Cisco Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cisco Systems Bundle

What is included in the product

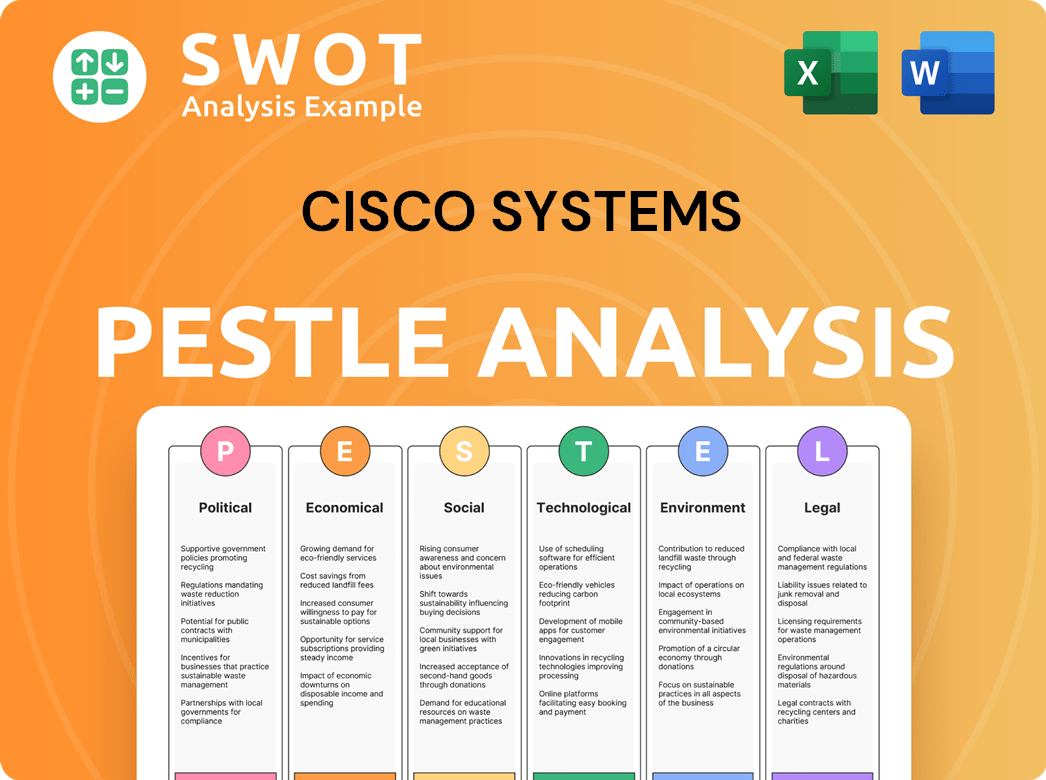

Assesses Cisco's position considering Political, Economic, Social, Tech, Environmental, & Legal factors.

Helps support discussions on external risk & market positioning during planning sessions.

What You See Is What You Get

Cisco Systems PESTLE Analysis

Previewing our Cisco Systems PESTLE Analysis? What you see is what you get! This detailed document, fully structured, awaits after purchase. No edits needed; it’s ready for immediate use. This is the real, completed file you’ll download. Your complete PESTLE analysis is just a click away!

PESTLE Analysis Template

Cisco Systems operates within a complex web of external forces. Political shifts impact trade regulations and cybersecurity policies. Economic trends influence investment in IT infrastructure and digital transformation. Technological advancements drive innovation and competition. Social factors affect user behavior and workforce dynamics. Environmental concerns shape sustainability strategies. Legal frameworks govern data privacy and intellectual property. Download the full Cisco PESTLE Analysis to unlock deep insights and inform your strategic decisions now!

Political factors

Ongoing trade tensions, especially between the U.S. and China, have affected Cisco's supply chain. These tensions have led to higher tariff costs; for instance, in 2024, tariffs on certain components increased expenses by approximately 5%. Geopolitical instability in regions like Eastern Europe also disrupts business. Cisco reported a 3% decrease in revenue from affected markets in Q1 2024.

Governments globally are tightening cybersecurity regulations. This includes mandates like the US NIST Cybersecurity Framework. Cisco must invest in product development to meet these standards. For example, in fiscal year 2024, Cisco's security revenue was $4.8 billion. Expanding compliance teams is also crucial for Cisco.

Governments worldwide are prioritizing technology sovereignty, leading to stricter data privacy regulations. Cisco must invest heavily in global data privacy compliance. The global data privacy market is projected to reach $17.1 billion by 2024. Companies must develop new data protection features. This is essential for operating in regions with stringent data requirements.

Political instability in international markets can affect revenue

Political instability significantly impacts Cisco's revenue, particularly in regions experiencing conflict or sanctions. These events disrupt supply chains and reduce market access, directly affecting sales. For example, the ongoing conflict in Eastern Europe has led to a decrease in tech spending. Cisco’s 2023 revenue was $57 billion, with international sales representing a large portion. Operating in diverse markets means exposure to political risks.

- Geopolitical tensions can quickly alter market dynamics.

- Sanctions can limit access to key markets.

- Political shifts can impact business regulations.

- Instability increases operational costs.

Government spending priorities can shift demand

Government spending decisions significantly influence Cisco's market. Delays in U.S. federal spending, particularly in areas like cybersecurity, can directly reduce demand for Cisco's related products. For example, a slowdown in government IT contracts can impact Cisco's revenue. Cisco must adjust its strategies to align with evolving government priorities and spending cycles. This includes focusing on areas with sustained investment, such as cloud computing and AI, or expanding into international markets.

- In 2024, U.S. federal spending on cybersecurity is projected to be $25 billion.

- Cisco's government sales account for approximately 10-15% of its total revenue.

- Delays in government contract awards can lead to a 5-10% decrease in sales in affected product lines.

- Cisco is actively pursuing contracts in the Asia-Pacific region to diversify revenue streams.

Geopolitical risks, like U.S.-China trade tensions, affect Cisco's supply chain and costs; tariffs in 2024 increased expenses by around 5%. Governments' cybersecurity mandates, such as the NIST framework, necessitate compliance investment, with the security revenue at $4.8 billion in fiscal year 2024. Government spending delays, specifically in IT and cybersecurity, and global instability have direct market impacts, pushing diversification.

| Political Factor | Impact on Cisco | Data/Facts (2024-2025) |

|---|---|---|

| Trade Tensions | Supply chain disruption, cost increases | Tariff impact approximately 5% increase in expenses |

| Cybersecurity Regulations | Increased compliance costs | Security revenue $4.8B in fiscal 2024 |

| Government Spending | Market Demand changes | US Cybersecurity spending projected to be $25B in 2024 |

Economic factors

Global economic uncertainties, including inflation and interest rate hikes, can make companies cautious about large investments. Cisco may face reduced demand for its networking products. For example, in Q1 2024, Cisco's revenue decreased by 6% year-over-year, due to macroeconomic headwinds.

Cisco faced revenue declines in fiscal year 2024, with network revenue down. Total revenue also decreased year-over-year. Despite the challenges, product orders and recurring software revenue, fueled by acquisitions like Splunk, showed growth. This indicates shifting market dynamics for Cisco.

Cisco is increasingly focused on subscription and recurring revenue models, moving towards cloud-delivered solutions. This transition provides a more stable financial outlook. For instance, in Q1 FY2024, Cisco's software revenue reached $4.5 billion, with 86% of it being subscription-based. This strategy is a key response to evolving market dynamics.

Strong profit margins despite revenue fluctuations

Cisco's robust gross profit margins, even with revenue shifts, highlight its operational prowess. The company has shown resilience, maintaining profitability in the face of economic pressures. This financial stability is crucial for weathering market volatility and investing in future growth. In fiscal year 2024, Cisco's gross margin reached around 65%, demonstrating efficient cost management.

- Fiscal year 2024 gross margin: approximately 65%

- Resilience in revenue fluctuations

- Focus on operational efficiency

- Ability to adapt to market challenges

Inventory corrections and weakened demand from service providers

Cisco has navigated inventory corrections and reduced demand from telecom and cable service providers. These providers, managing tighter budgets, have curbed spending on network infrastructure. Industry analysts suggest these headwinds could ease by late 2024 or early 2025 as market conditions stabilize.

- Cisco's Q3 FY24 revenue decreased by 13% in the Americas, partly due to service provider spending cuts.

- The service provider segment, a key Cisco customer, experienced a decline in demand.

- Analysts project a potential rebound in demand as service providers refresh their networks.

Cisco faced revenue declines in fiscal 2024 due to economic headwinds; network revenue declined, but recurring software revenue grew, reaching $4.5B in Q1 2024. The company focuses on subscriptions, and the gross margin reached around 65% in fiscal 2024. Navigating inventory corrections and reduced demand, Cisco showed resilience.

| Metric | Q1 FY24 Data | Fiscal Year 2024 |

|---|---|---|

| Revenue | Decreased 6% YoY | Decline |

| Software Revenue | $4.5 Billion (86% subscription-based) | Growth |

| Gross Margin | Data not available | Approximately 65% |

| Americas Revenue (Q3 FY24) | Down 13% | Data not available |

Sociological factors

Hybrid work arrangements are fueling the need for sophisticated collaboration tools. Cisco's Webex, for instance, is crucial in this shift. Recent data shows the hybrid work model is still popular. In 2024, Webex revenue grew by 10%.

Societal emphasis on digital inclusion is intensifying, pushing for technology and connectivity access for all. Cisco, as a major tech player, is crucial in tackling this digital divide. In 2024, approximately 37% of the global population still lacks internet access, highlighting the scope of the challenge. Cisco's initiatives, such as those focused on digital skills training, are vital for bridging this gap. This creates both social and economic opportunities.

Consumer behavior significantly impacts tech trends. AI adoption is driven by changing needs. Cisco must adapt to the evolving digital landscape. In 2024, 77% of consumers used digital channels. Understanding these shifts is vital for Cisco's success.

Human-AI collaboration in the workplace is emerging

Human-AI collaboration is reshaping workplaces. The integration of AI-powered humanoids and autonomous agents necessitates rethinking workplace structures and infrastructure. This shift also brings job-related concerns. The World Economic Forum predicts 85 million jobs may be displaced by 2025 due to technology.

- AI adoption is expected to create 97 million new jobs by 2025.

- Companies must adapt to support human-AI teamwork, focusing on reskilling.

Societal expectations regarding corporate responsibility and sustainability

Societal expectations now heavily emphasize corporate responsibility and sustainability, especially concerning Environmental, Social, and Governance (ESG) standards. Consumers and partners are increasingly influenced by a company's ESG performance, driving Cisco to prioritize sustainability. Cisco's focus includes reducing its carbon footprint and promoting ethical sourcing.

- Cisco's 2023 CSR report highlighted a 60% reduction in Scope 1 and 2 emissions since 2019.

- In 2024, Cisco aims to increase its use of renewable energy sources to 85%.

- Cisco's ESG initiatives have been recognized by FTSE Russell, scoring 4.8 out of 5.

Cisco thrives on digital inclusion, essential for connecting the unconnected. AI's expansion prompts both workforce adjustments and novel job opportunities. Corporate sustainability, reflected in ESG metrics, is crucial.

| Factor | Impact on Cisco | 2024-2025 Data |

|---|---|---|

| Digital Divide | Opportunities in connectivity. | 37% lack internet access, but global internet users are at 66% |

| AI and Jobs | Adaptation and reskilling programs. | 85M jobs displaced, 97M created by 2025 |

| ESG Pressure | Focus on sustainability & responsibility. | Cisco's renewable energy use goal is 85% by 2024 |

Technological factors

Rapid advancements and the integration of AI are reshaping the tech industry, a trend Cisco is actively navigating. Artificial intelligence is a major force, driving innovation and efficiency. Cisco is strategically investing in AI, focusing on AI-powered products and solutions. In 2024, Cisco's AI investments reached $1 billion, reflecting its commitment to this technology.

The surge in cyberattacks, especially those leveraging AI, fuels demand for robust cybersecurity. Cisco's security solutions, crucial to its portfolio, are experiencing growth. In Q1 2024, Cisco's security revenue reached $1.1 billion, up 3% year-over-year. This growth reflects the increasing need for advanced threat protection.

Quantum computing's growth threatens current encryption. Cisco, like others, is integrating post-quantum cryptography. This protects data. The global quantum computing market is projected to reach $12.9 billion by 2029, per Fortune Business Insights. This shift is vital for data security.

Evolution of networking technologies, including AI-first and intent-based networking

Cisco is adapting to the rise of AI-first and intent-based networking. These technologies leverage machine learning for predictive analytics, automation, and performance optimization. This shift impacts network management strategies. For example, the global intent-based networking market is projected to reach $12.6 billion by 2025.

- AI-driven automation reduces operational costs by up to 30%.

- Intent-based systems improve network uptime by 20%.

- Cisco's AI-powered solutions are experiencing a 15% annual growth.

Expansion of cloud and edge computing markets

The expansion of cloud and edge computing presents significant opportunities for Cisco. This growth, fueled by increasing data volumes and demand for real-time processing, drives the need for robust network infrastructure. Cisco's hardware and software solutions, including routers, switches, and security products, are essential for supporting these evolving computing environments. For instance, the global edge computing market is projected to reach $250.6 billion by 2024, with a CAGR of 25.2% from 2024 to 2030. This expansion allows Cisco to capitalize on rising demand.

- The global edge computing market is forecasted to reach $250.6 billion by 2024.

- Cisco's infrastructure solutions are crucial for cloud and edge computing.

- The CAGR for edge computing from 2024 to 2030 is expected to be 25.2%.

Technological factors significantly impact Cisco, with AI and cybersecurity as key focuses. AI-driven products show a 15% annual growth. Cisco's investment in AI reached $1 billion in 2024.

| Technology Area | Impact on Cisco | Data |

|---|---|---|

| AI | Drives innovation & efficiency, investment. | $1B in AI in 2024. |

| Cybersecurity | Boosts demand for robust security solutions. | Security revenue reached $1.1B in Q1 2024. |

| Cloud & Edge Computing | Presents infrastructure opportunities. | Edge market proj. $250.6B in 2024. |

Legal factors

Cisco faces a complex web of data privacy rules globally, with new laws constantly emerging. Companies like Cisco must comply with regulations such as GDPR, CCPA, and others to operate internationally. Investing in compliance is crucial, as non-compliance can lead to hefty fines. Cisco's 2024 revenue was approximately $57 billion, highlighting the scale of operations affected by these legal factors.

Governments globally are increasing cybersecurity mandates, impacting tech firms. Cisco must comply with standards like those from NIST. Failure to comply can lead to hefty fines. In 2024, cybercrime costs are projected to reach $9.5 trillion globally.

Cisco confronts legal risks from past actions and human rights issues. Lawsuits and scrutiny may arise concerning technology use by governments. Ethical conduct and thorough due diligence are vital. In 2024, these concerns impact corporate reputation and financial performance. Consider the potential for fines and reputational damage.

Regulatory approval processes for technology products and services

Regulatory approvals for technology products and services are crucial for Cisco, varying by region and technology type. These approvals can significantly affect time-to-market, potentially delaying product launches. For instance, new cybersecurity solutions must meet stringent data privacy regulations like GDPR in Europe. Delays can impact revenue projections, with the global cybersecurity market expected to reach $345.7 billion by 2025.

- Cybersecurity market growth is projected to reach $345.7 billion by 2025.

- Compliance with GDPR in Europe is a significant regulatory hurdle.

- Regulatory delays can impact product launch timelines and revenue.

Trade regulations and tariffs impacting business operations

Trade regulations and tariffs significantly influence Cisco's operations. The imposition of tariffs, such as those seen during the U.S.-China trade disputes, can increase the cost of imported components, squeezing profit margins. These regulations also affect supply chain logistics, potentially leading to delays and increased expenses. Market access can be limited if tariffs make products less competitive in certain regions.

- In 2024, tariffs on specific Chinese tech products could increase costs by up to 25%.

- Cisco's global supply chain network has over 1,000 suppliers.

- Navigating varied international trade laws is crucial for compliance.

Legal factors heavily influence Cisco's operations, particularly in data privacy. Strict adherence to GDPR, CCPA, and other global data regulations is critical. Cybersecurity mandates, increasing worldwide, add more layers of compliance with fines if not met.

Regulatory approvals and trade policies significantly affect Cisco's financial performance. Product launches may be delayed. In 2024, tariffs can increase costs.

Cisco deals with legal risks, including those related to ethical conduct and technology use. The ethical challenges can affect corporate reputation. Investment in thorough legal due diligence is thus essential.

| Legal Area | Impact | Financial Data |

|---|---|---|

| Data Privacy | Compliance costs & fines | 2024: ~$57B Revenue impacted by GDPR & others. |

| Cybersecurity | Mandates & regulatory issues | Cybercrime costs in 2024 are projected to reach $9.5T. |

| Trade Regulations | Tariffs & Supply chain issues | Tariffs can increase costs by up to 25%. |

Environmental factors

Cisco is deeply committed to environmental sustainability, setting ambitious goals to cut greenhouse gas emissions and reach net zero. The company actively works to reduce emissions from its operations, suppliers, and the use of its products by customers. In 2023, Cisco cut its Scope 1 and 2 emissions by 60% compared to 2019. Cisco aims to achieve net-zero emissions across its value chain by 2040.

Cisco is embracing circular economy principles to reduce environmental impact. This involves designing products for longevity and ease of recycling, alongside initiatives like product take-back and refurbishment programs. For example, Cisco's efforts in 2024 included increasing the use of recycled materials in its products by 15%, reducing e-waste.

Cisco's PESTLE analysis highlights growing investment in clean energy and energy efficiency. This shift is vital for lowering the environmental impact of digital infrastructure. In 2024, the global green energy market is projected to reach $1.5 trillion. Cisco's efforts align with these trends.

Addressing electronic waste through responsible product lifecycle management

Cisco Systems faces environmental pressures due to the increasing volume of electronic waste. This necessitates strategies for the responsible management of products at the end of their lifecycle. Cisco must establish and expand programs for product takeback, reuse, and recycling. These initiatives are critical for compliance and sustainability. Globally, e-waste generation reached 62 million tons in 2022, a 82% increase since 2010.

- Cisco's Takeback and Recycling Program has recycled 1.5 billion pounds of hardware.

- The global e-waste recycling market is projected to reach $100 billion by 2028.

- Cisco's initiatives support a circular economy model, reducing environmental impact.

Leveraging technology for environmental monitoring and protection

Cisco leverages technology for environmental monitoring and protection, focusing on IoT and AI to boost sustainability. This includes monitoring energy use, optimizing resource management, and supporting conservation efforts. For example, Cisco's smart building solutions can reduce energy consumption by up to 30%. The company is also involved in projects using AI for wildlife monitoring and habitat preservation.

- Cisco's smart building tech can cut energy use by up to 30%.

- AI is used in conservation, like wildlife monitoring.

Cisco targets net-zero emissions by 2040 and reduces emissions significantly. It focuses on circular economy and designs for longevity. The company boosts sustainability via tech, reducing energy consumption, and supporting conservation efforts. In 2022, global e-waste was 62 million tons.

| Sustainability Goal | Current Status (2024) | Future Goal |

|---|---|---|

| Emissions Reduction | 60% reduction in Scope 1 & 2 emissions (vs. 2019) | Net-zero emissions across the value chain by 2040 |

| Circular Economy | 15% increase in recycled materials usage | Expand take-back and recycling programs |

| E-waste Management | Recycled 1.5 billion pounds of hardware | Reduce e-waste and boost reuse initiatives |

PESTLE Analysis Data Sources

Our PESTLE leverages sources such as financial reports, tech trend forecasts, & government publications for credible insights.