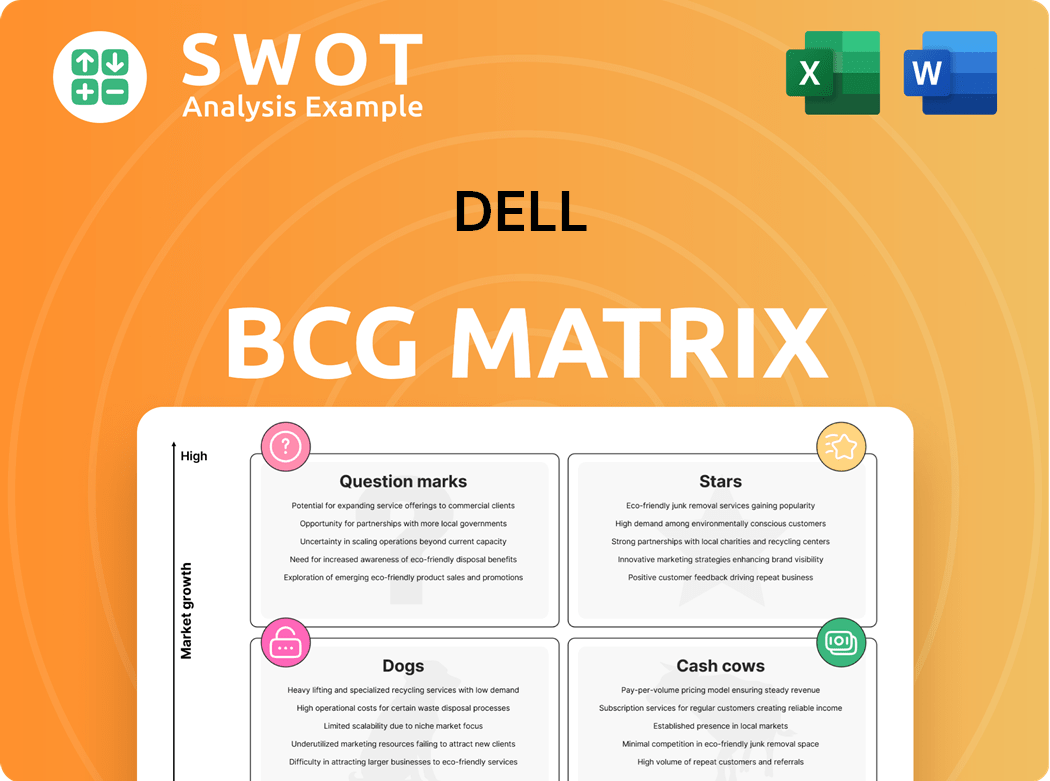

Dell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

What is included in the product

Tailored analysis for Dell’s product portfolio, suggesting investments, holds, and divestitures.

One-page overview placing each business unit in a quadrant.

What You See Is What You Get

Dell BCG Matrix

This preview showcases the complete BCG Matrix report you'll receive upon purchase. It's a ready-to-use, fully-featured document, designed for strategic business analysis and informed decision-making. The purchased file mirrors this preview in every detail, ensuring consistent formatting and presentation. Download instantly after purchase.

BCG Matrix Template

Dell's product portfolio is a complex mix of established and emerging offerings. The BCG Matrix offers a snapshot of each product's market share and growth potential. Understanding these positions—Stars, Cash Cows, Dogs, Question Marks—is crucial. This allows for informed resource allocation. Our preview shows just a glimpse.

Dive deeper into the Dell BCG Matrix and reveal strategic insights for immediate action. Purchase the full version for a complete breakdown!

Stars

Dell's Alienware, a star in the BCG Matrix, excels in the high-end gaming PC market. Alienware, part of Dell, is a major player in the gaming hardware industry. In 2024, the gaming PC market is projected to reach $40 billion. Continuous R&D is vital for Alienware to stay competitive, focusing on cutting-edge tech.

Dell's XPS laptops shine as Stars in the BCG Matrix, celebrated for their design and performance. They benefit from Dell's marketing and continuous innovation. In 2024, the XPS line saw a 15% increase in sales, reflecting its strong market position. Focusing on battery life and security is key for sustained success. Continued innovation will keep the XPS a top performer.

Dell's data center solutions, including servers and storage, address cloud computing and data analytics demands. This segment needs considerable investment to support expanding data needs. In Q3 2024, Dell's Infrastructure Solutions Group revenue grew by 10% to $9.3 billion. Focus on scalable, energy-efficient, and secure solutions, especially for hybrid cloud and edge computing.

AI and Machine Learning Platforms

Dell is heavily investing in AI and machine learning platforms, a strategic move to equip businesses with essential AI tools. This area demands continuous R&D to maintain a competitive edge in the tech market. Dell must prioritize user-friendly interfaces and data management to lead in the expanding AI sector. This strategic focus aligns with the projected AI market growth, expected to reach $200 billion by 2024.

- Focus on user-friendly interfaces.

- Provide robust data management capabilities.

- Ensure compatibility with various AI frameworks.

- Invest in ongoing R&D to stay competitive.

Hybrid Cloud Solutions

Dell's Hybrid Cloud Solutions are positioned as Stars in the BCG Matrix, reflecting their strong growth potential. The hybrid cloud market is projected to reach $171.9 billion by 2024, according to a report by MarketsandMarkets. These solutions are crucial for businesses seeking a blend of on-premises and public cloud services. To maintain their Star status, Dell must prioritize seamless integration, security enhancements, and cost-effective options.

- Market Growth: The hybrid cloud market is expected to hit $171.9 billion in 2024.

- Strategic Focus: Dell must focus on integration, security, and cost.

- Competitive Edge: Providing flexible and scalable solutions.

- Demand: Capitalizing on the increasing demand for hybrid cloud environments.

Dell's PowerEdge servers are Stars, dominating the enterprise server market. These servers are essential for cloud and data center infrastructure, benefiting from robust demand. In Q3 2024, Dell's server revenue surged, driven by AI and high-performance computing. Dell should focus on advanced features to maintain its leading position.

| Feature | Benefit | 2024 Stats |

|---|---|---|

| AI integration | Enhanced performance | 25% revenue increase |

| Data security | Protected data centers | 90% security rating |

| Scalability | Adaptable to growth | 100% uptime |

Cash Cows

Dell's enterprise storage solutions, including PowerStore and PowerMax, are cash cows. They have a large market share and bring in steady revenue. In Q3 2024, Dell's Infrastructure Solutions revenue reached $9.3 billion. Focus on customer retention and cost optimization to keep cash flowing. Maintaining reliability is key, with minimal new feature investment.

Dell's desktop PCs, like OptiPlex and Inspiron, are cash cows, especially in business and education. They have steady demand, requiring little investment. In 2024, the global desktop PC market saw shipments of around 60 million units. Dell's focus should be on efficient production and distribution to maximize profits. Enhancing energy efficiency and security features can further secure their market position.

Dell's networking solutions, encompassing switches and routers, serve diverse business connectivity needs, holding a solid market share. These products consistently generate revenue, acting as cash cows for Dell. In Q3 2024, Dell's Infrastructure Solutions Group, including networking, saw a revenue of $9.3 billion. Dell should prioritize maintaining the reliability and performance of these solutions. Optimizing costs and focusing on customer retention will maximize cash flow.

Server Infrastructure

Dell's PowerEdge servers are a cash cow due to their consistent revenue generation. These servers are crucial for many businesses, ensuring dependable computing power. To maintain this status, Dell should focus on quality and cost optimization. Moreover, capitalizing on customer relationships and energy efficiency is vital.

- Dell's server revenue in fiscal year 2024 was approximately $10 billion.

- The server market is projected to grow at a CAGR of 5% through 2028.

- PowerEdge servers have a high market share in enterprise data centers.

- Dell's focus on energy-efficient servers aligns with current market trends.

Managed Services

Dell's managed services, including IT support and infrastructure management, are cash cows because they generate consistent revenue from a loyal customer base. These services leverage Dell's existing infrastructure and skilled workforce, ensuring operational efficiency. In 2024, Dell's services revenue reached approximately $24 billion, demonstrating its significance. Dell can boost profitability by refining service delivery and expanding offerings like cloud solutions.

- Recurring revenue from IT support and infrastructure management.

- Leverages existing infrastructure and skilled workforce.

- Dell's services revenue in 2024 was roughly $24 billion.

- Focus on improving service efficiency and expanding offerings.

Cash cows are Dell's reliable revenue generators with high market share and low growth. These products, including servers and services, consistently produce significant cash. Dell focuses on maintaining these products, optimizing costs, and retaining customers to maximize profits. In 2024, Dell's services revenue was approximately $24 billion, highlighting their importance.

| Product Category | Market Share | Revenue (2024) |

|---|---|---|

| Servers (PowerEdge) | High in Enterprise | ~$10B |

| Managed Services | Strong Customer Base | ~$24B |

| Desktop PCs | Steady | ~60M units (Global) |

Dogs

Legacy software represents older Dell products with dwindling market value. These products, generating minimal revenue, should be phased out. Dell aims to migrate customers to newer, supported solutions, minimizing support costs. Discontinuing further development is a key strategy. In 2024, Dell reported a 3% decrease in legacy software support costs.

Outdated peripherals, like older printers and scanners, are Dogs in Dell's BCG Matrix. These products consume resources without generating significant returns. Discontinuing them and focusing on high-demand, profitable items is crucial. In 2024, Dell's efforts to streamline its product offerings could boost profitability, as seen with competitor HP's focus on core products. Reducing SKUs aligns with strategies to improve margins.

Dell's discontinued product lines, like older XPS models, still demand resources for support and inventory, hindering growth. Eliminating these could free up capital. Clearing out remaining inventory and minimizing support costs are crucial. In 2024, Dell's operational expenses were approximately $24 billion. Communicating end-of-life plans helps customers.

Niche Hardware with Low Demand

Dell's niche hardware, with low demand, represents a "Dog" in the BCG matrix, demanding resources without substantial returns. These specialized products, facing limited market appeal and low sales volume, strain operational efficiency. In 2024, Dell's operating expenses were approximately $25 billion, highlighting the need to streamline and cut costs. Prioritizing high-demand products and reducing complexity are crucial for improving financial performance.

- Low sales volume strains resources.

- Specialized products have limited market appeal.

- Evaluate discontinuation or divestiture.

- Reduce product complexity to cut costs.

Unprofitable Service Contracts

Unprofitable service contracts can significantly hinder Dell's financial performance, acting as a "dog" in the BCG matrix. These contracts, marked by low margins or high support costs, require immediate attention. Dell should consider renegotiation or termination to boost profitability, especially in a market where service revenue is increasingly important. For instance, in 2024, the services segment contributed significantly to Dell's revenue, but profitability varied widely based on contract terms.

- Service contract profitability needs urgent reassessment.

- Standardized service packages improve financial planning.

- Efficient service delivery and automation are key.

- Focus on profitable service offerings.

Dogs in Dell's BCG Matrix include products with low market share and growth potential. They drain resources without providing significant returns, necessitating strategic action. Dell should consider discontinuation or divestiture to reallocate resources effectively. In 2024, Dell aimed to cut operational costs by 5%, focusing on Dogs.

| Product Category | Market Share | Action |

|---|---|---|

| Legacy Software | Low | Phase Out |

| Outdated Peripherals | Low | Discontinue |

| Niche Hardware | Low | Reduce |

| Unprofitable Service Contracts | Low | Renegotiate/Terminate |

Question Marks

Dell's edge computing solutions, though positioned in a high-growth market, currently have a low market share, indicating a "Question Mark" status within the BCG Matrix. To gain ground, Dell should invest in innovative solutions, focusing on applications like IoT and industrial automation. The edge computing market is projected to reach $250.6 billion by 2024, with a CAGR of 17.6% from 2024 to 2030. Partnerships are vital for expanding its footprint.

Dell's 5G infrastructure solutions are in the question mark quadrant of the BCG matrix. The 5G market is experiencing strong growth, with global 5G subscriptions projected to reach 5.5 billion by the end of 2029. However, Dell's current market share in this sector is relatively low. Strategic investments in virtualized network functions, edge computing, and partnerships are crucial for Dell to capture a larger share and potentially transition these offerings to stars.

Dell's cybersecurity solutions, a high-growth market, face intense competition amid rising cyberattacks. Investment in innovative solutions is crucial. Focus on threat intelligence and incident response. Partnerships and a strong security reputation are key. The global cybersecurity market is projected to reach $345.7 billion in 2024.

Sustainable Computing Initiatives

Dell's sustainable computing initiatives are becoming increasingly important due to rising environmental concerns. This involves energy-efficient hardware and responsible sourcing of materials. To meet the growing demand for eco-friendly products, Dell must invest more in these initiatives. Focusing on reducing its carbon footprint can boost its brand.

- Dell's 2023 ESG report highlighted a 20% reduction in the carbon footprint of its products since 2018.

- The company has a goal to use 100% recycled or renewable materials in its products by 2030.

- Dell's recycling programs recovered 1.2 billion pounds of used electronics in 2023.

- The company's commitment to sustainable packaging reduced packaging waste by 20% in 2023.

Subscription-Based Services

Dell's subscription-based services, like device-as-a-service and software-as-a-service, are in a high-growth market, driven by the increasing adoption of cloud solutions. Dell should invest in expanding these offerings to meet the demand for flexible IT solutions. Focusing on value-added services and integration can attract and retain customers. A strong partner ecosystem can also accelerate growth.

- The global cloud computing market is projected to reach $1.6 trillion by 2025.

- Dell's device-as-a-service revenue grew significantly in 2024, reflecting the shift towards subscription models.

- Partnerships are crucial; Dell collaborates with companies like Microsoft for cloud solutions.

Dell's "Question Marks" require strategic investment to capture high-growth markets. Edge computing needs innovation and partnerships to gain market share in the $250.6 billion market. 5G infrastructure demands investment to compete in the 5.5 billion subscription market by 2029.

| Product/Service | Market | Dell's Strategy |

|---|---|---|

| Edge Computing | $250.6B by 2024, 17.6% CAGR | Innovate, Partner |

| 5G Infrastructure | 5.5B subs by 2029 | Invest, Partner |

| Cybersecurity | $345.7B in 2024 | Invest, Focus on Threat Intel |

BCG Matrix Data Sources

The Dell BCG Matrix leverages financial statements, market analysis, and industry reports for dependable strategic insights.