CI&T SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

What is included in the product

Analyzes CI&T’s competitive position through key internal and external factors.

Provides a simple SWOT template for swift and confident decision-making.

What You See Is What You Get

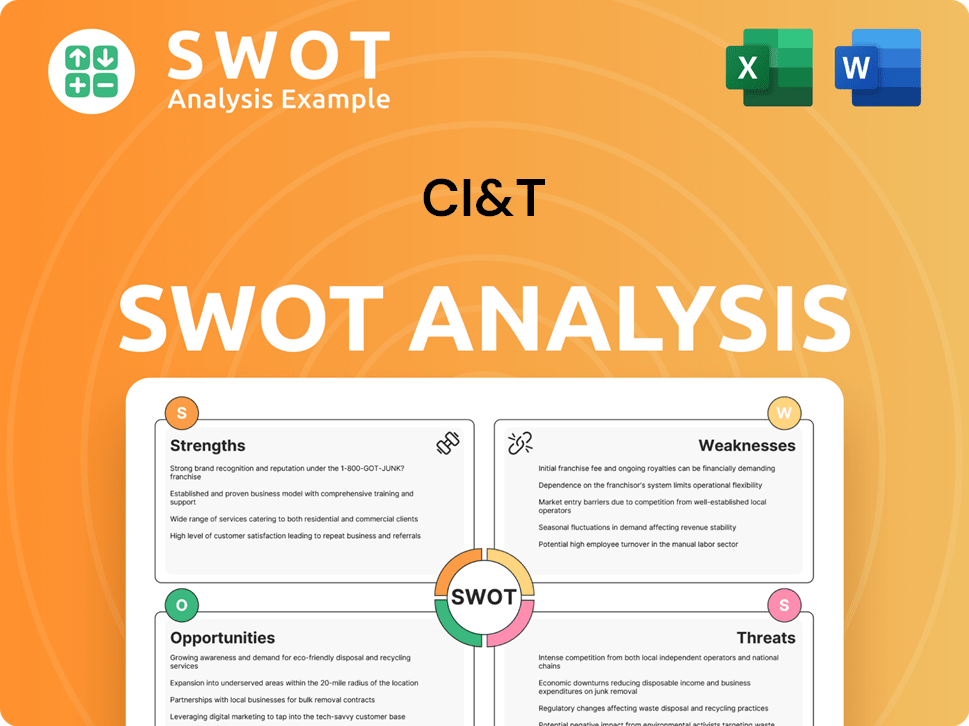

CI&T SWOT Analysis

See a snippet of the exact CI&T SWOT analysis. What you see here is what you'll receive immediately after purchase.

It’s a comprehensive breakdown of Strengths, Weaknesses, Opportunities & Threats.

The full document mirrors this professional quality and insightful structure.

Purchase now to get the complete analysis for strategic planning!

SWOT Analysis Template

The CI&T SWOT analysis offers a glimpse into their competitive landscape, revealing core strengths like technological prowess and strategic acquisitions. Weaknesses, such as potential market concentration, are also examined. Opportunities in digital transformation and data analytics are presented, contrasted by threats like changing market dynamics. Our snapshot provides valuable insights.

Unlock the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

CI&T excels in digital transformation, using AI, ML, cloud, and analytics. They offer tailored, scalable solutions. CI&T FLOW, their AI platform, boosts productivity. In Q1 2024, digital transformation spending rose by 16% globally. This expertise drives client success.

CI&T boasts strong client relationships, serving major global companies. Their client portfolio includes big names across sectors like consumer goods and healthcare. This positions CI&T as a preferred partner. For example, in Q1 2024, CI&T reported a 15% increase in revenue from key accounts.

CI&T's consistent revenue growth is a significant strength. In Q4 2024, net revenue increased, with strong profitability and cash flow. The full year 2024 also showed revenue and profit growth. This financial health supports future investments.

Global Presence and Expanding Footprint

CI&T's global reach is a significant strength, enabling it to serve a wide array of international clients. It has a presence in several countries, enhancing its ability to offer diverse services. This global footprint supports its expansion into new markets. CI&T's workforce exceeds 7,000 professionals, demonstrating its capacity to handle large-scale projects. This extensive network allows for 24/7 service and access to diverse talent pools.

- Presence in North America, South America, Europe, and Asia-Pacific.

- Over 7,000 professionals globally.

- Expansion into new markets like the Middle East.

- Offers services in multiple languages.

Focus on Innovation and Talent Development

CI&T's strength lies in its dedication to innovation and talent development. They prioritize continuous learning and development, especially in areas like AI. This commitment allows CI&T to offer advanced digital solutions. Their investment in talent helps them stay competitive. It's a key factor in delivering cutting-edge services.

- In Q1 2024, CI&T reported a 12.5% increase in revenue, driven by demand for AI and digital transformation services.

- CI&T invests approximately 10% of its revenue in R&D and employee training programs.

- They have increased their AI-related training programs by 30% in 2024.

CI&T leverages digital expertise and an AI-powered platform to boost client productivity, with Q1 2024 digital transformation spending increasing globally. It maintains strong relationships with major global firms across key sectors, with Q1 2024 revenue from key accounts up 15%. Consistent revenue growth is another strength; in Q4 2024, the net revenue went up, alongside healthy profitability. This fuels future investments.

CI&T has a worldwide presence across Americas, Europe, and Asia-Pacific with a workforce over 7,000, facilitating worldwide services, plus expansion, and talent diversity. Furthermore, CI&T heavily invests in innovation and talent development, concentrating on AI. In Q1 2024, a 12.5% rise in revenue, because of AI and digital transformation, was noticed. This continuous improvement keeps the business competitive. CI&T commits approximately 10% of its revenue into R&D.

| Strength | Description | Data Point |

|---|---|---|

| Digital Transformation | AI, ML, cloud, and analytics. | Q1 2024: Digital Transformation Spending up 16% |

| Client Relationships | Global company portfolio. | Q1 2024: Revenue from Key Accounts +15% |

| Revenue Growth | Financial performance. | Q4 2024: Revenue increased |

Weaknesses

CI&T's digital transformation market presence means it faces strong competition from established IT service providers and digital agencies. This intense competition requires continuous differentiation of services to stand out. In 2024, the global digital transformation market was valued at approximately $800 billion, with projections to reach over $1.4 trillion by 2027. This rapid growth attracts many players, intensifying competition for market share.

CI&T's revenue, though generally upward, shows volatility, with past declines. Long-term contracts, while stable, risk revenue if clients cut spending. In Q1 2024, revenue decreased slightly despite overall growth. This highlights the vulnerability to client spending changes. The company's reliance on specific sectors can amplify this risk.

CI&T's growth via acquisitions introduces integration hurdles. Merging distinct teams and technologies can be complex. This impacts operational efficiency and potentially financial outcomes. For instance, in Q1 2024, integration costs from recent acquisitions slightly affected profit margins. Successful integration is critical for realizing anticipated synergies and boosting overall performance.

Need for Continued Investment in Technology Infrastructure

CI&T faces the challenge of continually investing in technology infrastructure to remain competitive. This ongoing investment represents a considerable financial commitment, potentially impacting profitability. The company must allocate resources effectively to upgrade and maintain its technological capabilities, which can be expensive. Failure to do so could lead to obsolescence and a loss of market share. For instance, in 2024, IT spending worldwide reached $4.7 trillion.

- High Capital Expenditure: Significant ongoing investment in hardware, software, and cloud services.

- Rapid Technological Advancements: Constant need to adapt to new technologies and upgrade systems.

- Maintenance Costs: Continuous expenses for maintenance, support, and security upgrades.

- Potential for Cost Overruns: Risks associated with project delays or unforeseen expenses.

Exposure to Cybersecurity Threats

CI&T faces cybersecurity risks, a common challenge for tech firms. Data breaches could halt operations and harm its image. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025. Strong security measures are essential to protect client data and maintain trust. Failing to do so could impact financial performance.

- Projected cost of cybercrime by 2025: $10.5 trillion annually.

- Cybersecurity incidents can disrupt operations.

- Reputational damage from breaches can reduce trust.

- Robust security is crucial for client data protection.

CI&T's weaknesses include intense competition in a growing but crowded market. Revenue volatility and reliance on client spending pose financial risks, illustrated by slight decreases in Q1 2024 despite growth. Acquisition integration introduces operational complexities. Continual tech investment impacts profitability. Cybersecurity risks are significant.

| Weakness | Impact | Data |

|---|---|---|

| Market Competition | Erosion of Market Share | Digital transformation market ~$800B in 2024, >$1.4T by 2027 |

| Revenue Volatility | Unpredictable Earnings | Q1 2024 revenue decline (slight) |

| Acquisition Integration | Operational Inefficiencies | Integration costs impacted profit margins |

| Tech Investment | Margin Pressure | IT spending worldwide: $4.7T in 2024 |

| Cybersecurity Risks | Financial & Reputational Damage | Cybercrime cost ~$10.5T annually by 2025 |

Opportunities

The global digital transformation market is booming, offering CI&T a prime chance to grow. In 2024, this market was valued at over $760 billion, and is projected to reach $1.4 trillion by 2027. This expansion fuels demand for CI&T's digital solutions. This growth opens doors to new clients and broader service offerings.

CI&T can capitalize on strategic appointments and target key verticals like financial services and healthcare. North America offers significant growth potential, supported by a 2024 market size of $2.8 trillion in financial services alone. Expansion into Asia-Pacific and Japan, where digital transformation spending is rising, presents further opportunities. These regions saw digital transformation investments reach $500 billion in 2024.

The rising use of AI, especially Generative AI, offers CI&T chances to create new AI-driven services. This includes boosting internal efficiency and improving what they offer to clients. The AI market is projected to reach $1.8 trillion by 2030. CI&T can capitalize on this through innovative solutions.

Strategic Partnerships and Collaborations

Strategic partnerships offer CI&T significant growth prospects. Collaborations with tech leaders boost reach and enhance service capabilities. Recent data shows that partnerships can increase revenue by up to 20%. These alliances enable broader, more comprehensive solutions.

- Enhanced Market Access: Partnerships with established firms can open doors to new markets and customer segments.

- Technology Integration: Collaborations facilitate access to cutting-edge technologies and innovation.

- Increased Service Offerings: Partnerships allow CI&T to expand its service portfolio and offer more integrated solutions.

- Shared Resources: Joint ventures can lead to cost savings and resource optimization.

Capitalizing on the Shift to AI-First Businesses

The trend toward AI-first businesses presents a significant opportunity for CI&T. Their deep understanding of AI and platforms such as CI&T FLOW are crucial for companies undergoing digital transformation. The global AI market is projected to reach $1.81 trillion by 2030, growing at a CAGR of 36.8%. This growth indicates a rising demand for AI implementation services.

- AI market growth: $1.81T by 2030.

- CI&T FLOW helps AI integration.

- Demand for AI services is increasing.

CI&T has major growth prospects with the digital transformation market, expected to hit $1.4T by 2027. Strategic partnerships enhance market access, driving revenue up to 20%. The expanding AI sector, set to reach $1.8T by 2030, also offers key opportunities.

| Opportunity | Description | Financial Impact |

|---|---|---|

| Digital Transformation | Growth in demand for digital solutions and services. | Market Size: $1.4T by 2027. |

| Strategic Partnerships | Collaborations expanding reach and services. | Revenue Increase: Up to 20%. |

| AI Market Growth | Rising demand for AI integration services. | Market Size: $1.8T by 2030. |

Threats

CI&T faces tough competition in the digital transformation space, with established firms and new entrants constantly battling for clients. In 2024, the digital transformation market was valued at approximately $790 billion globally. This fierce competition can pressure CI&T's pricing and profit margins. The rise of new competitors poses a challenge to CI&T's market position.

Economic downturns pose a significant threat, as clients may cut IT spending. CI&T's revenue and expansion could be directly affected by reduced budgets. For example, in Q1 2024, IT spending growth slowed to 3.2% due to economic concerns. This could lead to project delays or cancellations.

CI&T faces threats in acquiring and retaining talent, especially in a competitive tech market. High employee turnover can disrupt project timelines and increase costs. For instance, the IT sector sees an average turnover rate of around 18-20% annually (2024 data). Moreover, the cost of replacing an employee can be substantial, potentially reaching up to 1.5x their annual salary.

Rapid Technological Changes

Rapid technological changes present a significant threat to CI&T. The relentless pace of innovation demands continuous adaptation and substantial investment in new technologies. Companies that fail to evolve risk falling behind, losing market share, and becoming obsolete. For instance, the IT services market is projected to reach $1.4 trillion in 2024, highlighting the scale of competition and need for innovation.

- Increased R&D spending is essential to keep pace.

- Outdated systems can lead to reduced efficiency and customer dissatisfaction.

- Cybersecurity threats are constantly evolving, requiring ongoing vigilance.

- Emerging technologies, such as AI, can disrupt existing business models.

Data Privacy and Security Concerns

Data privacy and security concerns are growing, presenting a real threat. Stricter regulations, like those in the EU's GDPR and California's CCPA, demand robust data protection. CI&T must invest heavily in security to avoid breaches and maintain client trust. Failure could lead to significant financial penalties and reputational damage. In 2024, data breaches cost companies an average of $4.45 million globally.

- Compliance costs could rise by 15% annually.

- Cybersecurity insurance premiums are increasing by 20%.

- Client churn could increase by 10% if data breaches occur.

CI&T faces intense competition, impacting pricing and market position in the $790 billion digital transformation market of 2024. Economic downturns and reduced IT spending, with a Q1 2024 IT spending growth of only 3.2%, threaten revenue. Talent acquisition and retention challenges, along with rapid tech changes (IT services market projected to $1.4 trillion in 2024), and rising data security demands ($4.45M average breach cost) pose significant risks.

| Threat | Impact | 2024/2025 Data |

|---|---|---|

| Competition | Price pressure, market share loss | Digital transformation market: $790B (2024) |

| Economic Downturns | Reduced IT spending, project delays | Q1 2024 IT spending growth: 3.2% |

| Talent & Tech | Increased costs, innovation gap, Cybersecurity breaches | IT sector turnover rate 18-20%; average data breach cost $4.45M (2024) |

SWOT Analysis Data Sources

This SWOT analysis leverages robust sources: financial reports, market studies, analyst assessments, and company disclosures, ensuring a reliable evaluation.