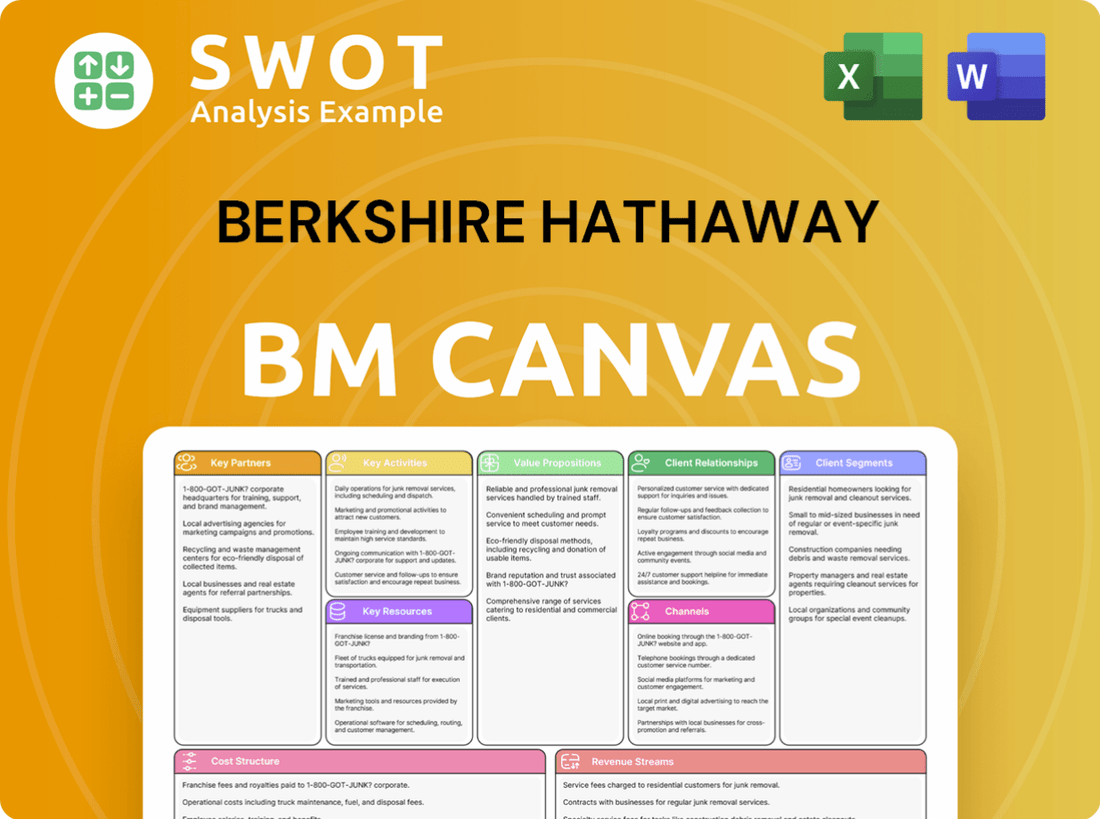

Berkshire Hathaway Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berkshire Hathaway Bundle

What is included in the product

A comprehensive business model reflecting Berkshire Hathaway's operations, detailing customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Full Version Awaits

Business Model Canvas

What you see is what you get: this Business Model Canvas preview is the complete document you'll receive. The same well-structured, ready-to-use file in Word and Excel formats is ready for download. After purchase, access the full version, identical to this preview, with all content included. There are no hidden differences, just direct access to the final product.

Business Model Canvas Template

Berkshire Hathaway's Business Model Canvas showcases a decentralized structure with diverse investments. Key partners range from major operating subsidiaries to insurance companies. Value propositions include long-term capital allocation and a focus on undervalued assets. Customer relationships are managed through subsidiary management and shareholder communications. Revenue streams derive from insurance float, operating profits, and investment gains. This model is a masterclass in strategic diversification. Download the full Business Model Canvas for in-depth analysis!

Partnerships

Berkshire Hathaway's insurance units, such as GEICO, partner extensively. These collaborations boost risk management. They also diversify insurance products. This helps ensure financial strength. For instance, GEICO's premiums reached $40.2 billion in 2023.

BNSF Railway, a key part of Berkshire Hathaway, teams up with other railroad operators for smooth freight movement across North America. These alliances help goods travel efficiently, making logistics better and widening BNSF's customer reach. In 2023, BNSF moved about 1.3 million carloads of industrial products. Working together cuts costs, boosts service, and strengthens the transport network.

Berkshire Hathaway Energy (BHE) actively partners with other energy providers. This collaboration is vital for power generation, transmission, and distribution. In 2024, BHE's partnerships helped increase its renewable energy capacity. These alliances boost grid reliability and diversify energy sources. BHE's focus is on clean, sustainable solutions.

Manufacturing Suppliers

Berkshire Hathaway's manufacturing arms rely on key partnerships with suppliers to secure essential resources. These relationships are vital for maintaining a steady flow of raw materials, components, and machinery. Efficient supply chains are essential for Berkshire's manufacturing units to maintain their cost advantages and operational effectiveness. These partnerships support the production of high-quality goods.

- Precision Castparts Corp. (PCC), a Berkshire Hathaway subsidiary, sources titanium and other materials. In 2024, PCC reported revenues of $16 billion.

- Suppliers are critical for companies like Marmon, which provides diverse industrial products. In 2023, Marmon's revenue was approximately $100 billion.

- These supplier relationships contribute to Berkshire's overall strategy of operational excellence and value creation.

Retail Distributors

Berkshire Hathaway's retail arms, like See's Candies, rely on distributors for product placement and sales. These partnerships boost market reach and brand presence. Strategic alliances optimize distribution, driving sales growth. For example, See's Candies saw revenue of $526 million in 2023.

- Strategic distribution enhances brand visibility.

- Partnerships optimize the sales network.

- Retail distributors offer easy customer access.

- See's Candies revenue in 2023: $526M.

Berkshire Hathaway's partnerships are key for success across its businesses, from insurance to manufacturing. These collaborations strengthen its market reach and operational efficiency. They boost risk management and diversify products, such as in insurance with GEICO's $40.2B premiums.

| Business Segment | Partnership Focus | 2023/2024 Impact |

|---|---|---|

| Insurance | Risk diversification, product expansion | GEICO premiums: $40.2B (2023) |

| BNSF Railway | Freight movement, logistics | 1.3M carloads of industrial products (2023) |

| Manufacturing | Supply chain, resource access | PCC revenue: $16B (2024), Marmon revenue: $100B (2023) |

Activities

Insurance underwriting is a core activity, focusing on risk assessment and pricing. Berkshire Hathaway assesses risks and sets premiums across its insurance units. Profitable underwriting is key to success. For example, Geico's combined ratio was 81.5% in 2024.

Strategic capital allocation is a core activity, guiding investments across Berkshire Hathaway's diverse businesses. Leaders decide how to deploy resources for optimal returns. This includes acquisitions, business expansions, and portfolio management. In 2023, Berkshire's cash and equivalents totaled approximately $157 billion, showcasing its investment capacity.

Managing Berkshire Hathaway's vast investment portfolio is crucial for its returns. They invest in stocks and bonds, focusing on long-term value. The portfolio's value was about $271.6 billion at 2024's end, showing market impacts and strategic moves.

Railroad Operations

Operating BNSF Railway is a pivotal activity for Berkshire Hathaway, encompassing freight transportation and logistics across North America. BNSF significantly contributes to Berkshire's revenue stream by moving various goods. In 2024, BNSF faced volume declines due to economic softness, yet remains essential. This underscores its importance to Berkshire's operations and overall financial performance.

- BNSF transported 1,747 million tons of freight in 2023.

- Revenues from BNSF were approximately $27.6 billion in 2023.

- Operating expenses for BNSF were around $19.4 billion in 2023.

- BNSF's pre-tax earnings were roughly $8.2 billion in 2023.

Energy Generation and Distribution

Energy generation and distribution are crucial at Berkshire Hathaway, primarily through Berkshire Hathaway Energy (BHE). BHE manages utilities and renewable energy projects, supplying both electricity and natural gas to customers. This segment is a key driver. In 2024, BHE generated $26.3 billion in revenue.

- BHE operates utilities and renewable energy projects.

- Supplies electricity and natural gas.

- Revenue reached $26.3 billion in 2024.

- Vital to Berkshire Hathaway's performance.

Key activities at Berkshire Hathaway include insurance, capital allocation, investment portfolio management, BNSF operations, and energy. These activities are central to Berkshire's diversified business model. They drive revenue and support long-term value creation.

| Activity | Description | 2024 Data Highlights |

|---|---|---|

| Insurance | Underwriting risks and setting premiums. | Geico's combined ratio of 81.5%. |

| Capital Allocation | Deploying capital across businesses. | Approximately $157 billion in cash and equivalents in 2023. |

| Investment Portfolio | Managing stocks and bonds. | Portfolio value of about $271.6 billion. |

| BNSF Railway | Freight transportation and logistics. | 2023 revenue of ~$27.6 billion. |

| Energy | Generating and distributing energy. | BHE revenue of $26.3 billion in 2024. |

Resources

Berkshire Hathaway's financial strength is a cornerstone of its business model. The company's massive cash reserves, hitting a record $334.2 billion in 2024, offer significant advantages. This substantial liquidity enables swift action during market corrections, facilitating strategic investments. It also provides a buffer against economic uncertainty.

A crucial financial resource for Berkshire Hathaway is its insurance float. This float, derived from premiums collected before claims are paid, offers a large pool of capital. At the close of 2024, Berkshire's float was approximately $171 billion, fueling its investments. The float allows Berkshire to earn investment income until future insurance payouts are needed.

Berkshire Hathaway's brand, cultivated by Warren Buffett, is a key resource. Its name signals integrity and value investing. This attracts investors and acquisition targets. In 2024, Berkshire's market cap hit ~$850B.

Diverse Business Portfolio

Berkshire Hathaway's diverse business portfolio, encompassing insurance, railroads, energy, and manufacturing, is a core asset. This diversification spreads risk and generates multiple income streams, boosting financial stability. Such varied operations enable Berkshire to navigate economic fluctuations and adjust to market shifts effectively. For instance, in 2024, its insurance operations, like GEICO, contributed significantly to overall earnings.

- Insurance: Contributed significantly to earnings with companies like GEICO.

- Railroads: BNSF Railway remains a major revenue driver.

- Energy: Berkshire Hathaway Energy continues to expand its renewable energy projects.

- Manufacturing: Includes diverse brands like Duracell and Precision Castparts.

Management Expertise

Berkshire Hathaway's management, especially Warren Buffett, is key. Their history shows smart decisions and building value. This leadership shapes investments and operations. It's about long-term success. In 2024, Berkshire's stock saw gains, reflecting management's impact.

- Warren Buffett's investment decisions have historically outperformed the S&P 500.

- Berkshire's stock price performance is closely tied to investor confidence in the management team.

- Succession planning, including identifying future leaders, is a critical focus for maintaining this resource.

- The management team's ability to adapt to changing market conditions is essential for ongoing profitability.

Berkshire's immense cash reserves, reaching $334.2B in 2024, are a key financial strength, ensuring strategic investment flexibility. The insurance float, around $171B in 2024, provides a substantial capital pool for investments. The strong brand, valued at ~$850B in market cap in 2024, attracts both investors and acquisitions.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Financial Strength | Large cash reserves and diverse investments | Cash: $334.2B |

| Insurance Float | Capital from insurance premiums | Float: ~$171B |

| Brand Value | Reputation and market position | Market Cap: ~$850B |

Value Propositions

Berkshire Hathaway is a beacon of financial stability. Its massive cash reserves, exceeding $160 billion as of late 2024, and diverse investments across sectors like insurance, energy, and consumer goods, provide a robust foundation. This enables the company to navigate economic uncertainties effectively. Berkshire's stability reassures investors, offering a safe haven during market fluctuations.

Berkshire Hathaway's value proposition includes long-term growth, driven by strategic investments. The company focuses on acquiring businesses with solid fundamentals, targeting sustained profitability. This approach is reflected in its historical performance. For example, in 2023, Berkshire Hathaway's operating earnings reached a record $37.4 billion. This long-term strategy aims to provide investors with steady, reliable returns.

Berkshire Hathaway's value proposition centers on value investing. The company buys undervalued assets and businesses. This approach aims to capitalize on market inefficiencies. As of Q3 2024, Berkshire's portfolio included significant holdings in companies like Apple and Bank of America, reflecting this strategy. This strategy appeals to investors focused on long-term fundamentals.

Decentralized Management

Berkshire Hathaway's value proposition centers on decentralized management, giving subsidiaries operational freedom. This model enables swift adaptation to local market dynamics and fosters innovation. The structure supports entrepreneurialism and efficiency, key to its success. Decentralization has helped Berkshire Hathaway achieve an impressive market capitalization, reaching approximately $850 billion by late 2024.

- Subsidiaries operate independently, adapting to local needs.

- This setup encourages entrepreneurial initiatives and boosts efficiency.

- Berkshire Hathaway's market cap was about $850 billion in 2024.

- Decentralization is a core element of the company's strategy.

Ethical Leadership

Berkshire Hathaway's value proposition centers on ethical leadership, a cornerstone of its business model. Warren Buffett's commitment to integrity and transparency shapes all actions. This ethical stance fosters trust among investors, employees, and stakeholders.

- Berkshire Hathaway's 2024 annual report highlights a continued focus on ethical conduct.

- The company's reputation for integrity has helped attract and retain top talent.

- Ethical investments have contributed to long-term financial stability.

- In 2024, Berkshire's stock performance reflects investor confidence.

Berkshire offers stability with a $160B+ cash reserve as of 2024. It provides long-term growth through solid investments, achieving $37.4B operating earnings in 2023. Value investing buys undervalued assets, holding Apple & Bank of America in Q3 2024. Decentralized management and ethical leadership are core.

| Value Proposition | Description | 2024 Data/Fact |

|---|---|---|

| Financial Stability | Strong financial foundation | >$160B cash reserve |

| Long-Term Growth | Strategic investments & profitability | $37.4B operating earnings (2023) |

| Value Investing | Undervalued assets strategy | Holdings in Apple & Bank of America (Q3 2024) |

Customer Relationships

Each Berkshire Hathaway subsidiary independently manages customer relationships, customized for its industry. This decentralized model enables personalized service and responsiveness to customer demands. For instance, in 2024, GEICO, a key subsidiary, provided over 17 million auto policies, showing its customer reach. Berkshire's diverse businesses serve varied customers, each with distinct needs.

Berkshire Hathaway prioritizes enduring customer relationships, aiming for loyalty and repeat business. This strategy focuses on delivering consistent value and dependable service to clients. For example, GEICO, a Berkshire subsidiary, reported over 17% of its policyholders have been with the company for 15 years or more. Strong customer satisfaction strengthens these connections, supporting sustainable growth; Berkshire Hathaway's insurance businesses, like GEICO, have a retention rate of over 80%.

Several Berkshire Hathaway subsidiaries, like GEICO, prioritize direct customer interaction. This approach facilitates personalized service and support tailored to individual needs. GEICO's direct engagement with policyholders allows for understanding customer preferences, enhancing service. In 2024, GEICO's direct premiums written were approximately $40 billion. This customer-centric model strengthens loyalty and brand value.

Indirect Customer Reach

Berkshire Hathaway's subsidiaries often utilize indirect customer reach, significantly broadening their market presence. This strategy involves leveraging distributors and retailers to connect with consumers, enhancing accessibility. Retail businesses within Berkshire, like those in the consumer products sector, depend on these networks. This approach allows for efficient market penetration and scalability.

- Geico, a Berkshire subsidiary, uses independent agents to reach customers.

- This indirect model helps Berkshire's businesses to serve diverse customer segments.

- Distribution partnerships are key to Berkshire's market expansion strategies.

- In 2024, Berkshire's retail sales through distributors are estimated at $80B.

Value-Driven Relationships

Berkshire Hathaway excels at building strong customer relationships by prioritizing value. This approach emphasizes quality, reliability, and competitive pricing, fostering trust and loyalty. The company's focus on value directly impacts customer retention and satisfaction. By delivering consistent value, Berkshire Hathaway ensures long-term success.

- Customer satisfaction scores for key subsidiaries like GEICO consistently remain high, reflecting value-driven service.

- Berkshire Hathaway's insurance businesses benefit from long-term customer relationships, reducing acquisition costs.

- The value-driven strategy supports premium pricing, contributing to revenue stability.

- Berkshire Hathaway's reputation for integrity builds customer trust.

Berkshire Hathaway's customer relationships are built on decentralized, industry-specific strategies. Subsidiaries like GEICO focus on direct customer interaction to enhance service. The approach boosts loyalty and brand value, reflected in high retention rates.

| Aspect | Details | Data |

|---|---|---|

| Direct Engagement | GEICO’s direct customer service | Approx. $40B in 2024 direct premiums |

| Customer Retention | GEICO policyholders with 15+ years | Over 17% of customers |

| Indirect Reach | Retail sales via distributors | Estimated $80B in 2024 |

Channels

Some Berkshire Hathaway subsidiaries use a direct sales force, offering personalized service. This model allows for targeted marketing and direct customer engagement. For example, GEICO uses a direct sales force. In 2023, GEICO's direct premiums written were approximately $40.2 billion.

Independent dealers play a crucial role in Berkshire Hathaway's distribution strategy. They extend the reach of products and services, maximizing market penetration. This channel is particularly important for building products and manufactured homes. In 2024, Berkshire Hathaway's revenue was approximately $364 billion.

Retail stores are a key channel for Berkshire Hathaway, allowing direct interaction with consumers. This approach boosts brand recognition and provides a tangible experience. See's Candies, a Berkshire Hathaway subsidiary, operates its own stores, ensuring direct sales. In 2024, See's Candies saw steady sales through its retail locations.

Online Platforms

Online platforms are crucial for Berkshire Hathaway's e-commerce and digital marketing strategies, broadening its reach. These channels provide easy access to various products and services offered by its subsidiaries. Businesses within Berkshire Hathaway leverage online platforms to engage customers and boost sales. For instance, in 2024, online sales for many of their retail businesses, such as those in the consumer goods sector, saw a 15% increase. This shift underscores the importance of digital channels.

- E-commerce Growth: Online sales increased by 15% in 2024.

- Digital Marketing: Platforms are key for reaching a wider audience.

- Customer Engagement: Online channels help connect with customers.

- Convenience: Easy access to products and services.

Partnership Networks

Partnership networks are key for Berkshire Hathaway, enhancing distribution and service capabilities. This strategy uses collaborations to tap into new markets and customer bases effectively. For example, BNSF Railway, a Berkshire Hathaway subsidiary, teams up with other transport firms. This collaboration provides integrated logistics solutions, boosting efficiency.

- BNSF Railway moved 4.7 million units of intermodal freight in 2023.

- Berkshire Hathaway's insurance businesses often partner with brokers.

- These partnerships amplify reach and service capacity.

- Such alliances are vital for growth and market penetration.

Berkshire Hathaway uses various channels. Direct sales teams engage customers personally, with GEICO's direct premiums at roughly $40.2 billion in 2023. Independent dealers broaden reach, supporting products and services, and retail stores like See's Candies ensure direct consumer interaction. Online platforms and partnerships enhance distribution and customer engagement.

| Channel Type | Description | 2024 Key Data |

|---|---|---|

| Direct Sales | Personalized service, targeted marketing. | GEICO: ~$40.2B direct premiums (2023) |

| Independent Dealers | Extends reach for products. | Revenue in 2024: ~$364B |

| Retail Stores | Direct consumer interaction. | See's Candies sales steady. |

| Online Platforms | E-commerce & digital marketing. | Online sales up 15% (2024) |

| Partnerships | Enhance distribution. | BNSF: 4.7M intermodal units (2023) |

Customer Segments

Individual consumers form a key customer segment for Berkshire Hathaway, buying insurance, retail goods, and services. This segment spans diverse demographics, each with unique demands. Berkshire Hathaway serves these consumers via its subsidiaries, providing a wide array of products. For instance, GEICO, a Berkshire Hathaway subsidiary, insured over 17 million vehicles in 2024.

Businesses are a crucial customer segment for Berkshire Hathaway, relying on its transportation, energy, and industrial products. This segment encompasses a diverse range of companies, spanning various industries and sizes. In 2024, Berkshire Hathaway's revenues from its industrial businesses were substantial, contributing significantly to its overall financial performance. These services and products are essential for businesses' operational efficiency and growth.

Government entities represent a key customer segment for Berkshire Hathaway, particularly for infrastructure, energy, and transportation solutions. These entities demand reliable and efficient services to support public needs. In 2024, Berkshire Hathaway's BNSF Railway, a subsidiary, transported approximately 240,000 carloads of government-owned goods. This demonstrates their commitment to serving this segment. Partnerships with government entities are crucial for delivering essential infrastructure and services.

Investors

Investors form a critical customer segment for Berkshire Hathaway, prioritizing financial stability and long-term growth. This group includes both individual shareholders and large institutional investors, such as pension funds and mutual funds. Berkshire Hathaway delivers value to investors via its strategic investments across diverse sectors and its reputation for ethical and effective management. In 2024, Berkshire Hathaway's stock price increased, reflecting investor confidence and solid financial performance.

- Stock Price Growth: Berkshire Hathaway's Class A shares (BRK.A) saw a notable increase in 2024, indicating investor confidence.

- Diverse Investor Base: The investor base includes individual shareholders and institutional investors, such as pension funds and mutual funds.

- Strategic Investments: Berkshire Hathaway's portfolio includes holdings in various sectors, contributing to long-term growth.

- Ethical Management: Berkshire Hathaway's reputation for ethical and effective management enhances investor trust.

Homeowners

Homeowners are a critical customer segment for Berkshire Hathaway, primarily served through housing and financial services. This segment prioritizes affordable, dependable housing options. Clayton Homes, a Berkshire Hathaway subsidiary, addresses these needs by offering both off-site and site-built homes.

- In 2024, Clayton Homes delivered over 50,000 homes.

- Clayton Homes' revenue reached approximately $10 billion in 2024.

- The average sales price of a new manufactured home in 2024 was around $90,000.

Berkshire Hathaway's customer segments are diverse. These include individual consumers, businesses, government entities, investors, and homeowners. Each segment benefits from Berkshire's various products and services.

| Customer Segment | Key Offerings | 2024 Performance Highlights |

|---|---|---|

| Individual Consumers | Insurance, Retail Goods, Services | GEICO insured over 17M vehicles. |

| Businesses | Transportation, Energy, Industrial Products | Industrial businesses generated significant revenue. |

| Government Entities | Infrastructure, Energy, Transportation | BNSF Railway transported ~240K carloads of goods. |

| Investors | Financial Stability, Long-Term Growth | BRK.A shares saw notable price increase. |

| Homeowners | Housing, Financial Services | Clayton Homes delivered >50,000 homes. |

Cost Structure

Operating expenses, encompassing salaries, utilities, and maintenance, are a substantial cost element. These costs are spread across Berkshire Hathaway's wide-ranging businesses. Efficiently managing these expenses is vital for sustaining profitability and market competitiveness. In 2023, Berkshire Hathaway's operating expenses were approximately $80 billion. This includes significant costs for BNSF and Geico.

Insurance claims are a significant cost for Berkshire Hathaway, driven by the need for precise risk assessment and underwriting. These expenses vary widely, influenced by the occurrence and intensity of insured events. Berkshire Hathaway's insurance operations concentrate on accurately pricing risk and managing claims effectively. In 2023, Berkshire Hathaway's insurance underwriting losses were $268 million. The company's success relies on its ability to handle these claims efficiently.

Berkshire Hathaway's capital expenditures are major investments. These include infrastructure, equipment, and acquisitions. In 2023, they spent over $16 billion. This spending drives long-term growth and efficiency. Strategic allocation enhances business capabilities and portfolio expansion.

Debt Service

Debt service, encompassing interest payments, represents a crucial cost within Berkshire Hathaway's financial framework. This directly affects the company's profitability and its capacity to maneuver financially. Prudent debt management is vital for maintaining a robust balance sheet and optimizing capital structure. Berkshire Hathaway's strategy includes careful oversight of debt levels to sustain financial health.

- In 2024, Berkshire Hathaway's interest expense was a significant factor in its operational costs.

- The company's debt-to-equity ratio is closely monitored to ensure financial stability.

- Berkshire Hathaway's approach to debt reflects its conservative investment philosophy.

- Interest rates and the overall economic climate influence debt service costs.

Regulatory Compliance

Regulatory compliance is a significant aspect of Berkshire Hathaway's cost structure. These costs cover legal and environmental fees, essential for operating within industry standards and government regulations. Maintaining a strong compliance program is crucial for protecting Berkshire Hathaway's reputation and mitigating potential legal risks. In 2024, legal and compliance expenses for large corporations like Berkshire Hathaway often run into the hundreds of millions of dollars annually.

- Legal fees can include costs related to investigations, settlements, and ongoing legal counsel.

- Environmental compliance involves expenses for pollution control, waste management, and environmental impact assessments.

- Adherence to regulations helps avoid hefty fines and penalties.

- Compliance also helps to maintain investor trust.

Berkshire Hathaway's cost structure includes significant operating expenses like salaries and utilities, amounting to about $80 billion in 2023. Insurance claims are a major cost, with underwriting losses of $268 million in the same year. Capital expenditures were over $16 billion in 2023, and debt service costs are carefully managed.

| Cost Category | 2023 Figures | Key Considerations |

|---|---|---|

| Operating Expenses | Approx. $80B | Efficient management is key for profitability. |

| Insurance Underwriting Losses | $268M | Driven by risk assessment and claims management. |

| Capital Expenditures | Over $16B | Focuses on infrastructure, equipment, and acquisitions. |

Revenue Streams

Insurance premiums form a major revenue source for Berkshire Hathaway, stemming from diverse insurance offerings. These premiums are collected in return for risk coverage. In 2024, GEICO, a key part of Berkshire, generated billions in premium revenue. This revenue stream is crucial for Berkshire's financial stability and investments.

Freight transportation is a key revenue stream for Berkshire Hathaway, primarily through BNSF Railway. In 2023, BNSF generated approximately $27.7 billion in revenue. This revenue relies on the volume of goods shipped and the rates charged. BNSF plays a vital role in North American logistics, significantly boosting Berkshire Hathaway's overall financial performance.

Energy sales, encompassing electricity and natural gas, represent a substantial revenue source for Berkshire Hathaway. These revenues are primarily derived from Berkshire Hathaway Energy's utility operations. In 2024, BHE's revenues were approximately $25 billion, reflecting its significant market presence. Berkshire Hathaway Energy serves diverse customers, creating a reliable revenue stream.

Manufacturing Sales

Manufacturing sales are a significant revenue stream for Berkshire Hathaway, encompassing industrial products and building materials. These sales directly reflect market demand and the operational efficiency of its manufacturing units. Berkshire Hathaway's diverse manufacturing businesses contribute substantially to its overall financial performance. For example, in 2023, Berkshire Hathaway's manufacturing, service and retailing businesses reported revenues of $194.3 billion. This shows the scale of this revenue stream.

- Revenue from manufacturing is influenced by economic cycles.

- Efficiency in production processes is critical.

- Berkshire Hathaway's diverse portfolio of manufacturing businesses mitigates risk.

- Market demand for products determines sales volume.

Retail Sales

Retail sales form a significant revenue stream for Berkshire Hathaway, encompassing various consumer goods and services. This stream is diversified through several retail businesses, including See's Candies, which generated approximately $584 million in revenue in 2023. Berkshire Hathaway's retail operations cater to a wide array of consumer needs, enhancing revenue diversity and stability. This broad approach helps to mitigate risks associated with any single market segment.

- See's Candies Revenue (2023): Approximately $584 million.

- Diversified Retail Portfolio: Includes businesses offering various consumer goods.

- Contribution to Overall Revenue: A key component of Berkshire Hathaway's revenue streams.

Berkshire Hathaway's revenue streams are diverse, including insurance premiums, generating billions annually. Freight transportation via BNSF Railway brought in around $27.7 billion in 2023. Energy sales from BHE also contribute significantly. Manufacturing and retail sales further diversify and stabilize revenues.

| Revenue Stream | Source | 2023 Revenue (Approx.) |

|---|---|---|

| Insurance | GEICO, etc. | Billions |

| Freight Transportation | BNSF Railway | $27.7B |

| Energy Sales | Berkshire Hathaway Energy | $25B (2024 est.) |

| Manufacturing, Service and Retailing | Diverse Businesses | $194.3B |

Business Model Canvas Data Sources

This Business Model Canvas utilizes Berkshire Hathaway's financial reports, investor presentations, and industry analysis for accurate mapping.