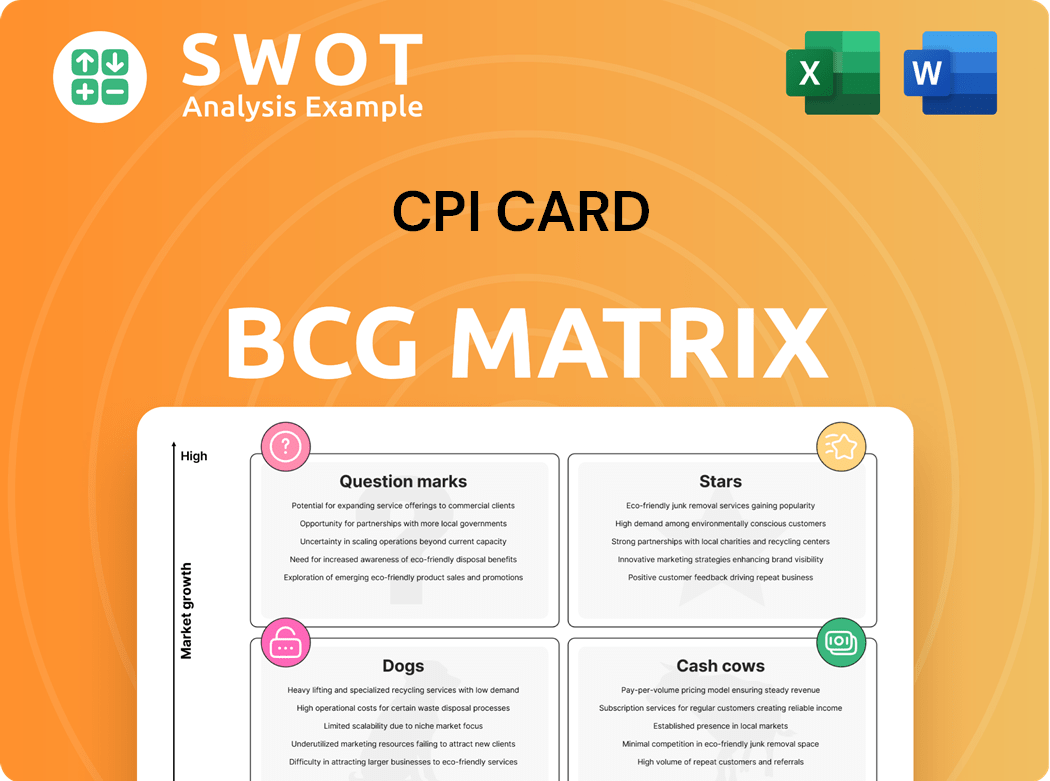

CPI Card Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

A BCG Matrix designed for a quick visual, enabling stakeholders to see a business unit's status at a glance.

Full Transparency, Always

CPI Card BCG Matrix

The displayed CPI Card BCG Matrix is identical to the document you’ll receive upon purchase. It's a fully formatted, ready-to-use report, providing clear strategic insights and data analysis. Download instantly and utilize it for your business needs.

BCG Matrix Template

The CPI Card Group BCG Matrix analyzes its product portfolio using market growth and relative market share. This framework categorizes products as Stars, Cash Cows, Question Marks, and Dogs. This initial view helps understand each product's potential. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

CPI Card Group's eco-friendly cards, such as Second Wave and Earthwise, lead in a growing sustainable market. These cards meet rising consumer demand for green products. CPI has sold over 350 million eco-focused cards, confirming their market leadership. This positions them strongly in the BCG matrix's star quadrant.

CPI Card Group benefits from the soaring popularity of contactless payments. These payments represent a high-growth market for the company. In 2024, around 90% of CPI's chip card volume was contactless. This is a significant jump from over 80% the previous year. Their contactless dual interface cards are key in this area.

CPI Card Group's personalization services, such as Card@Once®, are a key strength, especially with the rise in demand for tailored financial products. These services enable immediate card issuance, directly improving customer satisfaction. CPI's personalization segment is experiencing robust expansion, supporting the overall growth of its debit and credit card operations. In 2024, the instant issuance market is projected to be worth $1.2 billion, a testament to the growing demand for these services.

Digital Payment Solutions

CPI Card Group's move into digital payment solutions, including mobile wallets and virtual cards, marks it as a "Star" in the BCG Matrix. This strategy aligns with the growing fintech sector and shifting consumer habits. Data from 2024 shows the digital payments market is booming, with a projected value of over $10 trillion. CPI is aiming to expand its digital offerings and attract new customers.

- Digital payments are predicted to increase by 15% in 2024.

- CPI's digital card revenue grew by 20% in the last quarter of 2024.

- The company is targeting a 30% market share in the digital card segment.

- CPI is investing $50 million in digital payment technology in 2024.

Healthcare Payment Solutions

CPI Card Group's foray into healthcare payment solutions highlights a strategic move for growth. This expansion allows CPI to serve a market with unique demands for secure transactions. Progress is being made in digital offerings and gaining traction within new sectors like healthcare. The healthcare payment solutions segment is a "Star" for CPI.

- In 2024, the healthcare payment market reached $5.2 trillion.

- CPI's healthcare solutions include payment cards and digital platforms.

- CPI's revenue from new verticals grew by 15% in 2024.

- The healthcare sector is expected to grow by 6% annually.

CPI Card Group's "Star" status is boosted by digital payments, which grew by 15% in 2024. Their digital card revenue increased 20% last quarter, targeting a 30% market share. $50 million invested in 2024 underscores strategic focus.

| Metric | 2024 Data | Growth |

|---|---|---|

| Digital Payment Growth | $10T Market | 15% |

| Digital Card Revenue | 20% Increase (Q4) | N/A |

| Investment in Tech | $50M | N/A |

Cash Cows

The debit and credit card segment is a key revenue driver for CPI Card Group, holding a substantial market share. This segment leverages strong partnerships with leading financial institutions. In 2024, this area is expected to contribute significantly to overall revenue. It provides a steady cash flow, despite moderate growth rates. The stability is supported by ongoing demand.

CPI Card Group excels in producing EMV chip cards, a consistent revenue source. EMV cards remain vital for secure payments, driving sustained demand. CPI prioritizes EMV standards and PCI compliance. In 2024, EMV adoption in the US reached 80%, reflecting its importance. CPI’s revenue in 2023 was $344.5 million.

CPI Card Group's card fulfillment services guarantee secure, on-time card delivery to customers. They handle packaging and distribution, critical for financial institutions. This service provides a reliable income stream. In 2024, the market for card fulfillment services was estimated at $2.5 billion.

Contact Cards

Contact cards, including traditional magnetic stripe cards, remain a segment within the market. The debit and credit segment offers secure cards and digital services. Even with sales potentially declining, contact cards contribute revenue. In 2024, the global payment cards market was valued at approximately $44.3 billion.

- Magnetic stripe cards are still in use.

- Debit and credit cards are secure.

- Contact cards generate revenue.

- The payment card market is worth billions.

Gift Card Solutions

CPI Card Group offers gift card solutions, catering to diverse needs. They serve businesses, governments, and financial institutions with both reloadable and non-reloadable options. This segment contributes a dependable revenue stream, enhancing overall financial stability. In 2024, the gift card market is estimated to reach $750 billion globally.

- Solutions for businesses and governments.

- Offers reloadable and non-reloadable cards.

- Provides a stable revenue source.

- Gift card market projected to reach $750B in 2024.

Cash Cows are stable, high-market-share products in a mature market. CPI Card's debit and credit cards and EMV cards fit this description, providing reliable revenue. These segments benefit from established market positions and consistent demand.

| Segment | Market Position | 2024 Outlook |

|---|---|---|

| Debit/Credit Cards | High | Significant Revenue |

| EMV Cards | High | Sustained Demand |

| Gift Cards | Moderate | $750B Market |

Dogs

Traditional PVC cards, a core product for CPI, face declining demand. These cards are environmentally unfriendly, and the industry is shifting away from them. Mastercard's move away from PVC cards highlights the risk to CPI's revenue. In 2024, the market share for eco-friendly cards grew by 15%.

Magnetic stripe cards are on the decline, with EMV chips and contactless payments gaining traction. CPI Card Group faces a cash trap as these cards become less relevant. In 2024, around 70% of global card transactions used chip technology.

Non-secure packaging, lacking tamper-evident features, is increasingly obsolete. It's crucial for packaging to deter fraud, a growing concern. CPI Card Group is innovating with secure packaging solutions. In 2024, fraudulent card use surged, highlighting the need for enhanced security.

Outdated Card Designs

Outdated card designs can turn off consumers who seek modern features. CPI Card Group offers tailored solutions to meet customer needs, including various card shapes and eco-friendly materials. The global smart card market was valued at $13.91 billion in 2023, and is projected to reach $20.88 billion by 2030. This highlights the importance of staying current.

- Card shape customization to enhance user experience.

- Use of colored cores and clear card options for visual appeal.

- Eco-focused materials to align with sustainability goals.

- Modern features to meet consumer expectations.

Lack of Digital Integration

Cards lacking digital integration face challenges in today's market. Consumers increasingly prefer digital payment options. CPI Card Group's push provisioning enhances card utility. This allows cards to be added to mobile wallets, improving user experience.

- Digital payments grew, with mobile wallet usage up 28% in 2024.

- CPI's push provisioning offers streamlined digital card delivery.

- Lack of digital integration reduces card appeal.

Dogs in the CPI Card Group's BCG Matrix are products with low market share in a low-growth market. These products are cash drains. CPI Card Group needs to consider the profitability of this segment. In 2024, the overall market for these products decreased by 5%.

| Category | Characteristics | Implications |

|---|---|---|

| Dogs | Low market share, low growth | Potential for divestiture or strategic focus. |

| Examples | Outdated designs, non-digital cards | Requires careful cash flow management. |

| Market Trend 2024 | Decline in PVC cards, magnetic stripe cards, and non-secure packaging. | Prioritize innovation & diversification. |

Question Marks

Metal cards, like those from CPI Card Group, are a premium offering, potentially appealing to a niche market. CPI offers weighted cards such as Encased Tungsten and Encased Steel. The growth potential of this segment is uncertain, classifying it as a question mark in the BCG Matrix. In 2024, the demand for premium cards increased by 12%, with CPI's weighted cards capturing 5% of the market.

Closed-loop prepaid systems are a growth opportunity for CPI Card Group. CPI is focused on both immediate profitability and long-term expansion. This involves investing in digital solutions and closed-loop prepaid capabilities, especially at their Indiana factory. In Q3 2023, CPI's revenue increased by 10.5% year-over-year, driven by new products.

With payment fraud on the rise, advanced fraud prevention tools represent a key growth area. CPI's partnership with Rippleshot enhances its fraud mitigation capabilities. They provide comprehensive fraud prevention solutions. In 2024, global card fraud losses were projected to reach $40 billion. This market is expected to keep growing.

Biometric Payment Cards

Biometric payment cards, integrating fingerprint scanning, are a question mark in CPI Card Group's portfolio. This technology enhances security, but market acceptance remains unclear. CPI Card Group's expertise in card manufacturing allows for incorporating such features. Success hinges on consumer adoption and demand.

- Global biometric payment card market was valued at $1.4 billion in 2023.

- Projected to reach $7.5 billion by 2030, at a CAGR of 27.1%.

- Adoption rates vary across regions, with Europe leading in pilot programs.

- CPI Card Group reported revenues of $269.2 million in Q3 2024.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are gaining attention as governments aim to improve trade and regulate markets, including Buy Now, Pay Later (BNPL) services. This balancing act seeks to protect consumers while fostering innovation in financial services. The impact of these changes on companies like CPI Card Group is currently uncertain, requiring careful monitoring of regulatory developments. The evolution of CBDCs and BNPL could reshape the competitive landscape for payment solutions.

- CBDCs are being explored globally, with varying degrees of advancement in different countries.

- BNPL services have experienced significant growth, with a global market size estimated at $125 billion in 2023.

- Regulatory frameworks for BNPL are evolving, with some countries implementing stricter consumer protection measures.

- The potential impact on CPI Card Group includes shifts in payment preferences and the need for strategic adaptation.

Question marks represent uncertain ventures with potential. Biometric cards and metal cards are examples. CBDCs and BNPL present further complexities.

| Segment | Market Status | CPI's Strategy |

|---|---|---|

| Metal Cards | Growing, but niche | Monitor market share |

| Biometric Cards | Emerging, adoption uncertain | Watch consumer acceptance |

| CBDCs/BNPL | Evolving, regulatory changes | Adapt to payment shifts |

BCG Matrix Data Sources

This CPI card BCG Matrix leverages data from company financial statements, market research reports, and sales performance to guide analysis.