure Assured Guaranty's focus on high-quality risks. Investing in skilled underwriters and risk management systems is key. In 2024, Assured Guaranty reported $189.6 million in underwriting and other operating expenses. This is crucial for financial stability.

Operating expenses, encompassing salaries, rent, and administrative costs, are crucial for Assured Guaranty's profitability. In 2023, the company reported operating expenses of approximately $200 million. Assured Guaranty focuses on streamlining operations and reducing costs. This strategic approach helps maintain financial health.

Reinsurance Premiums

Reinsurance premiums are costs Assured Guaranty pays to transfer risk. They're essential for managing risk and boosting underwriting capacity. Strategic reinsurance use enhances financial stability. In 2023, Assured Guaranty's net premiums written were approximately $476 million. This reflects the cost of protecting its portfolio.

- Risk Transfer: Reinsurance shifts a portion of Assured Guaranty's risk to other insurers.

- Capacity Enhancement: It allows Assured Guaranty to underwrite more policies.

- Financial Stability: Reinsurance strengthens the company's financial position.

- Cost Component: Premiums paid are a significant expense.

Investment Management Fees

Investment management fees cover expenses for managing Assured Guaranty's investments. These fees are paid to external managers and internal staff. Efficient management is crucial for returns and liquidity. In 2023, Assured Guaranty reported $1.2 billion in net investment income.

- Investment management fees are a significant part of operational costs.

- These fees directly impact profitability and investment returns.

- Assured Guaranty strategically selects investment managers.

- Effective management is key to meeting financial obligations.

Assured Guaranty's cost structure includes claims payments, fluctuating with defaults; in 2024, they totaled roughly $100 million. Underwriting and operating expenses, such as salaries and rent, are also significant; the 2024 underwriting expenses reached $189.6 million. Reinsurance premiums and investment management fees further shape their financial profile.

| Cost Category | Description | 2024 Data (Approx.) |

|---|---|---|

| Claims Payments | Payments due to issuer defaults. | $100 million in net losses |

| Underwriting & Operating Expenses | Credit assessment, salaries, admin costs. | $189.6 million |

| Reinsurance Premiums | Costs to transfer risk. | Reflects portfolio protection |

Revenue Streams

Assured Guaranty's main income source is premium income from its insurance policies. These premiums are usually paid upfront or throughout the policy's term. Accurate premium pricing is crucial for profitability and covering potential claims. In 2024, Assured Guaranty reported over $1 billion in gross premiums written. Effective pricing strategies directly impact the company's financial health.

Assured Guaranty's investment income comes from its diverse portfolio of fixed-income securities. This revenue stream supports claims payments and operational costs. In 2024, investment income was a key driver of financial performance. Effective investment management is crucial for liquidity and return maximization. As of Q3 2024, the investment portfolio yielded approximately 4.5%.

Assured Guaranty boosts revenue via reinsurance commissions, earned by offering reinsurance to other financial guaranty insurers. These commissions are a key revenue driver, boosting profitability. Strategic alliances are vital. In 2024, reinsurance premiums earned were approximately $110 million.

Fees for Credit Enhancement

Assured Guaranty generates revenue by charging fees for credit enhancement services, beyond premiums. These fees encompass structuring, advisory, and other charges. This fee income boosts profitability, complementing premium revenue. For instance, in 2024, fee income contributed significantly to their total revenue. These additional fees reflect the value of their financial expertise.

- Fee income supplements premium income.

- Includes structuring and advisory fees.

- Enhances overall profitability.

- Reflects value of financial expertise.

Asset Management Income

Assured Guaranty's partnership with Sound Point Capital Management is a key revenue stream, generating asset management income. This income is derived from management fees and performance fees based on assets under management. Asset management diversifies Assured Guaranty's earnings, offering a stable source of revenue. This diversification is crucial for financial stability and growth.

- Asset management income includes management fees and performance fees.

- This partnership diversifies Assured Guaranty's revenue.

- It provides a stable source of earnings.

- Diversification is key for financial stability.

Assured Guaranty primarily earns through insurance premiums and investment income, vital for covering claims and operations. Reinsurance commissions also provide a steady revenue stream, especially through strategic partnerships. Fee income from credit enhancement services and asset management further diversifies and boosts profitability.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Premium Income | Income from insurance policies. | Gross premiums written exceeded $1 billion. |

| Investment Income | Income from fixed-income securities. | Investment portfolio yield around 4.5%. |

| Reinsurance Commissions | Commissions from reinsurance. | Reinsurance premiums earned were ~$110M. |

| Fee Income | Fees for credit enhancement services. | Significant contribution to total revenue. |

| Asset Management | Income from asset management. | Stable earnings from management & performance fees. |

Business Model Canvas Data Sources

This Assured Guaranty Business Model Canvas leverages financial statements, market research, and industry reports. These sources ensure strategic alignment and accurate business representation.