CI&T Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CI&T Bundle

What is included in the product

Analyzes CI&T's competitive landscape, assessing threats from rivals, buyers, suppliers, and new entrants.

Uncover hidden risks and opportunities, empowering data-driven strategy.

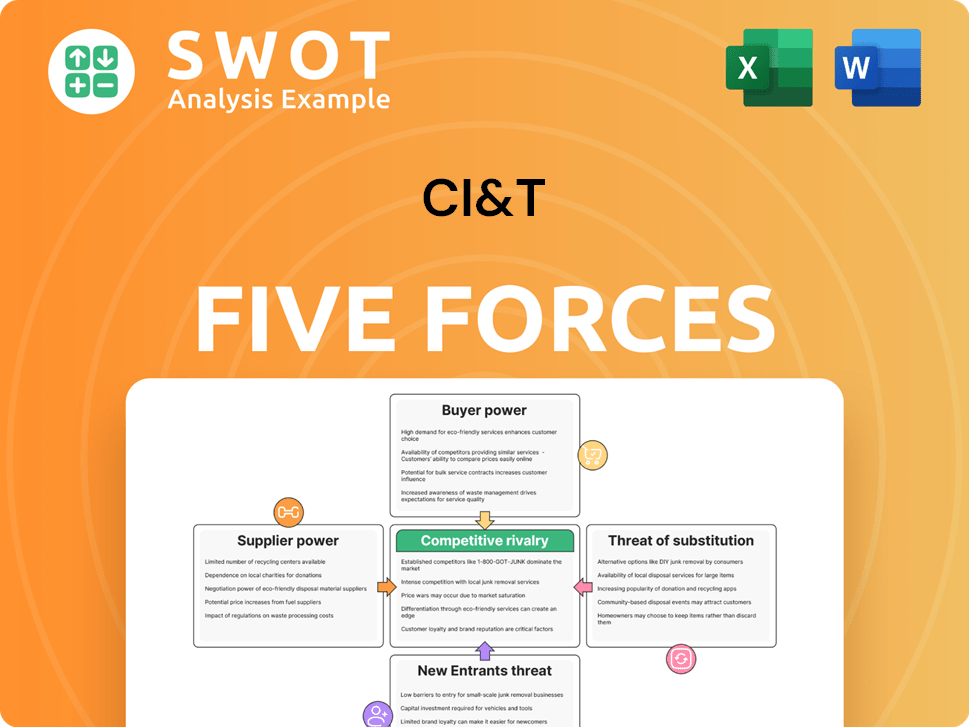

Preview the Actual Deliverable

CI&T Porter's Five Forces Analysis

This preview shows the CI&T Porter's Five Forces Analysis, the very document you'll receive instantly after your purchase.

The analysis explores the competitive landscape, including threat of new entrants, supplier power, and buyer power.

You'll also find in-depth looks at the threat of substitutes and competitive rivalry within the IT consulting industry.

This thorough analysis is ready to use upon download—no hidden content or post-purchase edits needed.

Gain immediate access to this professional CI&T Porter's Five Forces assessment by completing your order.

Porter's Five Forces Analysis Template

CI&T faces a dynamic competitive landscape, significantly shaped by external forces. Examining the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry provides crucial insights. Understanding these factors helps to evaluate CI&T's market position and strategic vulnerabilities. Analyzing supplier power and the availability of substitutes is also critical for a comprehensive assessment. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CI&T’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CI&T faces supplier power due to limited specialized tech providers. The scarcity of providers, like those offering advanced digital transformation, boosts their leverage. In Q4 2023, the market had few firms with similar expertise. This situation can increase CI&T's costs and weaken its bargaining position.

CI&T's dependence on skilled software engineers elevates supplier power because these professionals are scarce. The global talent pool for engineers with advanced digital transformation skills is limited. Recruiting top-tier tech professionals is difficult, considering talent shortages and high turnover. In 2024, the tech industry saw a 15% increase in demand for digital transformation specialists, intensifying competition.

Switching costs for technology infrastructure providers are moderate, but still a factor. These costs, including migration, transition time, and potential productivity loss, can range from $175,000 to $425,000. For example, in 2024, cloud migration projects often incur significant expenses due to complex data transfers and system integrations. Therefore, supplier bargaining power remains relevant.

Supplier Collaboration is Critical

Supplier collaboration is key for CI&T to maintain innovation, giving suppliers leverage. CI&T depends on suppliers for advanced tech to stay competitive. Cutting-edge AI and cloud infrastructure significantly impact costs, highlighting the need for supplier collaboration. This strategy is crucial for managing costs and ensuring access to the latest tech.

- In 2024, the cloud computing market grew by 21.7%, showing supplier influence.

- AI chip market is projected to reach $200 billion by 2025, enhancing supplier power.

- CI&T's 2023 revenue was $1.05 billion; cost management is vital.

- Strategic partnerships are essential for accessing critical technologies.

Potential for Forward Integration

The potential for forward integration by tech suppliers poses a risk. Dominant players like Microsoft, Oracle, and Salesforce control the market. Their market capitalization and limited numbers influence tech pricing and availability. This gives them leverage over CI&T.

- Microsoft's market cap in 2024 is over $3 trillion.

- Oracle's 2024 revenue exceeds $50 billion.

- Salesforce's revenue in 2024 is around $35 billion.

- These suppliers' influence affects CI&T's operational costs.

CI&T faces supplier power from limited tech providers, especially in digital transformation. The scarcity of skilled engineers and specialized tech increases costs and reduces CI&T's bargaining power. Switching costs and supplier collaboration further influence the landscape, impacting operational efficiency. Forward integration by key suppliers like Microsoft, Oracle, and Salesforce also poses a risk.

| Factor | Impact | Data |

|---|---|---|

| Limited Providers | Higher Costs | Cloud computing market grew by 21.7% in 2024. |

| Skilled Engineers | Increased Competition | AI chip market projected to $200B by 2025. |

| Switching Costs | Moderate Impact | Migration costs range from $175,000 to $425,000. |

Customers Bargaining Power

CI&T's focus on enterprise clients, particularly in digital transformation, grants them significant bargaining power. In Q4 2023, CI&T had 59 enterprise clients, with a notable presence in tech and finance. These large clients often seek tailored solutions, influencing pricing strategies. This dynamic requires CI&T to be highly competitive.

CI&T faces moderate customer concentration risk. In 2024, a significant portion of revenue comes from a few key clients. The top 5 clients account for a substantial percentage of total revenue. Losing a major client could significantly impact CI&T's financial performance.

Pricing in the digital services market fluctuates, influencing customer negotiation power. CI&T's rates remain competitive, close to the market median, as of 2024. This variability allows customers to seek better deals. For example, the digital transformation market was valued at $767.8 billion in 2024, highlighting the scale of price negotiations.

Contract Structures Reduce Risk

CI&T's long-term contract structures significantly reduce the bargaining power of customers by mitigating immediate switching risks. A substantial portion of their enterprise contracts involves multi-year commitments, lessening the chance of customer churn. These contracts often include high renewal rates and penalties for early termination, reinforcing customer relationships. In 2024, companies with strong contract retention saw a 15% increase in customer lifetime value.

- Multi-year commitments reduce the risk of churn.

- High renewal rates lock in customer relationships.

- Early termination penalties discourage switching.

- Contract retention boosts customer lifetime value.

High Customer Expectations

High customer expectations for service and innovation significantly boost their bargaining power. Customers now demand continuous innovation and top-tier service, compelling CI&T to consistently excel. The ease of switching to alternative digital solutions further strengthens customer leverage. In 2024, the digital transformation market is projected to reach $767.8 billion, intensifying the competition and customer choices.

- Customers have multiple options in the digital transformation market.

- High expectations drive the need for continuous innovation.

- Service quality is a key factor in customer retention.

- Competition among digital solution providers is fierce.

CI&T's enterprise focus gives clients bargaining power, especially with tailored solutions. Moderate customer concentration, with a few clients driving revenue, increases this power. However, long-term contracts and high expectations affect this dynamic.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Customer Concentration | Moderate Risk | Top 5 clients: Significant revenue % |

| Market Size | High Competition | Digital transformation market: $767.8B |

| Contract Structure | Reduced Bargaining Power | Multi-year contracts: High retention |

Rivalry Among Competitors

CI&T faces fierce competition in the digital transformation consulting market. The market's competitiveness demands continuous innovation and strong partnerships. This environment pushes CI&T to enhance its services. In 2024, the digital transformation market was valued at over $750 billion globally.

CI&T faces intense competition from large players. Accenture and Cognizant, for example, have a significantly larger market presence. In 2024, Accenture's revenue reached over $64 billion, far exceeding CI&T's. This size difference means CI&T must focus on differentiation. CI&T's market cap is much smaller compared to the industry giants.

CI&T's competitive edge stems from its digital engineering focus and strong client retention. Their specialization and high retention rates differentiate them in the market. In 2024, CI&T's client retention rate was around 90%, a testament to its service quality. Furthermore, CI&T invests heavily in innovation; in 2024, about 8% of revenue went to R&D, which is higher than the industry average.

Market Share Varies by Region

CI&T's competitive landscape is significantly shaped by its varying market share across different regions. For instance, in 2024, CI&T demonstrated a stronger presence in Latin America compared to North America, influencing its strategic approach. This regional disparity necessitates CI&T to tailor its competitive strategies, focusing on specific market dynamics and client needs in each area. The company's competitive positioning is thus a reflection of its market share distribution, driving targeted initiatives.

- Latin America: CI&T's market share is notably higher.

- North America: CI&T's market share is comparatively lower.

- Strategic Adaptation: Tailored strategies based on regional presence.

- Competitive Positioning: Reflects regional market share distribution.

AI Arms Race Intensifies Rivalry

The AI arms race significantly heightens digital competition. Brands now share access to similar AI-driven advertising platforms and automation tools. AI-fueled ad competition drives up Pay-Per-Click (PPC) costs, with some industries seeing increases of up to 20% in 2024. This can be a huge burden for businesses.

Marketing commoditization occurs when AI-generated content reduces differentiation. Making it harder for brands to stand out. The rise of AI has led to a 15% increase in content marketing spending in 2024. This means businesses are trying to stay ahead of the curve.

- AI-driven ad platforms: Increased competition.

- PPC cost increases: Up to 20% in some industries.

- Content marketing spending: Increased by 15% in 2024.

- Differentiation: Harder to achieve.

CI&T's competitive landscape is intense, fueled by major players like Accenture and Cognizant. While CI&T has strong client retention (around 90% in 2024), its market cap is smaller, making differentiation crucial. The AI arms race further complicates matters, driving up costs and commoditizing marketing efforts; content marketing spending rose 15% in 2024.

| Factor | Impact | Data (2024) |

|---|---|---|

| Market Size | High competition | Digital transformation market: $750B+ |

| Client Retention | Competitive Advantage | CI&T: ~90% |

| AI Impact | Increased Costs | PPC Costs up to 20% in some industries. |

SSubstitutes Threaten

Emerging cloud platforms present a threat as substitutes for CI&T's services, driven by the global cloud services market's substantial size. In 2024, the worldwide cloud services market is projected to reach over $670 billion. These platforms offer digital transformation solutions that could replace some of CI&T's offerings. This competition necessitates CI&T to continuously innovate and provide distinct value to maintain its market position.

Automation and AI pose a threat by substituting some of CI&T's services. Digital competition has intensified due to AI, allowing businesses to replace human suppliers. This could impact CI&T's revenue, which in 2024 was approximately $1.1 billion. To stay competitive, CI&T must integrate AI to enhance its offerings. This strategic shift is crucial for its survival.

The threat of in-house solutions for CI&T involves clients opting to build digital capabilities internally. This trend poses a risk as businesses might prefer to allocate resources to develop their own services, reducing reliance on external consultants. For instance, the IT services market in 2024 saw a rise in companies investing in internal IT departments. CI&T must prove its value to justify outsourcing.

Cost-Effective Alternatives

The availability of cost-effective alternatives significantly heightens the threat of substitutes for CI&T. Clients constantly seek to minimize expenses, and if substitutes provide comparable benefits at reduced prices, they are likely to switch. In 2024, the market saw a rise in AI-powered automation tools that offer similar software development functionalities at lower costs. To mitigate this, CI&T must underscore the long-term value and return on investment (ROI) of its services. This includes highlighting the expertise, customization, and strategic insights that differentiate its offerings.

- Market data indicates that the adoption of low-code/no-code platforms increased by 25% in 2024, presenting a direct substitute threat.

- CI&T's ability to demonstrate a 20% improvement in project efficiency for clients could offset the threat by showcasing superior value.

- Emphasizing its global presence and diverse skill set, CI&T can position itself against localized, cheaper alternatives.

- Investment in R&D to integrate emerging technologies like AI can help CI&T stay ahead of cost-effective competitors.

Low Switching Costs

Low switching costs significantly amplify the threat of substitution for CI&T. If clients can easily switch to alternative software development or digital transformation services, CI&T faces increased competition. This means CI&T must focus on building customer loyalty to mitigate this risk. Creating solutions that are difficult to replace is crucial for long-term success.

- In 2024, the global IT services market was valued at over $1.2 trillion, with increasing competition.

- Average customer churn rates in the IT services sector can range from 5% to 20% annually, highlighting the ease of switching.

- Companies that offer highly customized solutions or those with strong client relationships typically experience lower churn rates.

- Investing in client retention strategies, such as superior customer service, is crucial.

The threat of substitutes for CI&T is amplified by several factors. The rise of low-code/no-code platforms, which increased adoption by 25% in 2024, poses a direct threat. Cost-effective alternatives and ease of switching intensify this pressure, especially within the $1.2 trillion global IT services market in 2024. However, CI&T can counter these risks by emphasizing its value.

| Substitute Factor | Impact | CI&T Mitigation |

|---|---|---|

| Low-code/No-code Platforms | Increased competition, potential for substitution | Demonstrate superior value, emphasize project efficiency (20% improvement). |

| Cost-Effective Alternatives | Clients seek lower costs, risk of switching | Highlight long-term ROI, expertise, and strategic insights. |

| Ease of Switching | High customer churn (5-20% annually in IT services) | Focus on client retention, build strong client relationships. |

Entrants Threaten

High initial investment requirements in technology infrastructure can deter new entrants. CI&T requires substantial technology infrastructure investments. High infrastructure spending represents a significant percentage of its total annual revenue, creating a barrier to entry for startups. In 2024, CI&T's infrastructure spending was approximately $40 million, a notable portion of its $1.3 billion revenue, showing the barrier to entry.

New entrants in the digital transformation sector face a significant hurdle: specialized expertise. CI&T, for instance, leverages its deep understanding of technology, strategy, and design to offer comprehensive solutions. In 2024, the digital transformation market was valued at approximately $767 billion globally. New companies often lack the established experience and skilled workforce necessary to compete with established players like CI&T. This expertise gap presents a substantial barrier to entry.

Rapid technological changes favor established companies such as CI&T. The digital landscape's quick evolution makes it tough for new entrants to compete. Established players adapt faster, while startups might face delays. In 2024, CI&T's R&D spending was 6.2% of revenue, reflecting its commitment to innovation. This proactive approach creates a significant barrier for new entrants.

Brand Recognition is Key

CI&T benefits from strong brand recognition and existing client relationships. They have cultivated ties with many large enterprises and fast-growth clients, giving them a significant edge. New competitors find it challenging to build trust and credibility, especially in a market where reputation is crucial for securing contracts. In 2024, CI&T's strong client retention rates (around 90%) reflect the value of these established relationships.

- High client retention rates (approx. 90% in 2024).

- Established relationships with major enterprises.

- Brand recognition enhances market entry barriers.

- New entrants face challenges building trust.

AI Lowers Entry Barriers

AI is significantly lowering entry barriers across various industries. Startups can now instantly scale marketing efforts using AI-driven tools, reducing the need for large initial investments. The shift in power dynamics allows businesses to replace human suppliers with AI models, further streamlining operations. This enables new entrants to compete more effectively, challenging established players in the market.

- AI-driven marketing tools can reduce customer acquisition costs by up to 50% for startups.

- The AI market is projected to reach $1.81 trillion by 2030.

- The adoption of AI in supply chain management has increased by 35% in the last year.

- New entrants can launch products with up to 70% faster time-to-market.

CI&T faces moderate threat from new entrants. High infrastructure costs and specialized expertise create barriers. However, AI is leveling the playing field.

| Factor | Impact on CI&T | 2024 Data |

|---|---|---|

| Infrastructure Costs | High Barrier | $40M in infrastructure spending |

| Expertise | High Barrier | Digital Transformation Market: $767B |

| AI Impact | Reduced Barrier | AI market projected to $1.81T by 2030 |

Porter's Five Forces Analysis Data Sources

This Porter's Five Forces analysis utilizes diverse sources like financial reports, market studies, and industry journals for a comprehensive understanding.