CLP Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

What is included in the product

Analysis of CLP Holdings' businesses using BCG Matrix, with strategic insights for each quadrant.

Printable summary optimized for A4 and mobile PDFs, delivering actionable insights on the go.

Full Transparency, Always

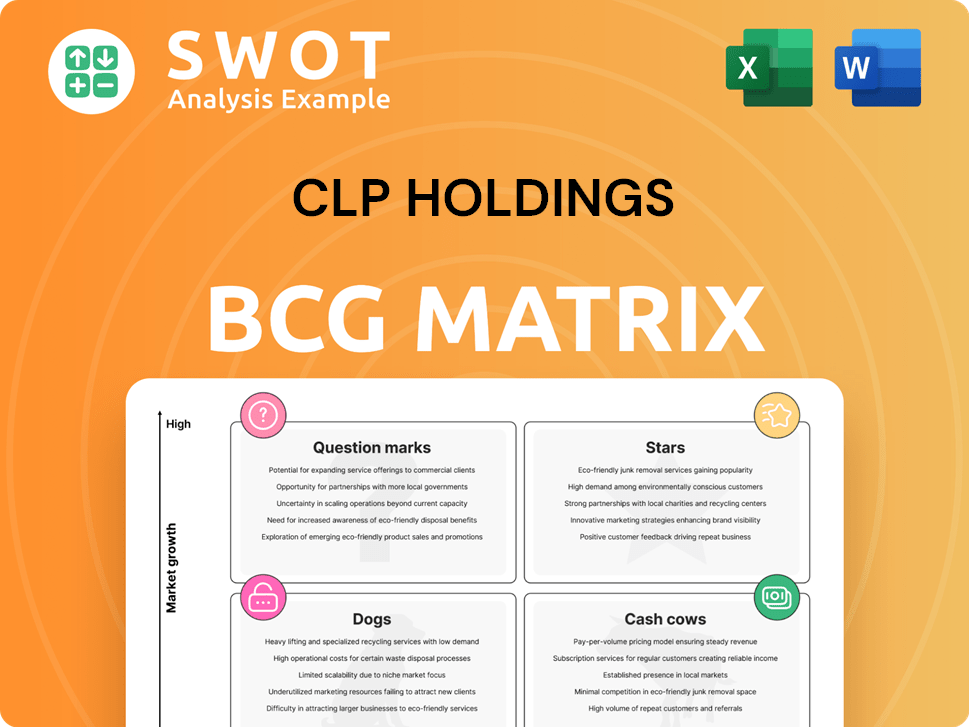

CLP Holdings BCG Matrix

The CLP Holdings BCG Matrix preview is identical to the purchased document. Receive a full, ready-to-use report, fully formatted, after purchase. No alterations are needed after the instant download.

BCG Matrix Template

CLP Holdings navigates a complex energy market. Its BCG Matrix reveals product strengths and weaknesses. Identifying "Stars" and "Dogs" is critical for investment. Understanding market share and growth rates is key. This overview scratches the surface.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

CLP Holdings is actively expanding in renewable energy, particularly in China and India, with significant investments in wind and solar projects, which are key growth areas. These initiatives include projects with a capacity of 300 MW each. Furthermore, EnergyAustralia's battery project adds 350 MW. This expansion boosts its renewable energy capacity.

CLP Holdings is strategically investing in non-carbon energy. They have 1.8GW of projects underway in Mainland China. This aligns with the dual-carbon targets set by the Central Government. CLP aims to double its renewable energy portfolio in Mainland China. In 2024, CLP's investments in renewables are a key growth area.

Apraava Energy, a joint venture of CLP Holdings, is a rising star in India's energy sector. They are heavily involved in developing low-carbon projects, including renewables. With over 2GW of non-carbon projects underway, Apraava aims to triple its portfolio, supporting India's decarbonization goals. In 2024, Apraava demonstrated solid performance across its varied energy assets.

New Gas Generation Unit at Black Point

The new gas generation unit at Black Point Power Station in Hong Kong is a strategic move by CLP Holdings. It reduces carbon emissions and supports a reliable power supply. This initiative facilitates the retirement of coal-fired units at Castle Peak Power Station. The offshore LNG terminal's successful operation enhances gas generation infrastructure.

- In 2023, CLP's carbon intensity decreased to 0.51 kgCO2e/kWh.

- The Black Point Power Station has a capacity of 2,500 MW.

- CLP aims to achieve net-zero carbon emissions by 2050.

- The LNG terminal ensures a diverse gas supply.

Strategic Partnerships for Growth

CLP Holdings strategically forges partnerships to fuel growth, a key aspect of its "Stars" quadrant in the BCG Matrix. Collaborations like the one with China General Nuclear Power Group (CGN) bolster its expertise in nuclear and wind power. These alliances enable the development of renewable energy projects, crucial for long-term sustainability. In 2024, CLP's investments in renewable energy partnerships reached a record high, reflecting its commitment to sustainable development.

- Partnerships with CGN for nuclear and wind projects.

- Enhances capabilities and new projects development.

- Positioning for sustainable, long-term growth.

- 2024 saw record investments in renewable energy partnerships.

CLP's "Stars" quadrant highlights strategic partnerships boosting renewable energy ventures, crucial for growth.

These collaborations, such as with CGN, enhance capabilities in nuclear and wind power. Record investments in 2024 underscore a commitment to sustainable growth.

Partnerships drive the development of projects.

| Partnership Type | Partner | Objective |

|---|---|---|

| Nuclear & Wind | China General Nuclear Power Group | Expand renewable energy portfolio |

| Renewable energy projects | Various | Boost sustainable development |

| Energy projects | Multiple | Increase capacity |

Cash Cows

CLP Power Hong Kong, a cash cow, supplies electricity to 80% of Hong Kong. This generates steady revenue. The Scheme of Control guarantees returns. Reliability in 2024: 99.999%.

CLP Holdings benefits from a stable regulatory environment in Hong Kong. The Scheme of Control agreement offers predictable returns, reducing financial risk. This supports consistent dividend payouts and long-term planning. The current agreement runs until 2033; the continuation is expected. In 2024, CLP's revenue was HKD 109.5 billion.

CLP Power Hong Kong's 99.999% reliability rate is a hallmark of its "Cash Cow" status, ensuring a stable power supply. This translates to approximately 1.2 minutes of annual unplanned power interruptions per customer. Such reliability boosts customer satisfaction and strengthens their loyalty. In 2024, this consistent performance underpinned CLP's strong financial results.

Feed-in Tariff (FiT) Scheme

CLP Power's Feed-in Tariff (FiT) Scheme is a cash cow, benefiting from customer participation in renewable energy. This initiative supports Hong Kong's sustainability goals by incentivizing renewable energy system installations. The FiT scheme contributes to a lower-carbon electricity grid. As of December 2023, over 400MW of generation capacity was approved under the FiT scheme since its 2018 inception.

- FiT scheme encourages renewable energy installations.

- Supports Hong Kong's sustainability goals.

- Contributes to a lower-carbon electricity grid.

- Over 400MW generation capacity approved by December 2023.

Operational Excellence

CLP Holdings excels in operational efficiency, leveraging technology to optimize performance. The Jhajjar thermal plant in India demonstrated this commitment by achieving record efficiency levels in 2024. In Hong Kong, CLP’s network reliability remained exceptionally high, at 99.999% in 2024, underscoring its dedication to dependable service.

- Jhajjar thermal plant achieved record efficiency.

- Hong Kong network reliability: 99.999% in 2024.

- Focus on efficient management and tech innovation.

CLP Power Hong Kong epitomizes a cash cow, fueled by its dominant market share and stable returns. The Scheme of Control guarantees predictable profits, solidifying its financial stability. High reliability, like the 99.999% in 2024, ensures consistent revenue.

| Key Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | Electricity supply in Hong Kong | 80% |

| Reliability | Power supply availability | 99.999% |

| Revenue | CLP Holdings' Total | HKD 109.5 Billion |

Dogs

CLP Holdings' coal-fired power plants are classified as "Dogs" in the BCG Matrix due to decreasing profitability. Stricter environmental rules and the global shift towards cleaner energy sources are key factors. In 2024, CLP's operational performance was impacted by the ongoing energy transition. The company aims for net-zero emissions by 2050.

The Yallourn power plant's 2028 closure in Australia signifies a strategic shift for CLP Holdings. This closure will lead to a revenue decline, necessitating careful transition planning. The company's proactive ESG approach involves replacing fossil fuels. In 2024, CLP is focused on expanding renewable energy sources. This move is crucial for long-term sustainability.

EnergyAustralia, within CLP Holdings' portfolio, grapples with fierce competition and rising living costs in the Australian retail energy market. These factors significantly squeeze profit margins, necessitating a strong emphasis on operational efficiency and customer retention. In 2024, the retail market saw continued pressures from competition and economic constraints. This environment demands strategic agility to maintain market share.

Potential Stranded Assets

CLP Holdings faces the risk of stranded assets due to the shift to renewables. Investments in fossil fuel infrastructure could lose value. Managing these assets is vital to prevent financial setbacks. CLP has been investing in gas, renewables, and storage.

- CLP's 2024 Interim Report noted a HKD 4.8 billion impairment loss.

- The company aims to reduce coal-fired generation.

- Renewable energy capacity is growing.

- They are investing in energy storage.

Underperforming International Assets

CLP Holdings' international assets, particularly in Australia, India, Taiwan, and Thailand, are categorized as "Dogs" in its BCG matrix. These assets face hurdles such as regulatory and political risks, potentially diminishing their contribution to overall profitability. The company anticipates a decline in these regions' contribution to recurring profit, projecting it to be 15% over the next decade. This necessitates strategic decisions on their future.

- Regulatory hurdles in these regions pose significant challenges.

- Political risks add to the uncertainty surrounding these assets.

- Declining profitability necessitates strategic reassessment.

- The projected 15% profit contribution highlights the need for action.

CLP Holdings' international assets face challenges, classified as "Dogs." Regulatory and political risks decrease profitability. A 15% profit contribution decline is projected. Strategic decisions are crucial.

| Category | Description | 2024 Data |

|---|---|---|

| Impairment Loss | HKD 4.8 billion | From 2024 Interim Report |

| Profit Decline | Projected Contribution | 15% in the next decade |

| Operational Challenges | Regulatory & Political Risks | Across international assets |

Question Marks

New energy storage projects, like battery storage and pumped hydro, are question marks for CLP Holdings, demanding capital with tech and market risks. These are crucial for integrating renewables and stabilizing the grid. EnergyAustralia's 350 MW battery project is a key example. In 2024, global energy storage investments reached $20 billion, highlighting growth potential.

CLP Holdings is growing its renewable energy presence in Mainland China, though it faces regulatory and competitive hurdles. Successful ventures hinge on smart partnerships and project choices. For example, in 2024, CLP's investment in China's energy sector reached HK$2.1 billion. The company plans to keep collaborating with CGN on nuclear and wind projects.

Green hydrogen presents a "Question Mark" for CLP Holdings, indicating high growth potential but also significant risk. The sector requires substantial investment and technological breakthroughs to become economically feasible. In 2024, CLPe explored energy efficiency solutions with Hysan, showing early-stage exploration. The global green hydrogen market is projected to reach $15.5 billion by 2028, offering a substantial upside if CLP can navigate the challenges.

Advanced Metering Infrastructure (AMI)

CLP Holdings' investments in Advanced Metering Infrastructure (AMI) represent a strategic move, balancing potential gains with considerable risks. These projects, aiming to modernize grid management and enhance customer service, demand substantial capital and navigate complex regulatory environments. AMI's ability to boost efficiency and integrate distributed energy resources is key to its value proposition. Development milestones have been achieved for two projects and a growing portfolio of > 6.8 million smart meters are to be installed in six states.

- Capital expenditure for AMI projects can be substantial, potentially impacting short-term profitability.

- Regulatory approvals and compliance are critical, introducing uncertainties and delays.

- AMI supports the integration of renewable energy sources, aligning with sustainability goals.

- AMI enhances customer service through improved data and real-time insights.

Emerging Technologies

CLP Holdings' foray into emerging technologies, such as Vehicle-to-Grid (V2G) and microgrids, positions them as a "Question Mark" in the BCG matrix. These ventures represent high-growth potential but currently face uncertainties regarding market adoption and technological maturity. In 2024, the global V2G market was valued at approximately $1.2 billion, with projections to reach $10.8 billion by 2030, indicating significant growth prospects. CLP is actively exploring these areas through collaborations, aiming to capitalize on the evolving energy landscape.

- Vehicle-to-Grid (V2G) and microgrids offer high growth potential.

- Market adoption and technological maturity are uncertain.

- The global V2G market was worth $1.2 billion in 2024.

- CLP is actively exploring these areas through collaborations.

CLP's "Question Marks" like V2G and microgrids balance high growth with tech and market uncertainties. These require investment and face adoption risks, but the V2G market alone could reach $10.8 billion by 2030.

| Category | Focus | Challenges |

|---|---|---|

| Emerging Tech | V2G, Microgrids | Market adoption, Tech maturity |

| Key Projects | Exploration, Collaborations | Investment, R&D |

| Market Value (2024) | V2G $1.2B | Regulatory hurdles |

BCG Matrix Data Sources

CLP's BCG Matrix relies on financial reports, market analysis, and sector data for insightful strategic positioning.