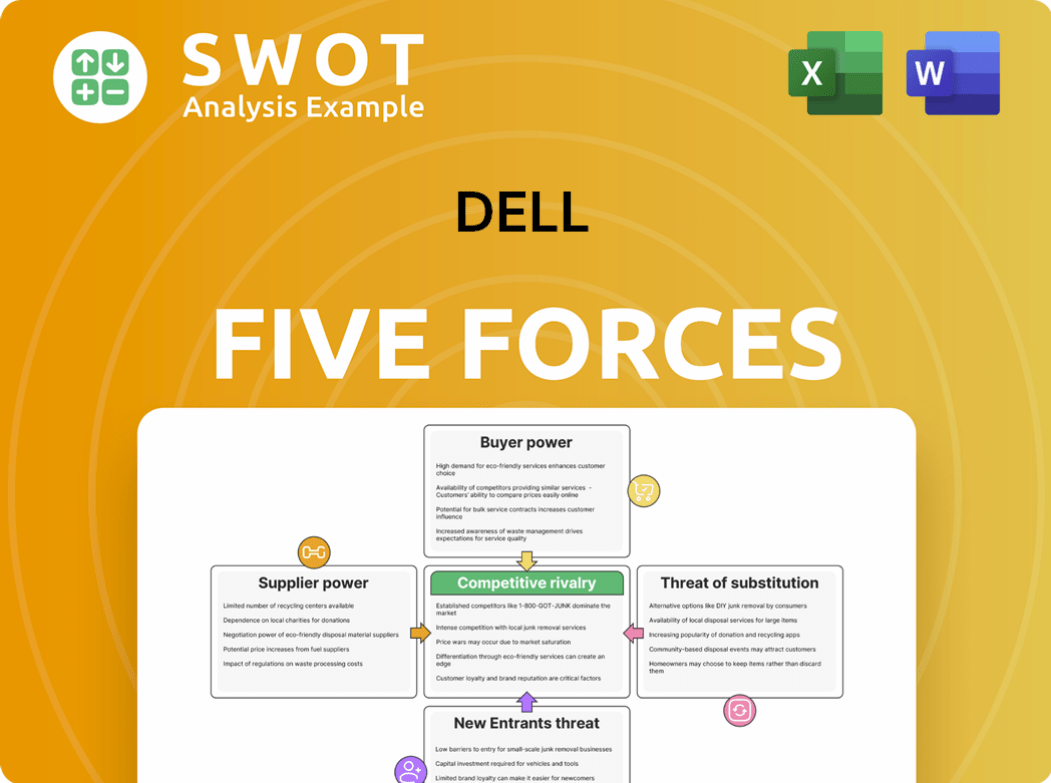

Dell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

What is included in the product

Analyzes Dell's competitive position by evaluating the strength of each market force, ensuring strategic insights.

Tailor force impacts to your unique scenario by easily adjusting all threat levels.

Full Version Awaits

Dell Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis you'll receive. It examines industry competition, supplier power, buyer power, threats of substitutes, and new entrants. The document is fully developed with insightful analysis, ensuring you get the same comprehensive file immediately after purchase. No changes or modifications are needed; it's ready to use. You're looking at the final product.

Porter's Five Forces Analysis Template

Dell's industry landscape is shaped by five key forces: supplier power, buyer power, threat of new entrants, threat of substitutes, and competitive rivalry. Strong supplier relationships are crucial, given the reliance on components. Conversely, Dell's large customer base gives them considerable bargaining power. The PC market's maturity limits new entrants but intensifies competition. Consider the impact of evolving technology.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Dell’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Dell faces supplier concentration, especially for semiconductors. A 2024 study shows top three suppliers control over 90% of key components. This gives these suppliers strong bargaining power. Dell risks higher costs and less flexibility due to this dependency.

Dell faces significant supplier power in the semiconductor market, particularly from Intel and AMD. These companies' dominance, with Intel holding about 75% and AMD 25% of the Q4 2023 market share, limits Dell's negotiating leverage. This duopoly allows suppliers to control prices and supply, directly impacting Dell's profitability. Dell's dependence on these key components increases its vulnerability to supplier-driven cost fluctuations.

Switching suppliers presents substantial challenges and expenses for Dell, thereby amplifying the influence of suppliers. The costs associated with changing suppliers, including supply chain adjustments and ensuring compatibility, amounted to around $87 million in 2024. This financial burden significantly increases Dell's dependency on its current suppliers. As a result, Dell faces reduced bargaining power when negotiating terms.

Component Price Volatility

Component price volatility directly affects Dell's profitability. Fluctuations in memory and storage costs can significantly impact their financial performance. In 2024, component price volatility was approximately 14%, creating challenges in cost forecasting and margin management. This situation empowers suppliers to adjust prices based on market dynamics.

- Price swings in key components like DRAM and NAND flash memory directly influence Dell's production costs.

- Dell faces challenges in accurately predicting expenses due to supplier pricing flexibility.

- Suppliers can leverage market conditions to their advantage, impacting Dell's profit margins.

Vertical Integration Limitations

Dell's limited vertical integration, estimated at 22.5% in 2024, significantly impacts its supplier bargaining power. This low level of in-house component manufacturing makes Dell heavily reliant on external suppliers. The dependence weakens Dell's ability to negotiate favorable terms, increasing its vulnerability to supplier price hikes or disruptions. Dell's strategic decisions must consider these supply chain dependencies.

- Vertical integration at 22.5% in 2024.

- Reliance on external suppliers.

- Weakened bargaining position.

Dell's supplier power is significant, especially with concentrated semiconductor suppliers. In 2024, top suppliers controlled over 90% of components, giving them strong leverage. This dependence increases Dell's costs and reduces flexibility.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | High dependency on key suppliers | Top 3 suppliers control >90% of components. |

| Market Share (Intel/AMD) | Limits Dell's negotiating power | Intel: ~75%, AMD: ~25% (Q4 2023) |

| Component Price Volatility | Affects profitability | ~14% volatility in 2024 |

Customers Bargaining Power

Dell's diverse customer base, including consumers and businesses, limits customer bargaining power. In 2024, revenue distribution was roughly: consumers 28%, small/medium businesses 36%, and large enterprises 36%. This spread prevents any single group from strongly influencing pricing or terms.

Consumers wield significant power due to price sensitivity, particularly in the PC market. In 2023, average laptop prices dropped over 5% because of strong competition. Many consumers use 'buy now, pay later' options. This pressure forces Dell to offer competitive prices, potentially shrinking profit margins.

Enterprise customers, major revenue drivers for Dell, wield significant bargaining power. They often seek tailored solutions and advantageous terms, impacting profitability. For instance, in 2024, large orders might secure up to 15% discounts.

Direct Sales Channel Influence

Dell's direct sales strategy significantly shapes customer bargaining power. This approach, which generated over $60 billion in revenue in 2023, empowers Dell to manage pricing and customer interactions directly. The online sales growth rate of nearly 17% in 2023 demonstrates the effectiveness of this channel. Direct engagement helps Dell understand and meet customer needs.

- Direct Control: Dell's direct sales model gives it more control over pricing and customer relationships, reducing the bargaining power of intermediaries.

- Revenue: Dell's direct sales channel generated over $60 billion in revenue in 2023.

- Growth: Online sales growth rate of nearly 17% in 2023.

- Engagement: This direct engagement allows Dell to manage customer expectations and pricing more effectively.

Switching Costs for Enterprise

Switching costs significantly influence customer bargaining power, especially in enterprise IT. While consumers can easily switch brands, enterprise clients experience higher switching costs. These costs arise from integration, compatibility issues, and the complexity of replacing IT infrastructure. Dell benefits from this "stickiness," fostering long-term relationships and stable revenue. This reduces pressure from enterprise clients to demand lower prices.

- Enterprise IT spending in 2024 is projected to reach $4.7 trillion globally.

- The average contract length for IT services is 3-5 years, indicating client commitment.

- Switching costs for large enterprises can range from hundreds of thousands to millions of dollars.

Dell's customer base distribution (2024) mitigates concentrated customer power; with consumers (28%), SMBs (36%), and enterprises (36%). However, price-sensitive consumers and enterprise clients exert distinct pressures. Direct sales, over $60B in 2023, and high switching costs for enterprises provide Dell leverage.

| Customer Segment | Bargaining Power | Impact on Dell |

|---|---|---|

| Consumers | High (Price-sensitive) | Price competition, margin pressure |

| SMBs | Moderate | Balanced, competitive pricing |

| Enterprises | High (Negotiating power) | Customization, potential margin impacts |

Rivalry Among Competitors

The tech industry is fiercely competitive. Dell competes with HP, Lenovo, and Apple in the PC market. Server and storage markets see Dell battling IBM and HPE. This rivalry pressures pricing and innovation. In 2024, Dell's PC market share was around 17%, facing constant challenges.

Product differentiation is crucial in the computer industry. Companies invest heavily in R&D, facing short product lifecycles. Dell, for instance, spent $4.6 billion on R&D in 2023. They launched 42 new enterprise solutions to remain competitive. Constant innovation increases costs and risks.

Market share fluctuations in the tech industry are common. Dell's PC market share fell over 1% in 2023. Conversely, its enterprise solutions share rose modestly. These shifts show the intense competition and need for constant change in the market.

Pricing Pressure

Competitive rivalry significantly affects pricing strategies, particularly in the PC market. Intense competition leads to reduced prices, squeezing profit margins. For example, average laptop prices have decreased by over 5% due to aggressive pricing. This pricing pressure is a key concern for Dell's gross margins.

- Price wars with competitors like HP and Lenovo continue.

- Enterprise solutions also see price compression.

- Dell's profitability is directly impacted by these trends.

- Gross margins are under constant pressure.

Strategic Alliances and Acquisitions

In the tech sector, strategic alliances and acquisitions are prevalent, reshaping competitive dynamics. Companies like Microsoft and Google frequently acquire firms to broaden their offerings and enter new markets. These moves intensify competition, forcing Dell to reassess its strategic approach constantly. The value of global M&A deals reached $2.9 trillion in the first half of 2024, highlighting the aggressive pursuit of market share.

- M&A deal value in the tech sector in Q1 2024 was $150 billion.

- Dell Technologies completed 1 acquisition in 2024.

- Strategic alliances increased by 15% in 2024 compared to 2023.

- The cloud computing market, a key area for alliances, is projected to reach $800 billion by the end of 2024.

Competitive rivalry in the tech sector is intense. Dell faces significant competition, impacting pricing and innovation. Market share fluctuates; Dell's PC share declined in 2023. Strategic moves like M&A reshape the landscape.

| Metric | Data | Year |

|---|---|---|

| Dell R&D Spending | $4.6 Billion | 2023 |

| PC Market Share Change | -1% | 2023 |

| Global M&A Deals | $2.9 Trillion | H1 2024 |

SSubstitutes Threaten

Cloud computing and SaaS are major threats to traditional hardware. The cloud computing market was valued at over $560 billion in 2023. SaaS is projected to hit $700 billion by 2030. These alternatives reduce the need for on-premises hardware, impacting Dell's sales.

Smartphones and tablets increasingly serve as PC substitutes, particularly for individual consumers and mobile professionals. The growing power of these devices, combined with their portability, enables them to replace PCs in many scenarios. For instance, in 2024, global smartphone sales reached approximately 1.2 billion units, indicating their widespread adoption. This shift can diminish the demand for traditional PCs.

Virtualization and software-defined storage pose a threat to Dell. These solutions offer alternatives to traditional hardware. They optimize existing resources, potentially cutting new hardware purchases. This impacts demand for Dell's products. The global virtualization market was valued at $90.8 billion in 2024, showing growth.

Open-Source Solutions

Open-source solutions pose a significant threat to Dell. The growing availability of open-source software and hardware offers cost-effective alternatives to Dell's products. This shift affects server environments, increasing demand for customizable, budget-friendly options. These alternatives can undermine Dell's market share and pricing strategy. The open-source market is projected to reach $32.3 billion by 2024.

- Open-source software market size: $32.3 billion (2024).

- Demand for customizable servers is rising.

- Alternatives erode Dell's market share.

- Open-source solutions offer cost-effective options.

Managed Service Providers

Managed service providers (MSPs) pose a threat to Dell by offering comprehensive IT solutions. These solutions can reduce the need for in-house hardware and expertise. Services like infrastructure management and cybersecurity offered by MSPs can decrease the demand for Dell's hardware and related services. The global MSP market was valued at $285.7 billion in 2023, and is projected to reach $492.8 billion by 2029.

- Market Growth: The MSP market is experiencing significant growth, indicating increasing adoption.

- Service Scope: MSPs offer a wide range of services, directly competing with Dell's offerings.

- Cost Reduction: MSPs often provide cost-effective solutions, attracting businesses.

The threat of substitutes significantly impacts Dell. Cloud computing, smartphones, virtualization, and open-source options offer viable alternatives. These substitutes erode demand for Dell's hardware and services. The open-source market reached $32.3 billion in 2024, showing the competitive landscape.

| Substitute | Impact on Dell | 2024 Data |

|---|---|---|

| Cloud Computing | Reduces hardware demand | Market value over $560B (2023) |

| Smartphones/Tablets | PC replacement | Smartphone sales: ~1.2B units |

| Virtualization | Optimizes resources, cuts purchases | Market value: $90.8B |

| Open-Source | Cost-effective alternative | Market value: $32.3B |

Entrants Threaten

Entering the tech industry demands substantial capital, a major barrier to new firms. Dell, for example, needs billions for data centers, R&D, and factories. These huge capital needs keep many potential competitors out. In 2024, Dell's capital expenditures were approximately $2.5 billion. This financial hurdle significantly limits new entrants.

Continuous innovation demands huge R&D spending, a barrier for newcomers. Dell's 2023 R&D spending was substantial, billions to maintain its edge and create new products. New entrants must match these investments to compete. This financial burden discourages new market entries. R&D intensity is a key deterrent.

Dell's well-established brand is a major barrier for new competitors. Dell's decades of customer relationships create a significant edge. This brand strength lowers customer acquisition costs. Strong brand loyalty means higher customer retention rates, as seen in 2024 with a 90% customer satisfaction.

Economies of Scale

Dell's established economies of scale pose a significant barrier to new entrants. Dell's vast operations in manufacturing and distribution enable it to offer competitive pricing. Dell's size allows for advantageous supplier negotiations and reduced production expenses. New companies struggle to match these cost efficiencies.

- Dell's revenue in fiscal year 2024 was approximately $91 billion.

- Dell's global market share in the PC market was around 17% in 2024.

- Large-scale production often reduces per-unit costs by 10-20%.

- New entrants may face initial production costs that are 15-25% higher.

Complex Technological Expertise

The technology industry's demand for complex expertise is a significant barrier to entry. New companies face challenges without specialized knowledge. Dell's large engineering and technical teams, numbering in the thousands, highlight this barrier. New entrants must invest heavily in similar expertise to compete effectively.

- Dell employs over 130,000 people globally, with a significant portion in technical roles.

- Research and development spending by major tech firms often exceeds billions annually.

- Startups require specialized talent, such as AI and cybersecurity experts, to compete.

- The cost of acquiring or training this expertise can be prohibitive.

New tech firms face high capital needs, like Dell's $2.5B 2024 CapEx. Dell's R&D spending, in the billions, sets a high bar, deterring entrants. Strong branding, exemplified by Dell's high customer satisfaction, poses another challenge.

| Factor | Dell's Advantage | Impact on Entrants |

|---|---|---|

| Capital Needs | $2.5B CapEx (2024) | High initial investment |

| R&D | Billions spent annually | Costly to match innovation |

| Brand | 90% customer satisfaction (2024) | Harder customer acquisition |

Porter's Five Forces Analysis Data Sources

Our Dell analysis leverages financial reports, industry benchmarks, market studies, and news articles for competitive assessments.