CI&T Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Export-ready design for quick drag-and-drop into PowerPoint, allowing for instant presentation readiness.

Full Transparency, Always

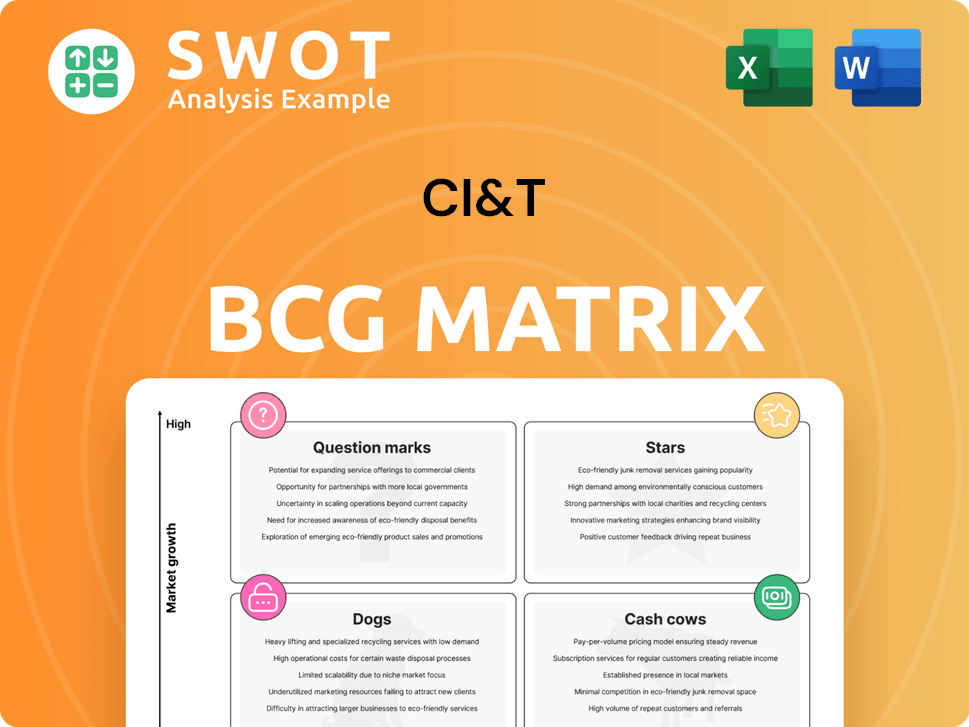

CI&T BCG Matrix

The preview showcases the complete CI&T BCG Matrix report you'll receive. This is the final, editable document, free of watermarks, ready for your strategic analysis and business planning.

BCG Matrix Template

CI&T's BCG Matrix spotlights its diverse offerings. See which are stars, dominating the market, and which are cash cows, generating profit. Are there any question marks needing strategic investment, or dogs dragging down performance? Uncover product placements and strategic guidance in our full BCG Matrix report.

Stars

CI&T's AI platform, CI&T FLOW, is a star, boosting software development. It has shown results, like cost savings and fewer manual fixes. The AI Innovators Program highlights clients using AI to transform industries. CI&T's revenue grew by 19.7% in Q3 2023, showing AI's impact.

CI&T's digital transformation services are a star, driven by modernization demand. They show consistent revenue growth, highlighting their market position. Their edge lies in managing complex, high-risk projects. In 2024, CI&T reported strong revenue growth of 15%.

CI&T's strategic partnerships with AWS and Microsoft Azure are indeed stars within its BCG Matrix. These alliances boost CI&T's ability to offer cloud-based solutions and integrate technologies. In 2024, CI&T's revenue from cloud services grew by 28%, reflecting the impact of these collaborations. The collaborative model with other providers fortifies its market presence.

Modern Application Development Services

CI&T's Modern Application Development Services are a "Star" in its BCG Matrix, validated by Forrester's Leader recognition. This reflects CI&T's proficiency in agile development and DevSecOps, pivotal for modern app creation. A key strength is their focus on accelerating app delivery and updates, critical in today's fast-paced market. CI&T excels at shifting clients to product-centric models.

- Forrester's recognition of CI&T as a leader in modern application development services.

- Focus on agile development and DevSecOps.

- Ability to reduce time to deliver apps and changes.

- Transitioning clients to product-based working models.

Financial Services and Healthcare Verticals

CI&T views financial services and healthcare as star verticals, driving growth through leadership appointments. This focus strengthens its AI-powered digital transformation capabilities. Solutions for financial services include improved customer experiences and automated processes. For instance, in 2024, digital transformation spending in financial services reached $250 billion globally.

- CI&T's strategic focus is on high-growth sectors.

- Key leadership appointments accelerate growth.

- Solutions enhance customer experiences.

- Automation is a core offering.

CI&T's expansion into the financial services and healthcare sectors is a star, fueled by key appointments and AI integration. This strategic focus strengthens CI&T’s digital transformation abilities in high-growth areas. They improve customer experiences and automation; the financial sector saw $250B in digital transformation spending in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Strategic Focus | High-growth sectors | Financial services, healthcare |

| Key Actions | Leadership appointments | Driving growth |

| Core Offering | Automation and Customer Experience | Enhanced solutions |

Cash Cows

CI&T's legacy system modernization services function as a cash cow, generating consistent revenue. Enterprises depend on ongoing support and upgrades for existing systems. This leverages CI&T's expertise in core system migrations. In 2024, the global IT modernization market was valued at $200 billion, showing sustained demand.

CI&T's custom software development is a cash cow, providing tailored solutions. Their global presence ensures steady demand. In 2024, CI&T's revenue reached $390.4 million. Expertise includes AI, cloud, and analytics. This generates consistent revenue.

CI&T's outsourcing services are a cash cow, generating steady revenue through cost-effective tech solutions. These services enable clients to concentrate on core business functions, while CI&T handles tech demands. Nearshore LATAM teams ensure high performance and cultural alignment. In 2024, outsourcing contributed significantly to CI&T's revenue, with a reported $300 million in revenue from these services.

Digital Experience Platforms (DXP)

CI&T's Digital Experience Platform (DXP) services are a cash cow, leveraging their expertise to boost digital presence for businesses. Partnerships, such as with Acquia, ensure a consistent demand for these services. These solutions boost engagement, which increases delivery quality for clients. In 2024, the DXP market is valued at approximately $8 billion.

- CI&T's DXP services generate stable revenue.

- Acquia partnership supports service demand.

- Solutions improve client digital engagement.

- DXP market is a growing sector.

Data and Analytics Services

CI&T's data and analytics services are a stable cash cow. They offer clients data-driven decisions, AI, and ML. These services boost performance and improve customer experiences. CI&T's expertise in data modeling delivers long-term value. In 2024, the data analytics market reached $271 billion.

- Provides clients with data-led decisions and AI/ML.

- Helps businesses accelerate performance and improve customer experiences.

- Focuses on data modeling, gathering, integration, and centralization.

- The data analytics market was valued at $271 billion in 2024.

CI&T's cash cows consistently generate revenue through mature services. This includes system modernization, custom software, outsourcing, and DXP services. These services benefit from ongoing demand, as evidenced by robust market valuations. For instance, in 2024, CI&T reported $390.4 million in revenue.

| Service | Description | 2024 Revenue (approx.) |

|---|---|---|

| System Modernization | Ongoing support & upgrades | $200 billion (market) |

| Custom Software | Tailored solutions | $390.4 million (CI&T) |

| Outsourcing | Cost-effective tech | $300 million (CI&T) |

| DXP | Digital presence | $8 billion (market) |

Dogs

Traditional IT services, lacking digital transformation or AI focus, resemble dogs in CI&T's BCG matrix. These services often show limited growth and market share. For instance, in 2024, such services saw only a 2% revenue increase. CI&T should reduce investments here. Focus on areas with greater potential.

Services with low market adoption are often classified as "dogs" in the CI&T BCG matrix. These services typically demand considerable investment without delivering significant returns. For example, in 2024, a specific AI-driven service saw only a 5% adoption rate, indicating potential underperformance. CI&T needs to assess these underperforming services. Options include divestiture or strategic repositioning, focusing on areas with better growth prospects.

Solutions without innovation can be "dogs" in CI&T's BCG Matrix. These solutions often lag behind market trends. In 2024, the global AI market grew by 37%, highlighting the need for CI&T to integrate AI. For instance, the company's revenue in 2023 was $1.03 billion.

Services with Limited Scalability

Services with limited scalability can be classified as dogs in CI&T's BCG Matrix. Such services struggle to expand and meet increasing market demands. For example, in 2024, CI&T's revenue growth was 10%, but certain specialized services saw only a 3% increase, indicating scalability issues. CI&T should focus on scalable offerings to enhance overall growth and profitability. Prioritizing scalable services aligns with market demands and growth targets.

- Revenue Growth: CI&T's overall revenue grew by 10% in 2024.

- Scalability Challenges: Specialized services experienced only 3% growth.

- Strategic Focus: Prioritize services with the potential for efficient scaling.

- Market Alignment: Focus on offerings that match market demands.

Regions with Low Market Presence

In regions where CI&T's market presence is weak and growth rates are low, they might be classified as "dogs." These areas may need substantial investments to generate significant returns. For instance, in 2024, CI&T's revenue in emerging markets showed slower growth compared to established regions. Focusing on high-growth areas is crucial for CI&T's strategic expansion and resource allocation.

- Areas with low market share face high investment needs.

- Growth rates in these regions are typically limited.

- Resource allocation should prioritize high-growth areas.

- CI&T's financial performance varies regionally.

Dogs in CI&T's BCG Matrix represent services with low growth and market share, often requiring high investment. In 2024, these services may show limited revenue increases. For example, IT services with no digital transformation focus could see only a 2% increase, with low adoption.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Low Growth | Limited Returns | 2% revenue increase |

| Low Market Share | High Investment Needs | 5% adoption rate |

| Limited Scalability | Restricted Expansion | 3% growth in specialized services |

Question Marks

CI&T's immersive experiences, like those for onboarding and shopping, fit the "Question Mark" quadrant of the BCG Matrix. These offerings are in a high-growth market, yet CI&T currently holds a small market share. The strategy involves focused marketing to increase adoption. For example, the global VR/AR market was valued at $46.9 billion in 2023, showing significant growth potential.

CI&T's digital sustainability solutions are question marks within its BCG Matrix, capitalizing on the rising demand for eco-friendly practices. These solutions, which focus on assisting large corporations with their ESG goals through digital services, require strategic investment to boost market presence. In 2024, the ESG software market was valued at $1.02 billion, projected to reach $1.6 billion by 2029. This market growth presents a significant opportunity for CI&T to become a key player.

Generative AI applications are question marks, showing high potential but uncertain market acceptance. These applications need investments to prove their worth and gain market share. CI&T is focusing on Gen AI agents, boosting software development. In 2024, the Gen AI market grew significantly, with investments reaching billions.

New Industry Verticals

CI&T's move into new industry verticals is a question mark in its BCG matrix. This expansion beyond finance and healthcare presents growth opportunities but also entails risks and investments. The company strategically appoints leaders to fuel growth in sectors beyond its core. This approach aims at diversifying revenue streams.

- Expansion into new sectors beyond financial services and healthcare is a question mark.

- These sectors offer potential growth but require investments to establish a market presence.

- Strategic appointments are aimed at driving growth in key verticals.

- Diversification is a key strategy.

Product Maturity Assessment

CI&T's product maturity assessment service is positioned as a question mark within the BCG Matrix, indicating high market growth potential but low market share. This service helps clients improve their product strategies and navigate a competitive landscape. To succeed, CI&T must invest in marketing and enhance the service. The goal is to increase its market share.

- 2024: The global product lifecycle management market is projected to reach $80.3 billion.

- CI&T's revenue in 2023 was $1.02 billion.

- Investment in marketing can increase brand awareness.

- Refinement of services can boost client satisfaction.

CI&T's immersive experiences represent "Question Marks" in the BCG Matrix. They operate in high-growth markets. Currently, they have a small market share. This requires focused marketing. The VR/AR market was worth $46.9B in 2023.

| Aspect | Details |

|---|---|

| Market | High Growth, Low Share |

| Strategy | Focused Marketing |

| Example | VR/AR market worth $46.9B (2023) |

BCG Matrix Data Sources

The CI&T BCG Matrix uses company data, market analysis, industry reports, and expert views for data-backed insights.