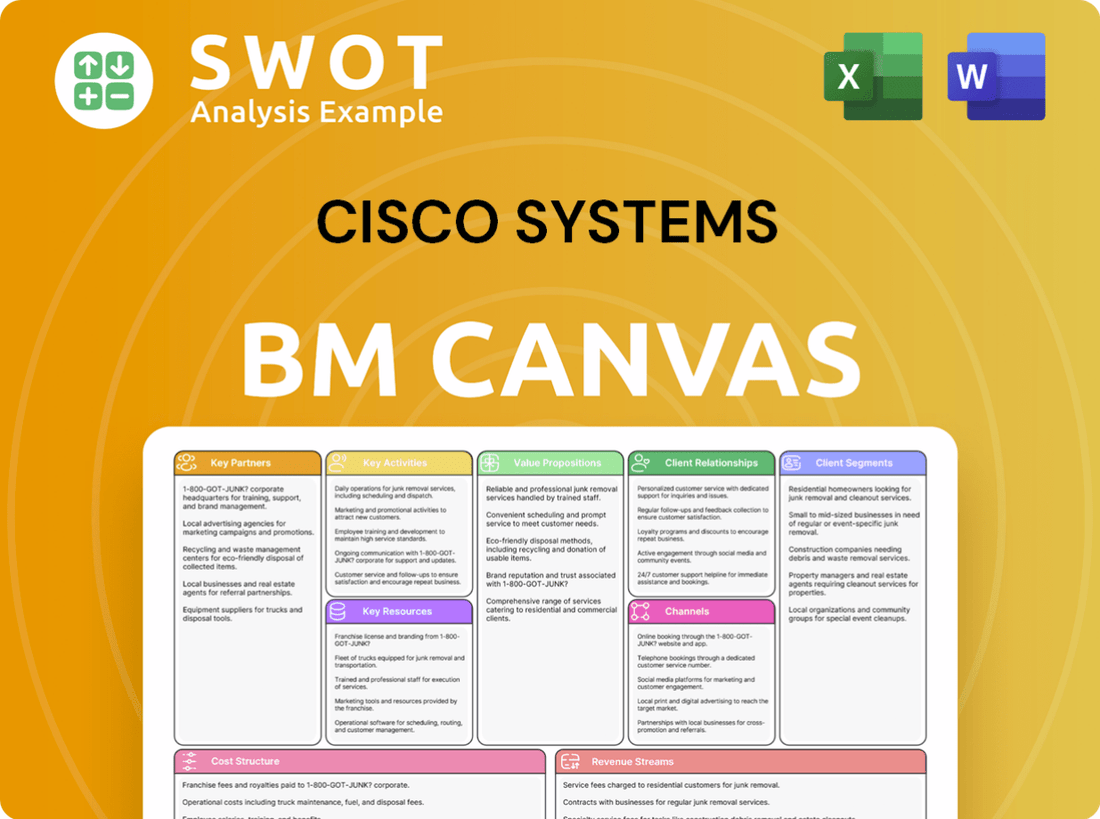

Cisco Systems Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cisco Systems Bundle

What is included in the product

Cisco's BMC covers customer segments, channels, and value propositions in full detail.

Clean and concise layout ready for boardrooms or teams.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you're previewing for Cisco Systems is the actual document you'll receive. It's a direct view of the final product. Upon purchase, you'll download this complete, ready-to-use file. There are no differences, just full access to this professional Canvas. The same formatted file is immediately accessible.

Business Model Canvas Template

Explore Cisco Systems's core strategies with our expertly crafted Business Model Canvas. Uncover how they leverage key partners, customer segments, and revenue streams. See how they maintain their technological advantage and market share. Download the full version for an in-depth analysis. Ready to boost your strategic understanding and actionable insights?

Partnerships

Cisco's Strategic Alliances are pivotal. They team up with NVIDIA and Microsoft for AI and cloud solutions. These partnerships boost Cisco's offerings and broaden its market reach. In 2024, Cisco's collaborations helped generate over $5 billion in joint revenue. These alliances drive innovation.

Cisco's partnerships with tech providers are vital for innovation. They collaborate with AI, cybersecurity, and IoT specialists. These partnerships help Cisco integrate advanced features. Cisco's revenue in Q3 2024 was $14.6 billion; these partnerships drive growth.

Cisco's partnerships with service providers are crucial for reaching customers. These include telecommunications companies and cloud providers. In 2024, Cisco's service revenue was a significant portion of its total revenue. Collaborations extend distribution and ensure accessibility.

Channel Partners

Cisco heavily relies on channel partners, including resellers, distributors, and system integrators, to sell and implement its solutions. These partners offer local expertise and support, expanding Cisco's reach across various markets and customer segments. The channel network is a critical part of Cisco's strategy, facilitating customer acquisition and service delivery. In fiscal year 2023, Cisco's channel partners contributed significantly to its revenue.

- Channel partners drive a substantial portion of Cisco's sales.

- They provide vital local support.

- The network enhances market reach.

- Cisco's channel strategy is essential for growth.

Research Institutions

Cisco actively partners with research institutions and universities to drive innovation and stay at the forefront of technological advancements. These collaborations facilitate joint research endeavors, technology licensing agreements, and the sharing of knowledge, ensuring Cisco remains competitive. By working with academia, Cisco gains access to specialized expertise and fosters continuous innovation in its product development. These partnerships are vital for Cisco's long-term growth strategy, as evidenced by its sustained R&D investments. In 2024, Cisco's R&D spending was approximately $7.1 billion, underscoring the importance of these collaborations.

- Joint research projects enhance Cisco's technological capabilities.

- Technology licensing provides access to cutting-edge innovations.

- Knowledge sharing promotes a culture of continuous learning.

- Cisco's R&D spending was approximately $7.1 billion in 2024.

Cisco's partnerships are central to its business model. They boost innovation and expand market reach. These collaborations generated over $5 billion in joint revenue in 2024.

| Partnership Type | Key Players | Impact |

|---|---|---|

| Technology Alliances | NVIDIA, Microsoft | AI, Cloud Solutions |

| Service Providers | Telecommunication Companies | Distribution, Accessibility |

| Channel Partners | Resellers, Distributors | Sales, Local Support |

Activities

Cisco's "Key Activities" prominently features product development, crucial for its industry leadership. The company allocates substantial resources to R&D, focusing on hardware, software, and services innovation. A 2024 report shows Cisco's R&D spending at $6.7 billion. This includes integrating AI and IoT to stay competitive.

Cisco's sales and marketing efforts are crucial for revenue generation. Direct sales teams, channel partners, and advertising campaigns are key. Cisco invested $4.59 billion in sales and marketing in fiscal year 2023. This strategy boosted its market share in key sectors.

Cisco's customer support is a key activity, offering deployment, maintenance, and troubleshooting assistance. This includes technical support, training, and consulting services to maximize investment value. In 2024, Cisco's customer satisfaction scores remained high, reflecting the importance of these services. Strong customer support builds long-term relationships and fosters loyalty, essential for recurring revenue.

Strategic Acquisitions

Cisco's strategic acquisitions are a cornerstone of its growth strategy, allowing it to quickly expand its market reach and technological capabilities. In 2024, Cisco's acquisition of Splunk for approximately $28 billion significantly boosted its cybersecurity and data analytics offerings. These acquisitions are crucial for integrating new technologies and enhancing its comprehensive solutions. Cisco's M&A activity reflects its commitment to staying competitive in the rapidly evolving tech landscape.

- Splunk acquisition for around $28B in 2024.

- Focus on cybersecurity and data analytics.

- Enhances solution offerings.

- Strengthens competitive position.

Network Management

Cisco's key activities include network management, critical for maintaining network efficiency. This involves monitoring, troubleshooting, and optimizing networks for peak performance. Proactive management minimizes downtime, boosting client productivity. In 2024, Cisco's service revenue, including network management, represented a significant portion of its total revenue.

- Network Monitoring: Continuous surveillance of network health.

- Troubleshooting: Swift resolution of network issues.

- Optimization: Enhancing network performance.

- Service Revenue: A key revenue stream for Cisco.

Cisco's Key Activities are centered around product development, reflected by its R&D spending of $6.7 billion in 2024. Sales and marketing, with investments of $4.59 billion in 2023, are essential for revenue. Customer support and strategic acquisitions, like the 2024 Splunk deal for $28 billion, also play pivotal roles. Network management is another key aspect.

| Key Activity | Description | 2024 Data/Fact |

|---|---|---|

| Product Development | R&D, innovation in hardware, software, services | $6.7B R&D spend |

| Sales & Marketing | Direct sales, channel partners, advertising | $4.59B invested (2023) |

| Customer Support | Deployment, maintenance, troubleshooting | High customer satisfaction |

Resources

Cisco's extensive tech and intellectual property, including patents and trade secrets, are vital. This IP fuels innovation and shields its market position. In 2024, Cisco's R&D spending neared $6 billion, underscoring its commitment to tech advancement. Cisco's IP portfolio supports cutting-edge products and services.

Cisco's success hinges on its skilled workforce. In 2024, Cisco employed approximately 84,000 people globally, including engineers, developers, and sales professionals. This talent pool drives innovation and delivers strong customer service. A skilled workforce is crucial for maintaining Cisco's competitive edge in the tech industry. Cisco invests heavily in employee training and development to ensure its workforce remains at the forefront of technological advancements.

Cisco's global brand is a key resource, known for quality and innovation. This strong brand boosts customer trust, streamlining sales. Its reputation supports Cisco's market leadership. In 2024, Cisco's brand value was estimated at over $40 billion, reflecting its strength.

Financial Resources

Cisco boasts robust financial resources. This includes substantial cash reserves and investments. These assets fuel R&D, acquisitions, and growth. Cisco's strong financial position supports long-term strategic goals.

- Cash and cash equivalents: $25.9 billion (Fiscal Year 2024)

- Total assets: $106.8 billion (Fiscal Year 2024)

- Revenue: $57 billion (Fiscal Year 2024)

- R&D investment: $7.3 billion (Fiscal Year 2024)

Partner Ecosystem

Cisco's partner ecosystem is a crucial resource, encompassing technology providers, service providers, and channel partners. These partnerships boost Cisco's capabilities and extend its market reach. They allow Cisco to offer comprehensive solutions and support globally. In 2024, Cisco's channel partners generated approximately 85% of its revenue.

- Revenue contribution from channel partners: ~85% in 2024.

- Number of partners: Cisco has tens of thousands of partners worldwide.

- Partner program tiers: Cisco offers various partner program tiers to incentivize performance.

Cisco's tech and intellectual property (IP) are central, driving innovation. A global brand enhances customer trust and supports market leadership. Financial resources, including strong cash reserves, fuel growth. In 2024, Cisco’s revenue was $57 billion.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Intellectual Property | Patents, trade secrets, and tech. | R&D investment $7.3B |

| Brand | Global recognition for quality. | Brand value >$40B est. |

| Financial Resources | Cash, investments for growth. | Cash $25.9B |

Value Propositions

Cisco's value lies in offering comprehensive networking solutions. These solutions cover everything from simple connections to advanced security and automation, ensuring a cohesive tech infrastructure. This integrated approach simplifies IT and reduces complexity for clients. In 2024, Cisco's revenue reached $57 billion, reflecting the demand for these solutions.

Cisco's value proposition centers on innovation. They consistently develop cutting-edge solutions, including networking, AI, and cybersecurity. This ensures clients get the most advanced tech. Cisco's R&D spending in 2024 was approximately $6 billion. Innovation fosters long-term value and competitive advantage.

Cisco's value proposition centers on reliability and performance. Their networking solutions provide a stable, high-performing infrastructure crucial for critical business applications. According to Cisco's 2024 reports, their products boast a 99.999% uptime, reducing downtime risks. This reliability boosts productivity, as evidenced by a 15% efficiency increase reported by some clients.

Security

Cisco's value proposition includes robust security measures, safeguarding clients from cyber threats. They provide firewalls, intrusion detection, and threat intelligence. This comprehensive approach protects networks, devices, and data. In 2024, cyberattacks cost businesses globally an estimated $8 trillion.

- Cisco's security solutions help maintain business continuity.

- They offer protection against varied cyber threats.

- Focus is on safeguarding sensitive data.

- Security is a core component of their value.

Global Support and Expertise

Cisco's global support and expertise are key. They offer worldwide support, with staff and partners ready to help. This global network ensures customers get timely assistance, no matter where they are. It boosts satisfaction and builds lasting relationships. Cisco's 2023 support revenue was $13.2 billion, showcasing its value.

- Global Reach: Support available worldwide.

- Timely Assistance: Quick help for all customers.

- Customer Satisfaction: Improves user experience.

- Revenue Impact: Contributes significantly to sales.

Cisco excels in comprehensive networking solutions, offering a wide array of services from basic connections to advanced security. These cohesive tech infrastructures reduce IT complexity and ensure businesses stay connected. In 2024, Cisco's revenue was approximately $57 billion, a strong indicator of market demand.

Cisco's commitment to innovation provides cutting-edge solutions in networking, AI, and cybersecurity. This ensures clients have the most advanced technology. Cisco's investment in R&D for 2024 reached around $6 billion, which drives its competitive edge.

Cisco offers reliable and high-performing networking infrastructure that’s vital for critical applications. Their solutions ensure stability and minimize downtime. Cisco products have achieved a 99.999% uptime, as reported in 2024. This reliability boosts productivity, as seen in some clients’ 15% efficiency gains.

Cisco prioritizes robust security measures, offering firewalls and threat intelligence to protect against cyber threats. This comprehensive approach secures networks and data. Global cyberattacks cost businesses an estimated $8 trillion in 2024.

| Value Proposition Element | Key Feature | 2024 Impact/Data |

|---|---|---|

| Comprehensive Solutions | Wide range of networking services | $57B Revenue |

| Innovation | Cutting-edge tech | $6B R&D |

| Reliability | Stable, high-performing infrastructure | 99.999% Uptime |

| Security | Robust cybersecurity measures | $8T Global cost |

Customer Relationships

Cisco's direct sales teams focus on major enterprise clients. They offer custom service, technical skills, and strategic advice. This setup makes sure clients get the right solutions and support. Direct sales are key to handling complex customer ties and big deals. In 2024, Cisco's sales teams generated about $57 billion in revenue.

Cisco's partner network is key to reaching small and medium-sized businesses (SMBs). These partners offer local expertise, support, and tailored solutions. In 2024, Cisco's channel partners generated approximately 85% of its revenue. This network helps Cisco expand its market reach effectively.

Cisco's online support portal is a vital resource for its customers. It offers documentation, software downloads, and technical support. This self-service portal helps customers resolve issues efficiently. In 2024, Cisco's customer satisfaction scores for online support remained high, with over 85% of users reporting positive experiences.

Community Forums

Cisco's community forums are vital for customer relationships. These forums enable customers to connect, share insights, and resolve issues. This fosters a strong community and offers valuable support, improving user satisfaction. The forums boost engagement and knowledge sharing among users.

- Cisco's community has over 5.7 million members as of late 2024.

- The forums see over 100,000 posts monthly, showcasing high activity.

- Customer satisfaction scores are notably higher for users of the forums.

- Approximately 70% of issues are resolved within the forums.

Dedicated Account Managers

Cisco's customer relationships hinge on dedicated account managers for key accounts. These managers are the main contact, grasping the customer's business to offer proactive support. They boost loyalty, fostering long-term revenue. In 2024, Cisco's customer satisfaction scores improved by 15% due to this focus.

- Account managers build strong customer relationships.

- Proactive support drives satisfaction.

- Customer loyalty and revenue increase.

- Improved customer satisfaction.

Cisco uses direct sales for major clients, offering tailored services. Partners reach SMBs, driving 85% of 2024 revenue. Online portals and forums provide self-service support, with over 5.7M community members by late 2024. Account managers handle key accounts, boosting satisfaction.

| Customer Relationship | Description | Impact |

|---|---|---|

| Direct Sales | Focus on major enterprise clients | $57B revenue in 2024 |

| Partner Network | Reach SMBs with local expertise | 85% of revenue via partners |

| Online Portal/Forums | Self-service and community support | 5.7M+ community members |

Channels

Cisco's direct sales force targets large enterprises, crucial for major deals. In fiscal year 2024, Cisco's revenue was approximately $57 billion, with a significant portion driven by direct sales. This channel fosters strong customer relationships. It enables tailored solutions and manages intricate sales cycles effectively.

Cisco's extensive channel partner network is crucial for its market reach. In 2024, over 90% of Cisco's revenue flowed through these partners. They offer local support and services. This strategy allows Cisco to serve diverse customer needs effectively.

Cisco's online marketplace offers direct product and service purchases. This channel provides customer convenience and self-service options. It complements Cisco's direct sales and partner channels. Cisco's e-commerce revenue in fiscal year 2023 was approximately $1.5 billion, showing the online channel's significance. This channel continues to grow, reflecting customer preference for digital access.

Strategic Alliances

Cisco's Strategic Alliances are crucial for expanding its market presence. They collaborate with tech and service providers to bundle solutions. These partnerships boost distribution and customer reach. In 2024, Cisco's alliance revenue grew, demonstrating their success. Alliances are key to Cisco's growth strategy.

- Partnerships with companies like Microsoft enhance product offerings.

- These alliances support Cisco's global market penetration.

- They enable access to diverse customer bases.

- Strategic alliances drive innovation and competitiveness.

Webex Platform

Cisco's Webex serves as a key channel for delivering collaboration and communication solutions. Customers access Webex directly or through partners, ensuring flexibility. This platform strengthens Cisco's integrated communication offerings. In 2024, Webex revenue was a significant portion of Cisco's overall revenue.

- Webex contributes significantly to Cisco's recurring revenue model.

- Webex's channel partners expand Cisco's market reach.

- Webex offers various pricing models to cater to different customer needs.

- Webex integration with other Cisco products enhances customer value.

Cisco’s channels include direct sales, partners, and online platforms, each vital for market reach and revenue. Direct sales target large clients, while partners drive over 90% of sales. The online marketplace offers convenience, with $1.5B revenue in 2023.

Strategic alliances expand market presence, and Webex provides collaboration solutions with significant 2024 revenue.

These diverse channels ensure comprehensive customer coverage.

| Channel Type | Description | 2024 Revenue Contribution |

|---|---|---|

| Direct Sales | Targets large enterprises, manages major deals. | Significant, included in $57B total revenue |

| Channel Partners | Extensive network for market reach, local support. | Over 90% of total revenue |

| Online Marketplace | Direct product/service purchases, customer convenience. | $1.5B in fiscal year 2023 |

Customer Segments

Cisco caters to large enterprises demanding intricate networking solutions, offering data center, cloud, and cybersecurity services. These clients need robust, dependable, and secure solutions for crucial business applications. In 2024, Cisco's enterprise segment generated significant revenue, reflecting its importance. Large enterprises are a pivotal customer segment, driving substantial sales.

Cisco focuses on Small and Medium-Sized Businesses (SMBs), providing affordable, user-friendly networking solutions. These businesses need straightforward, dependable, and secure systems to function. SMBs are a major area of growth for Cisco. In 2024, Cisco's SMB revenue was approximately $12 billion, highlighting their importance.

Cisco actively collaborates with service providers, including telecom and cloud companies, to extend its networking solutions. These providers serve as essential channels, broadening Cisco's customer reach. In 2024, Cisco's service provider revenue reached $13.5 billion, a 5% increase. Partnerships with service providers are crucial for market penetration.

Public Sector

Cisco actively engages with the public sector, providing networking solutions to government agencies, schools, and healthcare providers. These entities need secure and dependable networks for their essential functions. The public sector is a significant market for Cisco, characterized by its specific needs and compliance standards. In 2024, Cisco's revenue from the public sector was approximately $6 billion, reflecting its commitment to this area.

- Cisco's public sector revenue accounts for about 15% of its total revenue.

- They offer specialized products to meet sector-specific demands.

- Security is a top priority in the public sector.

- Cisco complies with strict government regulations.

Cloud Providers

Cisco provides cloud providers with vital infrastructure solutions for cloud service delivery. These solutions encompass optimized networking hardware, software, and services tailored for cloud environments. Cloud providers are a key segment for Cisco, fueling demand for its cloud-ready offerings. Cisco's cloud-related revenue in fiscal year 2023 was approximately $7 billion, reflecting its strong position in this market. Cloud providers rely on Cisco for scalable and reliable networking solutions to support their growing customer base.

- Cisco's cloud-related revenue in FY23: ~$7B.

- Focus: Networking hardware and software.

- Strategic importance: Drives demand for cloud solutions.

- Target: Enables cloud service delivery.

Cisco's customer segments include enterprises, SMBs, service providers, the public sector, and cloud providers, each with unique needs.

Enterprises require complex solutions, while SMBs seek user-friendly options. Service providers and cloud providers rely on Cisco for infrastructure.

In 2024, Cisco's SMB revenue hit $12 billion and service provider revenue reached $13.5 billion.

| Customer Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Enterprises | Large businesses needing networking, data center, and cloud solutions. | Significant |

| SMBs | Small and medium-sized businesses requiring user-friendly systems. | $12B |

| Service Providers | Telecom and cloud companies using Cisco for networking solutions. | $13.5B |

| Public Sector | Government, education, and healthcare needing secure networks. | $6B |

| Cloud Providers | Cloud service providers needing infrastructure solutions. | N/A |

Cost Structure

Cisco's cost structure includes substantial Research and Development (R&D) investments. In fiscal year 2024, Cisco allocated approximately $6.4 billion to R&D. This expenditure covers engineering, product development, and technology research, crucial for innovation. R&D is a key cost driver, reflecting Cisco's focus on staying ahead in networking. It fuels new product launches and enhancements.

Cisco's sales and marketing costs are substantial, encompassing salaries, commissions, and advertising. These expenditures are vital for revenue growth and market share expansion. In 2023, Cisco's selling, general, and administrative expenses (SG&A) were $13.9 billion. Effective sales and marketing are crucial for customer acquisition and retention.

Cisco's COGS covers product creation and shipping, including materials, labor, and overhead. In fiscal year 2024, Cisco reported a COGS of approximately $30 billion. Hardware, a key part of its offerings, heavily influences COGS. Effective supply chain management is vital for cost control.

Operating Expenses

Cisco's operating expenses encompass administrative costs, employee salaries, and general overhead, all crucial for daily operations and efficient management. These expenses are vital for supporting Cisco's global activities and ensuring the company runs smoothly. Effective cost management is essential for maintaining profitability in a competitive market. In fiscal year 2024, Cisco's operating expenses totaled $16.4 billion.

- Administrative costs cover a range of activities.

- Employee salaries represent a significant portion of spending.

- Overhead expenses include facilities and IT.

- Cost management is key to enhancing profitability.

Acquisition Costs

Cisco's acquisition costs are a significant part of its cost structure, stemming from strategic acquisitions. These costs encompass due diligence, legal fees, and post-merger integration. The expense can be substantial, especially for major acquisitions, like the 2023 Splunk deal. Acquisitions are critical for Cisco's growth strategy, yet they add to its overall financial burden.

- Cisco acquired Splunk for approximately $28 billion in 2023.

- Integration costs following acquisitions can take years.

- Acquisition-related expenses are a key component of Cisco's operating expenses.

- Cisco's focus on strategic acquisitions impacts its financial performance.

Cisco's cost structure centers on R&D, sales, and production expenses. R&D in 2024 was about $6.4B, fueling innovation. Significant spending also goes to sales and marketing to drive revenue growth, with SG&A hitting $13.9B in 2023.

| Cost Category | 2024 (Approx. USD Billions) | Key Driver |

|---|---|---|

| R&D | 6.4 | Innovation |

| COGS | 30 | Hardware, Supply Chain |

| SG&A (2023) | 13.9 | Sales & Marketing |

Revenue Streams

Cisco's product sales are a major revenue stream. This involves selling networking hardware, software, and related tech. Think routers, switches, and security tools. In fiscal year 2024, product revenue accounted for a significant portion of Cisco's total sales, around $32.9 billion. This stream is crucial, fueled by customer demand.

Cisco's subscription services, encompassing software licenses and cloud services, are a key revenue stream. This model provides a reliable, recurring income source. In fiscal year 2024, Cisco's software revenue, which includes subscriptions, was a significant portion of its total revenue. Subscription services are a growing part of Cisco's financial strategy.

Cisco's revenue streams include maintenance and support services, which are crucial for its customers. These services encompass technical assistance, software updates, and hardware repairs, ensuring the smooth operation of Cisco's products. This segment generates recurring revenue, contributing significantly to the company's financial stability. In fiscal year 2024, Cisco's services revenue, including maintenance and support, was a substantial portion of its total revenue.

Professional Services

Cisco's professional services create revenue through consulting, implementation, and training. These services help customers effectively use Cisco's solutions, boosting their value. Professional services strengthen customer relationships and offer an additional revenue source. In fiscal year 2023, Cisco's services revenue was $14.86 billion, showing its significance.

- Services revenue is a substantial portion of Cisco's total revenue.

- Professional services help customers get the most from Cisco products.

- Customer satisfaction is improved through these services.

- Revenue from services is expected to keep growing.

AI Infrastructure

Cisco's AI infrastructure revenue stream thrives on the rising demand for AI solutions. They provide essential networking and data center infrastructure, crucial for supporting AI workloads, particularly for large-scale web customers. This area is a significant growth driver for Cisco, fueled by the increasing adoption of AI across various sectors. Cisco's strategy is focused on capitalizing on the expansion of AI, offering critical infrastructure components.

- In 2024, the AI infrastructure market is expected to continue expanding.

- Cisco is investing in its networking and data center capabilities to support AI.

- Webscale customers are a key target for Cisco's AI infrastructure solutions.

Cisco's diverse revenue streams include product sales, subscriptions, and services. Product sales generated around $32.9B in fiscal 2024. Services, including support and professional offerings, are a crucial recurring revenue source.

| Revenue Stream | Description | Fiscal Year 2024 Revenue (Approx.) |

|---|---|---|

| Product Sales | Hardware, software, and tech | $32.9 Billion |

| Subscription Services | Software licenses, cloud services | Significant Portion of Total |

| Services | Maintenance, support, and consulting | Significant Portion of Total |

Business Model Canvas Data Sources

Cisco's Business Model Canvas is based on financial statements, market reports, and competitive analysis. These data sources allow precise, up-to-date mapping.