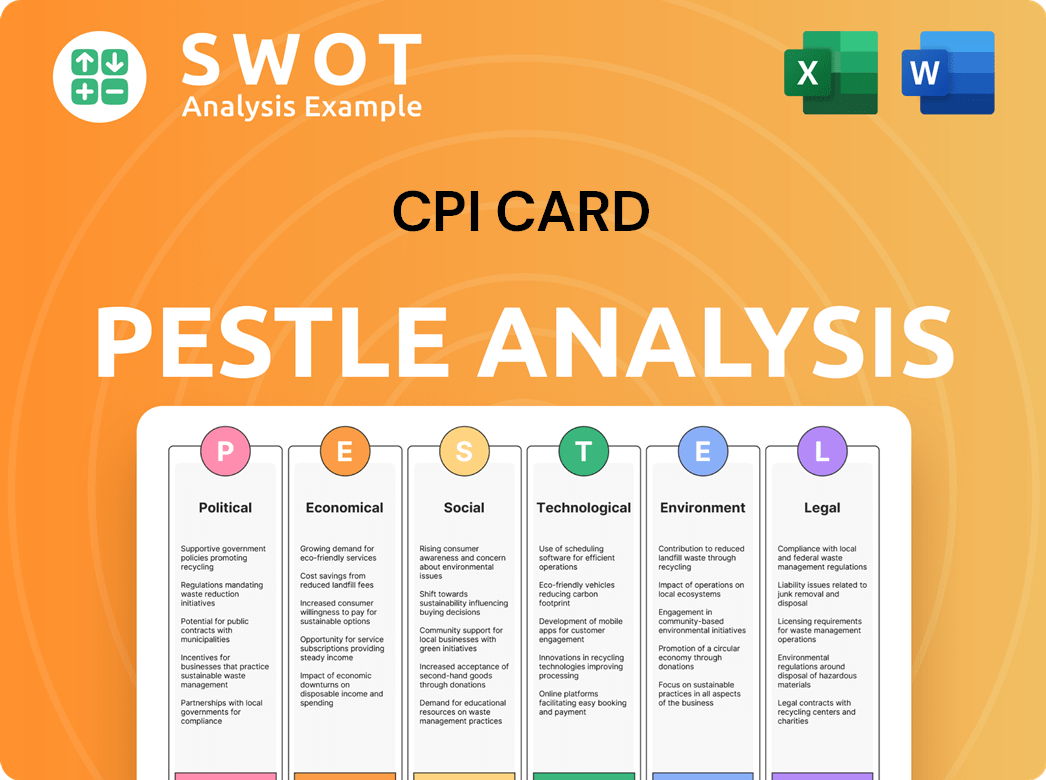

CPI Card PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CPI Card Bundle

What is included in the product

CPI Card's PESTLE analyzes macro-environmental factors. It guides strategy, uncovering threats and chances.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

CPI Card PESTLE Analysis

See a detailed preview of the CPI Card PESTLE Analysis? That's exactly what you'll download immediately after purchase.

PESTLE Analysis Template

Explore CPI Card's future with our PESTLE analysis. Uncover how politics, economics, social trends, tech, legal, and environment impact them. Get actionable insights to inform strategy and decisions.

Download the full analysis now for in-depth intelligence and elevate your understanding. Don’t miss out; buy it today!

Political factors

Government regulations are crucial for CPI Card Group. Data security/privacy regulations (like GDPR) affect how data is handled. Compliance with standards like PCI DSS v4.0, mandatory from April 2025, is key. Failure to comply can lead to penalties. Data breaches cost companies an average of $4.45 million in 2023.

International trade policies and tariffs are critical for CPI Card Group, impacting raw material costs and supply chains. For example, tariffs on plastics or electronics, key card components, can directly increase expenses. Monitoring policy shifts in regions like the US and Europe, where CPI operates and sources materials, is essential, particularly with the US-China trade dynamics. As of early 2024, changes in tariffs on imported goods have the potential to influence CPI's profitability and competitive positioning.

Political factors significantly influence CPI Card Group's operations. Instability in regions like Eastern Europe, where CPI has manufacturing, can disrupt supply chains and increase costs. For example, the ongoing conflict in Ukraine and its impact on global chip supplies affected the card manufacturing industry. This uncertainty can lead to reduced investment and slower market growth.

Government Promotion of Digital Payments

Government policies significantly influence the digital payments landscape, creating both opportunities and risks for CPI Card. Initiatives promoting cashless economies, such as those seen in India with UPI, can boost electronic transactions. However, this shift might reduce the reliance on physical cards in some markets. For instance, the Indian digital payments market is projected to reach $10 trillion by 2026. This growth could challenge CPI Card's traditional revenue streams.

- Digital payment adoption is growing rapidly worldwide, with mobile payments expected to account for 51% of all e-commerce transactions by 2025.

- Government support for digital infrastructure, like faster internet and mobile networks, is crucial for this growth.

- Regulatory changes, such as those impacting interchange fees, can also affect card usage and profitability.

Industry-Specific Legislation

Industry-specific legislation, particularly concerning interchange fees and network routing, poses a significant risk to CPI Card Group's profitability. Regulatory changes could limit revenue streams or mandate costly operational adjustments. For example, the European Union's Interchange Fee Regulation, implemented in 2015, capped interchange fees, impacting card issuers. In 2024, similar discussions continue in various jurisdictions.

- Interchange fees are a key revenue source.

- Regulations can dramatically reshape market dynamics.

- Compliance costs can be substantial.

- CPI Card Group must adapt to stay competitive.

Political factors affect CPI Card's operations and profitability, influenced by global trade policies and regional instability. Tariffs on materials like plastics and electronics can raise costs, impacting competitiveness. The digital payment landscape is transforming; government support for cashless economies and digital infrastructure could reduce reliance on physical cards. Regulatory changes on interchange fees pose risks.

| Political Factor | Impact | Example |

|---|---|---|

| Trade Policies/Tariffs | Affect material costs and supply chains | Tariffs on key components from China |

| Regional Instability | Disrupts supply chains; increases costs | Conflict in Eastern Europe on chip supply |

| Government Initiatives | Promote digital payments; affect card use | UPI growth in India, forecast to $10T by 2026 |

Economic factors

Inflation and interest rates significantly impact consumer behavior. Persistent inflation and high interest rates squeeze household budgets. For example, in Q1 2024, the US inflation rate remained above 3%. This can lead to reduced discretionary spending. Consumers might increasingly use credit or prepaid cards to manage expenses.

Consumer spending, crucial for CPI Card, is tied to economic confidence. Lower confidence often means less card use. In 2024, consumer spending grew modestly, about 2.5% (Q1). Rising interest rates could curb spending in late 2024 and into 2025. Delinquency rates on credit cards edged up to 3.1% in Q1 2024.

The surge in digital transactions globally, driven by e-commerce and mobile payments, influences CPI Card Group's market. In 2024, e-commerce sales reached approximately $6 trillion worldwide. CPI must adapt to digital solutions while supporting traditional card usage, which still represents a significant portion of transactions. Digital payment methods are expected to grow by 17% in 2025.

Financial Inclusion Initiatives

Financial inclusion initiatives globally are expanding, creating substantial opportunities for CPI Card Group. These efforts, particularly in emerging markets, drive demand for payment cards. The growth is fueled by increased access to formal financial systems. This expansion is especially beneficial for prepaid and debit cards.

- Global financial inclusion is growing, with 1.4 billion unbanked adults gaining access to financial services since 2011, as of 2023.

- Mobile money transactions reached $1.2 trillion in 2023, expanding financial access.

- Prepaid card market projected to reach $4.8 trillion by 2028.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose significant risks for CPI Card Group, especially with its global operations. These fluctuations directly affect the conversion of foreign earnings, potentially increasing or decreasing reported revenue and profitability. For example, a strengthening U.S. dollar can make CPI's products more expensive for international customers, potentially reducing sales volumes.

- In 2024, the EUR/USD exchange rate fluctuated significantly, impacting international revenues.

- Companies often use hedging strategies to mitigate these risks, which can add to operational costs.

Economic factors shape CPI Card's landscape. Inflation, though moderating, influences consumer spending, with rates around 3% in early 2024 impacting card use. Consumer confidence and spending trends are key indicators, while interest rates pose further economic pressures.

| Economic Factor | Impact | 2024/2025 Data |

|---|---|---|

| Inflation | Reduces purchasing power | US Inflation: ~3% in Q1 2024 |

| Interest Rates | Impacts borrowing costs | Rising rates curb spending. |

| Consumer Confidence | Affects card usage | Modest spending growth: 2.5% (Q1 2024) |

Sociological factors

Consumer payment preferences are shifting; contactless and mobile wallets are rising. In 2024, mobile payments grew, with 34% using them weekly. BNPL is also impacting card choices. For instance, in 2024, BNPL transactions reached $100 billion. These trends affect card product demand.

Changes in population demographics significantly influence payment technology adoption. An aging population might show slower adoption of new tech. The digital-native younger generation favors digital solutions. Data from 2024 shows mobile payments increased by 30% among Gen Z.

Financial literacy directly impacts card product adoption. In 2024, only 24% of adults globally demonstrated basic financial literacy. Financial literacy programs could increase CPI's customer base. Increased financial understanding often leads to greater card usage. For example, in regions with strong financial education, card transaction volumes are 15% higher.

Security and Privacy Concerns

Consumers are increasingly worried about the security and privacy of their financial data. High-profile data breaches, such as the 2023 MOVEit hack affecting numerous organizations, have heightened these concerns. These breaches can erode consumer trust in payment systems, potentially leading to a shift away from digital payment methods. For instance, a 2024 study revealed that 40% of consumers are less likely to use a payment method after a data breach.

- Data breaches in 2023 exposed over 4 billion records.

- Identity theft losses in 2024 are projected to exceed $7 billion.

- 60% of consumers are more concerned about online security than five years ago.

Lifestyle and Convenience

Modern lifestyles emphasize convenience, significantly influencing payment preferences. The demand for quick, easy transactions boosts the adoption of payment cards and digital solutions. Consumers seek seamless experiences, impacting card design and features. This trend is evident in the rising use of contactless payments; for example, Mastercard reported a 40% increase in contactless transactions in 2024.

- Contactless payments grew by 20% in 2024.

- Mobile payments have increased by 25% YOY.

- Demand for faster transactions continues to rise.

Sociological factors significantly impact CPI Card's performance, driven by evolving consumer preferences. Increasing mobile and contactless payment adoption reshapes card demand; mobile payments rose 34% weekly in 2024. Data privacy and security concerns post-data breaches influence trust. Convenience demands fuel growth; 2024 saw a 40% rise in contactless transactions.

| Factor | Impact | 2024 Data |

|---|---|---|

| Payment Preferences | Shift to digital drives card feature changes | Mobile payment use: +34% weekly |

| Data Security | Breaches erode trust in payment systems | Identity theft losses: $7B est. |

| Convenience | Demand for quick transactions grows | Contactless transaction growth: 40% |

Technological factors

CPI Card Group must adapt to evolving tech. In 2024, contactless payments grew, with 60% of in-store transactions using them. Secure chips, like EMV, are essential. Biometric cards are emerging. Sustainable materials are also gaining traction. These changes impact CPI's product development.

The surge in digital wallets and mobile payments presents both hurdles and chances. CPI Card Group must align with these platforms, providing digital-first options. In 2024, mobile payment users in the U.S. are expected to reach 134.3 million. This means CPI needs to innovate to stay relevant. Digital payments are projected to hit $10 trillion by 2025. This requires strategic adaptation.

Cybersecurity threats are constantly evolving, requiring significant investment in advanced security measures. In 2024, the cost of data breaches is estimated to be around $4.45 million globally. This includes encryption, tokenization, and AI-driven fraud detection. The global fraud prevention market is projected to reach $63.5 billion by 2025.

Development of Alternative Payment Systems

Alternative payment systems, like account-to-account transfers, blockchain, and cryptocurrencies, are gaining traction and could shake up the card industry. In 2024, the global digital payments market was valued at around $8.0 trillion, and it's projected to reach $14.5 trillion by 2028, showing significant growth. This shift is driven by technological advancements and evolving consumer preferences. The rise of these systems introduces new competition and could influence how CPI Card operates.

- The global digital payments market is expected to reach $14.5 trillion by 2028.

- Account-to-account payments are growing in popularity.

- Blockchain and cryptocurrencies are also impacting the payment landscape.

Automation and AI in Operations

CPI Card Group can leverage automation and AI across its operations. This includes manufacturing, where robots can handle precise tasks, and personalization, allowing for customized card designs. Customer service can also benefit from AI-powered chatbots. These technologies can reduce operational costs by up to 20% and improve efficiency.

- AI adoption in manufacturing is projected to increase by 30% by 2025.

- Automated customer service can reduce operational costs by 15%.

- Personalized card production can increase customer satisfaction by 25%.

CPI Card Group must navigate rapid tech changes like contactless payments, which account for 60% of in-store transactions. Digital wallets are vital; U.S. mobile payment users are set to reach 134.3M in 2024. Cybersecurity is key, as data breaches cost about $4.45M globally in 2024. Alternative payment systems present challenges and opportunities.

| Technology Trend | Impact on CPI Card | 2024-2025 Data |

|---|---|---|

| Contactless Payments | Adapt to chip & biometric tech. | 60% in-store use. |

| Digital Wallets | Integrate with digital platforms. | Mobile payments users 134.3M (U.S.). |

| Cybersecurity | Invest in security measures. | Data breach cost ~$4.45M globally. |

Legal factors

Compliance with PCI DSS is crucial for CPI Card Group. The shift to PCI DSS v4.0, mandated by April 2025, demands strategic investment. Failure to comply can result in hefty penalties, potentially impacting financial performance. The global payment card market is projected to reach $55.68 billion by 2025.

CPI Card Group must comply with stringent data protection laws, like GDPR, which mandate how they handle sensitive data. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of a company's annual global turnover. In 2024, the average cost of a data breach hit $4.45 million globally, underscoring the financial risk. These regulations necessitate robust data security measures, increasing operational costs.

Consumer protection regulations are crucial for CPI Card. These rules cover fees, disclosures, and dispute resolution. For instance, the Consumer Financial Protection Bureau (CFPB) enforces these. In 2024, the CFPB handled over 1.5 million consumer complaints. These regulations directly shape card terms, affecting CPI's operations.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

CPI Card Group must adhere strictly to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These laws are crucial for preventing financial crimes, requiring thorough identity verification. This is especially vital for prepaid cards and digital payment solutions. Non-compliance can lead to hefty fines and reputational damage. In 2024, financial institutions faced over $2.5 billion in AML fines.

- AML/KYC compliance is crucial for CPI Card Group.

- Identity verification and transaction monitoring are essential.

- Non-compliance can result in significant financial penalties.

- Digital payments solutions face scrutiny under these regulations.

Contractual Obligations with Financial Institutions

CPI Card Group's operations are significantly shaped by its contractual agreements with financial institutions. These contracts, often governed by contract law, dictate the terms of service, product delivery, and financial transactions. Service Level Agreements (SLAs) within these contracts define performance standards, crucial for maintaining client relationships. Liability clauses addressing potential breaches, such as data security incidents, are also key.

- Breach of contract lawsuits in the financial sector rose by 12% in 2024.

- Average settlement for data breaches in 2024 was $4.45 million.

- Approximately 70% of financial institutions use SLAs with their vendors.

- Contract law cases in the US financial industry increased by 8% in Q1 2025.

Legal factors heavily impact CPI Card Group's operations, requiring adherence to PCI DSS v4.0 by April 2025. Data protection laws like GDPR demand robust security measures; failure results in severe fines, and in 2024 the average cost of a data breach hit $4.45 million. Compliance with AML/KYC regulations is crucial. Breach of contract lawsuits in the financial sector rose by 12% in 2024, which dictates SLAs.

| Regulation | Impact | 2024/2025 Data |

|---|---|---|

| PCI DSS | Mandatory security standards | V4.0 by April 2025, market forecast of $55.68 billion by 2025 |

| GDPR | Data protection | Avg. cost of a data breach: $4.45M; GDPR fines up to 4% annual global turnover |

| AML/KYC | Financial crime prevention | Financial institutions faced over $2.5 billion in AML fines in 2024 |

| Contract Law | Service agreements | Breach of contract suits rose 12% in financial sector in 2024, 8% Q1 2025 |

Environmental factors

Consumers increasingly favor sustainable products, pushing for eco-friendly card materials. CPI Card Group is responding, having piloted sustainable card options. In 2024, the market for sustainable plastics grew by 8%, reflecting this trend. This shift impacts CPI's material choices and market positioning.

The environmental impact of CPI card production is significant. PVC card manufacturing uses harmful chemicals, consuming substantial energy and generating waste. For instance, in 2024, the industry’s carbon footprint was estimated at 150,000 metric tons of CO2. Efforts to reduce this include using recycled materials and sustainable practices.

The disposal of expired payment cards adds to e-waste, posing environmental risks. Globally, billions of cards are discarded yearly, contributing to pollution. Data from 2024 shows e-waste is a rising concern. Recycling programs are crucial to mitigate this impact.

Energy Consumption of Digital Transactions

Digital transactions, while seemingly virtual, rely on energy-intensive data centers and networks, increasing their carbon footprint. The energy consumption of these systems is substantial, with the global data center industry estimated to use over 2% of the world's electricity. This includes the energy required for processing transactions, maintaining servers, and powering network infrastructure.

- Data centers consume significant electricity, contributing to the carbon footprint.

- The rise of digital payments increases energy demand.

- Efforts to improve energy efficiency are crucial.

Regulations on Material Use and Waste Disposal

CPI Card Group faces environmental regulations on materials and waste. These rules affect production costs and processes. Compliance with e-waste disposal laws is crucial. The global e-waste market was valued at $61.35 billion in 2023, with projected growth. Stricter rules may raise operational expenses.

- E-waste market expected to reach $102.59 billion by 2030.

- Regulations vary by region, adding complexity.

- Sustainable practices can mitigate risks.

- Recycling programs can reduce disposal costs.

Consumers favor eco-friendly cards; CPI Card Group responds with sustainable options. PVC card production's carbon footprint hit 150,000 metric tons of CO2 in 2024, spurring recycling. Digital transactions also strain the environment; data centers use substantial electricity.

| Environmental Factor | Impact on CPI | 2024 Data/Trends |

|---|---|---|

| Sustainable Materials | Material Choice, Brand Perception | Market for sustainable plastics grew by 8%. |

| Carbon Footprint | Production Costs, Regulatory Compliance | Industry’s carbon footprint estimated at 150,000 metric tons of CO2. |

| E-waste | Disposal Costs, Recycling Programs | Global e-waste market valued at $61.35 billion in 2023. |

PESTLE Analysis Data Sources

This CPI Card PESTLE leverages global financial reports, governmental regulatory data, consumer market analyses, and industry trend publications.