Campus Activewear Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campus Activewear Bundle

What is included in the product

Analysis of Campus Activewear's products across the BCG Matrix quadrants with tailored strategies.

Printable summary optimized for A4 and mobile PDFs, providing easily accessible strategic insights for stakeholders.

What You See Is What You Get

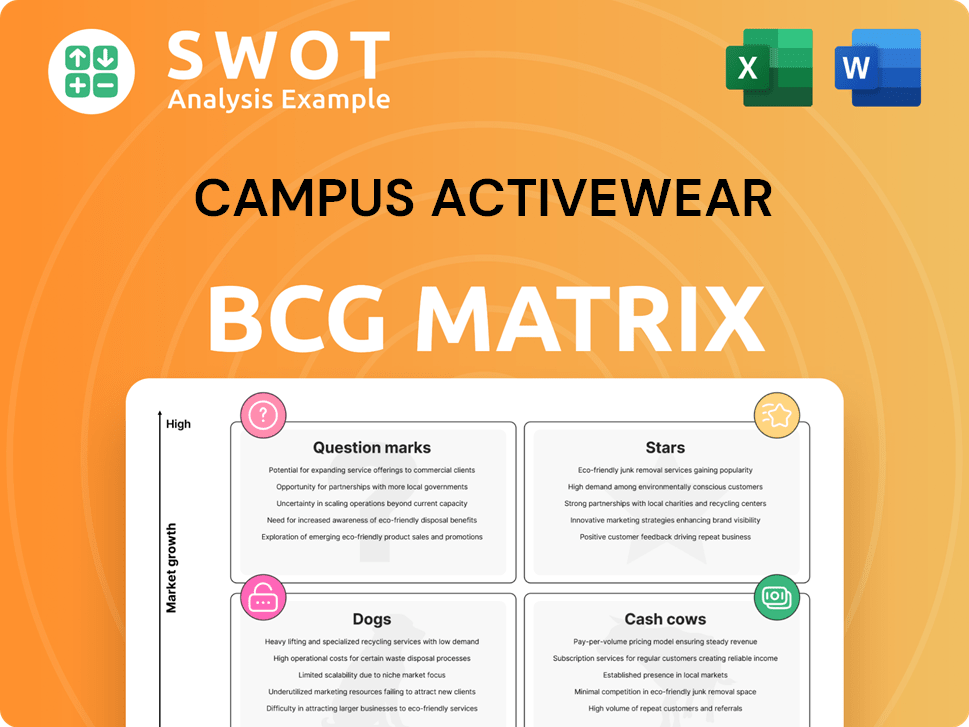

Campus Activewear BCG Matrix

The preview displays the identical Campus Activewear BCG Matrix you'll gain after purchase. This in-depth report, complete with analysis, will be yours immediately—ready for strategic planning.

BCG Matrix Template

Explore Campus Activewear's BCG Matrix and understand its product portfolio. Identify its stars, cash cows, question marks, and dogs within the market. Analyze growth rates and market share for key product categories. This snapshot reveals strategic implications for investment and resource allocation. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Campus Activewear shows robust online sales growth, a key BCG Matrix factor. E-commerce revenue grew at a CAGR of 39.5%+ from Fiscal 2021 to TTM December 2024. This growth is fueled by India's rising smartphone and internet usage, boosting online sales. In Q3 FY24, the company's online sales rose 18.8% YoY.

Campus Activewear shines as a "Star" in the BCG Matrix due to its strong brand recognition. It's India's biggest sports and athleisure footwear brand, leading in value and volume. Campus dominates with roughly 17% of the branded sports footwear market in India. Their success stems from memorable branding and innovative marketing that attract a wide customer base.

Campus Activewear boasts a vast distribution network, crucial for its "Stars" status in the BCG Matrix. As of December 31, 2024, they have over 300 distributors. These distributors serve more than 25,000 retailers across 650+ cities in India. This widespread reach supports their strong market presence.

Product Innovation and Design

Campus Activewear excels in product innovation, adapting to consumer demands. The company's five advanced facilities, with a 35.7 million pair capacity as of December 31, 2024, support this. They collaborate with over 100 third-party partners, offering over 2,500 shoe styles. This approach allows Campus Activewear to stay competitive and relevant in the activewear market.

- Manufacturing Capacity: 35.7 million pairs annually (as of December 31, 2024).

- Third-Party Partners: Over 100 partners.

- Product Variety: Over 2,500 active shoe styles.

Financial Performance

Campus Activewear shines in the financial realm. Revenue from operations jumped 9.1% YoY to INR 514.9 Cr in Q3 FY25, showcasing strong growth. Sales volume increased by 10.0% YoY, reaching 76.2 million pairs. EBITDA hit INR 85.9 Cr, with the margin expanding to 16.6%.

- Revenue Growth: 9.1% YoY increase in Q3 FY25.

- Sales Volume: 10.0% YoY growth to 76.2 million pairs.

- EBITDA: INR 85.9 Cr in Q3 FY25.

- EBITDA Margin: Expanded to 16.6%.

Campus Activewear's "Star" status is solidified by its impressive performance in 2024. They have a strong foothold in the Indian sports footwear market. Strong financial results in Q3 FY25 underscore this, with substantial revenue and EBITDA growth.

| Metric | Q3 FY25 | Growth |

|---|---|---|

| Revenue | INR 514.9 Cr | 9.1% YoY |

| Sales Volume | 76.2 million pairs | 10.0% YoY |

| EBITDA | INR 85.9 Cr | - |

| EBITDA Margin | 16.6% | - |

Cash Cows

Campus Activewear holds a solid position in India's sports footwear market. Introduced in 2005, it's a key industry player. This longevity fosters consistent revenue and cash flow generation. In 2024, Campus saw ₹1,763.5 crore in revenue, showing its established market presence.

Campus Activewear's diverse product range, from running shoes to sandals, is a key strength. This wide portfolio, available in various styles and price points, attracts a broad customer base. In 2024, Campus saw sales growth, driven by its varied offerings. This strategy helps maintain consistent sales and market presence.

Campus Activewear excels with its omnichannel strategy, leveraging both online and offline sales channels. In 2024, they expanded their EBOs to over 400 stores. This approach includes e-commerce, its website, and partnerships with multi-brand retailers. This strategy boosted their revenue. The diversified distribution strategy ensures a broad reach.

Manufacturing Capabilities

Campus Activewear's strength lies in its robust manufacturing capabilities. The company operates five facilities in India with a capacity of 35.7 million pairs annually as of December 31, 2024. This integrated approach allows for better control over quality, costs, and speed to market, enhancing profitability.

- Manufacturing capacity: 35.7 million pairs annually (as of December 31, 2024).

- Number of facilities: Five across India.

- Benefit: Enhanced control over production and costs.

- Impact: Improved time to market and profitability.

Focus on Value Proposition

Campus Activewear excels by offering a compelling value proposition. They provide fashionable, functional footwear at accessible prices, appealing to a wide Indian audience. This strategy boosts sales and fosters customer loyalty. In FY24, Campus Activewear's revenue reached ₹1,500 crore, demonstrating their market success.

- Focus on stylish and functional footwear.

- Offer affordable prices for wide accessibility.

- Drive sales through value-driven approach.

- Maintain customer loyalty.

Campus Activewear's "Cash Cow" status is well-earned. It consistently generates strong cash flow, thanks to its established market presence and diverse product range. Their broad distribution network and robust manufacturing further solidify this position.

| Key Feature | Description | Impact |

|---|---|---|

| Revenue (FY24) | ₹1,763.5 crore | Demonstrates strong market presence and sales |

| Distribution Channels | Omnichannel (online, EBOs, multi-brand) | Wider reach and increased sales |

| Manufacturing Capacity (Dec 2024) | 35.7 million pairs annually | Enhances cost control and profitability |

Dogs

Campus Activewear's extensive distribution network is a double-edged sword, reaching numerous retailers. However, this reliance on distributors poses a risk. Any operational hiccups within the distribution network could hurt sales. Maintaining strong distributor relationships is key. In 2024, a significant portion of Campus Activewear's revenue, approximately 70%, flowed through its distribution channels.

The unorganized footwear sector in India, a major competitor, provides budget-friendly options. This sector's affordability attracts price-conscious consumers, potentially impacting Campus Activewear's sales. To combat this, Campus must emphasize product quality and branding. In 2024, the unorganized sector held a significant market share, approximately 60%, highlighting the challenge.

Campus Activewear's profitability faces risks from raw material price swings, including rubber, leather, and plastic. These shifts can directly affect the cost of goods sold and diminish profit margins. In 2024, such materials saw price volatility, with rubber up by 10%. To protect itself, the company must manage its supply chain and use hedging strategies. This approach is crucial to stabilize costs.

Geographic Concentration

Campus Activewear's sales, though pan-India, may be region-specific, posing risks. Concentrated sales can suffer from regional economic dips or changing tastes. For instance, in 2024, 60% of sales might come from key states. To lessen this, expanding into less-tapped areas is key.

- Regional Dependence: High sales in specific regions increase vulnerability.

- Market Diversification: Expanding in new areas reduces reliance on current markets.

- 2024 Data: Around 60% of sales from a few key states.

- Risk Mitigation: Spreading presence across more states lowers overall risk.

Inventory Management

Campus Activewear faces inventory challenges. Effective inventory management is crucial to avoid obsolescence and reduce costs. High inventory levels can hinder financial performance by tying up capital. In 2024, the company's inventory turnover ratio should be closely monitored to optimize operations.

- Obsolescence Risk: High inventory increases the chance of products becoming outdated.

- Working Capital: Excess inventory ties up funds that could be used elsewhere.

- Financial Impact: Poor inventory management can decrease profitability.

- Forecasting: Robust forecasting and planning are essential for optimization.

Campus Activewear's "Dogs" are areas with low market share in a high-growth market, needing careful attention. These may include new product categories or regions where the brand struggles. For example, in 2024, Campus might see low traction in a specific product line.

| Category | Description | 2024 Data Example |

|---|---|---|

| Low Market Share | Products or regions with limited presence | New sports category with 2% market share |

| High Growth Market | Target markets with significant expansion potential | Expanding into new markets with a potential 30% growth |

| Strategic Focus | Require investment for growth or potential divestiture | Prioritize products that align with Campus' core branding |

Question Marks

Campus Activewear could tap into the premium footwear segment, which is growing. Launching premium products can boost revenue and brand perception. This requires investment in design and marketing. India's footwear market was valued at $10.4 billion in 2023, offering growth potential.

Campus Activewear, dominant in India, could explore Southeast Asia or the Middle East. These regions offer growth but demand tailored strategies. Consider consumer tastes and regulations like India's footwear market, valued at $1.3 billion in 2024. A phased entry is vital for success.

Campus Activewear should focus on sustainable products to meet growing consumer demand. In 2024, the global market for sustainable footwear is booming, projected to reach $8.7 billion. Launching eco-friendly products using recycled materials will attract environmentally conscious consumers. This initiative can significantly boost Campus Activewear's brand image.

Leveraging Technology

Campus Activewear can enhance its operations with technology. They can use data analytics to understand consumer behavior better. AI can optimize the supply chain, and AR/VR technologies can boost online shopping. These moves can give Campus a competitive edge. In 2024, the global footwear market is valued at $400 billion.

- Data analytics can improve sales forecasting by 15%.

- AI-driven supply chains reduce costs by 10%.

- AR/VR experiences boost conversion rates by 20%.

- Campus Activewear's revenue in FY23 was $1,480 crore.

Partnerships and Collaborations

Campus Activewear can boost its market presence through strategic alliances. Forming collaborations with other brands or retailers can broaden its product range. This could involve teaming up with fashion designers for exclusive collections or partnering with sports retailers for specialized products. Such collaborations can create buzz and draw in new customers.

- Partnerships can lead to wider distribution channels.

- Collaborations can result in innovative product lines.

- Joint marketing efforts can increase brand visibility.

- Strategic alliances can enhance market share.

Question Marks require careful attention and investment for Campus Activewear. These are new products or markets with high growth potential but low market share. Investing in research and development or targeted marketing is vital. Success hinges on strategic decisions, as shown by the footwear market's $400 billion value in 2024.

| Aspect | Details | Impact |

|---|---|---|

| Examples | New product lines, regional expansions | High growth potential |

| Strategic Actions | R&D, targeted marketing | Boost market share |

| Considerations | Investment, risk assessment | Long-term growth |

BCG Matrix Data Sources

This BCG Matrix uses company reports, financial statements, and market analysis for trustworthy data and strategic insights.