CLP Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CLP Holdings Bundle

What is included in the product

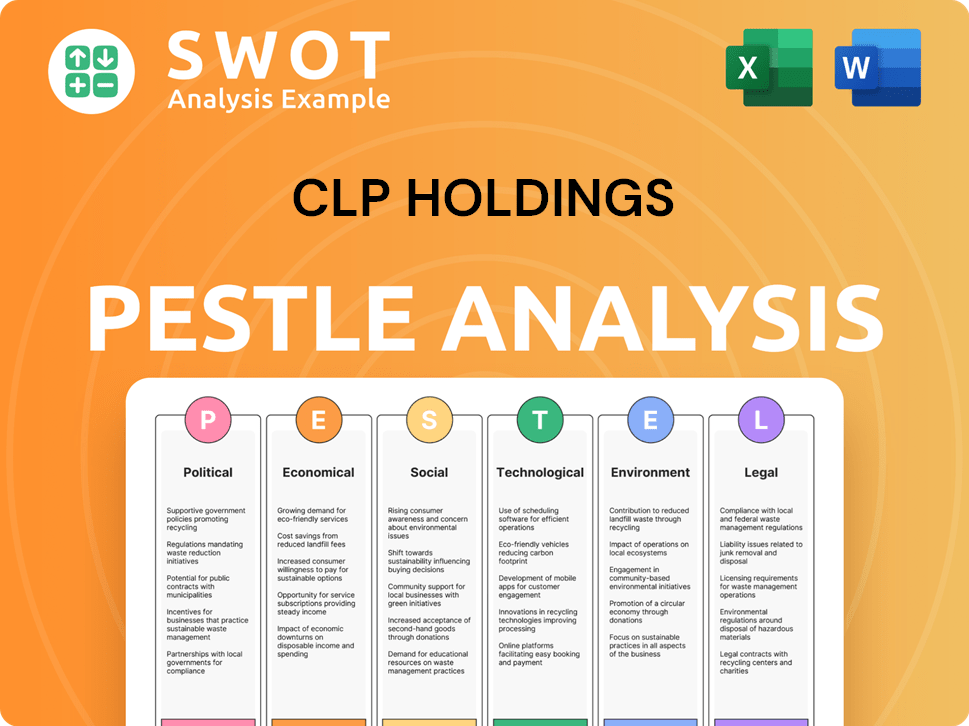

The PESTLE analysis assesses how external forces impact CLP Holdings across six areas: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support risk discussion, guiding strategic planning and decision-making.

Preview Before You Purchase

CLP Holdings PESTLE Analysis

Preview the detailed CLP Holdings PESTLE analysis here. The document showcases the company's external factors. All political, economic, social, technological, legal & environmental aspects are assessed. After purchasing, you'll receive this same expertly formatted analysis immediately.

PESTLE Analysis Template

Navigate the complex world of CLP Holdings with our in-depth PESTLE Analysis. Discover how political changes and economic shifts are affecting their operations.

Understand the impact of social trends and technological advancements on their business model.

Uncover crucial insights into environmental regulations and legal frameworks impacting CLP's strategy.

This meticulously researched analysis gives you a competitive advantage.

Our ready-to-use report simplifies strategic planning and market analysis.

Empower your decisions and download the complete PESTLE Analysis now!

Get the actionable intelligence you need today.

Political factors

CLP's Hong Kong operations are heavily shaped by the Scheme of Control agreement, impacting financial returns. As of 2024, this agreement's terms and potential adjustments are crucial for investors. The Hong Kong government's push for carbon neutrality by 2050 directs CLP's investments in green energy. In 2023, CLP invested HK$11.7 billion in decarbonization projects.

CLP Holdings faces significant political influence due to regional decarbonization goals. Hong Kong and mainland China's governments push for lower emissions, impacting CLP's operations. These policies favor renewables and reduce coal use, shaping CLP's investment plans. In 2024, CLP invested heavily in green projects, aligning with these targets; for example, in 2024, 24% of CLP's total energy supply was renewable.

CLP's decarbonization strategy heavily relies on importing clean electricity from mainland China, a move contingent on robust regional cooperation. This requires ongoing government agreements to facilitate power transmission and nuclear power imports. In 2024, CLP's imports from the mainland accounted for a significant portion of Hong Kong's electricity supply, underscoring the importance of these political relationships. The expansion of cross-border power trade is crucial for long-term sustainability.

Political Stability in Operating Regions

CLP Holdings faces varied political landscapes across its operational regions. Political stability in Hong Kong and mainland China is crucial, impacting regulatory frameworks and investment climates. Australia's political climate, along with that of India, Taiwan, and Southeast Asia, affects project approvals and operational continuity. Geopolitical shifts, such as trade tensions or policy changes, can influence CLP's strategic decisions.

- Hong Kong's GDP growth in 2024 is projected at 2.5-3.5%, influenced by political and economic factors.

- China's electricity demand growth is expected to be around 5-6% in 2024, affecting CLP's investments.

- Australia's political focus on renewable energy impacts CLP's investment strategies.

Community and Stakeholder Relations

CLP Holdings actively cultivates positive relationships with the community and stakeholders, vital for its operations. This involves addressing community concerns and supporting underprivileged households. The CLP Community Energy Saving Fund is a key initiative. Engagement with local governments is also a priority.

- In 2023, CLP invested HK$14.5 million in community programs.

- The CLP Community Energy Saving Fund has helped over 17,000 households.

- CLP regularly consults with local governments on energy projects.

Political factors significantly impact CLP Holdings' operations, particularly concerning decarbonization targets and regional cooperation. Hong Kong and China's decarbonization goals, coupled with government regulations, drive investment in renewables. The growth in electricity demand, projected around 5-6% in China for 2024, influences CLP's strategy.

| Factor | Impact | Data |

|---|---|---|

| Decarbonization Goals | Investment in renewables, reduced coal use | 24% renewable energy supply in 2024. |

| Electricity Demand (China) | Influence on investment strategies | 5-6% growth expected in 2024 |

| Political Stability | Regulatory environment and project approvals. | Hong Kong GDP growth projected at 2.5-3.5% in 2024. |

Economic factors

CLP Holdings' Hong Kong operations thrive on a regulated return mechanism. The Scheme of Control ensures a steady cash flow, crucial for financial stability. This regulated return is calculated on the average net fixed assets. For 2024, the allowed return was approximately 7.5%.

CLP Holdings faces fuel cost volatility, crucial for thermal power plants. A diversified fuel mix and HK's stable earnings help mitigate risks. However, extreme fuel cost swings can hit earnings. In 2023, fuel costs significantly affected global energy firms. Expect continued volatility.

CLP Holdings is making substantial capital expenditures to modernize its power infrastructure. For 2024-2025, investments aim at decarbonization and asset portfolio expansion. Successful investment management and returns are vital for CLP's future. In 2023, CLP's capital expenditure was approximately HK$18.2 billion.

Economic Growth and Electricity Demand

CLP's electricity sales directly correlate with economic growth and climate conditions. A robust economy boosts electricity demand, especially with new residential and commercial developments. The Hong Kong economy, a key market, saw a 3.2% GDP growth in 2023. This growth, alongside temperature variations, significantly impacts CLP's revenue streams.

- 2023 GDP growth in Hong Kong was 3.2%.

- Temperature changes are a major driver of electricity demand.

Market Competition and Customer Affordability

CLP Holdings faces diverse market competition, notably in Australia's customer segment. To stay competitive, the company must balance its pricing strategies, particularly in regions with significant competition. Customer affordability is a key concern, especially for low-income households, influencing demand and regulatory scrutiny. The company's financial performance is impacted by its ability to manage these economic factors effectively.

- In 2024, the average electricity bill in Australia was approximately $300 per quarter.

- CLP's market share in Australia is around 10%.

- Government subsidies and rebates significantly impact affordability for vulnerable customers.

CLP Holdings' revenue hinges on Hong Kong's economic growth, which impacts electricity demand. A strong economy and temperature fluctuations significantly influence sales. In 2023, Hong Kong's GDP grew by 3.2%, with 2024's growth figures eagerly anticipated.

| Economic Factor | Impact | Data |

|---|---|---|

| GDP Growth (Hong Kong) | Direct impact on electricity demand | 2023: 3.2% growth |

| Fuel Costs | Affect profitability | Fuel cost volatility is persistent |

| Interest Rates | Affect capital expenditure costs | Anticipated rate shifts in 2025 |

Sociological factors

CLP's community programs promote energy conservation and support vulnerable households. These programs address social issues related to energy affordability and safety. In 2024, CLP invested $15 million in community initiatives. They helped over 50,000 families with energy-saving measures and safety checks.

Customer needs and expectations are shifting towards smarter, flexible energy services. This drives CLP to offer digital solutions. In 2024, CLP saw a rise in customer demand for renewable energy options. Feed-in tariff schemes encouraged investment in solar, with an increase of 15% in installations.

CLP Holdings must manage employee relations across diverse regions, navigating labor market conditions. In 2024, CLP employed approximately 3,500 people. Ensuring a safe work environment and investing in workforce skills are crucial. Employee-related expenses were around HK$1.2 billion in the 2024 interim results.

Public Perception and Community Relations

CLP Holdings' public image hinges on power supply dependability and how it addresses community issues. In 2024, CLP consistently achieved a system availability of over 99.999%, showcasing its commitment to reliability. Effective community engagement, including prompt responses to concerns, is vital for maintaining a positive reputation. This proactive approach helps build trust and support.

- System availability exceeded 99.999% in 2024.

- Community engagement initiatives are ongoing.

- Public perception directly impacts operational success.

Social Equity and Support for Vulnerable Groups

CLP Holdings actively addresses social equity through community initiatives. They offer subsidies and safety upgrades, particularly for the elderly and low-income households. These programs boost living conditions and promote fair access to essential services. This commitment reflects a focus on societal well-being. In 2024, CLP invested $20 million in community programs.

- Subsidies for low-income families.

- Electrical safety improvements.

- Community outreach initiatives.

- Focus on vulnerable demographics.

CLP's social initiatives support communities, including energy conservation efforts and aid for vulnerable groups, such as elderly or low-income families. In 2024, around $35 million was allocated to such community efforts. Positive public perception, which can be a factor of share performance, depends on reliable services and community engagement, further solidifying their social standing.

| Factor | Description | 2024 Data |

|---|---|---|

| Community Investment | Social programs funding | $35M |

| System Availability | Reliability metric | >99.999% |

| Customer Satisfaction | Satisfaction score | 78% |

Technological factors

CLP Holdings is significantly investing in renewable energy. They are focusing on solar, wind power, and energy storage solutions. Technological advancements are vital for their shift. In 2024, CLP planned to increase its renewables capacity. For example, in 2023, CLP Power Hong Kong's renewables accounted for 6.8% of its total fuel mix.

CLP Holdings is heavily invested in smart grid technologies and digital transformation to enhance efficiency and customer service. The company is deploying smart meters, with approximately 80% of households in Hong Kong already equipped by late 2024. This initiative allows for personalized energy services and improves grid management. CLP allocated around HK$1.5 billion for digital projects in 2024, focusing on data analytics and cybersecurity.

CLP Holdings is focusing on advanced gas-fired generation units. This shift supports a move away from coal-based power. These technologies enhance efficiency. They also boost reliability, ensuring a steady power supply. In 2024, CLP's gas-fired capacity is expected to increase by 10%.

Cyber Security

Cyber security is a significant technological factor for CLP Holdings, given its increasing digitalization and reliance on technology to operate and manage customer data. The company needs to invest in advanced cyber security measures to protect its infrastructure and sensitive information from potential threats. In 2024, cyberattacks cost the global economy an estimated $9.2 trillion, a figure expected to rise.

- CLP should prioritize investments in the latest cyber security technologies.

- Recruiting and retaining skilled cyber security professionals is crucial.

- Regular security audits and employee training are necessary.

Innovation in Energy Solutions

CLP Holdings is embracing technological advancements to reshape its energy solutions. The company is actively exploring and implementing Artificial Intelligence (AI) across its operations, aiming to improve efficiency and decision-making. This includes smart grid technologies and advanced metering infrastructure, which help in optimizing energy distribution. These technologies are key in its transition to a lower-carbon economy. In 2024, CLP invested HK$1.8 billion in smart grid technologies.

- AI integration for operational efficiency.

- Deployment of smart grid technologies.

- Investment in advanced metering infrastructure.

- Focus on lower-carbon energy solutions.

CLP's tech strategy centers on renewables (solar, wind) and energy storage, essential for its sustainability targets. Investments in smart grids, like smart meters, enhance grid efficiency and customer service. They're also boosting cyber security due to rising threats, with global cyberattack costs at $9.2T in 2024, according to IBM. Artificial intelligence is key too.

| Technology Focus | Investment/Initiative | Impact/Benefit |

|---|---|---|

| Renewable Energy | Increased capacity (2024 plan) | Reduced carbon footprint |

| Smart Grids | HK$1.8B (2024) in smart grid | Enhanced efficiency & customer service |

| Cyber Security | Advanced security measures | Protection against threats |

Legal factors

The Scheme of Control Agreement (SCA) is a crucial legal factor for CLP Holdings in Hong Kong. It regulates CLP's electricity operations, including generation and distribution. This agreement sets the allowed rate of return, impacting profitability. The current SCA is effective until 2033, influencing long-term investment strategies. In 2024, CLP's net profit reached HK$10.2 billion.

CLP Holdings faces stringent environmental regulations across its operating regions. Compliance involves managing air emissions, waste, and biodiversity. These standards are continuously tightening. For example, in 2024, CLP invested significantly in emissions reduction technologies, with a projected increase in spending of 15% by 2025.

CLP faces new legal obligations due to evolving reporting standards. The HKFRS S1 and S2 and the ESG Reporting Code mandate disclosures. In 2024, these standards require detailed sustainability and climate-related financial data. This includes reporting on carbon emissions and climate risk assessments. Compliance is crucial to avoid penalties and maintain investor trust.

Nuclear Power Regulations and Agreements

CLP Holdings' nuclear power operations, primarily in mainland China, are heavily regulated. These operations are governed by stringent safety standards and environmental regulations. The import of nuclear power necessitates government-to-government agreements, adding another layer of complexity. For instance, in 2024, CLP's attributable output from nuclear sources was approximately 16,000 GWh.

- Compliance with international nuclear safety standards.

- Agreements ensuring the secure import of nuclear fuel.

- Regular inspections and audits by regulatory bodies.

Energy Transition Policies and Regulations

CLP Holdings faces legal factors tied to energy transition policies. These policies, encouraging renewables and phasing out coal, shape its investments and operations. For instance, Hong Kong's Climate Action Plan 2030+ aims for a 50% reduction in carbon emissions by 2035 compared to 2005 levels, influencing CLP's strategy. The company's 2024 interim results showed significant investments in renewable projects.

- Hong Kong's Climate Action Plan 2030+ targets a 50% emissions cut by 2035.

- CLP's 2024 investments reflect the shift towards renewables.

Legal factors significantly shape CLP Holdings. The Scheme of Control Agreement (SCA) regulates operations, with the current one lasting until 2033, and in 2024, CLP’s net profit reached HK$10.2 billion. Environmental regulations require investments in emissions reduction; the spending increased by 15% by 2025. New reporting standards such as HKFRS S1 and S2 impact detailed sustainability data.

| Legal Aspect | Details | 2024/2025 Impact |

|---|---|---|

| SCA | Regulates electricity operations; sets allowed rate of return. | Influence on profitability; long-term strategy impact. |

| Environmental Regs | Compliance with air emission, waste, biodiversity standards. | 15% increase in emissions tech spending. |

| Reporting Standards | HKFRS S1/S2, ESG reporting code mandates disclosures. | Detailed sustainability, climate-related data required. |

Environmental factors

CLP Holdings prioritizes climate change, targeting net-zero emissions by 2050. They're phasing out coal, investing in renewables. In 2024, they allocated ~$2B for green projects. By Q1 2025, renewables made up 30% of their generation capacity, up from 22% in 2023.

CLP Holdings actively works to minimize air emissions from its power stations. They have emission reduction goals for pollutants such as sulfur dioxide, nitrogen oxides, and particulate matter. This is achieved through a combination of fuel choices and cutting-edge technologies. In 2024, CLP's focus remains on improving air quality, aligning with global environmental standards.

CLP Holdings emphasizes biodiversity conservation, striving for 'no net loss'. This involves integrating external guidelines and internal assessments. In 2024, CLP invested HK$1.2 billion in environmental protection. Their commitment includes habitat preservation and species protection, aligning with global sustainability goals.

Circular Economy Transition

CLP Holdings actively promotes a circular economy to tackle resource scarcity and pollution, integrating circular principles into its business model. This involves identifying and executing initiatives across its operations to minimize waste and maximize resource utilization. For example, in 2024, CLP invested $50 million in renewable energy projects that support circular economy practices. This commitment is further demonstrated through partnerships with waste management companies to convert waste into energy.

- $50 million invested in renewable energy projects (2024).

- Partnerships with waste management companies.

Extreme Weather Conditions

Intensifying climate change brings more extreme weather, potentially affecting CLP's power supply. This includes risks like increased flooding or heatwaves, which can disrupt operations. CLP is investing in system upgrades to boost resilience against these weather-related challenges. For example, in 2024, CLP allocated HK$3.5 billion for grid infrastructure improvements.

- HK$3.5 billion investment in 2024 for grid improvements.

CLP Holdings emphasizes environmental stewardship, targeting net-zero emissions by 2050. They are actively reducing air emissions through fuel choices and tech improvements, focusing on global environmental standards. The firm also prioritizes biodiversity conservation and promotes a circular economy to minimize waste.

| Environmental Aspect | CLP Initiatives | 2024/2025 Data |

|---|---|---|

| Climate Change | Transition to renewables; Reduce carbon footprint | $2B green project investment (2024); 30% renewable capacity (Q1 2025) |

| Air Quality | Emission reduction technologies; Adherence to standards | Ongoing emission targets; Focus on improving air quality |

| Biodiversity | 'No net loss' approach; habitat preservation | HK$1.2B investment in environmental protection (2024) |

| Circular Economy | Minimize waste; Maximize resource utilization | $50M in renewable energy projects (2024); waste-to-energy partnerships |

| Extreme Weather | Infrastructure upgrades; Resilience measures | HK$3.5B grid infrastructure investment (2024) |

PESTLE Analysis Data Sources

CLP Holdings PESTLE analysis relies on diverse sources, including regulatory bodies and industry reports.