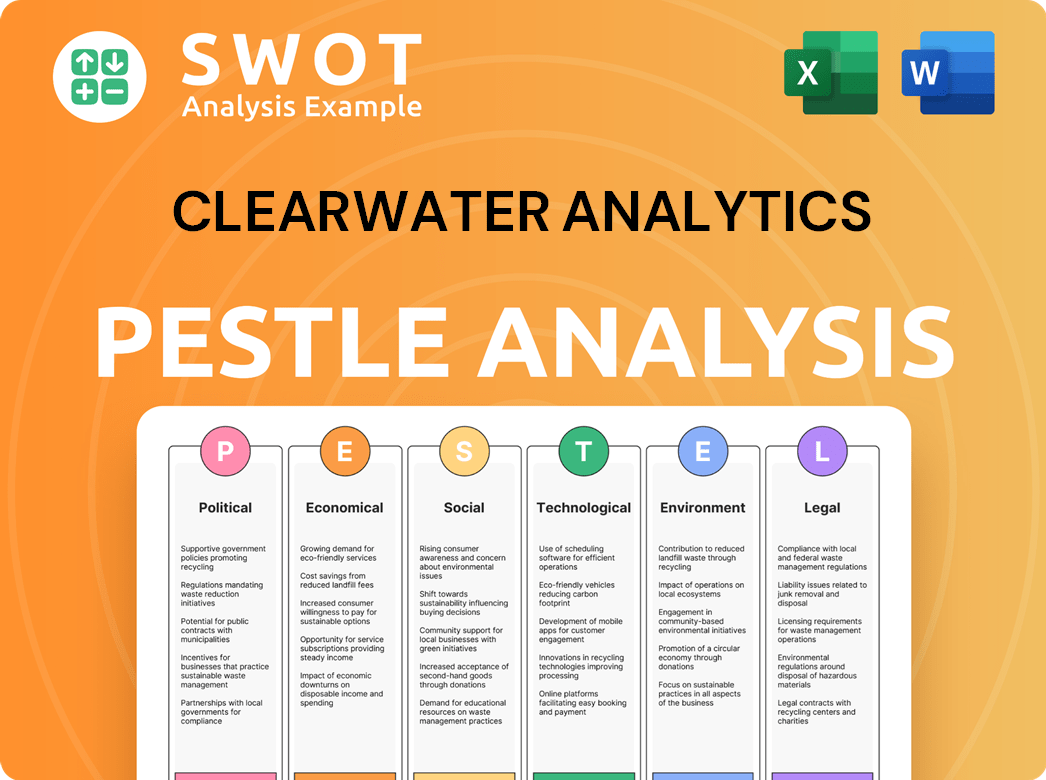

Clearwater Analytics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clearwater Analytics Bundle

What is included in the product

This PESTLE analysis assesses external macro-environmental forces influencing Clearwater Analytics' strategy across six factors.

Allows users to modify the analysis with tailored information or local business environment notes.

Preview the Actual Deliverable

Clearwater Analytics PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured for Clearwater Analytics.

Examine the PESTLE analysis elements thoroughly.

The preview reveals the real, in-depth, insightful analysis.

After purchase, download and utilize it instantly.

The document delivers the structure and content visible here.

PESTLE Analysis Template

Dive into Clearwater Analytics' world with our detailed PESTLE analysis. Uncover the external forces impacting its trajectory, from political shifts to technological advancements. Grasp the economic landscape and anticipate future market trends. Enhance your understanding of social factors and legal requirements shaping their operations. Equip yourself with crucial insights for strategic planning and gain a competitive edge. Get the full PESTLE analysis now!

Political factors

The political sphere heavily shapes fintech via regulations. The SEC and FCA oversee stringent rules impacting investment reporting. Clearwater Analytics must comply with these regulations. For example, in 2024, the SEC proposed rules on cybersecurity risk management for investment advisors. These rules could impact compliance costs.

Government spending and economic policies significantly impact the investment management sector. For example, in 2024, the U.S. government's budget was approximately $6.8 trillion, influencing market dynamics. Changes in tax laws or fiscal policies can alter asset allocation strategies. Political stability is crucial; instability in emerging markets can deter investment, as seen in some regions in early 2025.

For Clearwater Analytics, operating globally means international relations and trade policies are crucial. Geopolitical shifts can impact investments and regulations. For example, the US-China trade tensions continue, affecting tech firms. In 2024, global trade growth is projected at 3.3% by the WTO. Clearwater must navigate these dynamics.

Political Stability in Operating Regions

Political stability is crucial for Clearwater Analytics, given its global operations and client base. Regions experiencing instability can disrupt operations and affect financial institutions, potentially reducing demand for its services. For example, the World Bank reported that political instability has cost some countries up to 30% of GDP growth. Clearwater must assess political risks in key markets to ensure business continuity.

- Political risks include changes in regulations, trade policies, and government instability.

- Clearwater's presence in stable regions like North America and Europe mitigates some risks.

- Emerging markets may present higher risks but also opportunities for growth.

Government Initiatives in Digital Finance

Government initiatives heavily influence the digital finance landscape. Regulations such as the EU's Financial Data Access (FIDA) aim to broaden data sharing, potentially reshaping data access and utilization. This might affect firms like Clearwater Analytics. Such shifts demand adaptation to stay compliant and competitive.

- FIDA aims to create a single market for financial data in the EU by 2025, potentially impacting Clearwater.

- Open banking initiatives globally are increasing, with a 30% rise in API usage in 2024.

- Regulatory changes can lead to both new opportunities and compliance costs.

Political factors significantly impact Clearwater Analytics via regulations and global trade. Regulatory changes, such as those from the SEC, can alter compliance costs. Trade policies and geopolitical tensions also affect Clearwater's operations and market strategies. Political stability remains crucial for sustaining business.

| Aspect | Impact | Data |

|---|---|---|

| Regulations | Compliance costs and market access | SEC cybersecurity rules proposed in 2024 |

| Trade | Market strategies and global operations | Global trade growth projected at 3.3% by WTO in 2024 |

| Political Stability | Business continuity and client trust | Political instability may cut GDP growth up to 30% |

Economic factors

Economic growth and market volatility significantly impact the investment management sector. Strong economic growth often boosts investment activity, increasing demand for advanced accounting and reporting services. Conversely, market volatility can decrease asset values and affect client portfolios, potentially reducing revenue. For example, in 2024, the S&P 500 saw fluctuations, reflecting these impacts.

Interest rates and inflation are key economic factors influencing investment strategies. Rising interest rates, as seen with the Federal Reserve's hikes in 2023 and early 2024, can shift investor preferences. This impacts the types of financial instruments used. For instance, in March 2024, the US inflation rate was 3.5%, influencing bond yields and market volatility. Clearwater Analytics must adapt its data processing to reflect these changes for its clients.

As a global entity, Clearwater Analytics is exposed to currency exchange rate volatility, which can affect its financial results. Currency fluctuations influence the value of assets reported on its platform, especially for international clients. For instance, in 2024, the EUR/USD exchange rate varied significantly. Managing currency risk is a crucial consideration for Clearwater and its clients to mitigate potential financial impacts.

Investment Trends and Capital Flows

Investment trends, like the surge in alternative assets, are reshaping investment accounting. Private credit's growth demands software capable of managing complex instruments. Capital flows between markets affect transaction volumes and types. In 2024, alternative assets saw significant inflows. The private credit market is projected to reach $2.8 trillion by 2028.

- Alternative assets have grown significantly.

- Capital flows impact transaction processing.

- Software must adapt to handle complex assets.

- Private credit is a major growth area.

Client Financial Health and Budgets

The financial health of Clearwater Analytics' clients, including insurance companies and asset managers, directly impacts their investment in SaaS solutions. During economic downturns, clients may tighten budgets, potentially reducing spending on services like Clearwater Analytics'. Conversely, periods of economic growth can boost demand for sophisticated investment accounting tools. For instance, the global SaaS market is projected to reach $716.52 billion by 2028, growing at a CAGR of 12.2% from 2021 to 2028. This growth indicates potential for Clearwater Analytics.

- SaaS market projected to reach $716.52 billion by 2028.

- CAGR of 12.2% from 2021 to 2028 for the global SaaS market.

Economic factors deeply influence Clearwater Analytics, impacting investment management. Market volatility and economic growth alter investment activity and client portfolios. Interest rates and inflation, with recent Federal Reserve actions, also shape strategies.

Currency exchange rates affect the valuation of assets and financial results for the company. Furthermore, investment trends like the rise in alternative assets, and capital flow directions require special software solutions for successful processing and analysis.

Client financial health directly influences their investment in SaaS solutions. The SaaS market's continued expansion suggests positive opportunities, potentially leading to $716.52 billion by 2028.

| Economic Factor | Impact on Clearwater Analytics | Relevant Data (2024-2025) |

|---|---|---|

| Economic Growth | Boosts investment, increases demand | S&P 500 fluctuations in 2024. |

| Interest Rates & Inflation | Shifts investor preferences, influences market | US inflation 3.5% in March 2024, fed's interest rate hikes in 2023/2024. |

| Currency Exchange Rates | Affects financial results | Significant EUR/USD volatility in 2024. |

Sociological factors

Investor demographics are changing, with a growing demand for transparency. This shift influences investment accounting platforms. For example, in 2024, 70% of investors prioritized ESG factors. This trend pushes for better reporting features.

Clearwater Analytics relies on skilled professionals in finance, accounting, and technology. The demand for talent proficient in AI and data analytics is increasing. According to the U.S. Bureau of Labor Statistics, employment in computer and information technology occupations is projected to grow 13% from 2022 to 2032. This growth fuels competition for talent. Clearwater must adapt its hiring and training to attract and retain skilled employees.

Client adoption of technology is a critical sociological factor for Clearwater Analytics. Their success hinges on clients readily adopting SaaS solutions for investment accounting. The shift from outdated systems to cloud-based platforms requires client willingness and capability. As of Q1 2024, SaaS adoption in finance grew by 20%, indicating a favorable trend for Clearwater.

Focus on Corporate Social Responsibility

Societal expectations for corporate social responsibility (CSR) are rising, impacting Clearwater Analytics. Clients and partners now prioritize ethical practices and social impact. This shift influences service provider selection, reflecting broader values. In 2024, CSR-related investments hit $18.5 billion, showing its importance.

- Client decisions now reflect CSR values.

- Partnerships hinge on ethical alignment.

- CSR investments reached $18.5B in 2024.

Data Privacy Concerns and Public Trust

Data privacy and security are increasingly critical. Public concern over data breaches is rising, impacting how financial data is managed. Clearwater Analytics, handling sensitive information, must prioritize trust through strong data protection. A 2024 study showed a 20% increase in data breach awareness.

- Data breaches cost an average of $4.45 million globally in 2023.

- 68% of consumers are very concerned about data privacy.

- GDPR fines have reached billions, highlighting compliance risks.

Societal values prioritize CSR, influencing client and partner choices. Investments in CSR reached $18.5B in 2024, reflecting its importance. Data privacy and security are also crucial; breaches cost an average of $4.45M.

| Factor | Impact | 2024 Data |

|---|---|---|

| CSR Focus | Ethical alignment, investment choices | $18.5B in CSR investments |

| Data Privacy | Trust and compliance requirements | Average breach cost: $4.45M |

| SaaS Adoption | Client technology integration | Finance SaaS growth: 20% |

Technological factors

Clearwater Analytics thrives on SaaS advancements. Cloud infrastructure, scalability, and security are key. For 2024, the SaaS market grew 20%, reaching $200B. Security spending rose 15%. Clearwater's platform performance hinges on these factors.

The integration of AI and machine learning is a key technological factor for Clearwater Analytics. These technologies enhance portfolio analytics, automate processes, and improve data accuracy. They provide deeper insights for clients, offering a competitive edge in the market. The global AI market is projected to reach $2 trillion by 2030, suggesting significant growth potential.

Cybersecurity threats are escalating, demanding constant investment in strong defenses. Financial data protection is crucial for client trust and regulatory compliance. The global cybersecurity market is projected to reach $345.7 billion in 2024. Companies like Clearwater Analytics must prioritize cybersecurity to mitigate risks. Data breaches can lead to significant financial and reputational damage.

Data Management and Analytics Capabilities

Clearwater Analytics thrives on its technological prowess in data management and analytics. Their platform excels at handling massive, intricate investment data sets, a critical need in the financial sector. The core of their service involves sophisticated data aggregation, reconciliation, and reporting. For example, in Q1 2024, Clearwater processed over $65 trillion in assets on its platform.

- Data Volume: In 2024, Clearwater's platform managed over $65 trillion in assets.

- Data Processing: Clearwater's platform processed over 6 billion transactions in 2024.

- Reporting: The platform generates over 100,000 reports daily.

- Analytics: Clearwater's analytics capabilities provide insights into 200+ investment types.

Integration with Other Financial Technologies

Clearwater Analytics must integrate with other financial technologies. This integration is key to remaining competitive. Clearwater aims to offer end-to-end solutions. In 2024, they acquired several companies to boost capabilities. This strategy allows for better data flow and efficiency.

- Acquisitions are a key part of Clearwater's tech strategy.

- Integration improves data management.

- End-to-end solutions enhance user experience.

- Enhanced capabilities strengthen market position.

Clearwater's tech hinges on SaaS, with 2024's $200B market, crucial for scaling and security. AI & ML boost analytics, with the AI market predicted to hit $2T by 2030. Cybersecurity, key for financial data protection, is a priority. The market is projected to reach $345.7B in 2024.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| SaaS | Platform performance, scalability | $200B market |

| AI/ML | Portfolio analytics, automation | $2T market by 2030 |

| Cybersecurity | Data protection, compliance | $345.7B market |

Legal factors

Clearwater Analytics faces strict financial regulations. Compliance is vital for its services. These include GAAP, IFRS, and reporting demands. In 2024, regulatory fines in the financial sector totaled billions.

Clearwater Analytics must navigate strict data privacy laws like GDPR. These regulations dictate how client data is managed and secured. Compliance is crucial for legal standing and client trust. In 2024, GDPR fines reached €1.5 billion.

Securities regulations are crucial for Clearwater Analytics. These rules impact data, reporting, and investment portfolios. Updates to the platform are often needed to meet these changing compliance requirements. The SEC's focus on cybersecurity and data privacy, as seen with recent enforcement actions, is a key area. In 2024, the SEC proposed rules to enhance cybersecurity risk management for investment advisors.

Acquisition and Merger Regulations

Clearwater Analytics' growth strategy, which includes acquisitions, places it under the scrutiny of merger and acquisition (M&A) regulations. These legal frameworks dictate how acquisitions proceed, affecting timelines and integration. Regulatory bodies, such as the Department of Justice (DOJ) and the Federal Trade Commission (FTC) in the U.S., closely examine deals. For example, in 2024, the FTC challenged several tech acquisitions, demonstrating the active enforcement.

- Regulatory approvals can extend the acquisition process by several months.

- Compliance costs, including legal and consulting fees, can increase significantly.

- Failure to comply can lead to penalties, including fines and deal cancellations.

Tax Laws and Accounting Standards

Tax laws and accounting standards are critical for Clearwater Analytics. Changes in these areas can affect financial reporting requirements for clients. Clearwater's platform must adapt to support these changes. For example, the SEC's 2024 focus on climate-related disclosures impacts financial reporting. Recent updates in IFRS and US GAAP also necessitate platform adjustments.

- SEC's 2024 focus on climate-related disclosures.

- IFRS and US GAAP updates.

Clearwater Analytics must adhere to rigorous financial regulations, with significant fines in 2024 for non-compliance. Data privacy laws, such as GDPR, demand secure client data handling, as reflected in substantial fines. Securities and M&A regulations also significantly influence Clearwater’s operations, including its growth strategies.

| Legal Aspect | Regulatory Focus (2024) | Impact on Clearwater |

|---|---|---|

| Financial Regulations | GAAP, IFRS compliance. | Platform adjustments, risk of fines. |

| Data Privacy | GDPR, data security. | Data handling procedures, client trust. |

| Securities | SEC cybersecurity. | Compliance, platform updates. |

Environmental factors

ESG reporting requirements are increasing due to regulatory and investor pressure. Financial institutions face new obligations to disclose their ESG performance. In 2024, the SEC finalized climate-related disclosure rules, impacting many firms. Clearwater Analytics must help clients meet these evolving ESG demands. The global ESG market is projected to reach $53 trillion by 2025.

Climate change awareness is growing, impacting investment strategies. Investors increasingly seek to understand climate-related risks and opportunities. In 2024, sustainable investments reached $40 trillion globally. Climate-related financial disclosures are becoming more common. This trend is expected to continue into 2025.

Sustainability is indirectly relevant. Clients increasingly value eco-friendly vendors. In 2024, 70% of consumers favored sustainable brands. Companies like Clearwater Analytics may face pressure to demonstrate environmental responsibility.

Resource Consumption and Energy Use

As a SaaS provider, Clearwater Analytics' primary environmental impact stems from its data centers and energy usage. The company's commitment to energy efficiency and renewable energy sources is crucial. Clearwater is exploring options for sustainable practices. In 2024, the global data center energy consumption reached 3% of total electricity usage.

- Data center energy consumption is a key area for environmental impact.

- Transitioning to renewable energy sources is a relevant consideration.

- Clearwater is focused on sustainable practices.

- In 2024, data centers used 3% of the world's electricity.

Waste Management and Recycling

Clearwater Analytics recognizes waste management and recycling as integral to its environmental stewardship. The company likely implements recycling programs for paper, plastics, and electronics to reduce its carbon footprint. Globally, the recycling rate for municipal waste hovers around 20%, yet Clearwater likely aims for higher internal rates. Effective waste management can also lead to cost savings through reduced disposal fees.

- Recycling rates for paper, plastics, and electronics are constantly monitored.

- The company may partner with certified recycling vendors.

- Waste reduction initiatives are implemented.

- Compliance with local environmental regulations is ensured.

Clearwater Analytics faces rising ESG reporting demands and climate change concerns within the investment sphere, influenced by regulations and investors. Sustainability is important, with the focus on eco-friendly operations and sustainable data center practices to minimize its footprint. Waste management and recycling efforts, in compliance with local rules, support Clearwater's environmental stewardship goals.

| Factor | Impact on Clearwater | Data (2024/2025) |

|---|---|---|

| ESG Reporting | Increased compliance costs, potential market advantage | Global ESG market expected to hit $53T by 2025; SEC finalized climate disclosure rules. |

| Climate Change | Influences investment decisions and impacts brand value. | Sustainable investments reached $40T globally in 2024. |

| Data Center Efficiency | Operational costs, environmental impact, and renewable energy. | Data centers use 3% of global electricity in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis integrates data from financial news, governmental publications, industry reports, and market forecasts. Every element reflects credible sources.