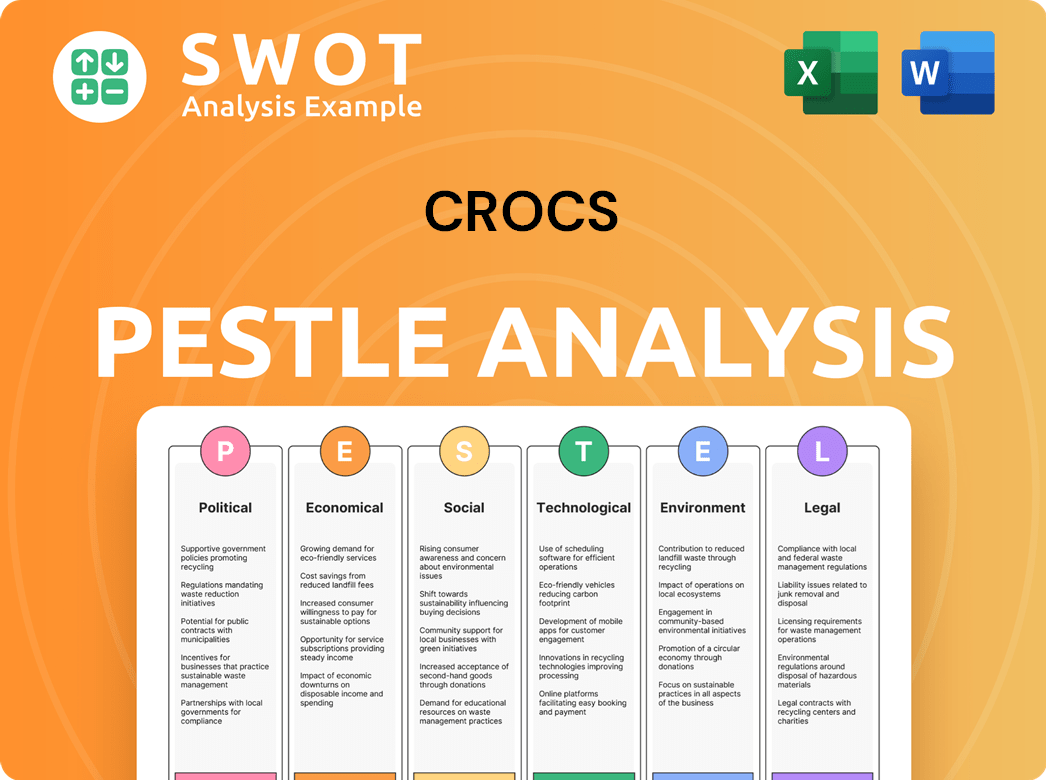

Crocs PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crocs Bundle

What is included in the product

Analyzes Crocs via PESTLE factors: Political, Economic, Social, Tech, Environmental, Legal, using data to reveal insights.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

Crocs PESTLE Analysis

We’re showing you the real product. The Crocs PESTLE Analysis you see now? That's exactly what you'll receive. All details are ready to go! Purchase, and this is yours immediately. Everything's included!

PESTLE Analysis Template

Crocs faces a dynamic external environment. Our PESTLE analysis provides a snapshot of how politics, economics, social factors, technology, legal issues, and environmental considerations are shaping the company. Learn how trends influence everything from consumer behavior to supply chains and the competitive landscape. Don't miss the opportunity to understand Crocs's vulnerabilities and strengths. Download the complete, in-depth analysis now!

Political factors

Crocs faces risks from fluctuating trade policies globally. Tariffs, like the Section 301 tariffs on Chinese imports, directly affect production costs. In 2023, China accounted for a significant portion of global footwear manufacturing. Changes in trade agreements can reshape Crocs' supply chain and profitability. Trade wars and protectionist measures pose ongoing challenges.

Geopolitical stability significantly impacts Crocs' performance. Political stability in major markets, including the U.S., Europe, and Asia, directly affects consumer confidence and spending on discretionary items like Crocs footwear. Instability, whether from social unrest or international conflicts, can lead to decreased consumer demand. For instance, a 2024 report showed a 5% decrease in consumer spending in regions experiencing political turmoil. This directly impacts sales.

International relations significantly affect Crocs. Shifts in diplomatic ties among countries where Crocs manufactures and sells can disrupt supply chains. For instance, trade tensions in 2024/2025 could lead to higher import tariffs, increasing costs. Crocs' Q1 2024 revenue was $661.1 million; political instability could jeopardize this.

Labor Laws and Regulations

Crocs faces diverse labor laws across its global manufacturing network. Adherence to these regulations is critical for avoiding legal issues. In 2024, labor disputes cost companies an average of $1.2 million per incident. Non-compliance can lead to penalties and reputational damage. Crocs must ensure fair labor practices and safe working conditions.

- Average cost per labor dispute: $1.2M (2024)

- Global labor law compliance is crucial.

Regulatory Pressures

Crocs faces regulatory pressures across diverse markets, influencing its operations. Compliance with consumer product safety acts and chemical regulations is crucial. These regulations affect material sourcing and elevate compliance costs. For example, the footwear market is subject to stringent safety standards in the EU and North America.

- EU REACH regulation impacts material sourcing and production processes.

- U.S. Consumer Product Safety Commission (CPSC) oversees safety standards for footwear.

- Failure to comply can lead to product recalls and financial penalties.

- Crocs must adapt to evolving regulations globally to maintain market access.

Political factors significantly impact Crocs' trade. Trade policies, like tariffs, can affect production costs. Geopolitical stability also affects consumer spending. International relations further disrupt supply chains.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Tariffs | Increase production costs. | Section 301 tariffs affected footwear; Q1 2024 revenue: $661.1M |

| Geopolitical Stability | Affects consumer spending. | 5% decrease in consumer spending in unstable regions (2024). |

| International Relations | Disrupts supply chains. | Trade tensions may raise import tariffs (2024/2025). |

Economic factors

Inflation rates impact consumer behavior, potentially decreasing spending on non-essential items like Crocs. In 2024, the U.S. inflation rate fluctuated, impacting retail sales. During the first quarter of 2024, consumer spending slowed, reflecting economic uncertainty. Reduced consumer confidence often leads to decreased purchases of discretionary goods. Crocs must monitor these trends closely.

Crocs' global presence makes it vulnerable to currency swings. For instance, a strong US dollar can decrease the value of international sales. In Q1 2024, currency headwinds affected revenue. The company actively manages these risks through hedging strategies, aiming to stabilize earnings.

Economic growth in developing nations, particularly those with expanding middle classes, offers Crocs substantial market prospects. These regions present avenues for strategic product development and increased market penetration. For instance, India's footwear market is projected to reach $15.5 billion by 2025. This expansion signifies a growing consumer base.

Wholesale and Direct-to-Consumer Trends

Crocs navigates shifting wholesale and direct-to-consumer (DTC) trends, impacting its revenue and distribution. While DTC sales have expanded, wholesale revenue saw a modest uptick. In 2024, DTC represented about 45% of total sales, while wholesale accounted for roughly 55%. This requires strategic adaptation in sales channels.

- DTC sales are growing, reflecting changing consumer preferences.

- Wholesale remains significant, necessitating strong relationships with retailers.

- Crocs must balance both channels to maximize revenue and market reach.

Impact of Global Economic Markets

Global economic instability, including banking system disruptions and financial market volatility, poses risks to Crocs. Inflation rates remain a concern, with the U.S. experiencing a 3.5% increase in March 2024. These factors can impact consumer spending and supply chains, potentially affecting Crocs' sales and profitability. The recent volatility in the stock market, with the S&P 500 fluctuating, further complicates the economic landscape.

- Inflation in the U.S. reached 3.5% in March 2024.

- Stock market volatility, such as fluctuations in the S&P 500, is present.

- These factors affect consumer spending and Crocs' profitability.

Economic factors significantly affect Crocs' performance, particularly inflation and currency fluctuations, which impact consumer spending and international sales. The US inflation reached 3.5% in March 2024, and currency headwinds influenced Q1 2024 revenue.

Emerging markets, such as India, with its footwear market projected at $15.5 billion by 2025, present growth opportunities. Navigating both DTC and wholesale channels requires careful sales channel management.

Global economic instability, including market volatility, poses further challenges, influencing consumer behavior and Crocs’ profitability. These economic conditions necessitate strategic financial planning and adaptability.

| Economic Factor | Impact on Crocs | Recent Data/Trends |

|---|---|---|

| Inflation | Decreased consumer spending | U.S. inflation at 3.5% (March 2024) |

| Currency Fluctuations | Affect international sales | Q1 2024 currency headwinds |

| Market Growth | Expand sales | India footwear market: $15.5B by 2025 |

Sociological factors

Crocs' success hinges on fashion trends and consumer tastes. The brand must adjust designs and marketing to stay relevant. In 2024, Crocs' revenue hit $3.99 billion, up 11.1% YoY. Consumer preference shifts impact sales; a focus on collaborations and new styles is key.

The growing focus on comfort and personal style boosts Crocs' appeal, especially for younger buyers. Gen Z's preference for self-expression and ease boosts sales. In 2024, Crocs' revenue hit $3.98 billion, showing this trend's impact.

Social media heavily shapes consumer choices in the clog market, directly affecting Crocs. Platforms like TikTok and Instagram drive trends, with #Crocs garnering millions of views in 2024. This influences marketing, with Crocs collaborating with influencers, boosting brand visibility and sales. The brand's social media strategy saw a 20% increase in engagement in Q1 2024, demonstrating its impact on consumer perception and purchase decisions.

Health Consciousness

Rising health awareness influences consumer choices, potentially favoring Crocs. Their comfort and design may appeal to those prioritizing well-being. This trend could boost sales, especially if Crocs highlight health-related features. The global wellness market is projected to reach $7 trillion by 2025.

- Comfort and foot health are becoming more important.

- Crocs can emphasize their ergonomic designs.

- Marketing can target health-conscious consumers.

- Partnerships with health-focused brands.

Cultural Differences

Crocs faces cultural differences across its global markets, impacting product acceptance and marketing strategies. For example, color preferences vary significantly; what's popular in North America might not resonate in Asia. In 2024, Crocs reported that international sales accounted for over 40% of total revenue, highlighting the importance of adapting to local tastes. Effective marketing campaigns must also consider local customs and values to build brand relevance and trust.

- Color preferences vary across regions.

- International sales accounted for over 40% of total revenue in 2024.

- Marketing must adapt to local customs.

Consumer preferences heavily influence Crocs' performance. Social media drives trends; the #Crocs hashtag had millions of views in 2024. The focus on comfort and health boosts Crocs, with the global wellness market set to hit $7 trillion by 2025.

Cultural variations shape product acceptance and marketing. In 2024, international sales comprised over 40% of Crocs' total revenue. Tailoring designs and promotions to local tastes is crucial for global growth.

Collaborations and innovative styles are key to meeting fashion trends. In 2024, Crocs’ revenue reached $3.99 billion, which underlines the necessity to stay relevant.

| Factor | Impact | Data |

|---|---|---|

| Fashion Trends | Design changes impact sales | Revenue up 11.1% YoY in 2024 |

| Social Media | Influences consumer choice | #Crocs has millions of views |

| Health Awareness | Boosts demand for comfort | Wellness market to $7T by 2025 |

Technological factors

Crocs is investing in material innovation. This includes using bio-circular content in its Croslite. They aim to boost sustainability and attract eco-minded buyers. Crocs' Q1 2024 revenue reached $661.1 million, showing growth. This focus could lead to higher sales.

E-commerce continues its ascent, presenting Crocs with a robust avenue for direct consumer engagement. This digital expansion enables tailored marketing campaigns. Crocs' online sales surged, with digital representing over 30% of total revenue in 2024. This trajectory suggests a growing reliance on e-commerce for sales.

Crocs utilizes AI and blockchain to personalize Jibbitz charms, boosting customer engagement. In 2024, Crocs' digital sales grew, reflecting the effectiveness of these tech strategies. This digital focus aligns with a broader trend, with global e-commerce sales predicted to reach $6.3 trillion in 2024. These technologies enhance creativity and brand interaction.

Supply Chain Technology and Automation

Crocs must leverage supply chain technology and automation to enhance operational efficiency, reduce costs, and improve responsiveness. Investing in advanced technologies like AI-powered demand forecasting and robotic process automation (RPA) is vital. These technologies can streamline operations and mitigate supply chain disruptions. For example, in 2024, the global supply chain automation market was valued at $45.6 billion, projected to reach $88.7 billion by 2029, growing at a CAGR of 14.2% from 2024 to 2029.

- AI-driven demand forecasting can reduce inventory costs by 15-20%.

- RPA implementation can improve supply chain efficiency by up to 30%.

- The adoption of blockchain for supply chain tracking increases transparency.

- Automated warehousing solutions can boost order fulfillment speed by 25%.

Sustainable Transportation Technologies

Crocs is monitoring sustainable transportation technologies to lessen its environmental footprint. The company is particularly focused on electric vehicles and sustainable aviation fuel to optimize its distribution network. In 2024, the global electric vehicle market was valued at $388.1 billion, and is projected to reach $823.7 billion by 2030. Sustainable aviation fuel use is expected to grow significantly.

- Electric vehicle market valued at $388.1 billion in 2024.

- Projected to reach $823.7 billion by 2030.

Crocs utilizes material innovation like bio-circular content in Croslite. They also implement AI, blockchain for personalization. Digital sales represented over 30% of total revenue in 2024. The supply chain automation market, valued at $45.6B in 2024, will reach $88.7B by 2029.

| Technology | Impact | Data (2024) |

|---|---|---|

| E-commerce | Direct consumer engagement | Digital sales >30% of revenue |

| AI/Blockchain | Personalized marketing | Digital sales grew |

| Supply Chain Tech | Operational Efficiency | $45.6B market |

Legal factors

Crocs heavily relies on intellectual property protection, particularly for its unique designs and trademarks. In 2024, the company continued to invest in patents and registered designs to protect its iconic clog and other product innovations. This proactive approach is essential to fend off counterfeiters and maintain its market position. Crocs spent $10.9 million in 2024 on intellectual property legal fees.

Crocs has navigated legal battles over advertising. Lawsuits have challenged claims about Croslite's patented status and product features. In 2023, the FTC cracked down on false advertising, leading to increased scrutiny. Companies like Crocs must ensure marketing accuracy to avoid penalties. Recent data shows a 15% rise in consumer protection complaints.

Crocs must adhere to product safety regulations globally, especially concerning chemical substances. These regulations vary by market, requiring meticulous compliance. Failure to comply can lead to product recalls and legal penalties. In 2024, regulatory non-compliance cost some companies millions.

Supply Chain Compliance and Audits

Crocs must legally ensure its supply chain adheres to labor standards and human rights. This involves consistent audits of third-party factories and suppliers. Non-compliance can lead to legal penalties and reputational damage. Crocs' commitment includes rigorous supplier evaluations. In 2023, Crocs reported 98% of its factories were assessed for labor standards.

- Audits ensure legal and ethical compliance.

- Non-compliance risks penalties and reputational harm.

- Crocs actively evaluates suppliers.

- In 2023, 98% of factories were assessed.

Securities Law and Financial Disclosures

Crocs operates within the framework of securities law, which mandates transparent financial disclosures to investors. The company has encountered legal challenges, including investor lawsuits, related to its financial reporting. These lawsuits often focus on the accuracy of revenue growth strategies and the performance of acquired brands, demanding precise financial data. In 2024, the SEC reported that the median time to resolve securities class action lawsuits was approximately 2.5 years, underscoring the potential duration and cost of such legal battles for Crocs.

- Crocs must comply with regulations like the Sarbanes-Oxley Act.

- Investor lawsuits can arise from misstated financial results.

- Accurate revenue reporting is crucial.

- Acquired brands' performance must be disclosed.

Crocs must actively protect its intellectual property through patents and trademarks to combat counterfeiting, investing $10.9M in IP legal fees in 2024. The company faces scrutiny over advertising and product claims, navigating lawsuits, with a 15% rise in consumer complaints, highlighting the need for marketing accuracy. Additionally, Crocs' supply chain must adhere to stringent labor standards, as 98% of its factories underwent assessments in 2023, ensuring ethical conduct.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Intellectual Property | Protects Designs & Trademarks | $10.9M spent on IP legal fees. |

| Advertising | Ensures Marketing Accuracy | 15% rise in consumer protection complaints |

| Supply Chain | Requires Ethical Compliance | 98% of factories assessed for labor standards (2023). |

Environmental factors

Crocs is focused on sustainable materials, increasing bio-circular and recycled content. This shift supports a circular economy and reduces fossil fuel dependence. In Q1 2024, Crocs reported that 85% of its footwear is made with Croslite, a proprietary material.

Crocs is actively cutting its carbon footprint. They're using eco-friendly materials. Crocs aims for net-zero emissions. In 2024, Crocs announced steps to reduce emissions across its value chain. The company is investing in sustainable transport.

Crocs is actively reducing waste. They're running take-back programs for old shoes. Crocs recycles production scraps too. In 2024, Crocs recycled 1.5 million pairs. This supports circular economy principles.

Supply Chain Environmental Impact

Crocs faces environmental challenges within its supply chain, which constitutes a major part of its environmental footprint. The company actively collaborates with suppliers to lessen emissions and promote sustainable practices. Crocs has set a goal to be a net-zero company by 2030, focusing on reducing its carbon footprint across its value chain. A 2023 report showed that 60% of Crocs' emissions came from its supply chain.

- Supply chain emissions account for the majority of Crocs' environmental impact.

- Crocs aims for net-zero emissions by 2030, emphasizing supply chain improvements.

- In 2023, the supply chain contributed 60% to Crocs' overall emissions.

Chemical Regulations and Responsible Sourcing

Crocs adheres to chemical regulations and responsibly sources materials. This commitment ensures environmental and health standards are integrated into its products and manufacturing. Crocs has a robust supplier code of conduct. They focus on minimizing environmental impact. This includes reducing waste and emissions in their supply chain.

- Crocs aims to increase the use of sustainable materials in its products.

- The company is expanding its eco-friendly initiatives.

- Crocs is working to reduce its carbon footprint.

Crocs prioritizes sustainability. They aim to achieve net-zero emissions by 2030. The supply chain is a key focus, with 60% of emissions coming from it in 2023.

| Environmental Aspect | Crocs' Initiative | Data |

|---|---|---|

| Sustainable Materials | Increase bio-circular and recycled content | 85% of footwear uses Croslite in Q1 2024 |

| Carbon Footprint | Reduce emissions; eco-friendly materials | Target net-zero by 2030, sustainable transport |

| Waste Reduction | Take-back programs; recycle production scraps | 1.5M pairs recycled in 2024 |

PESTLE Analysis Data Sources

This Crocs PESTLE analysis is compiled from government publications, market research, and industry-specific databases, ensuring up-to-date relevance.