Booking Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booking Holdings Bundle

What is included in the product

Maps out Booking Holdings’s market strengths, operational gaps, and risks

Offers a clear SWOT snapshot to understand Booking's strengths, weaknesses, opportunities, and threats.

What You See Is What You Get

Booking Holdings SWOT Analysis

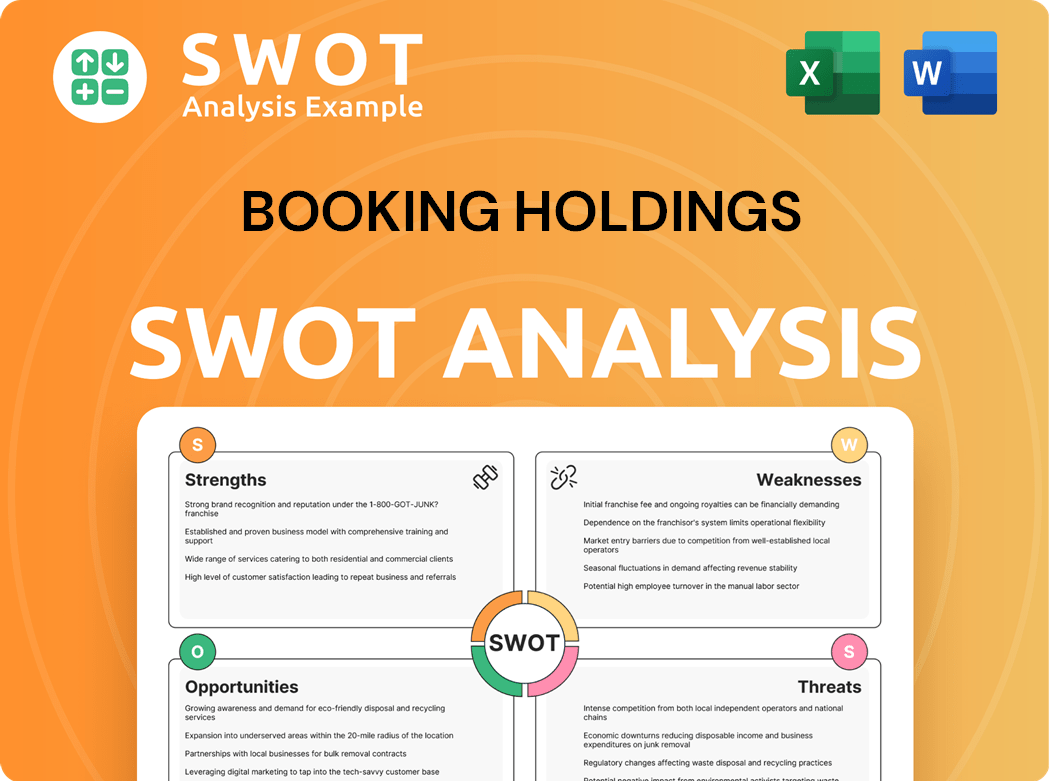

Check out this live preview of the Booking Holdings SWOT analysis. What you see here mirrors the full document. Purchase provides the complete, in-depth analysis. This is the real thing—no watered-down version.

SWOT Analysis Template

Booking Holdings, a powerhouse in online travel, faces dynamic market forces. Our brief analysis hints at their strengths: strong brand recognition and diverse offerings. Weaknesses include reliance on external factors. Opportunities lie in market expansion, while threats include increasing competition. To grasp Booking Holdings' entire strategic landscape, buy the full SWOT analysis for deeper insight and a customizable, editable format!

Strengths

Booking Holdings has a powerful brand portfolio, featuring Booking.com and Priceline. These brands offer diverse travel services, attracting a broad customer base. In 2024, Booking.com's revenue was a significant portion of the $21.4 billion total. This diversification reduces risks and boosts market share.

Booking Holdings boasts a substantial global presence, operating in over 220 countries and territories. This widespread reach allows them to access diverse travel markets and cater to a broad customer base. Their global footprint provides a competitive edge in negotiating deals with suppliers. In 2024, Booking Holdings reported a revenue of $21.4 billion, reflecting its expansive global presence.

Booking Holdings excels in technological innovation, consistently investing in its platforms. They focus on user-friendly interfaces and advanced search algorithms. Data analytics personalize customer experiences, crucial for staying competitive. In 2024, Booking.com's app downloads surged, showcasing tech's impact. This strategy helps the company meet evolving traveler needs.

Extensive Partner Network

Booking Holdings' extensive partner network is a significant strength, encompassing a diverse portfolio of brands like Booking.com and Priceline. This wide range caters to various travel market segments, offering diverse services and experiences. The diversified brand portfolio helps capture a larger market share, reducing risks. In 2024, Booking Holdings reported over $21 billion in revenue, showcasing the power of its network.

- Booking.com, Priceline, Agoda, KAYAK, Rentalcars.com, and OpenTable.

- Diversified brand portfolio.

- Over $21 billion in revenue in 2024.

Loyalty Programs and Customer Retention

Booking Holdings excels in customer retention, fueled by its robust loyalty programs. These programs incentivize repeat bookings, fostering strong customer relationships and driving revenue. The company's focus on customer loyalty has yielded positive results, with a significant portion of bookings coming from returning customers. This strategy enhances brand loyalty and reduces customer acquisition costs.

- In 2023, Booking.com's Genius loyalty program had over 38 million active members.

- Loyalty programs contribute to higher customer lifetime value.

- Loyalty programs boost customer retention rates.

Booking Holdings' brand portfolio, like Booking.com, boosts its market presence, attracting a wide user base and mitigating risks. Its global footprint reaches over 220 countries, providing access to diverse travel markets and strong supplier deals. Investments in technology and advanced algorithms enhance user experience and personalization, essential for market competitiveness.

| Strength | Details | 2024 Data |

|---|---|---|

| Strong Brands | Booking.com, Priceline | Revenue contribution from Booking.com. |

| Global Presence | Operating in 220+ countries | $21.4 billion total revenue. |

| Tech Innovation | User-friendly, algorithms | Booking.com app downloads surge. |

Weaknesses

Booking Holdings' reliance on online marketing is a weakness. The company heavily depends on channels like Google and social media for customer acquisition. This exposes Booking Holdings to algorithm changes and rising ad costs. In 2024, digital ad spending hit record highs. Diversification is key to mitigate these risks.

Booking Holdings faces significant exposure to economic downturns. The travel industry is notably sensitive to economic fluctuations. During economic downturns, consumers often reduce discretionary spending, including travel. This directly impacts Booking Holdings' revenue and profitability; for example, in 2023, total revenue was $21.4 billion.

Booking Holdings faces fierce competition in the online travel sector, including Expedia and Airbnb. This rivalry can squeeze profit margins and necessitate aggressive pricing strategies. To stay ahead, Booking Holdings needs constant innovation in its services and technology. In 2024, the company's net revenue was $21.4 billion, showing the competitive pressure. Maintaining a competitive edge demands significant investment in marketing and customer experience.

Fluctuations in Currency Exchange Rates

Booking Holdings faces currency exchange rate fluctuations, impacting its financial results. These fluctuations can affect the cost of transactions and reported revenues. In 2024, the company's international presence made it susceptible to currency volatility. Currency risk management strategies are crucial, but not always fully effective. These fluctuations can significantly impact profitability and financial planning.

- Currency exchange rates directly affect Booking Holdings' revenue and expenses.

- Volatility can lead to unpredictable financial outcomes.

- Effective hedging strategies are essential.

- Geographic diversification can help mitigate risk.

Customer Service Challenges

Booking Holdings faces customer service challenges, especially during peak travel seasons or crises. Handling a large volume of inquiries and resolving issues quickly can be difficult. This can lead to customer dissatisfaction and damage the company's reputation. Improving customer service efficiency and responsiveness is essential for maintaining customer loyalty. In 2024, Booking Holdings' customer satisfaction scores dipped slightly due to increased travel demand.

- Customer service issues can impact brand perception.

- High call volumes during peak seasons strain resources.

- Inefficient issue resolution can lead to customer churn.

- Investing in customer service technology is crucial.

Booking Holdings is heavily reliant on online marketing. The company's exposure to economic downturns significantly impacts its revenue. Intense competition in the online travel sector puts pressure on profit margins. Currency fluctuations further complicate financial results, and customer service issues present ongoing challenges.

| Weakness | Impact | 2024 Data |

|---|---|---|

| Reliance on Online Marketing | Vulnerable to algorithm changes and ad cost hikes | Digital ad spending reached record levels, impacting acquisition costs. |

| Economic Sensitivity | Revenue affected by travel spending cuts. | Revenue in 2023 was $21.4B, affected by economic shifts. |

| Intense Competition | Pressure on profit margins requires constant innovation. | The company's 2024 net revenue was $21.4 billion, under pressure from rivals. |

Opportunities

Booking Holdings can tap into underserved markets globally, fueling growth. Emerging markets offer considerable potential for online travel services. Successful expansion requires detailed market analysis and customized strategies. Booking Holdings’ revenue in 2023 was $21.4 billion, showing strong growth potential.

Mobile is crucial as more use it for travel. In Q3 2024, mobile bookings rose, showing its importance. Investing in mobile tech can boost user satisfaction and sales. Booking Holdings can capitalize on this growth. Focusing on mobile is key to staying ahead.

Booking Holdings can capitalize on the rising demand for personalized travel experiences. By using data analytics and AI, they can offer tailored recommendations. This approach boosts customer satisfaction and fosters loyalty, crucial in 2024. The personalized travel market is projected to reach $235 billion by 2025, presenting a significant opportunity.

Strategic Partnerships and Acquisitions

Booking Holdings can explore strategic partnerships and acquisitions to enter untapped markets, which present substantial growth potential. These moves can significantly boost revenue, especially in regions where online travel adoption is still developing. Successful expansion requires detailed market research and customized strategies to meet local consumer preferences. For instance, Booking.com's revenue in 2024 reached $21.4 billion, showing strong growth through strategic initiatives.

- Market penetration in Asia-Pacific region is a key growth area.

- Acquisitions of smaller, regional players can accelerate market entry.

- Partnerships with local travel agencies enhance market reach.

- Customized marketing campaigns increase brand awareness.

Sustainable Travel Initiatives

Sustainable travel is a growing trend, presenting opportunities for Booking Holdings. The company can capitalize on this by partnering with eco-friendly accommodations and promoting sustainable travel options. This aligns with increasing consumer demand for responsible travel choices. In 2024, sustainable tourism is projected to have a market size of $332.7 billion. Investing in sustainable initiatives can attract environmentally conscious travelers.

- Growing demand for sustainable travel.

- Potential for partnerships with eco-friendly providers.

- Enhance brand image.

- Attract environmentally conscious travelers.

Booking Holdings has numerous opportunities for expansion. Focusing on Asia-Pacific, it can leverage acquisitions and local partnerships. Personalized travel and sustainable tourism also provide growth avenues. In 2024, market growth for Booking.com was at 15%.

| Opportunity | Strategy | 2024 Stats/Facts |

|---|---|---|

| Market Expansion | Strategic acquisitions, partnerships | 15% Booking.com growth, Asia-Pac adoption rising |

| Personalized Travel | Data analytics and AI | Market projected at $235B by 2025 |

| Sustainable Tourism | Eco-friendly partnerships | $332.7B market in 2024 |

Threats

Geopolitical instability poses a significant threat to Booking Holdings. Events like political unrest and international conflicts can disrupt travel, directly impacting bookings and revenue. For instance, in 2024, geopolitical tensions led to a decrease in travel to certain regions. Developing contingency plans is essential to navigate these challenges effectively. Adaptability and swift responses are crucial for mitigating the negative effects of geopolitical risks on Booking Holdings' operations.

Booking Holdings faces cybersecurity threats, especially with its handling of sensitive customer data. A data breach could severely harm its reputation and lead to financial repercussions. In 2024, the cost of data breaches globally averaged $4.45 million. Investing in robust cybersecurity is crucial for protection. Constant vigilance is necessary.

Changes in travel regulations, like visa rules and restrictions, pose a threat to Booking Holdings. These shifts can directly affect travel demand and booking volumes. Booking Holdings must stay updated on these changes. Compliance with new regulations is crucial for maintaining operations. In 2024, the travel sector faced evolving rules globally, impacting international travel.

Natural Disasters and Pandemics

Natural disasters and pandemics pose significant threats to Booking Holdings. Global events like the COVID-19 pandemic severely curtailed travel, leading to substantial revenue declines. Geopolitical instability also disrupts travel, impacting bookings. Booking Holdings must prepare for such events.

- In 2020, Booking Holdings' revenue decreased by 60% due to the pandemic.

- The company's operating income went from $5.9 billion in 2019 to a loss of $700 million in 2020.

- Booking Holdings needs to adapt to unpredictable global events.

Emergence of New Competitors

Booking Holdings faces risks from new competitors entering the online travel market. Increased competition could erode its market share and profitability. New entrants may offer innovative services or aggressive pricing strategies. This necessitates continuous innovation and strategic adaptation to maintain a competitive edge. In 2024, Booking Holdings' revenue was about $21.4 billion.

- Competition from new online travel agencies (OTAs).

- Emergence of new travel technology platforms.

- Disruptive business models.

- Price wars.

Booking Holdings faces threats from geopolitical instability, like political conflicts, disrupting travel and revenues. Cybersecurity risks, including data breaches, can damage the company's reputation. Evolving travel regulations and the rise of new competitors also pose challenges. Booking Holdings reported a revenue of $21.4 billion in 2024.

| Threat | Impact | 2024 Data/Example |

|---|---|---|

| Geopolitical Instability | Disrupted travel, reduced bookings | Reduced travel to conflict zones |

| Cybersecurity Threats | Data breaches, reputational damage | Average data breach cost: $4.45M globally |

| Regulatory Changes | Reduced booking volumes | Evolving visa rules/travel restrictions |

| New Competitors | Erosion of market share | New OTAs & tech platforms emerge |

SWOT Analysis Data Sources

This Booking Holdings SWOT analysis draws from financial filings, market research, industry reports, and expert analysis to ensure precision and reliability.