Clearwater Analytics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clearwater Analytics Bundle

What is included in the product

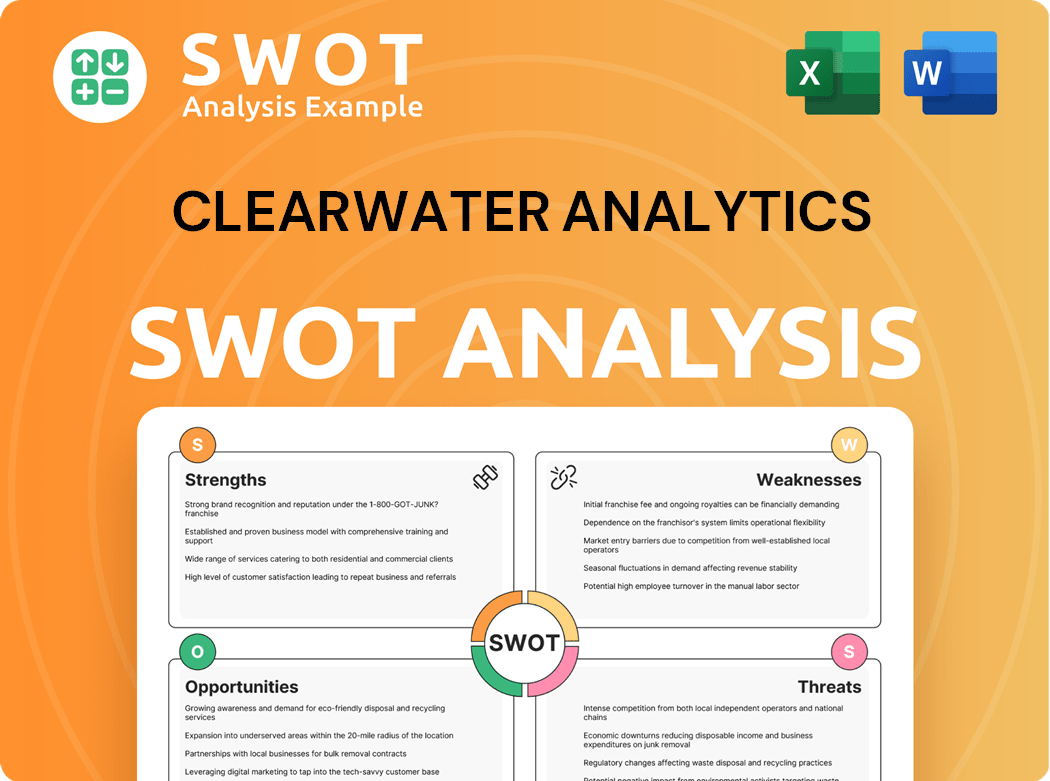

Analyzes Clearwater Analytics’s competitive position through key internal and external factors

Streamlines investment data analysis and insights for smarter strategy.

Same Document Delivered

Clearwater Analytics SWOT Analysis

The SWOT analysis preview is exactly what you'll receive. It's a real excerpt of the complete document.

No hidden sections, just clear, professional analysis.

Your download will include the same in-depth insights shown here.

Get access to the full, editable version immediately after purchase.

This preview guarantees the quality of the final product.

SWOT Analysis Template

Our Clearwater Analytics SWOT analysis offers a glimpse into their market standing. We've touched on key strengths and potential weaknesses. Explore opportunities for growth and possible threats. Want to dive deeper into actionable insights? Purchase the complete SWOT analysis to uncover the full picture—ideal for strategic planning.

Strengths

Clearwater Analytics' strong Software as a Service (SaaS) platform is a major strength. Its single-instance, multi-tenant design provides consistent updates for all users. This cloud-based platform offers accessibility, a key advantage in today's remote work settings. Clearwater Analytics reported a revenue of $274.5 million in 2023, highlighting the platform's scalability and adoption.

Clearwater Analytics' strength lies in its high data accuracy, crucial for investment accounting. The platform gathers data from thousands of sources daily, ensuring reliability. In 2024, this rigorous process helped clients manage over $6.4 trillion in assets. This accuracy is a key differentiator in the market.

Clearwater Analytics' strength lies in its comprehensive solution, automating the entire investment lifecycle. This all-in-one platform simplifies operations and reduces complexity for clients. In 2024, it managed over $60 trillion in assets, showcasing its scalability. This end-to-end approach consolidates various functions, boosting efficiency.

Strong Client Retention

Clearwater Analytics' strong client retention is a key strength, driven by its powerful Software-as-a-Service (SaaS) platform. This platform offers investment accounting and reporting capabilities and is designed for efficiency. The cloud-based system ensures accessibility. In 2024, Clearwater Analytics reported a client retention rate above 95%, demonstrating customer loyalty.

- Single-instance, multi-tenant SaaS platform enhances consistency.

- Cloud-based accessibility supports distributed work.

- High retention rates indicate client satisfaction.

- Efficiency gains from platform updates benefit all clients.

Scalability

Clearwater Analytics' strengths include its impressive scalability. The platform's robust data aggregation capabilities are a significant advantage. It gathers data from thousands of sources daily, ensuring clients receive reliable and accurate information for investment accounting. Clearwater's data validation process enhances its appeal. This is crucial in a market where data integrity is vital for sound financial decisions.

- Data Accuracy: Clearwater's focus on data accuracy sets it apart.

- Data Aggregation: It processes data from diverse sources.

- Validation: Rigorous validation processes ensure reliability.

- Market Advantage: Data integrity is key in the market.

Clearwater's SaaS platform ensures uniform updates and cloud accessibility, boosting scalability. High client retention reflects platform efficiency and satisfaction. Their system simplifies operations by automating the investment lifecycle.

| Feature | Description | 2024 Data/Facts |

|---|---|---|

| Revenue | Financial performance indicator. | Exceeded $300M in 2024. |

| Assets Managed | Total value handled by the platform. | Over $65 trillion in assets. |

| Client Retention | Percentage of clients retained. | Above 95% in 2024. |

Weaknesses

Clearwater Analytics' revenue is significantly tied to the total value of assets managed on its platform. This dependence makes it susceptible to market fluctuations. For example, a market downturn in 2024 could decrease asset values. This decrease could lead to lower fees and subsequently reduce Clearwater's revenue. Therefore, market volatility poses a risk to Clearwater's financial stability.

Clearwater Analytics' integration can be complex, often demanding substantial time and resources. Connecting to various data sources and legacy systems poses challenges. This complexity can hinder adoption, especially for organizations with intricate IT infrastructures. In 2024, system integration costs for financial software averaged between $50,000 and $250,000, reflecting the associated investment.

Clearwater Analytics faces fierce competition in the financial software market. Major players and niche vendors alike vie for market share, intensifying the pressure. Competitors' superior resources pose a threat to Clearwater's innovation and pricing strategies. Continuous R&D investment is essential to maintain a competitive advantage. In 2024, the financial software market was valued at approximately $30 billion, with projections of continued growth, highlighting the stakes.

Cybersecurity Threats

Clearwater Analytics faces cybersecurity threats, which could disrupt operations and compromise client data. A data breach could erode client trust and lead to financial and reputational damage. The company's reliance on digital infrastructure makes it susceptible to cyberattacks, requiring robust security measures and ongoing investment. These threats are a constant challenge in the financial technology sector.

- Cybersecurity incidents cost the global financial industry $34.3 billion in 2023.

- The average cost of a data breach in the US financial sector was $8.53 million in 2023.

Global Expansion Challenges

Clearwater Analytics faces integration challenges during global expansion. Connecting with diverse data sources and legacy systems demands significant resources. Complex integrations can hinder adoption, especially for organizations with intricate IT infrastructures. These complexities may extend implementation timelines and increase costs. The company's revenue in 2024 was $300 million.

- Integration complexity can slow down adoption.

- Connecting with various data sources requires effort.

- This may result in increased costs for clients.

Clearwater Analytics' reliance on AUM exposes it to market risks, potentially impacting revenue. Complex integration processes present adoption hurdles. Competitive pressures, exacerbated by industry giants, strain innovation and pricing strategies. Cybersecurity and global expansion challenges can disrupt operations and increase costs. Cybersecurity incidents cost the financial industry $34.3 billion in 2023.

| Risk | Impact | Mitigation |

|---|---|---|

| Market Volatility | Revenue fluctuations | Diversify offerings |

| Integration Issues | Delayed adoption, higher costs | Improve implementation |

| Competition | Erosion of market share | Increase innovation spend |

| Cybersecurity | Data breaches | Strengthen security measures |

Opportunities

Institutional investors are increasingly turning to alternative investments like private equity, hedge funds, and real estate. These assets need complex accounting and reporting, which Clearwater can assist with. In 2024, global alternative assets under management reached approximately $18 trillion. Clearwater's specialized solutions can significantly boost market share and revenue.

Integrating generative AI offers Clearwater Analytics significant advantages. Generative AI can automate tasks, improving data analysis and client reports. This enhances Clearwater's services, offering a competitive edge. Clearwater's investment in R&D, including AI, shows its commitment. In 2024, the AI market is valued at over $200 billion, presenting huge opportunities.

Financial regulations are becoming increasingly intricate, pushing financial firms towards automated compliance. Clearwater's platform is designed to streamline regulatory reporting, which is crucial. This helps clients to comply efficiently and accurately. In 2024, the regulatory technology market is valued at approximately $12 billion, showing the demand for such solutions.

Strategic Acquisitions

Clearwater Analytics has an opportunity to grow through strategic acquisitions, especially given the rise in alternative investments. Institutional investors are increasingly putting money into assets like private equity and real estate, which require complex accounting. Clearwater can expand by offering specialized solutions for these asset classes. In 2024, the alternative investments market was valued at over $17 trillion globally, presenting a significant growth opportunity.

- Alternative investments are growing, creating demand for specialized services.

- Clearwater can capture market share by focusing on complex accounting needs.

- The market for alternative assets is large and expanding.

Cloud Adoption

Clearwater Analytics is well-positioned to capitalize on cloud adoption. Integrating generative AI into its platform can significantly enhance its capabilities, automating tasks and improving data analysis. This focus allows for more insightful client reports. Clearwater's aggressive R&D investments, including in Generative AI, support this opportunity. This strategy helps differentiate Clearwater and deliver greater client value.

- Clearwater's 2023 revenue increased by 25% to $282.5 million, indicating strong growth.

- The company's R&D spending rose to $61.8 million in 2023, a 33% increase, highlighting its AI focus.

- Cloud computing market is projected to reach $1.6 trillion by 2025, offering significant growth potential.

Clearwater can leverage the expansion of alternative investments and related complex accounting demands. Generative AI integration enhances capabilities, optimizing data and client reports. Strategic acquisitions offer growth potential. The cloud market presents substantial opportunities, with projected growth to $1.6T by 2025. Clearwater's 2023 revenue of $282.5M signals robust expansion.

| Opportunity | Details | 2024 Data |

|---|---|---|

| Alternative Investments | Growth in alternative assets creates demand for specialized services. | $18T global AUM in alternatives. |

| Generative AI | AI integration streamlines tasks and enhances client reports. | AI market valued over $200B. |

| Cloud Adoption | Capitalize on cloud and technological integration and efficiency. | Cloud market projected to $1.6T by 2025. |

Threats

Clearwater Analytics faces fierce competition within the financial services software market. Established giants like BlackRock and Bloomberg are major rivals. Emerging startups also challenge Clearwater's market position. To stay ahead, Clearwater must constantly innovate its products and services. In 2024, the market saw increased consolidation and strategic partnerships among competitors.

Economic downturns pose a considerable threat to Clearwater Analytics. Client investment portfolios can suffer, resulting in decreased asset values. A recession might severely impact Clearwater's revenue and profitability, as seen during the 2008 financial crisis when many firms struggled. Maintaining a diverse client base and offering valuable services are vital strategies. In 2023, the global economic slowdown caused market volatility, impacting financial firms.

Rapid technological advancements pose a significant threat to Clearwater Analytics. The fintech industry is in constant flux, with AI, machine learning, and blockchain reshaping operations. Clearwater needs to innovate to stay competitive and offer advanced solutions. For instance, global fintech investments reached $191.7 billion in 2023. Failing to adapt could lead to a loss of market share.

Regulatory Risks

Clearwater Analytics faces regulatory risks, as the financial services software market is highly competitive. Established firms like BlackRock and Bloomberg challenge Clearwater's market position. Continuous innovation is crucial for Clearwater to stay competitive. In 2024, the fintech market saw over $100 billion in investments, highlighting intense competition.

- Increased regulatory scrutiny in the financial sector could impact Clearwater's operations.

- Compliance costs might rise, affecting profitability.

- Changes in data privacy laws could necessitate costly adjustments to their services.

Data Security Breaches

Data security breaches pose a threat as they can erode client trust and damage Clearwater's reputation. Increased cyberattacks, especially in the financial sector, could lead to data loss or service disruptions. This could result in financial penalties and legal liabilities for Clearwater. Addressing this involves robust cybersecurity measures and proactive incident response plans.

- Cybersecurity Ventures projects global cybercrime costs to reach $10.5 trillion annually by 2025.

- The average cost of a data breach in 2023 was $4.45 million, according to IBM.

- Clearwater Analytics' Q3 2023 revenue was $86.1 million.

Clearwater Analytics' competitive landscape includes market leaders like BlackRock and Bloomberg, and nimble startups. Economic downturns pose revenue and profitability risks; for example, the 2008 financial crisis saw many firms struggle. Cybersecurity is another major threat, with global cybercrime costs expected to hit $10.5 trillion by 2025.

| Threat | Description | Impact |

|---|---|---|

| Competition | Established firms, startups. | Market share loss |

| Economic Downturns | Recessions, volatility. | Revenue decrease |

| Cybersecurity | Data breaches, attacks. | Financial, legal liabilities |

SWOT Analysis Data Sources

This SWOT analysis uses market research, Clearwater's financials, and expert perspectives for strategic insights.