Cisco Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cisco Systems Bundle

What is included in the product

Tailored analysis for Cisco's product portfolio across the BCG Matrix, revealing strategic investment priorities.

Cisco's BCG Matrix with an export-ready design for swift drag-and-drop into PowerPoint.

Preview = Final Product

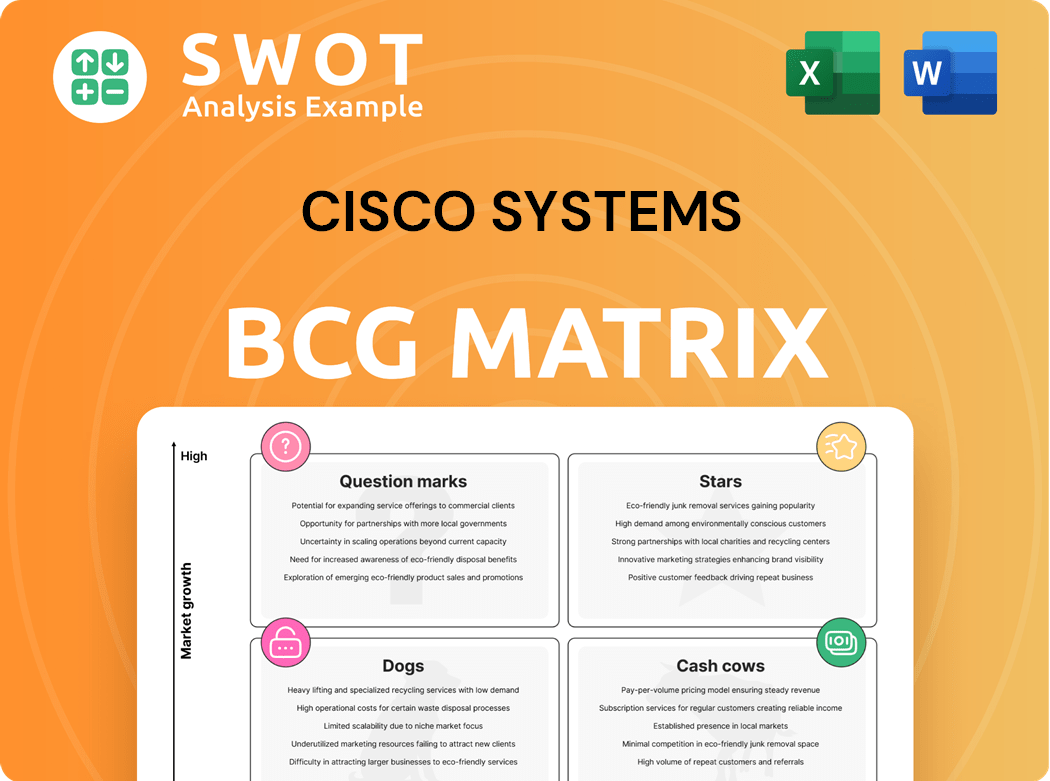

Cisco Systems BCG Matrix

The BCG Matrix preview is the complete report you'll receive after purchase. Featuring in-depth analysis and Cisco-specific data, this is the fully editable file for your strategic planning.

BCG Matrix Template

Cisco Systems' product portfolio spans various market segments, from networking hardware to cloud solutions. Understanding its position in the market is crucial for investment decisions. This peek offers a glimpse of how Cisco's offerings align within the BCG Matrix. Identifying Stars, Cash Cows, Dogs, and Question Marks is key to strategic planning. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Cisco's AI-driven networking is a "Star" due to its high growth potential. These solutions boost network performance and improve security. Cisco's AI infrastructure strategy saw strong growth in Q2 FY2025. AI-related orders reached $350 million for the quarter.

Cisco's cybersecurity platforms are thriving, fueled by escalating cyber threats. These platforms, enhanced with AI, offer robust threat detection and response. Security revenue surged by 117% in Q2 FY 2025, driven by Splunk, SASE, and network security. This segment's growth highlights Cisco's strong position in the market.

Cisco's data center switches, like the N9300 Series, are stars due to their high performance and low latency, essential for AI. In 2024, the data center switching market is valued at billions, with Cisco holding a significant share. These switches directly address the growing demand for AI infrastructure.

Secure Access Service Edge (SASE)

Cisco's Secure Access Service Edge (SASE) is a "Star" within its BCG matrix, indicating high growth potential and market share. SASE solutions are crucial for secure remote access and cloud connectivity, aligning with evolving business needs. Cisco's strong position in this area enables it to benefit from the increasing demand for secure cloud-based resources. Security revenue, including SASE, surged, demonstrating its importance.

- SASE adoption is driven by the need for robust security in hybrid work environments.

- Cisco's SASE offerings integrate security and networking into a unified cloud-delivered service.

- The market for SASE is expanding as businesses prioritize secure access to applications.

WiFi 7 Access Points

Cisco's WiFi 7 access points are positioned as Stars in the BCG Matrix due to their strong growth potential in the evolving wireless market. These access points are designed to meet the rising demand for high-speed, reliable wireless connectivity across various sectors. Cisco's focus on intelligent, secure, and assured wireless infrastructure enhances their market competitiveness. The company's investment in WiFi 7 reflects its commitment to innovation and market leadership.

- Cisco's revenue from wireless products was $1.8 billion in Q4 2023.

- The global WiFi 7 market is projected to reach $11.9 billion by 2028.

- Cisco's market share in the enterprise wireless market is about 45%.

Cisco's "Stars" include AI-driven networking, cybersecurity platforms, data center switches, SASE, and WiFi 7 access points, showing strong growth. AI-related orders reached $350 million in Q2 FY2025. Security revenue surged 117% in Q2 FY2025. WiFi revenue was $1.8 billion in Q4 2023, with the WiFi 7 market projected at $11.9B by 2028.

| Star Product | Key Feature | Financial Data (2023-2025) |

|---|---|---|

| AI-Driven Networking | Boosts network performance, security. | AI orders: $350M (Q2 FY2025) |

| Cybersecurity | Robust threat detection, AI-enhanced. | Security revenue up 117% (Q2 FY2025) |

| Data Center Switches | High performance, low latency. | Data Center Market: Billions (2024) |

| SASE | Secure remote access, cloud connectivity. | SASE growing due to hybrid work. |

| WiFi 7 | High-speed, reliable wireless. | WiFi revenue $1.8B (Q4 2023); WiFi 7 market to $11.9B by 2028 |

Cash Cows

Cisco's enterprise routing products, known for high performance, are a cash cow. The router market is mature, ensuring stable demand and consistent revenue. Cisco holds a significant market share; in 2024, Cisco's revenue from switching and routing was approximately $30 billion. This segment provides predictable cash flow, supporting investments in other areas.

Cisco's enterprise switching is a cash cow, a mature market where Cisco holds a solid position. Their switches, known for reliability and advanced features, consistently generate revenue. In 2024, Cisco's switching revenue totaled billions, reflecting its market strength. This product line supports significant profitability for the company, providing funds for investment.

Cisco's telephony products, like Cisco Unified IP Phones, are cash cows. They have a broad customer base and bring in consistent revenue. In 2023, Cisco's total revenue was approximately $57 billion. These products are vital for business communication. The steady revenue stream makes them a reliable source of funds.

Network Management Software

Cisco's network management software is a cash cow, offering steady revenue through its essential network optimization tools. Demand remains stable, fueling consistent financial results. Cisco's innovation, especially with AI-driven tools, strengthens its market position. In fiscal year 2024, Cisco's software revenue reached $15.3 billion, a solid contribution.

- Stable revenue streams from network management tools.

- Focus on AI-driven innovation to maintain market relevance.

- Software revenue was $15.3 billion in fiscal year 2024.

- Essential for network performance and optimization.

Core Networking Hardware

Cisco's core networking hardware, such as switches and routers, is a Cash Cow. These products support established networks and yield consistent revenue from upkeep and enhancements. In fiscal year 2023, this sector brought in $13.2 billion, contributing 32.4% to Cisco's overall revenue. This demonstrates the segment's financial stability.

- Large installed base ensures steady revenue.

- Generates recurring revenue from maintenance.

- $13.2 billion revenue in fiscal year 2023.

- 32.4% of total company revenue.

Cisco's cash cow products, including switching and routing hardware, generate stable revenue. Network management software, essential for optimization, also performs well. Telephony products contribute consistently, supporting Cisco's financial health. Overall, these product lines provide significant, reliable revenue streams.

| Product Category | Revenue Source | 2024 Revenue (approx.) |

|---|---|---|

| Switching and Routing | Hardware Sales, Maintenance | $30 billion |

| Network Management Software | Software Licenses, Subscriptions | $15.3 billion |

| Telephony Products | Hardware, Services | Significant, steady |

Dogs

Traditional telephony hardware, a Cisco product, is positioned as a "Dog" in the BCG matrix. The market for these products is shrinking, with revenues down. Cisco's legacy hardware sales continue to decline as cloud-based solutions gain traction. In 2024, Cisco's voice hardware revenues were approximately $1 billion.

Cisco's on-premise data center infrastructure faces a challenging market. The segment's growth potential is diminishing. Many businesses are shifting to cloud services. This shift impacts Cisco's hardware sales. In 2024, this sector's revenue saw a decline.

Cisco's legacy security appliances face declining market appeal due to the rise of cloud-based solutions. This shift is evident in the cybersecurity market, with cloud security predicted to reach $77.5 billion by 2024. These appliances may need to be phased out or modernized to remain competitive. Cisco's strategic decisions must reflect this changing landscape to maintain market share.

Older Generation Network Management Software

Older generation network management software, a "Dog" in Cisco's BCG matrix, struggles due to limited market appeal. These solutions often can't compete with modern, advanced alternatives, potentially requiring expensive upgrades or eventual retirement. Cisco's shift towards cloud-based solutions highlights this trend, with a 2024 focus on software-defined networking. This segment faces declining revenues as customer preferences evolve, impacting its overall contribution to Cisco's portfolio.

- Declining market share due to technological obsolescence.

- High maintenance costs compared to newer solutions.

- Limited integration capabilities with modern network architectures.

- Potential for significant revenue decline.

Hardware-Focused Business Model

Cisco's hardware-focused business model faces challenges as software and cloud solutions gain prominence. The company's historic reliance on hardware is now a potential weakness, especially in a market valuing subscription models. Despite these shifts, Cisco is adapting by focusing on SaaS to enhance its growth, especially within the changing virtual communication landscape.

- In 2023, Cisco's hardware sales still accounted for a significant portion, approximately 65%, of its total revenue.

- Cisco's shift towards software is evident, with subscription revenue growing by 18% year-over-year in 2024.

- The company's market capitalization as of late 2024 is around $200 billion, reflecting its ongoing adaptation.

Cisco's "Dogs" include legacy hardware and software facing declining markets. These products experience reduced demand, contributing to decreasing revenues. Obsolescence and high maintenance costs challenge their competitiveness.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue Decline | Specific product segments face revenue decreases. | Legacy hardware ~ $1B, Security appliances down |

| Market Position | Fading appeal due to cloud and software shifts. | Cloud security market ~$77.5B |

| Strategic Focus | Requires phasing out or modernization. | Subscription revenue +18% YoY |

Question Marks

The integration of AI-powered humanoids in workplaces presents a question mark for Cisco. This collaboration, still nascent, demands re-evaluation of network infrastructure. Cisco's solutions must adapt to handle the real-time data needs of these interactions. The market for humanoid robots is projected to reach $17.3 billion by 2024, highlighting the stakes.

Cisco is exploring AI for sustainability, a "Question Mark" in its BCG Matrix. The market's growth is promising, but adoption rates are still evolving. Cisco's focus includes energy-efficient products, with AI enhancing efficiency. In 2024, Cisco invested heavily in AI initiatives, targeting a $5 billion market by 2027.

Cisco's AI-Based Security for AI Models falls under the Question Marks quadrant in the BCG Matrix. The increasing use of AI introduces novel security threats, like prompt injection attacks. Cisco is investing in AI-driven security solutions to counter these risks. However, market adoption and the efficacy of these solutions are currently uncertain. In 2024, the AI security market was valued at $20 billion, projected to reach $60 billion by 2028, indicating high growth potential.

Hypershield and Hybrid Mesh Firewall

Cisco's Hypershield and Hybrid Mesh Firewall are recent additions aimed at securing AI applications, fitting into the Question Marks quadrant of the BCG Matrix. The market's response and the actual impact of these security solutions are still uncertain. Cisco is leveraging its network integration to bolster security for AI. These new offerings are designed to protect against evolving cyber threats.

- Cisco's security revenue in FY24 reached $4.7 billion.

- Hypershield is built on eBPF, boosting performance.

- Hybrid Mesh Firewall aims to simplify security across hybrid environments.

- The AI security market is projected to grow significantly by 2024.

AI-Ready Infrastructure for Webscalers

Cisco is strategically entering the AI-ready infrastructure market, specifically targeting webscale customers. This move involves providing AI training infrastructure, a sector where competition is notably fierce. While Cisco is making strides, its market share in this arena remains to be seen. In Q2 FY 2025, AI-related orders reached $350 million, indicating initial traction.

- Focus on AI training infrastructure for webscale clients.

- Intense competition within the AI infrastructure market.

- Cisco's market share is currently evolving.

- AI-related orders hit $350 million in Q2 FY 2025.

Cisco's BCG Matrix spotlights several question marks. These include AI-powered humanoids, AI for sustainability, and AI-based security. Hypershield and Hybrid Mesh Firewall also fall under this category. The success hinges on market adoption and innovation.

| Area | Status | Financials (2024) |

|---|---|---|

| AI Security Market | High Growth | $20B Market Value |

| Cisco Security Revenue | Growing | $4.7B |

| AI-related orders Q2 FY25 | Initial traction | $350M |

BCG Matrix Data Sources

The Cisco Systems BCG Matrix leverages financial reports, industry analysis, and market trend data for strategic insights.