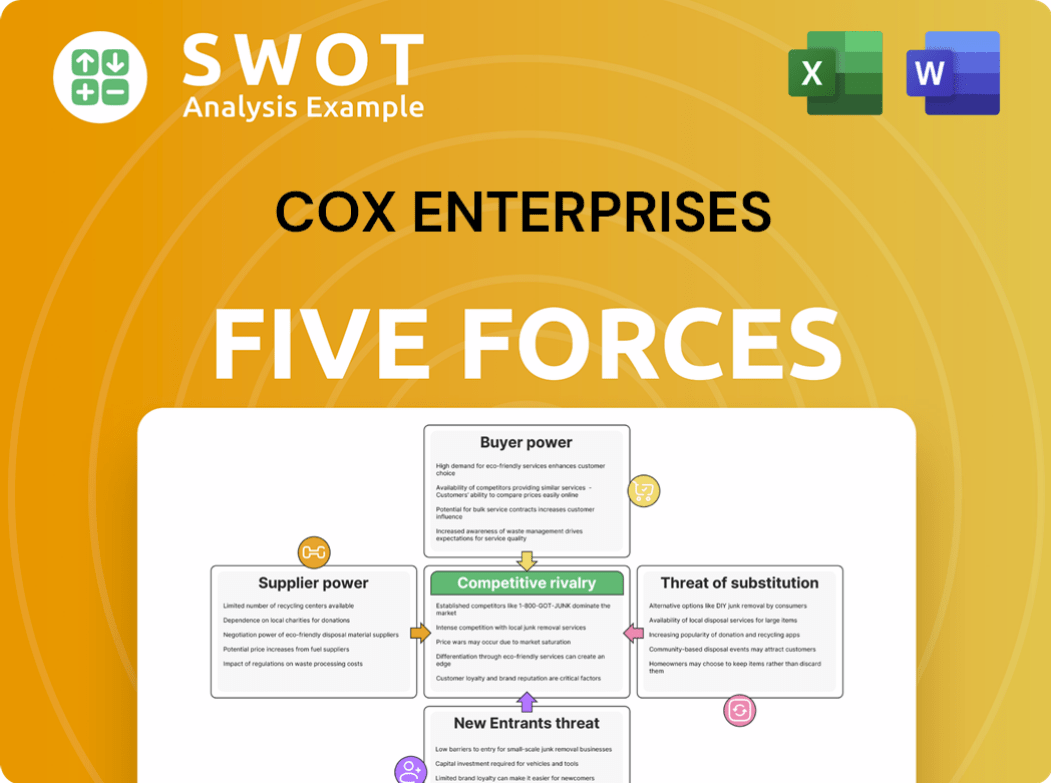

Cox Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cox Enterprises Bundle

What is included in the product

Analyzes Cox Enterprises' position, competition, and potential threats within its market.

Duplicate tabs simulate various Cox Enterprises market scenarios for proactive strategy.

Same Document Delivered

Cox Enterprises Porter's Five Forces Analysis

This preview is the complete Cox Enterprises Porter's Five Forces analysis. It includes the exact content and formatting you'll receive after purchasing. There are no differences between the preview and the downloadable document. The analysis is ready to use immediately upon purchase. Get instant access to this professionally written study!

Porter's Five Forces Analysis Template

Cox Enterprises faces a complex competitive landscape. Buyer power is moderate, influenced by customer choice in media and broadband. Supplier power varies across its diverse businesses, from media content providers to equipment vendors. The threat of new entrants is moderate, given the capital-intensive nature of some of its industries.

Substitute products are a concern, especially in media, with digital alternatives. Competitive rivalry is intense, with established players and digital disruptors vying for market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cox Enterprises’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cox Enterprises, in telecommunications and automotive, has a diverse supplier base, limiting individual supplier influence. This allows for favorable terms and supplier switching. Cox's diversified network reduces supply chain disruption risks. For instance, in 2024, Cox invested $1 billion in network upgrades, showing its commitment to supply chain resilience.

Cox Enterprises benefits from the use of standardized components. These components are crucial for its telecommunications infrastructure and automotive services. Multiple suppliers offer these parts, reducing supplier bargaining power. This competitive landscape helps Cox negotiate lower prices and secure a steady supply. In 2024, Cox's ability to source standardized parts helped manage costs effectively.

Cox Enterprises has the potential for backward integration, especially in content creation. Producing its own content could lower costs and improve programming control. This strategy reduces dependence on external suppliers, strengthening Cox's market position. In 2024, Cox Media Group saw its digital revenue grow, showcasing its content strategy. This shift indicates a move towards greater control over content supply.

Negotiation Leverage

Cox Enterprises benefits from strong negotiation leverage with suppliers due to its significant purchasing volume across diverse divisions. This scale allows Cox to negotiate advantageous pricing, payment terms, and service levels. Suppliers are often compelled to meet Cox's demands to secure large, consistent orders, boosting Cox's profitability. For instance, Cox Media Group, a division of Cox Enterprises, generates billions in revenue annually, giving it significant bargaining power.

- Cox Enterprises' annual revenue: over $20 billion.

- Cox Media Group's revenue: billions of dollars annually.

- Cox's diverse business units: provide leverage in negotiations.

- Favorable terms: contribute to cost savings.

Impact of Technology Shifts

Rapid technological advancements, especially in telecommunications and automotive sectors, can significantly shift supplier power dynamics for Cox Enterprises. Cox must continuously evaluate emerging technologies and adapt its sourcing strategies to maintain a competitive advantage. For example, 5G technology's rollout has changed the demand for network equipment, impacting supplier relationships. Staying ahead of these shifts ensures Cox can leverage new suppliers and innovative solutions, further diluting supplier power, such as the emergence of new electric vehicle (EV) component suppliers.

- Telecommunications: The global 5G infrastructure market was valued at $16.2 billion in 2023.

- Automotive: The electric vehicle (EV) market is projected to reach $823.7 billion by 2030.

- Cox Communications: Cox has invested billions in fiber-optic network upgrades.

- Cox Automotive: Manheim, a Cox Automotive subsidiary, sold over 8 million vehicles in 2023.

Cox Enterprises' supplier power is mitigated by its diverse supplier base, ensuring favorable terms. Standardized components and potential for backward integration, especially in content, further reduce supplier influence. Cox's significant purchasing volume across divisions bolsters its negotiation strength. Technological advancements require agile sourcing to maintain leverage.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Base | Diverse, reducing individual supplier power | Cox invested $1B in network upgrades |

| Standardization | Multiple suppliers, lower prices | Cost management through part sourcing |

| Backward Integration | Increased control and cost reduction | Cox Media Group's digital revenue growth |

Customers Bargaining Power

Customers, especially in Cox's telecom sector, show price sensitivity, boosting their leverage. The presence of rivals offering broadband, cable, and phone services makes switching straightforward. This competitive landscape compels Cox to balance pricing with top-notch service to keep clients. In 2024, the average monthly cable bill rose, emphasizing the need for Cox to offer competitive rates. Cox Communications' revenue in 2023 was approximately $22.6 billion.

Switching costs in telecommunications are relatively low, increasing customer power. This encourages competition among providers like Cox. In 2024, the churn rate (customers switching providers) in the U.S. cable industry was around 2.5%. Cox must offer excellent service and competitive prices to retain customers. Reducing switching costs remains a crucial challenge for Cox.

Customers' access to information significantly boosts their bargaining power. They can readily compare Cox's services with competitors online. Platforms like Yelp and Consumer Reports offer insights, enabling informed choices. Cox needs strong customer relations to counter this, as seen with a 2024 customer satisfaction score of 78%.

Service Bundling

Cox Enterprises uses service bundling to reduce customer bargaining power. Packages combine broadband, cable, and telephone services. This increases the perceived value, making it harder to switch. It boosts customer retention and lessens price comparison effects.

- Cox offers bundles to retain customers in a competitive market.

- Bundling strategies have helped Cox maintain a strong market position.

- These packages often include discounts and added features.

- Customer satisfaction and retention rates are key metrics.

Customer Segmentation

Cox Enterprises strategically segments its customer base to manage buyer power, tailoring services and pricing to different groups. This segmentation allows Cox to offer customized solutions, increasing customer satisfaction and loyalty. For example, Cox Communications reported approximately 6.7 million residential customers in 2024. This approach reduces the incentive for customers to switch providers.

- Customer segmentation enables Cox to offer tailored solutions.

- Loyalty programs and bundled services enhance customer retention.

- Cox Communications reported 6.7 million residential customers in 2024.

Customers of Cox wield considerable power due to price sensitivity and ease of switching between providers. The telecom sector's competitive nature compels Cox to balance pricing with service quality. In 2024, customer satisfaction was a priority, reflected in a satisfaction score of 78%.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Average monthly cable bill increase |

| Switching Costs | Low | Churn rate ~2.5% |

| Information Access | High | Online comparison tools |

Rivalry Among Competitors

Cox Enterprises experiences fierce competition across its diverse sectors. This rivalry, encompassing telecommunications, automotive services, and media, significantly impacts pricing strategies. Cox must continually innovate and market effectively to preserve its competitive edge. For example, the telecommunications market saw a decline in revenue in 2023, highlighting the need for differentiation.

Market consolidation intensifies competitive pressures for Cox Enterprises. Mergers and acquisitions create larger rivals, like the 2024 merger of Warner Bros. Discovery. Cox needs to adapt strategies to compete with these powerful entities. The telecommunications and media sectors saw significant consolidation in 2024.

Rapid tech advancements in digital media and automotive tech heighten competition. Cox must invest in innovation to stay competitive. Companies quickly integrating tech gain an edge. Cox Communications saw 2023 revenue of $12.8B, signaling the need for digital adaptation. Automotive tech is also key for its Manheim business.

Advertising and Promotion

The advertising and promotion landscape is fiercely competitive. Companies spend heavily to capture customer attention through aggressive marketing. Cox Enterprises must implement effective, targeted marketing to stay competitive. For instance, in 2024, the advertising industry's revenue is projected to reach $364 billion in the United States alone. This emphasizes the need for Cox to compete through innovative promotional strategies.

- Advertising revenue in the U.S. is forecast to be $364 billion in 2024.

- Effective marketing is crucial to stand out from competitors.

- Targeted strategies are necessary to capture customer attention.

Service Differentiation

Service differentiation is vital for Cox Enterprises to lessen competitive rivalry. Cox must offer unique value propositions that competitors find hard to copy. Focusing on excellent customer experience and innovative solutions is key for Cox. This strategy helps in maintaining market share and profitability. Cox's emphasis on service quality is evident in its high customer satisfaction scores.

- Cox Communications reported a 2024 customer satisfaction score of 78 out of 100, reflecting its focus on service.

- In 2024, Cox invested $1.5 billion in network upgrades and new services, highlighting its commitment to innovation.

- Cox Business saw a 10% increase in new customer acquisitions in 2024 due to its specialized offerings.

- Cox's average revenue per user (ARPU) increased by 5% in 2024, showing the success of its premium services.

Competitive rivalry at Cox Enterprises is intense, driven by market dynamics and tech advancements. Consolidation among rivals, such as the Warner Bros. Discovery merger in 2024, increases pressure. Effective marketing and service differentiation are crucial to gain market share. Cox Communications' 2024 customer satisfaction score was 78/100.

| Aspect | Details | Impact |

|---|---|---|

| Market Consolidation | Mergers & Acquisitions | Intensifies competition. |

| Tech Advancements | Digital Media, Automotive | Requires innovation and investment. |

| Marketing | Advertising Revenue | Needs effective, targeted strategies. |

SSubstitutes Threaten

The rise of streaming services presents a major threat to Cox's cable TV. Cord-cutting is growing, as consumers seek cheaper options. Cox faces pressure to adjust its services to stay competitive. In 2024, roughly 30% of U.S. households have cut the cord. Cox's revenue is affected by this shift.

The emergence of ride-sharing and electric vehicles (EVs) poses a significant threat to Cox Automotive. These substitutes are gaining popularity, especially in cities, and could reduce the need for individual car ownership. In 2024, ride-sharing usage increased by 15% in major metropolitan areas, reflecting the growing preference for alternatives. Cox Enterprises must adapt to these shifts by exploring new business models to stay relevant.

The rise of digital media poses a significant threat to Cox Enterprises. Online platforms and social media are direct substitutes for traditional media. Cox Media Group faces challenges as digital advertising gains market share. In 2024, digital ad revenue is projected to reach $280 billion, impacting Cox's broadcast and print revenues. Cox must invest in its digital capabilities to stay competitive.

VoIP Services

VoIP services present a significant threat to Cox Communications, as they serve as a direct substitute for traditional telephone services. Companies like Vonage and RingCentral offer comparable functionality at lower prices, intensifying the competitive pressure. Cox faces the challenge of innovating its telephone offerings to maintain market share and profitability. In 2024, the VoIP market is projected to reach $48.6 billion, highlighting the growing adoption and potential impact on traditional telecom providers.

- VoIP market growth is a key indicator.

- Competitive pricing is a primary driver.

- Innovation in services is crucial.

- Cox must adapt to stay relevant.

DIY Automotive Solutions

The rise of DIY automotive solutions poses a threat to Cox Automotive. Online platforms and readily available diagnostic tools empower consumers to handle repairs independently. This trend challenges Cox's reliance on professional services. Cox needs to adapt and enhance its offerings to maintain market share and customer loyalty.

- DIY auto parts sales grew, with online sales accounting for over 30% of the market in 2024.

- The global automotive diagnostic tools market was valued at $22.5 billion in 2024.

- Cox Automotive's revenue in 2024 was approximately $25 billion.

- The average age of vehicles on the road is increasing, potentially driving DIY repairs.

DIY automotive solutions and online platforms significantly challenge Cox Automotive. Consumers increasingly perform repairs independently, impacting Cox's professional service revenue. Adaptations and enhancements are necessary to maintain market share and customer loyalty, as DIY auto parts sales continue to rise.

| Indicator | Data |

|---|---|

| DIY auto parts sales (2024) | Over 30% online |

| Diagnostic tools market (2024) | $22.5 billion |

| Cox Automotive revenue (2024) | Approximately $25 billion |

Entrants Threaten

The telecommunications sector demands considerable upfront capital, posing a major hurdle for new competitors. Constructing networks and obtaining necessary licenses represent significant financial obstacles. Cox Enterprises, with its existing infrastructure, holds a distinct advantage. For instance, in 2024, infrastructure spending in the telecom sector was approximately $90 billion, underlining the high investment needed. This helps Cox retain its market position.

Regulatory hurdles significantly impact new entrants in telecommunications and media. Stringent requirements and compliance, like those enforced by the FCC, are costly. Cox Enterprises, with its established infrastructure and expertise, benefits from this barrier. The approval processes can take years and cost millions. This protects Cox from new competition.

Cox Enterprises benefits from strong brand recognition, making it difficult for new competitors to gain traction. Building a solid brand takes substantial investments and time, acting as a significant entry barrier. Cox's established brands, like Cox Communications and AutoTrader, give it a competitive advantage. In 2023, Cox Communications reported approximately $23.4 billion in revenue, highlighting its market presence.

Economies of Scale

Cox Enterprises benefits from significant economies of scale, presenting a barrier to new entrants. Its large operations allow for cost spreading across a broad customer base, enhancing efficiency. This makes it tough for new competitors to match Cox's cost structure. New entrants often lack the scale to compete effectively on price. The company's revenue in 2024 was estimated at $22.5 billion.

- Large customer base supports lower per-unit costs.

- New firms struggle with similar cost efficiencies.

- Cox's established infrastructure provides a cost advantage.

- Economies of scale create a competitive edge.

Technological Expertise

The need for advanced technological expertise acts as a significant barrier for new entrants into Cox Enterprises' sectors. Both telecommunications and automotive industries demand substantial investments in cutting-edge technology. Continuous R&D is crucial to keep pace with rapid technological changes, which can be costly and risky for newcomers. Cox's established technological prowess gives it a strong competitive edge.

- Telecommunications industry R&D spending reached $80 billion globally in 2024.

- Cox Automotive's investments in digital solutions and data analytics are key competitive advantages.

- New entrants face high entry costs due to the need for advanced infrastructure and software.

- Cox leverages its tech capabilities to innovate and improve customer experiences.

High capital costs and regulatory demands hinder new telecom and automotive entrants. Strong brands and economies of scale further protect Cox. The need for advanced tech expertise presents a major barrier.

| Barrier | Impact on Cox | 2024 Data |

|---|---|---|

| Capital Requirements | Existing infrastructure advantage. | Telecom sector infrastructure spending: $90B |

| Regulatory Hurdles | Benefits from established compliance. | FCC compliance costs in millions. |

| Brand Recognition | Competitive advantage. | Cox Communications revenue: $23.4B (2023) |

Porter's Five Forces Analysis Data Sources

We use company reports, industry publications, and financial analysis to evaluate competitive dynamics, alongside market research and regulatory filings.