Crocs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Crocs Bundle

What is included in the product

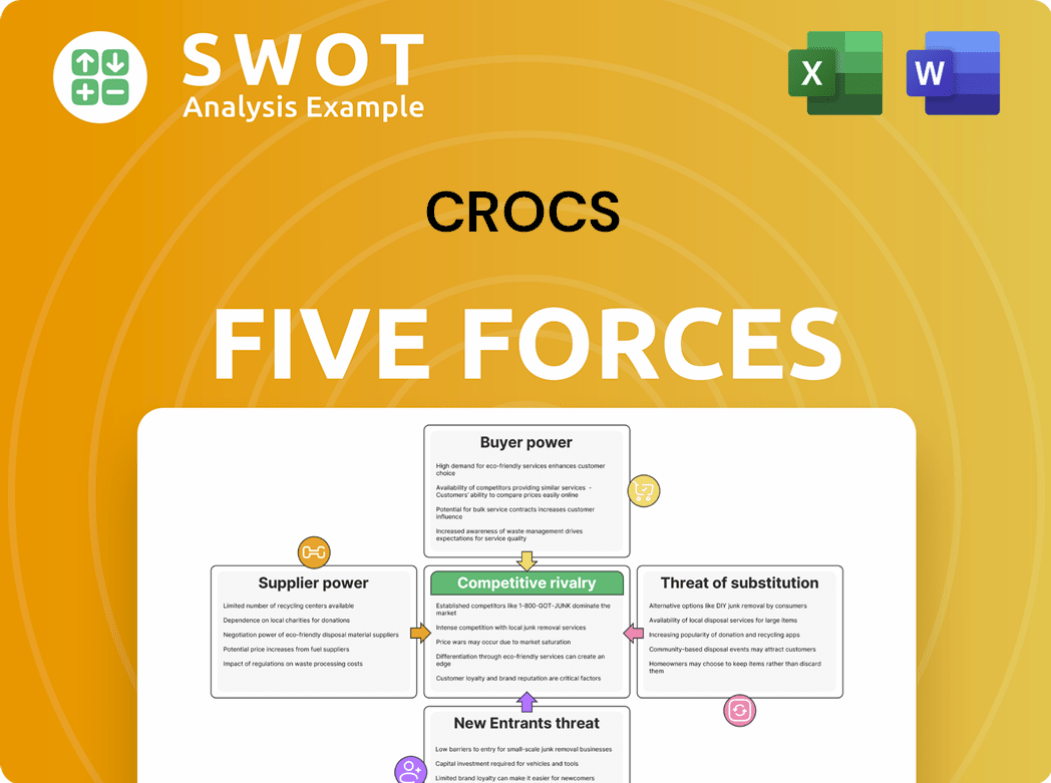

Analyzes Crocs' competitive landscape, detailing its position against rivals, suppliers, and buyers.

Quickly assess competitive threats with a color-coded visualization of each force.

Preview Before You Purchase

Crocs Porter's Five Forces Analysis

This is the Crocs Porter's Five Forces analysis preview. It comprehensively examines competitive rivalry, supplier power, buyer power, the threat of substitutes, and the threat of new entrants within the Crocs market.

Porter's Five Forces Analysis Template

Crocs faces moderate rivalry in the footwear market, battling established brands and emerging competitors. Buyer power is moderate, as consumers have numerous alternatives. Supplier power is low, with readily available materials. The threat of new entrants is moderate, offset by brand recognition. The threat of substitutes, particularly from athletic and casual shoes, is also a factor.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Crocs’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Crocs' bargaining power of suppliers is somewhat limited due to its reliance on a few Croslite material suppliers. This concentration of suppliers, with only around 3-4 global manufacturers for the unique material, gives them some negotiating strength. In 2024, if these suppliers raise prices, Crocs may face increased costs, which could affect their profitability. This situation highlights a potential vulnerability in Crocs' supply chain.

Crocs faces supplier power challenges, particularly due to material specificity. Croslite's unique properties, key for comfort and durability, limit substitution options, strengthening supplier influence. BASF SE, a major supplier, provides around 35-40% of Crocs' specialized polymers. The supplier concentration level is estimated at 60-65%, indicating significant reliance. This dependence can constrain Crocs' sourcing flexibility.

Crocs' global sourcing strategy offers a buffer against supplier power. The company sources globally, which helps in negotiating better terms. In 2024, Crocs' cost of sales was $2.2 billion, indicating significant purchasing activity. This diversification helps minimize dependency on any single supplier.

Supplier Compliance Audits

Crocs emphasizes responsible sourcing by requiring social compliance audits for all factories and suppliers. This focus might shrink the number of potential suppliers. By 2024, Crocs aimed for 100% of Tier 2 suppliers to undergo these audits. These audits ensure suppliers meet specific standards, potentially complicating quick supplier changes.

- Crocs' supplier base includes approximately 200 factories.

- The company's 2024 goal for Tier 2 supplier audits is 100%.

- Social compliance audits assess labor practices, safety, and environmental impact.

- Supplier compliance is a key part of Crocs' overall ESG strategy.

Moderate Supplier Power Overall

Crocs' supplier power is moderate. While specialized materials give some power to suppliers, global sourcing and a strong market position lessen this. Moderate supplier concentration boosts negotiation leverage. Unique material needs create a complex sourcing environment.

- Crocs sources materials globally, including EVA and other proprietary elements.

- The company's revenue in 2024 was approximately $3.99 billion.

- Crocs' market capitalization was around $9.6 billion as of late 2024.

- Crocs operates in over 90 countries, diversifying its supply chain.

Crocs faces moderate supplier power due to its reliance on specialized materials and a concentrated supplier base. In 2024, roughly 60-65% of Crocs' materials came from a few key suppliers, like BASF SE, which supplied 35-40% of the specialized polymers. Although Crocs' global sourcing strategy, with a 2024 revenue of approximately $3.99 billion and operation in over 90 countries, helps to mitigate this. The company's market capitalization was around $9.6 billion as of late 2024, showing its overall financial stability.

| Aspect | Details |

|---|---|

| Supplier Concentration | 60-65% from major suppliers |

| Key Supplier (2024) | BASF SE provided 35-40% of polymers |

| 2024 Revenue | Approximately $3.99 billion |

Customers Bargaining Power

Crocs benefits from strong brand loyalty, especially due to its recognizable clog design and the comfort of Croslite material. This loyalty reduces customer price sensitivity. In 2024, Crocs' revenue reached $3.99 billion, reflecting its brand's appeal. This allows for greater pricing control.

Crocs benefits from product differentiation, offering unique footwear, which diminishes customer bargaining power. The distinct design and comfort features set Crocs apart, making it less susceptible to price sensitivity. This differentiation allows Crocs to maintain pricing power. In 2024, Crocs' revenue reached $3.96 billion, reflecting strong brand value.

Crocs' diverse customer base, from individual consumers to retailers, limits the bargaining power of any single group. This distribution reduces the risk of over-reliance on a few key buyers. In 2024, Crocs' revenue was spread across various channels, with wholesale accounting for a significant portion, but direct-to-consumer sales also playing a crucial role. This diversification strengthens Crocs' position.

Retail and Wholesale Channels

Crocs' diverse distribution network, encompassing owned stores, online sales, and partnerships with various retailers, significantly impacts customer bargaining power. This multi-channel strategy allows Crocs to maintain pricing control and lessen dependence on any specific buyer. In 2024, online sales accounted for a substantial portion of Crocs' revenue, reinforcing its ability to dictate terms. This approach ensures Crocs can strategically manage its market presence.

- Crocs operates through diverse channels like owned stores and online platforms.

- This multi-channel strategy gives Crocs pricing control.

- Online sales are a significant revenue stream in 2024.

- Crocs can strategically manage its market presence.

Price Sensitivity

The footwear market offers numerous alternatives, making many customers price-sensitive. This is particularly true in budget-conscious segments. Price sensitivity enhances customer bargaining power to some degree. In 2024, the global footwear market was valued at approximately $400 billion, with significant competition.

- Price-conscious consumers seek lower prices.

- Availability of substitutes increases buyer power.

- Crocs faces competition from various brands.

- Market size and competition influence pricing strategies.

Crocs faces moderate customer bargaining power due to varied factors. Strong brand loyalty and product differentiation partially offset this. However, the availability of many footwear alternatives increases price sensitivity. In 2024, the footwear market reached about $400 billion, impacting Crocs' pricing.

| Factor | Impact | 2024 Data |

|---|---|---|

| Brand Loyalty | Reduces buyer power | $3.99B revenue |

| Product Differentiation | Decreases sensitivity | $3.96B revenue |

| Market Alternatives | Increases buyer power | $400B market size |

Rivalry Among Competitors

The footwear market is fiercely competitive. Crocs battles established brands and new entrants. This pressure demands continuous innovation. In 2024, the global footwear market was valued at over $400 billion, highlighting the intense rivalry. Crocs' revenue in Q3 2024 was $1.1 billion, indicating the scale of competition.

Crocs' product differentiation, highlighted by its Croslite material and design, faces challenges. Competitors constantly innovate, pressuring Crocs to maintain its edge. In 2024, Crocs' revenue reached $3.96 billion, yet it must strategically price its offerings. This ensures it remains competitive in the footwear market.

Crocs benefits from strong brand recognition and customer loyalty, crucial in a competitive landscape. In 2022, Crocs reported $2.39 billion in revenue, reflecting its market presence. The brand enjoys 87% recognition in major global markets. This recognition is a key competitive advantage, supporting its market position.

Market Share

Crocs faces fierce competition in the footwear market. Major players like Nike, Adidas, and Skechers vie for market share across diverse segments. This intense rivalry demands that Crocs strategically defend and grow its market position. Maintaining a strong market share is crucial for Crocs' sustained success amidst these competitors.

- Crocs' revenue in 2023 reached $3.96 billion.

- Nike's 2023 revenue was approximately $51.2 billion.

- Adidas generated around $24 billion in revenue in 2023.

- Skechers' revenue for 2023 totaled $7.46 billion.

Innovation and Marketing

Innovation and marketing are crucial for Crocs in a competitive market. Crocs must consistently update its product line and pricing strategies. Effective branding is vital for maintaining market share and profitability. Adapting to trends ensures relevance and sales growth.

- Crocs' revenue in 2023 reached $3.96 billion, a 11.4% increase.

- Marketing expenses were about 10% of sales in 2023.

- New product launches have increased sales by 15% in some quarters.

- Digital marketing boosted online sales by 20% in 2023.

Competitive rivalry in the footwear market is intense, as Crocs competes with major brands like Nike and Adidas.

Crocs must continuously innovate to maintain its market position and profitability. In 2023, Crocs' revenue hit $3.96 billion, showing its scale in the market.

The company faces strategic challenges in pricing, and marketing to stay competitive. Digital marketing boosted Crocs' online sales by 20% in 2023, showing the impact of marketing.

| Company | 2023 Revenue (Billions) | Market Share |

|---|---|---|

| Crocs | $3.96 | Moderate |

| Nike | $51.2 | High |

| Adidas | $24 | High |

SSubstitutes Threaten

The footwear market presents numerous substitutes for Crocs. Consumers can choose from sandals, sneakers, and more. In 2022, the global footwear market was valued at $384.21 billion. Comfort and casual segments hold significant market share. This wide array of choices increases the threat of substitution.

Functional substitutes, such as footwear from brands like Skechers or Adidas, pose a threat. These alternatives utilize materials like memory foam and EVA, offering comfort similar to Crocs. In 2024, the global footwear market, including these substitutes, was valued at approximately $400 billion. These substitutes offer similar comfort with different styles, appealing to a broader consumer base.

Fashion trends pose a significant threat to Crocs. Consumers might choose stylish alternatives, affecting Crocs' market share. To counter this, Crocs needs continuous innovation. In 2024, the global footwear market was valued at $400 billion. Crocs must differentiate to retain its customer base.

Brand Perception

Crocs' unique design leads to brand perception issues, pushing consumers to alternatives. Many view Crocs negatively, seeking substitutes with similar comfort but different styles. This impacts Crocs' market share, forcing it to innovate and adapt. In 2024, Crocs' revenue reached $3.9 billion, but aesthetic concerns persist.

- Distinctive Look: Crocs' design divides consumers.

- Stigma Impact: Negative perceptions drive substitution.

- Market Share: Aesthetics affect sales and market position.

- 2024 Revenue: $3.9 billion shows sales despite challenges.

Moderate to High Threat

The threat of substitutes for Crocs is moderate to high. Consumers have many choices, including sandals, sneakers, and other types of shoes. Fashion trends also play a significant role, potentially impacting Crocs' popularity. To stay competitive, Crocs needs to keep innovating.

- Footwear market size was valued at $416.8 billion in 2023.

- Crocs' revenue in 2023 was $3.96 billion.

- Crocs' main competitors include Nike, Adidas, and Skechers.

- Fashion trends can quickly shift consumer preferences.

The threat of substitutes significantly impacts Crocs due to diverse footwear options. Consumers often opt for alternatives like sandals or sneakers. In 2024, the global footwear market was valued at $400 billion, highlighting the wide availability of substitutes. Crocs' need to innovate to stay ahead.

| Aspect | Details | Impact |

|---|---|---|

| Market Size (2024) | $400 billion | Large substitution pool |

| Crocs Revenue (2024) | $3.9 billion | Affected by substitutes |

| Key Substitutes | Sneakers, sandals | Direct competition |

Entrants Threaten

Crocs benefits from robust brand loyalty and recognition, especially for its signature clog design. This consumer affinity acts as a significant barrier to entry for new competitors. To compete, new entrants face hefty marketing and branding costs to build similar awareness and trust. This strong market presence, as of late 2024, has helped Crocs maintain a solid market share, with revenue figures suggesting continued consumer preference. Crocs' brand recognition is a key factor in its ongoing success.

Crocs, as an established brand, enjoys economies of scale in manufacturing, distribution, and marketing. New competitors struggle to match Crocs' cost-effectiveness, hindering price or profit-based competition. Crocs' robust infrastructure, including a global distribution network, gives it a considerable edge. In 2024, Crocs' revenue reached $3.96 billion, highlighting its scale advantage.

New entrants in the footwear industry face relatively low capital barriers, with initial production setups costing between $250,000 and $500,000. This ease of entry stems from the accessibility of design and manufacturing processes. However, to challenge Crocs, new brands need substantial investments in marketing and distribution. Successful entrants often allocate 20-30% of their revenue to marketing.

Distribution Channels

New entrants in the footwear market face significant hurdles in establishing distribution channels. Crocs benefits from its extensive global network, including physical stores and a robust e-commerce platform. This established presence gives Crocs a competitive edge, making it tough for newcomers to achieve similar reach. Building such a distribution network requires substantial investment and time. The company reported that its direct-to-consumer sales represented 41.9% of its total revenue in 2023.

- High Costs: Establishing distribution networks is expensive.

- Time-Consuming: Building a widespread presence takes time.

- Crocs' Advantage: Existing global footprint.

- E-commerce Strength: Crocs' strong online sales.

Moderate to Low Threat

The threat of new entrants for Crocs, Inc. is considered moderate to low. The footwear industry is competitive, but Crocs has built strong brand recognition. This includes significant economies of scale and established distribution networks that pose barriers to new companies. New competitors face challenges in replicating Crocs' market position. They need to offer unique value to gain traction.

- Crocs' revenue in 2023 was $3.96 billion, demonstrating its market strength.

- The company's global presence includes over 350 retail stores, which supports its distribution advantage.

- Crocs' strong brand identity and innovative product designs provide a competitive edge.

- New entrants must overcome high marketing costs to compete effectively.

The threat of new entrants to Crocs is moderate, thanks to strong brand recognition and economies of scale. However, new competitors can enter with relatively low capital, around $250,000 to $500,000 for initial production, but face higher marketing expenses. To succeed, new entrants often allocate 20-30% of revenue to marketing to build awareness and market share against established brands like Crocs, which had revenues of $3.96 billion in 2024.

| Factor | Impact on New Entrants | Crocs' Advantage |

|---|---|---|

| Brand Recognition | High marketing costs to build awareness | Strong, established brand |

| Economies of Scale | Difficult to match cost-effectiveness | Significant advantages in production |

| Distribution Networks | Expensive and time-consuming to establish | Extensive global network (over 350 stores) |

| Capital Requirements | Relatively low for production | Substantial investments needed for marketing |

Porter's Five Forces Analysis Data Sources

This analysis synthesizes data from financial reports, industry research, competitor analysis, and market share reports.