Crocs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crocs Bundle

What is included in the product

Tailored analysis for Crocs' product portfolio within the BCG Matrix.

Simplified BCG Matrix for Crocs, alleviating complex strategy, providing easy-to-understand business insights.

What You’re Viewing Is Included

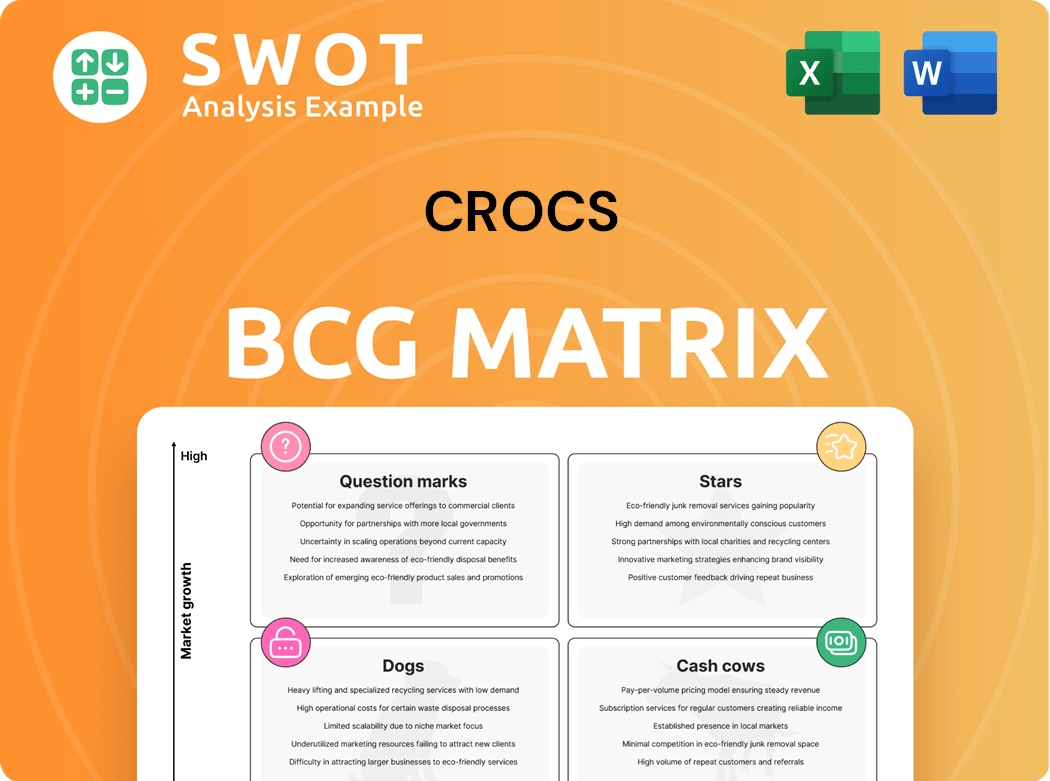

Crocs BCG Matrix

The displayed preview is identical to the BCG Matrix report you'll receive post-purchase. This is the final, fully editable document—ready to integrate into your strategic planning without any extra steps. No watermarks or placeholders are included.

BCG Matrix Template

Crocs, the iconic footwear brand, faces interesting market dynamics. Its classic clogs likely act as a Cash Cow, providing steady revenue. New product lines and collaborations might be Question Marks, needing careful investment. Some niche styles could be Dogs, requiring strategic decisions. Understanding Crocs' BCG Matrix helps with resource allocation.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Crocs brand, with its classic clogs and newer versions, shines as a Star in the BCG Matrix. In 2024, Crocs saw a revenue increase of about 9%, driven by strong demand. Projections for 2025 estimate a further 4-5% rise, demonstrating sustained growth. This success stems from innovative product updates and smart marketing strategies.

Jibbitz charms are a Star for Crocs, boosting revenue and brand appeal. In 2024, they earned over $260 million, or 6% of total sales. These high-margin charms grow with Crocs, letting customers personalize their shoes. This self-expression angle keeps consumers engaged and buying.

Crocs' international expansion, especially in Asia, is a Star. CEO Andrew Rees highlights Asia's growth potential. In 2024, Crocs saw strong international sales. This expansion boosts the brand's global presence. Crocs targets emerging markets for growth.

Direct-to-Consumer (DTC) Channel

The Direct-to-Consumer (DTC) channel is a Star for Crocs, driving substantial revenue growth. In 2024, DTC revenue grew by 7.2%, highlighting the success of their online and retail strategy. This channel fosters a direct connection with consumers, enhancing the brand experience. It also provides valuable customer data for targeted marketing.

- DTC revenue growth in 2024: 7.2%

- Focus: Online and retail presence

- Benefit: Direct consumer connection

- Advantage: Customer data collection

Sustainability Initiatives (Bio-Circular Croslite)

Crocs shines as a Star due to its strong sustainability efforts, especially with its bio-circular Croslite material. This move appeals to eco-aware consumers, boosting its brand image and market position. Crocs has integrated 25% bio-circular content into its Croslite, covering over 80% of its materials. This is a significant step in reducing the carbon footprint of its products.

- 25% bio-circular content in Croslite.

- 80%+ of Crocs materials are Croslite.

- Aiming for 50% bio-circular by 2030.

- Targeting Net Zero emissions by 2040.

Crocs thrives as a Star, fueled by diverse strengths. Its classic clogs and new versions drive revenue, with about 9% growth in 2024. Direct-to-Consumer sales, up 7.2%, boost profits. Sustainability initiatives enhance its brand appeal.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Growth | Overall Sales Increase | ~9% |

| DTC Growth | Direct-to-Consumer Revenue Increase | 7.2% |

| Sustainability | Bio-circular Content in Croslite | 25% |

Cash Cows

Crocs' North American market is a Cash Cow, offering solid revenue and brand recognition. While North American revenue was flat in 2024, it still makes up over half of Crocs' total sales. This region's profits help fund growth. In Q1 2024, North America sales were $378.2 million.

The Classic Clog is a Cash Cow for Crocs, generating substantial revenue. This core product and its variations make up about 75% of Crocs' sales. The clog's popularity requires little promotional investment. In 2024, Crocs' revenue hit $3.98 billion, with the Classic Clog playing a key role.

Crocs' celebrity and brand collaborations are a reliable Cash Cow. These partnerships boost brand visibility and sales, tapping into current trends. Collaborations with stars like Justin Bieber and Bad Bunny have significantly increased demand. For example, in 2024, Crocs' collaboration revenue grew by 15%.

Croslite Material (Proprietary Technology)

Crocs' proprietary Croslite material is a Cash Cow, giving the company a strong competitive edge. This unique material offers comfort, lightweight durability, and is odor-resistant, which distinguishes Crocs from its rivals. Crocs protects its intellectual property through patents and trade secrets, ensuring its exclusivity. In 2024, Crocs' revenue reached $3.98 billion, showing the strength of its brand.

- Croslite's unique properties drive customer loyalty.

- Patents and trade secrets protect the intellectual property.

- In 2024, revenue reached $3.98 billion.

Personalization (Jibbitz Ecosystem)

The Jibbitz ecosystem is a Cash Cow for Crocs, driving customer engagement and repeat purchases. Crocs keeps consumers engaged by regularly releasing new, limited-edition charms, often linked to collaborations. This strategy boosts demand as customers seek exclusive designs. In 2024, Crocs' revenue reached $3.99 billion, with accessories like Jibbitz contributing significantly.

- Cash Cow status confirmed by consistent revenue from Jibbitz.

- New charm releases fuel demand.

- Collaborations with influencers and brands boost sales.

- 2024 revenue of $3.99 billion.

Cash Cows provide reliable revenue, like Crocs' North American market, Classic Clogs, celebrity collabs, Croslite material, and Jibbitz. These generate consistent income. In 2024, Crocs hit $3.99 billion in revenue, fueled by these products. They require little investment.

| Cash Cow | 2024 Revenue (USD) | Key Features |

|---|---|---|

| North America | $378.2M (Q1) | Solid brand, major market. |

| Classic Clog | ~75% of Sales | Core product, minimal promo. |

| Collaborations | Up 15% | Brand visibility, trends. |

| Croslite | N/A | Unique material, protection. |

| Jibbitz | Significant | Engagement, repeat buys. |

Dogs

The Foam Creations line, including boat cushions and hot-tub pillows, could be considered a "dog" in the Crocs BCG Matrix. These products likely don't align with Crocs' primary focus on footwear. In 2024, these items may contribute a small percentage of overall revenue compared to footwear sales. Divestiture of these lines could allow Crocs to concentrate on higher-growth areas.

The Crocs Gear line, including t-shirts, sunglasses, and socks, likely fits the "Dogs" quadrant of the BCG Matrix. These accessories likely have a low market share and operate within a slow-growth market. In 2024, such products may not significantly impact overall revenue. They might not contribute much to Crocs' profitability, given their niche appeal.

Outdated Crocs styles are classified as "Dogs" in the BCG matrix. These styles, like older models, no longer resonate with consumers. Clearing out these products is crucial, as they can tie up inventory, as evidenced by the 2024 inventory write-downs. Investing in fresh designs is key to success.

Underperforming Retail Locations

Underperforming retail locations, categorized as Dogs, drain resources without adequate returns. These stores may suffer from low foot traffic or shifting demographics. Crocs should assess these locations, considering closures or relocations. In 2024, Crocs' store count was approximately 350 globally, with a focus on optimizing its retail footprint.

- Underperforming stores are resource drains.

- Locations may face low foot traffic.

- Consider closures or relocations.

- Crocs had around 350 stores in 2024.

Certain Wholesale Partnerships

Certain wholesale partnerships might be a question mark in Crocs' BCG Matrix if they don't fit the brand or make enough money. Crocs should carefully check these partnerships, focusing on those that boost growth and profit. In Q4 2024, wholesale revenue dipped by 0.2%. This highlights the need for strategic partnership choices.

- Brand Alignment: Evaluate if partners match Crocs' image.

- Revenue Generation: Ensure partnerships deliver sufficient sales.

- Strategic Focus: Prioritize partnerships that aid growth.

- Financial Performance: Monitor wholesale revenue trends.

Outdated styles and accessories are "Dogs," tying up resources. Underperforming retail locations also fall into this category. Crocs had around 350 stores in 2024, optimizing its footprint.

| Category | Description | Action |

|---|---|---|

| Outdated Styles | Older models with low appeal. | Clear inventory. |

| Accessories | Low market share. | Re-evaluate and possibly divest. |

| Underperforming Stores | Low foot traffic/returns. | Assess and consider closure. |

Question Marks

HeyDude, acquired in 2022, is a Question Mark for Crocs, with high growth potential but low market share. In 2024, HeyDude's revenue dropped 13.2%, signaling integration challenges. Despite this, Crocs aims to stabilize the brand through new products and marketing. Crocs' 2024 revenue reached $3.99 billion, indicating the need to improve HeyDude's performance.

The Crocs EXP line, a Question Mark, merges innovative design with comfort. These products, like the Trailbreak 2, target growing markets. Crocs must invest to boost market share. In Q3 2024, Crocs' revenue grew 11.8% to $1.1 billion.

Crocs' sandal line is a Question Mark in its BCG Matrix. Sandals accounted for 13% of Crocs' 2024 sales. Clogs still dominate, holding a 75% share. Crocs aims to boost North American growth through diversification.

Emerging Markets (Untapped Regions)

Crocs' expansion into untapped regions, like Southeast Asia and the Middle East, fits the Question Mark category in the BCG Matrix. These areas offer high growth potential but currently have a low market share for Crocs. In 2024, Crocs aimed to boost international sales, seeing opportunities in these emerging markets. This strategy involves risk, but successful penetration could significantly increase revenue.

- Growth: Emerging markets often have higher economic growth rates.

- Market Share: Crocs' market share is typically lower in these regions.

- Investment: Requires significant investment in marketing and distribution.

- Risk: Success is uncertain due to market volatility and competition.

New Material Innovations (Beyond Croslite)

New material innovations beyond Croslite fit the Question Mark category in Crocs' BCG Matrix. These innovations could disrupt the footwear market, potentially offering enhanced performance or sustainability. However, significant investment in research and development is necessary, with uncertain returns. Crocs must decide whether to invest heavily to gain market share or to sell these innovations. In 2023, Crocs' revenue reached $3.96 billion, demonstrating strong market presence, but future growth hinges on strategic material choices.

- Question Marks require careful evaluation due to high risk and potential reward.

- Investment in new materials could create a competitive advantage.

- A sell strategy might generate capital for core product lines.

- The decision impacts future revenue and market positioning.

Question Marks in Crocs' BCG Matrix represent high-growth potential markets with low market share, demanding strategic investment.

HeyDude's 2024 revenue dip of 13.2% highlights integration challenges, urging targeted efforts to stabilize the brand.

Expansion into regions like Southeast Asia and the Middle East, alongside material innovations, underscores the need for careful evaluation due to high risk and reward dynamics.

| Category | Description | 2024 Data |

|---|---|---|

| HeyDude | Acquired brand, high growth, low share | Revenue down 13.2% |

| EXP Line | Innovative designs, market growth | Q3 revenue up 11.8% to $1.1B |

| Sandals | Diversification, North America growth | 13% of 2024 sales |

BCG Matrix Data Sources

This Crocs BCG Matrix is informed by financial data, market reports, competitor analysis, and industry insights.