Booking Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booking Holdings Bundle

What is included in the product

Detailed analysis of each competitive force, supported by industry data and strategic commentary.

Quickly grasp market dynamics with interactive charts, instantly spotting threats and opportunities.

Preview the Actual Deliverable

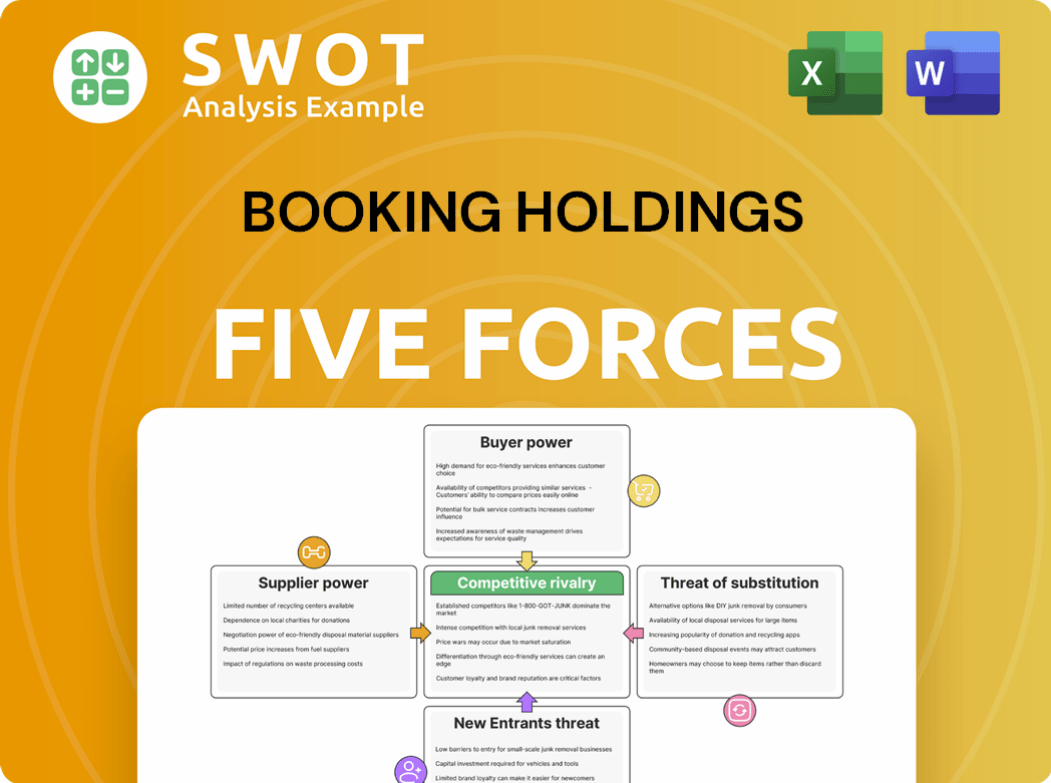

Booking Holdings Porter's Five Forces Analysis

This preview unveils the complete Booking Holdings Porter's Five Forces analysis. The detailed assessment you see is the exact document available for immediate download post-purchase.

Porter's Five Forces Analysis Template

Booking Holdings navigates a complex online travel agency (OTA) landscape. Its strong brand and network mitigate buyer power, though competition from alternative accommodations persists. Supplier power is significant, particularly from major hotel chains. The threat of new entrants is moderate, given the established market dominance. Substitute threats, like direct booking, are a constant challenge.

Unlock key insights into Booking Holdings’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Booking Holdings faces moderate supplier power, mainly from hotels and accommodations. These suppliers aren't solely reliant on Booking.com, as they use other OTAs and direct bookings. In 2024, Booking.com's revenue was $21.4 billion. This diversification somewhat balances the power dynamic in negotiations.

The bargaining power of accommodation suppliers for Booking Holdings fluctuates geographically. Concentrated, unique property markets give suppliers more leverage. In contrast, regions with many similar hotels reduce individual supplier power. For instance, in 2024, Booking.com featured over 28 million listings globally, but the concentration varies greatly.

Strong hotel brands gain leverage over Booking Holdings. In 2024, major chains like Marriott and Hilton could negotiate lower commission rates. These brands invest heavily in direct booking channels. This reduces their dependence on OTAs.

Technology adoption impacts leverage

Technology adoption significantly impacts supplier leverage, especially for property owners. Suppliers using advanced property management systems (PMS) and channel management tools can streamline inventory across various platforms. This reduces their reliance on any single Online Travel Agency (OTA), boosting their pricing and availability control. In 2024, the global PMS market is valued at approximately $10 billion, reflecting the importance of these technologies.

- PMS adoption enables suppliers to optimize pricing dynamically.

- Channel management tools enhance distribution efficiency.

- Real-time data analysis improves decision-making.

- Reduced dependency on OTAs increases bargaining power.

Commission rates are a key point of contention

Commission rates are a central issue in Booking Holdings' negotiations with suppliers, primarily hotels. Suppliers consistently strive for reduced commission rates to boost their profit margins, while Booking Holdings aims to preserve rates that cover its operational costs and technology investments. These negotiations directly affect the financial dynamics between Booking Holdings and its suppliers. In 2024, Booking Holdings' gross bookings reached $160.7 billion, highlighting the scale of these financial interactions.

- Commission rates are a key negotiation point.

- Suppliers seek lower rates to enhance profitability.

- Booking Holdings aims to maintain rates for operational needs.

- Negotiations significantly impact financial relationships.

Booking Holdings faces moderate supplier power, primarily from hotels and accommodations. Strong hotel brands and tech-savvy suppliers negotiate better terms. Commission rates are a central negotiation point. Booking Holdings’ gross bookings in 2024 hit $160.7 billion.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Type | Hotels, Accommodations | Over 28M listings on Booking.com |

| Negotiation Points | Commission Rates, Tech Integration | Booking Holdings revenue: $21.4B |

| Leverage Factors | Brand Strength, Tech Adoption | Gross Bookings: $160.7B |

Customers Bargaining Power

Customers on Booking Holdings platforms show strong price sensitivity. With many travel choices and easy price comparisons, they hunt for the best deals. This pressure makes Booking Holdings keep prices competitive, impacting profit margins. In 2024, Booking Holdings' gross bookings reached $146.2 billion, reflecting customer price awareness.

Customers enjoy low switching costs in the online travel agency (OTA) market. Travelers can effortlessly compare prices across various platforms like Booking.com, Expedia, and direct hotel sites. The absence of binding contracts and the ease of comparing options further empower customers. In 2024, Booking Holdings reported that 65% of its gross bookings were from repeat customers.

Customers wield considerable power due to readily available information. Online reviews, social media, and travel forums provide vast data for informed decisions. This access allows for in-depth property and service evaluations. Consequently, customer bargaining power rises, influencing booking choices. In 2024, 75% of travelers used online reviews before booking.

Loyalty programs offer limited stickiness

Booking Holdings' loyalty programs have limitations in fostering lasting customer loyalty. Customers frequently choose lower prices and easier booking experiences over loyalty benefits, particularly if they don't travel often. For instance, in 2024, price-sensitive travelers accounted for approximately 60% of all bookings on major platforms. The success of these programs hinges on constant improvement.

- Price Sensitivity: Around 60% of travelers prioritize price.

- Infrequent Travel: Loyalty is less impactful for occasional travelers.

- Program Enhancement: Continuous improvement is vital for effectiveness.

Customers can bypass OTAs

Customers can sidestep Online Travel Agencies (OTAs) like Booking Holdings by booking directly with hotels and airlines. This direct booking option provides an alternative, reducing customer reliance on OTAs. Direct booking availability boosts customer bargaining power, especially when providers offer better deals. In 2024, direct bookings accounted for a significant portion of travel sales, with some airlines reporting over 50% of bookings through their websites.

- Direct booking options give customers alternatives to OTAs.

- This reduces customer dependence on Booking Holdings.

- Exclusive deals on direct booking increase customer power.

- Airlines and hotels often incentivize direct bookings.

Booking Holdings faces strong customer bargaining power. Price-sensitive travelers and easy price comparisons intensify this. Direct booking options also boost customer influence. In 2024, over 70% of travelers used OTAs, but direct booking share grew.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | 60% prioritize price |

| Switching Costs | Low | Easy platform comparison |

| Direct Booking | Increased power | Direct booking growth |

Rivalry Among Competitors

The online travel agency (OTA) landscape, including Booking Holdings, faces fierce competition. Expedia, Airbnb, and Tripadvisor are key rivals. They battle on price, user experience, and marketing. Booking Holdings must innovate to stay ahead, with a 2024 marketing spend of $6.1 billion.

Metasearch engines, including Kayak (Booking Holdings), Google Flights, and Skyscanner, aggregate travel options, intensifying competition by offering a comprehensive view. Price transparency is increased by these platforms, empowering customers to compare deals easily. In 2024, Booking Holdings saw a 16% increase in gross travel bookings, showing the impact of these competitive pressures.

Online Travel Agencies (OTAs) like Booking Holdings are locked in fierce marketing battles to gain customers. These companies spend huge amounts on advertising, increasing customer acquisition costs. In 2024, Booking Holdings spent over $5.5 billion on marketing expenses. This high spending creates a tough barrier to entry for new competitors.

Focus on user experience and technology

Intense competition drives online travel agencies (OTAs) to prioritize user experience and technology. They invest heavily in user-friendly mobile apps and personalized recommendations. Seamless booking processes are vital for customer attraction and retention. The need for constant tech and UX improvements demands significant ongoing investments.

- Booking Holdings spent $5.9 billion on sales and marketing in 2023, reflecting the importance of user acquisition.

- Mobile bookings accounted for over 60% of Booking.com's total room nights booked in 2024.

- Personalization efforts include AI-driven recommendation engines.

- Investments in technology infrastructure are crucial for handling high booking volumes.

Consolidation and partnerships

The online travel market's competitive rivalry is significantly shaped by ongoing consolidation and strategic partnerships. Mergers and acquisitions lead to larger entities, increasing market concentration and competition. These shifts require Booking Holdings to continually adapt to maintain its market position. For example, Expedia Group's revenue in 2024 reached $12.8 billion, showcasing the scale of key competitors.

- Consolidation among competitors intensifies competition.

- Mergers and acquisitions increase market share for key players.

- Strategic partnerships reshape the competitive landscape.

- Booking Holdings must adapt to these market changes.

Booking Holdings faces intense competition from rivals like Expedia and Airbnb. They compete on price, user experience, and marketing, with Booking.com's mobile bookings over 60% in 2024. Strategic partnerships and consolidation further reshape the landscape.

| Metric | Booking Holdings (2024) | Competitor Example (2024) |

|---|---|---|

| Marketing Spend | $6.1B | Expedia Group: $4.5B |

| Gross Bookings Increase | 16% | N/A |

| Mobile Bookings | Over 60% of room nights | N/A |

SSubstitutes Threaten

Direct bookings with suppliers, such as hotels and airlines, act as a key substitute to Booking Holdings' platforms. Travelers might book directly to access potentially better deals or loyalty benefits. The shift towards direct booking is fueled by user-friendly online platforms and mobile apps, increasing the threat. In 2024, many airlines and hotels are heavily investing in their direct booking channels. This competition impacts Booking Holdings' commission-based revenue model.

Alternative accommodations, like Airbnb and VRBO, pose a substantial threat. They offer diverse experiences, space, and often better value. In 2024, Airbnb's revenue reached approximately $9.9 billion, showing strong market presence. This diversification reduces reliance on traditional hotels booked through OTAs.

Offline travel agencies and traditional travel agents still exist, offering personalized service and curated experiences. Some customers value the human touch, especially for complex trips. Despite market share declines, they're viable substitutes. In 2024, traditional travel agencies generated $10.9 billion in revenue. Their expertise remains a draw.

Package deals and bundled services

Package deals from airlines, hotels, and tour operators pose a threat to Booking Holdings. These bundles, offering flights, accommodations, and activities, can be more convenient and cost-effective. In 2024, such packages accounted for a significant portion of travel bookings, reflecting their popularity. Booking Holdings must compete with these attractive offerings to maintain its market share.

- Cost Savings: Bundles often have lower prices than booking components separately.

- Convenience: One-stop shopping for travel needs simplifies planning.

- Market Share: Package deals have a significant share of the travel market.

- Competition: Booking Holdings faces direct competition from package providers.

Emergence of new travel platforms

New travel platforms and specialized services pose a threat to Booking Holdings by offering alternatives. These platforms target niche markets, like adventure or eco-tourism, providing unique experiences. This can divert customers seeking specific travel types. In 2024, the global adventure tourism market was valued at $700 billion, highlighting the scale of these niche opportunities.

- Niche platforms attract customers seeking specialized travel experiences.

- The adventure tourism market alone is substantial, indicating significant competition.

- These substitutes offer differentiated value propositions.

- Booking Holdings must adapt to compete with these specialized services.

Booking Holdings faces threats from various substitutes, including direct bookings and alternative accommodations. Competitors like Airbnb and VRBO continue to grow. Package deals and niche travel platforms also divert customers.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Direct Bookings | Undercuts commission | Airlines/Hotels invest heavily |

| Alternative Accommodations | Diverse offerings | Airbnb revenue ~$9.9B |

| Package Deals | Convenience/Cost | Significant market share |

Entrants Threaten

The online travel market demands heavy upfront investments. Building tech, marketing, and customer service infrastructure is costly. New entrants face high financial hurdles, as shown by Booking Holdings' significant R&D spending.

Booking Holdings, with brands like Booking.com, enjoys substantial brand recognition and customer trust, a key barrier to new entrants. It's hard for newcomers to immediately match this established reputation, which is a significant advantage. In 2024, Booking Holdings' marketing expenses were about $6 billion, reflecting its investment in brand building and customer loyalty.

The online travel market is characterized by strong network effects, enhancing platform value with more users. Booking Holdings leverages scale economies, offering competitive pricing and driving innovation. New entrants face challenges competing with established networks and cost advantages. In 2024, Booking Holdings reported over $21 billion in gross travel bookings, underscoring its market dominance.

Technological expertise

Booking Holdings faces threats from new entrants who need substantial technological expertise. Developing and maintaining a competitive online travel platform demands significant investment in advanced technology. This includes data analytics, AI, and mobile capabilities to effectively compete. The rapid pace of tech innovation further increases the challenge for new competitors.

- In 2024, Booking Holdings spent approximately $2.3 billion on technology and content.

- The online travel market is highly competitive, with established players like Expedia also investing heavily in tech.

- New entrants must build sophisticated platforms to offer personalized experiences and compete with existing user bases.

- The cost of developing and maintaining such platforms can be prohibitive for smaller companies.

Regulatory and compliance hurdles

The travel industry faces stringent regulations and compliance demands, including data privacy laws and consumer protection measures. New entrants must overcome these complex regulatory obstacles, which can be expensive and time-intensive. This adds to the difficulty of entering the market and competing with established firms like Booking Holdings. These hurdles can deter smaller companies from entering the market, favoring those with more resources.

- Data privacy regulations, like GDPR and CCPA, require significant investment in compliance.

- Consumer protection laws mandate adherence to specific standards, increasing operational costs.

- Travel advisories and safety protocols necessitate constant updates and adjustments.

- Compliance costs can include legal fees, technology upgrades, and staff training.

The threat of new entrants to Booking Holdings is moderate due to high barriers.

These barriers include significant upfront investments in technology and brand building.

Booking Holdings spent roughly $2.3 billion on technology in 2024, representing one such barrier.

| Barrier | Details | Impact |

|---|---|---|

| Capital Requirements | Tech, marketing, and customer service infrastructure | High upfront costs deter new entrants |

| Brand Recognition | Booking Holdings' established reputation | Hard for newcomers to gain customer trust |

| Network Effects | Platform value increases with more users | Established players have a competitive advantage |

Porter's Five Forces Analysis Data Sources

Booking Holdings' analysis is informed by annual reports, market studies, competitor analyses, and regulatory filings for competitive assessments.