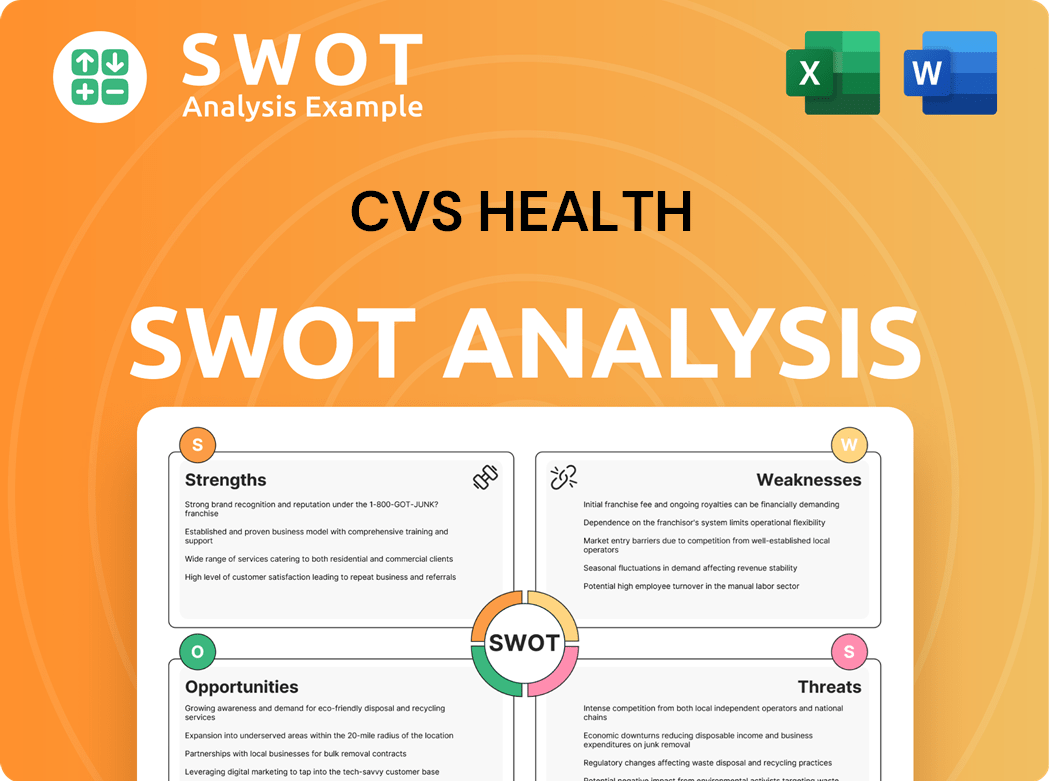

CVS Health SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Health Bundle

What is included in the product

Highlights internal capabilities and market challenges facing CVS Health.

Provides a concise SWOT matrix for quick insights on CVS Health's Strengths, Weaknesses, Opportunities, and Threats.

Same Document Delivered

CVS Health SWOT Analysis

You’re seeing the authentic CVS Health SWOT analysis here. What you see is precisely the same professional document you'll get upon purchase.

SWOT Analysis Template

CVS Health's strengths include its vast retail network and integrated healthcare services. However, weaknesses such as debt and competition pose challenges. Opportunities involve expanding digital health and pharmacy offerings, while threats like changing regulations loom. Understanding these elements is crucial.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

CVS Health's diverse operations across pharmacy services, health insurance, and retail clinics are a key strength. This diversification, which includes offerings like pharmacy benefit management and MinuteClinic, reduces reliance on any single area. In 2024, CVS generated approximately $357 billion in revenue, reflecting its broad market presence. This diversification enhances stability and provides various growth avenues.

CVS Health's vast retail pharmacy network is a major strength, giving it a strong physical presence. This widespread network allows easy access to prescriptions for many customers. In 2024, CVS operated over 9,000 pharmacies across the U.S. This network supports integrated healthcare services, improving customer experience.

CVS Health boasts strong brand recognition, critical for customer trust and market share. Its established reputation attracts new customers and partners. In 2024, CVS Health's revenue reached approximately $357 billion, underscoring its market presence. This robust brand helps maintain a competitive edge.

Integrated Pharmacy Benefits Management (PBM)

CVS Health's integrated Pharmacy Benefits Management (PBM) is a significant strength. Its diverse operations across pharmacy services, health insurance, and retail clinics reduce reliance on a single revenue stream. This diversification enables CVS Health to capture value throughout the healthcare sector. The company's broad service offerings cater to a wide customer base, strengthening its market position.

- In 2024, CVS Health's revenue was approximately $357.8 billion.

- The company's pharmacy services segment contributed significantly to this revenue.

- The integration of PBM with other services provides a competitive edge.

Focus on Innovation and Technology

CVS Health's commitment to innovation and technology is a key strength. They invest heavily in digital health solutions and telehealth services, enhancing patient care accessibility. This focus on technology helps streamline operations and improve customer engagement. CVS Health is actively exploring and implementing tech-driven solutions across its healthcare offerings. In 2024, CVS invested $2.3 billion in technology and digital initiatives.

- Digital Health Initiatives: CVS Health offers a range of digital health tools.

- Telehealth Services: Telehealth services expanded to improve patient access.

- Technology Investment: They invested significantly in technology.

CVS Health’s broad service offerings and physical presence through a large pharmacy network provide multiple revenue streams, reflected in its approximately $357 billion in 2024 revenue. This integration of PBM and other healthcare services creates a competitive edge. Investments in technology and digital initiatives, such as the $2.3 billion spent in 2024, improve patient access.

| Strength | Details | 2024 Data |

|---|---|---|

| Diversified Operations | Pharmacy, insurance, and retail services | $357.8B Revenue |

| Extensive Network | Over 9,000 pharmacies | |

| Brand Recognition | Established Reputation | $357.8B Revenue |

| Integrated PBM | Competitive Advantage | |

| Innovation & Tech | Digital health and telehealth | $2.3B Tech Investment |

Weaknesses

CVS Health faces substantial debt, largely from acquisitions like Aetna. This debt curtails financial flexibility and growth investments. Elevated interest expenses negatively affect profitability. In 2023, CVS Health's long-term debt was approximately $64 billion.

CVS Health's profitability heavily relies on pharmacy reimbursement rates. These rates, influenced by regulators and market pressures, are a key revenue driver. Any reduction in these rates can directly hurt CVS Health's financial performance. In 2024, the company closely monitors and manages these fluctuations to ensure revenue stability. According to recent reports, pharmacy services accounted for roughly 65% of CVS Health's revenue.

CVS Health faces integration challenges post-acquisition. Integrating large acquisitions, like Aetna, is complex. Operational inefficiencies and cost overruns are possible. Synergies may not be quickly realized. Effective integration is vital. In 2024, CVS is still integrating Aetna, impacting financial performance.

Competitive Pressures

CVS Health faces competitive pressures, particularly from rivals like Walgreens and Amazon, which can erode market share and profitability. The company's substantial debt, stemming from acquisitions such as Aetna, is a significant weakness. High interest expenses impact its financial flexibility and constrain investments. In 2024, CVS Health's long-term debt reached approximately $60 billion.

- High Debt: CVS Health's debt burden limits its financial agility.

- Interest Expenses: These costs reduce profitability.

- Competitive Threats: Rivals challenge market dominance.

Regulatory Scrutiny

CVS Health faces regulatory scrutiny, particularly regarding pharmacy reimbursement rates, which significantly impact revenue. Changes in these rates, often driven by government policies, can pressure profitability. The company must adeptly manage these fluctuations to maintain financial stability. In 2024, regulatory adjustments led to a 5% decrease in pharmacy reimbursement rates.

- Reimbursement rates are vital for CVS's financial results.

- Regulatory changes can lead to rate reductions.

- CVS must navigate these changes to protect profits.

- Decreased rates can affect the company's performance.

CVS Health struggles with heavy debt, which curbs its flexibility, hindering investment capabilities, and elevating interest costs. Intense competition from rivals also poses a continuous threat. The complex integration of recent acquisitions causes potential operational inefficiencies.

| Weakness | Description | Impact |

|---|---|---|

| High Debt | Large financial obligations from acquisitions. | Limits growth & raises interest costs. |

| Competition | Rivals, e.g., Walgreens, Amazon. | Erodes market share and profits. |

| Integration | Challenges of integrating Aetna. | Potential for inefficiencies and costs. |

Opportunities

CVS Health has opportunities to broaden its healthcare services, moving beyond its typical pharmacy and retail services. This includes expanding the MinuteClinic network, increasing telehealth options, and offering specialized care programs. In 2024, CVS Health's healthcare benefits segment saw revenues of $94.4 billion, a 12.4% increase. These services can attract new customers and boost revenue.

CVS Health can capitalize on the rising use of digital health. Expanding telehealth and remote monitoring improves patient access and outcomes. Digital tools boost efficiency and cut costs. In 2024, the telehealth market is valued at $62.5 billion. CVS's digital strategy can capture this growth.

CVS Health has opportunities to partner with various entities. These collaborations can boost its services and competitive edge. For example, in 2024, CVS expanded partnerships for healthcare access. These actions are aimed at innovation and growth. Such moves could lead to increased market share and revenue.

Aging Population and Increased Healthcare Demand

CVS Health has significant opportunities in the aging population and healthcare demand sector. The company can broaden its healthcare services beyond pharmacy and retail, focusing on growth areas like MinuteClinic, telehealth, and specialized care programs. These expansions can attract new customers and boost revenue. For example, in 2024, telehealth utilization remained high, with over 30% of Americans using telehealth services. CVS Health's strategic moves in these areas are critical for long-term growth.

- MinuteClinic expansion: CVS Health can increase the number of clinics and services offered.

- Telehealth services: Integration of virtual care to improve accessibility.

- Specialized care programs: Development of programs for chronic conditions.

- Revenue stream diversification: Increase revenue sources beyond traditional pharmacy.

Focus on Personalized Healthcare

CVS Health can capitalize on the personalized healthcare trend by leveraging digital health technologies. This includes expanding telehealth and remote monitoring, which can improve patient access and outcomes. Digital solutions also enhance efficiency and potentially lower healthcare costs. For example, in 2024, the telehealth market is projected to reach $60 billion.

- Telehealth market projected at $60 billion in 2024.

- Expansion of telehealth services improves patient access.

- Digital solutions can reduce healthcare costs.

CVS Health can grow through expanding services, like telehealth and specialized programs, attracting more customers. Digital health, including telehealth, offers significant growth opportunities, with the market valued at $62.5 billion in 2024. Partnerships and collaborations provide avenues for boosting services and market share, with initiatives continually expanding to meet evolving healthcare needs.

| Opportunity | Description | 2024 Data Highlight |

|---|---|---|

| Service Expansion | Increase in MinuteClinic, telehealth and specialized care programs. | Healthcare benefits revenue at $94.4 billion. |

| Digital Health | Expand telehealth and remote monitoring. | Telehealth market valued at $62.5 billion. |

| Strategic Partnerships | Collaborations to enhance service and reach. | Expanded partnerships in healthcare access. |

Threats

Changes in healthcare policy, like those impacting the Affordable Care Act or drug pricing, pose threats. Uncertainty in regulations makes long-term planning difficult. CVS Health must adapt to these shifts to mitigate risks. For example, the Inflation Reduction Act of 2022 impacts drug pricing, potentially affecting CVS's pharmacy benefits. In 2024, the healthcare industry is watching for updates.

Online retailers, including Amazon, are intensifying competition in pharmacy and healthcare, threatening CVS Health. These competitors provide convenience, competitive prices, and extensive offerings. In 2024, Amazon Pharmacy expanded its services, directly challenging CVS. CVS must improve its online presence to stay competitive, as online pharmacy sales grew by 15% in 2024.

Economic downturns pose a threat to CVS Health by potentially reducing consumer spending on healthcare. Reduced spending can lead to lower revenue and profit margins for CVS Health. In 2024, the US healthcare spending growth slowed, reflecting economic pressures. CVS Health must manage costs and maintain financial flexibility to navigate economic uncertainty. A decline in demand for healthcare services during economic downturns is also possible.

Data Security and Privacy Breaches

CVS Health faces threats from data security and privacy breaches, potentially exposing sensitive patient information. These breaches can lead to significant financial penalties, reputational damage, and loss of customer trust. The healthcare industry is a prime target for cyberattacks, with the average cost of a healthcare data breach reaching $10.9 million in 2024. This includes costs for breach detection, notification, and legal expenses.

- Data breaches can lead to regulatory fines under HIPAA.

- Cybersecurity incidents can disrupt operations.

- Patient data is highly valuable on the black market.

- Ransomware attacks are a growing threat.

Rising Healthcare Costs

Online retailers are expanding into pharmacy and healthcare, challenging CVS Health. Amazon's entry into the pharmacy sector intensifies competition. CVS Health faces pressure to match online convenience and pricing. Adapting requires a strong online presence and improved customer experience. This could impact CVS's market share and profitability.

- Amazon Pharmacy's launch in 2020 significantly impacted the market.

- CVS Health's 2024 revenue was approximately $357 billion.

- Online pharmacy sales are projected to grow substantially by 2025.

CVS Health confronts risks from evolving healthcare policies, like the Inflation Reduction Act, which impact drug pricing.

Competition is increasing, particularly from online retailers, such as Amazon, challenging CVS's market share. Data breaches and cybersecurity threats pose a growing danger, with potential fines.

Economic downturns may reduce consumer healthcare spending.

| Threat | Description | Impact in 2024 |

|---|---|---|

| Policy Changes | Uncertainty from regulations (e.g., drug pricing). | Slowed healthcare spending growth in the US |

| Competition | Online retailers such as Amazon expand services | Amazon pharmacy sales increased; CVS revenue $357B |

| Economic Downturns | Reduced spending from consumers | Potential reduced profit margins for CVS Health |

SWOT Analysis Data Sources

This SWOT analysis relies on financial reports, market analysis, and expert insights, ensuring data-driven strategic depth.