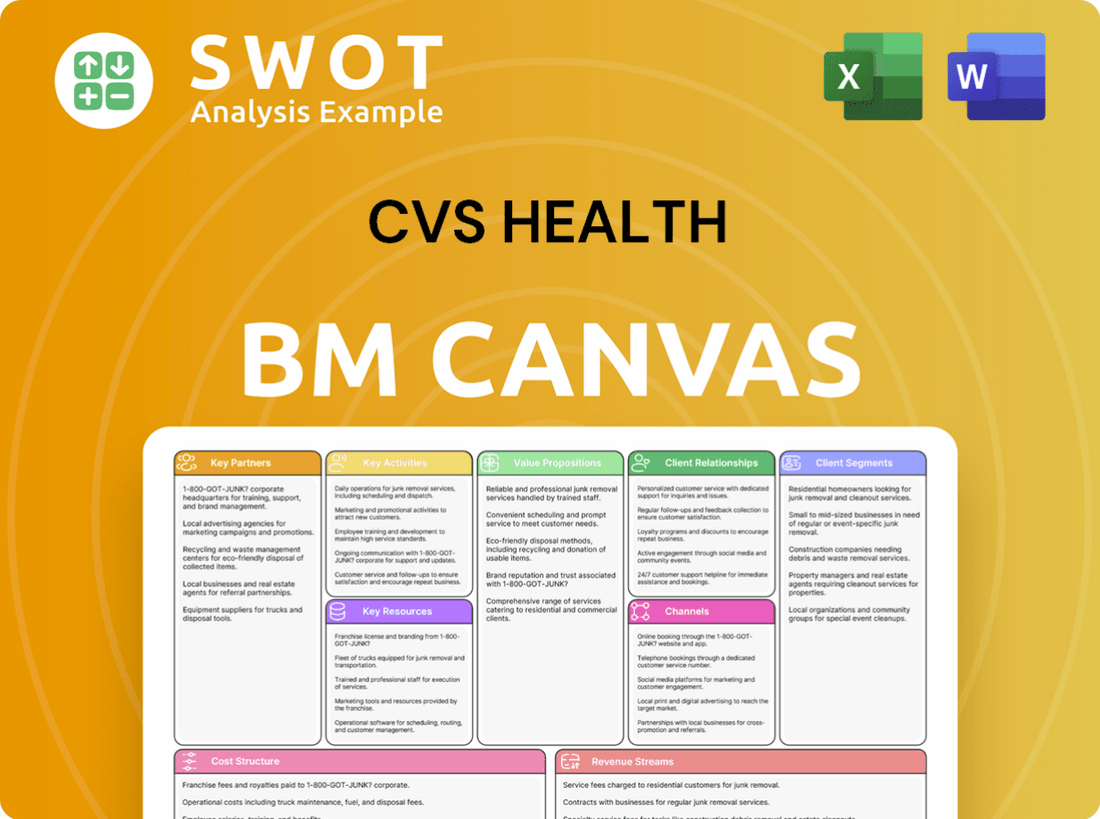

CVS Health Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CVS Health Bundle

What is included in the product

Covers CVS Health's customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Full Version Awaits

Business Model Canvas

The Business Model Canvas previewed showcases the actual document. This is the exact file you will receive post-purchase. It's complete, ready to use, reflecting the real content. Access the same CVS Health overview upon buying; it's what you see.

Business Model Canvas Template

Explore CVS Health's multifaceted business model, a cornerstone of its market dominance. Understand its core value propositions, from pharmacy services to healthcare innovations. Analyze key partnerships driving its extensive network and customer reach. Discover how CVS Health generates revenue through diverse streams and manages costs effectively. Uncover its strategic advantages and potential growth areas. Unlock the full strategic blueprint behind CVS Health's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CVS Health collaborates with pharmaceutical manufacturers to secure a reliable supply of drugs. These partnerships are essential for price negotiations and efficient inventory management. In 2024, CVS's pharmacy services segment generated $116.8 billion in revenue, highlighting the importance of these relationships. They help CVS offer competitive prices and a diverse medication selection.

CVS Health's collaborations with health insurers, including Aetna, are key. These partnerships merge pharmacy services with health plans, improving healthcare delivery. In 2024, Aetna's revenue contributed significantly to CVS's total. These relationships boost patient access to care and medications.

CVS Health teams up with retail partners, like Target, for in-store pharmacies. This strategy boosts CVS's reach, offering easy access to pharmacy services. These partnerships make things convenient, drawing customers and increasing foot traffic. In 2024, CVS reported over $350 billion in revenue, showing the impact of such collaborations.

Technology and Digital Health Solution Providers

CVS Health heavily relies on partnerships with tech and digital health firms. These alliances boost its digital services, including telehealth and mobile apps for prescription management. Technology integration helps CVS improve customer experiences and streamline operations. In 2024, CVS expanded partnerships to offer more personalized healthcare solutions.

- Partnerships with tech companies enhanced digital offerings.

- Telehealth services saw increased adoption.

- Mobile apps streamlined prescription management.

- Customer experience and operational efficiency were improved.

Accountable Care Organizations (ACOs)

CVS Health's collaborations with Accountable Care Organizations (ACOs) are key. These partnerships aim to coordinate patient care, focusing on better health outcomes. They work closely with providers to manage chronic conditions and boost preventative care. This approach also helps reduce overall healthcare expenses. In 2024, CVS expanded ACO partnerships by 15%.

- ACOs help manage chronic conditions, such as diabetes.

- Preventative care services include vaccinations and screenings.

- These partnerships aim to reduce healthcare costs.

- CVS increased its ACO partnerships by 15% in 2024.

CVS Health relies on partnerships to support operations. They team up with drug manufacturers for supply and price advantages, and in 2024, the pharmacy services segment made $116.8B. Collaborations with health insurers, like Aetna, integrate services, with Aetna significantly contributing to 2024 revenue.

Retail partnerships, such as those with Target, expand CVS's reach; CVS reported over $350B in 2024. Tech collaborations boost digital health, with telehealth expanding. Accountable Care Organizations (ACOs) partnerships, which CVS increased by 15% in 2024, enhance coordinated care and preventative services.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Pharmaceutical Manufacturers | Supply Chain & Pricing | $116.8B (Pharmacy Services Revenue) |

| Health Insurers (e.g., Aetna) | Integrated Healthcare | Significant Revenue Contribution |

| Retail Partners (e.g., Target) | Increased Access & Foot Traffic | Over $350B Revenue |

| Tech & Digital Health | Digital Service Enhancement | Telehealth Expansion |

| Accountable Care Organizations (ACOs) | Coordinated Care | 15% Increase in Partnerships |

Activities

Dispensing prescriptions is central to CVS Health, involving verification, drug info, and patient safety. They prioritize efficient, accurate fulfillment to meet customer needs. CVS provides medication therapy management to help patients optimize regimens. In 2024, CVS Health's pharmacy services generated significant revenue, reflecting their importance. As of Q3 2024, pharmacy sales were strong.

Managing health insurance plans, mainly through Aetna, is a core activity for CVS Health. This involves enrolling members, handling claims, and overseeing provider networks. CVS offers affordable and comprehensive health insurance, with 24.5 million medical members as of Q4 2023. The focus is also on enhancing care quality and health outcomes for its members.

Retail operations at CVS Health are central to its business model. This includes managing inventory, from prescriptions to general merchandise. CVS focuses on a positive customer experience within its stores. In 2024, retail sales contributed significantly to CVS's overall revenue. The stores offer health and wellness products, OTC medications, and general goods.

MinuteClinic Services

MinuteClinic services are a pivotal component of CVS Health's operations. They provide walk-in medical care, including vaccinations, health screenings, and treatment for minor ailments. These clinics offer accessible healthcare, aligning with CVS's goal of expanding its service network. CVS is continually enhancing its MinuteClinic offerings.

- In 2023, CVS Health operated approximately 1,100 MinuteClinic locations across the United States.

- MinuteClinics treated over 6 million patients in 2023.

- CVS has plans to increase the number of MinuteClinics and broaden the scope of services.

- MinuteClinic's revenue contribution to CVS Health has been steadily increasing.

Digital Health Solutions

Digital health solutions are a core activity for CVS Health. They develop and maintain digital tools like mobile apps and telehealth services to boost customer engagement. CVS focuses on user-friendly tech to improve healthcare access and personalize patient experiences. The goal is to streamline healthcare using technology.

- In 2024, CVS Health saw a 20% increase in telehealth visits.

- The CVS app had over 50 million active users by Q4 2024.

- Digital health investments reached $1.5 billion in 2024.

- User satisfaction with digital tools improved by 15%.

CVS Health's key activities include dispensing prescriptions, managing health insurance plans, and operating retail stores. MinuteClinic services, such as walk-in care, are another focus. Digital health solutions, like mobile apps and telehealth, are pivotal for customer engagement.

| Activity | Description | 2024 Data |

|---|---|---|

| Pharmacy Services | Dispensing prescriptions and medication management. | Pharmacy sales were strong in Q3 2024. |

| Health Insurance | Managing health insurance plans, mainly Aetna. | Aetna had 24.5M medical members by Q4 2023. |

| Retail Operations | Managing inventory and providing customer experience. | Retail sales significantly contributed to overall revenue in 2024. |

| MinuteClinic | Walk-in medical care services. | In 2023, treated over 6M patients in 1,100 locations. |

| Digital Health | Developing digital tools, like mobile apps, and telehealth services. | 20% increase in telehealth visits in 2024; the CVS app had over 50M active users by Q4 2024. |

Resources

CVS Health's vast pharmacy network is a key resource. It offers easy access to prescriptions and healthcare services. This network includes retail, specialty, and mail-order pharmacies. In 2024, CVS operated over 9,000 retail pharmacies. They consistently improve their network to meet customer needs.

CVS Health's health insurance infrastructure, notably Aetna, is crucial. This includes claims systems, provider networks, and actuarial skills. CVS uses this to manage plans and offer coverage. In 2024, Aetna's revenue was a significant part of CVS's total, highlighting the infrastructure's value.

CVS Health's retail stores are crucial, offering pharmacy, healthcare, and MinuteClinic services. Strategically placed for customer convenience, they drive accessibility. CVS invests in store upgrades to enhance customer experience. In 2024, CVS operated over 9,000 retail locations across the U.S., demonstrating their significance. These stores generate substantial revenue, with pharmacy sales being a key component.

Technology and Digital Platforms

Technology and digital platforms are crucial for CVS Health, facilitating online prescription management, telehealth, and personalized healthcare. These platforms boost customer interaction and care accessibility. CVS Health invests heavily in technology to stay competitive. In 2024, CVS reported over $10 billion in digital sales.

- Digital sales reached over $10 billion in 2024.

- Telehealth services are expanding rapidly.

- Investments in tech are ongoing.

- Focus on personalized health solutions.

Brand Reputation

CVS Health's brand reputation is a critical intangible asset, built on trust and quality, significantly impacting customer loyalty. A strong brand attracts customers and supports premium pricing strategies. In 2024, CVS invested heavily in marketing and PR, spending $1.2 billion to enhance its brand. This focus helped maintain a high Net Promoter Score (NPS) of 65, reflecting strong customer satisfaction.

- Brand reputation drives customer loyalty and attracts new customers.

- Marketing and PR investments are crucial for brand maintenance.

- High NPS scores indicate strong customer satisfaction.

- Brand strength supports premium pricing.

CVS Health's key resources include its extensive pharmacy network, health insurance infrastructure, and retail stores. These physical assets provide essential services and drive revenue, with pharmacies and retail locations numbering over 9,000 in 2024. Digital platforms and brand reputation are crucial for customer engagement and loyalty.

| Resource Type | Description | 2024 Data |

|---|---|---|

| Pharmacy Network | Retail, specialty, and mail-order pharmacies. | Over 9,000 retail pharmacies |

| Health Insurance | Aetna's infrastructure, plans, coverage. | Aetna's revenue significant |

| Retail Stores | Pharmacy, healthcare, MinuteClinic services. | Over 9,000 locations |

Value Propositions

CVS Health's convenient access is a core value proposition. With over 9,000 retail locations across the U.S., CVS offers easy access to prescriptions and healthcare needs. MinuteClinic, with roughly 1,100 locations, provides convenient walk-in medical care. This accessibility is crucial for time-strapped consumers. In 2024, CVS's revenue reached approximately $357 billion.

CVS Health emphasizes affordable healthcare, offering competitive prescription and insurance pricing. They reduce costs via efficient operations and innovative programs. This commitment makes healthcare accessible. In 2024, CVS reported a 6.9% increase in pharmacy sales, reflecting their focus on affordable medications.

CVS Health's value proposition centers on comprehensive services, offering pharmacy, insurance, and walk-in medical care. This integration streamlines healthcare management for customers. In 2024, CVS Health's revenue reached approximately $357.7 billion, demonstrating its market reach. This one-stop-shop approach aims to meet diverse healthcare needs efficiently.

Personalized Care

Personalized care is a key value proposition for CVS Health. They use tech and data to customize healthcare solutions. This includes medication recommendations and wellness programs. CVS aims to improve health outcomes through individualized care. In 2024, CVS invested heavily in digital health tools.

- Personalized medication recommendations.

- Customized health plans.

- Targeted wellness programs.

- Improved health outcomes.

Trusted Expertise

CVS Health's value proposition centers on "Trusted Expertise." They leverage their network of qualified pharmacists, healthcare professionals, and insurance specialists to offer reliable health guidance. This approach builds customer trust by providing accurate information and professional advice. The company strives to be a dependable partner in health management. In 2024, CVS Health's revenue reached approximately $357 billion.

- Expertise is delivered through 9,000+ pharmacy locations.

- CVS Health employs over 100,000 healthcare professionals.

- The company's health insurance segment, Aetna, serves millions of members.

- CVS Health's Net Income in 2024 was around $8.3 billion.

CVS Health offers convenient access with 9,000+ locations and MinuteClinics for easy healthcare access. Their value includes affordable healthcare, offering competitive pricing and cost-saving programs, with $357B revenue in 2024. CVS provides comprehensive services, integrating pharmacy, insurance, and care. Personalized care uses tech to tailor solutions, improving outcomes. Trusted expertise is delivered through a network of professionals.

| Value Proposition | Key Features | 2024 Data |

|---|---|---|

| Convenient Access | 9,000+ locations, MinuteClinic | Revenue: ~$357B |

| Affordable Healthcare | Competitive pricing, cost-saving programs | Pharmacy sales increased 6.9% |

| Comprehensive Services | Pharmacy, insurance, medical care | Market reach: ~$357.7B revenue |

| Personalized Care | Tech-driven, tailored solutions | Invested heavily in digital health |

| Trusted Expertise | Expert network, reliable guidance | Net Income ~$8.3B |

Customer Relationships

CVS Health fosters customer relationships with personal assistance from pharmacists and healthcare professionals. This direct support offers personalized advice, crucial for building customer trust. In 2024, CVS operated over 9,000 retail locations, ensuring widespread access to this service. This approach is key to their strategy, with pharmacy services accounting for a significant portion of their revenue.

CVS Health's self-service options via its website and app are key for customer interaction. These tools let customers manage prescriptions and schedule appointments. CVS saw over 100 million app downloads by late 2024, showing high user adoption. The company regularly updates these platforms to improve the customer experience.

CVS Health uses automated services to boost efficiency and customer satisfaction. Think prescription refill reminders and automated support. These tools streamline tasks, providing timely info. The company leverages tech, like in 2024, when digital sales rose. This automation boosts customer satisfaction.

Loyalty Programs

CVS Health heavily relies on loyalty programs to foster customer relationships, driving repeat business and engagement. These programs offer various incentives, including discounts and personalized promotions, to reward customer loyalty. The strategy aims to cultivate lasting relationships, enhancing customer lifetime value. In 2024, CVS's ExtraCare program boasted over 74 million active members.

- ExtraCare members represent a significant portion of CVS's revenue.

- These programs drive repeat purchases and increased customer spending.

- Loyalty data helps CVS personalize offers and improve customer service.

- CVS saw a 6% increase in loyalty program enrollment in 2024.

Community Engagement

CVS Health actively fosters customer relationships via robust community engagement. This strategy includes health fairs, educational programs, and charitable efforts, enhancing its local presence. Community involvement boosts CVS's image as a caring corporate entity, vital for customer loyalty. CVS's commitment to community health is evident through various initiatives.

- In 2024, CVS Health invested over $100 million in community health programs.

- They conducted over 5,000 health fairs across the U.S.

- CVS partnered with 1,000+ local organizations for health education.

- The company supported 2,500+ charitable initiatives in 2024.

CVS Health nurtures customer connections through personalized care from pharmacists, which creates trust. Digital tools like apps and websites enhance interaction, managing prescriptions and appointments. Loyalty programs, such as ExtraCare, and community involvement, boosts customer retention and satisfaction.

| Aspect | Details | 2024 Data |

|---|---|---|

| Personal Assistance | Pharmacist consultations, health advice. | 9,000+ retail locations |

| Digital Tools | App and website for prescription management. | 100M+ app downloads |

| Loyalty Programs | ExtraCare for discounts and promotions. | 74M+ active members, 6% increase in enrollment |

Channels

CVS Health's retail pharmacies are a key channel for prescriptions, health products, and MinuteClinic services. In 2024, CVS operated roughly 9,000 pharmacies. Strategic locations boost customer convenience. CVS invests in store improvements, with $1.1 billion in capital expenditures in 2023 for retail initiatives.

CVS Health's online pharmacy channel offers prescription delivery. It caters to customers seeking remote medication management. This channel enhances convenience and accessibility. CVS prioritizes secure and reliable online services. In 2024, online pharmacy sales continue to grow.

CVS Health's mobile app serves as a key channel, allowing customers to manage prescriptions and schedule appointments. This digital tool enhances customer engagement, offering convenient access to healthcare services. CVS regularly updates the app, with over 40 million active users by late 2024, boosting customer satisfaction. In 2024, the app processed over 100 million prescription refills.

Mail Order Pharmacy

The mail-order pharmacy is a key distribution channel for CVS Health, offering prescription delivery directly to customers. It is especially convenient for those needing regular medication. CVS ensures reliable and timely delivery through this channel. In 2024, mail-order prescriptions accounted for a significant portion of CVS's pharmacy revenue.

- Convenient prescription delivery to customers' homes.

- Serves customers with chronic conditions requiring refills.

- CVS focuses on timely and reliable medication delivery.

- Contributes to a substantial portion of CVS's pharmacy revenue.

MinuteClinics

MinuteClinics, a key part of CVS Health's model, offer readily accessible healthcare. These clinics provide walk-in services for minor ailments and vaccinations. In 2024, CVS operated over 1,100 MinuteClinic locations across the U.S. CVS continues to enhance services, aiming to increase patient access.

- Over 1,100 MinuteClinic locations as of 2024.

- Focus on expanding services like chronic disease management.

- Convenient access in retail settings.

- Walk-in care for common health needs.

CVS Health utilizes multiple channels, including retail pharmacies and digital platforms, to reach customers. In 2024, CVS operated around 9,000 retail pharmacies and its mobile app had over 40 million active users. The company invests in channels like mail-order pharmacies to ensure efficient prescription delivery, contributing to a significant portion of revenue, for instance, in 2023, retail/LTC revenue was $102.9B.

| Channel | Description | 2024 Data |

|---|---|---|

| Retail Pharmacies | Physical stores for prescriptions, health products, and services. | ~9,000 locations, $1.1B spent on retail improvements (2023). |

| Online Pharmacy | Prescription delivery via the internet. | Continued sales growth. |

| Mobile App | Manages prescriptions, appointments. | 40M+ active users, 100M+ prescription refills. |

| Mail-Order Pharmacy | Direct prescription delivery. | Significant portion of pharmacy revenue. |

| MinuteClinic | Walk-in healthcare services. | 1,100+ locations. |

Customer Segments

Individuals represent a core customer segment for CVS Health, primarily seeking prescription medications, healthcare products, and walk-in medical care. These customers prioritize convenience, affordability, and expert advice. CVS caters to diverse healthcare needs through its extensive retail locations and online platforms. In 2024, CVS saw a significant increase in retail pharmacy sales, reflecting strong demand. CVS Health reported $94.5 billion in revenue for the first quarter of 2024.

Health plan members, especially Aetna's, are a core CVS customer segment. They use CVS for pharmacies, insurance, and healthcare access. CVS seeks to offer members affordable, complete healthcare solutions. In 2024, Aetna's revenue was a substantial part of CVS's overall income. CVS Health's total revenue in 2024 was around $357 billion.

Employers represent a key customer segment for CVS Health, offering health insurance benefits. They want affordable, complete healthcare for their employees. CVS provides health plans and pharmacy benefit management services to employers. In 2024, CVS Health's revenue reached approximately $357 billion, including significant contributions from employer-sponsored health plans.

Seniors

Seniors form a crucial customer segment for CVS Health, frequently needing specialized healthcare and prescriptions. They prioritize trustworthy expertise, personalized care, and easy healthcare access. CVS caters to seniors with Medicare plans and senior-focused healthcare centers. In 2023, the U.S. population aged 65+ reached over 58 million, showcasing the segment's significance.

- Medicare plan enrollment is a key revenue driver for CVS, with significant growth projected.

- Senior-focused services, like medication management and chronic disease support, are increasingly important.

- Convenient access, through retail locations and online services, is highly valued by seniors.

Chronic Condition Patients

CVS Health identifies chronic condition patients as a key customer segment. These individuals, dealing with illnesses like diabetes and heart disease, need continuous care. CVS offers tailored programs to support these patients effectively. This segment’s importance is reflected in CVS's focus on medication adherence and disease management.

- In 2024, CVS Health reported that medication adherence programs significantly improved patient outcomes.

- Approximately 40% of adults in the U.S. have multiple chronic conditions.

- CVS Health's specialized programs target conditions like diabetes, with dedicated support services.

- These services include medication reminders and health coaching.

CVS Health's customer segments include individuals, health plan members (like Aetna), employers, and seniors. These groups seek pharmacy, insurance, and healthcare services. CVS reported approximately $357 billion in revenue for 2024.

| Customer Segment | Service/Benefit | 2024 Relevance |

|---|---|---|

| Individuals | Rx, Healthcare Products | Convenience, retail growth |

| Health Plan Members | Pharmacies, Insurance | Aetna revenue contribution |

| Employers | Health Benefits | Revenue from plans |

| Seniors | Medicare Plans, Care | 58M+ aged 65+ in the U.S. |

Cost Structure

The cost of goods sold (COGS) at CVS Health primarily involves the expense of prescription drugs, healthcare items, and retail merchandise. In 2024, COGS represented a significant portion of CVS's total revenue. CVS aims to reduce COGS by negotiating deals with suppliers. Efficient inventory management further helps control these costs.

Operating expenses cover retail stores, pharmacies, and MinuteClinics, plus admin and marketing. CVS focuses on cost control for efficiency and profit. In 2024, SG&A expenses were a significant portion of revenue. CVS Health aims for operational streamlining to cut costs.

Healthcare costs, encompassing claims and reimbursements, are vital for CVS Health's profitability. In 2024, U.S. healthcare spending reached $4.8 trillion. CVS actively manages these costs through care coordination and preventive care initiatives. The company also negotiates rates with providers. This approach is crucial for financial health.

Technology and Infrastructure

Technology and infrastructure costs are a significant part of CVS Health's expenses, covering digital platforms and IT systems. These investments are crucial for efficiency and customer experience. CVS consistently upgrades its technology to stay competitive. In 2024, CVS allocated a substantial portion of its budget to IT and digital initiatives.

- 2024 IT spending is estimated to be a significant percentage of total costs.

- Investments support telehealth and digital pharmacy services.

- Ongoing upgrades for data analytics and cybersecurity are in place.

- These investments enhance operational efficiency.

Acquisition and Integration

Acquisition and integration costs form a crucial part of CVS Health's cost structure. These costs encompass expenses related to acquiring and merging other companies, notably including Oak Street Health and Signify Health. Managing these costs effectively is essential due to their potential magnitude. CVS Health prioritizes achieving synergies and maximizing the value derived from its acquisitions. For example, in 2023, CVS Health's total revenues reached approximately $357.8 billion, with significant investments in acquisitions.

- Acquisition costs include purchase price and due diligence.

- Integration costs encompass IT system alignment and operational changes.

- CVS aims to realize $1 billion in synergies from Oak Street Health by 2026.

- Signify Health's acquisition is expected to generate cost savings.

CVS Health's cost structure includes COGS, covering drugs and merchandise. Operating expenses encompass retail, admin, and marketing. Healthcare costs involve claims and reimbursements. Technology and infrastructure investments are ongoing.

| Cost Category | Description | 2024 Data |

|---|---|---|

| COGS | Drugs, merchandise | Significant percentage of revenue |

| Operating Expenses | Retail, admin, marketing | Focus on cost control |

| Healthcare Costs | Claims, reimbursements | Managed via care coordination |

| Tech & Infrastructure | Digital platforms, IT | Substantial IT budget allocated |

Revenue Streams

Prescription medication sales are a core revenue source for CVS Health. They come from retail, online, and mail-order pharmacies. In 2024, this segment significantly contributed to overall revenue. CVS focuses on increasing sales via efficient operations and customer care. This revenue is influenced by prescription volume, drug prices, and insurance reimbursement.

Health insurance premiums, primarily from Aetna, represent a substantial revenue stream for CVS Health. This revenue is directly influenced by membership numbers, premium prices, and the overall health of its members. In 2024, Aetna's revenue is projected to be a significant portion of CVS Health's total revenue. CVS Health strategically focuses on expanding its health insurance membership base.

Retail product sales are a significant revenue stream for CVS Health. Sales from healthcare products, over-the-counter medications, and general merchandise contribute substantially. CVS's focus is optimizing retail offerings and customer experience to boost revenue. In 2024, CVS reported a revenue of $361.3 billion, with retail sales being a key component. This segment's success hinges on store traffic and strategic pricing.

Healthcare Services Revenue

Healthcare Services Revenue is a critical revenue stream for CVS Health, encompassing fees from MinuteClinic, pharmacy benefit management, and other healthcare offerings. This stream's performance is tied to service volume, pricing strategies, and consumer demand. CVS Health actively seeks to broaden its healthcare services and improve care accessibility. In 2024, CVS Health's healthcare services revenue is projected to increase due to the ongoing expansion of its healthcare offerings.

- MinuteClinic visits contribute significantly to this revenue stream.

- Pharmacy benefit management services generate substantial revenue.

- CVS Health is focused on expanding its healthcare services to boost revenue.

- Customer demand and pricing strategies directly impact revenue generation.

Investment Income

CVS Health generates investment income from its financial assets and investments. This income stream's performance is subject to market conditions and the effectiveness of investment strategies. CVS Health carefully manages its investments to secure steady returns. The fluctuations in investment income can affect the company's overall financial performance.

- In 2023, CVS Health's net investment income was reported.

- The company invests in diverse assets, including marketable securities.

- Investment income contributes to CVS Health's overall revenue.

- Market volatility can influence the returns from investments.

CVS Health's revenue streams include prescription sales, health insurance premiums, retail products, healthcare services, and investment income. Retail product sales are a significant component, contributing to the company's overall financial health. The company also earns investment income from managing its financial assets.

| Revenue Stream | Description | 2024 Revenue (Projected) |

|---|---|---|

| Prescription Sales | Sales of prescription medications from various pharmacy channels. | Significant, contributing to overall revenue |

| Health Insurance Premiums | Revenue from Aetna insurance premiums, influenced by membership. | Projected to be a large portion of total revenue |

| Retail Product Sales | Sales from healthcare, OTC medications, and general merchandise. | Key component of CVS Health's revenue |

Business Model Canvas Data Sources

The CVS Health Business Model Canvas is constructed using market analysis, financial reports, and competitor data.