Ball Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ball Bundle

What is included in the product

Analyzes competition, supplier power, and buyer influence impacting Ball's profits.

Customize pressure levels based on new data or evolving market trends.

Same Document Delivered

Ball Porter's Five Forces Analysis

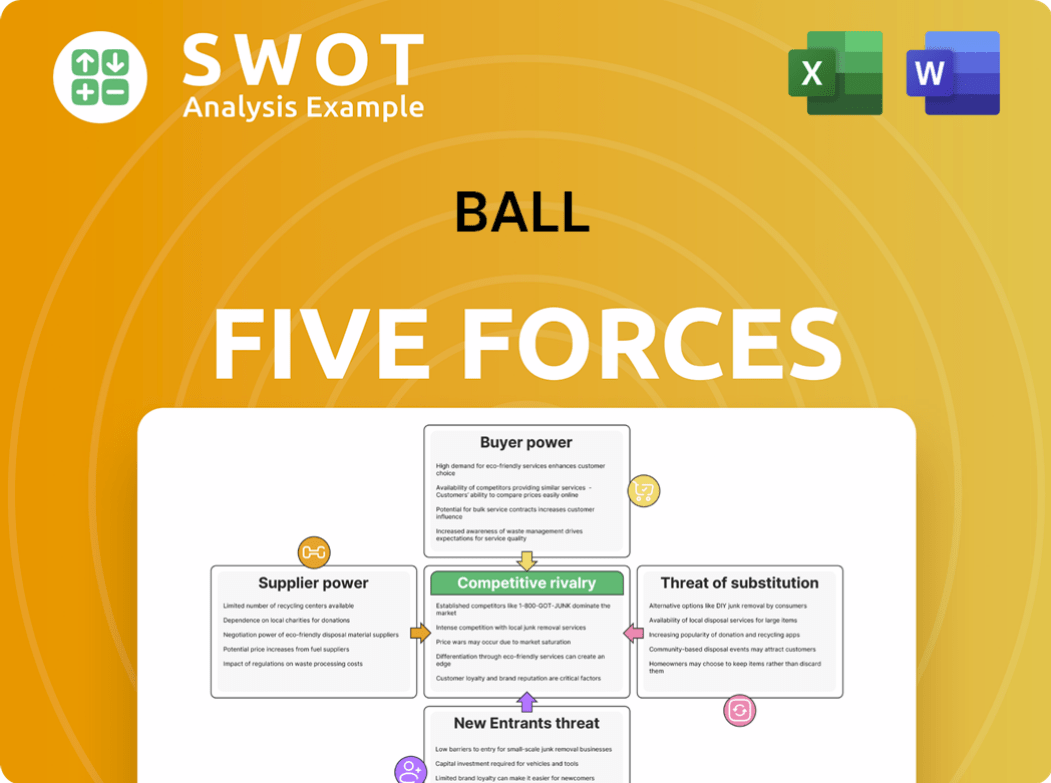

This preview showcases the Ball Porter's Five Forces analysis you'll receive. It's the complete, ready-to-use document with a thorough examination. The very analysis you're viewing is the one you'll download after purchase. No hidden content or alterations; it's identical. Enjoy the insightful, professionally crafted analysis.

Porter's Five Forces Analysis Template

Ball Corporation navigates a dynamic industry, constantly shaped by competitive forces. Supplier power, particularly for aluminum and glass, significantly impacts profitability. Buyer power varies across its diverse customer base, including beverage companies. The threat of new entrants is moderate, with high capital requirements acting as a barrier. Substitutes, such as plastic and alternative packaging, pose ongoing challenges. Intense rivalry among existing players, like Crown and Ardagh, further complicates the landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ball’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In the aluminum and metal packaging sector, a handful of suppliers dominate globally, concentrating significant power. This limited supplier base means Ball Corporation faces fewer choices, reducing its negotiation leverage. Market concentration can drive up raw material expenses and worsen supply conditions for Ball. For example, in 2024, the top three aluminum suppliers controlled over 60% of the global market.

Aluminum price volatility is a significant factor for Ball Corporation. As a primary raw material, fluctuations directly impact production costs. In 2024, aluminum prices saw considerable shifts, affecting profitability. This necessitates careful supply chain management to mitigate risks. Ball's financial performance hinges on navigating these price swings effectively.

Ball Corporation leverages long-term contracts with suppliers to stabilize pricing and supply chains. These agreements provide protection from volatile market swings, ensuring a steady flow of materials. For example, in 2024, Ball's contracts helped mitigate the impact of rising aluminum prices. The terms and renegotiation possibilities within these contracts significantly shape supplier bargaining power.

Supplier Switching Costs

Switching aluminum suppliers presents challenges for Ball, creating supplier dependence. The costs of establishing new relationships and ensuring quality control are considerable. Adapting manufacturing processes to accommodate new suppliers also demands investment. This dynamic boosts current suppliers' bargaining power, as Ball may hesitate to switch unless the advantages are significant.

- Aluminum prices fluctuated in 2024, impacting manufacturers' costs.

- Establishing new supplier relationships can take several months.

- Quality control measures can add 5-10% to production costs.

- Switching suppliers requires a detailed vendor selection process.

Vertical Integration

Vertical integration is a strategy where Ball Corporation might take control of its supply chain to counter supplier power. This approach allows Ball to produce essential inputs, reducing dependency on external suppliers. For instance, Ball could manufacture its own aluminum cans, lessening the impact of supplier price hikes. This strategic move improves Ball's bargaining position and operational stability.

- Ball Corporation's revenue in 2023 was approximately $15.46 billion.

- In 2023, Ball's cost of goods sold was about $12.62 billion, indicating significant input costs.

- Vertical integration can reduce costs, as seen in companies like Tesla, which produces many of its components.

- Ball's capital expenditures in 2023 were about $925 million, potentially supporting vertical integration initiatives.

Supplier bargaining power significantly impacts Ball Corporation, particularly in the aluminum packaging sector. Limited suppliers and volatile aluminum prices—which fluctuated in 2024—challenge Ball's cost management. Long-term contracts and potential vertical integration are strategies to mitigate these risks and enhance Ball's negotiating leverage.

| Aspect | Impact | Data (2024 est.) |

|---|---|---|

| Supplier Concentration | Reduced choices, higher costs | Top 3 Aluminum Suppliers: 60%+ market share |

| Aluminum Price Volatility | Production cost fluctuations | Prices shifted significantly |

| Vertical Integration Potential | Enhanced bargaining power | Ball's 2023 Revenue: $15.46B |

Customers Bargaining Power

Ball Corporation's customer concentration is a key factor. A few large companies account for a significant portion of Ball's sales, making it vulnerable. In 2024, major beverage companies like Coca-Cola and PepsiCo represent a substantial part of its revenue. This concentration can lead to risks. Ball must maintain strong customer relationships.

Contract dynamics significantly shape customer bargaining power. Long-term contracts, while ensuring demand, demand careful negotiation for favorable terms. In 2024, companies faced fluctuating input costs, highlighting the need for flexible pricing. For instance, major suppliers revised contract terms to adapt to volatile raw material prices, impacting profitability. Companies with strong negotiation skills maintained margins, while others struggled.

Switching costs for Ball's customers exist, though not excessively high. Logistics, equipment changes, and production disruptions accompany supplier shifts. For instance, in 2024, Ball Corporation's customers faced adjustments when adopting new packaging. Yet, substantial savings or sustainability gains could incentivize moves, bolstering buyer power. In 2024, the packaging industry saw about a 3% shift in supplier preference due to sustainability demands.

Product Commoditization

Aluminum beverage cans are indeed largely commoditized, making differentiation challenging. This lack of uniqueness boosts customer bargaining power, as they can easily compare prices and switch suppliers. In 2024, the global aluminum can market was valued at approximately $60 billion. Innovations in can design are key to reducing customer power, allowing companies like Ball to stand out.

- Commoditization limits differentiation in the aluminum can market.

- Customer power increases due to easy supplier switching.

- The global aluminum can market was worth $60 billion in 2024.

- Innovation is key to reducing customer bargaining power.

Sustainability Demands

Customers are increasingly prioritizing sustainable packaging. Ball Corporation's emphasis on aluminum's recyclability is a key strength. However, if alternatives offer better sustainability or cost, customer bargaining power rises. In 2024, the global sustainable packaging market was valued at $300 billion.

- Aluminum has a 67% recycling rate in the U.S.

- The demand for sustainable packaging is growing by 5-7% annually.

- Ball Corporation's net sales in 2023 were $14.9 billion.

- Customers are willing to pay a premium for eco-friendly options.

Customer bargaining power significantly impacts Ball Corporation. Key factors include market commoditization and the availability of alternatives. In 2024, the aluminum can market was worth around $60 billion, with sustainability being a major driver. Successfully managing this power requires innovation and strong customer relationships.

| Factor | Impact | 2024 Data |

|---|---|---|

| Commoditization | Increases customer power | Aluminum can market: $60B |

| Sustainability | Influences buyer choices | Sustainable packaging market: $300B |

| Switching Costs | Moderate impact | Packaging shift: ~3% |

Rivalry Among Competitors

The packaging market is concentrated, with key players like Ball Corporation, competing fiercely. This rivalry is fueled by a need to maintain or grow market share. In 2024, the top 10 packaging companies generated over $300 billion in revenue, underscoring the stakes. To succeed, Ball must innovate and offer superior service to stand out.

Competitive pricing pressures can significantly affect Ball Corporation's margins. Maintaining pricing stability is crucial, especially in North America, a key market. Intense competition can spark price wars, hindering the ability to pass on rising costs. In 2024, Ball's net sales were around $15.5 billion, showcasing the scale impacted by pricing dynamics.

Ball Corporation's global footprint amplifies competitive rivalry. They face diverse players regionally. Consider their 2024 revenue: $15.3 billion. Each region presents unique challenges. Local market adaptation is key, as seen in their varying performance across continents.

Innovation and Differentiation

Technological innovation significantly shapes competitive rivalry. Ball Corporation's ability to create lightweight, cost-effective, and sustainable packaging provides a strong competitive edge. Investment in research and development is crucial for staying ahead. In 2024, Ball Corporation allocated $150 million for R&D, focusing on eco-friendly materials. This is essential to meet changing customer demands.

- R&D spending of $150 million in 2024.

- Focus on sustainable packaging.

- Competitive advantage through innovation.

- Meeting evolving customer needs.

Customer Relationships

Customer relationships significantly influence competitive rivalry, particularly within the packaging industry. Securing long-term supply contracts, as Ball Corporation has done with key clients, offers a distinct edge. Consistent service, high quality, and competitive pricing are essential for retaining these valuable customer connections. For example, Ball Corporation's revenue in 2024 was approximately $15.5 billion, demonstrating their ability to maintain strong customer relationships.

- Long-term contracts provide stability.

- Service quality directly impacts contract renewal.

- Competitive pricing is a continuous requirement.

- Customer loyalty reduces rivalry's impact.

Competitive rivalry in packaging is intense, with companies like Ball Corporation fighting for market share. Pricing pressures and global competition are significant factors. Ball Corporation's R&D investment and customer relationships offer a competitive edge, supporting its $15.5 billion revenue in 2024.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Share | High competition | Top 10 packaging companies generated over $300B |

| Pricing | Margin pressure | Ball Corp. net sales: ~$15.5B |

| Innovation | Competitive edge | R&D spending: $150M |

SSubstitutes Threaten

Plastic packaging presents a considerable threat to Ball's aluminum cans, mainly due to its cost-effectiveness and lighter profile. The global plastic packaging market reached approximately $370 billion in 2024, showcasing its widespread use. Ball must highlight aluminum's recyclability; over 70% of aluminum cans get recycled, to counter plastic's advantages.

Glass containers pose a threat, especially in beverages. Cans gained market share, but consumer tastes change. In 2024, the global glass container market was valued at $67.3 billion. Ball Corporation must watch these shifts. Consider glass's sustainability appeal.

Paper-based packaging poses a growing threat. Advancements in sustainable materials offer alternatives to aluminum cans. Eco-friendly options attract environmentally conscious consumers. This shift could erode market share, impacting companies like Ball Corporation. Continuous innovation is vital to maintain competitiveness, as seen in the 2024 rise of sustainable packaging solutions.

Consumer Preferences

Consumer preferences significantly shape demand for packaging. For Ball Corporation, a shift away from canned beverages could weaken its pricing power. Staying ahead of these trends is vital. In 2024, the beverage can market faced challenges, with aluminum prices fluctuating.

- Changing consumer tastes directly affect packaging choices.

- Ball Corporation's pricing can be sensitive to these shifts.

- Tracking and adapting to trends is a key business strategy.

- Aluminum prices in 2024 were around $1.10-$1.20 per pound.

Cost Competitiveness

The cost competitiveness of substitute packaging materials significantly impacts their threat to Ball Corporation. If alternatives like plastic or paper offer lower prices, customers might switch. Ball Corporation needs to focus on operational efficiency to minimize costs and stay competitive. This includes streamlining production and supply chain management. In 2024, Ball Corporation's cost of goods sold was approximately $12.5 billion.

- Lower-cost alternatives can erode Ball's market share.

- Operational efficiency is critical to maintaining competitive pricing.

- Ball needs to continuously innovate to reduce costs.

- Cost optimization is an ongoing strategic priority.

Substitute packaging materials, like plastic, glass, and paper, present a dynamic threat to Ball Corporation. These alternatives compete based on cost, sustainability, and consumer preferences. In 2024, the global packaging market showed a complex landscape, with aluminum prices varying around $1.10-$1.20 per pound.

| Substitute | Impact | 2024 Market Size |

|---|---|---|

| Plastic Packaging | Cost & Weight Advantages | $370 Billion |

| Glass Containers | Changing Consumer Preferences | $67.3 Billion |

| Paper-Based Packaging | Eco-Friendly Appeal | Growing |

Entrants Threaten

The metal packaging industry presents a high barrier to entry due to substantial capital expenditures. Building metal container manufacturing facilities requires significant upfront investments. These costs include specialized machinery, land, and infrastructure. This financial burden significantly reduces the threat of new entrants, as smaller firms struggle to compete. In 2024, the average cost to establish a new metal packaging plant ranged from $50 million to over $200 million.

Ball Corporation, a major player, enjoys significant economies of scale. This advantage makes it hard for new companies to compete on price. High-volume production and efficient plant utilization are key to profitability. New entrants typically face challenges in rapidly achieving the same cost benefits. In 2024, Ball Corporation's revenue was approximately $15.5 billion.

Established customer relationships form a significant barrier for new entrants. Beverage companies often have long-term contracts and strong ties with existing suppliers, such as Ball Corporation. These established relationships provide predictable demand, making it hard for new companies to gain traction. In 2024, Ball Corporation's strong customer relationships contributed to its stable revenue. Building trust and credibility takes considerable time and resources.

Limited Product Differentiation

The aluminum can market sees limited product differentiation, making it hard for new entrants to stand out. Innovation is easily copied, preventing a lasting advantage. Price wars often become the only option, which can be risky. In 2024, the global aluminum can market was valued at approximately $60 billion. This environment makes entry tough.

- Commoditized products limit unique offerings.

- Replicable innovation reduces advantages.

- Price competition is a primary strategy.

- Market entry faces significant hurdles.

Regulatory and Environmental Compliance

The packaging industry faces increasing regulatory and environmental pressures, which raises entry barriers. New companies must adhere to regulations regarding recycling, emissions, and material use, increasing upfront costs. In 2024, the EU's Packaging and Packaging Waste Directive (PPWD) continues to evolve, mandating stricter recycling targets. Existing firms have established compliance systems, offering a competitive edge.

- EU's PPWD imposes stringent recycling goals, influencing packaging design and material choices.

- Compliance costs include investment in sustainable materials, waste management, and reporting.

- Established players have developed economies of scale in compliance, reducing per-unit expenses.

- Regulatory changes can quickly render non-compliant new entrants' investments obsolete.

New entrants face high barriers. Substantial capital is needed for plant construction. Established firms like Ball Corp. have cost advantages, hindering new competition. Regulatory demands increase entry costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Capital Costs | High upfront investment | Plant setup: $50M-$200M+ |

| Economies of Scale | Competitive advantage | Ball Corp. revenue: ~$15.5B |

| Regulations | Increased expenses | EU PPWD compliance costs |

Porter's Five Forces Analysis Data Sources

We employ industry reports, financial filings, and competitor analysis to gauge competitive intensity.