Cox Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

What is included in the product

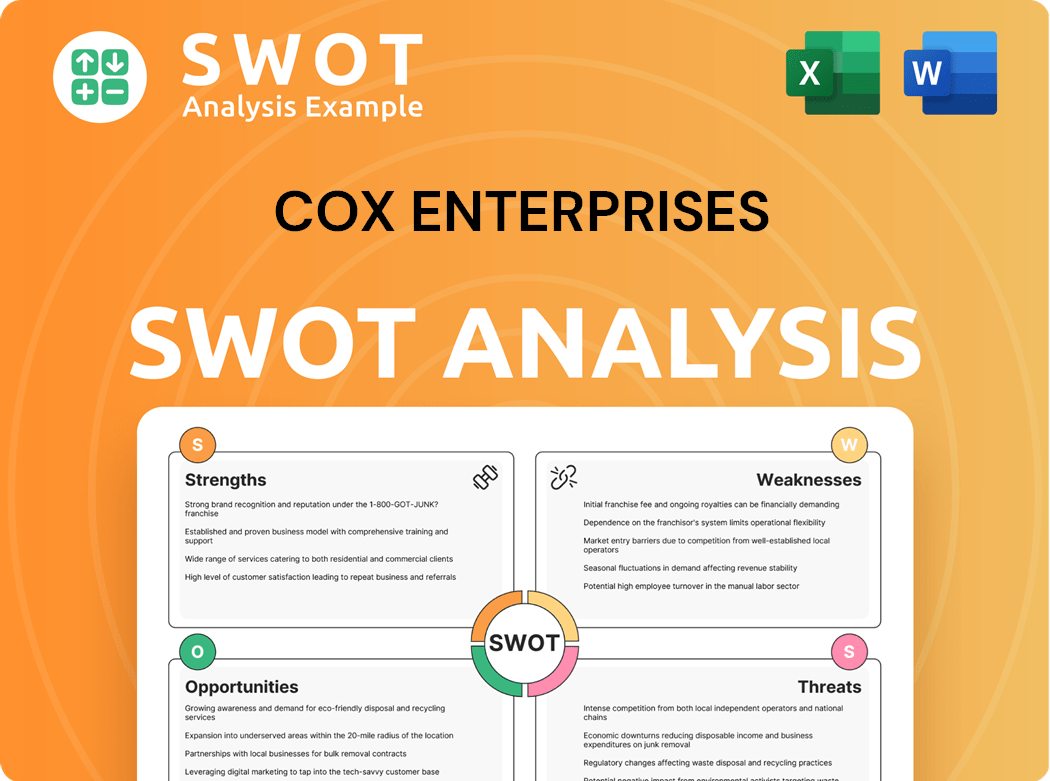

Outlines the strengths, weaknesses, opportunities, and threats of Cox Enterprises.

Provides a concise SWOT matrix for fast, visual strategy alignment.

What You See Is What You Get

Cox Enterprises SWOT Analysis

What you see below *is* the full SWOT analysis! This preview gives you the exact document you'll receive.

SWOT Analysis Template

Cox Enterprises' success stems from strong media brands and diverse investments, yet it faces threats from digital disruption and industry consolidation. This snapshot highlights key strengths, weaknesses, opportunities, and threats. We've touched on financial areas. But to truly understand Cox's trajectory, you need the whole picture. Purchase the complete SWOT analysis and get a dual-format package: a detailed Word report and a high-level Excel matrix. Built for clarity, speed, and strategic action.

Strengths

Cox Enterprises' strength lies in its diversified business portfolio. This includes telecommunications, automotive services, and media. This diversification helps to reduce risks from any single industry's downturn. In 2022, Cox Communications had around $12.5 billion in revenue, while Cox Automotive made about $7 billion.

Cox Enterprises benefits from strong brand recognition, cultivated over years of delivering quality and innovation. Customer satisfaction is high, reflecting a commitment to service excellence. This positive brand image fosters loyalty and attracts new customers, giving Cox a market edge. In 2023, Cox Communications achieved a score of 75 out of 100 on the American Customer Satisfaction Index.

Cox Enterprises boasts substantial financial strengths, fueling its expansion and innovation. The company's solid financial standing supports investments in various growth areas. Strong cash flow enables organic growth and strategic acquisitions. In 2022, net income was $1.7 billion, with assets exceeding $14 billion.

Innovative Technology

Cox Enterprises' commitment to innovative technology is a key strength, particularly in its telecommunications and automotive divisions. They continuously invest in advanced technologies to improve services and products. This focus allows them to remain competitive and meet evolving customer demands across various sectors. For example, Cox Communications invests heavily in fiber optic infrastructure, enhancing its broadband capabilities.

- Cox Communications reported approximately $12.5 billion in revenue in 2022.

- Cox Automotive generated roughly $7 billion in revenue in 2022.

- Investments in fiber optic infrastructure enhance broadband capabilities.

Commitment to Social Impact

Cox Enterprises demonstrates a strong commitment to social impact, enhancing its brand reputation. This focus on quality and innovation has built a positive image. Customer satisfaction scores consistently high, reflecting service excellence. A strong brand boosts customer loyalty and attracts new clients. In 2023, Cox Communications scored 75/100 in the American Customer Satisfaction Index.

- Reputation for quality and innovation.

- High customer satisfaction scores.

- Strong brand equity.

- Competitive advantage in the market.

Cox Enterprises' diverse portfolio mitigates industry-specific risks. Strong brand recognition and high customer satisfaction fuel customer loyalty. Substantial financial resources support ongoing expansion and technological investments.

| Strength | Details | 2023 Data/Example |

|---|---|---|

| Diversified Business | Operations across telecommunications, automotive services, and media. | Cox Communications: $13B (est.) revenue. |

| Strong Brand | Positive image, customer loyalty. | Customer satisfaction (75/100 in 2023) |

| Financial Stability | Robust financial standing, growth support. | Net Income: $1.7B (2022). Assets: >$14B. |

Weaknesses

Cox Enterprises' reliance on communications, media, and automotive sectors poses a weakness. This concentration exposes the company to market-specific downturns. A slump in these areas could severely affect its financial health. In 2022, 70% of revenue came from these sectors, underscoring the risk. Diversification remains crucial for stability.

Cox Enterprises faces a significant weakness: a limited global presence compared to its rivals. International revenue forms a small portion of its overall earnings. This restricts growth opportunities in burgeoning markets, impacting its global competitiveness. In 2022, international revenue represented less than 5% of the total.

Cox Enterprises faces weaknesses due to its legacy systems, especially in cable and media operations, which can slow down efficiency. The high maintenance costs of these systems, reportedly around $200 million annually, impact profits. Upgrading these systems is crucial for boosting agility. Addressing these outdated systems is essential for operational improvements.

Potential Challenges in Adapting to Technological Changes

Cox Enterprises faces challenges due to its focus on communications, media, and automotive sectors. This concentration makes the company susceptible to market-specific downturns. A decline in any of these sectors could negatively affect performance. As of 2022, about 70% of its revenue came from these areas. Diversification is crucial to mitigate risks.

- Market concentration increases vulnerability.

- Sector-specific downturns pose a risk.

- Revenue heavily relies on core sectors.

- Diversification is needed for stability.

Workforce Reductions

Cox Enterprises' workforce reductions may signal internal challenges. Compared to its competitors, Cox Enterprises has a limited global presence, which can hinder growth. The company's international revenue was less than 5% of total revenues in 2022, restricting its ability to compete globally. This limited outreach can also reduce its ability to tap into emerging markets.

Cox Enterprises' weaknesses include concentrated market focus. Reliance on specific sectors makes it vulnerable. Limited global presence restricts growth.

| Weakness | Impact | Data |

|---|---|---|

| Market Concentration | Increased Risk | 70% revenue from core sectors in 2022 |

| Limited Global Presence | Restricted Growth | <5% international revenue (2022) |

| Legacy Systems | Operational Inefficiencies | $200M annual maintenance costs |

Opportunities

The global communications market, projected to hit $1.87 trillion by 2027, offers Cox Enterprises expansive prospects. Entering new markets, especially those with rising internet and mobile device use, could fuel substantial revenue growth. This strategic move diversifies the customer base, mitigating risks associated with regional economic fluctuations. Such expansion allows Cox to tap into underserved areas, boosting its overall market share and profitability.

Investing in emerging technologies presents a significant opportunity for Cox Enterprises to bolster its competitive edge. By prioritizing AI, IoT, and cybersecurity, the company can drive growth and operational improvements. These investments facilitate the creation of new products and services, drawing in new customers and keeping existing ones engaged. In 2022, Cox Enterprises invested around $1 billion in technological advancements and enhancing customer interactions, demonstrating a firm commitment to innovation.

Cox Enterprises can leverage the growing demand for digital media. Expansion of digital offerings is a key opportunity. Streaming and digital platforms are set for growth, boosting revenue. The digital media market is projected to hit $700 billion by 2027, per market analysis. This represents a significant growth potential for Cox Enterprises.

Strategic Partnerships

Cox Enterprises can tap into the expanding global communications market, projected to hit $1.87 trillion by 2027. Strategic alliances can fuel expansion into high-growth geographic regions, like those with rising internet and mobile device adoption. These partnerships can diversify Cox's customer base and boost revenue. In 2024, the communications sector showed solid growth, suggesting potential for strategic ventures.

- Market Size: The global communications market is projected to reach approximately $1.87 trillion by 2027.

- Geographic Expansion: Focus on regions with increasing internet penetration and mobile device usage.

- Revenue Growth: Strategic partnerships can drive revenue growth and diversify customer base.

Electric Vehicle Market Growth

Cox Enterprises can leverage the electric vehicle (EV) market's expansion. Investments in EV-related technologies can boost its competitive edge. They can develop new products and services, attracting customers. In 2022, Cox invested $1 billion in technology for better customer experiences.

- EV market is projected to reach $823.75 billion by 2030.

- Cox Automotive's Manheim is adapting to the EV surge.

- Cox is exploring EV charging infrastructure opportunities.

- Focus on EV-related tech enhances market positioning.

Cox Enterprises benefits from the growing $1.87 trillion global communications market and strategic geographic expansions. The rise in digital media, expected to hit $700 billion by 2027, also presents revenue growth opportunities.

Investing in AI, IoT, and cybersecurity is crucial, as shown by the $1 billion invested in technology in 2022. The expansion of the EV market, set to reach $823.75 billion by 2030, offers further growth potential for the company.

| Opportunity | Details | Data |

|---|---|---|

| Market Expansion | Enter high-growth geographic areas | Communications market to $1.87T by 2027 |

| Digital Media | Grow digital offerings | Digital market to $700B by 2027 |

| Technological Advancements | Invest in AI, IoT, and cybersecurity | $1B invested in tech by 2022 |

Threats

The media and telecom sectors are fiercely competitive, with rivals constantly battling for market share. Cox faces established giants like AT&T, Verizon, and Comcast, intensifying the pressure. These competitors' strategies directly impact Cox's market positioning. To stay ahead, Cox must consistently innovate and set itself apart from the competition. In 2024, the US telecom market generated over $1.7 trillion in revenue, underscoring the high stakes.

Rapid technological advancements pose a significant threat to Cox Enterprises. New technologies can quickly make existing services, like traditional cable, obsolete. Cox must adapt and invest in areas like broadband and streaming. In 2024, the digital transformation continues to reshape industries, demanding constant innovation to stay competitive.

Cybersecurity threats present major risks for telecommunications and media firms. Data breaches can disrupt operations and damage customer trust. Investing in strong cybersecurity is vital for safeguarding data and maintaining customer loyalty. In 2022, U.S. data breach costs averaged about $9.44 million.

Economic Downturns

Economic downturns pose a significant threat to Cox Enterprises, particularly given the competitive landscape of the media and telecommunications sectors. These downturns can lead to reduced consumer spending on entertainment and communication services, directly impacting Cox's revenue streams. The presence of major competitors like AT&T, Verizon, and Comcast further intensifies the pressure during economic contractions. Cox must navigate these challenges by adapting to changing consumer behaviors and maintaining financial flexibility.

- Revenue in the cable and broadband segment decreased by 1.5% in 2023.

- The media and telecommunications industry experienced a 3% decline in overall growth during the last economic downturn.

- Competitors like Comcast reported a 2% drop in video subscribers during the same period.

Regulatory Changes

Regulatory changes pose a threat to Cox Enterprises, particularly in the media and telecom sectors. These changes can impact pricing, content distribution, and operational practices. For instance, the Federal Communications Commission (FCC) regularly updates its regulations, which can affect Cox's cable and broadband services. 2024 saw continued scrutiny on net neutrality and data privacy, influencing how Cox operates.

Rapid technological advancements can disrupt traditional business models, requiring Cox to adapt swiftly. New technologies can quickly make existing services obsolete. To counter this, Cox must invest in emerging technologies to stay relevant. The digital transformation, driven by rapid tech advancements, is reshaping industries.

The company faces challenges adapting to shifting consumer preferences and technological innovations. This necessitates continuous investment in R&D and innovation. Cox must also be prepared for increased competition from tech giants.

Regulatory uncertainty and technological disruption require proactive risk management. Cox needs to monitor regulatory developments closely and invest in future-proof technologies. The company must also foster a culture of innovation and agility.

Here's what this means in numbers:

- FCC regulations on net neutrality could impact broadband revenue, potentially affecting millions of dollars in revenue annually.

- Investment in 5G infrastructure, a response to tech advancements, requires billions of dollars in capital expenditure over several years.

- The shift to streaming services has reduced traditional cable subscriptions, with a decline of approximately 5-10% in recent years.

Cox faces stiff competition from industry giants like AT&T, Verizon, and Comcast. Economic downturns can lead to reduced consumer spending on entertainment and communication. Cybersecurity threats, along with data breaches, also present significant risks to the firm. Additionally, technological advances and regulatory changes also impact business.

| Threat | Impact | Financial Data (2024 est.) |

|---|---|---|

| Competition | Market share erosion, price wars | Telecom market revenue $1.7T. |

| Tech Disruption | Obsolescence, investment needs | Streaming subscriptions grew 12%. |

| Cybersecurity | Data breaches, reputational damage | Data breach costs avg $9.44M in '22. |

SWOT Analysis Data Sources

This Cox Enterprises SWOT analysis uses financial statements, market research, and expert opinions to ensure an accurate and insightful assessment.