Campus Activewear PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Campus Activewear Bundle

What is included in the product

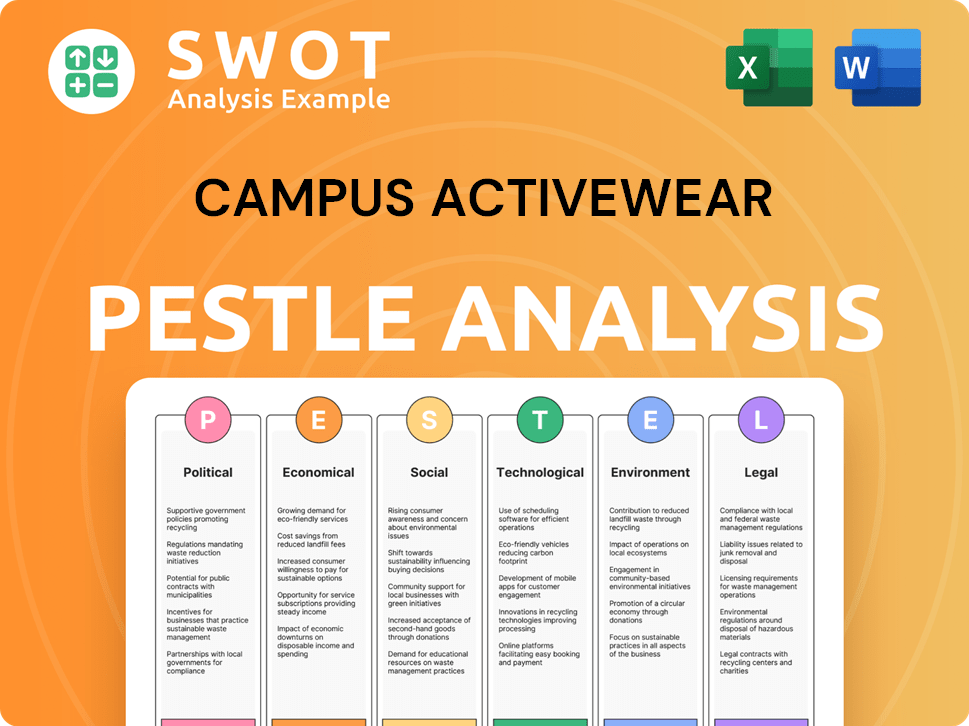

Explores how macro-environmental factors affect Campus Activewear across six PESTLE dimensions.

Helps support discussions on external risk during planning sessions, highlighting areas that need deeper focus.

Full Version Awaits

Campus Activewear PESTLE Analysis

The preview offers a complete Campus Activewear PESTLE analysis.

See how the factors impact the business? The content is ready to download.

Structure is professionally presented.

This file is the final version.

Download instantly after purchase.

PESTLE Analysis Template

Our PESTLE analysis offers a snapshot of Campus Activewear's external environment. We examine political factors, like import regulations, affecting the business. Explore the economic climate, including consumer spending habits and inflation impacts. Understand technology's role, such as e-commerce and supply chain advancements. Download the complete analysis for a comprehensive understanding.

Political factors

The Indian government's 'Make in India' initiative and export incentives support the footwear industry, benefiting Campus Activewear. These policies create a positive environment for growth. In 2023-24, the Indian footwear market was valued at approximately $10 billion, with expectations of further expansion. The government's focus on global supply chains and self-reliance in manufacturing aligns with Campus Activewear's potential for expansion.

Trade policies are crucial for Campus Activewear. Changes in customs duties and export incentives directly affect costs and competitiveness. Recent budget announcements include full exemptions on certain leather types and export duties on crust leather. These moves can positively impact the footwear industry. For example, in 2024, India's footwear exports reached $2.5 billion, showing the impact of such policies.

Political stability in India fosters a favorable climate for Campus Activewear's operations and expansion. Consistent government policies and a predictable regulatory framework are vital for sustained business confidence. Stable governance supports consumer trust, potentially boosting sales and market share for Campus Activewear. According to recent reports, India's political landscape has shown relative stability, which can positively influence investment decisions.

Labor Laws and Regulations

Labor laws and regulations in India are crucial for Campus Activewear's manufacturing. These laws directly impact production costs and operational practices. Compliance is not just a legal requirement, it's vital for uninterrupted business. Non-compliance can lead to penalties and operational disruptions. In 2024, India's labor reforms aimed at simplifying compliance.

- The Ministry of Labour and Employment oversees these regulations.

- Factories Act, 1948, sets safety standards.

- Minimum Wages Act, 1948, mandates minimum pay.

- Compliance costs may increase operational expenses.

Bureau of Indian Standards (BIS) Mandates

The Indian government, via the Department for Promotion of Industry and Internal Trade (DPIIT) and the Bureau of Indian Standards (BIS), enforces mandatory BIS certification for footwear. This ensures product quality and prevents substandard goods. Campus Activewear must comply with these standards to legally operate in India. Non-compliance can lead to penalties and market restrictions. The footwear market in India was valued at approximately $2.3 billion in 2024.

- BIS certification is legally required for various footwear products.

- Compliance is crucial to avoid penalties and market issues.

- The Indian footwear market's value was around $2.3 billion in 2024.

Political factors significantly influence Campus Activewear. Government initiatives like 'Make in India' boost the footwear industry. Stable policies and labor regulations are vital for operations. The BIS certification is mandatory for quality assurance.

| Aspect | Impact | Data |

|---|---|---|

| Make in India | Supports production, exports | Footwear exports in 2024: $2.5B |

| Trade Policies | Affect costs, competitiveness | Exemptions on leather & export duties on crust leather |

| Political Stability | Supports confidence, growth | India’s market shows relative stability |

Economic factors

The increase in disposable income in India's middle class boosts demand for premium footwear. Consumer spending on discretionary items like athletic shoes is directly linked to economic growth. In 2024, India's GDP is projected to grow by 6.8%, potentially increasing consumer spending. Campus Activewear can capitalize on this trend by offering products that appeal to this growing market.

Inflation significantly influences Campus Activewear's operational costs. Rising inflation, especially in 2024 and projected into 2025, increases raw material and production expenses. This could lead to higher prices for consumers. In 2024, India's inflation rate averaged around 5.5%, impacting consumer spending. Decreased purchasing power, due to inflation, may lower demand for discretionary items like athletic footwear.

India's economic growth is crucial for the footwear market, like Campus Activewear. Strong economic growth boosts consumer confidence and spending. In FY24, India's GDP grew by 8.2%, reflecting a robust economy. This growth supports increased retail spending, including footwear.

E-commerce Growth

The surge in e-commerce across India is a pivotal economic influence. This expansion offers Campus Activewear broader market access, notably in smaller cities, boosting sales. E-commerce in India is projected to reach $111 billion by 2024. Campus Activewear leverages this growth, enhancing its online presence.

- E-commerce sales in India are expected to reach $111 billion by the end of 2024.

- Online sales contribute significantly to Campus Activewear's revenue growth.

Competition and Market Share

The Indian footwear market, where Campus Activewear operates, is highly competitive, featuring both global and local brands, alongside the unorganized sector. This competition significantly affects pricing strategies and market share dynamics. Campus Activewear's success hinges on its ability to capture and retain market share in the growing athleisure and sports footwear segment, which is vital for its economic health. In FY24, Campus Activewear's revenue from operations was approximately ₹1,165.92 crore. The company faces competition from brands like Adidas, Nike, and Puma.

- Competitive landscape includes domestic and international brands, and unorganized players.

- Pricing and market share are influenced by competition.

- Campus Activewear competes in athleisure and sports footwear.

- Maintaining or increasing market share is crucial for economic performance.

India's growing middle class and increased disposable income boost demand for athletic footwear, benefiting companies like Campus Activewear. However, rising inflation and associated cost increases may pose challenges. E-commerce expansion presents significant opportunities, with sales expected to hit $111 billion by the end of 2024. Robust economic growth, with an 8.2% GDP rise in FY24, fosters increased consumer spending.

| Economic Factor | Impact on Campus Activewear | Data (2024) |

|---|---|---|

| Disposable Income | Increased demand | Growing middle class |

| Inflation | Increased costs, potential price hikes | ~5.5% average |

| E-commerce | Wider market access | $111B expected sales |

| Economic Growth | Boosts consumer confidence | 8.2% GDP (FY24) |

Sociological factors

Rapid urbanization and shifting lifestyles in India fuel demand for varied footwear. The market for casual and athletic shoes is expanding due to rising fitness trends. Campus Activewear can capitalize on this, with the athletic and casual footwear market in India projected to reach $1.8 billion by 2025. This growth signifies significant opportunities.

India's substantial youth demographic, heavily influenced by social media and fashion trends, forms a core market for Campus Activewear. This generation's high fashion consciousness drives demand for trendy athletic and lifestyle footwear. In 2024, India's youth (15-29 years) comprised roughly 27% of the population. This segment's spending on apparel continues to rise, with athleisure witnessing significant growth. Campus Activewear strategically targets this group.

India's increasing health and fitness consciousness fuels demand for athletic footwear. Campus Activewear benefits from this, with sales of sports and athleisure shoes rising. The Indian sports and fitness market is projected to reach $3.87 billion by 2025. This trend supports Campus's growth.

Consumer Preference for Branded Products

Consumer preference increasingly favors branded footwear, reflecting rising brand awareness and a focus on quality and style. Campus Activewear benefits from this trend, especially among younger consumers. In 2024, branded footwear sales grew by 15% in India, highlighting this shift. Campus Activewear's strong brand loyalty among youth is a significant advantage.

- Branded footwear sales in India grew by 15% in 2024.

- Campus Activewear enjoys strong brand loyalty among young consumers.

Influence of Social Media and Online Trends

Social media significantly influences consumer preferences, fueling demand for fashionable footwear. Online shopping and exposure to global trends through digital platforms also impact choices. Campus Activewear benefits from this trend, with digital marketing campaigns driving sales. For instance, in 2024, social media ad spending in India reached $2.5 billion, highlighting its importance in retail.

- Social media ad spending in India hit $2.5 billion in 2024.

- Online retail sales in India are projected to reach $160 billion by 2025.

India's shifting lifestyles and urbanization boost footwear demand. A youthful demographic, highly influenced by social media, drives trends toward stylish athletic and lifestyle footwear. The rising focus on health and fitness further supports growth. Branded footwear's preference, up by 15% in 2024, enhances Campus Activewear's appeal, particularly via digital marketing.

| Factor | Description | Impact on Campus |

|---|---|---|

| Lifestyle Shifts | Urbanization increases, fitness trends grow | Expands market for casual and athletic shoes; Sales Growth |

| Youth Influence | Fashion-conscious, social media-driven | High demand for trendy footwear; Brand loyalty |

| Health Trends | Growing health and fitness consciousness | Increases sales of athletic footwear; Market Growth |

Technological factors

Automation and AI are revolutionizing footwear manufacturing, promising to cut costs and boost efficiency for companies like Campus Activewear. AI enhances inventory management and demand forecasting. In 2024, the global AI in manufacturing market was valued at $2.4 billion, projected to reach $22.8 billion by 2030. This growth underscores the technological shift's impact.

The rise of e-commerce necessitates strong online platforms, effective digital marketing, and streamlined supply chains. Campus Activewear must boost online sales and digital transformation. Online sales grew, contributing significantly to revenue. In fiscal year 2024, Campus Activewear's digital sales saw a 40% increase, showing the importance of a strong online presence.

Technological advancements drive product innovation in footwear, allowing for new materials and designs. Campus Activewear can leverage these technologies to create lightweight, durable footwear. This innovation is crucial for maintaining a competitive edge in the market. In FY24, Campus Activewear invested ₹45 crore in R&D, showcasing its commitment to technological integration.

3D Printing and Customization

3D printing presents a technological frontier for Campus Activewear, enabling bespoke footwear designs and potentially minimizing waste. While still nascent, adoption could lead to unique product offerings and enhanced customer satisfaction. The global 3D printing market is projected to reach $55.8 billion by 2027. This technology allows for rapid prototyping and on-demand manufacturing, which may reduce inventory costs.

- Market size: The 3D printing market is expected to grow to $55.8 billion by 2027.

- Customization: Offers tailored footwear options.

- Waste reduction: Potential for less material waste.

- Efficiency: Enables rapid prototyping.

Augmented Reality (AR) for Customer Experience

Augmented Reality (AR) offers Campus Activewear exciting possibilities. AR can revolutionize online shopping, letting customers virtually "try on" shoes. This enhances the customer experience and could lower return rates. By 2025, the AR market is projected to reach $70 billion, demonstrating its growth potential.

- Virtual try-ons improve customer satisfaction.

- AR may reduce returns.

- AR market expected to hit $70B by 2025.

Automation and AI improve efficiency, with the AI in manufacturing market reaching $22.8B by 2030. E-commerce growth requires robust online platforms. Digital sales rose by 40% in FY24 for Campus Activewear. Product innovation, fueled by R&D (₹45 crore in FY24), is crucial.

| Technological Factor | Impact on Campus Activewear | Data/Statistics (2024/2025) |

|---|---|---|

| AI and Automation | Boost efficiency and reduce costs. | AI in manufacturing market to $22.8B by 2030. |

| E-commerce | Drives the need for online presence. | Digital sales increased 40% in FY24. |

| Product Innovation | Creates lightweight and durable footwear. | ₹45 crore investment in R&D in FY24. |

Legal factors

Campus Activewear must adhere to mandatory BIS certification for footwear. This is a crucial legal aspect for manufacturers and importers in India. Non-compliance can lead to penalties like fines and legal issues. In 2024, the Indian footwear market was valued at $13.3 billion.

Campus Activewear must comply with labor laws to ensure fair working conditions, wages, and employment practices. These regulations significantly affect operational costs, influencing pricing strategies and profitability. Non-compliance can lead to legal penalties, reputational damage, and operational disruptions. For instance, in 2024, the footwear industry faced increased scrutiny regarding worker rights, with several brands experiencing supply chain challenges due to labor disputes.

Campus Activewear faces environmental regulations affecting footwear manufacturing. Compliance involves pollution control, waste management, and hazardous substance handling. Proper chemical waste disposal is crucial. Non-compliance can lead to penalties. The global footwear market was valued at $400 billion in 2024, highlighting the scale of operations.

Consumer Protection Laws

Consumer protection laws are vital for Campus Activewear, focusing on product quality, labeling, and complaint resolution. These laws ensure fair practices and protect consumers. Accurate labeling and clear information are essential for compliance. In 2024, consumer complaints in the footwear sector increased by 12%, highlighting the importance of these regulations.

- Product quality standards must be met to avoid legal issues and maintain customer trust.

- Labeling should be accurate, including materials and manufacturing details.

- A robust grievance redressal system is needed to handle consumer complaints efficiently.

- Compliance with these laws helps in building a strong brand reputation and avoiding penalties.

Taxation Laws (e.g., GST)

Compliance with GST and other tax laws is crucial for Campus Activewear's financial health. Changes in tax policies directly impact pricing strategies and profitability margins. A stable and simplified tax regime, as aimed for in 2024/2025, fosters a more predictable environment for business planning and investment.

- GST rates on footwear can vary, affecting consumer prices.

- Tax reforms in India aim for easier compliance and reduced litigation.

- Effective tax management is vital for maintaining competitive pricing.

Campus Activewear must comply with mandatory BIS certification and product quality standards to avoid legal issues, crucial for footwear manufacturers and importers in India. They need to accurately label their products. Failure to comply may lead to financial penalties and reputational damage. GST and other tax regulations affect the pricing and profitability of Campus Activewear.

| Legal Aspect | Impact | Data |

|---|---|---|

| BIS Certification | Ensures product standards and avoids penalties. | The Indian footwear market in 2024 was $13.3 billion. |

| Labor Laws | Affects costs and compliance with fair practices. | Footwear industry saw increased scrutiny regarding workers' rights in 2024. |

| Consumer Protection | Requires product quality, accurate labeling, and complaint resolution. | Consumer complaints in the sector increased by 12% in 2024. |

Environmental factors

The footwear industry, including Campus Activewear, faces waste management challenges. A significant amount of waste, such as defective products and material scraps, ends up in landfills, contributing to pollution. Implementing efficient waste segregation and disposal strategies is vital to lessen the environmental impact. In 2024, the global footwear market waste was estimated at 20 million tons. Campus Activewear must prioritize sustainable practices.

Campus Activewear can capitalize on the rising consumer preference for sustainable products. The use of recycled materials in footwear is increasing, with the global market for sustainable footwear valued at $7.6 billion in 2024, projected to reach $10.9 billion by 2029. By using eco-friendly materials such as recycled plastics, organic cotton, and vegan leather, Campus Activewear can reduce its environmental impact and attract environmentally conscious consumers. This aligns with the growing consumer demand for sustainable products, as 67% of consumers globally consider sustainability when making purchasing decisions.

Footwear manufacturing uses chemicals and adhesives, potentially polluting water and soil. Proper waste treatment is crucial for Campus Activewear. The global footwear market was valued at $400 billion in 2023, with environmental concerns growing. Campus Activewear's chemical management can impact its market share and sustainability.

Energy Consumption and Emissions

Manufacturing footwear requires significant energy, leading to greenhouse gas emissions. Campus Activewear can reduce its carbon footprint by adopting renewable energy and boosting efficiency. The footwear industry faces scrutiny, with consumers and regulators pushing for sustainability. For example, the global footwear market's carbon emissions were estimated at 1.4% of total global emissions in 2023.

- Transitioning to renewable energy sources like solar or wind power can significantly decrease emissions.

- Implementing energy-efficient technologies in factories and supply chains is also crucial.

- Focusing on reducing waste and optimizing resource utilization will also help.

Circular Economy and Recycling

Campus Activewear's environmental strategy must address the circular economy and recycling challenges. Promoting a circular model involves designing durable footwear, improving recycling processes, and finding innovative uses for old shoes to minimize waste. The footwear industry faces complex recycling hurdles due to material combinations. In 2024, the global footwear recycling market was valued at $1.2 billion, projected to reach $1.8 billion by 2029.

- Footwear recycling market value: $1.2B (2024).

- Projected market value by 2029: $1.8B.

- Focus on material innovation for recyclability.

- Efforts to repurpose discarded shoes.

Environmental factors are critical for Campus Activewear's operations. Waste management is crucial; the footwear industry generated 20 million tons of waste in 2024. Sustainable materials are in demand, with the market valued at $7.6B in 2024. Reducing emissions by using renewable energy is essential due to growing consumer and regulator pressures.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Waste | Landfill pollution; environmental impact | Footwear waste: 20M tons globally |

| Sustainability | Consumer preference; market opportunity | Sustainable footwear market: $7.6B |

| Emissions | Carbon footprint; regulatory pressure | Footwear emissions: 1.4% global |

PESTLE Analysis Data Sources

Campus Activewear's PESTLE analysis uses market research reports, financial publications, and government databases. It incorporates consumer behavior analyses and industry-specific data to ensure comprehensive coverage.