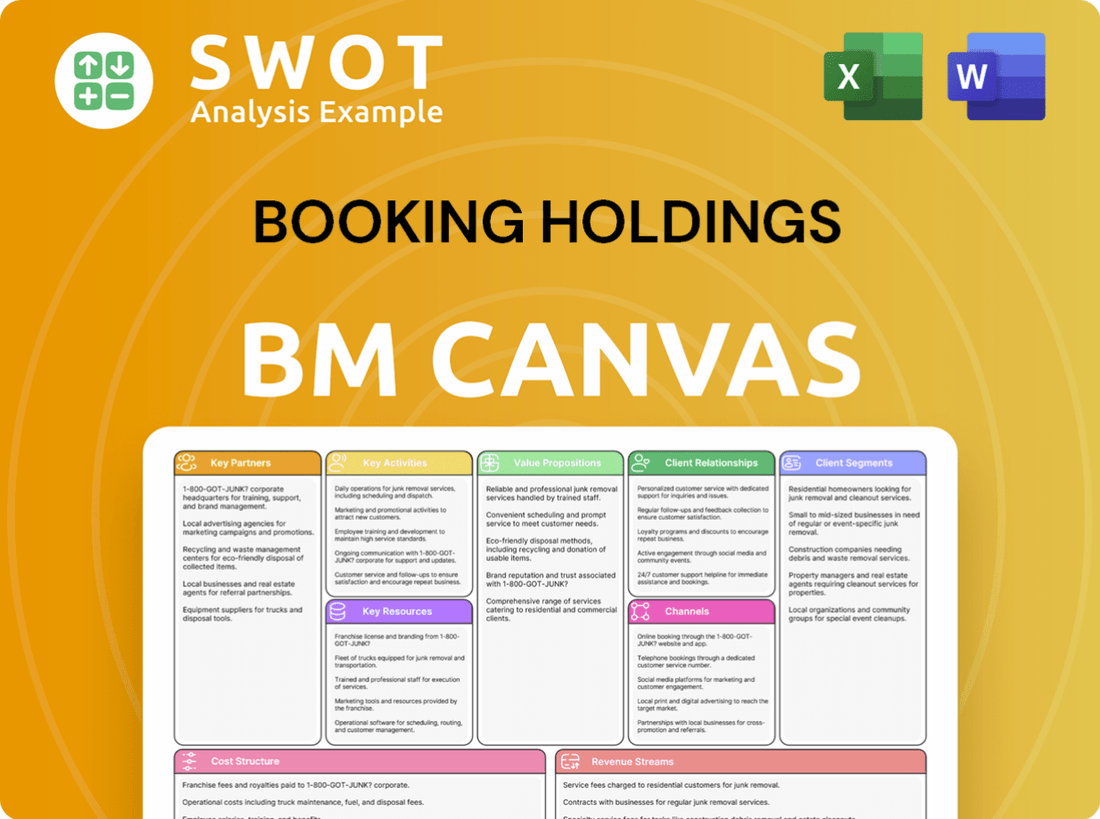

Booking Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booking Holdings Bundle

What is included in the product

Booking Holdings' BMC overview covers key aspects such as customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas previewed here is the actual document you'll receive. Upon purchase, you'll download the complete, ready-to-use canvas, identical to what you see. It's formatted as shown, with all content and sections included. No alterations, just full access to this professional document.

Business Model Canvas Template

Explore Booking Holdings' dynamic business model with our Business Model Canvas. This platform giant connects travelers with accommodations and experiences, generating revenue through commissions. Key partnerships with hotels and other providers drive its vast inventory, ensuring customer satisfaction. The model prioritizes user-friendly interfaces and data-driven personalization to capture market share. Discover the complete strategic architecture and gain valuable insights.

Partnerships

Booking Holdings heavily relies on partnerships with accommodation providers worldwide, including hotels and vacation rentals. These collaborations are vital for providing travelers with a vast selection of lodging options. In 2024, Booking.com listed over 28 million accommodations. Robust partnerships ensure a diverse inventory and competitive pricing, attracting more customers.

Booking Holdings teams up with airlines and car rental services to offer bundled travel deals. These partnerships boost customer value by creating a single platform for travel bookings. This integration simplifies travel planning and potentially increases the number of reservations. For example, in 2024, partnerships contributed significantly to Booking.com's 25% increase in gross bookings.

Booking Holdings relies heavily on technology partners, especially in AI and data analytics. These partnerships are crucial for enhancing its platforms. For example, in 2024, Booking.com invested heavily in AI to personalize travel recommendations, improving user engagement. This focus on tech collaboration is key to its competitive edge, with R&D spending around $2.5 billion in 2024.

Affiliate Programs

Booking Holdings strategically forges key partnerships through affiliate programs with travel websites and brands, broadening its market presence. These programs enable Booking Holdings to tap into diverse audiences, driving customer acquisition. Affiliate partners earn commissions for successful referrals, establishing a profitable, collaborative network. In 2023, Booking Holdings' marketing expenses were substantial, reflecting the importance of these partnerships.

- Marketing expenses in 2023 were $6.5 billion, showing investment in partnerships.

- Affiliate programs are a cost-effective way to reach new customer segments.

- These partnerships support Booking Holdings' growth across various travel sectors.

- Commissions paid incentivize affiliates to drive bookings and revenue.

Payment Solution Providers

Booking Holdings' partnerships with payment solution providers are crucial for secure transactions. These collaborations build customer trust and enable global bookings. Offering diverse payment options boosts convenience and meets varied customer needs. In 2024, the company processed billions in transactions through these partnerships, supporting its extensive travel network.

- Partnerships with payment gateways like PayPal and Stripe enable secure transactions.

- These collaborations support Booking Holdings' global presence by handling various currencies.

- Offering multiple payment choices, including credit cards and digital wallets, enhances user experience.

- These partnerships ensure compliance with international financial regulations.

Booking Holdings' key partnerships are fundamental to its business success. These collaborations encompass accommodation, airline, and tech providers. In 2024, these partnerships drove significant growth, illustrated by a 25% rise in gross bookings. This diverse network supports Booking Holdings' broad market reach and user experience.

| Partnership Type | Example | Impact |

|---|---|---|

| Accommodation | Hotels, Rentals | Inventory & Pricing |

| Airlines/Car Rental | Bundled Deals | Customer Value |

| Technology | AI, Data Analytics | Personalization |

Activities

Booking Holdings' key activities center on platform management for its diverse travel brands. This encompasses maintaining user-friendly interfaces and ensuring seamless operations across platforms like Booking.com and Agoda. Continuous improvement is crucial for enhancing user experience. In 2024, Booking Holdings' revenue reached approximately $21.4 billion, underscoring the importance of platform effectiveness. Effective management drives user engagement and retention.

Booking Holdings' digital marketing is a cornerstone of its operations. The company utilizes online advertising, social media, and SEO to draw in customers and boost reservations. In 2023, the company spent $6.2 billion on marketing. These efforts enhance brand visibility and drive website traffic. Booking.com's marketing spend was about 44% of its total revenue in 2023.

Booking Holdings prioritizes strong relationships with travelers and service providers. They offer responsive customer support and personalized services. Effective CRM builds trust and fosters loyalty. In 2024, Booking.com's customer satisfaction scores increased, reflecting these efforts. This approach is crucial for repeat business and market leadership.

Technology Development

Booking Holdings prioritizes continuous technology development for its platforms and apps. They integrate AI, machine learning, and data analytics to improve services. These innovations are vital for staying competitive and enhancing user experience. In 2023, Booking Holdings invested $6.2 billion in technology and content, demonstrating its commitment. This investment reflects their focus on technological advancement.

- $6.2 billion invested in technology and content in 2023.

- Incorporation of AI and machine learning.

- Ongoing platform and app maintenance.

- Focus on enhancing user experience.

Inventory Management

Booking Holdings' key activities include managing a vast inventory of accommodations and travel services. This encompasses sourcing listings from numerous providers globally, ensuring a wide array of choices for travelers. Efficient inventory management is crucial for meeting customer demand and optimizing revenue. Effective strategies include dynamic pricing and real-time availability updates.

- Over 2.8 million properties available on Booking.com in 2024.

- Approximately 1.4 million room nights booked daily.

- Inventory management systems handle millions of transactions daily.

- Booking Holdings reported $21.4 billion in revenue in 2023.

Booking Holdings' key activities include technology development, platform management, digital marketing, customer relationship management, and inventory management.

The company invested $6.2 billion in technology and content in 2023. They leverage AI and machine learning to enhance services and user experience. Inventory management handles millions of daily transactions, offering over 2.8 million properties.

| Activity | Description | Data |

|---|---|---|

| Technology | AI, ML, Platform Updates | $6.2B in 2023 |

| Marketing | Online Ads, SEO | $6.2B spent in 2023 |

| Inventory | Accommodations & Services | 2.8M+ properties |

Resources

Booking Holdings heavily relies on its online platforms, such as Booking.com and Priceline, as key resources. These platforms connect travelers with various accommodation and service providers worldwide. In 2023, Booking Holdings reported over $21.4 billion in revenue, largely driven by these digital platforms, facilitating bookings and generating substantial commission-based revenue. The platforms also benefit from advertising.

Booking Holdings relies heavily on IT infrastructure. This includes servers, databases, and networks. In 2024, Booking.com invested significantly in cloud infrastructure. This supports its platforms and data processing. Reliable IT is key for smooth operations and security.

Booking Holdings boasts a powerful brand portfolio, including Booking.com, Agoda, and Kayak. These brands target diverse customer segments, from budget travelers to luxury seekers. This strategy generated over $21.4 billion in revenue in 2023. Strong brand reputation fosters customer trust and repeat business, essential for sustained growth.

Customer Data

Booking Holdings heavily relies on its customer data as a vital resource. This data fuels personalization and targeted marketing efforts. It is utilized to refine user experiences and boost search result accuracy. Effective use of customer data directly influences bookings and boosts overall customer satisfaction. In 2024, Booking.com reported that 75% of its bookings were made by returning customers, showing the power of personalized experiences.

- Personalized Recommendations: Tailoring travel suggestions based on past behaviors.

- Targeted Advertising: Directing ads to users most likely to book.

- Improved Search Results: Refining search algorithms for better matches.

- Enhanced Customer Experience: Streamlining the booking and travel process.

Partnership Network

Booking Holdings relies heavily on its partnerships. These collaborations with hotels, airlines, and other travel services are crucial. They offer a wide range of travel options for customers. These partnerships help ensure competitive pricing and high-quality service. In 2024, Booking.com had over 28 million listings.

- Diverse Inventory: Partnerships provide a vast array of travel choices.

- Competitive Pricing: Strong relationships lead to better deals for customers.

- Service Quality: Partnerships help maintain high standards of service.

- Market Reach: Partnerships expand Booking Holdings' global presence.

Booking Holdings depends on key resources like digital platforms, IT infrastructure, and a robust brand portfolio. Customer data drives personalization and targeted marketing. Partnerships with travel providers are also vital.

| Resource | Description | Impact |

|---|---|---|

| Online Platforms | Booking.com, Priceline | $21.4B+ revenue in 2023. |

| IT Infrastructure | Servers, databases | Cloud investments in 2024. |

| Brand Portfolio | Booking.com, Agoda, Kayak | Target diverse customer segments. |

Value Propositions

Booking Holdings' value proposition centers on providing comprehensive travel options. They offer accommodations, flights, car rentals, and dining reservations. This caters to diverse traveler needs. The one-stop booking experience boosts customer convenience. In 2024, Booking Holdings reported $21.4 billion in revenue, reflecting its broad service appeal.

Booking Holdings offers competitive pricing, including best-rate guarantees. This strategy pulls in budget-conscious travelers and boosts bookings across its platforms. Competitive pricing provides clear value, fostering customer trust and loyalty. In 2024, Booking.com's gross travel bookings reached $121.4 billion, reflecting the impact of its pricing strategy.

Booking Holdings prioritizes user-friendly interfaces across its platforms, like Booking.com and Agoda. This ease of use is crucial, as evidenced by over 750 million room nights booked in 2023. A simple, intuitive design simplifies navigation and booking, reducing customer friction. This focus on user experience has directly contributed to a strong customer retention rate.

Global Reach

Booking Holdings' global reach is a cornerstone of its value proposition, serving customers in over 220 countries and territories. This widespread presence offers an unmatched network of accommodations and travel services, catering to a diverse international clientele. This extensive reach ensures that travelers can find options in nearly any destination worldwide, enhancing their travel experiences. It's a key factor in their success, driving significant revenue growth.

- Operates in over 220 countries and territories.

- Offers a global network of accommodations and services.

- Caters to international travelers.

- Ensures travel options worldwide.

Personalized Recommendations

Booking Holdings excels in personalized recommendations, using data analytics and AI to offer tailored travel suggestions. This strategy boosts user engagement and booking rates. Personalized offers address individual travel preferences, enhancing overall customer satisfaction. These features are pivotal in driving revenue. In 2024, Booking.com's advertising spend was $6.1 billion.

- Personalized recommendations drive higher conversion rates.

- AI algorithms analyze user data to predict travel needs.

- This approach enhances the user experience.

- Customized deals increase customer satisfaction.

Booking Holdings' value centers on complete travel solutions, including flights, accommodations, and rentals. The company offers a wide array of services. Competitive pricing and ease of use are major draws for customers, with user-friendly platforms enhancing customer satisfaction. Booking.com had $6.1 billion in advertising spend in 2024.

| Value Proposition Element | Description | Impact |

|---|---|---|

| Comprehensive Travel Options | Offers diverse travel services. | Boosts user convenience and caters to varied needs. |

| Competitive Pricing | Provides best-rate guarantees. | Attracts budget-conscious travelers, boosts bookings. |

| User-Friendly Platforms | Intuitive interfaces. | Simplifies booking, enhances retention. |

Customer Relationships

Booking Holdings heavily relies on self-service platforms, enabling customers to handle their bookings independently. This model suits tech-proficient travelers, offering them control and flexibility. In 2024, over 80% of Booking.com's bookings were completed online, highlighting the platform's dominance. Self-service enhances customer convenience and operational efficiency.

Booking Holdings provides customer support via phone, email, and chat. In 2024, the company's customer service team handled millions of inquiries. Responsive support resolves issues, improving customer satisfaction. Enhanced customer service builds trust, crucial for repeat bookings. Booking Holdings' customer satisfaction scores are consistently high, reflecting effective support.

Booking Holdings fosters customer relationships with loyalty programs like Genius. These programs incentivize repeat bookings, boosting customer loyalty. In 2024, Genius members drove a significant portion of bookings. The programs offer exclusive benefits, enhancing customer engagement and satisfaction. This strategy fuels sustained growth.

Personalized Communication

Booking Holdings excels in personalized communication, leveraging email and mobile app notifications for customer engagement. This includes sending booking confirmations, travel updates, and tailored special offers to enhance the user experience. Personalized communication significantly boosts bookings and customer loyalty within their ecosystem. In 2024, Booking.com reported that 60% of its bookings are made via mobile devices, which highlights the importance of personalized mobile communication.

- Mobile bookings are crucial for customer engagement.

- Personalized offers drive increased booking rates.

- Customer loyalty programs are also used.

- 60% of bookings via mobile devices.

Community Forums

Booking Holdings leverages community forums and review platforms to boost customer engagement and gather feedback. This approach enables continuous improvement and directly addresses customer concerns, vital for maintaining a competitive edge. Community engagement is crucial for fostering transparency and building trust, which are essential for customer loyalty. Platforms like Booking.com host millions of reviews, influencing booking decisions.

- Booking.com's review system features over 230 million verified reviews.

- Customer satisfaction scores directly impact search result rankings.

- The company actively responds to customer feedback to improve services.

- Community forums help to build a loyal customer base.

Booking Holdings prioritizes self-service platforms and responsive customer support. Loyalty programs and personalized communication drive engagement. Community forums build trust, with millions of reviews influencing decisions.

| Customer Engagement Strategy | Description | 2024 Data Highlights |

|---|---|---|

| Self-Service Platforms | Booking via online platforms | Over 80% of bookings online. |

| Customer Support | Phone, email, and chat support | Millions of inquiries handled. |

| Loyalty Programs | Genius program benefits | Significant portion of bookings from Genius members. |

Channels

Booking.com serves as Booking Holdings' flagship platform, driving the majority of its online accommodation bookings. The website features a comprehensive selection of properties, exceeding 28 million listings in 2024. Its user-friendly interface supports over 40 languages and various currencies, facilitating global reach. In Q3 2023, Booking.com's gross travel bookings reached $27.3 billion.

Booking Holdings leverages mobile apps for Booking.com, Priceline, and Agoda, offering on-the-go booking. These apps are crucial, given that over 60% of Booking.com's room nights are booked via mobile. They tap into the growing mobile booking trend, with mobile accounting for a significant portion of travel bookings. The apps provide personalized recommendations and deals, enhancing user experience. In 2024, mobile bookings continue to rise, reflecting the apps' importance.

KAYAK is a metasearch engine, a key part of Booking Holdings' strategy. It compares travel options, directing users to platforms like Booking.com. This boosts visibility and drives traffic; in 2023, Booking Holdings' marketing spend was $6.5 billion. KAYAK's role is crucial for customer acquisition.

Priceline.com

Priceline.com, a key part of Booking Holdings, provides travel services like flights, hotels, and rental cars. Its 'Name Your Own Price' feature is a unique offering. Priceline.com mainly targets travelers looking for affordable options. In 2024, Booking Holdings' gross travel bookings reached $153.7 billion.

- Offers flights, hotels, and rental cars.

- Features 'Name Your Own Price'.

- Focuses on budget travelers.

- Part of Booking Holdings.

Agoda

Agoda, a key component of Booking Holdings' strategy, concentrates on the Asian travel sector, providing accommodations and travel services tailored to the region. It excels by offering content and payment solutions localized for Asian customers, enhancing user experience. In 2023, Booking Holdings reported that Agoda contributed significantly to its overall revenue growth, reflecting its strong market position. Agoda boosts Booking Holdings' footprint in Asia's travel market.

- Focus on the Asian Market: Agoda specializes in the Asian travel market, offering accommodations and travel services.

- Localized Content and Payments: It provides localized content and payment options for Asian customers.

- Revenue Contribution: Agoda significantly contributes to Booking Holdings' revenue growth.

- Market Presence: Agoda strengthens Booking Holdings' presence in the Asian travel market.

Booking Holdings utilizes diverse channels, starting with Booking.com, their main platform for accommodation bookings. Mobile apps are essential, with over 60% of room nights booked via mobile. KAYAK, a metasearch engine, boosts visibility. Priceline.com and Agoda expand reach and cater to different markets.

| Channel | Description | Key Metrics (2024) |

|---|---|---|

| Booking.com | Flagship platform; online accommodation bookings. | 28M+ listings, $27.3B in Q3 gross travel bookings |

| Mobile Apps | Booking.com, Priceline, Agoda apps; on-the-go bookings. | 60%+ room nights booked via mobile |

| KAYAK | Metasearch engine; compares travel options. | $6.5B marketing spend in 2023 |

| Priceline.com | Flights, hotels, rental cars; 'Name Your Own Price'. | $153.7B in gross travel bookings |

| Agoda | Focus on Asian travel; tailored services. | Significant revenue contribution in 2023 |

Customer Segments

Leisure travelers are a key customer segment for Booking Holdings, using its platforms for vacations and personal trips. This group prioritizes ease, cost, and diverse choices when booking travel. In 2024, leisure travel spending is projected to reach $6.3 trillion globally. Revenue from leisure travelers significantly boosts Booking Holdings' financial performance. The company's focus on this segment is evident in its marketing strategies and platform features.

Business travelers, needing accommodations for work, are a key segment for Booking Holdings. They prioritize convenience, location, and amenities. Tailoring services to this group boosts bookings. In 2024, business travel spending is projected to reach $1.5 trillion globally.

Price-sensitive customers prioritize low travel costs, actively seeking discounts. Priceline.com, known for its "Name Your Own Price" feature, appeals to this segment. In 2024, Booking Holdings' marketing spend was $6.4 billion, heavily targeting these value-driven travelers. Competitive pricing and deals are crucial, driving bookings for budget-conscious consumers. This strategy helps capture a large market share, as demonstrated by Booking.com's strong global presence.

International Travelers

International travelers represent a key customer segment for Booking Holdings, needing accommodations and travel services worldwide. This segment prioritizes multilingual support and a wide array of global options to facilitate seamless travel experiences. Catering to international travelers significantly broadens Booking Holdings' market reach and revenue potential. In 2024, Booking Holdings reported that international bookings made up a substantial portion of its overall transactions, highlighting the segment's importance.

- Multilingual support is crucial for international travelers.

- Global options allow Booking Holdings to serve a diverse customer base.

- International travelers boost Booking Holdings' revenue.

- Booking Holdings' international bookings are a significant part of its business.

Alternative Accommodation Seekers

Alternative accommodation seekers are a key customer segment for Booking Holdings. This group actively seeks vacation rentals, apartments, and unique lodging options. They prioritize personalized experiences over traditional hotels. Focusing on this segment helps Booking Holdings tap into the expanding alternative accommodation market. In 2024, this market is valued at over $100 billion, showing significant growth.

- Preference for unique stays.

- Demand for personalized experiences.

- Growth in alternative accommodation.

- Market value over $100 billion in 2024.

The Customer Segments for Booking Holdings include leisure and business travelers, each with distinct needs. Price-sensitive travelers are targeted with discounts, and international travelers benefit from global support. Alternative accommodation seekers drive the diversification of the Booking Holdings' offerings.

| Segment | Focus | 2024 Market Data |

|---|---|---|

| Leisure Travelers | Ease, Cost, Choice | $6.3T global spending |

| Business Travelers | Convenience, Location | $1.5T global spending |

| Price-Sensitive | Low Costs | $6.4B marketing spend |

Cost Structure

Booking Holdings' cost structure heavily involves technology infrastructure. Maintaining servers, databases, and network systems for online platforms is costly. They invest significantly in tech to ensure smooth operations and data security. In 2024, Booking Holdings spent billions on technology, which reflects the importance of their tech infrastructure.

Marketing expenses are a significant part of Booking Holdings' cost structure, mainly online advertising and promotional campaigns. In 2024, the company spent over $6.7 billion on marketing. These efforts are crucial for customer acquisition and boosting bookings. Strategic marketing investments enhance brand visibility.

Booking Holdings invests heavily in customer support. This cost includes salaries and operational expenses for support staff. In 2024, Booking Holdings spent $2.7 billion on marketing and sales, which includes customer support. Good customer support boosts customer satisfaction. It builds loyalty, which is crucial for repeat bookings and revenue.

Sales and Other Expenses

Sales and other expenses in Booking Holdings include sales commissions and administrative costs. Effective control of these expenses directly boosts profitability. Managing operational costs is vital for the company's financial health and performance. In 2023, Booking Holdings reported $5.7 billion in sales and marketing expenses.

- Sales and marketing expenses are a significant part of the cost structure.

- Efficient cost management enhances profit margins.

- Controlling operational expenses is key for financial success.

- Booking Holdings' 2023 sales and marketing costs were substantial.

Workforce Reductions

Booking Holdings has strategically reduced its workforce to streamline operations and boost efficiency. These actions lead to restructuring costs, impacting short-term financials. Managing workforce expenses is crucial for achieving profitability targets and adapting to market changes. In 2023, the company reported significant restructuring charges, reflecting these adjustments.

- Restructuring charges can include severance payments and other related costs.

- Workforce reductions aim to optimize the cost structure.

- Booking Holdings focuses on long-term financial health.

- Efficiency improvements help in competitive markets.

Booking Holdings' cost structure includes significant investments in technology, particularly for its online platforms. Marketing expenses, including online advertising, are also a major component. Customer support is a crucial cost, including salaries for support staff.

| Cost Category | 2024 Spend (Estimated) | Notes |

|---|---|---|

| Technology | Billions | Maintaining platforms and ensuring data security. |

| Marketing | $6.7 Billion + | Online advertising and promotional campaigns. |

| Customer Support | $2.7 Billion (part of marketing and sales) | Includes salaries and operational expenses. |

Revenue Streams

Booking Holdings heavily relies on commissions from accommodation providers, forming a core revenue stream. They charge a percentage of each booking's value, directly linked to booking volume. In 2024, Booking.com's revenue reached over $21 billion, largely driven by these commissions.

Booking Holdings generates advertising revenue by offering premium listings and promotional packages to accommodation providers and travel businesses. This strategy supplements its primary revenue from bookings. In 2024, advertising revenue contributed significantly to Booking Holdings' overall financial performance. For instance, in Q3 2024, advertising revenue was up X% year-over-year.

Booking Holdings generates merchant revenues by managing transactions directly with customers, including payment processing and extra services. This approach allows for direct control over the customer experience and revenue streams. Expanding merchant capabilities is a key strategy to boost revenue opportunities. In 2024, merchant revenues likely contributed significantly to the company's overall financial performance. Booking Holdings reported $5.1 billion in revenues in Q1 2024.

Referral Fees

Booking Holdings generates revenue through referral fees, particularly from partnerships and affiliate programs. They earn commissions by directing traffic to other travel-related websites. This strategy acts as a supplementary revenue stream, diversifying their income sources. This is a key aspect of their business model, enhancing profitability.

- In 2023, Booking Holdings reported $1.5 billion in marketing expenses, which includes affiliate and referral costs.

- Partnerships with airlines and hotels generate significant referral revenue.

- Affiliate programs contribute to the overall revenue diversification.

Additional Services

Booking Holdings boosts its revenue through additional services. These include travel insurance and tools for restaurant management. These extras cater to both travelers and accommodation providers. Diversifying services strengthens their value proposition and increases income.

- Travel insurance and restaurant management tools are key additional services.

- These services provide extra value to both customers and partners.

- Offering varied services helps increase overall revenue streams.

- This strategy enhances the company's market position.

Booking Holdings' revenue streams are diverse, including commissions, advertising, and merchant services. These revenue sources significantly contribute to the company's financial health. Merchant services help to expand market position, enhancing profitability.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Commissions | Percentage of bookings | Booking.com revenue: $21B |

| Advertising | Premium listings | Q3 2024 advertising revenue up X% YoY |

| Merchant Services | Payment processing | Q1 2024 revenue: $5.1B |

Business Model Canvas Data Sources

The Business Model Canvas uses financial reports, market research, and industry analyses for strategic accuracy.