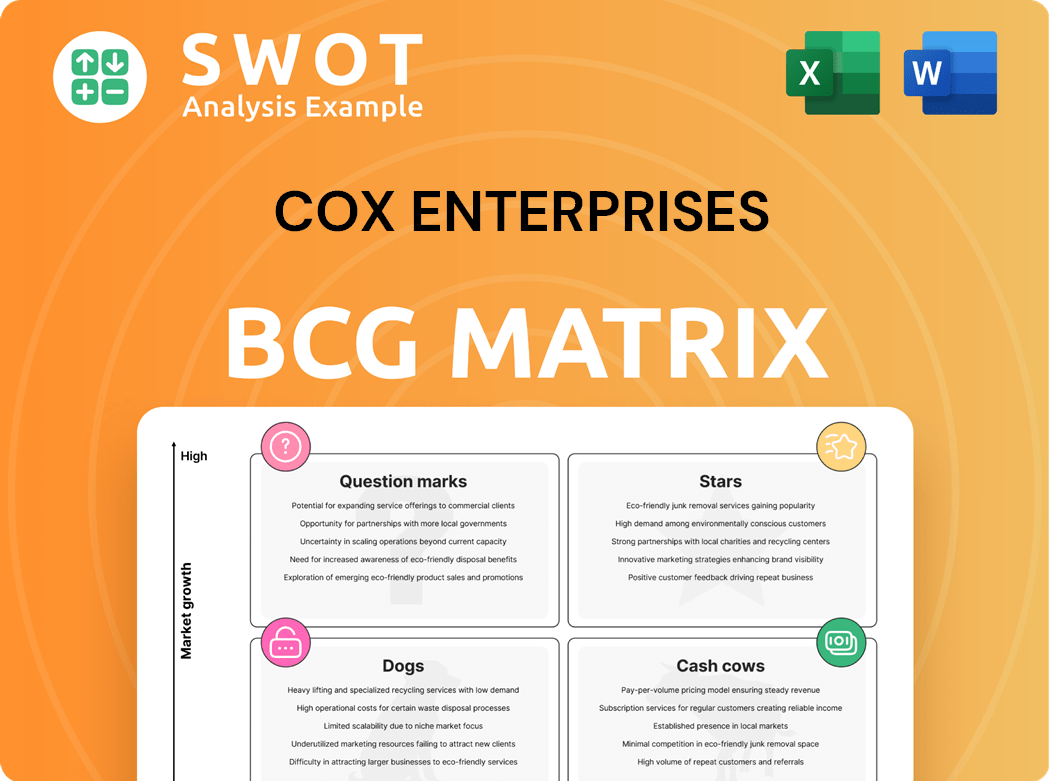

Cox Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

What is included in the product

Highlights which units to invest in, hold, or divest.

Clean and optimized layout for sharing or printing the Cox Enterprises BCG Matrix, providing a clear business overview.

What You’re Viewing Is Included

Cox Enterprises BCG Matrix

The BCG Matrix preview mirrors the purchase exactly. You'll receive the same strategic analysis, designed for Cox Enterprises' specific portfolio, ready to download and implement immediately.

BCG Matrix Template

Cox Enterprises navigates a diverse portfolio, from media to automotive services. This preview hints at product placements within the BCG Matrix. Understanding these quadrants—Stars, Cash Cows, Dogs, Question Marks—is crucial. It reveals where Cox excels and where challenges lie. This sneak peek barely scratches the surface.

Uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Cox Communications, a key segment of Cox Enterprises, operates within the telecommunications industry, providing cable, internet, and phone services. The telecommunications sector's growth trajectory necessitates ongoing investment in infrastructure and service enhancements. As of 2023, Cox Communications served over 6 million residential and commercial customers, demonstrating a substantial market presence. This positions Cox Communications as a "Star" in the BCG matrix, characterized by high market share and high growth potential.

Cox Automotive's digital platforms, including AutoTrader and Kelley Blue Book, are stars in the BCG Matrix. They lead the automotive service sector, benefiting from high market share in vehicle valuation and digital marketing. In 2022, Cox Automotive generated $24.8 billion in revenue, underscoring the strength of these digital assets. These platforms are key revenue drivers.

Cox Automotive is strategically positioned to leverage the burgeoning electrified vehicle market. Forecasts indicate substantial growth, with Cox Automotive anticipating electrified vehicles to comprise one in four sales by 2025. This includes electric vehicles accounting for roughly 10% of the market, supplemented by hybrids and plug-ins at 15%. This strategic alignment could yield significant returns.

Cox Business High-Speed Connectivity

Cox Business's high-speed connectivity services, including broadband and managed Wi-Fi, are essential for modern business operations. This sector supports major events, such as the Consumer Electronics Show (CES). The demand for these services is rising, indicating a strong growth potential. Cox Enterprises' investment in this area is crucial for its future.

- Cox Business revenue in 2023 was $6.7 billion.

- Cox Business serves over 350,000 business customers.

- High-speed internet adoption in the US continues to grow, with 88% of households having internet access in 2024.

- The managed Wi-Fi market is projected to reach $10.2 billion by 2025.

New Cleantech Ventures

Cox Enterprises is heavily investing in cleantech, with over $2 billion allocated since 2007. They focus on sustainable agriculture and energy management, meeting rising demand for eco-friendly solutions. These ventures could greatly boost revenue and environmental benefits. Cleantech investments align with Cox's sustainability goals.

- Over $2 billion invested in cleantech since 2007.

- Focus on sustainable agriculture and energy management.

- Aims to increase revenue and environmental impact.

- Supports Cox Enterprises' sustainability goals.

Cox Enterprises has several "Stars" in its BCG Matrix. These segments show high market share and growth potential. Cox Communications, Cox Automotive's digital platforms, and Cox Business all fit this category. They drive significant revenue and benefit from strategic market positioning.

| Segment | Key Features | Financial Data (2023/2022) |

|---|---|---|

| Cox Communications | Cable, internet, phone services. | Over 6M customers (2023) |

| Cox Automotive Digital | AutoTrader, Kelley Blue Book. | $24.8B revenue (2022) |

| Cox Business | High-speed connectivity. | $6.7B revenue (2023), 350K+ customers |

Cash Cows

Cox Enterprises' Cash Cows include established automotive service businesses. Cox Automotive, a subsidiary, houses brands like AutoTrader and Kelley Blue Book. This segment generated about $3.7 billion in revenue in 2022. These businesses benefit from strong market shares in valuation and digital marketing.

Cox Media Group's TV and radio stations are cash cows, generating stable revenue. These traditional media assets benefit from established market positions and loyal audiences. In 2024, Cox Media Group reported significant ad revenue from these sources. Traditional media still offers a reliable income stream with minimal new investment needed.

Cox Enterprises' legacy communications services, primarily through Cox Communications, are a cash cow. In 2022, Cox had about 6.5 million subscribers. This segment generated roughly $13.2 billion in revenue. Cox benefits from a solid profit margin thanks to its established infrastructure.

Manheim Auctions

Manheim Auctions, under Cox Automotive, is a cash cow within Cox Enterprises' portfolio. It dominates the vehicle auction market, ensuring steady revenue. The wholesale market is robust, with Cox Automotive projecting double-digit volume growth in 2025. This is a slight decrease from the 2024 increase, but still indicates strong performance.

- Manheim's revenue in 2023 was approximately $3.5 billion.

- Cox Automotive's revenue reached $25 billion in 2024.

- Double-digit volume growth is expected in 2025, although slower than 2024.

- Manheim's market share in the U.S. is over 40%.

Cable TV Subscriptions

Cox Communications' cable TV subscriptions are a cash cow, generating consistent revenue. Despite streaming competition, they maintain a loyal customer base through bundling and competitive pricing. Although subscriber numbers might slightly decrease, the revenue remains substantial. This stable revenue stream is crucial for Cox Enterprises.

- In 2024, the cable TV market is estimated to be worth billions, with Cox Communications holding a significant share.

- Cox offers various packages that include cable TV, internet, and phone services to keep customers.

- Competitive pricing strategies help keep a solid customer base.

- The revenue contribution from cable TV is still considerable.

Cash Cows for Cox Enterprises are stable, high-profit businesses that require minimal investment. These include Cox Automotive's brands, generating billions in revenue annually, and Cox Media Group's established TV and radio stations. Cox Communications also contributes significantly. Manheim Auctions, with over 40% market share, is another key Cash Cow.

| Segment | 2024 Revenue (approx.) | Market Position |

|---|---|---|

| Cox Automotive | $25 billion | Strong market share |

| Cox Media Group | Significant ad revenue | Established in media |

| Cox Communications | $13.2 billion (2022) | Stable customer base |

| Manheim Auctions | $3.5 billion (2023) | Dominant, over 40% |

Dogs

Cox Media Group's print newspapers struggle with falling readership and ad revenue. Turnaround strategies are often ineffective, potentially leading to asset sales. Cox reacquired Ohio newspapers from Apollo Global Management due to FCC regulations. In 2024, print ad revenue continued to decline across the industry.

Basic cable TV, a Dogs category for Cox Enterprises, struggles due to commoditization and streaming competition. In 2024, traditional pay-TV lost subscribers, while streaming grew. Cox's gigabit internet deployment tries to counter this decline. Cox generated approximately $22.4 billion in total revenue in 2023.

Low-penetration digital media ventures, like new platforms, face market uncertainty. These ventures, with high demands and low returns, struggle with low market share. To survive, these ventures must rapidly increase market share or risk becoming dogs. For example, in 2024, new social media platforms saw high user acquisition costs.

Outdated Radio Formats

Radio stations with outdated formats, like those playing classic hits or specific genres with dwindling audiences, often find themselves in the Dogs category. These stations usually require expensive overhauls, which are usually unhelpful. Their financial performance is often stagnant, barely generating or consuming cash. A 2024 study showed that traditional radio listening continues to decline, with a 10% drop in ad revenue in the first half of the year.

- Weak Market Position: Outdated formats struggle to compete with streaming services.

- Limited Cash Generation: These stations often break even, not contributing significantly to company profits.

- High Investment Needs: Turnaround strategies are costly and often ineffective.

- Declining Revenues: Ad revenues are shrinking due to reduced listenership.

Struggling Automotive Retail Locations

Struggling automotive retail locations fit the "Dogs" category in Cox Enterprises' BCG Matrix. These underperforming physical stores often grapple with low sales and high operational expenses. They typically hover around the break-even point, generating little to no cash flow.

- In 2024, the average operating costs for auto dealerships rose by 3.5%, squeezing profits.

- Many dealerships faced a 10-15% drop in foot traffic compared to pre-pandemic levels.

- Online sales continue to grow, putting pressure on traditional retail.

- These locations might require significant restructuring or divestiture.

In Cox Enterprises' BCG Matrix, "Dogs" are business units with weak market positions and low growth prospects.

These units, including struggling auto retail and radio stations with outdated formats, often barely break even.

They may require restructuring or divestiture due to declining revenues and high operational costs, which is a common issue across the board.

| Business Unit | Market Position | Financial Performance |

|---|---|---|

| Radio Stations | Outdated formats, declining listenership | Stagnant revenue, high investment needs |

| Automotive Retail | Low sales, high operational expenses | Low cash flow, potential restructuring |

| Print Newspapers | Falling readership, ad revenue decline | Ineffective turnaround, asset sales |

Question Marks

Cox Enterprises ventured into new digital content platforms to boost consumer connectivity. However, the market's reception is lukewarm, with just 25% of users aware of the platform in 2024. Acquiring each user costs about $75, posing a profitability hurdle. This situation places these platforms in the Question Mark quadrant of the BCG Matrix.

Esports investments fit the BCG Matrix's "Question Mark" category for Cox Enterprises. These ventures, like investments in digital industries, have high growth potential but low market share. They require significant cash infusions, yet returns are initially modest. Cox should strategically invest if growth is likely, or consider divestiture if not, as esports revenue is projected to reach $1.86 billion in 2024.

Cox Mobile, Cox Communications' new mobile phone service, represents a strategic move. It aligns with the company's long-term convergence and connectivity strategy. Customers will soon see combined offers integrating Cox Mobile and Cox Internet. This approach aims to boost affordability, features, and performance for users. As of late 2024, Cox has not released specific subscriber numbers for Cox Mobile.

Healthcare Technology Ventures

Healthcare technology ventures represent a "question mark" for Cox Enterprises in its BCG Matrix. These new ventures have high growth potential, but currently hold a low market share. Cox invests in these ventures, focusing on those that can improve health outcomes. The strategy involves investing more if growth is likely, or divesting if not. In 2024, the digital health market is valued at over $200 billion, signaling considerable growth potential.

- High growth potential.

- Low current market share.

- Focus on health outcomes.

- Investment or divestment strategy.

Public Sector Software

Cox Enterprises views investments in public sector software as a "Question Mark" within its BCG matrix. This designation reflects the high-growth potential of the public sector software market, yet its uncertain market share for Cox. The company is strategically expanding beyond core businesses with ventures into high-growth areas, including this sector. These investments are characterized by high growth prospects but currently hold a low market share, necessitating careful strategic management.

- Cox Enterprises is investing in adjacent industries and high-growth markets, including the public sector.

- Public sector software investments are categorized as "Question Marks" due to their high-growth potential and uncertain market share.

- This strategy aligns with Cox's broader goal of diversifying its portfolio and capitalizing on emerging opportunities.

- These ventures require strategic attention to increase market share and realize their growth potential.

Cox Enterprises' "Question Mark" ventures, like those in healthcare tech, have high growth potential but low market share. They require strategic investment or divestment. The digital health market, for instance, was worth over $200 billion in 2024.

| Venture Type | Market Share | Strategy |

|---|---|---|

| Digital Content | Low (25% awareness in 2024) | Invest or Divest |

| Esports | Low | Invest if growth likely |

| Healthcare Tech | Low | Invest or Divest |

| Public Sector Software | Uncertain | Focus on Market Share |

BCG Matrix Data Sources

Cox Enterprises' BCG Matrix leverages financial data, industry analysis, and market reports, alongside company insights for accuracy.