Ball Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ball Bundle

What is included in the product

Highlights competitive advantages and threats per quadrant

Export-ready design for quick drag-and-drop into PowerPoint!

Full Transparency, Always

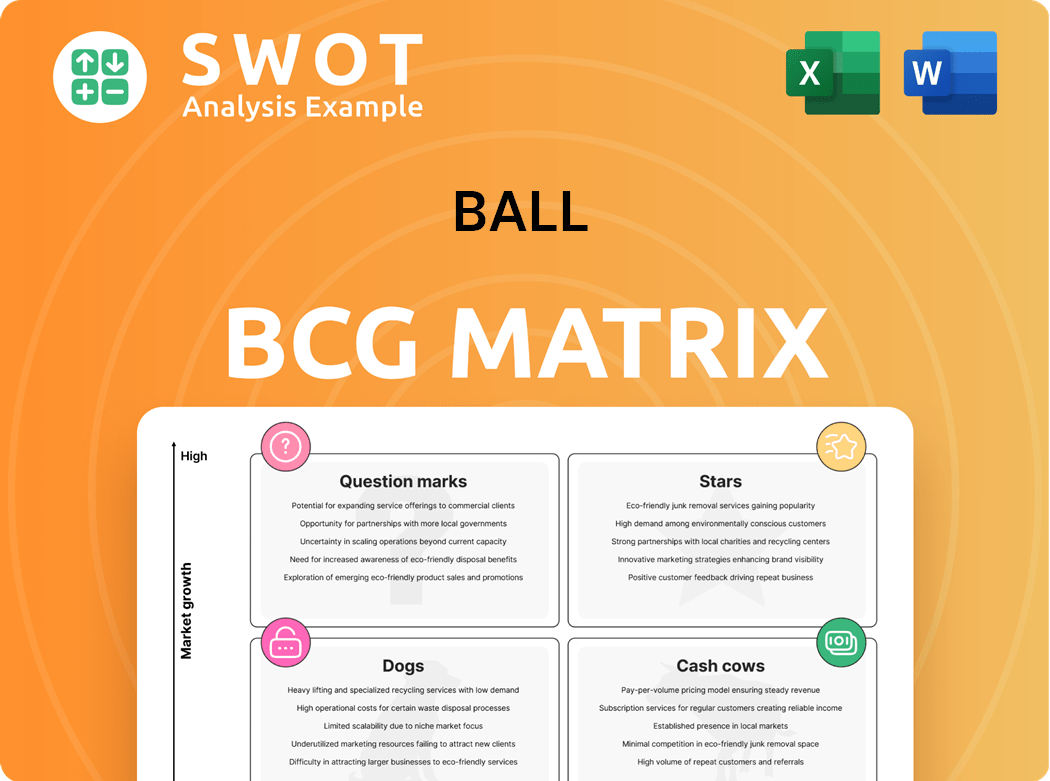

Ball BCG Matrix

The BCG Matrix displayed here is the exact document you'll receive upon purchase. This complete, ready-to-use version offers a clear strategic framework for your business analysis, without any alterations.

BCG Matrix Template

This glimpse into the company's product portfolio offers a snapshot of its market position using the Ball BCG Matrix. We see potential "Stars," possibly "Cash Cows," and likely some "Dogs" and "Question Marks." This strategic tool categorizes products based on market share and growth rate. It helps identify optimal resource allocation and strategic opportunities. For a complete analysis, purchase the full Ball BCG Matrix now, and receive actionable insights.

Stars

Ball Corporation's sustainable aluminum packaging is a star, given its leadership in eco-friendly solutions. They benefit from rising demand and environmental concerns. Partnerships with Coca-Cola and PepsiCo highlight their commitment to recyclability. In 2024, Ball's aluminum can shipments grew, reflecting this focus.

Ball Corporation strategically expands in key markets like North America, EMEA, and South America, meeting rising beverage packaging demands. In 2024, North America represented a significant portion of Ball's sales, with $4.8 billion in net sales. This global presence, supported by acquisitions such as Alucan Entec, enhances its market position. Ball's ability to adapt to local preferences and strong regional market shares drives its success.

Ball Corporation showcases robust financial health, evidenced by solid revenue and earnings per share (EPS) growth. In 2024, Ball's free cash flow generation remained strong. Operational efficiencies and cost management strategies boost profitability, aiding investments in growth. The aerospace business divestiture positively impacted its financial standing.

Innovation in Packaging Solutions

Ball Corporation's innovation in packaging is a strength, enabling it to introduce new products and enter new markets. Its MEADOW KAPSUL technology is a prime example. The emphasis on lightweight designs, enhanced recyclability, and lower carbon emissions makes it attractive to customers. This commitment to sustainability is vital.

- Ball Corporation's net sales in 2023 were $15.5 billion.

- The company invested $430 million in capital expenditures in 2023, supporting innovation.

- Ball's aluminum packaging is 100% recyclable.

Strategic Partnerships and Collaborations

Ball Corporation strategically partners with companies like Meadow and CavinKare to broaden its market reach. These collaborations bring innovative packaging solutions to more customers. Partnerships leverage external expertise, boosting sustainable packaging development. These alliances are key for circularity and sustainability goals.

- Ball's 2024 revenue was approximately $15.08 billion.

- Meadow, a Ball partner, focuses on plant-based packaging.

- CavinKare is a major consumer goods company.

- These partnerships enhance Ball's sustainability initiatives.

Ball Corporation's sustainable packaging is a star due to its strong market share and high growth in the eco-friendly sector. It benefits from robust demand, particularly from partnerships like Coca-Cola and PepsiCo. Financial health is evident, with approximately $15.08 billion in 2024 revenue, driven by strategic expansions and innovations.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total Sales | $15.08 billion |

| Market Presence | Key Markets | North America, EMEA, South America |

| Sustainability | Recyclability | 100% recyclable aluminum packaging |

Cash Cows

Ball Corporation's North American beverage packaging is a cash cow, a major revenue source. It benefits from strong aluminum can demand and a mature market. This segment boasts a large market share and steady cash flow. In 2024, the segment generated $7.3 billion in revenue. Despite competition, its established position ensures reliable income.

The EMEA beverage packaging segment is a cash cow for Ball Corporation, showing solid growth. This is fueled by rising demand for sustainable aluminum cans. Ball's strong EMEA presence and efficient operations boost its cash generation. Sustainability trends also help this segment thrive. In 2024, the EMEA beverage can market is expected to reach $10.2 billion.

The aluminum aerosol cans market shows consistent growth, fueled by consumer preference for convenient packaging. Ball Corporation thrives here, offering recyclable aluminum cans. In 2024, Ball's revenue from aluminum packaging reached $8.5 billion, marking a 3% increase. Its Alucan acquisition solidified its market standing, making it a cash cow.

Operational Efficiencies

Ball Corporation's dedication to operational efficiencies and cost reduction is key to its strong free cash flow and high-profit margins. The Ball Business System and continuous improvement initiatives boost productivity and financial results. These improvements are essential for maintaining its cash cow segments, ensuring consistent returns. In 2024, Ball Corporation's cost of goods sold decreased by 3.6%, reflecting these efficiencies.

- Cost of Goods Sold Reduction: 3.6% decrease in 2024.

- Ball Business System: Key driver for continuous improvement.

- Focus: Enhancing productivity and financial performance.

- Impact: Supports cash cow segment sustainability.

Sustainable Packaging Demand

The rising demand for sustainable packaging boosts Ball Corporation's aluminum packaging. Aluminum's recyclability aligns with eco-conscious consumer and regulatory trends. This strengthens Ball's cash flow from its sustainable packaging segment. The global sustainable packaging market was valued at $316.7 billion in 2023.

- Market growth is projected to reach $487.7 billion by 2028.

- Ball Corporation's net sales for 2023 were $15.5 billion.

- Aluminum can recycling rates in the U.S. are around 45%.

- Ball's focus on sustainable practices increases its market competitiveness.

Ball Corporation's cash cows, like North American and EMEA beverage packaging, generate substantial revenue. Aluminum aerosol cans also contribute, boosted by consumer trends. Operational efficiency and sustainability initiatives further enhance their performance.

| Segment | 2024 Revenue | Key Drivers |

|---|---|---|

| North America Beverage | $7.3B | Strong can demand, mature market. |

| EMEA Beverage | $10.2B (market est.) | Sustainable can demand, efficient ops. |

| Aluminum Aerosol Cans | $8.5B | Recyclability, consumer preference. |

Dogs

Ball Corporation's steel food and aerosol container segment, divested in 2018 and later sold to Sonoco in 2022, likely fit the 'dog' profile in the BCG matrix. This business had slower growth prospects and lower profitability compared to Ball's aluminum beverage packaging. This strategic move allowed Ball to concentrate on higher-growth areas. The divestiture improved the company's financial performance. In 2022, Sonoco acquired Ball Metalpack for approximately $1.35 billion.

The aerospace business, once crucial for Ball, was sold in February 2024. This move streamlined operations. Ball focused on its core aluminum packaging. The sale proceeds cut debt and boosted shareholder value.

Ball Corporation's aluminum cup business, facing strategic review, could be a 'dog' in its BCG matrix. The firm's move to explore options, including deconsolidation, hints at limited growth and profitability. In 2024, Ball's stock showed mixed performance, reflecting market uncertainty. Deconsolidation could free up resources for better opportunities.

Operations in Argentina

Ball Corporation's Argentina operations face significant hurdles. The nation's economic instability and political climate pose risks. These factors may lead to decreased revenue. This could classify Argentina as a "dog" in the BCG Matrix.

- Argentina's inflation rate reached 211.4% in 2023.

- Currency devaluation and demand fluctuations are major concerns.

- Regulatory challenges add to the operational complexity.

- Ball Corporation's financial results for 2024 will reflect these challenges.

Underperforming Segments in Specific Regions

In Ball Corporation's BCG matrix, certain segments, like the North American beer market, might be 'dogs'. These face declining demand and tough competition. Revitalizing these segments demands substantial resources, and their future is unclear. The company's strategic moves will define their fate.

- Ball Corporation reported a 6% decrease in North American beverage can volumes in Q3 2023.

- The beer category specifically saw a volume decline, contributing to the underperformance.

- Intense competition from other packaging types and brands adds to the challenges.

- Ball's strategic focus includes cost-cutting and portfolio optimization to address these issues.

In Ball Corporation's BCG matrix, "dogs" represent underperforming segments. These units have low market share and growth. They require significant resources. Ball's strategy aims to improve or exit these areas.

| Segment | Status | 2023 Performance |

|---|---|---|

| North American Beer | Dog | 6% volume decrease (Q3 2023) |

| Argentina Operations | Dog | High inflation (211.4% in 2023) |

| Aluminum Cup Business | Dog | Strategic review underway |

Question Marks

Ball's foray into personal and home care aluminum packaging is a 'question mark.' The market is growing, driven by sustainability trends. Ball faces competition, with success hinging on marketing and innovation. In 2024, the global aluminum packaging market was valued at $36.5 billion. The partnership with Meadow is a positive move, but long-term success is uncertain.

Ball Corporation's expansion into emerging markets like India and Southeast Asia places it in the 'question mark' category. These regions offer high growth potential, but come with challenges. Competition, demand fluctuations, and regulations are key hurdles. Ball's success hinges on overcoming these obstacles. For instance, the partnership with CavinKare in India. In 2024, India's beverage can market is expected to grow by 10%.

The aluminum bottle market, a 'question mark' for Ball, aligns with sustainability. Consumer adoption is still developing. Ball's innovation in design, cost reduction, and marketing will be key. The Alucan acquisition strengthens its position. However, market's potential is uncertain.

New Aluminum Can Technologies

Investment in new aluminum can technologies places them in the 'question mark' quadrant of the BCG matrix. These technologies, including advanced valves and dispensing systems, aim to improve product appeal. However, their market success is uncertain, with adoption rates and market share impact still unclear. Ball Corporation's capacity to commercialize these innovations will dictate their financial returns.

- Ball Corporation invested approximately $300 million in capital expenditures in 2024 to support innovation.

- The global aerosol can market was valued at around $7.5 billion in 2024.

- New technologies could increase the market share by 2-5% within 3 years.

- The average R&D spending in the packaging industry is about 2-3% of revenue.

Strategic Partnerships in Unproven Markets

Strategic partnerships, like the one with Meadow for MEADOW KAPSUL technology, classify as 'question marks' in the BCG matrix. These ventures into unproven markets carry inherent risks, demanding careful evaluation. Success hinges on effective collaboration and market acceptance, making their future uncertain. The potential for high growth exists, but so does the risk of failure.

- Partnerships offer access to innovative technologies and markets.

- Success depends on effective collaboration and market acceptance.

- Long-term potential is uncertain until tangible results are shown.

- Failure is a significant risk in unproven markets.

Ball's ventures in packaging, emerging markets, and tech are 'question marks.' These areas offer growth but face risks. Success depends on innovation, execution, and market acceptance. Investments total ~$300M in 2024.

| Aspect | Challenge | Opportunity |

|---|---|---|

| Packaging | Competition & Market Volatility | Sustainability & Innovation |

| Emerging Markets | Regulations & Demand | High Growth Potential |

| Tech | Adoption & Share | Improve Product Appeal |

BCG Matrix Data Sources

The BCG Matrix is data-driven. It leverages sales figures, market size data, and growth rate reports for its analysis.