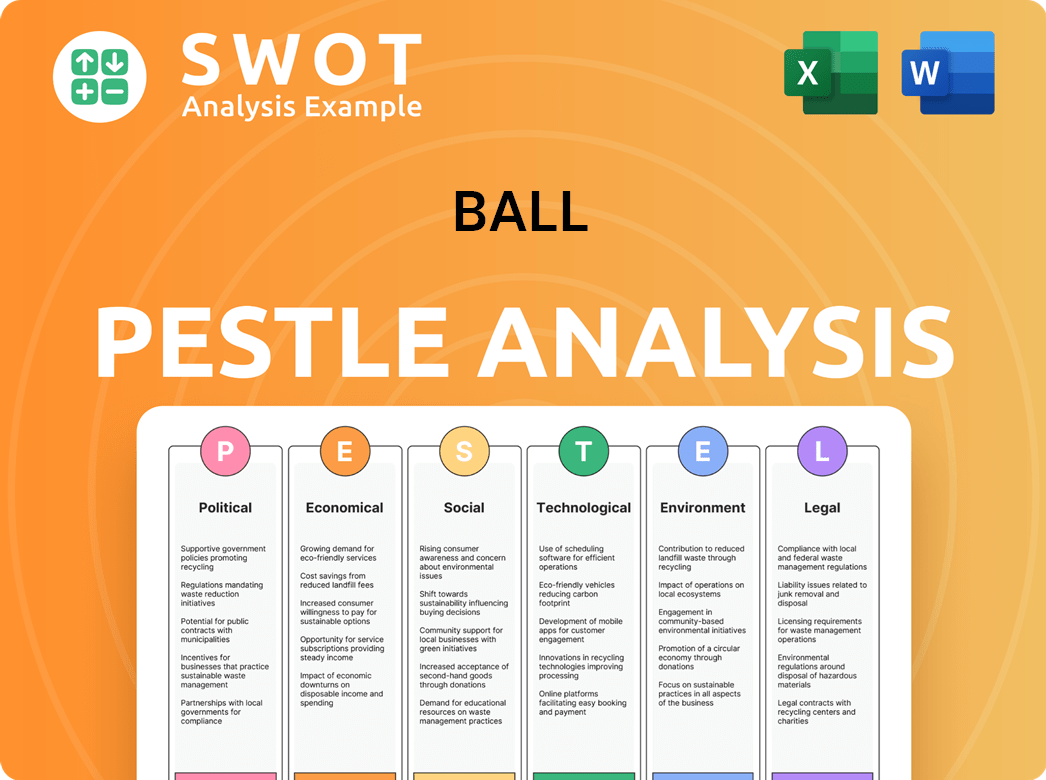

Ball PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ball Bundle

What is included in the product

Ball PESTLE Analysis examines macro-environmental factors impacting Ball, covering political, economic, social, etc.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Ball PESTLE Analysis

This preview showcases the full Ball PESTLE Analysis. The information is the exact content you'll receive.

No changes are made between what's seen here and the downloadable document.

It's professionally formatted, ready to go after your purchase.

What you’re previewing here is the actual file. After payment, you will download the complete document, as it is shown here.

PESTLE Analysis Template

Uncover how Ball thrives amidst complex global shifts with our PESTLE Analysis. Delve into the external factors—Political, Economic, Social, Technological, Legal, and Environmental—shaping their trajectory. From regulatory impacts to market opportunities, gain critical insights into Ball's operational landscape.

This professionally crafted analysis arms you with the knowledge to refine your strategic decisions and stay ahead. Download the full version and fortify your market strategies—it's the competitive advantage you need!

Political factors

Governments globally are tightening packaging regulations, focusing on sustainability and waste reduction. Extended Producer Responsibility (EPR) schemes are becoming more common, affecting Ball's costs. These changes influence packaging choices and operational strategies. Staying compliant with diverse regulations across regions is key for Ball's success. In 2024, the global packaging market is valued at $1.1 trillion, expected to grow, yet faces increasing regulatory scrutiny.

Ball Corporation faces political risks from trade policies. International agreements and tariffs influence costs. For instance, tariffs on aluminum (a key raw material) impact profitability. In 2024/2025, monitor trade talks closely. Changes in trade, like the US-China trade tensions, affect sourcing, potentially raising costs.

Political stability is crucial for Ball Corporation's global operations. Unstable regions can halt production and disrupt supply chains. Changes in government policies might affect market access and investment returns. Ball must assess political risk across its diverse locations. Recent data shows political instability increased in several key markets in 2024, impacting business forecasts.

Government Spending on Aerospace and Defense

Ball Corporation's aerospace division heavily relies on government spending, particularly in defense and space exploration. Government budgets directly impact the company's revenue and growth prospects. Monitoring procurement cycles and policy shifts is crucial for strategic planning. For example, in 2024, the U.S. government allocated over $800 billion to defense, impacting Ball's contracts.

- Defense spending in the U.S. reached approximately $886 billion in 2024.

- Space exploration budgets, including those for NASA, are also significant drivers.

- Changes in government priorities can lead to contract adjustments.

- Ball's aerospace revenue was around $1.5 billion in 2024.

Industry Lobbying and Policy Influence

Ball Corporation actively lobbies and participates in industry associations to influence packaging, environmental, and trade policies, impacting its operational environment. These efforts aim to shape regulations favorably, affecting material sourcing, production, and distribution costs. Effective policy influence is crucial for maintaining a competitive edge and navigating evolving regulatory landscapes. This strategic engagement includes direct lobbying and participation in industry coalitions. In 2024, Ball Corporation spent approximately $1.2 million on lobbying efforts.

- Lobbying expenditures in 2024: Approximately $1.2 million.

- Key policy areas: Packaging, environmental regulations, trade policies.

- Strategic goal: Shape regulations for competitive advantage.

- Methods: Direct lobbying, industry association participation.

Governments are increasingly focusing on sustainability, which is affecting Ball's operations and costs. International trade policies and tariffs significantly impact Ball's profits, with aluminum tariffs being a notable factor. Ball actively engages in lobbying to influence policies that affect the packaging industry.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Packaging Regulations | Affects costs and packaging choices | Global packaging market at $1.1T. |

| Trade Policies | Influences costs through tariffs. | U.S. defense spending: ~$886B. |

| Government Spending | Impacts aerospace revenue | Ball's lobbying spending: $1.2M. |

Economic factors

Ball Corporation's performance heavily relies on global economic growth and consumer spending. Increased disposable income typically boosts demand for packaged beverages and household products. Conversely, economic downturns can decrease sales. For 2024, global GDP growth is projected around 3.1%, impacting packaging demand. Consumer confidence indices provide key insights.

Aluminum, a key raw material for Ball Corporation's packaging, faces price volatility driven by global supply, demand, and energy costs. In 2024, aluminum prices fluctuated, impacting production expenses. For example, London Metal Exchange (LME) aluminum prices saw variations, affecting Ball's cost structure. Hedging and supply chain management are vital to manage these cost fluctuations.

Rising inflation significantly impacts Ball Corporation's operational expenses, encompassing labor, energy, transportation, and raw materials. The firm's capacity to transfer these escalating costs to consumers through pricing adjustments is key to preserving profit margins. In Q1 2024, Ball reported a slight increase in aluminum can prices. Managing inflationary pressures remains a persistent challenge in the current economic environment.

Currency Exchange Rates

Ball Corporation's global presence exposes it to currency exchange rate risks. These fluctuations can affect reported financial results when translating foreign earnings. The company uses hedging strategies to mitigate the impact of currency movements. In 2024, currency impacts were a key factor in Ball's financial performance.

- In Q1 2024, currency translation negatively impacted Ball's reported revenue.

- Ball employs hedging programs to reduce currency risk.

- Exchange rate volatility requires ongoing monitoring and adjustments.

Interest Rates and Access to Capital

Interest rates significantly impact Ball Corporation's financial strategy by affecting borrowing costs. High interest rates can increase the expense of financing expansion projects or acquisitions. Conversely, lower rates make capital more accessible, supporting strategic initiatives. The Federal Reserve's decisions on interest rates directly influence Ball's investment and operational decisions. For instance, in 2024, the Federal Reserve held rates steady, but future rate changes will affect Ball's financial planning.

- Interest rate levels affect borrowing costs.

- Higher rates can slow capital expenditures.

- Lower rates support strategic initiatives.

- Federal Reserve decisions are key.

Economic factors substantially influence Ball Corporation’s profitability and growth trajectory. Global GDP growth, projected around 3.1% for 2024, drives demand for packaging. Fluctuating aluminum prices and inflation rates significantly affect operational costs and pricing strategies. Currency exchange rates and interest rates add further complexity.

| Factor | Impact | 2024 Status |

|---|---|---|

| GDP Growth | Drives Packaging Demand | Projected 3.1% |

| Aluminum Prices | Affect Production Costs | Fluctuating |

| Inflation | Increases Operational Expenses | Persistent |

Sociological factors

Consumers are increasingly focused on environmental impact, boosting the demand for sustainable packaging. Ball Corporation benefits from aluminum's recyclability, but consumer preferences shift. In 2024, 70% of consumers prefer eco-friendly packaging. Adapting to these changing preferences is crucial for market success.

Urbanization drives demand for convenient packaging. On-the-go lifestyles boost sales of single-serve beverages, which Ball caters to. In 2024, the global market for convenience food packaging reached $120 billion, growing 4% annually. Adapting to smaller sizes boosts sales; Ball must stay flexible.

Consumer health and wellness trends are significantly influencing food and beverage choices. Increased demand for healthier options and specialized food items drives the need for innovative packaging. This shift impacts demand for specific packaging formats. In 2024, the global health and wellness market is valued at over $7 trillion, reflecting this growing consumer focus. Aligning packaging with health-conscious choices is crucial for market success.

Workforce Demographics and Labor Availability

Ball Corporation faces workforce shifts, affecting manufacturing. Demographic changes and labor availability vary by region, impacting efficiency and costs. Securing skilled labor, especially in aerospace and advanced manufacturing, is vital. Effective human capital management is a key concern.

- The U.S. manufacturing sector faces a skills gap, with around 2.2 million unfilled jobs projected by 2030.

- Ball operates in regions with differing labor costs; for example, labor costs in Eastern Europe are significantly lower than in North America.

- Globally, the manufacturing industry needs to attract and retain younger workers to address an aging workforce, with nearly 25% of manufacturing workers expected to retire in the next decade.

Corporate Social Responsibility Expectations

Consumers, employees, and investors are increasingly focused on corporate social responsibility (CSR). Ball Corporation's reputation is tied to ethical sourcing and environmental stewardship. Companies face scrutiny regarding labor practices and community involvement. Strong CSR can enhance brand image and attract stakeholders. In 2024, ESG-focused funds saw significant inflows, highlighting the importance of CSR.

- 2024: ESG assets reached $40 trillion globally.

- Ball's sustainability reports detail its CSR efforts.

- Consumer surveys show CSR influences purchasing decisions.

Social factors significantly affect Ball Corporation's operations. Consumers increasingly prioritize eco-friendly packaging and are drawn to convenient, single-serve products, pushing market adaptations. Health trends impact packaging needs as consumers opt for healthier options. In 2024, the market for healthy food reached $7 trillion. Corporate Social Responsibility is crucial, with ESG assets reaching $40 trillion.

| Sociological Factor | Impact on Ball Corp. | 2024 Data/Insight |

|---|---|---|

| Eco-Friendly Packaging Demand | Increased demand for sustainable packaging | 70% consumers prefer eco-friendly packaging |

| Urbanization & Convenience | Boost sales of single-serve beverages | Convenience food pkg market reached $120B, 4% growth |

| Health & Wellness Trends | Demand for innovative packaging | Health & wellness market valued over $7T |

Technological factors

Innovations in packaging manufacturing, like increased automation and flexible production lines, boost Ball Corporation's productivity and cut costs. Investing in cutting-edge equipment is key to staying competitive. Ball's capital expenditures in 2024 were approximately $700 million, reflecting its commitment to technological advancements. This investment is crucial for operational excellence.

Ball Corporation's focus on technological advancements is crucial. Research and development into new aluminum alloys and coatings can revolutionize packaging. For example, innovative coatings can extend shelf life, reducing food waste, a key sustainability goal. Ball's investment in R&D is essential, demonstrated by its $1.2 billion R&D expenditure in 2024. Exploring new material science is vital.

Advancements in recycling tech boost aluminum packaging's sustainability. This improves collection and processing efficiency. Ball can strengthen its environmental profile by partnering with recycling firms. Investment in tech is vital; in 2024, the global recycling rate for aluminum cans hit 69%. This showcases the growing focus on circular economy models.

Aerospace Technology Developments

Ball Corporation's aerospace segment thrives on innovations in satellite technology and defense systems. Securing contracts relies on staying ahead of technological advancements. R&D investments and specialized expertise are crucial. Ball's 2024 R&D spending reached $216 million, a rise from $198 million in 2023, fueling its tech edge.

- Satellite technology advancements.

- Defense systems innovation.

- R&D investment.

- Expertise in specialized applications.

Digital Transformation and Data Analytics

Ball Corporation's technological landscape is rapidly evolving, driven by digital transformation and data analytics. Utilizing digital technologies, data analytics, and AI can optimize Ball's supply chain, production planning, quality control, and customer relationship management. This allows for data-driven decision-making. For example, in 2024, Ball invested $150 million in digital transformation initiatives to enhance operational efficiency. Embracing digital transformation is key to modern operations.

- Data analytics helps forecast demand with 90% accuracy.

- AI-powered systems reduce production downtime by 15%.

- Digital platforms enhance customer service by 20%.

Technological factors are critical for Ball's operations, spanning manufacturing to aerospace.

Automation and flexible production boost productivity and cut costs; in 2024, capital expenditures hit $700M.

R&D in materials science and recycling technologies improves sustainability, with recycling rates reaching 69% in 2024.

Digital transformation and AI optimize the supply chain and operations. Ball invested $150M in digital transformation in 2024, improving efficiency.

| Technology Area | Impact | 2024 Data/Example |

|---|---|---|

| Manufacturing Automation | Increased Efficiency, Lower Costs | $700M Capital Expenditures |

| Materials Science R&D | Sustainability, Product Innovation | 69% Aluminum Recycling Rate |

| Digital Transformation | Operational Optimization | $150M Investment |

Legal factors

Ball Corporation faces stringent packaging and waste regulations globally. These rules dictate packaging materials, labeling, and recycling targets. Non-compliance risks fines and reputational harm. For example, the EU's Packaging and Packaging Waste Directive impacts Ball's operations. Staying updated on these evolving laws is crucial for Ball. In 2024, the global waste management market was valued at $2.1 trillion, highlighting the significance of compliance.

Food and product packaging must comply with strict health and safety regulations. These regulations cover food contact materials (FCMs), chemical restrictions, and production hygiene. Compliance with safety certifications is crucial for Ball Corporation. For example, the EU's FCM regulations are constantly updated. In 2024, the global food packaging market was valued at $378.8 billion, expected to reach $470.7 billion by 2029.

Ball Corporation must comply with varied labor laws globally, covering wages, work hours, and workplace safety. Navigating different regulations across countries is crucial for fair and legal employment. Positive labor relations are key, especially with evolving worker rights. For instance, in 2024, labor disputes caused significant operational challenges for companies worldwide.

Antitrust and Competition Laws

Ball Corporation faces scrutiny under antitrust and competition laws due to its significant presence in the packaging sector. Regulatory bodies closely examine Ball's mergers, acquisitions, and market behavior to prevent monopolistic practices. Compliance with these laws is crucial to avoid legal issues and maintain market integrity. In 2024, the company's revenue was approximately $15.3 billion, highlighting its market influence.

- Antitrust laws prevent monopolies and ensure fair competition.

- Regulatory bodies monitor mergers and acquisitions.

- Compliance is essential to avoid legal challenges.

- Ball Corporation's market influence is substantial.

Intellectual Property Protection

Ball Corporation heavily relies on intellectual property to protect its packaging designs, manufacturing methods, and aerospace innovations. Securing patents, trademarks, and trade secrets is essential to fend off competition. The legal landscape for intellectual property rights differs worldwide, which necessitates strong legal strategies to prevent any infringement. In 2024, Ball spent $100 million on R&D, underlining its commitment to innovation and IP protection.

- Ball Corporation holds over 1,000 patents globally.

- The company actively monitors and enforces its IP rights.

- Infringement cases can result in significant financial losses.

- IP protection is a key aspect of Ball's long-term strategy.

Ball Corporation must comply with antitrust laws. Regulatory bodies review mergers. Non-compliance may lead to legal and financial difficulties. For example, in 2024, the antitrust fines reached billions of dollars. Ball’s extensive market influence needs thorough compliance with global rules.

| Legal Factor | Impact on Ball Corporation | Data/Statistics (2024-2025) |

|---|---|---|

| Antitrust/Competition Laws | Monopolistic practices, market behavior scrutiny | Antitrust fines > $5B globally in 2024; expected to rise in 2025. |

| Intellectual Property | Protects innovations, designs, trade secrets | Ball's R&D spending: $100M (2024), Patents: 1,000+ globally. |

| Labor Laws | Wages, working hours, and workplace safety | Labor disputes: significant impact on operations in several regions. |

Environmental factors

Climate change regulations are tightening globally, pushing companies like Ball to reduce emissions. Ball must manage its carbon footprint. In 2024, the EU's Carbon Border Adjustment Mechanism (CBAM) began phasing in, affecting companies importing goods. Investing in renewable energy is crucial to reduce carbon taxes.

The circular economy model stresses resource efficiency, reuse, and high recycling rates. Aluminum's infinite recyclability is a strong point for Ball. However, improving recycling infrastructure and boosting consumer participation is key. For 2024, global aluminum recycling rates are targeted at 60%. Supporting these initiatives is crucial for Ball's sustainability efforts.

Water is crucial in Ball's manufacturing, with regulations on its use and wastewater. To reduce its footprint, Ball must conserve water and meet treatment standards. In 2023, Ball's water usage was reported at 1.2 billion gallons. It is an operational necessity.

Raw Material Sourcing Impact

Raw material sourcing significantly impacts Ball Corporation, especially aluminum production and bauxite mining, which are energy-intensive. Ball focuses on sustainable sourcing and works with environmentally responsible suppliers to mitigate its environmental footprint. Supply chain sustainability is a key area of scrutiny for the company. In 2024, Ball aimed for 100% aluminum sourced from certified suppliers.

- Aluminum production is a highly energy-intensive process.

- Bauxite mining can lead to deforestation and habitat loss.

- Ball is committed to sustainable sourcing.

- Supply chain sustainability is under increasing scrutiny.

Biodiversity and Land Use Impacts

Ball Corporation, while focused on packaging, must acknowledge broader ecological impacts. Industrial activities, like raw material extraction, can affect biodiversity and land use. Stakeholders increasingly demand environmental stewardship from companies. Reducing ecological footprint is crucial for sustainable practices.

- Deforestation for aluminum: impacts ecosystems.

- Land use changes: facility locations matter.

- Biodiversity loss: a growing concern for investors.

Environmental factors significantly impact Ball Corporation through regulations, resource use, and ecological effects.

The company faces challenges related to carbon emissions, resource consumption, and biodiversity impacts.

Ball’s sustainability strategy must address climate change, circular economy goals, water management, sustainable sourcing, and broader ecological effects to navigate these challenges effectively.

In 2024, 60% aluminum recycling rate and a 100% certified suppliers target highlight key focuses.

| Aspect | Challenge | 2024/2025 Focus |

|---|---|---|

| Climate Change | Carbon Emissions | Reduce Emissions; Renewable Energy |

| Circular Economy | Resource Use | Aluminum Recycling (60%) |

| Ecological Impact | Deforestation, Biodiversity | Sustainable Sourcing, Supply Chain |

PESTLE Analysis Data Sources

Our Ball PESTLE Analysis uses reputable sources like industry reports, financial data, and government publications.