CVS Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Health Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

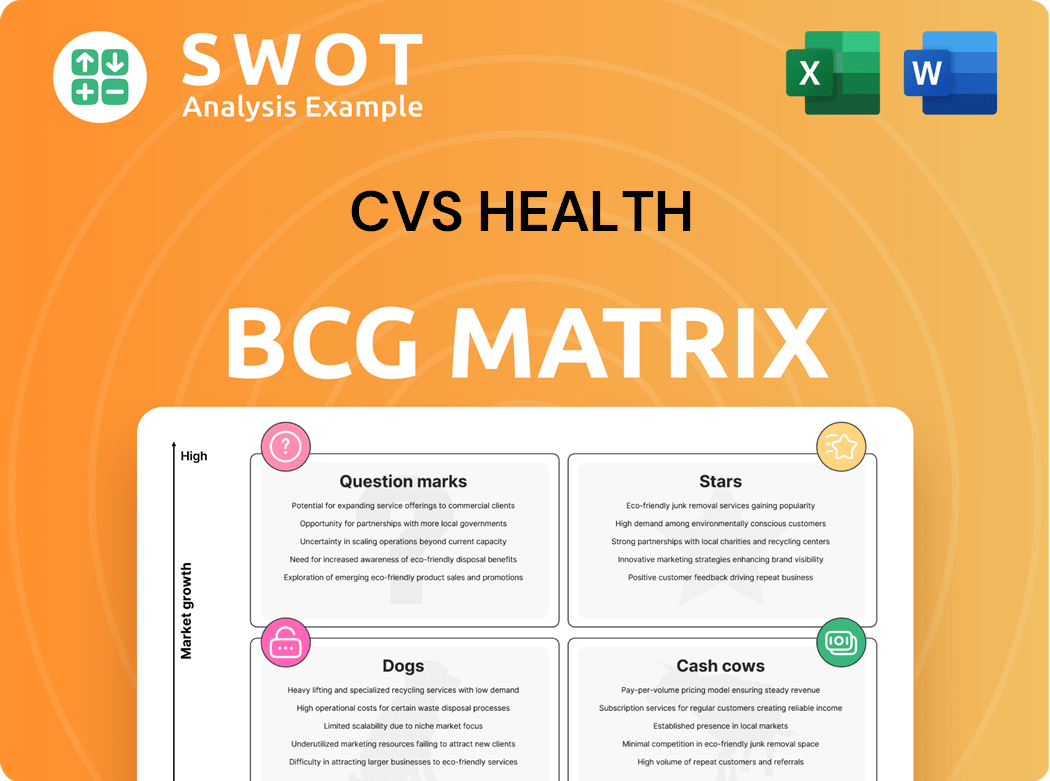

One-page overview placing each business unit in a quadrant, visualizing CVS Health's portfolio.

What You See Is What You Get

CVS Health BCG Matrix

The BCG Matrix preview mirrors the final, downloadable document after purchase. It's a fully realized report, complete with CVS Health-specific data and strategic insights. This is the exact file you'll receive, optimized for professional application and business planning. No alterations are necessary; it's ready for immediate use.

BCG Matrix Template

CVS Health's BCG Matrix reveals its diverse portfolio's strategic positioning. We explore how its pharmacy services, retail, and healthcare offerings fare. This snapshot hints at the company's growth potential and resource allocation. Understand which areas drive revenue and which require strategic pivots.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

The Pharmacy & Consumer Wellness segment within CVS Health demonstrates robust performance. It consistently generates substantial revenue, driven by high prescription volumes. In 2024, this segment accounted for a significant portion of CVS Health's overall revenue, reflecting its importance. This segment's stability makes it a key player in the company's portfolio. This segment is considered a Cash Cow for CVS Health.

CVS Health's expansion in healthcare benefits, particularly within Medicare and individual exchange products, showcases its robust market standing. In 2024, CVS reported a 12% increase in its Medicare Advantage membership. This growth is fueled by strategic acquisitions and enhanced service offerings. The company's focus on these segments aligns with the increasing demand for healthcare services.

Digital Health Innovation is a "Star" for CVS Health, driven by the launch of CVS Health Virtual Care and its mobile app, which boosts consumer access and convenience. In 2024, CVS Health's digital health initiatives, including virtual care, saw a 20% increase in user engagement, demonstrating strong growth. CVS Health's investments in telehealth reached $2 billion in 2024, reflecting their commitment to this area.

Strategic Acquisitions

CVS Health's "Stars" category includes strategic acquisitions aimed at expanding care delivery. These acquisitions, like Signify Health and Oak Street Health, bolster its capabilities and market reach. For example, CVS Health acquired Signify Health for about $8 billion in 2023, demonstrating a commitment to home healthcare. Oak Street Health was acquired for around $10.6 billion, further solidifying its primary care presence.

- Signify Health acquisition for approximately $8 billion.

- Oak Street Health acquisition for around $10.6 billion.

- These acquisitions enhance CVS Health's care delivery capabilities.

- They also expand CVS Health's market reach significantly.

Cost Savings Initiatives

CVS Health's "Stars" category includes cost savings initiatives aimed at boosting profitability. These multi-year efforts are projected to yield over $500 million in savings by 2025. Such initiatives are critical for strengthening CVS Health's financial position. These cost-saving efforts are a key component of CVS Health's strategic financial planning.

- Savings Target: Over $500 million by 2025.

- Impact: Improves profitability and financial health.

- Strategic Importance: Key part of financial planning.

CVS Health's "Stars" category includes digital health innovations and strategic acquisitions that fuel growth. Digital health initiatives saw a 20% increase in user engagement in 2024. Strategic acquisitions, such as Signify Health and Oak Street Health, boost care delivery capabilities.

| Metric | Data | Year |

|---|---|---|

| Digital Health Engagement Growth | 20% increase | 2024 |

| Signify Health Acquisition | $8 billion | 2023 |

| Oak Street Health Acquisition | $10.6 billion | 2023 |

Cash Cows

CVS's retail pharmacy network, with around 9,000 locations in 2024, is a cash cow. It generates consistent revenue through prescriptions and over-the-counter sales. This stable business model provides a reliable source of cash flow for CVS. The network supports other ventures, like health services.

CVS Caremark, a key segment, manages prescription drug plans, bringing in significant cash. In 2024, PBM revenue accounted for a large portion of CVS Health's total. For example, in Q3 2024, CVS Health reported a PBM revenue of $26.3 billion. This steady income stream makes it a cash cow.

CVS Health's store brands, like health and beauty products, are cash cows. These exclusive CVS Health products offer premium quality at affordable prices. This strategy drives consistent sales, contributing significantly to the company's revenue. In 2024, these brands generated a substantial portion of CVS's retail sales, around 25%.

Long-Term Care (LTC) Pharmacy Services

CVS Health's Long-Term Care (LTC) Pharmacy Services is a cash cow, offering consistent revenue. LTC pharmacies provide medications and services to nursing homes. This segment benefits from an aging population needing care. Data from 2024 shows steady growth in LTC pharmacy revenue.

- Stable Revenue: LTC services generate predictable income.

- Aging Population: Demand increases with a growing elderly population.

- Market Growth: The LTC pharmacy market expands annually.

Specialty Pharmacy

Specialty pharmacy is a Cash Cow for CVS Health, generating substantial revenue from complex medications. In 2024, this segment saw robust growth, fueled by the rising demand for specialty drugs. The focus on managing high-cost therapies ensures stable profitability. This area supports CVS's overall financial health.

- Specialty pharmacy revenue growth in 2024 was approximately 10%.

- Specialty drugs now represent over 50% of total pharmacy sales.

- CVS Health's specialty pharmacy market share is around 30%.

- Gross profit margins for specialty pharmacy are higher than traditional retail pharmacy.

CVS Health has several cash cows that consistently generate revenue. These include its retail pharmacy network, which had around 9,000 locations in 2024, and CVS Caremark, contributing significantly to overall revenue. CVS store brands and LTC pharmacy services are also key contributors, with the specialty pharmacy segment showing robust growth.

| Segment | Revenue (2024) | Market Share |

|---|---|---|

| Retail Pharmacy | Consistent | Leading |

| Caremark (PBM) | $26.3B (Q3 2024) | Significant |

| Specialty Pharmacy | ~10% Growth | ~30% |

Dogs

Underperforming Medicare Advantage plans are considered "Dogs" in CVS Health's BCG matrix. These plans face challenges like higher medical costs, which negatively impact profitability. In 2024, UnitedHealth Group reported a decline in its Medicare Advantage margins, highlighting the industry-wide pressure. Unfavorable star ratings further decrease revenue.

Decreased sales of general merchandise in CVS retail locations impact overall revenue and profitability, classifying this segment as a "Dog" within the BCG matrix. Front-store sales declined, with Q3 2023 showing a 3.5% decrease. This decline is more pronounced than the 0.9% drop in Q3 2022. The overall revenue for CVS Health in 2023 was $357.8 billion.

CVS Health's Health Services Division, categorized as a "Dog" in the BCG matrix, faces significant headwinds. The division saw a revenue decline, partly due to losing a major client. Furthermore, pricing pressures within the pharmacy sector have intensified. In Q3 2023, CVS Health's total revenue was $85.2 billion, a decrease from the prior year. This highlights the challenges.

Retail Pharmacy Closures

CVS Health's decision to close retail pharmacies in 2025 aligns with its BCG Matrix assessment, indicating these units are likely "Dogs." These closures are part of a broader restructuring aimed at improving profitability and efficiency. This strategic move involves divesting from underperforming segments to focus on higher-growth areas. In 2024, CVS announced plans to close approximately 900 stores over three years.

- Store closures are a direct response to market pressures and strategic realignment.

- The company aims to optimize its retail footprint and improve overall financial performance.

- Focus on higher-growth areas like healthcare services and pharmacy benefits management.

- This restructuring is about adapting to evolving consumer needs and market dynamics.

Premium Deficiency Reserves

Premium deficiency reserves are critical in CVS Health's Health Care Benefits segment, indicating expected losses. These reserves are set aside to cover potential future claims exceeding anticipated premiums. In 2024, these reserves are carefully monitored to ensure financial stability. The company's strategy aims at mitigating risks through efficient claims management.

- Reserves reflect potential future claim costs.

- These reserves are linked to the Health Care Benefits segment.

- They are crucial for financial planning and risk management.

- CVS uses them to maintain financial stability.

In the CVS Health BCG matrix, "Dogs" represent underperforming segments. These include struggling Medicare Advantage plans and general merchandise sales. The Health Services Division, facing revenue declines, also falls into this category. CVS's store closures, with around 900 planned, further highlight this strategic shift.

| Segment | Status | Key Issue (2024 Data) |

|---|---|---|

| Medicare Advantage | Dog | Margin decline |

| Retail (General Merchandise) | Dog | Sales decline: -3.5% in Q3 2023 |

| Health Services Division | Dog | Revenue decline |

| Retail Pharmacies | Dog | 900 store closures planned |

Question Marks

Healthspire, CVS Health's rebranded health services, is positioned as a question mark in the BCG matrix. This segment, encompassing home health and primary care, targets high-growth markets. In 2024, CVS Health's healthcare delivery revenue was $96.5 billion, up 18.5% year-over-year. Its success hinges on effective market penetration and competition.

Cordavis, a relatively new venture for CVS Health, is positioned as a "Question Mark" in the BCG matrix. It focuses on biosimilars, aiming to provide affordable alternatives to expensive biologic drugs. In 2024, the biosimilar market is estimated at $40 billion globally, with significant growth potential. Cordavis seeks to capture a share of this expanding market by offering cost-effective healthcare solutions. This strategy aligns with CVS Health's broader goal of enhancing healthcare accessibility and affordability.

MinuteClinic, a question mark in CVS Health's BCG matrix, eyes growth by expanding services. They are now offering chronic disease management and preventative care. In 2024, CVS Health saw a 7.1% increase in revenue. MinuteClinic's focus on these areas aims to boost its market share. This strategic shift could turn it into a star.

AI-Powered Chatbot for Pharmacies

CVS Health's planned AI-powered chatbot represents a potential Star in the BCG matrix, aiming to boost customer interaction and satisfaction. This initiative aligns with the rising trend of AI in healthcare, enhancing accessibility and convenience. CVS Health is investing heavily in digital transformation to improve patient care and operational efficiency. This move could significantly impact customer service, as chatbot adoption in retail increased by 38% in 2024.

- Enhances customer service accessibility.

- Improves operational efficiency through automation.

- Leverages AI to personalize customer interactions.

- Drives customer engagement and loyalty.

Personalized Medicine Initiatives

Personalized medicine initiatives are a question mark for CVS Health in the BCG matrix, representing potential but uncertain future growth. These initiatives involve leveraging data analytics to tailor patient care, which could lead to significant improvements in healthcare outcomes. However, the success of personalized medicine hinges on several factors, including technological advancements, regulatory approvals, and consumer acceptance. CVS Health's investment in these areas could yield high returns or face challenges, making this a key area to watch in 2024 and beyond.

- Data analytics is crucial for personalized medicine, with the global market expected to reach $4.6 billion by 2024.

- The success of personalized medicine depends on the ability to analyze vast amounts of patient data effectively.

- CVS Health is investing in digital health solutions to support personalized medicine initiatives.

- Regulatory hurdles and patient data privacy concerns present challenges to the widespread adoption of personalized medicine.

Healthspire, Cordavis, MinuteClinic, and personalized medicine initiatives are "Question Marks," indicating potential yet uncertain growth. These segments are key areas where CVS Health aims to establish a market presence. Success depends on strategic execution and market dynamics.

| Segment | Description | 2024 Revenue or Market Data |

|---|---|---|

| Healthspire | Focuses on health services in high-growth markets. | $96.5B Healthcare Delivery, up 18.5% YoY. |

| Cordavis | Develops biosimilars for affordable drugs. | $40B global biosimilar market. |

| MinuteClinic | Expands services for increased market share. | 7.1% revenue increase. |

| Personalized Medicine | Utilizes data analytics for tailored care. | $4.6B global data analytics market. |

BCG Matrix Data Sources

CVS Health's BCG Matrix utilizes financial data, market analysis, competitor assessments, and industry insights for data-backed strategy.